Beruflich Dokumente

Kultur Dokumente

Busting Stock Market Myths - Yahoo India Finance

Hochgeladen von

Daniel MartinezCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Busting Stock Market Myths - Yahoo India Finance

Hochgeladen von

Daniel MartinezCopyright:

Verfügbare Formate

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

Mon,31Aug,20156:58PMIndianMarketsareclosed

BustingStockMarketMyths

ByShoaibZamanandRahulOberoi|IndiaTodayGroupWed2Apr,20146:04PMIST

Howmanytimeshaveyoubeentoldabout'thenextbigstock'byabroker,afriendoracolleague?Thestock,youaretold,

hasallthemakingsofthenextblockbuster.

Theargumentispersuasive,eitherintheformofanecdotesorbackedbydata.Maybeaninvestmentguruhasmade

millionsonthestock.Or,thereisachartshowingthestock'spastreturnsor,maybe,astudylistingreasonswhyitwill

bringyouenormousriches.

However,onceyouinvest,thestockstopsperforming,orbeginswellandthenstartstofalter.Youaredisappointedand

decidenevertoinvestinanystock.

Ifthissoundsfamiliar,takeheart,foryouhavecompany.AswathDamodaran,ProfessoratNewYorkUniversity,inhis

book'InvestmentFables,'capturestheessenceofthesestories."Whiletherearehundredsofschemestobeatthemarket,

theyallarevariantsofaboutadozenbasicthemesthathavebeenaroundforaslongastherehavebeenstockstobuyand

sell.Thesebroadthemesaremodified,givennewnamesandmarketedasnewstrategies,"saysDamodaran.

Weidentifysomeofthesestrategiesthatappealtostockinvestorsandseeiftheyareworkableor,asDamodaransays,just

fables.

MYTH:BUYINGDIVIDENDPAYINGCOMPANIESISASSAFEASINVESTINGINDEBT.ANDA

COMPANYTHATHASANNOUNCEDTHATITWILLPAYHIGHDIVIDENDTHISYEARISAGOODBET.

Reality:Investorswithlittleriskappetitepreferthesafetyofgovernmentbondsorbankfixeddepositsratherthanstocks.

Thebeliefisthattheseareriskfree.Suchinvestorsaretoldthatadividendgivingstockofferssafety,regularincome,plus

scopeforcapitalappreciation.Butwhatisnotmentionedisthatdividendpaymentscanneverbepredicted,abigminus

foranyinvestorlookingforregularincome.

TakeBajajFinance.ItsstockwentupfromRs400on2January2006toRs1,318on31December2012.Thecompany

paiddividendineachofthesesixyears.In200506,itpaidRs4pershare.In200809,itpaidjustRs2.Somesaythisis

because200809wasayearofeconomiccrisis.Butthisargumentdoesnotholdmuchwaterasoutofnearly4,000

companieslistedontheBombayStockExchange,orBSE,662havepaiddividendeveryyearforthelast10years.Oneof

themisBajajFinance.Ofthese,100havebeenincreasingthepayoutormaintainingitatthepreviousyear'slevel.

VikasGupta,executivevicepresident,AlphaL50(India),ArthvedaFundManagement,saysUSpensionfundsand

investmenttrustsusedtoinvestinonlytopdividendpayingcompanies.Thisforcedbigcompanies,especiallythemarket

leaders,topaydividendsregularlysothattheycouldqualifyforinvestmentfromthesebiginvestors.Someevenborrowed

moneytopaydividends.

ButinIndiathestoryisdifferent."Here,thedividendyieldofthehighestdividendpayersisapproximatelyhalftherisk

freerate.Therefore,itisnotpossibletoimplementthestrategyinentirety,"saysGupta.Dividendyieldshowshowmuch

acompanypaysindividendseachyearrelativetoitsstockprice.

Butifyoustillwanttogoforhighdividendpayers,youmustaskthefollowingquestions.Howconsistentlyhasthe

companybeenpayingdividends?Istheindustrycyclicalandhasthecompanybeenpayingdividendsduringtoughtimes

aswell?And,ofcourse,howdoesitgetthemoneytopaydividendsregularly?

DipenShah,whoheadsprivateclientgroupresearchatKotakSecurities,saysinvestorsmustneverlosesightofthe

company'sfundamentalswhilechoosingastock."Oneshouldlookatdataforthelastthreeyearstoseeifthecompany

hasbeenpayingdividends,"hesays.

RupeshPatel,fundmanager,TataAssetManagement,saysthreetypesofcompaniespayhighdividends.First,those

whichhavestrongbusinessmodelsandalotoffreecashflow.Second,thosewhichhavesparecashtopayinvestorseven

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

1/8

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

afterinvestingforfuturegrowth.Third,thosewhichhavedon'thavemanyavenuestoinvestforgrowth.Thethird

categoryisproblematic,sayexperts,asitdoesn'tgiveinvestorstheadvantageoffastgrowth.

Buttherearemanywhovouchforthesafetyofcompaniesthatpayhighdividends.AnindyaBera,aretailinvestorfrom

Kolkata,says,"Iprefersafetyoverrisk.Highdividendyieldcompaniesaresaferinanotherwiseriskyinvestment

landscape.Mosttendtobematurecompanieswithstablerevenues.Thisgivescomfort."

