Beruflich Dokumente

Kultur Dokumente

Islamic N Conventional

Hochgeladen von

geena1980Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Islamic N Conventional

Hochgeladen von

geena1980Copyright:

Verfügbare Formate

Comparison on Stability Between Islamic and

Conventional Banks in Malaysia

Siti Rohaya Mat Rahim1

Roza Hazli Zakaria2

Abstract

Islamic banks were relatively unaffected during the recent financial meltdown. This has

raised the possibility that financial institutions, operating on Islamic principles are more

stable compared to their conventional counterparts. This motivates us to undertake to examine

relative stability between Islamic and conventional banks. Z-score and NPL are used as

proxies for bank stability. Computation of Z-score and NPL suggest that on average Islamic

banks are relatively more stable than their conventional counterparts. Standard panel data

analysis suggests that factors affecting both Islamic and conventional banks stability are

similar, except for the degree of diversification in income. Stability is not a function of income

diversification for Islamic banks but it is in the case of conventional banks. This explained

why during recent crisis, when various sources of bank income was adversely affected,

Islamic banks remained stable as opposed to the conventional banks.

Keywords: Islamic banks; Conventional banks; Stability; Z-score; Panel Data.

JEL specification: G21

1.0

Introduction

The global financial crisis that started in 2007 has led to renewed interest on Islamic

banking. Lack of stability corresponds with the financial instability situation or

financial crisis (Hussein, 2010). Several research done by (Venardos, 2010; Imam and

Kpaodar, 2010) briefly discuss regarding financial stability. This is as evidenced

during the liquidity crisis and sub-prime mortgage crisis in United States. When the

1

SITI ROHAYA MAT RAHIM, Lecturer, Department of Economics Faculty of Business and

Finance, Universiti Tunku Abdul Rahman (Perak Campus), Jalan Universiti,Bandar

aratKampar 31900. Perak, Malaysia. Tel: 6005-4688888 ext 4380 HP: 60012-8355082

Email: rohaya@utar.edu.my

2

ROZA HAZLI ZAKARIA, Senior Lecturer. Department of Economics, Faculty of

Economics and Administration, University of Malaya, 50603 Kuala Lumpur, MALAYSIA

Email: roza@um.edu.my

132

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

US bank Lehman Brothers went bankrupt on 15 September 2008, banks in the United

States and Europe were equally affected, as well as all financial institutions.

Studies and reports highlight the relatively better performance of the Islamic and

conventional banks. More recently, Alaro and Hakeem (2011) provide some evidence

that Islamic banking is more stable than conventional banks in term of risk

management. In addition to that, Financial Stability Report 2011 documents that

countries that practice Islamic banking is more stable than others that rely on

conventional banking, where Saudi Arabia (rank 1) ranked as the most stable as

opposed to United States (rank 41) and United Kingdom (rank 42).

The observation that Islamic banks were relatively unaffected by the crisis as

compared to their conventional counter parts highlight the strength of the Islamic

banking system as a possible alternative to replace the existing interest based

financial system. However, this requires more researches in breadth and depth to

examine issues surrounding Islamic banks stability as esxiting available researches is

rather limited. This is what motivate us to undertake this study. It aims to fill in the

gap by providing some sound evidence the stability issues of Islamic and

conventional banks during recent crisis. Besides, our study will also examine factors

that underlie bank stability in order to get some insight on the differences, if there is

any. Malaysia provides a good avenue for case study given that both types of banks,

Islamic and conventional work hand in hand in the economy under the dual banking

system. Hence, they are subjected to similar macroeconomic conditions.

The following of this paper is structured as follows; 2.0 details literature reviews on

banking stability, 3.0 discuss the methodology, followed by 4.0 in which the

empirical results are described. Finally, 5.0 conclude this paper along with policy

implications.

2.0

Why Islamic banks could be more stable?

Islamic banks are unique or different from their conventional counterparts in terms of

their underlying modus operandi. Guarded with the belief that interest or riba is

totally unacceptable, Islamic banks operation is based on Shariah compliance

principles such as profit sharing basis, real asset transactions and strict adherence to

no speculative element. With these differences on the three basic principles, Islamic

banks portray different response during the recent financial meltdown.

A review of past studies related to the issue of banking sector stability show that there

are at least three explanations on the relative stability. Firstly, banks operates under

Islamic possess greater liquidity holdings relative to conventional ones. Partly, this is

due to the relatively limited availability of investment avenues that are Shariah

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

133

compliance. This is in accordance with Hadeel Abu Loghod (2010), who found

attractiveness of Islamic banks products such as Mudaraba, Musharakah, Murabahah,

Ijarah, and profit and loss investment was the main reason behind the greater liquidity

holdings.

