Beruflich Dokumente

Kultur Dokumente

Rafael Arsenio S. Dizon, v. CTA and CIR G.R. No. 140944 April 30, 2008

Hochgeladen von

Jacinto Jr Jamero0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten2 SeitenThis case involved the estate of Jose P. Fernandez who died in 1987. His estate filed an estate tax return showing zero tax liability. However, the BIR issued a deficiency assessment of over 66 million pesos in estate taxes. The petitioner claimed the valid claims of creditors exceeded the gross estate, so no tax was due. The CTA and CA upheld the BIR's assessment but reduced it to over 37 million pesos. The Supreme Court ruled that 1) the BIR failed to properly present evidence to support its assessment, and 2) under the date-of-death valuation rule, the full claims of creditors at the time of death can be deducted even if later reduced by compromise, so no tax was actually

Originalbeschreibung:

Rafael Arsenio S. Dizon, v. CTA and CIR G.R. No. 140944; April 30, 2008

Originaltitel

Rafael Arsenio S. Dizon, v. CTA and CIR G.R. No. 140944; April 30, 2008

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis case involved the estate of Jose P. Fernandez who died in 1987. His estate filed an estate tax return showing zero tax liability. However, the BIR issued a deficiency assessment of over 66 million pesos in estate taxes. The petitioner claimed the valid claims of creditors exceeded the gross estate, so no tax was due. The CTA and CA upheld the BIR's assessment but reduced it to over 37 million pesos. The Supreme Court ruled that 1) the BIR failed to properly present evidence to support its assessment, and 2) under the date-of-death valuation rule, the full claims of creditors at the time of death can be deducted even if later reduced by compromise, so no tax was actually

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten2 SeitenRafael Arsenio S. Dizon, v. CTA and CIR G.R. No. 140944 April 30, 2008

Hochgeladen von

Jacinto Jr JameroThis case involved the estate of Jose P. Fernandez who died in 1987. His estate filed an estate tax return showing zero tax liability. However, the BIR issued a deficiency assessment of over 66 million pesos in estate taxes. The petitioner claimed the valid claims of creditors exceeded the gross estate, so no tax was due. The CTA and CA upheld the BIR's assessment but reduced it to over 37 million pesos. The Supreme Court ruled that 1) the BIR failed to properly present evidence to support its assessment, and 2) under the date-of-death valuation rule, the full claims of creditors at the time of death can be deducted even if later reduced by compromise, so no tax was actually

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Rafael Arsenio S. Dizon, v.

CTA and CIR

G.R. No. 140944; April 30, 2008

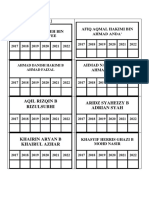

Facts: Jose P. Fernandez died in November 7, 1987. Thereafter, a petition for the probate of his

will was filed. The probate court appointed Atty. Rafael Arsenio P. Dizon as administrator of the

Estate of Jose Fernandez.

An estate tax return was filed later on which showed ZERO estate tax liability. BIR thereafter

issued a deficiency estate tax assessment, demanding payment of Php 66.97 million as deficiency

estate tax. This was subsequently reduced by CTA to Php 37.42 million. The CA affirmed the

CTAs ruling, hence, the instant petition.

The petitioner claims that in as much as the valid claims of creditors against the Estate are in

excess of the gross estate, no estate tax was due. On the other hand, respondents argue that

since the claims of the Estates creditors have been condoned, such claims may no longer be

deducted from the gross estate of the decedent.

Issue: Whether the actual claims of creditors may be fully allowed as deductions from the gross

estate of Jose despite the fact that the said claims were reduced or condoned through

compromise agreements entered into by the Estate with its creditors

Held: YES. Following the US Supreme Courts ruling in Ithaca Trust Co. v. United States, the

Court held that post-death developments are not material in determining the amount of

deduction. This is because estate tax is a tax imposed on the act of transferring property by will

or intestacy and, because the act on which the tax is levied occurs at a discrete time, i.e., the

instance of death, the net value of the property transferred should be ascertained, as nearly as

possible, as of the that time. This is the date-of-death valuation rule.

