Beruflich Dokumente

Kultur Dokumente

Cheese Market in India

Hochgeladen von

AmitOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cheese Market in India

Hochgeladen von

AmitCopyright:

Verfügbare Formate

Volume : 2 | Issue : 3 | March 2013

ISSN - 2250-1991

Research Paper

Management

A Strategic Analysis of Cheese and Cheese

Products Market in India

* G.R. Jayadevan

* Academic Consultant/Asst. Professor, Department of Dairy Business Management,

College of Dairy Science & Technology, Kerala Veterinary and Animal Sciences University, Mannuthy P.O., Thrissur, Kerala-680 651

Keywords:

INTRODUCTION

Indian dairying is emerging as an important growth leverage

of the economy. For sheer numbers, dairying here has no

match in the world. The figures are simply mind boggling. Milk

production has come a long way over the years from a low

volume of 17 million tonnes in 1951 to 112 million tonnes in

2010. The Indian dairy market is growing at an annual growth

rate of 7% at current prices. More than 50% of the total fluid

milk produced in the country is consumed in the urban market. The reason for the rise in consumption of the milk is that

its demand is highly income elastic. The dairy expenditure,

particularly of value added products of the richest household

are ten times that of the poorest3. This is in contrast with most

other countries where rich substitute milk with other sources

of protein including meat and poultry. Further, the domestic market for value added products like butter, cheese, ice

cream, dairy whiteners and spreads is galloping at 8-10% per

year4. The future of Indian dairy industry as a sustaining enterprise in the national and international market is promising

and its growth potential is high.

A few decades ago, India was more of a butter country. Butter finds place in the breakfast in many urban homes. We

could rarely find a cheese block somewhere in the house. Except for the popular Indian variety of cottage cheese - Paneer,

India is not traditionally a cheese nation. Cheese was more

or less kept for sandwiches, or to create dishes that would

go along as evening dishes or accompaniments to cocktails.

Now, the mainstream use of cheese and cheese spreads

has increased in the urban mainstream. Cheese is used

as cheese blocks, grated cheese and cheese spreads. With

the growing saturation of cheese consumption in the West

and the encouraging successes in other non-cheese Asian

countries like Japan and China; overseas cheese producers

are eyeing the Indian market for its huge promise. While a

few years ago Indians had access to only one type of basic

cheese, several companies have entered the foray and there

are multiple cheese types that are available at the stores.

CHEESE TYPES POPULAR IN INDIA

Cheese can basically be broadly defined into hard cheese,

soft cheese and very hard cheese. The different kinds of

cheese types that are available today are:

Cheddar: Cheddar is a kind of hard cheese that is relatively

more famous than other hard cheese types. Cheddar can be

mild or sharp flavoured and can be smooth or dry, depending on the age of the cheese. Cheddar can be anything from

just a month old to even three years old. Cheddar cheese is

normally used for cooking purposes and as ingredients for

soups and sauces. Cheese is also used for grating and melting. Spices are added to the Cheddar to improve its taste.

Paneer (Cottage Cheese): Paneer the very young Cheese

is most familiar to Indian households. In smaller towns and

rural areas, consumers still prefer non-branded cottage

cheese processed by local dairy owners called paneer. Unlike cheese cubes, paneer is softer and bland and all Indian

delicacies are made out of paneer. It arrives in the market in

large chunks that look like loaves of bread. It is cut, weighed

and sold loose. People prefer cheese in the form of paneer

because they get fresh stocks every day. It is also much more

economical as compared to branded cheese. Paneer sells

at 100-140 rupees per kilogram as against branded cheese

which sells around 200 rupees per kilogram. Paneer is used

as stuffing for popular deep-fried north Indian snacks such as

paneer pakora, bread pakora and paneer roll. It is also used

as stuffing for some south Indian snacks like paneer dosa and

paneer bonda. It is also frequently used in Indian curries and

other vegetable preparations.

Mozzarella Cheese: Mozzarella chesses of many types are

common in the marketplace. It is of high demand in grocery

shops across the world. What keeps mozzarella cheese in high

demand is its emergence as an integral part of pizzas. A testament to this increasingly popularity of mozzarella cheese is

the fact that various countries such as India have started producing this cheese. Mozzarella provides the best results when

it comes to making pizzas. Even though this cheese is often

substituted with other cheese when making pizza, nothing can

make a pizza look, feel and taste like a pizza like mozzarella

can. Best when it is fresh, it is this cheese that creates that

stringy look when a hot pizza is pulled apart or cut. Mozzarella

especially that which is made from buffalo milk has a richer

concentration of minerals, nutrients and proteins compared to

any other type of cheese. These increased amounts are due

to the fact that buffalo milk is inherently superior to cows milk.

