Beruflich Dokumente

Kultur Dokumente

Indonesia IFRS Profile PDF

Hochgeladen von

Taufik HidayatOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indonesia IFRS Profile PDF

Hochgeladen von

Taufik HidayatCopyright:

Verfügbare Formate

IFRS APPLICATION AROUND THE WORLD

JURISDICTIONAL PROFILE: Indonesia

Disclaimer: The information in this Profile is for general guidance only and may change from time to time. You should not act

on the information in this Profile, and you should obtain specific professional advice to help you in making any decisions or in

taking any action. If you believe that the information has changed or is incorrect, please contact us at ifrsapplication@ifrs.org.

This Profile has been prepared by the IFRS Foundation based on information from various sources. The starting point was the

answers provided by standard-setting and other relevant bodies in response to surveys that the Foundation conducted on the

application of IFRS around the world. The Foundation drafted the profile and invited the respondents to the survey and others

(including regulators and international audit firms) to review the drafts, and their comments are reflected.

Profile last updated

3 March 2015

PARTICIPANT IN THE IFRS FOUNDATION SURVEY ON APPLICATION OF IFRS

Organisation

Indonesian Financial Accounting Standards Board (Dewan Standar Akuntansi

Keuangan DSAK IAI)

Role of the organisation

The DSAK IAI as part of The Indonesian Institute of Accountants (Ikatan Akuntan

Indonesia IAI) is the independent national accounting standardsetting body

in Indonesia. It is tasked by the IAI National Council to establish the Indonesian

Financial Accounting Standards (Standar Akuntansi Keuangan SAK).

SAK as issued by the DSAK IAI is recognised by the Government of the Republic

of Indonesia through, among other things, the Indonesian Law No. 40/2007 on

Limited Liability Company and Law No. 8/1995 on Capital Market.

Website

http://www.iaiglobal.or.id/

Email contact

dsak@iaiglobal.or.id (cc aucky.pratama@iaiglobal.or.id)

COMMITMENT TO GLOBAL FINANCIAL REPORTING STANDARDS

Has the jurisdiction made a public

commitment in support of moving towards a

single set of high quality global accounting

standards?

Yes.

Has the jurisdiction made a public

commitment towards IFRS as that single set

of high quality global accounting standards?

Yes.

What is the jurisdiction's status of adoption?

Indonesia has not adopted IFRS.

Copyright IFRS Foundation

Additional comments provided on the

adoption status?

Indonesias commitment is to support IFRS as the globally accepted accounting

standard and to continue with the IFRS convergence process, further

minimising the gap between SAK and IFRS. Indonesia is yet to announce its

plan for the full adoption of IFRS in Indonesia.

The decision to elect the convergence approach instead of full adoption was

based on the consideration of the potential interpretation and implementation

issues.

Since making the public commitment to support IFRS in 8 December 2008, the

DSAK IAI has been converging the SAK towards IFRS. As a result of the first

phase of the IFRS convergence process, SAK as at 1 January 2012 is substantially

in line with IFRS as at 1 January 2009, but there are a number of differences and

several IFRS and IFRIC Interpretations do not have SAK equivalents.

The DSAK IAI is currently progressing with the second phase of the IFRS

convergence process. The objective of this phase is to further minimise the gap

between SAK and IFRS, from three years to one year. This would take SAK as at

1 January 2015 to be substantially in line with IFRS as at 1 January 2014, again

with some exceptions.

Currently there are two tiers of GAAP that are established in Indonesia:

Tier 1 SAK, for listed companies and other entities with significant public

accountability; and

Tier 2 SAK ETAP, for entities with no significant public accountability.

The DSAK IAI also issued PSAK 45 as part of the SAK for notfor-profit entities.

The Board is currently deliberating on whether a more robust set of standards

is necessary to meet the reporting requirements of notforprofit entities

Indonesia.

If the jurisdiction has NOT made a public

statement supporting the move towards a

single set of accounting standards and/or

towards IFRS as that set of standards,

explain the jurisdiction's general position

towards the adoption of IFRS in your

jurisdiction.

Not applicable.

EXTENT OF IFRS APPLICATION

For DOMESTIC companies whose debt or equity securities trade in a public market in the jurisdiction:

Are all or some domestic companies whose

securities trade in a public market either

required or permitted to use IFRS in their

consolidated financial statements?

No. All domestic companies whose securities trade in a public market are

required to use the SAK.

If YES, are IFRS REQUIRED or PERMITTED?

Not applicable.

Does that apply to ALL domestic companies

whose securities trade in a public market, or

only SOME? If some, which ones?

Not applicable.

Are IFRS also required or permitted for more

than the consolidated financial statements

of companies whose securities trade in a

public market?

No.

Copyright IFRS Foundation

For instance, are IFRS required or permitted

in separate company financial statements of

companies whose securities trade in a public

market?

No.

For instance, are IFRS required or permitted

for companies whose securities do not trade

in a public market?

No.

If the jurisdiction currently does NOT require

or permit the use of IFRS for domestic

companies whose securities trade in a public

market, are there any plans to permit or

require IFRS for such companies in the

future?

