Beruflich Dokumente

Kultur Dokumente

Chap 005

Hochgeladen von

nonesoloCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chap 005

Hochgeladen von

nonesoloCopyright:

Verfügbare Formate

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

CHAPTER FIVE

Accrual Accounting and Valuation: Pricing Book Values

Stephen H. Penman

The web page for Chapter Five runs under the following headings:

What this Chapter is Doing

The Key Ideas Behind Residual Earnings Valuation

Lessons from the Savings Account: Applying the Residual Earnings Model in a

Case Where There is No Premium

Lessons from the Savings Account: Dividend Irrelevance

Lessons from the Savings Account: Detecting Value Added

More on Dividend Irrelevance

Residual Earnings Valuation and (Value-Irrelevant) Share Issues and Dividends

Getting Analysts Forecasts from the Web

Analysts Forecasts and Residual Earnings Valuation: Hewlett Packard

The Calculation of Continuing Values

Target Prices

The Terminal Value for the Dividend Discount Model

Spreadsheet Engines to Develop a Residual Earnings Valuation

Derivation of the Residual Earnings Model

Readers Corner

5-1

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

What this chapter is Doing

Chapter 5 and Chapter 6 are the conceptual heart of the book. The valuation models laid

out in these two chapters provide the platform on which most of the rest of the book is

built. The book deals with analysis and valuation; the valuation models here instruct us

how to analyze and value firms.

A valuation model, remember, is not just a guide to calculating value, it is a way of

thinking about a business and how a business generates value. The model in this chapter

depicts business activity as investing in net assets (recorded in book value) and

employing those assets to produce a return. If the rate of return on the book value is

greater than the required return, value is added to the recorded book value.

In Chapter 1, we depicted valuation as anchoring on a particular fundamental, then

adding extra value:

Value = Anchor + Extra Value

In this chapter, the anchor is the book value of common equity (net assets):

Value = Book Value + Extra Value

This type of valuation applies to any asset to equities and bonds -- and to valuing

projects and strategies (as the chapter shows). As bonds and projects are terminal

investments, discounted cash flow analysis suffices. But for going-concern equities and

strategies, the advantages of accrual accounting are desired, and the valuation in this

model relies on accrual accounting.

The Key Ideas Behind Residual Earnings Valuation

The financial statements present three bottom line numbers, the free cash flow (in the

cash flow statement), the book value (in the balance sheet), and earnings (in the income

statement). Chapter 4 explained why we might not focus on the free cash flow. But we

can focus on book value and earnings. The focus in this chapter is on pricing the book

value, that is, on determining the multiplier (the P/B ratio) to apply to book value to get

the value. In Chapter 6 our focus will move to the pricing of earnings, that is, to

determining the multiplier to apply to earnings (the P/E ratio) to get value.

Book value is a natural starting point to value the equity. After all, it is a measure of the

shareholders equity. Its sometimes referred to as net worth. It is also a measure of the

net assets. However it is usually an imperfect measure; the accountants dont get it right.

It you worked the Weyerhaeuser case M3.3, you will have seen how difficult it is to

mark a balance sheet to market, so we have to be sympathetic to the accountants.

Indeed, in Chapter 3 we concluded that asset-based valuation is an impossibility.

5-2

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Chapter 5 lays out the methods of correcting the book value by calculating the difference

between value and book value, the premium over book value. The methods effectively

mark equity to market, not by getting market values of the assets and liabilities that make

up equity value (as with asset-based valuation), but by forecasting the return on book

values. The residual earnings model (or residual income model) tells us how to go about

doing this.

Here is the main concept: value depends on expected profitability of book values. If book

values are expected to earn at the required return, book value equals value; one should

not pay a premium over the book value. If book values are expected to earn at a rate

higher than the required return, they are worth a premium over book value. If book values

are expected to earn at a rate lower than the required return, they are worth a discount

from book value. The residual earnings model imbeds this key idea.

There is a further implication of this key idea. Value is added only if investments earn

above the required return. We want a valuation model to add value only if investments

earn more than the required return. Residual earnings charges investment with the

required return, so adds value appropriately. If we apply the model to strategy evaluation,

for example, it detects value added and identifies strategies where no value is added. See

the section, Beware of Paying Too Much for Book Value.

Here is another concept: value also depends on expected growth in book values. The

amount that will be earned on current book value depends not only on the expected return

on book value in future periods (the forecasted return on common equity, ROCE), but

also on the amount of future book values. So the model points to two value drivers:

ROCE and growth in book value. Figure 5.1 is a good summary.

Here is another concept: valuation does not depend on how book values are measured.

The model adjusts to the accounting employed so that different accounting methods do

not affect the valuation. If a firm uses conservative accounting methods that report low

balance sheets by expensing R&D expenditures, thus keeping knowledge assets off the

balance sheet, for example future residual income will be higher, compensating for the

low book values. See the section, Protection from Paying Too Much for Earnings

Created by the Accounting.

Here is another concept: valuations using the residual income model are not sensitive to

dividend payout. See the discussion of dividend irrelevance later in the Supplement. So

the valuations here obey the Miller and Modigliani principles that we outlined in Chapter

3. Unlike the dividend discount model in Chapter 3, the residual earnings model is not

affected by the (value irrelevant) dividends that a firm pays.

5-3

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Lessons from the Savings Account: Applying the Residual Earnings Model in a Case

Where There is No Premium

On the web pages for earlier chapters, we developed ideas by reference to the standard

savings account. Remember the maxim: what works for equities must work for a savings

account. Chapter 5 shows how the residual income model works for a savings account.

Here we elaborate and, in so doing, demonstrate the concepts alluded to above.

Consider the following pro forma, for five years ahead, for a savings account that earns

at 10% per year. This is similar to the pro forma used for the savings account example in

the web pages for chapters 1 and 4. The current book value (at date 0) is 100.

Savings Account with No Payout

Year

Book value

100

110

121

133.1

146.41

161.05

10

11

12.1

13.31

14.64

Earnings

Dividends

Earnings growth

10%

10%

10%

10%

10%

ROCE

10%

10%

10%

10%

10%

Residual earnings

When introducing the savings account on the web page for Chapter 1, we said that one

way of valuing the asset is to refer to its book value. The book value is 100, and we know

that this is the value of the account. So in this case there is no premium or discount; the

intrinsic P/B ratio is 1.

