Beruflich Dokumente

Kultur Dokumente

Eco CH 1

Hochgeladen von

liaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Eco CH 1

Hochgeladen von

liaCopyright:

Verfügbare Formate

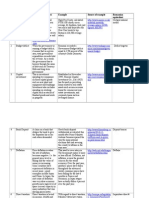

SHARON HS ECO NOTES CH 1:

International Economic

Integration:

THE GLOBAL ECONOMY:

The global economy consists of all the

countries in the world that produce goods and

services that contribute to Gross World

(GWP) or also

global

output.

Product

These countries

engage

in the world

In 2011, there were 34 advanced economies

which accounted for 15% of the world

population, 51% of world GDP and 62% of world

exports.

trade of goods and services, as well as

Three sub groupings of advanced

foreign direct and portfolio investment.

economies:

Economies become integrated through a

- Major advanced economies (G7): US, Japan,

reduction in trade barriers (tariffs &

Germany, UK, France, Italy and Canada. It

subsidies)

accounts for 38.5% of world GDP and 34.2% of

ECONOMIC INTEGRATION: the

world exports in 2011.

liberalisation of trade between two or more

- Euro Area of 17 countries: Economic and

countries formation of:

Monetary Union, which accounted for 14.3% of

- Free Trade Area: where a group of member

world GDP and 25.6% of world exports.

countries abolish trade restrictions between

- 4 newly industrialised Asian economies of

themselves but retain restrictions against nonSK, Taiwan, HK & Singapore accounted for

member countries. E.g. NAFTA where tariffs

3.9% of world GDP and 9.5% of world exports.

Major emerging economies BRIC nations

between the member countries of Canada, the

of Brazil, Russia, India and China (+ oil

USA and Mexico have been removed but each

exporting countries such as Saudi Arabia &

country maintains its own tariffs towards nonKuwait), which have sustained high rates of

members of NAFTA.

- Customs Union: where members not only

economic growth and development in the

abolish trade restrictions between themselves

2000s and now accounts for ~25.9% of world

World

but adopt a common set of trade restriction

GDP.GDP:

Total

market

value

of all goods and services

Gross

World

Product:

against non-member countries. E.g. The

produced

countries

over is

a measured

given timeby

period

Size of by

theall

global

economy

the

European Economic Community (EEC) prior to

(usually

one

year),

adjusted

for

national

variations

IMF which values countries GDP at PPP

1993.

- Common Market: involves the features of a

(purchasing power parities) in US dollars (the

customs union but allows for the free mobility

worlds reserve currency).

of labour and capital within the common market

countries, as well as the free flow of goods and

services.

E.g. European Community (EC) between 1993

- Adv economies 51% of world trade output

and 1998

- Developing countries 49% of world GDP

- Monetary Union: characterised by the

(2011)

features of a common market plus the adoption

HOWEVER, emerging & developing economies

of a common currency and the co-ordination of

have higher rates of growth & a rising share of

monetary policy through a single central bank.

world GDP. E.g. China and India produce 20% of

Fiscal, welfare and competition policies may

world GDP, the Euro Area 14.3% and the USA,

also be co-ordinated between member

19.1%.

countries. E.g. Economic and Monetary Union

During the GFC in 2009, advanced economies

Greater international economic integration

contracted whilst China and India and other

has been accompanied by an increasing

emerging economies showed slow but positive

proportion of world trade carried out by

growth.

multinational corporations (MNCs)

Emerging economies

and developing

economies inin

Advanced

face challenges

IMF classifies countries into:

the

process

of

raising

their

rates

economic

Advanced economies

characterised

by

sustaining

future rates

of GDPofgrowth.

growth

and

development,

but

have

lower

per

high

levels

of

economic

development,

with

They are:

capita incomesand

living standards

than the

average

per capita incomes

of >US$30,000

Undergoing financial restructuring with

major financial institutions repairing their

balance sheets and authorities strengthening

prudential supervision after the GFC.

- Demographic ageing, which limits

productivity growth + financial burden on

government finances.

- Large budget deficits and levels of public

debt which must be reduced through lower gov

spending & taxes, which will limit their

capacity for future growth.

GLOBALISATION:

ECONOMIC INTEGRATION: When trade

barriers (tariffs, subsidies & quotas) are

reduced or removed between countries to

GLOBALISATION:

levelof

of

facilitate the growthIncreasing

in FIT & flows

economic integration between countries,

leading to the emergence of a global market

place

Characteristics

of GLOBALISATION:

or a single world

market.

- The integration of national financial systems

has created a world system global

integration integration of K markets

+ mobility of K

(I.e. Flows of foreign direct and portfolio

investment & foreign exchange between

countries & regions)

- Trade & investment across national

boundaries is conducted across national

boundaries (& are increasingly footloose in

seeking out the most competitive locations

for business & maximise profits)

- ICT revolution new types of products,

services & employment in business servicing

the global market through the internet +

electronic commerce.

- Global market place includes the Asia

Pacific region (E.g. Japan, China, India & the

NIEs) + NAmerica & Europe as major regions

of economic activity.

- Growth products such as: ETMs,

technology goods & specialised services

such as finance, business, accounting,

insurance, transport, telecommunications,

entertainment, music, media & IT.