The Court, in adopting the date-of-death valuation principle, explained that: First. There is no law,

nor do we discern any legislative intent in our tax laws, which disregards the date-of-death

valuation principle and particularly provides that post-death developments must be considered in

determining the net value of the estate. It bears emphasis that tax burdens are not to be imposed,

nor presumed to be imposed, beyond what the statute expressly and clearly imports, tax statutes

being construed strictissimi juris against the government. Second. Such construction finds

relevance and consistency in our Rules on Special Proceedings wherein the term "claims"

required to be presented against a decedent's estate is generally construed to mean debts or

demands of a pecuniary nature which could have been enforced against the deceased in his

lifetime, or liability contracted by the deceased before his death. Therefore, the claims existing at

the time of death are significant to, and should be made the basis of, the determination of

allowable deductions.

Dizon v CTA G.R. No. 140944 April 30, 2008

FACTS:

On November 7, 1987, Jose P. Fernandez (Jose) died. Thereafter, a petition for the probate of

his will was filed with Branch 51 of the Regional Trial Court (RTC) of Manila (probate court). The

probate court then appointed retired Supreme Court Justice Arsenio P. Dizon (Justice Dizon) and

petitioner, Atty. Rafael Arsenio P. Dizon (petitioner) as Special and Assistant Special

Administrator, respectively, of the Estate of Jose (Estate). Petitioner alleged that several requests

for extension of the period to file the required estate tax return were granted by the BIR since the

assets of the estate, as well as the claims against it, had yet to be collated, determined and

identified.

ISSUES:

1. Whether or not the CTA and the CA gravely erred in allowing the admission of the pieces of

evidence which were not formally offered by the BIR; and

2. Whether the actual claims of the aforementioned creditors may be fully allowed as deductions

from the gross estate of Jose despite the fact that the said claims were reduced or condoned

through compromise agreements entered into by the Estate with its creditors Or Whether or not

the CA erred in affirming the CTA in the latter's determination of the deficiency estate tax imposed

against the Estate.

RULING:

1. Yes. While the CTA is not governed strictly by technical rules of evidence, as rules of procedure

are not ends in themselves and are primarily intended as tools in the administration of justice, the

presentation of the BIR's evidence is not a mere procedural technicality which may be disregarded

considering that it is the only means by which the CTA may ascertain and verify the truth of BIR's

claims against the Estate. The BIR's failure to formally offer these pieces of evidence, despite

CTA's directives, is fatal to its cause

2. Yes. The claims existing at the time of death are significant to, and should be made the basis

of, the determination of allowable deductions. Also, as held in Propstra v. U.S., where a lien

claimed against the estate was certain and enforceable on the date of the decedent's death, the

fact that the claimant subsequently settled for lesser amount did not preclude the estate from

deducting the entire amount of the claim for estate tax purposes. This is called the date-of-death

valuation rule.

Das könnte Ihnen auch gefallen

- Team Energy Corporation V CIR - DigestDokument1 SeiteTeam Energy Corporation V CIR - DigestKate GaroNoch keine Bewertungen

- Scion - The Grigori PantheonDokument11 SeitenScion - The Grigori Pantheonbrothersale100% (2)

- Rafael Arsenio Dizon vs. CTA & CIR (Digest)Dokument2 SeitenRafael Arsenio Dizon vs. CTA & CIR (Digest)madzarellaNoch keine Bewertungen

- Reading List Nonfiction Ap LangDokument6 SeitenReading List Nonfiction Ap Langapi-233431738Noch keine Bewertungen

- 5 Case Digest Cir Vs Estate of TodaDokument2 Seiten5 Case Digest Cir Vs Estate of TodaChrissy Sabella0% (1)

- The Medieval HuntDokument3 SeitenThe Medieval HuntCalangea Bogdan100% (1)

- ANPC v. BIR and CIR v. PAGCORDokument2 SeitenANPC v. BIR and CIR v. PAGCORDerek C. Egalla100% (2)

- Case DigestDokument2 SeitenCase DigestHoneylyne PlazaNoch keine Bewertungen

- Notes On Jurisdiction of CourtsDokument7 SeitenNotes On Jurisdiction of CourtsJacinto Jr Jamero100% (1)

- Dizon V CTADokument1 SeiteDizon V CTAjodelle11Noch keine Bewertungen

- CIR Vs Cebu Toyo CorporationDokument2 SeitenCIR Vs Cebu Toyo Corporationjancelmido1100% (2)