We can of course proof this valuation by applying the residual income model. For an

asset that is worth its book value, we must forecast that the rate of return is equal to the

required return, that is, the forecasted residual income is zero. The required return is 10%

(thats what you could get for the same type of savings account at the bank across the

street). The forecasted ROCE is 10%. So the forecasted residual earnings are zero, as

indicated in the pro forma. We have demonstrated the main concept above for the savings

account: if a firm is expected to earn an ROCE equal to its required return, it is worth

book value.

5-4

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Lessons from the Savings Account: Dividend Irrelevance

In the pro forma above, no dividends are paid out (there are no withdrawals from the

account). Dividend payout will not, of course, affect the value. In the following pro

forma, the account holder withdraws all earnings each year so that the book value is

always 100. Expected ROCE is still 10% and residual earnings are still zero. The value is

still 100; the valuation is insensitive to dividend payout. Hats off to Mr. Miller and Mr.

Modigliani.

Savings Account with Full Payout

Year

100

100

100

100

100

100

Earnings

10

10

10

10

10

Dividends

10

10

10

10

10

ROCE

10%

10%

10%

10%

10%

Book value

Residual earnings

Lessons from the Savings Account: Detecting Value Added

One of the other key concepts above involved adding forecasts of growth in book value

to forecasts of return on book value, ROCE. Lets see how this concept applies to the

savings account. Suppose that we have the same savings account as above, but add $10

more investment each period (that is, make additional deposits into the account). Deposits

into the account are negative dividends that are added to book value, so the pro forma is

as follows:

Savings Account with Further Investment

Year

-1

Book value

90.9

100

120

Earnings

9.1

Dividends

Earnings growth

142

166.2

192.8

222.08

10

12

14.2

16.6

19.3

(10)

(10)

(10)

(10)

(10)

10%

20%

18.3%

16.9%

16.3%

5-5

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

ROCE

10%

10%

10%

10%

Residual earnings

10%

0

You see that book values are growing at quite a pace here. According to the concept, the

P/B ratio depends not only of forecasts of ROCE but also on forecasts of growth in book

values to earn at that ROCE. In general this is true. But there is one exception, and that is

the case here: If added book value (investment) earns at a rate equal to the required

return, it does not add value. The value of the savings account at date zero is still 100.

This idea makes sense, of course. Value is added only if investments earn above the

required return. We want a valuation model to add value only if investments earn more

than the required return. The residual earnings charges investment with the required

return, so adds value appropriately. So, if one is evaluating strategies using the model (as

in Table 5.4 in the chapter), one is confident that strategies that do not add value (like

investing in a savings account) will be identified.

More on Dividend Irrelevance

Expected dividends do not affect residual earnings valuation because they do not affect

residual earnings. This is because dividends affect both earnings and book value in the

residual earnings calculation.

Here's a more detailed explanation :

Residual earnings(t) = Earnings (t) - (-1) x book value(t-1)

A dividend paid at t-1 reduces book value but it also reduces earnings(t); that is, as assets

are removed from the firm, subsequent earnings drop (this is the dividend displacement

property). If the assets would have earned at the required return, the amount of the

earnings displacement is (-1) x dividend, leaving residual earnings before and after the

dividend the same.

As an example, if RE = 12 - (0.10 x 100) = 2 before the dividend but then a dividend of

20 is paid out of book value, then RE is 10 - (0.10 x 80) = 2, as before. Earnings in year t

drops by 0.10 x 20 = 2 because 20 of assets have been removed from the firm. You can

see this very clearly in the case of a savings account.

You may ask: why does the dividend displace subsequent earnings at 10%; what if the

disbursed assets that would have earned 12% rather than 10%? Well, then, RE would

indeed decline, but this is not dividend irrelevance. The M&M dividend irrelevance

concept maintains that firms do not liquidate (or forego) positive NPV investment to pay

dividends (and so destroy value). Rather they pay dividends out of zero NPV assets (like

cash). Or, if they need to pay dividends and have no cash, they borrow (in another zero

NPV transaction) rather than liquidate profitable investments.

5-6

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Accordingly price falls when dividends are paid, dollar-for-dollar. Correspondingly a

residual earnings valuation also falls dollar-for dollar: book value drops by the amount of

the dividend but expected RE is unaffected. And value is not affected by anticipated

dividends in the future because expected residual earnings are not affected (and, of

course, neither in current book value).

Note that, while RE is not affected by dividends, ROCE is. But ROCE is not the

valuation attribute, but rather RE:

RE(t) = (ROCE(t) - r) x book value(t-1).

Residual Earnings Valuation and (Value-Irrelevant) Share Issues and Dividends

We saw in Chapter 3 that share issues, share repurchases and dividends typically do not create value if stock

markets are efficient. So anticipated net shares issues at fair value and dividends should not change a residual

earnings valuation of a firm. Yet residual earnings is forecasted by forecasting book values, and book values are

affected by share issues (and repurchases) and dividends. How, then, can the valuation be not affected by these

transactions with shareholders?

The example below values the equity of a firm with a book value of $1,000 and no expected dividends or share

issues. The firm is expected to have positive residual earnings for two years and zero residual earnings thereafter.

Valuation of equity with no share issues or dividends

Cost of equity capital: 10%

Earnings

Dividends

Share issues

Book value

ROCE

RE (0.10)

Total PV of RE

Value of equity

$1,000

$ 150

0

0

1,150

$ 140

0

0

1,290

$ 129

0

0

1,419

15%

50

12.2%

25

10%

0

66

$1,066

Shares outstanding

100

Value per share

$10.66

__________________________________

This firm now anticipates a share issue of $100 in Year 1 and a dividend of $25 in Year 2.