Parmesan:

Parmesan is a dry and hard cheese that is prepared from

skimmed cow milk. Sometimes, partially skimmed cows milk

is used to prepare Parmesan cheese. Parmesan cheese has

a richer and sharper flavour than other cheese and is commonly used for grating.

Romano: Romano is a type of very hard cheese which is

made with a mixture of cows milk along with a sheep or goats

milk. It is named after the City of Rome. Romano cheese is

normally used for grating. Romano is either very sharp or

even mild in flavour.

Brie: Brie is a kind of soft cheese that has a tangy or fruity

flavour. It is normally used to be served with fruits and salads.

Brie can also be used as an accompaniment for roast beef

sandwich.

PARIPEX - INDIAN JOURNAL OF RESEARCH X 247

Volume : 2 | Issue : 3 | March 2013

Mascarpone: Mascarpone is Italian cream cheese. This

cheese is very rich, used in desserts and sometimes can be

seen in cheesecakes.

HISTORY OF CHEESE IN INDIA

As a matter of fact, Paonta Sahib, a place in Himachal

Pradesh, discovers the cheesy route from India to America.

Indian Cheese industry was established by Man Mohan

Malik2. This was back in 1950s and considered as a great

steptowards the development of Cheese Industry in India. It

has been recently discovered that India exports more cheese

to America, than any other the Italian or European Cheese

industry. Though the popularity of cheese is not that massive

in India, yet the abundance of milk production has generated

the cheese industry in a much better way. As the buffalo milk

is thicker it was used more for the Cheese industry. However,

initially the Americans were complaining for the cheese made

of Buffalo milk. Actually in India the milk is considered to be

milk no matter whether it is from a buffalo or a cow. The shift

was soon made to cow milk and Malik was totally into the

business. He started producing mozzarella cheese but as he

was exactly unaware of the real Italian mozzarella cheese,

he was unable to cope up. He then invited Raffaele Cioffi

to Paonta Sahib. Cioffi was from coast of Sorrento and was

the fifth-generation cheese-maker. He was a constant consultant for cheese productions in Russia and Bulgaria. This

was a great step forwarded by Malik. Not only this, Malik also

brought special equipments from Germany for the purpose of

tracing out the impurities in the milk. This was the beginning

and was very effective in adding more quality to the manufacturing unit.

INDIAN CHEESE MARKET

It is true that India is not a traditionally structured cheese

nation. But the contributions made by Malik was so significant that in 2006, India exported Cheese in a volume of 8000

tonnes; a value of Rs 250 crore2. It can be well assessed that

the Cheese industry in India is growing at a regular speed

and will surely have a hold over the International market of

Cheese business. The organised cheese industry in India is

at best in its nascent stage, accounting for less than 1% of total dairy production and largely limited to urban consumption.

Though cheese was first marketed under the brand name

Amul, from the popular Amul butter stable in the late 1970s,

it attained an identity of its own only as late as 1990s. The

Cheese industry growth rate is estimated at about 10%-12%

per year in terms of volume and 16%-17% per year in value

terms13. Current household cheese penetration is 5%, with

about 50% of consumption being limited to cities. Mumbai

and Delhi together capture half of the cheese market. Within

cheese products, around 60% of the market is dominated by

processed cheese, 30% by cheese spreads and the remaining 10% by flavoured and specialty cheese13.

The Indian cheese market is dominated by Gujarat Cooperative Milk Marketing Federation that uses the brand name

Amul and Britannia New Zealand Foods Pvt. Limited, using

the brand name Britannia Milkman. Amul is way ahead of

competition and owns about 60% of the market. Britannia

has about 25% share. Other conspicuous players are Dabon

International Private Limited, a wholly owned subsidiary of

the French dairy company Bongrain S.A and other regional

brands like Mother Dairy and Vijaya. These companies have

a 10% market share. The remainder 5% of the market is taken by imported cheese brands, retailed in specialty stores.

Table 1: The Indian Cheese Market 14

Brand(s)

Estimated Share of Market (%)

Amul

60

Britannia Milkman

25

Le Bon, Regional brands 10

e.g. Mother Dairy, Vijaya

Imported brands e.g. Kraft, 5

Laughing Cow

An interesting fact is that the per capita consumption of

ISSN - 2250-1991

cheese, even among the cheese consuming households, is

a poor 2.4kg per annum as compared to over 20kg in the

US15. Cheese is very recently making its mark in the industrial sector and the market. The urban population accounts for

major cheese consumption in India. Taken together, the four

metropolitan cities viz., Delhi, Mumbai, Chennai and Kolkata

consume over 60% of the total cheese sold in India. Mumbai

tops the list with 30%, followed by Delhi at 20%, Kolkata at

7% and Chennai at 6%. In mom and pop stores as well as

supermarkets we find tinned cheese and cheese cubes which

are salted and ready-to-eat; cheese spread which was introduced as a substitute for butter; cheese singles (slice) which

are used as stuffing for sandwiches; pizza cheese used as

topping on pizzas which are fast becoming the preferred fast

food in Indian metros.