- International trade is linked with I as

companies use foreign direct investment to

gain access to foreign markets & to generate

exports of inputs & expertise from the home

country. (1992 1999: world trade volumes

grew at an average of 6.6& per annum, while

Globalisation has been adopted by adv

FDI grew by 23% per annum).

economies as a policy strategy through

TRADE LIBERALISATION and

MICROECONOMIC REFORMS in

Evidence of FINANCIAL CONTAGION

speed & impact of:

- GFC (2008-09) which caused a global

recession in output, trade & employment.

- European Sovereign Debt Crisis (201112), which was also transmitted to other

regions lower growth in O, X, foreign

Foreign Direct Investment (FDI): where

investment.

ordistribution

buy a controlling

- companies

Wideningestablish

gap in the

of Y & interest

in wealth

a foreign

subsidiary.

(Total

FDI valued

at

between

adv &

emerging

countries.

Four

Foreign

major

Portfolio

forces that

Investment:

underpinwhere equity

globalisation:

and debt securities are acquired (has grown

1)4)

levels

of technology,

communication,

substantially,

customisation

and totalled

of products

more than

& services

transport

&

information

technology

has

US$715,869m

led to the development

in gross terms

of a

innetwork

2007)have

or

reduced

transport,

communications

&

transaction

global web of production & distribution

costs in conducting global business.

2) The liberalisation of the global trading

environment has occurred through the signing

of bilateral, regional and multilateral trade

agreements.

3) Strengthening of financial and trade

linkages between countries faster

transmission of financial & economic shocks

TRADE, FINANCIAL FLOWS & FOREIGN

INVESTMENT:

Main

Globalisation

has

categories

ofled to growth in world

output & trade.

merchandise

Main categories of

exports are:

services exports

- Food

are:

- Agricultural raw

- Commercial

materials

- Transport

- Fuels

- Travel

- Ores

- Insurance

- Metals

- Financial

- Manufactured

- Computer

- ICT

goods

FINANCIAL FLOWS:

The GFC has led to significant falls in financial

activity (Debt securities as companies have

reduced their debt to ratios)

Main participants in the global forex

Also an in bond issues by governments to

markets are:

fund higher budget deficits due to the use of

(i) Reporting dealers commercial &

fiscal stimulus packages.

banks acting

on behalf of clients

investment

WORLD FOREX

MARKET:

total turnover

in forex

2010)markets = US$4

(38.9%

Daily of

turnover

in global

(ii) Financial institutions Hedge funds &

000 billion in 2010.

pension funds that buy & sell currencies on the

behalf of clients to make profits (47.7% of total

turnover in 2010)

(iii) Non-financial institutions govs, MNCs,

Many host govs offer incentives to

MNCs such as:

Tax allowances, government assistance, access

to infrastructure, less stringent labour &

environmental regulations.

GLOBALISATION AND FOREIGN

INVESTMENT:

General growth in FDI & FPI has been due to

the easing of capital controls between

countries as the process of financial

deregulation has spread globally.

Central banks have also removed direct

lending controls allowing a greater role for

market forces to allocate saving &

investment resources.

MNCs & FOREIGN INVESTMENT:

MNCs: Enterprises that manage production or

deliver services in more than one country and

are responsible for much of the worlds FDI

since they set up subsidiaries in other

countries to gain access to global markets.

They are large in terms of sales revenue,

output and employment & can have a

powerful influence on host economies

through their control of resources,

production, employment & sales

activities.

Top ten MNCs in 2010-11 include:

- Retailing (Walmart stores)

- Petroleum (E.g. Royal Dutch Shell, Exxon,

BP, Sinopec, China National Petroleum and

Chevron)

- Energy (State Grid) & automobiles (E.g.

Toyota

Motor) acquisition of >10% of the

FDI

by MNCs

voting power or shareholdings of an

enterprise in another economy by:

- Incorporating a wholly owned subsidiary or

company

- Acquiring shares in an associated enterprise

- Through a merger or acquisition of an

unrelated enterprise

- Participating in an equity joint venture with

DISADVANTAGES OF MNCs:

- Some MNCs exert undue market power over

host govs & can exploit local tax, labour &

environmental legislation for the benefit of

foreign investors.

- Remit profits & dividends to their parent

companies overflow of funds in host countrys

ADVANTAGES:

- Transfer of technological know-how

- Creation of export & employment

opportunities

Generation

of additional

tax revenue to host

GLOBAL

PRODUCTION

WEBS:

Global Production Networks: Webs that exist

where raw materials, processing, manufacturing

& the assembly of products take place in

different countries under the centralised control

of the

corporation.

The

major

factor driving the development of

global webs is the minimisation of costs in

achieving economies of scale.

Manufacturing plants tend to be located in

countries with low labour costs & favourable

government policies such as tax concessions &

export incentives (I.e. China, India, SK, Taiwan,

HK, Singapore, Malaysia, Indonesia & Mexico)

Once manufactured & assembled, the products

are distributed by MNCs to major high income

ECONOMIC

BENEFITS

OF North

TECHNOLOGY:

markets such

as East Asia,

America &

-Europe.