KiranKavikondala,directorWealthRays,says,"Wehavebeenrecommendingstocksthathavealonghistoryofearning

dividends.Butwesticktolargecompaniesinthiscategory."

ButAyushMittal,aresidentofLucknow,saysit'snotnecessarytosticktolargecapcompaniesinthecategory.After

rigorousresearch,heboughtsharesofMayurUniquotersandMPSLtd,whichhadalongrecordofpayingdividendsand

strongearningsgrowth.Hemadesubstantialprofits."Ratherthanlookingatjustthedividendpercentage,investorsmust

lookatthedividendpayoutpercentage(ofnetprofit)beingdistributed(agooddividendpayoutforamanufacturing

companyisgreaterthan25%ofnetprofit),"hesays.Thisreinforcestheviewthatfocusingonresearchtofindcompanies

withstrongfundamentalsisimportant.

"Ourexperienceisthatinvestorsinthe45+agegrouppreferpublicsectorcompaniesoverprivatesectorones,"says

KavikondalaofWealthRays.

"Butthereisnoevidencethatpublicsectorcompaniespayhigherdividendsthantheprivatesectorones.Investors

followingthedividendstrategyneednotskewtheirportfoliotowardspublicsectorcompanies."

Onwhichgroupofinvestorsshouldnotbetondividendearningstocks,Kavikondalasays,"Iftheaimiscapital

appreciation,thisisperhapsnotthebestapproach."Investorsshouldunderstandthatthestrategymaydeliverlower

returnsinbullmarkets.Thisisbecauseinvestorsfocusoncapitalappreciationinbullmarketsandstabilityofearningsin

bearmarkets.

MYTH:FASTGROWINGCOMPANIESWHOSEEARNINGSPERSHARE,OREPS,ISRISINGBY30%OR

MOREAYEARAREGOODINVESTMENTSATANYPRICELEVELASTHEYWILLKEEPGROWING.

Reality:Apresentmarketleaderwouldhavebeenafastgrowerinearlystages.Therearemanywaystodefineafast

growingcompany.ThemostcommonislookingatEPS,revenueorsalesgrowth.Forretailinvestors,thebestwayisto

lookattheannualEPSgrowthoverthelastfiveyears.

Whenitcomestoinvesting,thereisabeliefthatonecanpayanypriceforafastgrowingcompany.Forexample,ifan

investorwouldhavespottedPageIndustriestowardstheendof2009,hewouldhavefoundthatitsEPShadgrownfrom

Rs5.41(in2004)toRs28.36,agrowthrateof39%ayear.ThestockwasatRs874on31December2009andtouchedRs

5,878on28February2014theEPSgrewtoRs100duringtheperiod.Atthisstage,theannualEPSgrowthrateforthe

lastfiveyearswas36%.

Thereare21companiesthatgrewatmorethan30%ayearin200611,200712and200813.

Allthissoundsgreat.Buttheinvestor,whohastheunenviabletaskofpredictingthefuture,shouldaskifthisruncan

continue.Pastgrowth,asweallknow,maynotalwaysbereplicated.AnexcellentexampleofthisisICSA,whoseEPS

grewfromRs0.15in2004toRs26.31(growthof191%ayear).Afterthat,theEPSstartedfalling.In2012and2013,it

reportednegativeEPS(Rs36.99andRs171.06,respectively).Intheworldofinvestment,pastperformancetellslittle

aboutthefuture.

"Thepitfallofusingthisparameteristhatonewillenduplookingatjustrevenueorearningsgrowth.Acompanycan

alwaysboostitsearningsbyborrowingmoreandtheninvestingthatmoney,"saysGuptaofArthveda.Hesaysaleveraged

companynotgrowingaccordingtoplanisatariskofdefaultingondebt.

Hence,investorswhowanttofollowthisstrategyshouldlookatcompaniesthataregrowingfastbutwithouttakingon

toomuchdebt.Itisbesttolookforcompaniesthataregrowingthroughinternalaccruals.

AsDamodaranwritesinInvestmentFables:"Ifyouputyourmoneyintocompanieswithhighestearningsgrowth,youare

playingthesegmentthatismostlikelytohaveanexponentialpayofformeltdown."

MYTH:STOCKSTRADINGATLOWEARNINGSMULTIPLESAREGOODASTHEYAREBOTHCHEAP

ANDSAFE

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

2/8

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

Reality:BenjaminGrahamisoftennamedastheproponentofbuyingstockstradingatlowpricetoearnings,orPE,

multiples.Inhisbook,'SecurityAnalysis',GrahamsaysthataPEratioof16"isashighapriceascanbepaidinan

investmentpurchaseincommonstock."Onthelowerside,hesays,aPEofeightsuggeststhatthemarketisnotfactoring

ingrowth,makingitasafebet.

ButwhatisoftenmissedbythosewhofollowthelowP/EstrategyisthatGrahamsuggestedthisasoneoftheparameters

alongwithdebttoequityratio,pricetobookvalueandmarketcap.

