Beruflich Dokumente

Kultur Dokumente

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Hochgeladen von

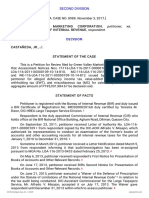

Justia.comOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Hochgeladen von

Justia.comCopyright:

Verfügbare Formate

56772 Federal Register / Vol. 70, No.

187 / Wednesday, September 28, 2005 / Notices

The following paragraph applies to all 3506(c)(2)(A)). Currently, the IRS is information shall have practical utility;

of the collections of information covered soliciting comments concerning Form (b) the accuracy of the agency’s estimate

by this notice: 2290/SP/FR Heavy Highway Vehicle of the burden of the collection of

An agency may not conduct or Use Tax Return. information; (c) ways to enhance the

sponsor, and a person is not required to DATES: Written comments should be quality, utility, and clarity of the

respond to, a collection of information received on or before November 28, information to be collected; (d) ways to

unless the collection of information 2005 to be assured of consideration. minimize the burden of the collection of

displays a valid OMB control number. ADDRESSES: Direct all written comments information on respondents, including

Books or records relating to a collection to Glenn Kirkland Internal Revenue through the use of automated collection

of information must be retained as long Service, room 6512, 1111 Constitution techniques or other forms of information

as their contents may become material Avenue, NW., Washington, DC 20224. technology; and (e) estimates of capital

in the administration of any internal or start-up costs and costs of operation,

FOR FURTHER INFORMATION CONTACT:

revenue law. Generally, tax returns and maintenance, and purchase of services

Requests for additional information or

tax return information are confidential, to provide information.

copies of the form and instructions

as required by 26 U.S.C. 6103. Approved: September 20, 2005.

should be directed to Larnice Mack at

Request for Comments Internal Revenue Service, room 6512, Glenn Kirkland,

Comments submitted in response to 1111 Constitution Avenue, NW., IRS Reports Clearance Officer.

this notice will be summarized and/or Washington, DC 20224, or at (202) 622– [FR Doc. E5–5311 Filed 9–27–05; 8:45 am]

included in the request for OMB 3179, or through the Internet at BILLING CODE 4830–01–P

approval. All comments will become a (Larnice.Mack@irs.gov).

matter of public record. Comments are SUPPLEMENTARY INFORMATION:

invited on: (a) Whether the collection of Title: Heavy Highway Vehicle Use DEPARTMENT OF VETERANS

information is necessary for the proper Tax Return. AFFAIRS

performance of the functions of the Abstract: Form 2290/SP/FR is used to

agency, including whether the compute and report the tax imposed by Reasonable Charges for Inpatient DRG

information shall have practical utility; section 4481 on the highway use of and SNF Medical Services; 2006 Fiscal

(b) the accuracy of the agency’s estimate certain motor vehicles. The information Year Update

of the burden of the collection of is used to determine whether the AGENCY: Department of Veterans Affairs.

information; (c) ways to enhance the taxpayer has paid the correct amount of

ACTION: Notice.

quality, utility, and clarity of the tax.

information to be collected; (d) ways to Current Actions: There are no changes SUMMARY: Section 17.101 of Title 38 of

minimize the burden of the collection of being made to Form 2290 at this time. the Code of Federal Regulations sets

information on respondents, including Type of Review: Extension of a current forth the Department of Veterans Affairs

through the use of automated collection OMB approval. (VA) medical regulations concerning

techniques or other forms of information Affected Public: Individuals or ‘‘reasonable charges’’ for medical care or

technology; and (e) estimates of capital households. services provided or furnished by VA to

or start-up costs and costs of operation, Estimated Number of Respondents: a veteran:

maintenance, and purchase of services 740,000.

Estimated Time Per Respondent: 28 —For a nonservice-connected disability

to provide information. for which the veteran is entitled to

hours, 4 minutes.

Approved: September 20, 2005 Estimated Total Annual Burden care (or the payment of expenses of

Glenn Kirkland, Hours: 21,164,000. care) under a health plan contract;

IRS Reports Clearance Officer. The following paragraph applies to all —For a nonservice-connected disability

[FR Doc. E5–5310 Filed 9–27–05; 8:45 am] of the collections of information covered incurred incident to the veteran’s

by this notice: employment and covered under a

BILLING CODE 4830–01–P

An agency may not conduct or worker’s compensation law or plan

sponsor, and a person is not required to that provides reimbursement or

DEPARTMENT OF THE TREASURY respond to, a collection of information indemnification for such care and

unless the collection of information services; or

Internal Revenue Service —For a nonservice-connected disability

displays a valid OMB control number.

incurred as a result of a motor vehicle

Books or records relating to a collection

Proposed Collection; Comment accident in a State that requires

of information must be retained as long

Request for Form 2290/SP/FR automobile accident reparations

as their contents may become material

insurance.