The ordering of stock & inputs can be done

instantaneously,

allowing firms

to respond

Developments

in technology,

transport

&

to changes in demand

communications

MNCs quickly.

to utilise global supply

-chains

Firmswhere

can use

information

they can sourcetechnology

the cheapest

systems

to

their inventories more

inputs of LLKEmaintain

for their operations.

efficiently, thereby

reducing inventory &

TECHNOLOGY,

TRANSPORT,

warehousing costs.& LABOUR:

COMMUNICATIONS

-Technological

New productsrevolution

& services

greater

based

onchoice

the use

for consumers

& international

competition

of personal

computers

and the take-up

of

lower

prices

of

goods

and

services

in

digital technologies.

global markets.

- Time savings through the use of the

Internet & electronic commerce firms to

labour costs in marketing & distributing

final G&S to consumers.

- Role of wholesalers & middlemen in the

distribution chain has with the use of ecommerce cuts in costs higher profits.

- Rapid changes in technology allow for a

faster rate of innovation in product

development, production methods,

marketing & distribution.

their home countries by remitting savings

from their wages & salaries in the form of

current transfers.

Changes in technology are created by countries

which are technology leaders & innovators. I.e.

USA & Japan

Transport infrastructure roads, railways,

ports, waterways, airports vital for the

operation of domestic economies & the global

economy.

Communications new technology &

methods of financing along with privatisation &

market liberalisation have led to the growth of

telecommunications spread of mobile phone

technology, internet access & ICT.

INTERNAL DIVISION OF LABOUR &

MIGRATION:

The division of labour: The specialisation of

people according to labour tasks in production.

On a global basis, the international division

of labour is linked to the operations of

MNCs in establishing subsidiaries (i.e.

offshoring) in foreign countries to utilise

labour skills at a lower cost &

increasing profits by selling G&S to the

global market. This has:

- Led to the relocation of manufacturing

& services to emerging countries where

labour is cheaper.

- Caused de-industrialisation & job

displacement in advanced economies as

more industries locate offshore or outsource

some of their services overseas.

Examples of the international division of

labour:

- The establishment of manufacturing plants

(either as subsidiaries or joint ventures) by MNCs

in China and Asian NIEs to utilise an abundant

supply of cheap labour.

- The outsourcing of telecommunications,

computing, IT, accounting, insurance, finance &

banking services to offshore locations, where

there is an abundance of labour.

Workers remittances:

Payments sent by foreign workers to their

home. make a substantial

families

Foreignatworkers

contribution to the balance of payments of

Problems associated with the global

movement of people:

- Workers from developing countries were often

exploited by their employers, because they were

not protected by ILO minimum standards for

wages & working conditions.

- Emerging black market in migrant workers

being smuggled into advanced counties to work

in illegal industries such as prostitution, drug

trafficking & other criminal activities

- Growing need for adv countries to labour

supply because of population ageing use of

illegal migrant labour & the associated cost of

authorities expending resources in enforcing visa

& other regulations on illegal workers.

- There has been a flow of illegal refugees from

many emerging & developing economies into

developed countries in the EU & North America

seeking refugee status, employment

opportunities & higher living standards u/e &

cost of apprehending, detaining & repatriating

illegal immigrants to their home countries.

- Brain drain of highly skilled workers

(E.g. in medicine, pharmaceuticals,

science & IT),

INTERNATIONAL

& REGIONAL BUSINESS

leaving

adv & dvp countries to seek employment

CYCLES:

INTERNATIONAL BUSINESS CYCLE:

changes in world output or GDP over time.

GLOBAL RESOURCES BOOM (2004-08):

World growth ~5% per annum, with adv

countries (esp G3 USA, Euro Area & Jap)

growing by 3-4% annually, and emerging

economies (BRICs) growing at ~7.5% p.a.

GLOBAL FINANCIAL CRISIS (2009):

Synchronised fall in global output & trade,

with

an annual contraction in world GDP of -0.5%.

Global Economic Recovery (2010):

World GDP by 5%, though this to

3.9% b/c of the European Sovereign Debt

Crisis with the IMF forecasting growth of 3.54% (2012/13)

FOUR MAJOR PHASES OF THE

INTERNATIONAL BUSINESS CYCLE:

i) Expansion characterised by a in

demand, a fall in inventories, increased

demand for resources (including labour) & new

investment in plant & equipment. E.g. Between

2003 05, the global resources boom led to a

world growth of4.5% p.a. (above trend)

ii) Peak characterised by supply or capacity

constraints, where inflation starts to & growth

in global outpit is no longer sustainable. E.g.

Between 2006-07, global growth peaked at

5.2% & global inflationary pressures emerged

due to higher oil & commodity prices.

iii) Downswing characterised by demand &

output & a rise in the rates of u/e as global

economic activity slows.

E.g. The onset of the GFC in 2007-08 & the

impact of the European Sovereign Debt Crisis in

2011-12.

iv) Trough or recession fall in global output

& demand reach their minimum point. E.g. The

GFC & world recession in 09 when global

growth in GDP by -0.5% before a recovery

began in 2010-11.

IMPACT OF CHANGES IN THE INTL

BUSINESS CYCLE:

Changes in the intl business cycle can affect

domestic business cycles depending on:

- A countrys level of internationalisation (I.e.