AmongtheBSElisted4,000stocks,239wereatPEratiosofbetween8and16onFebruary28.

"ThestrategybaseduponbuyingstockswithlowPEratiosiscalledvalueinvesting.Itisbasedontheassumptionthat

sharesofcomparablecompaniesshouldtradeatalmostthesamePEmultiples.Ifsharesofacompanyaretradingata

lowerPEthanthatofothersinthepeergroup,theyareconsideredundervalued.Theaimofvalueinvestingistobuythese

sharesandexpectthattheirpriceswillrisetolevelsatwhattheirpeersaretrading,"saysYashpalGupta,executivevice

president,IDBICapital.

Buttherealchallengeisfindingoutthelevelatwhichyoucancallastockcheap.Forinstance,foracompanyinthefast

movingconsumer,orFMCG,sector,aPEof20isconsideredreasonable.Thereasonsarestabilityofearningsandlow

debt.Fortheoppositereasons,foraninfrastructurecompany,thefigureis10.

"Therefore,oneshouldalwayslookatPEsofcompaniesinthesameindustry,plustheoverallindustryPE,"saysPatelof

TataAMC.

TheeffortshouldbetounderstandwhythecompanyistradingatalowPEratio.Thereasonscouldbeindustryspecificor

companyspecific.Ifitisthelatter,investorsmusttreadwithcaution.

LowPEisjustanindicator.YoushouldsiftthroughlowPEstocksandchooseyourinvestmentsonthebasisof

fundamentals.However,somecompanieswillalwaystradeatlowerPEratioswhileotherswillbevaluedhigherbecause

ofthenatureoftheirbusinessesormanagementrelatedissues,etc.So,itisimperativetounderstandthereasonforthe

lowPEratiobeforeinvesting.

ShahofKotakSecuritiessays,"Ifmyviewisthatthemarketwillremainsubdued,IshouldnotbelookingatlowPEasthe

criteria.Butwhenasectorisnotdoingbadlybutitsstocksaredownduetonegativenews,IshouldlookatlowPEstocks."

MYTH:MULTINATIONALCOMPANIES,ORMNCs,THATARELIKELYTODELISTWILLPAY

INVESTORSAGOODPREMIUMOVERTHEMARKETPRICEAND,SECOND,MNCsHAVEHIGH

GOVERNANCESTANDARDSANDLOOKAFTERTHEINTERESTSOFSHAREHOLDERS.

Reality:MNCswhichhavepresenceinIndiaarehighlyregarded.Buttherearetwotypesofstoriesthatinvestorsmustbe

cautiousabout.

ThefirstisthatMNCswillpayanypricetobuybacksharesanddelistfromtheIndianmarket.Thisbeliefhastakenhold

eversincetheSecuritiesandExchangeBoardofIndia,orSebi,themarketregulator,saidtwoyearsagothatalllisted

companiesmustensurethatatleast25%sharesarefloatingontheexchange.

AstrazenecaPharmaIndiasharesroseaftertheSebiannouncementasthepromoterowned90%ofthecompanyandthe

marketexpectedthatitwoulddelistratherthancomplywiththenewshareholdingnorm.However,thestockfell30%

afterthecompanytoldtheBSEthatitwilldilutepromoterholdingto75%inaspanof45daysbetweenMarchandApril

2013."Usingdelistingasastrategyisspeculation.Onecanonlyguesswhenacompanywilldelist,"saysPatelofTata

AMC.

Expertssaydelistingcanatbestworkasaspeculativestrategy.Thereareotherstrategiesthatonecanemploywhile

keepingMNCsasthebaserequirement.

"Investorscanconsiderthebuybackstrategyaswhetheracompanywilldelistornotissomethingonecanonlyguess,"

saysKavikondalaofWealthRays.Hesaysinabuyback,onemustlookatwhetherthecompanyhasopportunitiesto

expand.Ifnot,oneshouldseeifthemanagementwouldliketoreducethenumberofsharesinthemarket,asthiswould

raisethepossibilityofbuyback.Butamidallthis,it'simportantnottoforgettheprospectsofthecompany.Hesaysan

aggressiveinvestorcanusethisstrategybutshouldnotcommitmorethan1520%fundstoit.

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

3/8

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

ThesecondstoryoftennarratedtoinvestorsisthatMNCshavehighcorporategovernancestandards,strongbrands,use

capitalefficientlyandareinIndiaforthelongterm.

ThesefactorsseemtobeworkingwellforinvestorsinMNCs.Forinstance,theCNXMNCindex,comprising15

companies,hasbeenoutperformingtheNiftyoverthelastfewyears.

DeepakLadha,executivedirector,LadderupCorporateAdvisory,says,"ThereareMNCswhicharenotfastgrowingbut

payregulardividends.Somedonotgivedividendsbutgrowfast.TherearemanyexamplesofMNCstrategythathave

worked,forinstance,GlaxoPharmaceutical,HULandSiemens."

Butonegreyarea,saysPatelofTataAMC,iswhollyownedsubsidiariessetupbysomeMNCs."Thismeansonemaynot

getaclearpictureofwhichcostsarebeingchargedtothelistedentityandwhicharebeingchargedtothewhollyowned

subsidiary."Attimes,thesesubsidiariesmaystartoperatinginthesamelineofbusinessasthelistedentity,harmingthe

interestsofthelatter'ssmallshareholders.