AGENCY: Internal Revenue Service (IRS), in the administration of any internal

Treasury. revenue law. Generally, tax returns and The regulations include

ACTION: Notice and request for tax return information are confidential, methodologies for establishing billed

comments. as required by 26 U.S.C. 6103. amounts for the following types of

charges: Acute inpatient facility charges;

SUMMARY: The Department of the Request for Comments skilled nursing facility/sub-acute

Treasury, as part of its continuing effort Comments submitted in response to inpatient facility charges; partial

to reduce paperwork and respondent this notice will be summarized and/or hospitalization facility charges;

burden, invites the general public and included in the request for OMB outpatient facility charges; physician

other Federal agencies to take this approval. All comments will become a and other professional charges,

opportunity to comment on proposed matter of public record. Comments are including professional charges for

and/or continuing information invited on: (a) Whether the collection of anesthesia services and dental services;

collections, as required by the information is necessary for the proper pathology and laboratory charges;

Paperwork Reduction Act of 1995, performance of the functions of the observation care facility charges;

Public Law 104–13 (44 U.S.C. agency, including whether the ambulance and other emergency

VerDate Aug<31>2005 16:02 Sep 27, 2005 Jkt 205001 PO 00000 Frm 00151 Fmt 4703 Sfmt 4703 E:\FR\FM\28SEN1.SGM 28SEN1

Das könnte Ihnen auch gefallen

- Check Vs DraftDokument15 SeitenCheck Vs DraftJoshua Capa FrondaNoch keine Bewertungen

- Bank Robbery Suspects Allegedly Bragged On FacebookDokument16 SeitenBank Robbery Suspects Allegedly Bragged On FacebookJustia.comNoch keine Bewertungen

- Tax - CIR Vs Isabela Cultural CorpDokument11 SeitenTax - CIR Vs Isabela Cultural CorpLudica OjaNoch keine Bewertungen

- SAP Payroll Schemas, Rules and Functions ExplainedDokument21 SeitenSAP Payroll Schemas, Rules and Functions ExplainedUday KiranNoch keine Bewertungen

- AGNPO Midterms ReviewerDokument79 SeitenAGNPO Midterms ReviewerKurt Morin Cantor100% (2)

- Builder Letter in SBI FormatDokument2 SeitenBuilder Letter in SBI FormatKeerthi Sruthi33% (6)

- PMRFDokument2 SeitenPMRFKrizel Joy Serrano90% (10)

- Understanding Electronic Invoicing System in The PhilippinesDokument27 SeitenUnderstanding Electronic Invoicing System in The PhilippinesSUMIT KUMAR AGARWALANoch keine Bewertungen

- Cir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorDokument2 SeitenCir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorsakuraNoch keine Bewertungen

- Tax Updates by Atty. Riza LumberaDokument75 SeitenTax Updates by Atty. Riza Lumberadmad_shayne50% (2)

- General Reform SummaryDokument10 SeitenGeneral Reform SummaryRaghu RamNoch keine Bewertungen

- Final Project-Money MarketDokument60 SeitenFinal Project-Money MarketSneha Dubey50% (4)

- TAX CasesDokument78 SeitenTAX CasesRaymarc Elizer AsuncionNoch keine Bewertungen

- CIR v. Isabela Cultural Corp.Dokument4 SeitenCIR v. Isabela Cultural Corp.kathrynmaydevezaNoch keine Bewertungen

- Time Value of Money - The Buy Versus Rent Decision - StudentDokument1 SeiteTime Value of Money - The Buy Versus Rent Decision - StudentUmer Tahir17% (12)

- CIR Vs Isabela Cultural CorpDokument3 SeitenCIR Vs Isabela Cultural CorpfrankieNoch keine Bewertungen

- Court Upholds Tax Deductions But Limits Professional FeesDokument3 SeitenCourt Upholds Tax Deductions But Limits Professional Feesjleo1Noch keine Bewertungen

- Gravity Payments Salary Case StudyDokument13 SeitenGravity Payments Salary Case StudyGhanshyam Thakkar67% (3)

- CIR v Mirant Pagbilao Tax Credit RulingDokument1 SeiteCIR v Mirant Pagbilao Tax Credit RulingKate Garo83% (6)

- Federal Register-02-28266Dokument1 SeiteFederal Register-02-28266POTUSNoch keine Bewertungen

- CIR Vs Team SualDokument2 SeitenCIR Vs Team SualKim Patrick DayosNoch keine Bewertungen