Amul has even introduced a low calorie version of cheese

called slim cheese. Weight conscious people are slowly

taking to this new product. Top players of branded cheese

manufacturing in India include Amul, Britannia, Le Bon, Mother Dairy and others. Out of these, Amul has a market share

of 65% according to Agri-Commodity Federation. There are

others such as Vita and Vijaya who have a market share in

the cheese market but their share is insignificant. During the

last few years, the Indian cheese market has grown steadily

at 15 to 20 per cent per annum according to a market survey

of dairy products in India. The Australian cheese processor,

Kraft, has made an inroad into the Indian market followed

by Remia of Holland. Initially, the imported brands of cheese

were introduced into Delhi, Mumbai, Kolkata and Chennai

and were patronized by expatriates. But, now some Indians

too have started taking a fancy for these brands.

Market Profile

The Indian organized cheese market including its variants like

processed cheese, mozzarella, cheese spreads, flavoured

andspiced cheese, isvalued at around Rs 4.5 billion7. Processed cheese at 60% of the overall market is Rs 2.7billion7.

The next most popular variant is cheese spread claiming a

share of around 30% of the total processed cheese market.

The market is primarily an urban phenomenon and is known

to be growing at around 15%7. The market for cheese cubes,

slices and tins is growing. The flavoured cheese segment has

been constantly declining.

Gujarat Cooperative Milk Marketing Federation (GCMF) with

the Amul brand continues to be the main operator in the

branded cheese market in India7. It pioneeredthe marketfor

processed, branded cheese. What GCMF did was to develop the technology to make cheese from buffalo milk. World

over it is made from cow milk. Britannia Industries joined the

fray inthe cheese market in mid-1990sthrough anarrangementwithDynamixDairy Industries (DDI). It wasset upin

1995 by a consortium of five companies - Conwood, Indo

Saigon, Hiranandani, ETA and Metro. DDI has capacity to

process 500,000 litres of milk per day with an estimated investmentofRs 1500 million7. The plantdesigned by Valioof

Finlandis run ontechnologytie-up withSchreiberFoods of

the US. Schreiber is the largest supplier of processed cheese

to fast food chains in the US with expertise in sliced cheese.

Britannias cheese is sold in tins in the form of cubes, and in

individually wrapped slices in packs of fives and tens. The

slices are being promoted more aggressively worldwide, and

these account for abulkof cheese consumption. These are

gaining acceptanceinIndia as well. Amulfollowed Britanniain launchingslices. Itscheese spread in the form of paste

has been well received in the market. Britannia has been

concentrating on metros and large cities. The network covers

some 60,000 dairy outlets equipped with cold cabinets, refrigerators and insulated boxes. Amul covers some 500,000

retail outlets.

French cheese major, Fromageries Bel, a 10-billion French

franc outfit, has entered the Indian market with La Vache Kirit

or what is worldwide known as The Laughing Cow. Its target

market to start withwere the two metros of Delhi and Mum-

248 X PARIPEX - INDIAN JOURNAL OF RESEARCH

Volume : 2 | Issue : 3 | March 2013

ISSN - 2250-1991

bai withdistribution entrusted to Delhi-based Rai & Sons,

distributors for premium food brands, Ferraro Rocher and

Ricola. The Bel product will be produced at Bels facility in

Polandexclusivelyfor the Indian market. La Vache Kirit is a

guaranteedvegetarian product. Fromageries Belis expected to widen its product portfolio by launching laughing Kirit

(creamy cheese in cube form) and Babybel (semi-hard with a

wax coating appropriate for sandwiches). Laughing Cowwas

expected to be followed by an Austrian cheese brand, Happy

Cow (owned by Woerle). Woerle has entered into a licensing arrangement with Veekay Foods & Beverages in Mumbai.

Nestle and Kraft have been planning to make forayin the Indian market.

Foreign brands in India include: Probolene, Colby, Mozzarella

and Parmessan from Italy, Cheddar from Dutch, Gryueve.

The new entrants will have to compete with well-established

players such as Amul, Britannias Milkman and Daburs Le

Bon, enjoying substantial market sharesinthe overall Indian

cheese market. TheUS-based Philip Morris, which brought

in its Kraft cheese brand earlier,has gained a significant presence in the market. The rest of the market is spread among

Verka, Nandini, Vijaya and Vadilal.

Dabur had forayed into the dairy products market through

its joint venture company, Dabon International, a 50:50 joint

venture between Dabur India and French dairy products major Bongrain. The company claimed a product range of 20

different varieties of cheese under Le Bon brand. Dabon has

a manufacturing facility at Noida with an installed capacity of

12,000 tonnes per annum. Incidentally, the government had,

in a move in late April 2001, barred Dabon from marketing

flavoured milk and processed cheese in the country. Dabur

was to launch speciality cheese like blue cheese and hard

cheese. It had plans to developing cold chains at the distributor and retail levels in the state capitals and major towns

in order to increase penetration levels.