Exports & imports as a % of GDP)

- Integration of a national economy with the

world economy through trade, finance, FDI &

foreign exchange flows.

Main transmission mechanism for these

changes are through changes in world

demand, output, trade & finance:

(i) in world spending, output & growth in

demand for a countrys exports rate of GDP

growth (opp if )

(ii) If WG > countrys domestic rate of growth,

exports faster than imports, balance of

payments on current account should improve &

move into surplus. (opp if DG>WG)

(iii) Higher WG (E.g. resources boom) in

commodity prices & an appreciating exchange

rate for countries experiencing a in export

income, such as resource exporters. (opp will

occur with lower/negative WG)

STRUCTURAL SHOCKS:

(iv) Changes in financial flows A in foreign

- Negative real shocks the two world oil

confidence

increasing

capital inflows

investor

EXTERNAL

SHOCKS

TRANSMITTED

TO

crises

in

(i.e.

foreign

direct

&

portfolio

investment)

to a

DOMESTIC

ECONOMIES:

1973 & 1979, which raised the cost of energy,

country or region, helping to raise DG by

inflation

1) REAL SHOCKS: changes in real variables

&

slowed

WG, output,

particularly

in oil importing

such

as world

commodity

prices ornations

(USA

or Jpn) change.

technological

- Positive real shocks the global resources

boom, which lifted WG to >5% p.a. demand

2) FINANCIAL/MONETARY SHOCKS: changes

in financial variables such as intl share prices, a

rise in intl interest rates or inflation rates.

Financial shocks are transmitted more quickly

than real shocks, through changes in asset

prices (i.e. interest rates, exchange rates &

share prices) & capital flows in financial

markets.

E.g. The rapid withdrawal of capital from some

Asian economies in 1977 which caused the

Asian Currency Crisis (SK, Thailand, Indonesia

& Phillipines)

FINANCIAL SHOCKS:

Lead to a collapse in asset prices & c + biz

confidence & is transmitted from financial

markets to the real economy

Lower output growth & u/e rates.

E.g. collapse of the sub-prime mortgage

market in 2007-08 in the US housing industry

transmitted to global credit & share markets

in the form of i rates on credit & share

REGIONAL

BUSINESS

CYCLES:

prices for financial

stocks.

REGIONAL BUSINESS CYCLE: changes in

output, trade & financial flows in particular

geographic regions where economies are very

integrated, usually through a free trade

agreement,

customs cycles

union orcontribute

monetary union.

Regional business

to

the intl business cycle, with most of

world growth or GDP sourced from the

following regions:

- North America (USA, Canada & Mexico)

which are linked by the North American Free

Trade Agreement (NAFTA)

- EU (27 member countries with Germany, the

UK, France & Italy in the G7)

- East Asia: Japan, China, the Asian NIEs

(Korea, Taiwan, Singapore & HK) + other East

Asian

The growth

of theinUS

economy

as the Indo

worlds

economies

ASEAN

(Thailand,

+

largest

economy

has

been

the

main

driver

of

Philippines)

WG post-1945. The emergence of China &

India as major economic power since the

1990s has helped sustain high rates of EG due

to their demand for resources & capital.

GLOBAL FINANCIAL CRISIS:

July & Aug 2007 intl financial markets

experienced extreme volatility b/c of the

collapse of the sub-prime mortgage market in

the USA.

Bankruptcies rose in the major sub-prime

mortgage market & the collapse in the market

was made worse by a lack of liquidity.

The effects of this collapse were transmitted to

intl markets where asset prices for shares,

bonds

other securities

andcentral

there was

an

The

US&Federal

Reserve &fell

other

banks

upward movement

in cash

interest

rates to

to restore

reflect

injected

liquidity into

markets

the

higher

risk

of

borrowing.

confidence.

HOWEVER, the financial crisis in the US

housing market deepened in 2008 when it

spread to the real economy, causing sentiment

in global financial markets to deteriorate

throughout 2008 as banks tightened or

withdrew funding to highly leveraged investor,

triggering the forced sale of assets.

In response:

- The US gov introduced a fiscal stimulus

package worth US$14b to support

household spending & biz investment.

- The Federal Reserve cut the federal funds

Despite this, the crisis worsened in

rate to 2% to underpin confidence & liquidity.

September 2008, with the collapse of

Lehman Brothers merchant bank & the US

government providing financial support for

two mortgage guarantors Freddie Mac &

Fannie Mae, & the American Insurance Group

(AIG)

Transmission

The credit crisis

then transmitted

other

process

of the GFCtowas

major

due

to: economies (Euro Area, Jpn, NIEs) b/c of

linkages

to US financial

markets & the

(i)their

The GFC

represented

an external

US export

market.

financial

shock

to domestic economies

caused

By Dec

2008,

there wastoanthe

unprecedented

by a disruption

functioning&

global

contraction

output,

ofsynchronised

global credit

markets.

These in

markets

trade

& capital

(~-6.25%

contraction

are

necessary

forflows.

the smooth

functioning

of

in

global

GDP)

economic activity including international

trade & investment.