- Treasury Inspector General For Tax AdministrationDokument31 SeitenTreasury Inspector General For Tax AdministrationJeffrey DunetzNoch keine Bewertungen

- Aug 3 Amor-Bautista Credit Information CorporationDokument60 SeitenAug 3 Amor-Bautista Credit Information CorporationJee JeeNoch keine Bewertungen

- Treasury RFI SOFR FRN3Dokument3 SeitenTreasury RFI SOFR FRN3LaLa BanksNoch keine Bewertungen

- Description: Tags: 100501aDokument2 SeitenDescription: Tags: 100501aanon-715421Noch keine Bewertungen

- Federal Register-02-28477Dokument1 SeiteFederal Register-02-28477POTUSNoch keine Bewertungen

- CIR vs Isabela Cultural CorpDokument13 SeitenCIR vs Isabela Cultural CorpmifajNoch keine Bewertungen

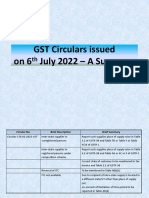

- GST Circulars Issued On 6th July - A SummaryDokument8 SeitenGST Circulars Issued On 6th July - A SummaryVijaya ChandNoch keine Bewertungen

- CTA upholds ICC's deduction claims and interest income reportingDokument45 SeitenCTA upholds ICC's deduction claims and interest income reportingAna AltisoNoch keine Bewertungen

- US Internal Revenue Service: 12256402Dokument6 SeitenUS Internal Revenue Service: 12256402IRSNoch keine Bewertungen

- Trust Guide T4013-22eDokument79 SeitenTrust Guide T4013-22eAngie CarletonNoch keine Bewertungen

- US Internal Revenue Service: p3383Dokument4 SeitenUS Internal Revenue Service: p3383IRSNoch keine Bewertungen

- Union Budget 2021 - Key Amendments Impacting TelecomsectorDokument6 SeitenUnion Budget 2021 - Key Amendments Impacting TelecomsectorabhiNoch keine Bewertungen

- Tax Cases April 28Dokument52 SeitenTax Cases April 28Treborian TreborNoch keine Bewertungen

- G.R. No. 180173 April 6, 2011 Microsoft Philippines, Inc., Petitioner, Commissioner of Internal Revenue, RespondentDokument3 SeitenG.R. No. 180173 April 6, 2011 Microsoft Philippines, Inc., Petitioner, Commissioner of Internal Revenue, RespondentCharisa BelistaNoch keine Bewertungen

- Goods and Services Tax Council Standing Committee On Capacity Building and FacilitationDokument61 SeitenGoods and Services Tax Council Standing Committee On Capacity Building and FacilitationJeyakar PrabakarNoch keine Bewertungen

- US Internal Revenue Service: 10534401Dokument9 SeitenUS Internal Revenue Service: 10534401IRSNoch keine Bewertungen

- Description: Tags: 120505aDokument2 SeitenDescription: Tags: 120505aanon-850923Noch keine Bewertungen

- Payment of Tax FAQ GuideDokument23 SeitenPayment of Tax FAQ Guidemun1barejaNoch keine Bewertungen

- TRAIN (Changes) ???? Pages 1, 3, 7Dokument3 SeitenTRAIN (Changes) ???? Pages 1, 3, 7blackmail1Noch keine Bewertungen

- Home Child Care Provider Pilot Retainer AgreementDokument4 SeitenHome Child Care Provider Pilot Retainer AgreementBeth JuaynoNoch keine Bewertungen

- Manila Bankers' Life Insurance Corp. v. CIRDokument18 SeitenManila Bankers' Life Insurance Corp. v. CIRJohn FerarenNoch keine Bewertungen

- EY Tax Alert: Executive SummaryDokument6 SeitenEY Tax Alert: Executive SummaryAjay SinghNoch keine Bewertungen

- Income Tax 11-12Dokument11 SeitenIncome Tax 11-12Crisanta Leonor ChianpianNoch keine Bewertungen

- Notice PDFDokument7 SeitenNotice PDFsachme1998Noch keine Bewertungen

- 50 - (G.R. NO. 172231. February 12, 2007)Dokument7 Seiten50 - (G.R. NO. 172231. February 12, 2007)alda hobisNoch keine Bewertungen

- Description: Tags: 090204aDokument2 SeitenDescription: Tags: 090204aanon-670054Noch keine Bewertungen

- Western Mindanao Power Corp. vs. CIR Dispute Over VAT RefundDokument7 SeitenWestern Mindanao Power Corp. vs. CIR Dispute Over VAT RefundJonjon BeeNoch keine Bewertungen

