Beruflich Dokumente

Kultur Dokumente

Workshop 2 Solutions

Hochgeladen von

Johan ShahCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Workshop 2 Solutions

Hochgeladen von

Johan ShahCopyright:

Verfügbare Formate

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

Workshop 2 Solutions

Accounts Preparation Exercise

(level of difficulty: Elementary to Intermediate)

Solution to Question 1 Valencia

A word of advice!

When figuring out the effect of each transaction on the companys accounts, it is useful to

think of the accounting equation:

Assets = Equity + Liabilities,

which in its expanded form is equivalent to

Assets + Expenses = (opening) Equity + Revenues + Liabilities

While going through each transaction below, one needs to make sure that the above equation

holds for each individual transaction. Otherwise, your new Balance Sheet will not balance!

EXPANDED ACCOUNTING EQUATION WORKINGS + NOTES

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

Note for Transaction 5: The closing inventories should be valued at the lower value

between their cost and their net realisable value. The net realisable value for one box

of inventories is 2,000, which is lower compared to its cost of 4,300. Therefore,

closing inventories should be written down by 2,300 (4,300 - 2,000). Thus,

closing inventories should be valued at: 37,500 - 2,300 = 35,200.

We can use the closing inventory value to compute the cost of inventories that were

sold during the year, i.e. the cost of goods sold or cost of sales.

Cost of Sales = Opening Inventories + Inventory Purchases Closing Inventories

Cost of Sales = 19,400 (from previous Balance Sheet) + 122,600 (from Transaction

1) 35,200

Cost of Sales = 106,800

Note for Transaction 6: From the previous Balance Sheet, we know that Valencia

owed 3,600 for wages at the end of the previous accounting year. During the current

accounting period it paid 35,500 for wages. Part of the money paid for wages during

the current period was spent to repay wages owed from the previous period.

Therefore, the money paid that relates only to wages incurred in the current

accounting period is equal to: 35,500 - 3,600 = 31,900. We also know that at the

end of the current period, Valencia still owes 2,200 for wages. Therefore, the wage

expense for the current accounting period is equal to the money paid for current

2

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

period wages plus the money still owed for wages incurred in the current period, i.e.

31,900 + 2,200 = 34,100.

Note for Transaction 7: The annual depreciation expense when using the straight line

method of depreciation is computed as: (asset purchase cost residual value) / useful

life = (82,600 0) / 5 years = 16,520.

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

Part a.

Valencias Income Statement

Valencia

Income Statement for the year ended 31 January 2011

132,400

Sales revenue

Cost of sales

(106,800)

Gross profit

25,600

Transactions

3

5

Operating Expenses

Wages

(34,100)

Motor vehicle depreciation

(16,520)

6

(50,620)

Operating profit (loss)

(25,020)

Profit (loss) for the year

(25,020)

The column with transaction numbers is not required it is for information only.

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

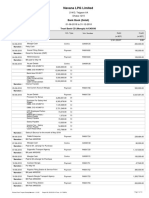

Valencias Balance Sheet

Valencia

Balance Sheet (Statement of Financial Position) as at 31 January 2011

Non-current assets

Motor vehicles

Less: Accumulated depreciation

[30,000+16,520]

82,600

(46,520)

Current assets

Inventories

[19,400+122,600-106,800]

Trade receivables

[32,700+126,200-120,200]

7

36,080

35,200

38,700

Total Assets

Transactions

1&5

73,900

2&3

109,980

Equity

Original

Retained profit

[32,300-25,020]

42,000

7,280

Liabilities

Current Liabilities

Bank overdraft1

[1,400+6,200+120,200-114,500-35,500]

Trade payables

[28,200+122,600-114,500]

Accruals (wages)

[3,600-3600+2,200]

Income

statement

22,200

2, 3, 4, 6

36,300

1&4

2,200

Total Equity and Liabilities

49,280

60,700

109,980

The column with transaction numbers is not required it is for information only.

Note that when the closing cash balance is negative, it is presented as a current liability called Bank

overdraft. This is a short-term loan that the business has taken from the bank in the form of an

overdraft.

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

Part b.

The following are suggestions and outline explanations.

