Beruflich Dokumente

Kultur Dokumente

Accounting For Managers Semester 2 2015 Bentley Campus INT

Hochgeladen von

Samarth PatelOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting For Managers Semester 2 2015 Bentley Campus INT

Hochgeladen von

Samarth PatelCopyright:

Verfügbare Formate

Curtin Business School (CBS)

School of Accounting

Unit Outline

ACCT5021 Accounting for Managers

Semester 2, 2015

Unit study package code:

ACCT5021

Mode of study:

Internal

Tuition pattern summary:

Note: For any specific variations to this tuition pattern and for precise information refer to

the Learning Activities section.

Online Class: 1 x 1 Hours Weekly

Workshop: 1 x 2 Hours Weekly

This unit does not have a fieldwork component.

Credit Value:

25.0

Pre-requisite units:

Nil

Co-requisite units:

Nil

Anti-requisite units:

Nil

Result type:

Grade/Mark

Approved incidental fees:

Information about approved incidental fees can be obtained from our website. Visit

fees.curtin.edu.au/incidental_fees.cfm for details.

Unit coordinator:

Title:

Name:

Phone:

Email:

Building:

Room:

Consultation

times:

Dr

Brian Perrin

+618 9266 7781

B.Perrin@curtin.edu.au

407

437

See Blackboard for Details

Administrative contact:

Name:

Phone:

Email:

Building:

Room:

Dr Brian Perrin

+618 9266 7781

b.perrin@curtin.edu.au

407

437

Learning Management System:

Blackboard (lms.curtin.edu.au)

Teaching Staff:

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 1 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Curtin Business School (CBS)

School of Accounting

Acknowledgement of Country

We respectfully acknowledge the Indigenous Elders, custodians, their descendants and kin of this land past and present.

Syllabus

This unit provides students with an understanding of basic financial and managerial accounting practices and ethical issues related to

accounting.

Introduction

This unit aims to develop a strong foundation in financial accounting and financial statement analysis for managers and nonaccountant financial statement users, and to increase students familiarity with the accounting language, concepts, and principles. The

unit also aims to provide an introduction to management accounting topics such as budgeting, performance evaluation, and

incentive. The exploration of the behavioural, cultural, and ethical aspects of accounting will also be covered.

Unit Learning Outcomes

All graduates of Curtin University achieve a set of nine graduate attributes during their course of study. These tell an employer that,

through your studies, you have acquired discipline knowledge and a range of other skills and attributes which employers say would

be useful in a professional setting. Each unit in your course addresses the graduate attributes through a clearly identified set of

learning outcomes. They form a vital part in the process referred to as assurance of learning. The learning outcomes tell you what

you are expected to know, understand or be able to do in order to be successful in this unit. Each assessment for this unit is carefully

designed to test your achievement of one or more of the unit learning outcomes. On successfully completing all of the assessments

you will have achieved all of these learning outcomes.

Your course has been designed so that on graduating we can say you will have achieved all of Curtin's Graduate Attributes through

the assurance of learning process in each unit.

Graduate Attributes

addressed

On successful completion of this unit students can:

1 Analyse accounting information to evaluate the profitability, liquidity, leverage and efficiency of a

company

2 Critique the ethical implications of accounting choices

3 Demonstrate proficiency in the provision of the accounting information for management

4 Appraise the behavioural aspects of budgeting and performance evaluation with cultural awareness

Curtin's Graduate Attributes

Apply discipline knowledge

Thinking skills

Information skills

(use analytical skills to solve problems)

(confidence to investigate new ideas)

Communication skills

Technology skills

International perspective

Cultural understanding

(value the perspectives of others)

(value the perspectives of others)

Learning how to learn

(apply principles learnt to new situations)

(confidence to tackle unfamiliar problems)

Professional Skills

(work independently and as a team)

(plan own work)

Find out more about Curtin's Graduate attributes at the Office of Teaching & Learning website: ctl.curtin.edu.au

Learning Activities

There are three teaching hours each week (one-hour online class and two-hour workshop). The online class aims to help students

understand the key concepts and accounting methods relevant to each week's topic(s). The online class materials will be available from

the Blackboard site on Monday each week. The workshop gives students opportunities to engage in problem-based learning, case

studies, and group discussion. The materials covered in the online class will be discussed in the workshop the week after. Students

should make sure to watch the online lecture and prepare the answers to the assigned questions and/or activities before coming to the

workshop each week. Model answers to workshop questions will be provided on Blackboard.