Also,thelocallistedentitycandecidetoincreaseroyaltypaymentstotheparent.Thisisnotinthebestinterestof

shareholders."Dividendsarefineastheybenefitsmallinvestorsalso,butnotroyaltypayments,"saysGuptaofArthveda.

InvestorsshouldlookatthesectortheMNCinquestionoperatesandunderstandtheindustrysituationtoseeifthebet

willwork."Forexample,Siemensisintheengineeringsectorandwill,therefore,benefitfromastablegovernmentand

pickupininfrastructureactivity,whereasifyoutakeGlaxoPharmaceuticals,itisaperpetualstory,aspharmaceuticals

willcontinuetogrowatacertainrate."

MYTH:FOLLOWINGANEXPERT'SPORTFOLIOISREWARDING.

Reality:Copycatinvestinginvolvesfollowinganexpert.Thisiscommonindevelopedcountries.Itisalsocalledtail

coatingorsidecarinvesting.

In2008,ProfGeraldMartinandJohnPuthenpurackalpublishedapapertitled,"ImitationIstheSincerestFormof

Flattery".TheycreatedaportfoliothatmimickedtheinvestmentsofWarrenBuffett'sBerkshireHathway.The

hypotheticalportfolioboughtstocksatthestartofthemonthafterBerkshire'sdisclosureofitsstockpositions.Despitethe

delayedinvestment,theportfolioearnedareturnof10.75%overthatgivenbytheS&P500index.Thestudysupported

thecopycatstrategy.

InIndia,themostrenownedstockinvestorisRakeshJhunjhunwala.Sowetriedtogetdatatoseecompaniesinwhichhe

hasastakeofmorethan1%(itismandatoryforcompaniestodisclosethenamesofallinvestorswhoholdmorethan1%

shares).ThisprovedtrickyasthereweremanypermutationcombinationsrangingfromRakeshJhunjhunwalatoRakesh

RadheshyamJhunjhunwalaandsomeshareswereinthenameofhiswifeRekhaJhunjhunwala.Insomecases,boththeir

nameswerecombinedasRakeshRekhaJhunjhunwala.So,wetooknameswherewehadconfidencethatitwouldbe

RakeshJhunjhunwala.

Throughout2013,JhunjhunwalareducedinvestmentinA2ZMaintenance&EngineeringServices.Thestockfell80%

fromRs56toRs10duringtheperiod.HesoldAgroTechFoodssharesbetweenJanuary2013andJune2013andbought

thesamebetweenJune2013andDecember2013whenthepricewasbetweenRs450andRs580.Butwedon'tknowthe

priceatwhichhemadehisinvestments.

Asthisshows,onechallengetheinvestorwhowantstofollowthecopycatstrategyfacesisthedeploymenttimeframe.

GuptaofArthvedasays,"ThereisnoproperwaytodocopycatinvestinginIndia.Onehurdleisthatyouwillneverknow

whentheinvestoryouarefollowinghassoldhisinvestments.Youmaynotevenknowwhenheboughtit."

"IntheIndianscenario,copycatinvestingcanworkonlyinundervaluedcompaniesorwhenyouarefollowingsomeone

whofollowsacontrarianstyle.Thecontrarianapproachtakesalongtimetoworkout.Youneedpatience."Heexplains

thatinUS,thereasonwhythestrategyworksisthe13Ffiling.13Fisaquarterlyfilingbyinstitutionalinvestment

managerswithover$100millioninassets.Itisdoneattheendofeachquarterwithin45days.Anotherbenefitofthe13F

filingisthatitisnotrestrictedto1%shareholding.Hence,yougettoseethefullportfolioofthemanager.

Therefore,theperennialquestionforaninvestorfollowingacopycatstrategyis:Whydidthebiginvestorboughtit?And,

ofcourse,howlongdoesheplantohold?

Thosewhowanttousethestrategyshouldunderstandthetemperamentofthepeopletheyplantocopy.Thisisbecausea

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

4/8

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

personinterestedinshorttermtradingcannevermakemoneybyfollowingabiginvestorsuchasBuffettwhoseholding

periodisverylong.

MYTH:IFFOREIGNINSTITUTIONALINVESTORS,ORFIIs,ORDOMESTICINSTITUTIONAL

INVESTORS,ORDIIs,AREBUYINGASTOCK,ITMUSTBEVERYGOOD.

Reality:Themarketcantakeastockinanydirection.IntheBSE100index,thereare26companiesinwhichFIIshave

beenincreasingtheirstakesinceMarch2013.Ofthese,ninegavenegativereturnsbetweenApril2013andFebruary2014.

Similarly,inMarchDecember2012,therewere34companiesinwhichFIIsincreasedtheirstake.Ofthese,13gave

negativereturnsin201213.

Forinstance,FIIsincreasedstakeinTataPowerCompanyfrom24.54%inthequarterendedMarch2013to24.78%,

25.05%and26.03%inquartersendedJune,SeptemberandDecember2013.However,onaccountofmutedcashflow,

thestockplunged17%fromRs95.8onApril1lastyeartoRs79.45onFebruary26thisyear.