Transaction 1 (buying inventories on credit) recognise purchase (even

though cash is paid later)

Transaction 2 (credit sales) recognise sale (even though cash is received

later)

Transactions 5 (cost of sales) match the expense made for purchase of

goods that were sold during the year with revenue received from the sale of

those goods.

Transaction 6 (wages expense) match the wages expense incurred during

the 12 month period with the revenues they helped generated during the same

period, even though not all wages have been paid for yet (matching principle).

For that purpose, the business creates an accrual (liability) in the Balance

sheet.

Transaction 7 (depreciation expense) when we buy a non-current asset we

do not record an immediate expense, but instead we record the purchase of an

asset. Then, gradually each year we record an expense called depreciation for

using up the asset during the year to help the business generate revenues

during the same period (matching principle). In other words, we match the

gradual usage of the asset with the revenues it helps generate in each period.

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

More Detailed Explanations on each Transaction and how to use this

information to prepare the Income Statement and Balance Sheet

Transaction 1

This is a simple straightforward transaction. The business purchased inventories on

credit. This leads to an increase in inventories (asset) of 122,600 and an increase in

trade payables (liabilities) by the same amount.

Assets

+Expenses

+122,600

(inventories)

= (opening)

Equity

0

+ Revenues

+ Liabilities

+122,600

(trade

payables)

Notice, that when the business buys inventories it DOES NOT incur an expense. On

the contrary, it buys an asset. An expense will be recorded once these inventories are

sold by the business in the form of cost of sales, as the matching principle dictates.

Transaction 2

This is another straightforward transaction. By cash sales, we mean sales for which

customers paid for the goods immediately by cash. This means that all remaining

sales (132,400 - 6,200 = 126,200) were made on credit, i.e. to credit customers

who have not paid for the goods yet, but will pay for them in the future. Remember

that all revenues should be recorded, whether or not the cash has been received for the

sale.

The effect of cash sales of 6,200 is to increase revenues by 6,200 and to increase

cash (assets) by the same amount.

The effect of sales on credit of 126,200 (i.e. 132,400 - 6,200) is to increase

revenues by 126,200 and to increase trade receivables (assets), as the customers owe

Valencia money.

Assets

+Expenses

+126,200

(trade

receivables)

+6,200 (cash)

= (opening)

Equity

0

+ Revenues

+ Liabilities

+132,400

(sales)

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

Transaction 3

Credit customers are customers who owe Valencia money from sales made to them by

Valencia in the past. The amounts owed to Valencia by credit customers are shown as

trade receivables in Valencias accounts. This transaction will increase cash (assets)

by 120,200, and reduce trade receivables (assets) by the same amount, as these

amounts are no longer owed to Valencia but have been received.

Assets

+Expenses

-120,200

(trade

receivables)

+120,200

(cash)

= (opening)

Equity

0

+ Revenues

+ Liabilities

Transaction 4

On the opening balance sheet, there were trade payables of 28,200. Further goods

have been purchased on credit during the year (transaction 1), so transaction 4 is

dealing with payments that have been made to the credit suppliers. These will reduce

cash and reduce the trade payables liability.

Assets

+Expenses

-114,500

(cash)

= (opening)

Equity

0

+ Revenues

+ Liabilities

-114,500

(trade

payables)

Transaction 5

We have shown the inventory purchases in transaction 1. However, the cost of sales

must be calculated to match against the revenues for sale of goods during the year.

Cost of sales = opening inventories + purchases closing inventories

The information given in transaction 5 is about the value of closing inventories. These

should be shown at the lower of cost and net realisable value. However, the net

realisable value of the damaged box of inventory is only 2,000, compared with the

cost of 4,300. It does not matter that the inventory has not been sold before the year

end the estimated net realisable value is used.

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

This means that there is a reduction of 2,300 in the value of closing inventory, so

instead of the initial 37,500, it should be valued at 35,200.

Having calculated the closing inventory, we now have all the information we need in

order to compute the Cost of Sales.