Processed Cheese

Leading Brands in the category: Amul, Britannia, Vijaya, Verka, Dabur (Le Bon), Vadilal, Kraft, Nandini

Table 2: Processed Cheese-Market Growth Rate7

Market Growth Rates

1990-91 1996-97

18.5%

1996-97 2001-02

20.6%

2001-02 2006-07

11.7%

2004-05 2009-10

9.4%

2009-10 2014-15

7.4%

Consumption Patterns

There have been two significant changes in consumption patterns, affecting each end of the spectrum. In the mass consumption category, Indian consumers are more ready to buy

off the shelf. Paneer, which all the major cheese producers

are marketing as a branded product, was traditionally home

made. Secondly, with greater international exposure, rising

incomes and brand affiliation; the demand for niche cheese

products has increased. Amul was an early mover in capitalizing on the demand for specialized cheeses like Gouda and

Emmental. However, cheese consumption continues to be

an urban phenomenon, with processed cheese and cheese

spreads accounting for about 80% of the total cheese consumption.

Also, cheese is mostly consumed by children and is yet to

be part of the mainstream adult diet on a mass scale. Children will continue to be the largest consumers of cheese. Of

the predicted increase in demand in future, children will contribute to the largest proportion in tier 2 cities while it will be

adults in the metros. To cater to this increase, it is also likely

that cheese producers introduce new varieties of specialty

cheese in the metros

Increasing and Widespread Demand

Based on a multi-year study of dairy consumption patterns in

China, Mckinsey predicts a growth in the demand for Cheese

by 40% by 2011. With India having similar consumer trendsnamely, growing incomes, westernization and urbanization

- Indian demand is likely to mirror Chinese patterns. Two conspicuous outcomes are: i) There is likely to be a 25%-30%

increase in demand in the metros and ii) There is likely to be a

5%-10% growth in demand in tier 2 cities as urbanization and

modern consumption patterns extend to these cities.

Food Technology Improvements

Many regional cheese brands are currently not able to retail

nationwide because of the limited shelf life of their cheese

products. For example, Mother Dairy, a subsidiary of the National Dairy Development Board and a hugely successful retailer has confined most of its sales to the northern belt. Its

reason- the shelf life of most of its dairy products including

cheese is only about 10 days. India being the second largest

country in the world and a land of distances, most regional

producers do not have the advanced packaging, processing and distribution technology for geographical expansion.

Despite this hindrance, Mother Dairys sales for cheese are

increasing at about 30-40% a year16. In the next 3 years,

regional players will be forced to adopt new technologies that

enable them to go national to survive.

Intense Competition among Sellers

The two pronged strategy that sellers will follow in the next

few years is i) to increase the size of the market through

greater awareness, and ii) to increase availability of cheese

products to the expanded market.

The Amul and Britannia brands have the strongest national dairy brand identity. To compete with these established

brands and gain national presence, other cheese retailers

will resort to heavy marketing. Cheese advertising budgets

alone are likely to be around 2%-4% of total revenues. Advertising strategies could include, for e.g. cross selling with

complementary food products and offering free cheese tasting sessions.

In the past couple of years, for example, Mother Dairy has

already been pursuing aggressive advertising strategies. One

successful promotion in Delhi and Mumbai was the Cheese

khao superhero ban jao (Eat Cheese to become a Superhero) event, where kids buying cheese at retail outlets were

invited for a photo shoot dressed as superheroes through

Polaroid cameras and the framed photograph presented to

them. Another helped the company bond better with its retailers. In November 2005, retailers in Delhi displayed banners

proclaiming, Cheese ke saath bees ki cheez (Buy Cheese

and get Rs. 20 worth of freebies), a proposal where, if a consumer bought Mother Dairy cheese, the retailer would offer

her free purchases worth Rs 20 from the store. Both these innovative campaigns were hugely successful in brand awareness and sales.

Indianization of Processed Cheese

Dabon, in acknowledgement of customer preferences for indigenous cheese, has customized their portfolio to include

paneer. The next three years will see new Indian flavours of

cheese being introduced in the processed cheese and cheese

spread market. The Indian consumer has unique tastes with

variations even across regions. Both Indian and International

brands are likely to Indianize their cheese products with Indian flavours to attract a larger customer base.

Marketing Efforts

In terms of market segmentation, all the Indian cheese brands

cater primarily to the retail sector. On the other hand, Dabon

International Private Limited and Bel Fromageries have a retail and institutional client focus. The institutional sector, comprising fast food chains, restaurants, in-flight caterers and

hotels also source their cheese from private dairy companies

like Dynamix Dairy.