Likewise,concernsoverhighdebtandsoaringinterestcostsarekeepingJaiprakashAssociatesunderpressure.Thestock

fell38%toRs41.90between1April2013andFebruary28thisyear.ThiswasdespiteFIIsincreasingstakefrom22.77%

inMarch2013to27.41inDecember2013.

WhatretailinvestorsforgetisthatFIIsandDIIshavetheirownparametersfortakinginvestmentdecisions.Pankaj

Pandey,headofresearch,ICICIdirect,says,"IfFIIsarefacingaliquiditycrunchtheymaysellevengoodstockstoraise

money.Inthiscase,aretailinvestorwhofollowsFIIs/DIIsandsellsthestockwillmissthechancetomakemoney."

"Theriskappetite,theinvestmenthorizonaswellastheholdingpowerofretailinvestorsaredifferentfromthatof

institutionalinvestors.Hence,ifaninvestorbuysastockthatFIIsarebuyinganditfallsinthenearormediumterm,

retailinvestorswithoutdeeppocketswilltendtoexit,losingmoney."However,institutions,whichhavedeeppockets,

maybeabletowaitforlongertogetoutoftheinvestment.

VikramDhawan,director,EquentisCapital,saysthestrategysuitslongterminvestorswhohavethedisciplineand

resolvetoaccumulatestocksateverysizeablecorrectionorshorttermtraderswhohavefixedprofitandlosstargets.

"OnealsoneedstounderstandthatwhatmaylooklikeahugestakemaybeaminusculeportionoftheFII'sportfolio.So,

theycandumpafewstocksanytimewithoutabigimpactontheiroverallportfolio,"saysPatelofTataAssetManagement.

MYTH:THESTOCKWILLRISEWHENEVERPROMOTERSSHOWCONFIDENCEINTHECOMPANYBY

RAISINGTHEIRSTAKE.

Reality:Thereisnodirectcorrelationbetweenthetwo.IntheBSE500index,thereare270stocksinwhichpromoters

havebeenincreasingormaintainingtheirstakeforthepastfivequarterstillDecember2013.Ofthese,140gavenegative

returnsduringtheperiod.

PareshShah,managingdirector,equities,CentrumBroking,says,"Astockcanfallduetothecompanyreportinglower

earningsgrowthvisavisothersinspiteofpromotersshowingconfidenceinthecompany.Otherreasonscouldbefear

overfutureearnings,exitoffinancialinstitutionsduetopledgedsharesandawidespreadselloffindomesticandglobal

markets."

TakeReiAgro,RuchiSoyaIndustries,ParsvnathDevelopers,JBFIndustriesandFutureRetail.Thesestocksfellover30%

thisyeartillMarch3despitepromotersincreasingtheirstakesinceDecember2012.

RajeshSharma,director,CapriGlobalCapital,says,"Followingpromotersisperhapsoneofthebestpossiblewaysof

investing.Butitrequiresalotofhardwork."

Beforefollowingthestrategy,hesays,onemustlookatdisclosuresaboutthepromoterandthemanagement.The

company,ifitistoqualifyasaninvestment,shouldhavemanageabledebtandgoodbrandsandproducts.Also,onemust

seehowthemanagementandthestockhavebeenperformingindownturns."FollowingpromoterslikeAjayPiramaland

Mahindrashasbeenrewardingforinvestors.Butifyoudon'tunderstandthecompanyanditsbusinessmodelandhave

notdoneproperduediligenceaboutpromotersandtheirbusinessassociates,youruntheriskofsufferinglosses."

MYTH:MOSTPEOPLETHINKTHATCOMPANIESTHATAREGOINGPUBLICAREFLOURISHING.

SECOND,THEISSUEPRICEISTHEFAIRVALUEOFTHESTOCKANDONECANNOTLOSEMONEYBY

INVESTINGATTHATPRICE,ANDLASTLY,IFTHEISSUEISOVERSUBSCRIBED,THESTOCKISA

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

5/8

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

'MUSTBUY'.

Reality:Somecompaniesgopublicataveryearlystage,beforeprovingtheirfinancialfeasibility.Therefore,itis

importanttoknowwhetherthecompanyisraisingmoneyforexpansionorclearingdebt.Youmaywanttoavoidtheissue

inthelattercaseunlessyouareconvincedaboutthefeasibilityofthebusinessmodelandotheraspectsofthebusiness.

Manybelievethatinitialpublicoffer,orIPO,pricesarefairandsobuyingatthisstageisthesafestwaytomakemoney.

ChethanShenoy,vicepresident,investmentproducts,AnandRathiPrivateWealthManagement,saysthisisnottrueasa

company'sfairvaluecanbecalculatedonlyaftertakingintoaccountvariousfinancialparametersandtheoverall

economicenvironment.Therearemanygoodandpopularcompanieswhoseshareslistedbelowpricesatwhichtheywere

allottedinIPOs.