Cost of sales = opening inventory 19,400 + purchases 122,600 closing inventory

35,200 = 106,800

Assets

+Expenses

-106,800

(inventories)

+106,800

(cost of sales)

= (opening)

Equity

0

+ Revenues

+ Liabilities

Transaction 6

On the opening balance sheet, there was an accrual for wages of 3,600. This

represented wages which had not been paid by Valencia at last years end date (31

January 2010). The amount of wages paid during the year to 31 January 2011 will

therefore include this amount, and it should be removed from the accruals on the

balance sheet, as it is no longer unpaid by 31 January 2011.

Wages have been earned by Valencias employees in the year to 31 January 2011,

most of which have been paid. However, in transaction 6, wages of 2,200 have been

earned relating to the year ended 31 January 2011, but have not been paid by Valencia

at 31 January 2011. The full wages expense for the year should be included in the

income statement, and the unpaid wages will need to be included as an accrual

(current liability) on the balance sheet as at 31 January 2011.

The wages expense can be worked out as a balancing figure required to make the

balance sheet equation balance.

Wages expense = cash paid opening accrual + closing accrual

Wages expense = 35,500-3,600+2,200 = 34,100

Assets

+Expenses

-35,500 (cash)

+34,100

(wages

expense)

= (opening)

Equity

0

+ Revenues

+ Liabilities

-3,600

(accrual)

+2,200

(accrual)

BMAN10621(A): Fundamentals of Financial Reporting

Workshops

2013-14

Transaction 7

The depreciation expense must first be calculated for the year, using the straight line

depreciation formula, with zero residual value and a useful life of 5 years.

Annual depreciation expense = cost residual value

useful life (years)

= 82,600 - 0

5

= 16,520

The depreciation expense needs to be shown as an expense in the income statement,

but it will also increase the accumulated depreciation which reduces the assets

carrying values in the balance sheet.

Assets

+Expenses

-16,520

(accumulated

depreciation)

+16,520

(depreciation

expense)

= (opening)

Equity

0

+ Revenues

+ Liabilities

Preparing the Income Statement and Balance Sheet using the above information

Its usually best to start with the Income Statement, as the profit for the year from the

income statement will be needed to complete the equity section of the Balance Sheet.

The relevant columns from the accounting equation for preparing the Income

Statement are Revenues and Expenses. For the Balance Sheet, the relevant

columns for preparing it are Assets, Liabilities and Equity (including the profit/loss

figure from the income statement).

You need to follow the appropriate format/layout when presenting your Income

Statement and Balance Sheet. Marks are also given for the title and format/layout of

the financial statements, so make sure you pay attention to these aspects as well.

10

Das könnte Ihnen auch gefallen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Chapter 7Dokument26 SeitenChapter 7EricKHLeawNoch keine Bewertungen

- Chapter2 Statement of Comprehensive IncomeDokument46 SeitenChapter2 Statement of Comprehensive IncomeRonald De La Rama100% (1)

- CHAPTER - 05 - Finacial StatementDokument12 SeitenCHAPTER - 05 - Finacial StatementSaneej SamsudeenNoch keine Bewertungen

- Accounts of The Sole Trader: Unit 1Dokument10 SeitenAccounts of The Sole Trader: Unit 1Beverly Carballo - Moguel100% (1)

- CH 7Dokument22 SeitenCH 7Zain Wahab GmNoch keine Bewertungen

- CBSE Class 11 Accounting-End of Period AccountsDokument34 SeitenCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyNoch keine Bewertungen

- IGCSE Business Studies - AccountsDokument53 SeitenIGCSE Business Studies - Accountsdenny_sitorusNoch keine Bewertungen

- Cash BudgetDokument50 SeitenCash BudgetMsKhan0078Noch keine Bewertungen

- Chapter 3 - Profit and Loss StatementDokument6 SeitenChapter 3 - Profit and Loss StatementrtohattonNoch keine Bewertungen

- Statement of Comprehensive Income Part 1Dokument24 SeitenStatement of Comprehensive Income Part 1Millare, PrincessNoch keine Bewertungen

- 2 Template PPT2Dokument16 Seiten2 Template PPT2ダイ アンNoch keine Bewertungen

- FABM 2 Lesson2Dokument11 SeitenFABM 2 Lesson2---Noch keine Bewertungen

- Funda 2Dokument20 SeitenFunda 2Lorraine Miralles67% (3)