PARIPEX - INDIAN JOURNAL OF RESEARCH X 249

Volume : 2 | Issue : 3 | March 2013

Geographically, cheese is produced and marketed for domestic consumption. Amul Malai Paneer is only cheese product

exported to the Middle East, Singapore and North America.

Paneer is targeted at the large Non Resident Indian (NRI)

population in these countries.

Importing cheese, especially for mass consumption faces two

main stumbling blocks:

i. High costs: Added to the high cost of importing cheese,

importers often also have to invest substantially in a distribution network due to the lack of cold chains. Indian

consumers are price sensitive and importers find it difficult competing against local, better priced brands, which

are also in synch with the local palate.

ii. Inordinate time lag in supplies: Due to logistics and the

duration of the import process, replenishing stock takes at

least a couple of months, making it difficult for importers

to cater rapidly to demand variations.

One of the biggest problems in the marketing of cheese is the

lack of existing infrastructure, especially cold chains from the

producer to the consumer. Existing players, especially Amul

that also uses such facilities for its other dairy products like

milk, already has a fairly well established national network.

However, new entrants, including importers need to make extra infrastructural investments. This can be quite daunting for

companies that are making a market entry into the dairy and

cheese industry, particularly with limited existing knowledge

of current distribution issues.

The lack of cold storage facilities cause the biggest problems

to regional players who are trying to gain a national presence.

They neither have existing infrastructure nor the financial

muscle of international companies. To improve logistical issues, some regional players, like Mother Dairy are positioning

their plants in different geographical regions.

ISSN - 2250-1991

ducer of vegetarian cheese. Indias Amul is now the biggest

brand for vegetarian cheese as the Global Indian even now

prefers desi shuddh taste over the premium Bries and Camemberts of the West.

With demand pouring in from London to Ludhiana, exports

will hit a record 600 tonnes this year as Amul shreds competition with a growth of more than 20per cent.Amuls vegetarian

cheeses are manufactured using rennet from either fungal

or bacterial sources. That makes it pure vegetarian, which

is important for Indians. That is also why it says vegetarian

cheese on the pack. As it also has a unique taste because it

is derived from buffalo milk, NRIs across the world prefer to

buy Indian cheese. Amul is exporting cheese to the Middle

East, USA, Singapore, Hong Kong, and neighbouring countries like Bhutan, Nepal and Sri Lanka.

Though there are many vegetarian cheese producers in the

world, Amul would certainly be the single largest exporter.

Amul Cheddar is the top selling brand in India, with a 50 per

cent share of the market. Its cheese spreads have a 90 per

cent share of the market, while it is the only large player in

mozzarella pizza cheese15.

CONCLUSION

The popularity and use of cheese though is less, yet it is

remarkable as it is still making lots of profits. The demand

for cheese is projected to grow from about Rs. 4.50 billion in

2003-04 to overRs 11.00 billionby the terminal year of the

projection period, 2014-157. Cheese is becoming a popular

item in the menu of all relatively affluent families. Nowhere

else do people consume cheese in so many different forms

and use cheese in so many varieties of food preparation as in

India. Slowly but surely, it will penetrate into the rural markets.

With one of the largest consumer bases in the world, cheese

could be a multi-million dollar industry in India.

Amul - the Worlds Biggest Vegetarian Cheese Brand

The Land of sacred cows has become the worlds largest pro-

REFERENCES

1. Acharya S & Yadav RK (1992). Production and marketing of milk and milk products in India. New Delhi: Mittal Publications. 2. Antoon Cox, Italian cheese, sold in

the US, made in India, Jan 13, 2008, http://www.indianexpress.com/news/Italian-cheese,-sold-in-the-US,-made-in-India/260933/ 3. Chawla, A., Chawla, N., & Pant,

Y. (2009). Milk and Dairy Products in India Production, Consumption and Exports: Introduction. India: Hindustan Studies & Services Ltd. Retrieved 17 June 2012,from

http://www.hindustanstudies.com/files/dairysept09tocintro.pdf 4. Ghore, Sudhir, White Crisis, Apr 23, 2010, http://indiatoday.intoday.in/story/White+crisis/2/94231.html

5. Mathur, H. (2007). Indian dairying: Prospects and Opportunities, Dairy India, 2007, pp 43-49. 6. Nair KN (1987). Animal protein consumption and the sacred cow

complex in India. In Harris and Ross (eds.). Food and evolution: Toward a theory of human habits. Philadelphia: Temple University Press. 7. Ministry of Food Processing

Industries, Government of India website, http://www.mofpi.nic.in 8. Patel, H.G (2005). Functionality of Cheeses, Indian Dairyman, 57(2): 65-72. 9. Processed Foods

and Agribusiness Opportunities for investment in India KPMG India and FICCI Research Paper 10. Reshmi. R. Dasgupta, The upcoming trends in Indian Cheese

Market, Mar 27, 2011,http://economictimes.indiatimes.com/features/et-sunday-magazine/the-upcoming-trends-in-indian-cheese-market/articleshow/7794183.cms 11.