Listinggainscanbeexpectedonlyinbullmarketsorwhenthemarketsentimentispositive.Forexample,in2007,when

themarketswerebullish,100companiescameoutwithIPOs.Quiteafewgeneratedtripledigitreturnsonlisting.The

examplesareEveronnSystems(241%),Alliedcomputers(214%),ReligareEnterprises(182%)andMundraPort(118%).

Similarly,inthebearmarketsof2008&2011,TreeHouse,ReliancePowerandOmkarSpecialityshareslistedbelowtheir

issueprices.In2008,nearly50%IPOsgavenegativereturnsonlisting,whereasinthebullmarketof2005just12%IPOs

gavenegativereturnsonlisting.In2005,theSensexhadrisen42%.In2008and2011,itfell110%and25%,respectively.

Shenoysaysoversubscriptiondoesnotguaranteehighreturnseither.Misreadingtheinitialdemandforapublicissuecan

havedamagingconsequences.Thisisbecauseoversubscriptioninitselfdoesnotprovethatthesharesarefairlyvalued.

WhilethereareenoughinstancesofIPOinvestingworkingforsmallinvestors,thereisnoshortageofcaseswherethey

havedisappointed.

Forinstance,CAREannounceditsIPOinDecember2012atRs750pershare.Theissuewassubscribed40.98times.The

stockendedthelistingdayatRs923.95,around23%higherthantheissueprice.Similarly,ICRAannounceditsIPOin

March2007atRs330pershare.Theissuewassubscribed75times.ThestockendedthelistingdayatRs797.6,over

140%higherthantheissueprice.

However,therehavebeensomebigflopstoo.ReliancePowerannounceditsIPOinFebruary2008atRs450ashare.The

issuewassubscribed73times.However,thestockfell17%onthelistingday.

ExpertssayIPOsshouldbeapproachedjustlikeanyotherformofequityinvesting.Assuch,investorsshouldfirstanalyse

ifthepriceatwhichthesharesarebeingofferedisright.Forthis,theycanlookatthePEratio,thepricetobookvalue,or

P/BV,ratio,earningsgrowthandprospectsvisavispeerstocheckiftheissueisundervalued,fairlyvaluedorovervalued.

SRanganathan,headofresearch,LKPSecurities,says,"AnIPOinvestorshouldalsostudythepromoterbackground,

competitivepositioning,pricingpowerandvaluationsothatheisbetterpreparedtotakeacallonlisting."

GuptaofArthvedasaystheIPOstrategydoesnotworkanymore.Thisisbecausetheissuesareoverpricedascompanies'

soleaimistoraiseasmuchmoneyfromthepublicaspossible,hesays.

MYTH:SOMEINVESTORSSELLSTOCKSWHICHAREABOVETHEIRPREVIOUS52WEEKHIGHON

EXPECTATIONOFACORRECTIONANDBUYTHOSEBELOW52WEEKLOWS.

Reality:Contrarianinvestorstrytobringthepriceofsecuritiesbacktotheirfairvaluebyadoptingstrategieslike"winners

arepunished"and"losersandpurchased".Accordingtomarketexperts,theinvestorwhoalwayssellsstockswhenthey

areabovetheir52weekhighsistakingahighriskinabullmarket,goodstockswillmovefirstandpoorqualitystocks

willfollow.Iftheinvestordoesnotknowthecorrectvalueofthestockbutwantstocreateashortposition,hemayend

withhugelosses.

However,inabearmarket,fundamentallypoorstockswilltouchnewlowseveryday.Buyingthesecanerodewealthas

thereisnowayonecanknowwhenthefallwillstop.Agoodexampleofthisisinfrastructurestocks,whichfell3075%in

thefouryearstoDecember2013.

SahilKapoor,chieftechnicalstrategist,retailcapitalmarkets,EdelweissFinancialServices,says,"Technicalanalysisis

baseduponthebeliefinbuyingstrengthandsellingweakness.Hence,ifastockhasmadeanew52weekhigh,itmeansit

hasstrongrelativestrengthcomparedtoothers.A52weekhighbreakoutafterconsolidationhasevenmoresignificance

asthereisarangeexpansionandthestockisreadyforastrongandasustainabletrend."

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

6/8

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

Marketsgenerallypreferqualitystocksandthosewhichremainabove52weekhighsalwaysfinddedicatedbuyers.Stocks

whicharebatteredandunabletobouncefromlowsaregenerallynotfavoured.

"Animportantreasontoavoidbottomfishingin52weeklowstocksisthedifficultyofspottingwinners.Theprobability

oflosingmoneyishigher.Ifyouweretobuystocksmakingnewhighs,theprobabilitythatyouwillpickmorewinners

thanlosersishigher,"saysKapoor.

VarunGoel,head,portfoliomanagementservice,KarvyStockBroking,says,"Fundamentally,thereisnoreasonto

buy/sellastockifitisata52weekhigh/low.Sometechnicalanalystsdolookatthesefiguresbutjusttounderstandthe

momentuminthestock.Ifapersonisbuyingastockjustbecauseitisata52weeklow,hecouldfallintoavaluetrap."

Forexample,HindustanUnilever(HUL)madeanew52weekhighinSeptember2010bycrossingRs300after10years.