- Lectures 5, 6Dokument10 SeitenLectures 5, 6Lolita IsakhanyanNoch keine Bewertungen

- Ay2324 Fabm2 Handout 2.1Dokument11 SeitenAy2324 Fabm2 Handout 2.1Shahinaz FatinNoch keine Bewertungen

- Corporate ReportingDokument24 SeitenCorporate ReportingAnjali RajendranNoch keine Bewertungen

- Ch08a Adjustments For Stock, Accruals & PrepaymentsDokument23 SeitenCh08a Adjustments For Stock, Accruals & PrepaymentsZyad BashsashaNoch keine Bewertungen

- The Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenuesDokument20 SeitenThe Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenueszainNoch keine Bewertungen

- Incomplete RecordsDokument13 SeitenIncomplete RecordsSylvan Muzumbwe MakondoNoch keine Bewertungen

- Topic 3 - Statement of Comprehensive IncomeDokument8 SeitenTopic 3 - Statement of Comprehensive Incomesab lightningNoch keine Bewertungen

- Practical Accounting 2 Review: Installment SalesDokument22 SeitenPractical Accounting 2 Review: Installment SalesJason BautistaNoch keine Bewertungen

- CH 5 SolutionDokument36 SeitenCH 5 SolutionSen Ho Ng0% (1)

- AFB Lecture 4 Completed DeckDokument41 SeitenAFB Lecture 4 Completed DeckAzure Pear HaNoch keine Bewertungen

- Week 006 - Module Statement of Comprehensive Income Part IIDokument7 SeitenWeek 006 - Module Statement of Comprehensive Income Part IIJulia AcostaNoch keine Bewertungen

- We Have Done This Because We Know Penalty Incurred in Year 2024 But Before That Year Contract Price Was Before Penalty AmountDokument11 SeitenWe Have Done This Because We Know Penalty Incurred in Year 2024 But Before That Year Contract Price Was Before Penalty AmountRangwala kasimNoch keine Bewertungen

- Fabm2 SLK Week 2 - 3 SCIDokument11 SeitenFabm2 SLK Week 2 - 3 SCIMylene SantiagoNoch keine Bewertungen

- Fabm 121.week 6-10 ModuleDokument22 SeitenFabm 121.week 6-10 Modulekhaizer matias100% (1)

- Chap04 Expenses RevenueDokument17 SeitenChap04 Expenses RevenueLinh Le Thi ThuyNoch keine Bewertungen

- Module 11 - Fabm 1 - Merchandising InventoryDokument20 SeitenModule 11 - Fabm 1 - Merchandising Inventoryjosefh martin cruz100% (1)

- Live Online Lecture 4 - PPE Measurement After Its Initial RecognitionDokument21 SeitenLive Online Lecture 4 - PPE Measurement After Its Initial RecognitionYaonik HimmatramkaNoch keine Bewertungen

- Accounting For Non-Accounting Students - Summary Chapter 4Dokument4 SeitenAccounting For Non-Accounting Students - Summary Chapter 4Megan Joye100% (1)

- Module 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Dokument34 SeitenModule 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Antonette LaurioNoch keine Bewertungen

- F2 ACCA Financial Accounting - Inventory by MOCDokument10 SeitenF2 ACCA Financial Accounting - Inventory by MOCMunyaradzi Onismas Chinyukwi100% (1)

- Financial StatementsDokument24 SeitenFinancial Statementstranlamtuyen1911Noch keine Bewertungen

- Incomplete RecordsDokument51 SeitenIncomplete RecordssoniaNoch keine Bewertungen

- Chapter - 5 - InventoriesDokument15 SeitenChapter - 5 - InventoriesHkNoch keine Bewertungen

- Dong Tien Ias 36Dokument8 SeitenDong Tien Ias 36Quoc Viet TrinhNoch keine Bewertungen

- Module 2 - Income Statement and Capital StatementDokument7 SeitenModule 2 - Income Statement and Capital StatementIsabelleDynahE.GuillenaNoch keine Bewertungen

- Student's Learning Activity in FUNDAMENTALS OF ACCOUNTANCY Business and Management 2Dokument7 SeitenStudent's Learning Activity in FUNDAMENTALS OF ACCOUNTANCY Business and Management 2Shelly RhychaelleNoch keine Bewertungen