Singh, R. (2011). India Dairy and Products Annual Report 2010. USDA Foreign Agricultural Service: Global Agricultural Information Network. Retrieved 16 June 2012,

from static.globaltrade.net/files/pdf/20110226231255627.pdf 12. http://www.india-reports.com/reports/Cheese10.aspx 13. http://www.india-reports.com/reports/The

Indian Cheese Industry.aspx 14. http://www.india-reports.com/reports/Cheese2.aspx 15. http://www.indiapackagingshow.com/news/newsfiles/403.htm 16. http://www.

india-reports.com/reports/Cheese12.aspx

250 X PARIPEX - INDIAN JOURNAL OF RESEARCH

Das könnte Ihnen auch gefallen

- Dairy Farming Is A Class of Agriculture For LongDokument13 SeitenDairy Farming Is A Class of Agriculture For LongSUNILKUMARPAHARINoch keine Bewertungen

- Indian pulses market sees steady to weak trendDokument4 SeitenIndian pulses market sees steady to weak trendravishri1234Noch keine Bewertungen

- Importance of PulsesDokument3 SeitenImportance of Pulsesseesi alterNoch keine Bewertungen

- Chickpeas and Peas Prices Remain FirmDokument15 SeitenChickpeas and Peas Prices Remain FirmsomyasaranNoch keine Bewertungen

- Journal of Food LegumesDokument83 SeitenJournal of Food Legumesdonbosskiss50% (2)

- India Pulses Report January 2012Dokument64 SeitenIndia Pulses Report January 2012chandu1113Noch keine Bewertungen

- NAmkeen PPRDokument46 SeitenNAmkeen PPRFăÍż SăįYąð100% (1)

- Ramdev Food's Project ReportDokument13 SeitenRamdev Food's Project ReportChitrang Patel67% (3)

- Ent Report Mother DairyDokument8 SeitenEnt Report Mother DairyAbhijeet SharmaNoch keine Bewertungen

- Survey of cattle feed distribution network in BiharDokument39 SeitenSurvey of cattle feed distribution network in BiharKing Deepak SnehiNoch keine Bewertungen

- International Rice Profile: Production, Varieties, PolicyDokument14 SeitenInternational Rice Profile: Production, Varieties, PolicySonaliiiNoch keine Bewertungen

- Analyzing The Promotional SchemeDokument60 SeitenAnalyzing The Promotional Schemepl_vaibhav101Noch keine Bewertungen

- Bhushan Flour Mill A9-B9 Live ProjectDokument39 SeitenBhushan Flour Mill A9-B9 Live ProjectABHIRUP ANANDNoch keine Bewertungen

- Project On The Establshment of Animal FeDokument39 SeitenProject On The Establshment of Animal FeYoniNoch keine Bewertungen

- Working Stress of Women in A Cashew Processing IndustryDokument18 SeitenWorking Stress of Women in A Cashew Processing Industryramprasad88100% (1)

- Project Report For Animal Feed PlantDokument6 SeitenProject Report For Animal Feed Plantsamars05Noch keine Bewertungen

- Agricultural Sector in PakistanDokument4 SeitenAgricultural Sector in PakistanimranramdaniNoch keine Bewertungen

- TURMERIC PROCESSING STEPSDokument9 SeitenTURMERIC PROCESSING STEPSTarsem MittalNoch keine Bewertungen

- Dairy and Products Annual - New Delhi - India - 10!15!2021Dokument13 SeitenDairy and Products Annual - New Delhi - India - 10!15!2021Saurabh NawaleNoch keine Bewertungen

- Market Opportunities in The Indian Dairy Market PT 1Dokument60 SeitenMarket Opportunities in The Indian Dairy Market PT 1Burcu Sarı100% (1)

- Snacks & NamkeensDokument33 SeitenSnacks & NamkeensNavjot SinghNoch keine Bewertungen

- Presentation On Comparative Analysis of The New IndianDokument22 SeitenPresentation On Comparative Analysis of The New IndianseemranNoch keine Bewertungen

- New ServottamDokument63 SeitenNew Servottammahendrabpatel100% (1)

- Eri and MugaDokument11 SeitenEri and Mugajatin_saikia100% (1)

- Pre-Feasibility Study for Parboiled Rice PlantDokument43 SeitenPre-Feasibility Study for Parboiled Rice PlantJunaid AhmedNoch keine Bewertungen

- Indian Dairy Industry ProfileDokument42 SeitenIndian Dairy Industry ProfileKajal PundNoch keine Bewertungen