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 2 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Curtin Business School (CBS)

School of Accounting

Learning Resources

Essential texts

The required textbook(s) for this unit are:

l

Atrill, McLaney & Harvey (2015), Accounting: An Introduction (6th Edition), Pearson.

The assigned textbook by Atrill et. al. (2015) can be sourced from many textbook retailers. However, if you wish to access the

Pearson MyAccountingLab resource, it is best and more economically purchased as a complete package. The ISBN for this

package is 9781486008797.

(ISBN/ISSN: 9781486008797)

Other resources

You do not have to purchase the following textbooks but you may like to refer to them.

l

l

l

l

l

Hilton (2011), Management Accounting: Creating Value in a Dynamic Business Environment, 9th Edition, McGraw-Hill.

Horngren, Harrison, Oliver, Best, Fraser, Tan & Willett (2013), Financial Accounting, 7th Edition, Pearson Education Australia.

Leo, Hoggett, & Sweeting (2012), Company Accounting, 9th edition, John Wiley & Sons Australia.

CPA, Finanical Reporting Handbook 2013, John Wiley & Sons Australia.

Alternatively, you can access the following websites for the Accounting Standards: http://www.aasb.com.au,

http://www.iasb.org.uk, http://www.cpaaustralia.com.au, and http://www.icaa.org.au.

Online resources

l

The FLECS-Blackboard facility provides students with a link to a copy of this unit outline as well as access to course materials

(including lecture notes) and other relevant information relating to the unit. The following link will take you to the FLECSBlackboard Login Page: http://lms.curtin.edu.au or use the OASIS portal at http://oasis.curtin.edu.au under the My Studies

tab.

l Click on Login and wait to be directed to the Login Page.

l Enter your Username: [your Student Number (e.g. 08716651)] and Password: [your Oasis password].

l Click Login to enter.

If the unit does not appear on your FLECS-Blackboard page, please check to ensure that you are correctly enrolled in this unit

by following the instruction on the following webpage http://oasis.curtin.edu.au/help/student/flecs.cfm#why. If you have further

problems, please contact the CBS Student IT Support Counter (402:221) or complete the Blackboard Student Help Form, which

is available at http://www.business.curtin.edu.au/business/current-students/unit-and-course-information/online-units-andblackboard.

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 3 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Curtin Business School (CBS)

School of Accounting

Assessment

Assessment schedule

Task

Value %

Unit Learning

Outcome(s)

Assessed

Date Due

Report 1

25 percent

Week: 6

Day: In-Class

Time: In-Class

Report 2

35 percent

Week: 11

Day: In-Class

Time: In-Class

1,2

Case study

40 percent

Week: 3,7,11 & 14

Day: In Class

Time: In Class

3,4

Detailed information on assessment tasks

1. Assessment #1 is an individual report that will require students to complete two (2) business reports. Full details provided on

Blackboard see Assessment Folder.

2. Assessment #2 is a group report that will require students to analyse an Australian listed public company using the techniques

learned in the unit. Each group should consist of 3 to 4 members and should include both local and international students.

3. Assessment #3 is designed to enable all students to engage with the breadth of material covered within ACCT5021 Accounting

with Managers in a way that deepens their understanding of the material and their ability to apply the theories and concepts

into the workplace. There are two parts to assessment #3:

1.

2.

Case Study Readiness Assurance Tests (RATs) there will be four Readiness Assurance Tests (RATs) conducted in class

during the semester. Each test will be for 15 minutes and will consist of 10 multiple choice questions.

Case study type questions that will require students to apply accounting knowledge and recommend possible solutions.

Note: See the separate information sheet (which will be available from the Blackboard site later) for more details about each

assessment task above. The work submitted must be the students own work. If the work is found to be plagiarised, penalty will

be imposed in accordance with the Universitys policy.

Pass requirements

To pass this unit, all assessment items must be attempted and the total mark (from all assessment tasks) must be 50% or higher.

Fair assessment through moderation

Moderation describes a quality assurance process to ensure that assessments are appropriate to the learning outcomes, and that

student work is evaluated consistently by assessors. Minimum standards for the moderation of assessment are described in the

Assessment and Student Progression Manual, available from policies.curtin.edu.au/policies/teachingandlearning.cfm

Late assessment policy

This ensures that the requirements for submission of assignments and other work to be assessed are fair, transparent, equitable, and

that penalties are consistently applied.