- Income StatementDokument56 SeitenIncome StatementEsmer AliyevaNoch keine Bewertungen

- BUU33532 - Financial Accounting II - HT - WK2 - 03.02.22Dokument3 SeitenBUU33532 - Financial Accounting II - HT - WK2 - 03.02.22simiNoch keine Bewertungen

- Lesson 2 The Statement of Comprehensive Income (Part 1 of 2)Dokument5 SeitenLesson 2 The Statement of Comprehensive Income (Part 1 of 2)Franchesca CalmaNoch keine Bewertungen

- MY Solution PaperDokument3 SeitenMY Solution Paperyara hazemNoch keine Bewertungen

- Act FinalDokument6 SeitenAct Finalabu.sakibNoch keine Bewertungen

- Accruals and Prepayments Webinar Student VersionDokument12 SeitenAccruals and Prepayments Webinar Student VersionBinay BhandariNoch keine Bewertungen

- AC1025 - Lecture Tute 05 V2Dokument13 SeitenAC1025 - Lecture Tute 05 V2etextbooks lkNoch keine Bewertungen

- Lo 4Dokument11 SeitenLo 4Omar El-TalNoch keine Bewertungen

- The Gross Profit Method For Estimated Ending InventoryDokument4 SeitenThe Gross Profit Method For Estimated Ending InventoryKeith Joanne Santiago100% (2)

- Class DocsDokument32 SeitenClass Docsgeorge antwiNoch keine Bewertungen

- Principles of Accounting Hand Outs Chapter 1-3Dokument85 SeitenPrinciples of Accounting Hand Outs Chapter 1-3edo100% (1)

- Income Statement 2Dokument7 SeitenIncome Statement 2Jonabed PobadoraNoch keine Bewertungen

- Statement of Comprehensive IncomeDokument16 SeitenStatement of Comprehensive IncomeDindin Oromedlav Lorica100% (4)

- Principal of Accounting-1Dokument34 SeitenPrincipal of Accounting-1thefleetstrikerNoch keine Bewertungen

- LAS ABM - FABM12 Ic D 7 Week 3Dokument9 SeitenLAS ABM - FABM12 Ic D 7 Week 3ROMMEL RABONoch keine Bewertungen

- Budgets & Budgetary Control Systems: Prepared byDokument35 SeitenBudgets & Budgetary Control Systems: Prepared byShakil AnwaarNoch keine Bewertungen

- Fabm2: Pres. Sergio Osmena High School Senior High School ABM 12 Prepared By: Mrs. Eleonor E. MujalDokument20 SeitenFabm2: Pres. Sergio Osmena High School Senior High School ABM 12 Prepared By: Mrs. Eleonor E. MujalKenneth C. BulanNoch keine Bewertungen

- Ma2 Examiner's Report S21-A22Dokument7 SeitenMa2 Examiner's Report S21-A22tashiNoch keine Bewertungen

- Definition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesDokument8 SeitenDefinition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesKae Abegail GarciaNoch keine Bewertungen

- (BPR)Dokument17 Seiten(BPR)Girmaye Haile GebremikaelNoch keine Bewertungen

- Using Quickbooks Accountant 2012 For Accounting 11th Edition Glenn Owen Solutions ManualDokument26 SeitenUsing Quickbooks Accountant 2012 For Accounting 11th Edition Glenn Owen Solutions ManualMaryJohnsonsmni100% (35)

- P3-2B IFRS 2ndDokument5 SeitenP3-2B IFRS 2ndAfrishalPriyandhanaNoch keine Bewertungen

- Accounting and Bookkeeping SOPDokument22 SeitenAccounting and Bookkeeping SOPJessa Mae Cac100% (2)

- Chapter 12Dokument9 SeitenChapter 12mizayanNoch keine Bewertungen

- Activity 2 - TB, W, CEDokument18 SeitenActivity 2 - TB, W, CEGina Calling Danao100% (1)

- SAP Production Planning TableDokument97 SeitenSAP Production Planning Tablesam96% (23)

- W 12control Account Recon Excelll23Dokument3 SeitenW 12control Account Recon Excelll23DaddyNoch keine Bewertungen

- RMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFDokument2 SeitenRMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFKriszan ManiponNoch keine Bewertungen

- Mahindra Supply ChainDokument14 SeitenMahindra Supply ChainDarshak ParikhNoch keine Bewertungen

- CH5 Accounting QuizDokument7 SeitenCH5 Accounting QuizTarun ImandiNoch keine Bewertungen

- Edgar DetoyaDokument16 SeitenEdgar DetoyaAngelica EltagonNoch keine Bewertungen

- Chapter 2Dokument16 SeitenChapter 2Rynette FloresNoch keine Bewertungen

- First Quarter Assessment in FABM2Dokument4 SeitenFirst Quarter Assessment in FABM2Nhelben ManuelNoch keine Bewertungen

- Navana LPG Limited: Bank Book (Detail)Dokument13 SeitenNavana LPG Limited: Bank Book (Detail)M. A. Alim SohelNoch keine Bewertungen

- Journal EntriesDokument19 SeitenJournal EntriesVenkatesh Prasad0% (2)

- Transaction Inquiry Download Single 20221105143436523Dokument16 SeitenTransaction Inquiry Download Single 20221105143436523Terminal DomestikNoch keine Bewertungen

- Managerial Accounting SPATS Problem 7-9: Student Name: 5th Canadian Edition Class: Garrison, Noreen and ChesleyDokument5 SeitenManagerial Accounting SPATS Problem 7-9: Student Name: 5th Canadian Edition Class: Garrison, Noreen and ChesleyForkensteinNoch keine Bewertungen

- Cash Flow Management: Jeff-M I K E SM Ith Sule, Cpa, Cia, Friacc, Enp, Reb, Rea, M IcbDokument53 SeitenCash Flow Management: Jeff-M I K E SM Ith Sule, Cpa, Cia, Friacc, Enp, Reb, Rea, M IcbJeremy LiboonNoch keine Bewertungen

- Managerial Accounting 5th Edition Jiambalvo Test BankDokument25 SeitenManagerial Accounting 5th Edition Jiambalvo Test BankKimberlyThomasrbtz100% (39)

- MQ 1 Receivables and InventoryDokument4 SeitenMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Challenges For Supply Chain Management in Today'sDokument11 SeitenChallenges For Supply Chain Management in Today'sMeet DaveNoch keine Bewertungen

- Lambeth Custom CabinetsDokument14 SeitenLambeth Custom CabinetsHaider AliNoch keine Bewertungen

- 3pl 4plDokument12 Seiten3pl 4plsuresh1852Noch keine Bewertungen

- FABM - L-10Dokument16 SeitenFABM - L-10Seve HanesNoch keine Bewertungen

- Date No Invoice Description in Unit Price: PT Cahaya Inventory Card DESEMBER, 2018Dokument26 SeitenDate No Invoice Description in Unit Price: PT Cahaya Inventory Card DESEMBER, 2018IvankaNoch keine Bewertungen

- Double Entry BookkeepingDokument23 SeitenDouble Entry BookkeepingAhrian BenaNoch keine Bewertungen

- Split 162013 190909 - 20220331Dokument5 SeitenSplit 162013 190909 - 20220331NUR FASIHAH BINTINoch keine Bewertungen

- Accounting 5Dokument8 SeitenAccounting 5khurramNoch keine Bewertungen

- 5 Material Requirements PlanningDokument86 Seiten5 Material Requirements PlanningArush BhatnagarNoch keine Bewertungen

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingVon EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingBewertung: 4.5 von 5 Sternen4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessVon EverandProject Control Methods and Best Practices: Achieving Project SuccessNoch keine Bewertungen

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsVon EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNoch keine Bewertungen

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCVon EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCBewertung: 5 von 5 Sternen5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Controllership: The Work of the Managerial AccountantVon EverandControllership: The Work of the Managerial AccountantNoch keine Bewertungen

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookVon EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNoch keine Bewertungen

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessVon EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessBewertung: 4.5 von 5 Sternen4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsVon EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsBewertung: 4 von 5 Sternen4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetVon EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetBewertung: 4.5 von 5 Sternen4.5/5 (14)