(ii) The financial shock was transmitted

quickly from the USA to other adv &

emerging economies global credit crisis &

ultimately a GFC (synchronised shock)

(iii) The GFC developed into a global

recession b/c it was transmitted from the

financial sector to the real economy,

affecting confidence, E, O & u/e.

(iv) The GFC required co-ordinated policy

responses by G20 govs in the form of cuts

to official interest rates, the use of fiscal

Since then, government policy

responses have focused on breaking

the cycle between financial market

stress & real economic activity by using

policies such as:

Governments worldwide extended

guarantees for bank deposits & announced

guarantees of banks wholesale funding, and

in some countries such as the USA & Britain,

insolvent financial institutions were recapitalised with public funds.

- Central banks cut official interest rates to

record lows & used a range of liquidity tools

to support demand & ease credit market

conditions.

- Governments

the

Major

trends to around

emerge

inworld

world trade &

implemented

substantial

fiscal

finance in the 1990s & 2000s:stimulus

& eastern

European

countries

has

the demand

to boost

growth

& support

(i)packages

The globalisation

of world

trade

for capital,

as

of

financial

system

stability,

including

employment.

In March

G20

emergence

of a E.g.

global

market2009.

place,The

with

the

US$1.1trillion

in

funding

for

intl

financial

institutions

economies announced fiscal stimulus

(IMF & World Bank) & trade finance.

European Sovereign Debt Crisis:

During the GFC, most governments (esp adv

economies) increased G to support confidence &

employment.

This in G occurred at a time where there was a

in T due to u/e & biz profits & consumer

expenditure.

This fiscal

led to a

cyclicalof

deterioration

in T & a

The

position

most adv economies

deteriorated

structural induring

G, resulting

the GFC

in larger

because

budget

of:deficits

(i)

&

A decline

levels ofinpublic

the level

borrowing.

of real GDP

(ii) The budgeting impact of automatic stabilisers

(iii) Fiscal stimulus measures

The IMF expects fiscal consolidation to occur

(iv) Government support for banking systems

using policies such as:

(i) Discretionary financial actions such as

reductions

Although budget

have

narrowedtaxes.

since

in gov deficits

spending

+ increased

2009,

they remain large

in many

economies &

(ii)

An improvement

in the

automatic

public debt of

to using

GDP ratios

have continued

togov

stabilisers

tax revenue

& reduced

increase.

spending associated with higher growth and lower

u/e.

(iii) Changes in interest payments as the lvl of

net public debt is reduced over time.

Fiscal consolidation is synchronised across 8 of the

largest adv economies (G7 + Spain). However,

some of the worst affected countries were small

economies such as Greece, Ireland & Portugal,

which precipitated the European Sovereign Debt

Crisis in 2011-12, requiring large bailout packages

from the IMF & ECB in return for fiscal austerity

measures.

Overall, the policies used for fiscal consolidation

will have an effect on the economies concerned &

these policies need to be carefully managed to

avoid excessive contraction & further

increases in u/e, especially in the Euro Area

market place, with the integration of financial

countries.

systems & the dominance of MNCs in world

CHANGES IN WORLD TRADE, FINANCIAL

trade.

FLOWS & FOREIGN INVESTMENT:

(ii)global

The growth

of intra-regional

trade

As

integration

proceeds, developing

(based

on

trade

liberalisation

under

EU, of

countries are more likely to expand theirthe

share

APEC & AFTA

multi-lateral

trade

the NAFTA,

global economy,

especially

regional

centres

agreements)

saw

trade

increasingly

linked

to

with large populations and a significant economic

direct

foreign

investment.

base. (Esp emerging economies)

(iii) The growth of the Asia-Pacific region &

China as the dynamos of the world economy.

The in power of NIEs, China & India, fuelled by

sustained rates of EG, investment & trade, pose

a threat to the USA & EU.

(iv) Trade was linked with investment as

companies used FDI to access foreign markets.

They have developed intra-firm and intraindustry trade networks through global

production webs & the expansion of exports to

global markets.

(v) Trade in elaborately transformed

manufactures (ETMs) & services have growth

more rapidly than trade in primary products.

These exports were less subject to protection,

and involved a high degree of value adding

activity. MNCs have exploited the cheapest

resource inputs in emerging & developing

countries & moved capital globally to create

global production networks.

(vi) Capital flows were very mobile, with the

trade surplus of Jpn, Germany, China, Taiwan,

HK & Singapore exporting capital to trade deficit

The emergence of a global market place is

linked to the integration of the worlds major

economies, including the OECD countries, the

NIEs of Asia, China & India.

The volume of trade has also growth with

increasing global economic integration. As

more countries engage in free trade, they

increase their trade with each other & within

their

region

(intra-regional

trade) economic

Reasons

for

increasing world

integration & trade integration include:

(i) Financial deregulation & floating exchange

rates have increased the mobility of capital.

(ii) The reduction in trade barriers through

bilateral, regional & multi-lateral trade

agreements (such as trade negotiations in the

WTO) has increased trade flows.

(iii) There is intl specialisation & exchange in

ETMs & services (E.g. Finance, business,

insurance, health, education, entertainment,

media, tourism & telecommunications)

(iv) The collapse of communism in the former

transition countries have sought more

integration with the EU & the global economy

through intl trade & investment.