Valuation of equity with an anticipated share issue and dividend

Cost of equity capital: 10%

0

Earnings

5-7

$ 150

$ 150

$137.5

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Dividends

Share issue

Book value

$1,000

ROCE

RE (0.10)

Total PV of RE

66

Value of equity

$1,066

Shares outstanding

100

Value per share

$10.66

____________________________________

0

100

1,250

25

0

1,375

0

0

1512.5

15%

50

12%

25

10%

0

The two valuations are the same: anticipated dividends and share issues are indeed irrelevant to the valuation. The

share issue of 100 in the first year earns at the required return of 10% to add an extra 10 to earnings in Year 2. But it

does not affect RE because the additional book value is charged at 10% also. 1 Of course, if proceeds of the issue

were invested in a project earning greater than 10%, RE would be higher and added value would be recognized,

appropriately, in the valuation. But the share issue itself does not add value. Similarly, the dividend in Year 3

reduces book value but not RE, so does not affect the value. Again, if the management liquidated value creating

investments (earning greater than a 10% return) to make the dividend, value would be lost. But that dividend would

not be value-irrelevant, and the RE valuation would reveal so.

These examples are illustrative of a more general principle: only investments that yield returns over the required

return add to RE (and to the valuation). Share issues (investments in firms) and share repurchases and dividends

(disinvestments) affect RE and value only if they affect investments within the firm that earn at a rate different from

the required return.

We saw in Chapter 4 that share issues, repurchases and dividends may signal about the value of the investments a

firm makes. If so, that information revises RE forecasts and the value signaled is captured by an RE calculation.

______________________

1

There may be leverage effects that are not incorporated. We deal with leverage effects in Chapter 14 and show that

they do not affect the conclusion here. Treat the firm here as one with no leverage .

Getting Analysts Forecasts on the Web

Analysts forecasts are usually made for the current and next fiscal quarter, the current

and next fiscal year, and the following fiscal year. Analysts also often give an estimate of

earnings growth for the three to five years after one year ahead.

Consensus estimates are available for most companies through the finance portal sites on

the Links Page. So, for example, it you go to http://finance.yahoo.com/ and enter a ticker

symbol, you will get consensus earnings forecasts and broker recommendations under

Analyst Estimates. You will also get analysts stock recommendations under Analysts

Opinions.

5-8

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Analysts Forecasts and Residual Earnings Valuation: Hewlett Packard

In November, 1999, Hewlett-Packards shares traded at $83 each. Analysts were

expecting the firm to announce earnings of $3.33 per share for the just-ended October 31

fiscal year and a book value per share of $19.36. The annual dividend per share for fiscal

1999 was 0.64.

Analysts were also forecasting earnings for fiscal 2000 at $3.75 per share, $4.32 for 2001,

and a growth rate in eps of 12% per year thereafter. From these forecasts, we can value

HP.

The majority of analysts had a BUY or STRONG BUY on HP at the time. We can also

apply the valuation techniques to ask whether these recommendations consistent with the

forecasts. Well use a cost of equity capital of 12%

(a) The Valuation

Time line:

Eps

1

Dps

BPS

1999A

2000E

2001E

2002E

2003E

3.33

0.64

3.75

0.71

4.32

0.82

4.83

0.92

5.42

1.03

6.07

1.15

6.80

1.29

19.36

22.40

25.90

29.81

34.20

39.12

44.63

1.43

1.63

1.72

1.84

1.97

2.11

5.5%

1.405

1.22

7.0%

7.0%

7.0%

1.12

1.28

14.0%

1.254

1.30

RE (0.12)

Growth in RE

Discount factor

t

PV of RE(1.12 )

Total PV of RE to 2002

3.80

36.80

Continuing value

PV of CV

26.19

Value per share

49.35

5-9

2004E 2005E

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

1. The dps forecast is based on maintaining the same pay out ratio as in 1999.

2. CV =

1.84

= 36.80, where 7% is the long-term growth ratio in RE.

1.12 1.07

PV of CV = 36.80/1.405 = 26.19.

The valuation from the forecasts is less than the market price of $83. The forecasts imply

a SELL, not a BUY.

Note that one could also calculate the continuing value at the end of 2002, based on the

1.72 of RE in 2002 growing at 7%, and get the same answer.

Note some difficulties we have in converting an analysts forecast to a valuation:

0

Analysts did not give a forecast of dps (which affects forecasted eps and bps).

We used a constant-payout forecast, but is this what analysts had in mind in forecasting

the eps (that are displaced by dividends)?

1

We relied on analysts long-run eps growth forecasts to calculate a value.

These forecasts are suspect. Research shows they are not very accurate and are usually

too optimistic.

3.

We relied on analysts forecasts to 2002 to get the implied long-run growth rate

from the current market price. Are these good forecasts?

The Calculation of Continuing Values

A (continuing) value is always calculated at the end of a period on the basis of a forecast

for the following period:

CVT

RET 1

g

The following calculations give the same value:

V0 B0

RE1

RE 2

( g)

(1)

5-10

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

V0 B0

RE1 RE 2

RE g

2 2 2

( g )

(2)

Calculation (1) draws the continuing value at the end of year 1 based on RE for year 2

Calculation (2) draws the continuing value at the end of year 2 based on RE for year 3

Use the HD valuation (with a 4% GDP growth rate) to show they are the same:

V0 12.67

1.713

1.755

1.10

1.10 (1.10 1.04)

V0 12.67

1.713 1.755

1.755 1.04

= $40.82

1.10

1.21 1.21 (1.10 1.04)

= $40.82

(1)

(2)

Target Prices

Analysts often announce their target prices in equity research reports. The target price is a

price to which they feel a stock will rise or fall. The chapter shows that a target intrinsic

value at some onward forecast horizon can be extracted, for this purpose, from the

continuing value calculation. The target price is:

Target price (at time T) = Book Value at T + Continuing Value at T.

The calculation differs for the Case1, Case2, and Case3 valuations.

For a Case 1 valuation,

Target Price (at time T) = Book Value at T

For a Case 2 valuation,

Target Price (at time T) = Book Value at T +

RET 1

1

For a Case 3 valuation,

Target Price (at time T) = Book Value at T +

5-11

RET 1

g

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

The target value calculated in the chapter is, of course, an expected intrinsic value. This

target is the market price that the analyst feels that the stock will revert to after any

mispricing is corrected in the market. However, an analyst could specify a target price

with the understanding that the stock will deviate from fundamentals in the future. He or

she may expect a stock to become (more) mispriced, as happened, for example, in the

1990s bubble as prices, already high, continued to go up even more. In this case, he or

she is telling us where the stock price will go as it deviates from fundamentals, not what

the intrinsic value is expected to be.