Secondly, Islamic banks focused on profit sharing investment and financing, in which

there is mutual risk sharing. For instance, Rahman (2011) details that Islamic banks in

Bangladesh currently adopt sophisticated qualitative and quantitative techniques to

overcome the credit risk problems.

In addition to that, Islamic banks are different in their business model as well as

financing or equity participation.. This led them to channel their investment more in

less risky investment sectors. For instance, Hasan and Dridi (2010), reports that

Islamic banks successfullly maintained stronger credit growth. His research proved

Islamic asset growth and bank credit was double than those conventional banks

during 2007-2009.

Thirdly, Islamic banks are less affected with many conventional banks because

Islamic banks were prohibited in any speculative practices and excessive leveraging,

which were root causes of the recent global financial crisis.

3.0

Methodology

3.1

Model Specification

A model is proposed to estimate what explains bank stability. In general, bank

stability depends on both external and internal factors. The external factors refer to

macroecnomic development while internal factors refer to bank specific

characteristics. Several variables that influenced bank stability has been identified

through literature review. The external factors refer to macroecnomic variables such

as market share (SHARE), inflation (INF) and real GDP (GDP).

Market share (SHARE) is an important determinant of bank stability, and its

relationship has been fairly agreed in the academic literature. Beck et al., (2010)

found that higher market shares of Islamic leads to stability, in contrast conventional

banks tend to be more cost-effective but less stable. Inflation rate (CPI) positively to

the profitability and stability of the banking sector, (Chapra, 2000) and (El-Gamel,

2000). (GDP) real gross domestic products measure total economic activity in a one

country. Bekaert et al., (2007) show that real (GDP) growth rate significantly affect

banking system and equity markets. Therefore in this research, we include (GDP)

real gross domestic products and we expect that economic growth has positive

impacts on financial stability.

134

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

Internal factors such as loan asset ratio (LAR),cost income ratio (CIR), log total

assets (LTA), and Herfindahl Index (HI). Bank liquidity is measured as loan assets

ratio, (LAR). Higher value of this ratio indicate that high risky a bank bear since it

shows a bank is loaned up to much and its liquidity is quite low. This is supported by

(Agusman et al., 2008). In our model, we hypothesize that loan-to-asset ratios are

negatively related to bank stability. According to Hassan (2010), higher loan-to-asset

ratio negatively impacts bank stability.

Efficiency element measured by cost income ratio (CIR). The ratio gives investors a

clear view of how efficiently the bank is being run; the lower it is, the more profitable

the bank will be. The hypotheses assume that higher cost income ratios negatively

related with Z-scores. Several studies claim that less efficient banks may tempt to

take on additional risk to increase their financial performance, similar finding also

noticed by (Kwan and Eisenbeis, 1997).

Bank size (LTA) measured log of total assets. We assume that as the bank size

becomes larger, bank would be more stable. Herfindahl Index (HI) measure of

concentration index.

Therefore, estimated model could be written as:

BankStability

1 LARit

6 SHARE it

3.2

2 CIRit

7 INFit

3 LTAit

8 GDPit

4 IDit

5 HI it

it

Variables Description

The variable of interest is bank stability. To ensure robustness, we employ two

definitions of bank stability, that is Z-Score (following Cihak and Hesse, (2008);

Demirguc-Kunt, Detragiache, and Thiesel (2008); Maechler, Mitra, and Worrell,

(2005) and NPL (following Ariff (2007); Madura et al., (1994).

Z-score test measure risk is recommended by many researches in the field, directly

relates to the bank s insolvency. Z-score represents number of standard deviations by

which the returns on asset have to decrease in order to incur a loss (a negative return).

Higher Z-score value indicates a lower probability of default.

Whereas, non-performing loans (NPL) is the most important factors causing

reluctance for the banks to provide credit. High level of NPL requires banks to raise

provision for loan loss. Action of this bank decreases banks revenue by cutting down

the funds for new lending.