(v) The rise of regional economic integration

through the formation of regional trade

agreements such as the EU, NAFTA, APEC &

AFTA, SADC (SAfrica) & Mercosaur (SAmerica)

Changes in the size, pattern and direction

of world trade & investment:

The increasing importance of China & India has

been an important part of the process continuing

globalisation.

Increased trade & financial flows have

resulted from:

(i) Reductions in policy barriers to cross border

trade & capital flows

(ii)

The

increase in global

economic

integration has

Improvements

in ICT

& transport

raised living standards by allowing countries to

focus on the production & export of G&S in which

they have a comparative advantage, in exchange

for those G&S in which other countries have a

comparative advantage.

INCREASING REGIONALISM:

Trade for the 3 major economic groupings

(Europe, North America, East Asia) has become

increasingly intra-regional & has been

accelerated by preferential liberalisation

favouring intra-regional trade, both within the

EU & with the formation of the NAFTA.

East Asias intra-regional integration has

complemented its broader integration with the

rest of the world since much of the process has

been driven by the development of intraregional supply chains for the manufacture of

goods for final sale in markets outside the

region (E.g. Europe & North America)

East Asias intra-regional integration has

complemented its broader integration with the

rest of the world since much of the process has

been driven by the development of intraregional supply chains for the manufacture of

goods for final sale in markets outside the

region (E.g. Europe & North America)

Changes in the size, pattern & direction of FDI

flows have occurred because of integration.

More FDI flows to developing economies

between 2000-08 reflected the increasing

importance of countries such as Brazil, China,

India, SAfrica & Russia as destinations for

foreign capital.

In China, most foreign investment is directed to

manufacturing & urban infrastructure

development.

In India, foreign investment is directed to

developing the services & IT sectors.

Das könnte Ihnen auch gefallen

- Taste of Paradise Chapter 1Dokument8 SeitenTaste of Paradise Chapter 1Gisele Ferreira100% (1)

- International Business: by Charles W.L. HillDokument41 SeitenInternational Business: by Charles W.L. Hillosaidahmed100% (2)

- International Business: by Charles W.L. HillDokument44 SeitenInternational Business: by Charles W.L. Hillarmaan malikNoch keine Bewertungen

- (#3) Basic Concepts of Risk and Return, and The Time Value of MoneyDokument22 Seiten(#3) Basic Concepts of Risk and Return, and The Time Value of MoneyBianca Jane GaayonNoch keine Bewertungen

- 2020 ECO Topic 1 International Economic Integration Notes HannahDokument23 Seiten2020 ECO Topic 1 International Economic Integration Notes HannahJimmyNoch keine Bewertungen

- International Economic IntegrationDokument16 SeitenInternational Economic IntegrationvdbduNoch keine Bewertungen

- Contemp 2Dokument1 SeiteContemp 2Julius VillarealNoch keine Bewertungen

- The Global EconomyDokument109 SeitenThe Global EconomyJasnoor MatharuNoch keine Bewertungen

- Week 1 - Topic OverviewDokument20 SeitenWeek 1 - Topic Overviewsibzz08Noch keine Bewertungen

- Global Economy - Economics - NotesDokument19 SeitenGlobal Economy - Economics - NotesSeth kumiNoch keine Bewertungen

- The Globalization of The World Economic: Lesson2Dokument8 SeitenThe Globalization of The World Economic: Lesson2Jan Peter PiliNoch keine Bewertungen

- Economic Globalization 1Dokument7 SeitenEconomic Globalization 1Geneva CaveNoch keine Bewertungen

- Globalisation - A-Level EconomicsDokument15 SeitenGlobalisation - A-Level EconomicsjannerickNoch keine Bewertungen

- International Economics GuideDokument38 SeitenInternational Economics GuideDiem Phuong NguyenNoch keine Bewertungen

- Topic 1 - The Global EconomyDokument32 SeitenTopic 1 - The Global EconomyjonnoNoch keine Bewertungen

- Fostering Trade and Export Promotion in Overcoming The Global Economic CrisisDokument19 SeitenFostering Trade and Export Promotion in Overcoming The Global Economic CrisisShariq NeshatNoch keine Bewertungen

- Chpter 1 Introduction To Internataional Trade and AgreementDokument13 SeitenChpter 1 Introduction To Internataional Trade and AgreementJOHN MICO AMIGONoch keine Bewertungen

- 07 Chpt-7 The Trade StructureDokument32 Seiten07 Chpt-7 The Trade StructurealikazimovazNoch keine Bewertungen

- Globalization OutlineDokument3 SeitenGlobalization OutlinePeabeeNoch keine Bewertungen

- Irish Economy GDP GrowthDokument39 SeitenIrish Economy GDP GrowthGitanjali RajputNoch keine Bewertungen

- Module 1 Module in International EconomicsDokument18 SeitenModule 1 Module in International EconomicsMar Armand RabalNoch keine Bewertungen

- Advantages of Export-Led GrowthDokument10 SeitenAdvantages of Export-Led Growthaman mittalNoch keine Bewertungen

- 1 - Growth and Direction of International Trade - PPT - 1Dokument18 Seiten1 - Growth and Direction of International Trade - PPT - 1Rayhan Atunu67% (3)