- Lorenzo vs. Posadas Jr. G.R. No. L-43082 June 18, 1937Dokument6 SeitenLorenzo vs. Posadas Jr. G.R. No. L-43082 June 18, 1937Andrea IvanneNoch keine Bewertungen

- MEDICARD PHILIPPINES V CIR DIGESTDokument3 SeitenMEDICARD PHILIPPINES V CIR DIGESTMiguel100% (1)

- Silicon Philippines vs. Cir DigestDokument1 SeiteSilicon Philippines vs. Cir DigestAnny YanongNoch keine Bewertungen

- Fort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDokument1 SeiteFort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDeus DulayNoch keine Bewertungen

- BDO v. RepublicDokument4 SeitenBDO v. RepublicBojo100% (1)

- Smart Communications, Inc. vs. Municipality of Malvar, BatangasDokument3 SeitenSmart Communications, Inc. vs. Municipality of Malvar, BatangasRaquel Doquenia100% (2)

- Commissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncDokument1 SeiteCommissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncMary AnneNoch keine Bewertungen

- A Memoir by The Real Housewives of NYC Cast Member Carole Radziwill: What RemainsDokument12 SeitenA Memoir by The Real Housewives of NYC Cast Member Carole Radziwill: What RemainsSimon and Schuster86% (7)

- Color Symbolism in Poe's "The Masque of The Red Death"Dokument2 SeitenColor Symbolism in Poe's "The Masque of The Red Death"Ashton WeigelNoch keine Bewertungen

- Philamlife Vs SOFDokument2 SeitenPhilamlife Vs SOFVel June100% (3)

- CIR Vs Seagate, GR 153866Dokument3 SeitenCIR Vs Seagate, GR 153866Mar Develos100% (1)

- Smart Vs City of DavaoDokument3 SeitenSmart Vs City of DavaoGR100% (2)

- Atlas Consolidated Mining V CIR (Case Digest)Dokument2 SeitenAtlas Consolidated Mining V CIR (Case Digest)Jeng Pion100% (1)

- Cir vs. Seagate TechnologyDokument1 SeiteCir vs. Seagate Technologygeorge almedaNoch keine Bewertungen

- China Banking Corporation vs. CADokument1 SeiteChina Banking Corporation vs. CAArmstrong BosantogNoch keine Bewertungen

- Pagcor Vs BirDokument1 SeitePagcor Vs Bir001nooneNoch keine Bewertungen

- Hickman Vs TaylorDokument4 SeitenHickman Vs TaylorJacinto Jr JameroNoch keine Bewertungen

- Montesclaros vs. Comelec, G.R. No. 152295, July 9, 2002Dokument6 SeitenMontesclaros vs. Comelec, G.R. No. 152295, July 9, 2002Jacinto Jr JameroNoch keine Bewertungen

- Contex Corp vs. CirDokument3 SeitenContex Corp vs. CirKath Leen100% (1)

- CIR v. MINDANO II (G.R. No. 191498. January 15, 2014.)Dokument2 SeitenCIR v. MINDANO II (G.R. No. 191498. January 15, 2014.)Emmanuel YrreverreNoch keine Bewertungen

- F - CIR Vs LaraDokument1 SeiteF - CIR Vs Laraceilo cobo50% (2)

- A - Pirovano Vs CIRDokument1 SeiteA - Pirovano Vs CIRceilo coboNoch keine Bewertungen

- University Physicians V CirDokument2 SeitenUniversity Physicians V CirLeeJongSuk isLifeNoch keine Bewertungen

- CIR Vs General Foods DigestDokument1 SeiteCIR Vs General Foods DigestCJNoch keine Bewertungen

- Diaz Vs Secretary of FinanceDokument3 SeitenDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- CIR vs. Filinvest Development Corp.Dokument2 SeitenCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- Marcos II Vs CA Case DigestDokument2 SeitenMarcos II Vs CA Case Digestlucky javellana100% (3)

- 05 CIR v. Metro Star Superama Inc.Dokument2 Seiten05 CIR v. Metro Star Superama Inc.Rem SerranoNoch keine Bewertungen

- Lorenzo vs. Posadas Jr.Dokument2 SeitenLorenzo vs. Posadas Jr.Lizzy Way100% (1)