1.

2.

All assessments students are required to submit will have a due date and time specified on this Unit Outline.

Students will be penalised by a deduction of ten percent per calendar day for a late assessment submission (eg a mark

equivalent to 10% of the total allocated for the assessment will be deducted from the marked value for every day that the

assessment is late). This means that an assessment worth 20 marks will have two marks deducted per calendar day late. Hence

if it was handed in three calendar days late and given a mark of 16/20, the student would receive 10/20. An assessment more

than seven calendar days overdue will not be marked and will receive a mark of 0.

Assessment extension

A student unable to complete an assessment task by/on the original published date/time (eg examinations, tests) or due date/time

(eg assignments) must apply for an assessment extension using the Assessment Extension form (available from the Forms page at

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 4 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Curtin Business School (CBS)

School of Accounting

students.curtin.edu.au/administration/) as prescribed by the Academic Registrar. It is the responsibility of the student to demonstrate

and provide evidence for exceptional circumstances beyond the student's control that prevent them from completing/submitting the

assessment task.

The student will be expected to lodge the form and supporting documentation with the unit coordinator before the assessment

date/time or due date/time. An application may be accepted up to five working days after the date or due date of the assessment

task where the student is able to provide an acceptable explanation as to why he or she was not able to submit the application prior

to the assessment date. An application for an assessment extension will not be accepted after the date of the Board of Examiners'

meeting.

Deferred assessments

If your results show that you have been granted a deferred assessment you should immediately check your OASIS email for details.

Deferred examinations/tests will be held from 20/07/2015 to 24/07/2015 . Notification to students will be made after the Board of

Examiners meeting via the Official Communications Channel (OCC) in OASIS.

Supplementary assessments

Supplementary assessments are not available in this unit.

Referencing style

The referencing style for this unit is Chicago.

More information can be found on this style from the Library web site: library.curtin.edu.au.

Academic Integrity (including plagiarism and cheating)

Any conduct by a student that is dishonest or unfair in connection with any academic work is considered to be academic misconduct.

Plagiarism and cheating are serious offences that will be investigated and may result in penalties such as reduced or zero grades,

annulled units or even termination from the course.

Plagiarism occurs when work or property of another person is presented as one's own, without appropriate acknowledgement or

referencing. Submitting work which has been produced by someone else (e.g. allowing or contracting another person to do the work

for which you claim authorship) is also plagiarism. Submitted work is subjected to a plagiarism detection process, which may include

the use of text matching systems or interviews with students to determine authorship.

Cheating includes (but is not limited to) asking or paying someone to complete an assessment task for you or any use of

unauthorised materials or assistance during an examination or test.

For more information, including student guidelines for avoiding plagiarism, refer to the Academic Integrity tab in Blackboard or

academicintegrity.curtin.edu.au.

Information and Communications Technology (ICT) Expectations

Curtin students are expected to have reliable internet access in order to connect to OASIS email and learning systems such as

Blackboard and Library Services.

You may also require a computer or mobile device for preparing and submitting your work.

For general ICT assistance, in the first instance please contact OASIS Student Support:

oasisapps.curtin.edu.au/help/general/support.cfm

For specific assistance with any of the items listed below, please contact The Learning Centre:

life.curtin.edu.au/learning-support/learning_centre.htm

l

l

Using Blackboard, the I Drive and Back-Up files

Introduction to PowerPoint, Word and Excel

Additional information

Enrolment

It is your responsibility to ensure that your enrolment is correct - you can check your enrolment through the eStudent option on

OASIS, where you can also print an Enrolment Advice.

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 5 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Curtin Business School (CBS)

School of Accounting

Student Rights and Responsibilities

It is the responsibility of every student to be aware of all relevant legislation, policies and procedures relating to their rights and

responsibilities as a student. These include:

l

l

l

l

l

the Student Charter

the University's Guiding Ethical Principles

the University's policy and statements on plagiarism and academic integrity

copyright principles and responsibilities

the University's policies on appropriate use of software and computer facilities

Information on all these things is available through the University's "Student Rights and Responsibilities" website at:

students.curtin.edu.au/rights.