Here is an exercise that computes target prices:

a. In 2003 an analyst forecast that the book value of the common equity of a firm

would be $6,120 million at the end of 2005. He also forecast that the firm would

earn on this common equity at a rate equal to the required return on equity, 11

percent. What is your forecast of the value of the equity at the end of 2005?

b. How would your answer change if the analyst forecast that the firm would earn

constant residual earnings of $25 million each year after 2005?

c. How would your answer change if the analyst forecast $25 million of residual

earnings for 2006, growing at a rate of 3 percent per year after that?

Here is the solution:

Recognize that a target (forecasted) value is calculated from forecasted book values and

continuing values:

Target value = Book value + continuing value

a. If residual earnings are forecasted to be zero (and thus the continuing value is

zero), the forecasted value must equal the book value of $6,120 million. (A Case 1

valuation)

b. In this case (Case 2), the continuing value (CV) is the RE for 2006 capitalized at

11%:

5-12

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

CV =

25

227.3

0.11

Target value = 6,120 + 227.3 = 6,347.3

c. In this case (Case 3), the continuing value is the RE for 2006 capitalized at the

growth rate of 3%:

CV =

25

312.5

1.11 1.03

Target value = 6,120 + 312.5 = 6,432.5.

The Terminal Value for the Dividend Discount Model

Chapter 4 discarded the dividend discount model because forecasted dividends up to

some point, T, in time do not tell you much about value for a going concern. Figure 3.4 in

Chapter 3 shows us that one needs to forecast, not only the dividends, but also the

terminal price that will be received when the investment is sold. So, the dividend discount

model includes the expected terminal price, as in model 4.2 in Chapter 4. But the terminal

price is unknown it is price that we are trying to estimate!

Chapter 5 shows how to estimate target prices. Accordingly, residual earnings

techniques supply the terminal value for the dividend discount formula. The following

elaborates.

Equivalent Valuation Methods: the Terminal Value for the Dividend Discount Model

5-13

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

In applying the RE model to value equity in this chapter, we found that we could not only

calculate the current value, V0E , but could also calculate the expected terminal value:

VTE = expected book value at T + expected premium (continuing value) at T. So for

General Electric, for example, the expected value at T was $7.96 + 8.82 = $16.78.

Remember that, in trying to apply the dividend discount model in Chapter 4, we

abandoned the task because we did not know how to get the terminal payoff. Now we

have it so, with VTE in hand, we can value the equity with the dividend discount model

as

d1

d 2 d3

dT

VTE

V 1 2 3 T T

E E E

E

E

E

0

Indeed we can state the models for cases 1, 2, and 3 in terms of discounted dividends plus

the present value of an expected terminal value. In Case 1 we expect the terminal payoff

to be equal to the forecasted book value, so the Case 1 valuation can be restated as

V0E

B

d

d1

d

d

22 33 TT TT Case 1

1

E

E

E

E

E

Go back to Flanigans Enterprises case in the chapter and discount the forecasted

dividends from 2000 to 2003 and 2003 book value of $5.41 to present value; you will get

the same valuation as before (4.53)

In Case 2, we expect the terminal value to be book value plus the (non-zero) continuing

value (CV). For Case 2, CVT

RET 1

, and RET+1 = RET. So the equivalent discounted

E 1

dividend valuation is

5-14

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

V0E

d

d1

d

d

RET

T

22 33 TT BT

/ E

1

1

E

E

E

E

Case 2

For General Electric, the term in the square brackets the target value is $16.78 for T =

2004. Plugging is the dividends for 2000 to 2004 into this formula, you will see than it

gives the same valuation ad in the text ($13.07).

The case 2 valuation can be written yet another way:

V0E

Earn T 1 T

d

d1

d

d

22 33 TT

/ E

1

E

E

E

E

E 1

Case 2

The terminal value here is just the capitalized net income that is forecasted for year T + 1.

This is applied to Wal-Mart below, for the years when it had negative free cash flow,

below:

________________________________________________________________________

______

Case 1 (Dividend Discounting): Wal-Mart

Forecast

year, t

1988

1989

1990

1991

1992

1993

1994

1995

1996

Dps

.03

.04

.06

.07

.09

.11

.13

.17

.20

Eps

.28

.37

.48

.57

.70

.87

1.02

1.17

1.19

Discount

factor

1.12

1.25

4

1.405

1.574

1.762

1.97

4

2.211

2.47

6

2.77

3

PV of dps

.027

.032

.043

.044

.051

.056

.059

.069

.072

Total PV

of dps

1987

.46

5-15

1997

1.31

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Terminal

value

(=

1.31/.12)

10.92

PV of TV

3.93

V0E

4.39

________________________________________________________________________

______

The terminal payoff is this earnings forecast, capitalized. The 1987 equity value is the

present value of this payoff plus the present value of the stream of dividends, or $4.39.

You can make the same calculation for GE by forecasting the 2005 eps from the

forecasted RE for 2005, $0.882.

The corresponding calculation for Case 3 uses the Case 3 terminal value (target price):

V0E

d

d1

d

d

RET

T

22 33 TT BT

/ E

1

E g

E

E

E

E

Case 3

This can also be written as

V0E

Earn T 1 g 1 BT T

d

d1

d

d

22 33 TT

/ E

1

E g

E

E

E

E

You can proof this with the Dell Computer Case 3 example in the text. This formula is a

good one to keep in mind because it captures all cases. If g = 1 then we have the Case 2

valuation. If Earn T 1 E 1 BT -- that is, RE T 1 = 0 -- then we have the Case 1

valuation.

5-16

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

As these calculations are equivalent to the RE valuations in the chapter, you can make the

calculation either way.

With the dividend discount approach here, we forecast the

earnings and book value at the horizon, combine them with the forecasted growth rate (if

any), and then add the present value of the dividend payoff up to the horizon.

In the strategy example in this chapter we saw that the RE valuation and the DCF

valuation are equivalent for a five-year horizon. In the web page supplement to Chapter

16 we will lay out the conditions where this is so. And we will show how the RE model

supplies the continuing value for the DCF valuation as well as for the dividend discount

valuation

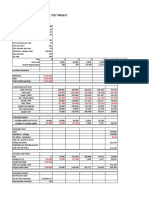

Spreadsheet Engines to Develop a Residual Earnings Valuation

Here are spreadsheet programs that you can use to perform residual earnings valuations.