- Shikharjee Rice Oil LLP PDFDokument29 SeitenShikharjee Rice Oil LLP PDFkushal chopdaNoch keine Bewertungen

- Spices Cryo-Grinding UnitDokument7 SeitenSpices Cryo-Grinding Unitbenrakesh75Noch keine Bewertungen

- Venkys ChickenDokument20 SeitenVenkys ChickenNilesh AhujaNoch keine Bewertungen

- Toaz - Info FMCG PRDokument71 SeitenToaz - Info FMCG PRPratham SharmaNoch keine Bewertungen

- Introduction of PulsesDokument48 SeitenIntroduction of PulsesAnjali Sinha0% (1)

- Current Status of Food Processing IndustryDokument19 SeitenCurrent Status of Food Processing IndustryAmit Kumar90% (21)

- Market Research Study Cashew-Export & DomesticDokument13 SeitenMarket Research Study Cashew-Export & DomesticAdwait GoreNoch keine Bewertungen

- Market Milk: Latha Sabikhi Y. Kotilinga ReddyDokument184 SeitenMarket Milk: Latha Sabikhi Y. Kotilinga Reddyprateek kushwahaNoch keine Bewertungen

- Srisairice Mill ProjectDokument59 SeitenSrisairice Mill Projectnational courses100% (1)

- Goat - Value - Chain - Study - Heifer - 2012Dokument57 SeitenGoat - Value - Chain - Study - Heifer - 2012Arpan ParajuliNoch keine Bewertungen

- History of Indian Spices: C C C C C CDokument9 SeitenHistory of Indian Spices: C C C C C CTanvi Rajde67% (3)

- Agro Chems Indian Agrochemical IndustryDokument42 SeitenAgro Chems Indian Agrochemical Industryapi-383389367% (3)

- An Exploratory Study On Competitive Milk Brands With Reference To Pathanamthitta DistrictDokument78 SeitenAn Exploratory Study On Competitive Milk Brands With Reference To Pathanamthitta DistrictShamilpsNoch keine Bewertungen

- Shri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryDokument9 SeitenShri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryNeerajSinghNoch keine Bewertungen

- E-Contract Labour Management System (e-CLMS) : User ManualDokument20 SeitenE-Contract Labour Management System (e-CLMS) : User Manualsrinivasyadav4Noch keine Bewertungen

- Ayurvet HPonics DubaiDokument28 SeitenAyurvet HPonics DubaidrgsainiNoch keine Bewertungen

- Dairy cooperatives-III PDFDokument12 SeitenDairy cooperatives-III PDFTapesh AwasthiNoch keine Bewertungen

- Dhanhar MasalaDokument116 SeitenDhanhar MasalaChetan Patel100% (1)

- 3.data - Milk Production and ConsumptionDokument7 Seiten3.data - Milk Production and ConsumptiondairyNoch keine Bewertungen

- Summer Internship Final ReportDokument57 SeitenSummer Internship Final ReportRiya BhogadeNoch keine Bewertungen

- Packaged Rice Market in India PDFDokument2 SeitenPackaged Rice Market in India PDFMahmood SadiqNoch keine Bewertungen

- Ramdev Garam Masala Retailer Satisfaction StudyDokument52 SeitenRamdev Garam Masala Retailer Satisfaction StudyGaurav GagwaniNoch keine Bewertungen

- Start a Namkeen FactoryDokument69 SeitenStart a Namkeen FactoryVishal Govind ChakrawarNoch keine Bewertungen

- An Introduction To Indian Spices FinalDokument52 SeitenAn Introduction To Indian Spices Finalmonicasharma02Noch keine Bewertungen

- Export of Red ChilliesDokument31 SeitenExport of Red ChilliesViraj PisalNoch keine Bewertungen

- SPICE GRINDING UNITDokument12 SeitenSPICE GRINDING UNITveer marathaNoch keine Bewertungen

- Venkys ChickenDokument20 SeitenVenkys ChickenMehervaan Kohli0% (1)

- Rkvy 14th FinDokument38 SeitenRkvy 14th FinAfeef AyubNoch keine Bewertungen

- Cheesemaking FundamentalsDokument39 SeitenCheesemaking FundamentalsPreeti Sharma100% (1)

- Pepsi Potato Contract FarmingDokument14 SeitenPepsi Potato Contract Farmingcobaltdeer50% (2)

- Kerala State Backward Classes Development Corporation LTD.: A Govt. of Kerala UndertakingDokument289 SeitenKerala State Backward Classes Development Corporation LTD.: A Govt. of Kerala UndertakingJamesNoch keine Bewertungen

- Cheese Market India AnalysisDokument17 SeitenCheese Market India AnalysisPulkit Agarwal100% (2)

- Cheese: Cheese Consumption in PakistanDokument5 SeitenCheese: Cheese Consumption in Pakistanmahnoor ashiqNoch keine Bewertungen