- 2020-07-21 Estimated Charges Letter PDFDokument3 Seiten2020-07-21 Estimated Charges Letter PDFRoyce KurmelovsNoch keine Bewertungen

- Tax Law Digests 5 (Q-T)Dokument28 SeitenTax Law Digests 5 (Q-T)Ivan ChuaNoch keine Bewertungen

- CIR appeals CTA ruling on Isabela Cultural Corp tax caseDokument28 SeitenCIR appeals CTA ruling on Isabela Cultural Corp tax caseWhoopi Jane MagdozaNoch keine Bewertungen

- Train Law Ra 10953Dokument32 SeitenTrain Law Ra 10953IanaNoch keine Bewertungen

- US Internal Revenue Service: I1120ric - 1996Dokument12 SeitenUS Internal Revenue Service: I1120ric - 1996IRSNoch keine Bewertungen

- Tax Deductions for Accrued ExpensesDokument31 SeitenTax Deductions for Accrued ExpensesBok MalaNoch keine Bewertungen

- Petitioner vs. vs. Respondent: Third DivisionDokument21 SeitenPetitioner vs. vs. Respondent: Third DivisionAnne AjednemNoch keine Bewertungen

- MCA Discussion Paper On Amendments To The IBC2016Dokument22 SeitenMCA Discussion Paper On Amendments To The IBC2016Zalak ModyNoch keine Bewertungen

- 243834-2019-Manila Bankers Life Insurance Corp. V.20210505-12-18fbrjuDokument20 Seiten243834-2019-Manila Bankers Life Insurance Corp. V.20210505-12-18fbrjuRJ YuNoch keine Bewertungen

- Description: Tags: 100499aDokument1 SeiteDescription: Tags: 100499aanon-952417Noch keine Bewertungen

- Pa Tax Brief - November 2019Dokument10 SeitenPa Tax Brief - November 2019Teresita TibayanNoch keine Bewertungen

- Accounting Periods and Methods Ruling Affirms Accrual Method for Tax DeductionsDokument4 SeitenAccounting Periods and Methods Ruling Affirms Accrual Method for Tax DeductionsYodh Jamin OngNoch keine Bewertungen

- The Extent To Which The Philippine Government Complied To Sections 27 and 28 of RDokument8 SeitenThe Extent To Which The Philippine Government Complied To Sections 27 and 28 of RJanine PagtakhanNoch keine Bewertungen

- Advanced Financial AccountingDokument2 SeitenAdvanced Financial AccountingBS Accoutancy St. SimonNoch keine Bewertungen

- RMO 47-2020 - Consolidated VAT RefundDokument36 SeitenRMO 47-2020 - Consolidated VAT Refunduno_01Noch keine Bewertungen

- SRO 376 (I) 2023 - Special Procedure For CollectionDokument4 SeitenSRO 376 (I) 2023 - Special Procedure For CollectionUbaidullah SiddiquiNoch keine Bewertungen

- Federal Register / Vol. 87, No. 219 / Tuesday, November 15, 2022 / NoticesDokument4 SeitenFederal Register / Vol. 87, No. 219 / Tuesday, November 15, 2022 / NoticesScott FryeNoch keine Bewertungen

- Green Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFDokument42 SeitenGreen Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFKriszan ManiponNoch keine Bewertungen

- Arbabsiar ComplaintDokument21 SeitenArbabsiar ComplaintUSA TODAYNoch keine Bewertungen

- U.S. v. Rajat K. GuptaDokument22 SeitenU.S. v. Rajat K. GuptaDealBook100% (1)

- USPTO Rejection of Casey Anthony Trademark ApplicationDokument29 SeitenUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comNoch keine Bewertungen

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDokument12 SeitenDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comNoch keine Bewertungen

- Signed Order On State's Motion For Investigative CostsDokument8 SeitenSigned Order On State's Motion For Investigative CostsKevin ConnollyNoch keine Bewertungen

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDokument1 SeiteGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comNoch keine Bewertungen

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDokument5 SeitenU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comNoch keine Bewertungen

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareDokument7 SeitenStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comNoch keine Bewertungen

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDokument4 SeitenRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comNoch keine Bewertungen

- Amended Poker Civil ComplaintDokument103 SeitenAmended Poker Civil ComplaintpokernewsNoch keine Bewertungen

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDokument22 SeitenClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comNoch keine Bewertungen

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDokument22 SeitenEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comNoch keine Bewertungen

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesDokument3 SeitenRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comNoch keine Bewertungen

- Van Hollen Complaint For FilingDokument14 SeitenVan Hollen Complaint For FilingHouseBudgetDemsNoch keine Bewertungen