Click on the panel, enter your forecasts of dividends and earnings, along with the

required return, and the program will fill out the rest of the calculations and calculate the

value.

Use the programs for sensitivity analysis: How does the valuation change when the

forecasts change? When the required return changes?

A warning: Do not use mechanically. Understand what you are doing.

Case1

The first spreadsheet is for a Case 1 residual earnings valuation. Click on the panel below

to get it into spreadsheet form. Enter the required return and forecasts of eps and dps for

years 1 6 ahead. Click out and you will have a valuation based on those forecasts.

5-17

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Forecast Year

Required Return

Eps

Dps

Bps

ROCE

RE

Discount factor

PV of RE

Total PV of RE

Value per share

0.09

1

2

2.81

2.53

2.00

2.02

19.85 20.66 21.17

14.2% 12.2%

1.02

0.67

1.090 1.188

0.94

0.56

2.58

22.43

3

2.48

2.06

21.59

11.7%

0.57

1.295

0.44

4

2.36

2.10

21.85

10.9%

0.42

1.412

0.30

5

2.4

2.14

22.11

11.0%

0.43

1.539

0.28

6

2.08

2.18

22.01

9.4%

0.09

1.677

0.05

Case 2 or 3

The second spreadsheet works for a Case 2 or Case 3 valuation. Set the growth rate equal

to 0.00 for a Case 2 valuation (as here) and a positive rate for a Case 3 valuation.

Forecast Year

Required Return

Eps

Dps

Bps

ROCE

RE

Discount factor

PV of RE

Total PV of RE

RE growth rate

Continuing value

PV of CV

Value per share

0.12

1

2

3

4

0.28

0.37

0.48

0.57

0.03

0.04

0.06

0.07

0.75 1.00

1.33

1.75

2.25

37.3% 37.0% 36.1% 32.6%

0.19

0.25

0.32

0.36

1.120 1.254 1.405 1.574

0.170 0.199 0.228 0.229

2.05

5

0.70

0.09

2.86

31.1%

0.43

1.762

0.244

6

7

8

9

0.87

1.02

1.17

1.19

0.11

0.13

0.17

0.20

3.62

4.51

5.51

6.50

30.4% 28.2% 25.9% 21.6%

0.53

0.59

0.63

0.53

1.974 2.211 2.476 2.773

0.267 0.265 0.254 0.191

0.02

5.394

1.95

4.74

5-18

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Here is another engine. Again, click on it to operate.

These programs are not flexible for different forecast horizons.go now and build your

own engines.

If you are adept with spreadsheet building, you should be able to

-

Build engines with different forecast horizons

Pull in analysts forecasts into you analysis (from Yahoo Finance, for example)

In building a spreadsheet, keep the following in mind:

1. Differentiate clearly between inputs that are hard-coded (meaning that one

enters them manually into the spreadsheet) and values that are calculated. The

different colors in the spreadsheet above make the distinction.

2. Also distinguish inputs that come from a source (eg, a Treasury Bill rate) from

those that come from ones forecasting (or assumptions).

3. Insert comments liberally (this can be done in Excel by pressing the SHIFT+F2

simultaneously), explaining data sources, calculations, and logic. This will

prevent errors as you reuse the spreadsheet.

5-19

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Derivation of the Residual Earnings Model

The mathematical proof involves substituting Dividends = Earnings Change in book

value (the stocks and flow equation for the equity statement in Chapter 2) into the

dividend discount model. Boundary conditions, like those for the dividend discount

model, require that book value should not grow too fast in the long run. The valuation is

also consistent with the DCF model for forecasts made over very long forecast horizons.

See Wolfgang Lcke, Investitionsrechnung auf der Grundlage von Ausgaben oder

Kosten? Zeitschrift fr Betriebswirtschaftliche Forschung 7 (1955), 310-324.

Heres how it goes:

Everyone agrees that equity value is equal to the present value of expected dividends plus

any price one gets in liquidation. To start simply, let's deal first with the one-period

payoff to equity which will be the dividend and price expected at the end of one period:

d1 + P1. In this case, present value, P0 =

(d 1 P 1 )

, where, as in the text, E is one plus the

E

required rate of return on equity. We saw in Chapter 5 that the expected dividend

component of the payoff is equal to forecasted comprehensive earnings minus the

forecasted change in book value: d1 Earn1 B1 B0 . This is called the cleansurplus equation rearranged and is, of course, the accounting relation that governs the

equity statement (as in Chapter 2), provided earnings are comprehensive income. So,

substituting for dividends in the payoff,

5-20

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

P0

Earn B

1

B 0 P1

B 0 Earn 1 P1 B1

E

E

B0

Earn 1 E 1 B 0 P1 B1

E

E .

The amount forecasted in the second term, Earn 1 ( E 1)B 0 , is the residual

earnings for equity for the coming year.

The model says that we get the no-arbitrage price by forecasting next year's

residual income and the premium at the end of the year, taking their present value, and

adding the current book value in the balance sheet. We can extend the formula to longer

forecast horizons by substituting comprehensive earnings and book values for dividends

in each future period. So, for a forecast for T periods,

RE1 RE 2

RE 3

RE T

P B

2

T T T.

3

T

E

E

E

E

E

For infinite periods,

P0 B0

P0 B0

R E1

R E2

R E3

.....................

2

E

E

E3

That is, the no-arbitrage price (value) is the present value of residual earnings forecast

indefinitely into the future because we have simply substituted earnings and book values

for dividends. This is always equal to the present value of dividends forecasted

indefinitely into the future: The infinite horizon residual earnings models is equivalent to

the infinite horizon dividend discount model.

5-21

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Readers Corner

The residual earnings model has had a long history. In the early part of the twentieth

century, the idea that a firms value was based on excess profits was firmly established

in the United Kingdom. The model is found in German literature of the 1920s and 1930s,

particularly in the writings of Schmalenbach.