Student Equity

There are a number of factors that might disadvantage some students from participating in their studies or assessments to the best

of their ability, under standard conditions. These factors may include a disability or medical condition (e.g. mental illness, chronic

illness, physical or sensory disability, learning disability), significant family responsibilities, pregnancy, religious practices, living in a

remote location or another reason. If you believe you may be unfairly disadvantaged on these or other grounds please contact

Student Equity at eesj@curtin.edu.au or go to http://eesj.curtin.edu.au/student_equity/index.cfm for more information

You can also contact Counselling and Disability services: http://www.disability.curtin.edu.au or the Multi-faith services:

http://life.curtin.edu.au/health-and-wellbeing/about_multifaith_services.htm for further information.

It is important to note that the staff of the university may not be able to meet your needs if they are not informed of your individual

circumstances so please get in touch with the appropriate service if you require assistance. For general wellbeing concerns or advice

please contact Curtin's Student Wellbeing Advisory Service at:

http://life.curtin.edu.au/health-and-wellbeing/student_wellbeing_service.htm

Recent unit changes

Students are encouraged to provide unit feedback through eVALUate, Curtin's online student feedback system. For more information

about eVALUate, please refer to evaluate.curtin.edu.au/info/.

To view previous student feedback about this unit, search for the Unit Summary Report at

https://evaluate.curtin.edu.au/student/unit_search.cfm. See https://evaluate.curtin.edu.au/info/dates.cfm to find

out when you can eVALUate this unit.

Recent changes to this unit include:

All workshop questions revised inline with new edition of textbook.

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 6 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Curtin Business School (CBS)

School of Accounting

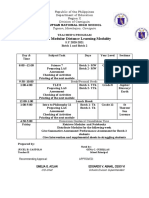

Program calendar

Week

Begin

Date

Lecture

Pre-readings

Workshop

Assessment Due

1.

3/8

Introduction to Accounting & Regulatory

Framework for Companies.

Atrill Ch 1 & 5

Introduction

2.

10/8

Measuring and Reporting Financial

Position

Atrill Ch 2

DQ 1.5, 1.6, 1.14, 1.22,

5.3, 5.6, 5.7

AE 5.5

3.

4.

5.

17/8

24/8

31/8

Measuring and Reporting Financial

Performance (1)

Atrill Ch 3

Measuring and Reporting Financial

Performance (2)

Atrill Ch 3

Tuition Free Week

DQ 2.8, 2.10

RAT #1 (5%)

AE 2.2, 2.3, 2.7, 2.9,

2.11

DQ 3.5, 3.11, 3.12, 3.15

AE 3.3, 3.6, 3.9

6.

7.

8.

7/9

14/9

21/9

Introduction to Limited Companies and

Measuring and Reporting Cash Flows

Atrill Ch 4 & 6

DQ 3.7, 3.16, 3.19

AE 3.2, 3.5, 3.7, 3.12

Analysis and Interpretation of Financial

Statements (1)

Atrill Ch 8

DQ 4.5, 4.6, 6.3, 6.6, 6.7

AE 6.1, 6.3, 6.6, 6.8

Analysis and Interpretation of Financial

Statements (2)

Atrill Ch 8

DQ 8.2, 8.7, 8.10

AASB 108

AE 8.4, 8.8, 8.11

Report 1: Individual

Report (25%)

RAT #2 (5%)

AASB 110

AASB 137*

9.

28/9

Tuition Free Week

10.

5/10

Cost-volume-profit analysis and relevant

costing

Atrill Ch 9

DQ 8.11, 8.14

AE 8.9

See Blackboard for

additional questions

11.

12/10

Full Costing

Atrill Ch 10

DQ 9.10

AE 9.5, 9.9, 9.11

12.

19/10

Budgeting

Atrill Ch 11

DQ 10.7, 10.12

Report 2: Group

Report (35%)

RAT #3 (5%)

AE 10.1, 10.6, 10.8

13.

26/10

Management control system,

performance evaluation and incentive

Atrill Ch 7

DQ 11.9, 11.14, 11.18

(p. 239 - 251)

AE 11.7, 11.8

Hilton Ch 12

13**

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 7 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Curtin Business School (CBS)

School of Accounting

14.

2/11

Corporate social responsibility and

sustainability accounting

Atrill Ch 7 (p.

220 - 239)

DQ 7.2, 7.5, 7.7 and

other activities.

RAT #4 (5%)

Case Study: Individual

(20%)

15.

9/11

Study Week

16.

16/11

Exam Week 1

17.

23/11

Exam Week 2

Note: The workshop questions can be found at the end of each chapter.

DQ = Discussion Question

AE = Application Exercise

RAT = Readiness Assurance Test

* Australian Accounting Standards can be downloaded from AASBs website at http://www.aasb.gov.au/Pronouncements/Currentstandards.aspx.