Investorswouldhaveearnedhandsomereturnseveniftheyhadboughtthestockattheselevels.Thestockrosemorethan

100%afterthattotouchanewhighofRs718.90inJuly2013.InMarch,itwasatRs555.

Similarly,IVRCLmadeanew52weeklowin2010bybreakingtheRs140level.OnMarch4,itwastradingatRs11.06.

"Investorsshouldmaintaina57%stoplossonceastocktouchesa52weekhigh.Ifthestrengthandrangeexpansion

persist,thereisahighprobabilitythatthestockwillgive20%plusreturnsinthemediumterm.Onlythosewhohave

tradingskillsanddisciplineshouldusetheabovestyle,"saysKapoorofEdelweissFinancialServices.

MYTH:PENNYSTOCKSARESOCHEAPTHATTHEYCANMAKEAPERSONRICHOVERNIGHT.

Reality:Thereareanumberofpennystockswhichhavemadeinvestorsrich.Forexample,CoreEducation&

Technologies,whichwastradingatRs12paiseon1March2004,rose122timesin10yearsittouchedRs14.44onMarch

3thisyear.

Ontheotherhand,SMSTechsoft(India)hasfallenover76%inthepast10years,andwasatRs0.09onMarch3this

year.NuTechCorporationServicesfellover66%duringtheperiod.

Apennystocknormallytradesataverylowprice,usuallybelowRs10,orisissuedbyacompanywhosemarket

capitalisationislessthanRs100crore.

"Pennystocksarerisky.Chancesofhugeprofitsusuallycomewithevenbiggerchancesofsufferinglosses.Hence,itis

bestfortheriskaversetoavoidthesestocks.However,iftheinvestorhastheriskappetite,hemusttakepainsto

understandthecompany'sfinancialsandtherisksinvolvedanddecidethehorizonforwhichhewishestoholdthestock.

Pennystocksmayyieldgoodreturnsduetochangesinbusinessfortuneormanagement,favourablepolicychangesor

takeoverbyagoodcompany,"saysYashpalGuptaofIDBICapitalMarketServices.

Accordingtoexperts,pennystocksarenotgreatoptionsifoneislookingforawaytogetrichquickly.Whenoneinvestsin

pennystocks,ahugeprofitisn'tguaranteed.Justbecauseastockischeapdoesnotmeanthatitisagoodbargain.Hence,

investorsmustdothoroughresearchandbereadytoholdsuchstocksforlongperiods.

Theotherreasonforbuyingthesestocksisthattheseareavailableatlowpricesandcanbeboughtinhugenumberswith

asmallcapital.Peopleperceivethesestockstobe'cheap'andawaytoovernightfortunes.

RakeshGoyal,seniorvicepresident,BonanzaPortfolio,says,"Stockscannotbetaggedascheaporexpensivesolelyonthe

basisoftheirmarketprice.Stocksarevaluedonthebasisoftheirfundamentalstheirnetworth,businesspotential,

incomegrowth,etc.So,ifastockistradingatalowprice,itisprimarilybecausemarketsdonotvalueitmuchinterms

networthorgrowth.Thus,everypennystockmaynotbeabargain.Peoplealsobuypennystocksinthebeliefthatasmall

additiontothepricecanbringinhugeprofits."

Forexample,ifsomeonespendsRs10,000tobuyastockvaluedatRs2ashareandifthesharepricereachesRs3,hewill

earnaprofitofRs5,000onaninvestmentofRs10,000.However,forthestocktogiveareturnofRe1,itwillhaveto

moveby50%inaparticularperiod.

Incaseyouarekeentobuyapennystock,itisadvisablethatyoustartonlyafterreadingthecompany'sfinancial

statementsanddoingproperresearchaboutbusinessplansandstrategy.

"Oneshouldstopinvestinginthestockwhenthecompanyisnotperformingwell.Further,ifthereisnegligiblepossibility

ofacompanyturningaround,thenalsooneshouldstopinvestinginsuchstocks,"saysYashpalGuptaofIDBICapital

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

7/8

8/31/2015

BustingStockMarketMythsYahooIndiaFinance

MarketServices.

ReproducedFromMoneyToday.April2014.LMIL.Allrightsreserved.

https://in.finance.yahoo.com/news/bustingstockmarketmyths123400084.html

8/8

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Implications of Educational Attainment To The Unemployment Rate Through Period of Time in The PhilippinesDokument34 SeitenThe Implications of Educational Attainment To The Unemployment Rate Through Period of Time in The PhilippinesStephRecato100% (3)

- Oz Shy - Industrial Organization: Theory and Applications - Instructor's ManualDokument60 SeitenOz Shy - Industrial Organization: Theory and Applications - Instructor's ManualJewggernaut67% (3)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Answers in English For Academic and Professional Purposes: Name: Grade and Section: 1 TeacherDokument22 SeitenAnswers in English For Academic and Professional Purposes: Name: Grade and Section: 1 TeacherSherilyn DiazNoch keine Bewertungen

- Advance Premium: Branch《Dokument2 SeitenAdvance Premium: Branch《Daniel MartinezNoch keine Bewertungen

- Acctstmt HDokument8 SeitenAcctstmt HDaniel MartinezNoch keine Bewertungen

- Affidavit ProprietorshipDokument2 SeitenAffidavit ProprietorshipDaniel Martinez33% (3)