In the U.S., Gabriel Preinreich, an accounting and valuation theorist associated with

Columbia University in the 1930s and 1940s wrote extensively on the model, including

The Fair Value and Yield of Common Stock, The Accounting Review (1936), 130-140

and Note on the Theory of Depreciation, Econometrica (1941), 80-88. In the latter

paper, Preinreich recognizes the model in a student essay prize paper published in

London in 1888: J. H. Bourne, Accountant, London, September 22, 1888, 605-606. A

very good summary of his papers is found in a collection edited by Richard Brief at New

York University:

Richard Brief, ed., A Landmark in Accounting Theory: The Work of Gabriel A.D.

Preinreich. New York: Garland Publishing, Inc., 1996.

Strangely, the model was ignored for many years. Williams The Theory of Investment

Value (Harvard University Press, 1938) promoted dividends as the fundamental for equity

valuation, and academics have followed that tradition. U.S. texts have modified the

model to focus on free cash flows within the firm rather than cash flows to shareholders

(dividends), and discounted cash flow analysis was the premier valuation technique in

investment houses for many years (less so in Europe). Investments texts still have a

substantial coverage of the dividend discount model.

Modern recognition of the residual income model is found in the following:

Lcke,W. 1955. Investitionsrechnung auf der grundlage von ausgaben oder kosten?

Zeitschrift fr Betriebswirtschaftliche Forschung, 310-324.

Edwards, E.O. and Bell, P.W., The Theory and Measurement of Business Income

(Berkeley: University of California Press, 1961), Note the appendix to chapter 2

particularly.

Peasnell, K.V., Some Formal Connections Between Economic Values and Yields and

Accounting Numbers, Journal of Business Finance and Accounting (Autumn, 1982):

361-381.

The model was revived in academic research by two important theoretical papers that put

accounting on the same (Modigliani and Miller) principles as modern finance. These are

difficult papers to master, but very rewarding:

5-22

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Ohlson, J. A., "Earnings, book values, and dividends in equity valuation." Contemporary

Accounting Research 11 (1995): 661-87.

Feltham, J., and J. Ohlson., Valuation and clean surplus accounting for operating and

financing activities, Contemporary Accounting Research 11 (1995): 689 731.

Tests of the model against the dividend discount model and the discounted cash flow

model are found in

Penman, S., and T. Sougiannis. The dividend displacement property and the

substitution of anticipated earnings for dividends in equity valuation. The Accounting

Review 72 (January 1997): 1-21.

Penman, S and T. Sougiannis, A Comparison of Dividends, Cash Flow, and Earnings

Approaches to Equity Valuation, Contemporary Accounting Research (Fall 1998), 343383.

The following paper shows how various valuation models are related to each other, and

shows how the residual income model supplies the terminal value for the dividend

discount model (as explained in the appendix to Chapter 5):

Penman, S., A synthesis of equity valuation techniques and the terminal value

calculation for the dividend discount model. Review of Accounting Studies 2 (1997):

303-323.

The residual earnings model has been applied to the valuation of the 30 Dow industrial

stocks in

Lee C. M. C, J. Myers and B. Swaminathan., "What is the intrinsic value of the Dow?"

Journal of Finance 54 (1999): 1693-1741.

Lee, C, and B. Swaminathan, Valuing the Dow: A Bottom-up Approach, Financial

Analysts Journal, July/October, 1999, 4-23.

Also look at

Ali, A., L. Hwang, and M. Trombley, Residual-Income-Based Valuation Predicts Future

Stock Returns: Evidence on Mispricing vs. Risk Explanations, Accounting Review

(April 2003), 377-396.

Residual income has been advocated as a management performance metric for some

time. Du Pont used in the 1920s for bonus plan calculations. General Electric adopted it

in the 1960s. The following book has good coverage:

Solomons, S. Divisional Performance: Measurement and Control (Homewood, Ill:

5-23

Chapter 05 - Accrual Accounting and Valuation: Pricing Book Values

Irwin, 1965.

In the 1990s the measure has been revived for performance evaluation by consulting

firms, and marketed under names like economic value added, EVA(registered) and

economic profit. It received wide recognition through the promotion efforts of Stern

Stewart & Co under the name EVA. See

Stewart, G.B., The Quest for Value ( HarperBusiness, 1991)

Heres a paper that takes you into more depth:

Magni, C., Splitting Up Value: A Critical Review of Residual Income Theories,

unpublished paper, Department of Economics, University of Modena, Italy.

5-24

Das könnte Ihnen auch gefallen

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- The Valuation of A Savings AccountDokument10 SeitenThe Valuation of A Savings AccountoybiewNoch keine Bewertungen

- Limitation of Ratio AnalysisDokument5 SeitenLimitation of Ratio AnalysisMir Wajahat AliNoch keine Bewertungen

- A Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation PurposesDokument21 SeitenA Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation PurposesK Park100% (1)

- Economic Value Added or Cash Value AddedDokument42 SeitenEconomic Value Added or Cash Value AddedmiiekoNoch keine Bewertungen

- Cohen Finance Workbook FALL 2013Dokument124 SeitenCohen Finance Workbook FALL 2013Nayef AbdullahNoch keine Bewertungen

- Economicmodel of Roic Eva WaccDokument29 SeitenEconomicmodel of Roic Eva Waccbernhardf100% (1)

- Understanding Business Accounting For DummiesVon EverandUnderstanding Business Accounting For DummiesBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Relaince IndustriesDokument30 SeitenRelaince IndustriesAkshata MasurkarNoch keine Bewertungen

- FP&ADokument7 SeitenFP&AomkarNoch keine Bewertungen

- Evaluating CompaniesDokument6 SeitenEvaluating Companiesnukes308Noch keine Bewertungen

- Shareholder Value Analysis FrameworkDokument9 SeitenShareholder Value Analysis Frameworkashish.the7353Noch keine Bewertungen

- New Constructs ArticlesDokument8 SeitenNew Constructs ArticleskongbengNoch keine Bewertungen

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDokument36 SeitenLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNoch keine Bewertungen

- FP&A Interview Questions and AnswersDokument7 SeitenFP&A Interview Questions and Answershrithikoswal1603Noch keine Bewertungen

- Constructing Consistent Financial Planning Models For ValuationDokument32 SeitenConstructing Consistent Financial Planning Models For ValuationFlavio Vilas-BoasNoch keine Bewertungen

- New-Venture ValuationDokument7 SeitenNew-Venture ValuationBurhan Al MessiNoch keine Bewertungen