** Hilton (2011), Management Accounting: Creating Value in a Dynamic Business Environment, 9th Edition, McGraw-Hill.

The two chapters can be downloaded from Curtin library website. The links for downloading the chapters will be provided on the

Blackboard site later.

ACCT5021 Accounting for Managers

Bentley Campus

27 Jul 2015

School of Accounting, Curtin Business School (CBS)

Page: 8 of 8

CRICOS Provider Code 00301J

The only authoritative version of this Unit Outline is to be found online in OASIS

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Drilling 1Dokument37 SeitenDrilling 1Samarth Patel100% (1)

- Emcee HostDokument2 SeitenEmcee HostDennis Cosmod100% (10)

- Patterns Grade 1Dokument4 SeitenPatterns Grade 1kkgreubelNoch keine Bewertungen

- Automotive Industry in Australia Industry Report IBISDokument32 SeitenAutomotive Industry in Australia Industry Report IBISSamarth PatelNoch keine Bewertungen

- Measuring Parts of The Body Lesson PlanDokument8 SeitenMeasuring Parts of The Body Lesson PlanVel_stNoch keine Bewertungen

- Curriculum Guide: Instructional PlanningDokument6 SeitenCurriculum Guide: Instructional PlanningJohn Perseus LeeNoch keine Bewertungen

- 3-Day Lesson Plan Template 2Dokument6 Seiten3-Day Lesson Plan Template 2api-490517875Noch keine Bewertungen

- Tank Bottom Plate Replacement TechniquesDokument9 SeitenTank Bottom Plate Replacement TechniquesMS100% (1)

- Training Manual For PVelite Basic LevelDokument41 SeitenTraining Manual For PVelite Basic LevelsudokuNoch keine Bewertungen

- Lesson Plan in Media and Information Literacy: Mil11/12Lesi-Iiig-19Dokument2 SeitenLesson Plan in Media and Information Literacy: Mil11/12Lesi-Iiig-19לארה מאי100% (1)

- RPMS PURPLE TEMPLATE For MALE TEACHERS - Results-Based-Performance-Management-SystemDokument46 SeitenRPMS PURPLE TEMPLATE For MALE TEACHERS - Results-Based-Performance-Management-SystemFretzelle Hope BadoyNoch keine Bewertungen

- LAW2 Syllabus FINALDokument10 SeitenLAW2 Syllabus FINALMaria SalongaNoch keine Bewertungen

- CAMS CKYC Application FormDokument4 SeitenCAMS CKYC Application Formdibyaduti_20009197Noch keine Bewertungen

- 2011 Annual ReportDokument64 Seiten2011 Annual ReportSamarth PatelNoch keine Bewertungen

- Credit Card - Additional Cardholder ApplicationDokument2 SeitenCredit Card - Additional Cardholder ApplicationSamarth PatelNoch keine Bewertungen

- MAT Calculation ToolDokument1 SeiteMAT Calculation ToolSamarth PatelNoch keine Bewertungen

- AssignDokument20 SeitenAssignSamarth PatelNoch keine Bewertungen

- Common Design CodesDokument3 SeitenCommon Design CodesSamarth PatelNoch keine Bewertungen

- 26 418Dokument6 Seiten26 418ari_prasNoch keine Bewertungen

- BSC Bodyscience Exercise GlossaryDokument73 SeitenBSC Bodyscience Exercise GlossarySamarth Patel100% (1)

- REV - ACC 550 Online Class M5Dokument54 SeitenREV - ACC 550 Online Class M5Samarth PatelNoch keine Bewertungen

- Different ConceptsDokument7 SeitenDifferent ConceptsSamarth PatelNoch keine Bewertungen

- Toy Doll Game Manufacturing in The US Industry ReportDokument37 SeitenToy Doll Game Manufacturing in The US Industry ReportSamarth PatelNoch keine Bewertungen

- 2014 Annual ReportDokument172 Seiten2014 Annual ReportSamarth PatelNoch keine Bewertungen

- Dual Porosity Models For Flow in Naturally Fractured ReservoirsDokument39 SeitenDual Porosity Models For Flow in Naturally Fractured ReservoirsSamarth PatelNoch keine Bewertungen