- AMUL Finall MPR PROJECT (MANVI)Dokument45 SeitenAMUL Finall MPR PROJECT (MANVI)Rishita TayalNoch keine Bewertungen

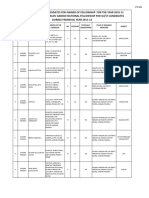

- Sr. Division Depot Name Place Address State Mobile EmailDokument75 SeitenSr. Division Depot Name Place Address State Mobile EmailOmkar DaveNoch keine Bewertungen

- CBSE Class 1 Maths Chapter 12 WorksheetDokument5 SeitenCBSE Class 1 Maths Chapter 12 WorksheetnidyaNoch keine Bewertungen

- APSPDCL Phone NumbersDokument8 SeitenAPSPDCL Phone NumbersManoj Digi LoansNoch keine Bewertungen

- Art & CultureDokument397 SeitenArt & CultureIAS Tapasvi100% (1)

- CBSE Class XII Compartment Exam Results 2022Dokument1 SeiteCBSE Class XII Compartment Exam Results 2022Corporate Admission CellNoch keine Bewertungen

- General Category: RESULT of PMT-2010 (Screening) ExaminationDokument17 SeitenGeneral Category: RESULT of PMT-2010 (Screening) ExaminationSoumya RayNoch keine Bewertungen

- Indian English Literature PDFDokument6 SeitenIndian English Literature PDFDDK0% (2)

- Delhi Route Map :: Delhi Colleges On Map (Delhi University)Dokument1 SeiteDelhi Route Map :: Delhi Colleges On Map (Delhi University)TehseenDehalvi50% (2)

- List of Govt. Sponsored Libraries in The District of HOWRAHDokument8 SeitenList of Govt. Sponsored Libraries in The District of HOWRAHHrittick Ram100% (1)

- Agriculture in India Issues and ChallengesDokument9 SeitenAgriculture in India Issues and ChallengesAkhil SatheeshNoch keine Bewertungen

- Navodaya All District PDFDokument356 SeitenNavodaya All District PDFMurugesh GowdaNoch keine Bewertungen

- Women Freedom FightersDokument3 SeitenWomen Freedom FightersKumar DateNoch keine Bewertungen

- India's Diverse Landscape and PeopleDokument15 SeitenIndia's Diverse Landscape and PeopleSuraj Roy100% (2)

- Sindhi Calender 2023Dokument1 SeiteSindhi Calender 2023Ranbir KapoorNoch keine Bewertungen

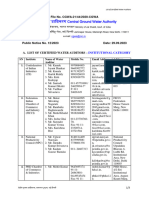

- Accredited Water AuditorsDokument3 SeitenAccredited Water AuditorsMithilesh KumarNoch keine Bewertungen

- India PartitionDokument14 SeitenIndia PartitionVinayan NairNoch keine Bewertungen

- Bank Branches ListDokument31 SeitenBank Branches ListPathan MustakimNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument29 SeitenNew Microsoft Office Word Documentneeraja126Noch keine Bewertungen

- Changing Business Environment in India - Group 9Dokument112 SeitenChanging Business Environment in India - Group 9rajat_singla100% (1)

- A Semi-Detailed Lesson Plan in Social Studies III-World StudiesDokument4 SeitenA Semi-Detailed Lesson Plan in Social Studies III-World StudiesNardNoch keine Bewertungen

- Amita Baviskar profile: Indian sociologist and environmental activistDokument18 SeitenAmita Baviskar profile: Indian sociologist and environmental activistThresy VallikappenNoch keine Bewertungen

- Model Paper BA (JMC) 2015Dokument4 SeitenModel Paper BA (JMC) 2015Mota Chashma100% (1)

- Janta Dal. This Is One of The Political Parties in India.Dokument1 SeiteJanta Dal. This Is One of The Political Parties in India.pradeepsambangiNoch keine Bewertungen

- 12 Political Science Challenges of Nation Building - Map & Cartoons PDFDokument3 Seiten12 Political Science Challenges of Nation Building - Map & Cartoons PDFsayooj tv86% (21)

- The Gift of India-MaterialDokument2 SeitenThe Gift of India-Materialvasu patelNoch keine Bewertungen

- The International Business ImperativeDokument25 SeitenThe International Business ImperativeitaliasixNoch keine Bewertungen

- Ra List ReportDokument171 SeitenRa List Reportutut yfhgNoch keine Bewertungen

- American Views. Jinnah As NegotiatorDokument8 SeitenAmerican Views. Jinnah As NegotiatorSaeed BrarNoch keine Bewertungen

- Address of The CandidateDokument201 SeitenAddress of The CandidateKathleen MaeNoch keine Bewertungen

- Books&Authors EbookDokument6 SeitenBooks&Authors EbookAnonymous ngY6NCuBNoch keine Bewertungen