- FIN924 Lecture Topic 3Dokument43 SeitenFIN924 Lecture Topic 3Yugiii YugeshNoch keine Bewertungen

- Projecting Income Statement Line ItemsDokument6 SeitenProjecting Income Statement Line ItemsFriedeagle OilNoch keine Bewertungen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- From Custumer To ValueDokument16 SeitenFrom Custumer To ValueIstiqlala AliaNoch keine Bewertungen

- Accountingtools: Income Statement AnalysisDokument5 SeitenAccountingtools: Income Statement Analysissiti muthmainnah ariefNoch keine Bewertungen

- Equity ValuationDokument18 SeitenEquity ValuationNaddieNoch keine Bewertungen

- Quiz Theory AccountingDokument8 SeitenQuiz Theory Accountingjucia wantaNoch keine Bewertungen

- Individual Assignment Semester 22022Dokument3 SeitenIndividual Assignment Semester 22022Navin GolyanNoch keine Bewertungen

- Accounting Survival Guide: An Introduction to Accounting for BeginnersVon EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNoch keine Bewertungen

- CFI Jeff Schmidt - Analysis of Financial StatementsDokument7 SeitenCFI Jeff Schmidt - Analysis of Financial StatementsDR WONDERS PIBOWEINoch keine Bewertungen

- Financial Statements AnalysisDokument3 SeitenFinancial Statements Analysisash SmithNoch keine Bewertungen

- Accounting For Manager DDokument315 SeitenAccounting For Manager DPRASANJIT MISHRANoch keine Bewertungen

- Income Statement Case StudyDokument18 SeitenIncome Statement Case StudyToto100% (1)

- Finance Interview QuestionsDokument17 SeitenFinance Interview Questionsfilmy.photographyNoch keine Bewertungen

- Class12 Accountancy2Dokument42 SeitenClass12 Accountancy2Arunima RaiNoch keine Bewertungen

- Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting RatiosDokument47 SeitenAccounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratiosviswa100% (1)

- What is Financial Accounting and BookkeepingVon EverandWhat is Financial Accounting and BookkeepingBewertung: 4 von 5 Sternen4/5 (10)

- The Complete Investment Banker ExtractDokument19 SeitenThe Complete Investment Banker ExtractJohn MathiasNoch keine Bewertungen

- Clo-3 Assignment: Chemical Engineering Economics 2016-CH-454Dokument9 SeitenClo-3 Assignment: Chemical Engineering Economics 2016-CH-454ali ayanNoch keine Bewertungen

- CH 5Dokument10 SeitenCH 5Miftahudin MiftahudinNoch keine Bewertungen

- A Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation PurposesDokument21 SeitenA Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation Purposesjulita rachmadewiNoch keine Bewertungen

- 20 Accounting Changes and Error CorrectionsDokument17 Seiten20 Accounting Changes and Error CorrectionsKyll MarcosNoch keine Bewertungen

- EVA Vs CVA AnalysisDokument42 SeitenEVA Vs CVA AnalysisMaria Bulgaru100% (1)

- Residual Income ValuationDokument6 SeitenResidual Income ValuationKumar AbhishekNoch keine Bewertungen

- CFI Interview QuestionsDokument5 SeitenCFI Interview QuestionsSagar KansalNoch keine Bewertungen

- Financial Modelling NOTESDokument29 SeitenFinancial Modelling NOTESmelvinngugi669Noch keine Bewertungen

- Corporate Val Unit 1Dokument32 SeitenCorporate Val Unit 1Prashant SharmaNoch keine Bewertungen

- First Module Financial ModellingDokument7 SeitenFirst Module Financial ModellingSeba MohantyNoch keine Bewertungen

- Stock Valuation - Common Stock Valuation: Two Categories of Valuation ModelsDokument13 SeitenStock Valuation - Common Stock Valuation: Two Categories of Valuation Modelssandeep26bandiNoch keine Bewertungen

- Creating Shareholder Value: A Guide For Managers And InvestorsVon EverandCreating Shareholder Value: A Guide For Managers And InvestorsBewertung: 4.5 von 5 Sternen4.5/5 (8)

- Accounting Ratios: Inancial Statements Aim at Providing FDokument47 SeitenAccounting Ratios: Inancial Statements Aim at Providing Fabc100% (1)

- Case Study - Stella JonesDokument7 SeitenCase Study - Stella JonesLai Kok WeiNoch keine Bewertungen

- FM Reliance IndustriesDokument30 SeitenFM Reliance IndustriesAkshata Masurkar100% (2)

- Classification of Financial Ratios On The Basis of FunctionDokument8 SeitenClassification of Financial Ratios On The Basis of FunctionRagav AnNoch keine Bewertungen

- ACCT 504 MART Perfect EducationDokument62 SeitenACCT 504 MART Perfect EducationdavidwarneNoch keine Bewertungen

- Earnings ManagementDokument15 SeitenEarnings ManagementsaurabhNoch keine Bewertungen

- Cashflow Models in ProjectDokument3 SeitenCashflow Models in ProjectLiamRushNoch keine Bewertungen

- Question Responses (2022-10-13)Dokument4 SeitenQuestion Responses (2022-10-13)Amira SamirNoch keine Bewertungen

- F & M AccountingDokument6 SeitenF & M AccountingCherry PieNoch keine Bewertungen

- Analysis of Accounts NOTEDokument5 SeitenAnalysis of Accounts NOTEAdetunbi TolulopeNoch keine Bewertungen

- Managerial Accounting - BUS 5110 - Schedule & Topics:: To-Business-V1.0 PDFDokument13 SeitenManagerial Accounting - BUS 5110 - Schedule & Topics:: To-Business-V1.0 PDFNidhi SrivastavaNoch keine Bewertungen

- OcdDokument1 SeiteOcdnonesoloNoch keine Bewertungen

- Porsche - Int Macan - 2016 PDFDokument69 SeitenPorsche - Int Macan - 2016 PDFSculatorNoch keine Bewertungen

- 2017 Badminton CatalogueDokument34 Seiten2017 Badminton CataloguenonesoloNoch keine Bewertungen

- 1 s2.0 S0047272715000286 MainDokument13 Seiten1 s2.0 S0047272715000286 MainnonesoloNoch keine Bewertungen