- ss231 1407enDokument2 Seitenss231 1407enSamarth PatelNoch keine Bewertungen

- Godec NIEESDokument40 SeitenGodec NIEESSamarth PatelNoch keine Bewertungen

- Dynamics LN1Dokument7 SeitenDynamics LN1Samarth PatelNoch keine Bewertungen

- Rubric For Individual Case StudyDokument5 SeitenRubric For Individual Case StudySamarth PatelNoch keine Bewertungen

- 2009Dokument6 Seiten2009Samarth PatelNoch keine Bewertungen

- Natural Fractures in Shales (Origins Characteristics and Relevance For Hydraulic Fracture Treatments)Dokument27 SeitenNatural Fractures in Shales (Origins Characteristics and Relevance For Hydraulic Fracture Treatments)Samarth PatelNoch keine Bewertungen

- Air Con Past Exam QuestionsDokument5 SeitenAir Con Past Exam QuestionsSamarth PatelNoch keine Bewertungen

- Fracture Development in Shale and Its Relationship To Gas AccumulationDokument1 SeiteFracture Development in Shale and Its Relationship To Gas AccumulationSamarth PatelNoch keine Bewertungen

- UntitledDokument6 SeitenUntitledapi-142797433Noch keine Bewertungen

- Assignment Module 2Dokument11 SeitenAssignment Module 2Laraib jabeenNoch keine Bewertungen

- SWAPNA Teacher ResumeDokument3 SeitenSWAPNA Teacher ResumecswapnarekhaNoch keine Bewertungen

- DEPED The Ne Secondary Education CurriculumDokument2 SeitenDEPED The Ne Secondary Education Curriculumyachiru121Noch keine Bewertungen

- Proceedings 2013 PDFDokument104 SeitenProceedings 2013 PDFrubenmena1Noch keine Bewertungen

- Final Lesson Plan InvertebratesDokument4 SeitenFinal Lesson Plan Invertebratesapi-301992134100% (2)

- Accountability or Accountability of The Teacher To Focus On Three Aspects of Responsibility Towards The ProfessionDokument4 SeitenAccountability or Accountability of The Teacher To Focus On Three Aspects of Responsibility Towards The ProfessionIzzat IsmailNoch keine Bewertungen

- Aetci36 2202Dokument69 SeitenAetci36 2202awol12345Noch keine Bewertungen

- CulturediagramDokument2 SeitenCulturediagramapi-239582398Noch keine Bewertungen

- Finalreport Icybs 2016 1Dokument46 SeitenFinalreport Icybs 2016 1api-356112324Noch keine Bewertungen

- P. 72 Amendment of Memo 92-40 PDFDokument84 SeitenP. 72 Amendment of Memo 92-40 PDFNelson G. CainghogNoch keine Bewertungen

- Profed 11Dokument8 SeitenProfed 11May-Ann S. CahiligNoch keine Bewertungen

- Arena Multi MediaDokument6 SeitenArena Multi MediaRameez AhmedNoch keine Bewertungen

- IAS Topper Profile: Gaurav Agrawal shares preparation strategyDokument46 SeitenIAS Topper Profile: Gaurav Agrawal shares preparation strategyOm Singh Inda100% (1)

- Adopt an Existing Course BookDokument12 SeitenAdopt an Existing Course BookEufrasia EboNoch keine Bewertungen

- The Use of Quexbook Pre-Calculus in Teaching Systems of Non-Linear Equation To Grade 11 StemDokument37 SeitenThe Use of Quexbook Pre-Calculus in Teaching Systems of Non-Linear Equation To Grade 11 StemJohn Mark Noveno100% (1)

- Course Institution Board Aggregate Year of PassingDokument3 SeitenCourse Institution Board Aggregate Year of PassingAnonymous 6VZtG6MNoch keine Bewertungen

- 11 Chapter3Dokument45 Seiten11 Chapter3Eloisa May LanuzaNoch keine Bewertungen

- Self Confidence IndiaDokument5 SeitenSelf Confidence IndiajosekinNoch keine Bewertungen

- Danielle Marie La Penna Resume Feb 2016 WebsiteDokument2 SeitenDanielle Marie La Penna Resume Feb 2016 Websiteapi-310546541Noch keine Bewertungen

- Heads Review Parents0809Dokument30 SeitenHeads Review Parents0809gwoodsford8785Noch keine Bewertungen

- Teachers Program Printed Modular Learning ModalityDokument2 SeitenTeachers Program Printed Modular Learning ModalityCastolo Bayucot JvjcNoch keine Bewertungen