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDokument1 SeiteBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comNoch keine Bewertungen

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDokument6 SeitenNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comNoch keine Bewertungen

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDokument48 SeitenDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Wisconsin Union Busting LawsuitDokument48 SeitenWisconsin Union Busting LawsuitJustia.comNoch keine Bewertungen

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDokument15 SeitenFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comNoch keine Bewertungen

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDokument52 SeitenOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comNoch keine Bewertungen

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDokument6 SeitenFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURNoch keine Bewertungen

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDokument24 SeitenOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comNoch keine Bewertungen

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionDokument1 SeiteSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comNoch keine Bewertungen

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawDokument1 SeiteCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comNoch keine Bewertungen

- Sweden V Assange JudgmentDokument28 SeitenSweden V Assange Judgmentpadraig2389Noch keine Bewertungen

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDokument25 SeitenDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comNoch keine Bewertungen

- 60 Gadgets in 60 Seconds SLA 2008 June16Dokument69 Seiten60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Dokument2 SeitenCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comNoch keine Bewertungen

- Lee v. Holinka Et Al - Document No. 4Dokument2 SeitenLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- Wealth Management PPT FinalDokument42 SeitenWealth Management PPT FinalCyvita VeigasNoch keine Bewertungen

- Investor / Analyst Presentation (Company Update)Dokument48 SeitenInvestor / Analyst Presentation (Company Update)Shyam SunderNoch keine Bewertungen

- Cash and Accrual Basis & Single Entry - OUTLINEDokument3 SeitenCash and Accrual Basis & Single Entry - OUTLINESophia Marie VerdeflorNoch keine Bewertungen

- RMC No 63-2012Dokument4 SeitenRMC No 63-2012veraNoch keine Bewertungen

- Brief of Savings Schems @potoolsDokument4 SeitenBrief of Savings Schems @potoolsNIKUNJA LENKANoch keine Bewertungen

- Receivables Management and FactoringDokument11 SeitenReceivables Management and FactoringpandubhagyaNoch keine Bewertungen

- Chapter Based Study Plan S.no. Chapter Size/Time ConsumptionDokument13 SeitenChapter Based Study Plan S.no. Chapter Size/Time ConsumptionchitraNoch keine Bewertungen

- The Financial Market EnvironmentDokument18 SeitenThe Financial Market Environmentlayan123456Noch keine Bewertungen

- FinShiksha Financials 2017-2015Dokument4 SeitenFinShiksha Financials 2017-2015debojyotiNoch keine Bewertungen

- Dividend Model NotesDokument8 SeitenDividend Model NotesLumumba KuyelaNoch keine Bewertungen

- ATM Student Worksheet Explains Automatic Teller MachinesDokument1 SeiteATM Student Worksheet Explains Automatic Teller Machinesneea29githuNoch keine Bewertungen

- Report On Sumeru Securities PVT LTDDokument48 SeitenReport On Sumeru Securities PVT LTDsagar timilsina50% (4)

- CST AppealDokument3 SeitenCST AppealvnbanjanNoch keine Bewertungen

- Answer The Following Questions: E Student's Name: ..................................... Student IDDokument8 SeitenAnswer The Following Questions: E Student's Name: ..................................... Student IDTaha Wael QandeelNoch keine Bewertungen

- Time Value of MoneyDokument48 SeitenTime Value of MoneyIqbal HanifNoch keine Bewertungen

- Common Size Statements: ParticularsDokument3 SeitenCommon Size Statements: ParticularsChandan GuptaNoch keine Bewertungen

- The Act Borrowers Guide To Lma Loan Documentation For Investment Grade Borrowers June 2014 SupplementDokument20 SeitenThe Act Borrowers Guide To Lma Loan Documentation For Investment Grade Borrowers June 2014 SupplementkamisyedNoch keine Bewertungen

- Selegna Management v. UCPB (2006)Dokument17 SeitenSelegna Management v. UCPB (2006)springchicken88Noch keine Bewertungen

- Officers Service RegulationsDokument78 SeitenOfficers Service RegulationsSourav Chakraborty0% (1)

- BIR Form 2306 Certificate of Final Tax Withheld At SourceDokument14 SeitenBIR Form 2306 Certificate of Final Tax Withheld At SourceBrianSantiagoNoch keine Bewertungen

- Kings College of The PhilippinesDokument6 SeitenKings College of The PhilippinesIzza Mae Rivera KarimNoch keine Bewertungen

- QUIZ1PRAC1Dokument23 SeitenQUIZ1PRAC1Marinel FelipeNoch keine Bewertungen

- PestleDokument17 SeitenPestleyatin rajputNoch keine Bewertungen