- Pathways Menjadi Cpa Indonesia: Pusat Pembinaan Akuntan Dan Jasa Penilai Kementerian Keuangan Republik IndonesiaDokument3 SeitenPathways Menjadi Cpa Indonesia: Pusat Pembinaan Akuntan Dan Jasa Penilai Kementerian Keuangan Republik IndonesianonesoloNoch keine Bewertungen

- ArmDokument1 SeiteArmnonesoloNoch keine Bewertungen

- IFM10 Ch20 LectureDokument48 SeitenIFM10 Ch20 LecturenonesoloNoch keine Bewertungen

- Piye Kabaree Nhenenen Ke Iwee Loheeeeeeeeeeeeeeeeeeeeeeee Kaua Akarnaga Lajanahsydnasgakiaaooai Piye Kabaree Nhenenen Ke Iwee Loheeeeeeeeeeeeeeeeeeeeeeee Kaua Akarnaga LajanahsydnasgakiaaooaiDokument2 SeitenPiye Kabaree Nhenenen Ke Iwee Loheeeeeeeeeeeeeeeeeeeeeeee Kaua Akarnaga Lajanahsydnasgakiaaooai Piye Kabaree Nhenenen Ke Iwee Loheeeeeeeeeeeeeeeeeeeeeeee Kaua Akarnaga LajanahsydnasgakiaaooainonesoloNoch keine Bewertungen

- Iki BlastikDokument1 SeiteIki BlastiknonesoloNoch keine Bewertungen

- Daftar Pustaka ArtikelDokument9 SeitenDaftar Pustaka ArtikelnonesoloNoch keine Bewertungen

- IFM10 Ch22 LectureDokument50 SeitenIFM10 Ch22 LecturenonesoloNoch keine Bewertungen

- Chapter 7Dokument42 SeitenChapter 7nonesoloNoch keine Bewertungen

- MasseyDokument32 SeitenMasseynonesoloNoch keine Bewertungen

- Velasquez C7Dokument23 SeitenVelasquez C7Raffi MouradianNoch keine Bewertungen

- Chapter 15Dokument57 SeitenChapter 15nonesoloNoch keine Bewertungen

- Long Term FinancingDokument20 SeitenLong Term FinancingKristian Jon Rallos PutalanNoch keine Bewertungen

- Capital Budgeting Test Bank CompressDokument30 SeitenCapital Budgeting Test Bank CompressBiancaNoch keine Bewertungen

- Stock Valuation (Version 1)Dokument32 SeitenStock Valuation (Version 1)محمد حمزه زاہدNoch keine Bewertungen

- PPP2&SolutionDokument52 SeitenPPP2&SolutionPrithvi BhushanNoch keine Bewertungen

- How To Value A Startup BusinessDokument12 SeitenHow To Value A Startup BusinessVicky_trycm100% (1)

- TCCT 1 Chapter6Dokument50 SeitenTCCT 1 Chapter6Thảo NhưNoch keine Bewertungen

- Caso 1Dokument7 SeitenCaso 1Carlos Rafael Angeles GuzmanNoch keine Bewertungen

- BG Group 11 4Dokument4 SeitenBG Group 11 4Suumit AroraNoch keine Bewertungen

- Black BookDokument43 SeitenBlack Booknedexed404Noch keine Bewertungen

- True or FalseDokument27 SeitenTrue or FalseMary DenizeNoch keine Bewertungen

- SFMmegerDokument5 SeitenSFMmegerKiran MinhasNoch keine Bewertungen

- IFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsDokument40 SeitenIFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsWubneh AlemuNoch keine Bewertungen

- Accounting - Herriot WattDokument38 SeitenAccounting - Herriot Watttwizas3926Noch keine Bewertungen

- Peter ThielDokument274 SeitenPeter Thielaparna_ta100% (2)

- Investment Decision 2Dokument1 SeiteInvestment Decision 2himanshu himanshuNoch keine Bewertungen

- Stock Picking StratregiesDokument33 SeitenStock Picking StratregiesFen Rajan100% (1)

- Eastboro Case SolutionDokument22 SeitenEastboro Case Solutionuddindjm100% (2)

- Sample Report DCFDokument0 SeitenSample Report DCFagarwalandyNoch keine Bewertungen

- Chapter 4 Income Based Valuation ActivitiesDokument4 SeitenChapter 4 Income Based Valuation ActivitiesAlliyah KayeNoch keine Bewertungen

- Valuation Report - MREIT INC. Festive Walk 1B Towers 1 2 FINAL SIGNEDDokument42 SeitenValuation Report - MREIT INC. Festive Walk 1B Towers 1 2 FINAL SIGNEDVinessah BalaoroNoch keine Bewertungen

- Financial Terminology Definition of The Financial TermDokument36 SeitenFinancial Terminology Definition of The Financial TermRajeev TripathiNoch keine Bewertungen

- Valuation Cheat Sheet - Invest in Asset ProductionDokument9 SeitenValuation Cheat Sheet - Invest in Asset ProductionAnonymous iVNvuRKGVNoch keine Bewertungen

- Capital BudgetDokument67 SeitenCapital BudgetSun SandNoch keine Bewertungen

- Financial Modling ExerciseDokument17 SeitenFinancial Modling Exerciserittic100% (1)

- Capital Budgeting Example ExcelDokument1 SeiteCapital Budgeting Example ExcelNgoc Hong DuongNoch keine Bewertungen

- Methods of Handling Project Risk: Lecture No. 30 Professor C. S. Park Fundamentals of Engineering EconomicsDokument23 SeitenMethods of Handling Project Risk: Lecture No. 30 Professor C. S. Park Fundamentals of Engineering EconomicsFeni Ayu LestariNoch keine Bewertungen

- Chapter 11Dokument27 SeitenChapter 11Hamis Rabiam MagundaNoch keine Bewertungen

- 1 - ST Benedicts Teaching Hospital - Case QuestionsDokument1 Seite1 - ST Benedicts Teaching Hospital - Case QuestionsJM LopezNoch keine Bewertungen

- PdfsDokument9 SeitenPdfsjoeNoch keine Bewertungen

- Limestone Mining Reserves and ValuationDokument5 SeitenLimestone Mining Reserves and ValuationrannscribdNoch keine Bewertungen