- NAAC Report March 2014Dokument363 SeitenNAAC Report March 2014Daniel MartinezNoch keine Bewertungen

- Detailed Notification - Aec - 120Dokument5 SeitenDetailed Notification - Aec - 120Daniel MartinezNoch keine Bewertungen

- Definitions and ArgumentsDokument49 SeitenDefinitions and ArgumentsDaniel MartinezNoch keine Bewertungen

- Std11 Acct EMDokument159 SeitenStd11 Acct EMniaz1788100% (1)

- CH1 Exploring Corporate StrategyDokument22 SeitenCH1 Exploring Corporate StrategySafdar KhanNoch keine Bewertungen

- Jayamangala of BuddhaDokument4 SeitenJayamangala of BuddhaDaniel MartinezNoch keine Bewertungen

- Electronic Commerce: Education and InformationDokument28 SeitenElectronic Commerce: Education and InformationmrchilliciousNoch keine Bewertungen

- Sop PDFDokument15 SeitenSop PDFpolikopil0Noch keine Bewertungen

- Audit of The Capital Acquisition and Repayment CycleDokument7 SeitenAudit of The Capital Acquisition and Repayment Cyclerezkifadila2Noch keine Bewertungen

- ISO Certification in NepalDokument9 SeitenISO Certification in NepalAbishek AdhikariNoch keine Bewertungen

- BSBMGT617 Develop and Implement A Business Plan: Assessment Task 2Dokument26 SeitenBSBMGT617 Develop and Implement A Business Plan: Assessment Task 2rida zulquarnain100% (1)

- Session 3 Unit 3 Analysis On Inventory ManagementDokument18 SeitenSession 3 Unit 3 Analysis On Inventory ManagementAyesha RachhNoch keine Bewertungen

- Admission FormDokument1 SeiteAdmission FormhinNoch keine Bewertungen

- Managerial Economics and Business Environment 1Dokument42 SeitenManagerial Economics and Business Environment 1dpartha2000479750% (2)

- Impsa: Restructuring To Innovate Existing ResourcesDokument1 SeiteImpsa: Restructuring To Innovate Existing ResourcesSydney LangenNoch keine Bewertungen

- Addis Ababa University College of Development StudiesDokument126 SeitenAddis Ababa University College of Development StudieskindhunNoch keine Bewertungen

- Visit Patterns Analysis of Foreign Tourist in Indonesian Territory Using Frequent Pattern Growth (FP-Growth) AlgorithmDokument1 SeiteVisit Patterns Analysis of Foreign Tourist in Indonesian Territory Using Frequent Pattern Growth (FP-Growth) AlgorithmM Egip PratamaNoch keine Bewertungen

- Week 4 Assignment 1Dokument2 SeitenWeek 4 Assignment 1Boroon MahantaNoch keine Bewertungen

- StratX Simulations Brochure - ADokument4 SeitenStratX Simulations Brochure - Adeepak30011993Noch keine Bewertungen

- Unemployment ProblemDokument12 SeitenUnemployment ProblemMasud SanvirNoch keine Bewertungen

- Ashish Chugh Reveals Top Secrets To Finding Multibagger StocksDokument10 SeitenAshish Chugh Reveals Top Secrets To Finding Multibagger StocksSreenivasulu E NNoch keine Bewertungen

- HULDokument2 SeitenHULShruti JainNoch keine Bewertungen

- Accomplisment Letter 120611Dokument3 SeitenAccomplisment Letter 120611Latisha WalkerNoch keine Bewertungen

- AHMAD ALMOTAILEG CV 2021 03 v1Dokument7 SeitenAHMAD ALMOTAILEG CV 2021 03 v1wajahat khanNoch keine Bewertungen

- What Are Commercial BanksDokument3 SeitenWhat Are Commercial BanksShyam BahlNoch keine Bewertungen

- Trust ReceiptDokument4 SeitenTrust ReceiptVenz LacreNoch keine Bewertungen

- Corporate Governance - IIA AustraliaDokument2 SeitenCorporate Governance - IIA AustraliaHaidee Flavier SabidoNoch keine Bewertungen

- Sri Lanka - MAS Holdings Enters New Venture With BAM KnittingDokument2 SeitenSri Lanka - MAS Holdings Enters New Venture With BAM KnittingsandamaliNoch keine Bewertungen

- Mawb LR 749-30816310Dokument1 SeiteMawb LR 749-30816310Hemant PrakashNoch keine Bewertungen

- SM Chapter 07Dokument57 SeitenSM Chapter 07mas aziz100% (1)

- Becg m-4Dokument25 SeitenBecg m-4CH ANIL VARMANoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Nishkarsh SinghNoch keine Bewertungen

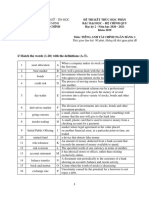

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Dokument4 SeitenĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuNoch keine Bewertungen

- Critical Work Day Memo - Comp Intel (July)Dokument1 SeiteCritical Work Day Memo - Comp Intel (July)AL KenNoch keine Bewertungen