- Why Study International Economics?Dokument13 SeitenWhy Study International Economics?SaadNoch keine Bewertungen

- International Business: Competing in The Global MarketplaceDokument32 SeitenInternational Business: Competing in The Global MarketplaceNeemal EhsanNoch keine Bewertungen

- Module 3 Global EconomyDokument28 SeitenModule 3 Global EconomyJeprox Martinez100% (1)

- Global Economy Topic Summary NotesDokument11 SeitenGlobal Economy Topic Summary NotesjimNoch keine Bewertungen

- Commercio Report AndrewDokument10 SeitenCommercio Report AndrewAndrew MiddletonNoch keine Bewertungen

- International Business: by Charles W.L. HillDokument44 SeitenInternational Business: by Charles W.L. Hillnostro1Noch keine Bewertungen

- Globalization: Understanding the Shifting Global Economic LandscapeDokument46 SeitenGlobalization: Understanding the Shifting Global Economic LandscapeabateNoch keine Bewertungen

- Globalization: Markets, Production and Changing DemographicsDokument37 SeitenGlobalization: Markets, Production and Changing DemographicsMyra CaringalNoch keine Bewertungen

- Chap001 GlobalizationDokument31 SeitenChap001 GlobalizationHạnh VõNoch keine Bewertungen

- Topic 1: The Global Economy: EconomicsDokument10 SeitenTopic 1: The Global Economy: EconomicsPavsterSizNoch keine Bewertungen

- Drivers of International BusinessDokument4 SeitenDrivers of International Businesskrkr_sharad67% (3)

- Final PPT Compilation in Dmba 502 by MeritcheDokument30 SeitenFinal PPT Compilation in Dmba 502 by MeritcheMeritche Rodrigo Solacito PeñarandaNoch keine Bewertungen

- INB372 Chapter 1 NotesDokument5 SeitenINB372 Chapter 1 NotesTasin RafaNoch keine Bewertungen

- 4311 1 Globalization Lec 1Dokument42 Seiten4311 1 Globalization Lec 1Abdul Moiz YousfaniNoch keine Bewertungen

- International Business: Strategy, Management, and The New RealitiesDokument25 SeitenInternational Business: Strategy, Management, and The New Realitiesmobeenscribd1Noch keine Bewertungen

- The Global Economic Crisis of 2008-2009: A. R A. GDokument19 SeitenThe Global Economic Crisis of 2008-2009: A. R A. GDanny BenmayorNoch keine Bewertungen

- Lecture 1 - Global Economy and GlobalizationDokument38 SeitenLecture 1 - Global Economy and GlobalizationThảo Nguyễn MinhNoch keine Bewertungen

- Globalization and its Impact on Indian EconomyDokument31 SeitenGlobalization and its Impact on Indian EconomyGaurav MahajanNoch keine Bewertungen

- International Business: by Charles W.L. HillDokument25 SeitenInternational Business: by Charles W.L. Hillmano_miniNoch keine Bewertungen

- Fiscal PolicyDokument6 SeitenFiscal PolicyBianca FormantesNoch keine Bewertungen

- GlobalizationDokument3 SeitenGlobalizationTuliao, Merarie Y.Noch keine Bewertungen

- International Economic Relations Full SummaryDokument41 SeitenInternational Economic Relations Full SummaryBoris van LieshoutNoch keine Bewertungen

- Eco ProjectDokument8 SeitenEco ProjectSahanaNoch keine Bewertungen

- The Structure of GlobalizationDokument16 SeitenThe Structure of GlobalizationRoselle Joy VelascoNoch keine Bewertungen

- News/uk-News/uk-Average-Salary-26500 - Figures-3002995Dokument7 SeitenNews/uk-News/uk-Average-Salary-26500 - Figures-3002995AnaMariaNoch keine Bewertungen

- Significance: Human Development IndexDokument6 SeitenSignificance: Human Development IndexAnbu GaneshNoch keine Bewertungen

- Economics - Topic 1Dokument28 SeitenEconomics - Topic 1Finn O'BrienNoch keine Bewertungen

- Globalization of Economic RelationDokument20 SeitenGlobalization of Economic RelationKristine OrtizNoch keine Bewertungen

- The Global Economy NotesDokument7 SeitenThe Global Economy Notesisabella RepoleNoch keine Bewertungen

- Globalization of Markets and ProductionDokument9 SeitenGlobalization of Markets and ProductionKatie WilliamsNoch keine Bewertungen

- Contemporary World. Lesson 2Dokument6 SeitenContemporary World. Lesson 2Kristine VillanuevaNoch keine Bewertungen

- Global Business Today: by Charles W.L. HillDokument39 SeitenGlobal Business Today: by Charles W.L. HillMori Chan GOHNoch keine Bewertungen

- Financial Management in A Global PerspectiveDokument6 SeitenFinancial Management in A Global PerspectiveRaj AnwarNoch keine Bewertungen

- II. The Global EconomyDokument37 SeitenII. The Global EconomyJenny PeraltaNoch keine Bewertungen

- Economic SystemDokument7 SeitenEconomic SystemHabib ur RehmanNoch keine Bewertungen