- Vidal de Roces vs. Posadas (Case Digest)Dokument1 SeiteVidal de Roces vs. Posadas (Case Digest)Vince Leido100% (2)

- 12 Dizon v. CTADokument3 Seiten12 Dizon v. CTAAngelie ManingasNoch keine Bewertungen

- Bir VS First e Bank Condominium CorporationDokument2 SeitenBir VS First e Bank Condominium Corporationyetyet0% (1)

- First Planters Pawnshop Inc V CIRDokument1 SeiteFirst Planters Pawnshop Inc V CIRcrisNoch keine Bewertungen

- CIR vs. Burmeister 153205Dokument1 SeiteCIR vs. Burmeister 153205magenNoch keine Bewertungen

- Republic v. SorianoDokument3 SeitenRepublic v. SorianoEllis LagascaNoch keine Bewertungen

- Property CasesDokument7 SeitenProperty CasesJacinto Jr JameroNoch keine Bewertungen

- Fort Bonifacio Dev Corp Vs CIR DigestDokument1 SeiteFort Bonifacio Dev Corp Vs CIR DigestChristian John Dela CruzNoch keine Bewertungen

- Africa vs. Caltex L-12986 (TORTS)Dokument1 SeiteAfrica vs. Caltex L-12986 (TORTS)Jacinto Jr Jamero100% (1)

- Dizon Vs Posadas JRDokument1 SeiteDizon Vs Posadas JRArahbells100% (1)

- PNB Vs District Court of HawaiiDokument4 SeitenPNB Vs District Court of HawaiiJacinto Jr JameroNoch keine Bewertungen

- Dizon V CTA DigestDokument2 SeitenDizon V CTA DigestNicholas FoxNoch keine Bewertungen

- MARCOS II Vs CADokument2 SeitenMARCOS II Vs CAIshNoch keine Bewertungen

- CIR vs. Fisher (Case Digest)Dokument2 SeitenCIR vs. Fisher (Case Digest)Angelo Castillo90% (10)

- CIR v. Hong Kong Shanghai Banking Corporation LimitedDokument1 SeiteCIR v. Hong Kong Shanghai Banking Corporation LimitedRizchelle Sampang-Manaog100% (1)

- CIR v. Cadiz Sugar FarmersDokument6 SeitenCIR v. Cadiz Sugar Farmersamareia yap100% (1)

- Abello vs. CIR & CA (Case Digest)Dokument1 SeiteAbello vs. CIR & CA (Case Digest)Vince Leido100% (6)

- SMI-ED Vs CIRDokument2 SeitenSMI-ED Vs CIRVel June50% (2)

- CIR-vs-SM-Prime-Holdings DIGESTDokument3 SeitenCIR-vs-SM-Prime-Holdings DIGESTMiguel100% (3)

- CIR vs. Gonzales 177279Dokument1 SeiteCIR vs. Gonzales 177279magen100% (1)

- Pepsi-Cola v. TanauanDokument2 SeitenPepsi-Cola v. TanauanIshNoch keine Bewertungen

- DIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUEDokument2 SeitenDIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUERose De JesusNoch keine Bewertungen

- PEOPLE Vs Sandiganbayan GR# 115439-41Dokument8 SeitenPEOPLE Vs Sandiganbayan GR# 115439-41Jacinto Jr JameroNoch keine Bewertungen

- CIR Vs SONY PDFDokument2 SeitenCIR Vs SONY PDFkaira marie carlosNoch keine Bewertungen

- 02 Soriano vs. Secretary of FinanceDokument1 Seite02 Soriano vs. Secretary of FinanceMark Anthony Javellana SicadNoch keine Bewertungen

- PHILIPPINE AMUSEMENT AND GAMING CORPORATION (PAGCOR) vs. THE BUREAU OF INTERNAL REVENUE (BIR), G.R. No. 172087 March 15, 2011 Case DigestDokument2 SeitenPHILIPPINE AMUSEMENT AND GAMING CORPORATION (PAGCOR) vs. THE BUREAU OF INTERNAL REVENUE (BIR), G.R. No. 172087 March 15, 2011 Case DigestJacinto Jr Jamero100% (5)

- Prestonkirk Churchyard SurveyDokument100 SeitenPrestonkirk Churchyard Surveydigitalpast100% (3)