Indonesias commitment is to support IFRS as the globally accepted accounting

standard and to continue with the IFRS convergence process, further

minimising the gap between SAK and IFRS. Indonesia is yet to announce its

plan for the full adoption of IFRS in Indonesia.

Any plan to permit or require the use of IFRS for domestic companies whose

securities trade in public market will depend on the progress of the

convergence process, and the commitment of both the standard setter and

relevant regulators.

For FOREIGN companies whose debt or equity securities trade in a public market in the jurisdiction:

Are all or some foreign companies whose

securities trade in a public market either

REQUIRED or PERMITTED to use IFRS in their

consolidated financial statements?

No. All foreign companies whose securities trade in a public market are

required to use the SAK.

If YES, are IFRS REQUIRED or PERMITTED in

such cases?

Not applicable.

Does that apply to ALL foreign companies

whose securities trade in a public market, or

only SOME? If some, which ones?

Not applicable.

IFRS ENDORSEMENT

Which IFRS are required or permitted for

domestic companies?

The use of IFRS for domestic purposes is not permitted. Companies are

required to use either SAK (Tier 1) or SAK ETAP (Tier 2).

The auditor's report and/or the basis of

presentation footnotes states that financial

statements have been prepared in

conformity with:

Depending on the Tier, the auditors report will refer to either SAK (Tier 1)

or SAK ETAP (Tier 2).

Does the auditor's report and/or the basis of

preparation footnote allow for dual

reporting (conformity with both IFRS and

the jurisdictions GAAP)?

No.

Are IFRS incorporated into law or

regulations?

No.

If yes, how does that process work?

Not applicable.

If no, how do IFRS become a requirement in

the jurisdiction?

Not applicable.

Does the jurisdiction have a formal process

for the 'endorsement' or 'adoption' of new

or amended IFRS (including Interpretations)

in place?

Indonesia does not have a process for endorsing IFRS. However, DSAK IAI as

the national standard setting body has established a due process for gradually

converging the SAK with IFRS.

Copyright IFRS Foundation

If yes, what is the process?

Based on the mandate that has been given by the IAI National Council, the due

process procedure for the DSAK IAI in converging the SAK with IFRS is as

follows:

Identification of the SAK that is going to be converged with IFRS.

Research and analysis of the concepts and issues.

Limited consultations with relevant stakeholders, among others,

regulators, associations and entities.

Public consultation through the issuance of exposure draft and public

hearings.

Board deliberations on public comments.

Issuance of SAK.

If no, how do new or amended IFRS become

a requirement in the jurisdiction?

Not applicable.

Has the jurisdiction eliminated any

accounting policy options permitted by IFRS

and/or made any modifications to any IFRS?

Not applicable. It should be noted, however, that those SAK standards that

were converged with IFRS effective 1 January 2009 included some

modifications to IFRS, and several IFRS and IFRIC Interpretations do not have

SAK equivalents.

If yes, what are the changes?

Not applicable.

Other comments regarding the use of IFRS in

the jurisdiction?

None.

TRANSLATION OF IFRS

Are IFRS translated into the local language?

No. It should be noted that the SAK is in Bahasa Indonesia.

If they are translated, what is the translation

process? In particular, does this process

ensure an ongoing translation of the latest

updates to IFRS?

Not applicable.

APPLICATION OF THE IFRS FOR SMEs

Has the jurisdiction adopted the IFRS for

SMEs for at least some SMEs?

No.

If no, is the adoption of the IFRS for SMEs

under consideration?

No. However, in developing the Tier 2 standard SAK ETAP, the DSAK IAI used

the IFRS for SMEs as a point of reference.

Did the jurisdiction make any modifications

to the IFRS for SMEs?

Not applicable

If the jurisdiction has made any

modifications, what are those

modifications?

Not applicable

Which SMEs use the IFRS for SMEs in the

jurisdiction, and are they required or

permitted to do so?

Not applicable

For those SMEs that are not required to use

the IFRS for SMEs, what other accounting

framework do they use?

SAK ETAP (Tier 2).

Copyright IFRS Foundation

Other comments regarding use of the IFRS

for SMEs?

Copyright IFRS Foundation

None.

Das könnte Ihnen auch gefallen

- Jurnal Finansia1Dokument8 SeitenJurnal Finansia1Taufik HidayatNoch keine Bewertungen

- Cost Chapter4Dokument12 SeitenCost Chapter4Vishnu PrasathNoch keine Bewertungen

- Skripsi Tanpa Bab PembahasanDokument68 SeitenSkripsi Tanpa Bab PembahasanAgie PrasetyoNoch keine Bewertungen

- ID Kajian Atas Perbandingan Penyusutan AktiDokument18 SeitenID Kajian Atas Perbandingan Penyusutan AktiTaufik HidayatNoch keine Bewertungen

- 2769 6363 1 SMDokument14 Seiten2769 6363 1 SMdyah mutiara indriasariNoch keine Bewertungen

- RechDokument18 SeitenRechTaufik HidayatNoch keine Bewertungen

- Larson Chap 1 ExercisesDokument10 SeitenLarson Chap 1 ExercisesvisothNoch keine Bewertungen