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

135

Where:

Dependent Variables

ZSCORE

NPL

Definition

Z = (ROA+CAP)/ (ROA)

NPL = mon-performing loans/ total loans

Independent ariables

Definition

LAR

Loans Assets Ratio

LAR = Total Loans/ Total Assets

CIR

Cost Income Ratio

CIR = Total Costs/ Total Income

LTA

In(Assets)

In (Total assets) of a bank (RM million)

ID

Income Diversity

Net interest income Other operating income)

1 - ----------------------------------------------------Total Operating Income

HI

Herfindahl Index

Herfindahl Index =

(market share n) 2

SHARE Market Share

Market Share of banks (per year)

INF

Inflation

CPI index (%)

GDP

Real GDP

Growth rate of real GDP

Error term

Error term that are not captured by the model

it

Table 1.0: Summary of Dependent and Independent Variables

3.3 Data Sources

Data is gathered from the bank s annual reports, and consolidated and unconsolidated

statement bank statement for various financial institution in Malaysia which is

sourced online as well as from published copies. The period of analysis spans from

year 2005-2010. Macroeconomics data were gathered through online database

Monthly Statistical Bulletin of Bank Negara Malaysia (BNM). Data were collected

from all 17 Islamic banks and 21 conventional banks in Malaysia. During this period

of study, there had been a few mergers and acquisitions of conventional banks,

affecting those banks which operate on Islamic window basis. Particularly, in 2008

Malaysia Islamic banking has observed some structural change since those banks that

operate under Islamic banking windows, has been transformed to full-fledge banks. In

the case of mergers have taken place within the sample banks, this study proceeds by

using the data of anchor bank prior to merger. Meanwhile, the new Islamic banks

upgraded from their Islamic banking operations are treated as a continuation from

Islamic banking operations or windows. Thus, this study includes both full fledge and

Islamic banking operations.

136

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

4.0

Findings

4.1

Normality Test

Jarque-Bera test (assume under the null hypothesis of a normal distribution, is

distributed as 2 with 2 degrees of freedom. Since the probability of Jarque-Bera

statistic less than 0.05, normal distribution can be rejected. Mostly our probability of

Jarque-Bera statistic is less than 0.05 (Table 2.0), therefore we conclude that our

sample is not normal distribution.

4.2

Correlation Coefficient

To check whether multicollinearity appears or not in the model the simple correlation

coefficients in Table 3.0 between the explanatory variables have been examined. The

pairwise correlations among the explanatory variables (LAR, CAR, LTA, ID, HI,

SHARE, INF and GDP) are particularly strong (r < 0.50 in each case). This shows

that the variables are not correlated among each other. As a conclusion multi-co

linearity problem does not appear in this study.

4.3

Unit Root Test

The p-values reported in Table 4.0, each of data series suggest that we fail to reject a

unit root test at least at the 1 % level and 5 % level at 1 st differences. As can be

readily seen, all time series at level contain unit roots according to ADF unit root test

and Levin, Lin & Chu (2002) at level except for cost income ratio, In (total assets),

income diversity and Herfindahl Index. We conclude that ADF unit root tests in first

differences show all variables are stationary.

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

137

DESCRIPTIVE STATISTICS

ZSCORE

NPL

LAR

CIR

In(TA)

ID

HI

SHARE

INF

GDP

Mean

0.722368

0.690204

0.432368

1.076924

14.41387

0.536328

6.160500

5.108904

2.726667

4.616667

Median

0.330000

0.286812

0.510000

0.290000

16.27373

0.550000

0.870000

0.930000

2.530000

5.600000

Maximum

23.67000

39.05209

0.940000

22.80000

21.45330

1.630000

74.20190

73.50000

5.400000

7.200000

Minimum

1.960000

1.501443

0.780000

1.420000

1.540000

0.470000

0.780000

0.670000

0.600000

-1.700000

Std. Dev.

2.029177

2.657692

0.256597

10.38575

6.015925

0.384194

1143.691

13.44865

1.537723

2.936986

Skewness

8.331474

3.156460

-0.580081

14.94308

-1.820843

0.387167

6.518537

5.279181

0.402549

-1.507184

Kurtosis

84.20247

10.83223

2.098793

224.8461

4.757063

2.760985

44.08796

32.54685

2.210679

3.722992

Jarque-Bera

45.03935

20.50241

1279.605

155.3169

6.238846

1762.77

88.99084

12.07650

91.28674

Prob

0.000000

0.029174

0.000035

0.000000

0.000000

0.044183

0.000000

0.000000

0.002386

0.000000

Sum

164.7000

348.8842

98.57982

245.5386

3286.362

122.2829

117.0459

116.4830

621.6800

1052.600

Sum Sq. Dev.