- Cir V CTA and PetronDokument2 SeitenCir V CTA and PetronRia Evita Revita100% (1)

- Asian Transmission Vs CIR - Case DigestDokument1 SeiteAsian Transmission Vs CIR - Case DigestKaren Mae Servan100% (1)

- Butcher of SeoulDokument619 SeitenButcher of SeoulBER 4 17 ANNoch keine Bewertungen

- 11 NDC V CIRDokument3 Seiten11 NDC V CIRTricia MontoyaNoch keine Bewertungen

- TAX1 - CIR Vs SM Prime Holdings GR 183505Dokument2 SeitenTAX1 - CIR Vs SM Prime Holdings GR 183505Jem Pagantian100% (1)

- Dizon V Cta: G.R. NO. 140944 APRIL 30, 2008 FactsDokument2 SeitenDizon V Cta: G.R. NO. 140944 APRIL 30, 2008 FactsMa Gabriellen Quijada-TabuñagNoch keine Bewertungen

- Report (Dizon vs. CTA)Dokument2 SeitenReport (Dizon vs. CTA)judielparejaNoch keine Bewertungen

- Agner Vs BPIDokument5 SeitenAgner Vs BPIJacinto Jr JameroNoch keine Bewertungen

- REGALA Vs SandiganbayanDokument16 SeitenREGALA Vs SandiganbayanJacinto Jr JameroNoch keine Bewertungen

- Lee vs. CA GR No. L - 37135Dokument7 SeitenLee vs. CA GR No. L - 37135Jacinto Jr JameroNoch keine Bewertungen

- Villa Rey Transit v. FerrerDokument8 SeitenVilla Rey Transit v. FerrerJacinto Jr JameroNoch keine Bewertungen

- Diaz VsDokument2 SeitenDiaz VsCayen Cervancia CabiguenNoch keine Bewertungen

- Diaz VsDokument2 SeitenDiaz VsCayen Cervancia CabiguenNoch keine Bewertungen

- Mitmug Vs Comelec - DigestDokument1 SeiteMitmug Vs Comelec - DigestJacinto Jr JameroNoch keine Bewertungen

- People V TandoyDokument6 SeitenPeople V TandoyJacinto Jr JameroNoch keine Bewertungen

- People Vs TanDokument2 SeitenPeople Vs TanJacinto Jr JameroNoch keine Bewertungen

- De Vera v. AguilarDokument3 SeitenDe Vera v. AguilarJacinto Jr JameroNoch keine Bewertungen

- Lee vs. CA GR No. L - 37135Dokument7 SeitenLee vs. CA GR No. L - 37135Jacinto Jr JameroNoch keine Bewertungen

- Chamber vs. Romulo 614 SCRA 605 2010Dokument17 SeitenChamber vs. Romulo 614 SCRA 605 2010Jacinto Jr JameroNoch keine Bewertungen

- HusseinDokument5 SeitenHusseinWilsonNoch keine Bewertungen

- G.R. No. 83907. September 13, 1989. NAPOLEON GEGARE, PetitionerDokument4 SeitenG.R. No. 83907. September 13, 1989. NAPOLEON GEGARE, PetitionerØbęy HårryNoch keine Bewertungen

- RA 7432 - Senior Citizens ActDokument5 SeitenRA 7432 - Senior Citizens ActChristian Mark Ramos GodoyNoch keine Bewertungen

- Villa Rey Transit v. FerrerDokument8 SeitenVilla Rey Transit v. FerrerJacinto Jr JameroNoch keine Bewertungen

- People V TandoyDokument6 SeitenPeople V TandoyJacinto Jr JameroNoch keine Bewertungen

- BIR RR 07-2003Dokument8 SeitenBIR RR 07-2003Brian BaldwinNoch keine Bewertungen

- Yessesin-Volpin V Novosti Press Agency - DIGESTDokument2 SeitenYessesin-Volpin V Novosti Press Agency - DIGESTJacinto Jr JameroNoch keine Bewertungen

- Tax TablesDokument4 SeitenTax TablesJacinto Jr JameroNoch keine Bewertungen

- Tax RateDokument10 SeitenTax RateErwin Dave M. DahaoNoch keine Bewertungen

- Philsec vs. Ca - FullDokument6 SeitenPhilsec vs. Ca - FullERNIL L BAWANoch keine Bewertungen