- MT 9 - GlobalizationDokument29 SeitenMT 9 - GlobalizationRuíz Figueroa, Jean E.Noch keine Bewertungen

- Summary Of "International Economy & The IMF" By Bernardo Lalanne: UNIVERSITY SUMMARIESVon EverandSummary Of "International Economy & The IMF" By Bernardo Lalanne: UNIVERSITY SUMMARIESNoch keine Bewertungen

- Unit 6: The Silk RoadDokument2 SeitenUnit 6: The Silk RoadLệ BânNoch keine Bewertungen

- Yes Bank - Ajit Singh (20 Lakh) (Copy)Dokument3 SeitenYes Bank - Ajit Singh (20 Lakh) (Copy)Sonu F1Noch keine Bewertungen

- Review For Quiz 3 Part 2Dokument18 SeitenReview For Quiz 3 Part 2Mariah ValizadoNoch keine Bewertungen

- Banko Sentral NG PilipinasDokument29 SeitenBanko Sentral NG PilipinasLol10_01Noch keine Bewertungen

- The Geography of Maritime Trade: Regions, Oceans, and Transit TimesDokument19 SeitenThe Geography of Maritime Trade: Regions, Oceans, and Transit TimesRicardo ChávezNoch keine Bewertungen

- Ocean Freight Market Update: June 2 0 2 2Dokument15 SeitenOcean Freight Market Update: June 2 0 2 2Salah NabaouiNoch keine Bewertungen

- RoDTEP FAQs ExplainedDokument27 SeitenRoDTEP FAQs ExplainedNeeraj VohraNoch keine Bewertungen

- International BusinessDokument9 SeitenInternational BusinessNiraj MishraNoch keine Bewertungen

- Billing and Shipping Address Details for OrderDokument1 SeiteBilling and Shipping Address Details for OrderrezolfNoch keine Bewertungen

- International PricingDokument33 SeitenInternational Pricingarvind_pathak_4Noch keine Bewertungen

- Original PDF Economics of Money Banking and Financial Markets The Business School Edition 5th PDFDokument52 SeitenOriginal PDF Economics of Money Banking and Financial Markets The Business School Edition 5th PDFwendy.ramos733100% (27)

- Annexure I MT DECLARATIONDokument2 SeitenAnnexure I MT DECLARATIONPrinceSadhotraNoch keine Bewertungen

- ScbaDokument46 SeitenScbaÎßhû ẞhåñdèlNoch keine Bewertungen

- Receipt CS-6686456Dokument1 SeiteReceipt CS-6686456Jean OrsayNoch keine Bewertungen

- Detailed Statement: Neft-Ani Integrated Services LTDDokument3 SeitenDetailed Statement: Neft-Ani Integrated Services LTDRohit raagNoch keine Bewertungen

- Valuation of Rules and Certificates of Origin For SME Export Process From PeruDokument16 SeitenValuation of Rules and Certificates of Origin For SME Export Process From PeruLaís Marques100% (1)

- The Impacts of RCEP (Regional Comprehensive Economic Partnership) On Its Member StatesDokument8 SeitenThe Impacts of RCEP (Regional Comprehensive Economic Partnership) On Its Member StatesSreypich NochNoch keine Bewertungen

- International Business: by Charles W.L. HillDokument37 SeitenInternational Business: by Charles W.L. Hilllongtran1191Noch keine Bewertungen

- Coffee ReportDokument10 SeitenCoffee ReportOktavian RizaldyNoch keine Bewertungen

- Trade Journal - DitariDokument43 SeitenTrade Journal - DitariNexhat RamadaniNoch keine Bewertungen

- Role of Wto in Achieving Sustainable Development GoalsDokument14 SeitenRole of Wto in Achieving Sustainable Development GoalsHarsh GuptaNoch keine Bewertungen

- ITWX95617: Cartagena COL, Cartagena, ColombiaDokument1 SeiteITWX95617: Cartagena COL, Cartagena, ColombiaLaura Camila Romero MalagonNoch keine Bewertungen

- Factoring FSDokument13 SeitenFactoring FSAvinaw KumarNoch keine Bewertungen

- Government and Business: Managerial EconomicsDokument68 SeitenGovernment and Business: Managerial EconomicsalauoniNoch keine Bewertungen

- Chapter I: Overview of Evfta, Eu Textile Market, Vietnam Textile and Garment Industry 1.1 Overview of EvftaDokument9 SeitenChapter I: Overview of Evfta, Eu Textile Market, Vietnam Textile and Garment Industry 1.1 Overview of EvftaHữu Phúc ĐỗNoch keine Bewertungen

- Rab DuckbroDokument49 SeitenRab DuckbroLalu AgungNoch keine Bewertungen

- Test Bank For International Business Environments Operations 14 e 14th Edition John Daniels Lee Radebaugh Daniel SullivanDokument26 SeitenTest Bank For International Business Environments Operations 14 e 14th Edition John Daniels Lee Radebaugh Daniel Sullivannataliebuckdbpnrtjfsa100% (24)

- Temenos Integration With Union Pay and VISADokument5 SeitenTemenos Integration With Union Pay and VISAPaxy SENGOUDONENoch keine Bewertungen