- Larson Chap 1 ExercisesDokument10 SeitenLarson Chap 1 ExercisesvisothNoch keine Bewertungen

- Financial Statement Analysis: Assignment Classification TableDokument54 SeitenFinancial Statement Analysis: Assignment Classification TableJolie PhamNoch keine Bewertungen

- Pengaruh Persepsi Wajib Pajak Orang Prib PDFDokument12 SeitenPengaruh Persepsi Wajib Pajak Orang Prib PDFTaufik HidayatNoch keine Bewertungen

- Jurnal - Ronny PDFDokument28 SeitenJurnal - Ronny PDFTaufik HidayatNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Moparm Action - December 2014 USADokument100 SeitenMoparm Action - December 2014 USAenricoioNoch keine Bewertungen

- Rundown Rakernas & Seminar PABMI - Final-1Dokument6 SeitenRundown Rakernas & Seminar PABMI - Final-1MarthinNoch keine Bewertungen

- Giuliani Letter To Sen. GrahamDokument4 SeitenGiuliani Letter To Sen. GrahamFox News83% (12)

- DC0002A Lhires III Assembling Procedure EnglishDokument17 SeitenDC0002A Lhires III Assembling Procedure EnglishНикола ЉубичићNoch keine Bewertungen

- BS en 118-2013-11Dokument22 SeitenBS en 118-2013-11Abey VettoorNoch keine Bewertungen

- CENT - Company Presentation Q1 2020 PDFDokument22 SeitenCENT - Company Presentation Q1 2020 PDFsabrina rahmawatiNoch keine Bewertungen

- จัดตารางสอบกลางภาคภาคต้น53Dokument332 Seitenจัดตารางสอบกลางภาคภาคต้น53Yuwarath SuktrakoonNoch keine Bewertungen

- Municipality of Boliney: Republic of The Philippines Cordillera Administrative Region Province of AbraDokument7 SeitenMunicipality of Boliney: Republic of The Philippines Cordillera Administrative Region Province of AbraErnest Aton100% (1)

- Singapore Electricity MarketDokument25 SeitenSingapore Electricity MarketTonia GlennNoch keine Bewertungen

- G JaxDokument4 SeitenG Jaxlevin696Noch keine Bewertungen

- Tax Accounting Jones CH 4 HW SolutionsDokument7 SeitenTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraNoch keine Bewertungen

- Stainless Steel 1.4404 316lDokument3 SeitenStainless Steel 1.4404 316lDilipSinghNoch keine Bewertungen

- Divider Block Accessory LTR HowdenDokument4 SeitenDivider Block Accessory LTR HowdenjasonNoch keine Bewertungen

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDokument9 SeitenUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiNoch keine Bewertungen

- ARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiDokument5 SeitenARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiGAURAV DANGARNoch keine Bewertungen

- AdvertisingDokument2 SeitenAdvertisingJelena ŽužaNoch keine Bewertungen

- Certification DSWD Educational AssistanceDokument3 SeitenCertification DSWD Educational AssistancePatoc Stand Alone Senior High School (Region VIII - Leyte)Noch keine Bewertungen

- Faida WTP - Control PhilosophyDokument19 SeitenFaida WTP - Control PhilosophyDelshad DuhokiNoch keine Bewertungen

- BSL-3 Training-1Dokument22 SeitenBSL-3 Training-1Dayanandhi ElangovanNoch keine Bewertungen

- Contemp World Module 2 Topics 1 4Dokument95 SeitenContemp World Module 2 Topics 1 4Miguel EderNoch keine Bewertungen

- Is 778 - Copper Alloy ValvesDokument27 SeitenIs 778 - Copper Alloy ValvesMuthu KumaranNoch keine Bewertungen

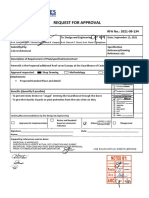

- CEC Proposed Additional Canopy at Guard House (RFA-2021!09!134) (Signed 23sep21)Dokument3 SeitenCEC Proposed Additional Canopy at Guard House (RFA-2021!09!134) (Signed 23sep21)MichaelNoch keine Bewertungen

- Reverse Osmosis ProcessDokument10 SeitenReverse Osmosis ProcessHeshamNoch keine Bewertungen

- h6811 Datadomain DsDokument5 Seitenh6811 Datadomain DsChristian EstebanNoch keine Bewertungen

- LISTA Nascar 2014Dokument42 SeitenLISTA Nascar 2014osmarxsNoch keine Bewertungen

- SVPWM PDFDokument5 SeitenSVPWM PDFmauricetappaNoch keine Bewertungen

- Volvo B13R Data SheetDokument2 SeitenVolvo B13R Data Sheetarunkdevassy100% (1)

- La Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlDokument6 SeitenLa Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlMarlouis U. PlanasNoch keine Bewertungen

- Database Management System and SQL CommandsDokument3 SeitenDatabase Management System and SQL Commandsdev guptaNoch keine Bewertungen

- Musings On A Rodin CoilDokument2 SeitenMusings On A Rodin CoilWFSCAO100% (1)