- A.W. Fluemer vs. Annie Hix, G.R. No. L-32636, March 17, 1930Dokument1 SeiteA.W. Fluemer vs. Annie Hix, G.R. No. L-32636, March 17, 1930Sarah Jane-Shae O. SemblanteNoch keine Bewertungen

- LATCH (Vol. 4, 2011, Appleton, Death in Atwood, Pp. 63-73, IP Mar)Dokument11 SeitenLATCH (Vol. 4, 2011, Appleton, Death in Atwood, Pp. 63-73, IP Mar)algo22Noch keine Bewertungen

- Determinisanјe Faktora Put Kao Uticajnog Faktora Na Saobraćajne Nezgode Primenom Dubinskih AnalizaDokument10 SeitenDeterminisanјe Faktora Put Kao Uticajnog Faktora Na Saobraćajne Nezgode Primenom Dubinskih AnalizaDarko LakicNoch keine Bewertungen

- Grand Jury Indictment For MurderDokument3 SeitenGrand Jury Indictment For MurderYubaNetNoch keine Bewertungen

- Moody, Raymond A. - Reflections On Life After LifeDokument83 SeitenMoody, Raymond A. - Reflections On Life After Lifemr.document95% (21)

- Music Genre AnalysisDokument5 SeitenMusic Genre AnalysisPeh Xin YingNoch keine Bewertungen

- Gned 15 Mod 3 SummaryDokument3 SeitenGned 15 Mod 3 SummaryRose Marie BaylonNoch keine Bewertungen

- Monster Nails Girl To TreeDokument7 SeitenMonster Nails Girl To TreeSteven Donnini100% (1)

- Existentialism in The The StrangerDokument3 SeitenExistentialism in The The StrangerBryan Flemming0% (1)

- Character PlaylistDokument3 SeitenCharacter Playlistapi-232909720Noch keine Bewertungen

- Action Adventure Comedy Drama Supernatural Human Weapons ShinigamiDokument26 SeitenAction Adventure Comedy Drama Supernatural Human Weapons Shinigamisincha13Noch keine Bewertungen

- Killing Our Dreams When Harvest Time ArrivesDokument1 SeiteKilling Our Dreams When Harvest Time Arrivesclandestine2684Noch keine Bewertungen

- Kami Export - Excerpt The Jungle PDF Jose IwakiDokument3 SeitenKami Export - Excerpt The Jungle PDF Jose Iwakiapi-354913050Noch keine Bewertungen

- LawsuitDokument7 SeitenLawsuitWMBF NewsNoch keine Bewertungen

- Forensic Identification (TJ)Dokument38 SeitenForensic Identification (TJ)RezaNoch keine Bewertungen

- GrammarDokument5 SeitenGrammarSofiko ChanturidzeNoch keine Bewertungen

- Succession-Digested CasesDokument45 SeitenSuccession-Digested CasesLilibeth CalopeNoch keine Bewertungen

- The Story of Mumtaz Mahal and Savitri (Short Script With Worksheet)Dokument5 SeitenThe Story of Mumtaz Mahal and Savitri (Short Script With Worksheet)Luxeria MystNoch keine Bewertungen

- Fail Maklumat MuridDokument51 SeitenFail Maklumat MuridAnonymous eEDmkcWbTmNoch keine Bewertungen

- Number Is 0134262931 and The Reference Number Is 1010456874 and The Location of TheDokument1 SeiteNumber Is 0134262931 and The Reference Number Is 1010456874 and The Location of TheJay SuarezNoch keine Bewertungen

- Form 2 Death ReportDokument1 SeiteForm 2 Death ReportSunilNoch keine Bewertungen

- HurryDokument3 SeitenHurryLauri SierraNoch keine Bewertungen

- Sucesos de Las Islas Filipinas (Chapter 8) : Kent Jayson F. Reteo BA History 4-1Dokument24 SeitenSucesos de Las Islas Filipinas (Chapter 8) : Kent Jayson F. Reteo BA History 4-1LuisensationalNoch keine Bewertungen

- HalloweenDokument16 SeitenHalloweenalysonmicheaalaNoch keine Bewertungen