934.6861

503.4312

14.94613

24485.09

8215.436

33.50639

212.6785

169.5040

536.7627

1958.077

228

228

228

228

228

228

228

228

228

228

No of banks

Table2.0: Descriptive Statistics

CORRELATION MATRIX

Correlation

ZSCORE

NPL

LAR

CIR

LTA

ID

HI

SHARE

INF

GDP

ZSCORE

1.000000

NPL

0.260348

1.000000

LAR

-0.131501

0.039276

1.000000

CIR

0.280227

0.024748

-0.098776

1.000000

LTA

0.075817

0.042823

0.672384

0.070399

1.000000

ID

-0.065527

0.084176

0.273420

-0.090543

0.051834

HI

0.247156

-0.004028

-0.132856

0.423686

0.183455 -0.076547

1.000000

SHARE

0.202214

0.112992

-0.032567

0.403106

0.298628 -0.033122

0.175314

1.000000

INF

0.039093

0.059654

-0.041761

0.037241

-0.053387

0.029037 -0.002152

-0.002136

1.000000

GDP

0.041271

0.016871

-0.137644

0.029387

-0.094316 -0.013087 -0.000553

-0.003305

0.049644 1.000000

1.000000

Table 3.0: Correlation Matrix

138

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

UNIT ROOT TESTS (LEVIN, LIN & CHU) AND (ADF TEST)

1ST DIFFERENCES

LEVEL

Variables

Levin, Lin & Chu

ADF

Levin, Lin & Chu

ADF

statistics

Probabilit

y

statistics

Probability

statistics

Probability

statistics

Probability

(1)Z-score

-5.16530

0.1365

16.0765

0.4034

-1.90110

0.0000***

8.91494

0.0013**

(2)NPL

-9.90068

0.7685

63.3617

0.7008

-9.83040

0.0000***

68.1719

0.0005**

(1) Cost Income Ratio

-50.1936

0.0000***

39.5321

0.0000***

-61.5416

0.0000***

28.3889

0.0004**

(2)In (Total Assets)

-1.81761

0.0346**

53.0892

0.0196**

4.59864

0.0000***

3.45482

0.0009**

(3)Loans Assets Ratio

-1.44237

0.7460

34.1149

0.6422

-1.92920

0.0269**

10.0626

0.0105**

(4)Income diversify

-1.47450

0.0022**

64.4860

0.0012**

-1.17393

0.0120**

40.2925

0.0001**

(5)Herfindahl Index

-1.09632

0.0000***

72.2052

0.0001**

-0.06135

0.0000***

14.4515

0.0272**

(1)Market Share

-2.05664

0.1909

35.3794

0.4029

-1.44358

0.0007**

13.6358

0.0001**

(2)Real GDP Growth

-2.84655

0.7022

28.0980

0.7517

-1.6980

0.0454**

9.31677

0.0232**

(3)Inflation

-4.65016

0.6201*

41.4589

0.1774

-2.76261

0.0029**

14.6326

0.0000***

Dependent

Bank specific

Macroeconomics

Table 4.0: Unit Root tests and ADF test

values in parentheses.

significant level at 10% (*), 5% (**), 1% (***)

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

4.4

139

Selection Procedures for Best Model

Using E-Views 6, we run panel data for several specifications to gather the results.

Test of Generalized Least Square (GLS) was done in order to test bank stability. The

estimation proceeds as follows; firstly, model is estimated via ordinary least squares

(OLS). This estimation methods assumes that all banks have the same behaviour in

which it is assumed that the intercepts for the banks are identical, it= . Since the

initial findings of the data set indicate the non-normality distributions, thus

Generalized Least Squares (GLS) estimation is likely to produce better estimation

results.

Secondly, this study proceeds with both fixed effect and random effects models. The

result show that the null hypothesis is rejected that is the individual effect associated

with the independent variables. The result of Hausman test statistics suggests that

fixed effects model (FEM) is the appropriate panel data estimator for this study. By

looking at chi-square statistic, Z-scores of the conventional banks sample with (117, 8

degree of freedom) were ( 2=6.970100) and having a low-p-value (0.0000), lead to

suggestion that the corresponding effect are statistically significant at 1 %

significance level. In summary, based on the result of specification test; the fixed

effects model (FEM) appears to be the best model based on the Likelihood Ratio and

Hausman test.

Dependent Variables: Z-score

Chi-Square

df

Probability

(1) Islamic Banks

2.891050

(93, 8)

0.0000

(2) Conventional banks

6.970100

(117, 8)

0.0000

Dependent Variables: NPL

Chi-Square

df

Probability

(1) Islamic Banks

2.890808

(93, 8)

0.0000

(2) Conventional banks

7.998643

(117, 8)

0.0000

Table 5.0: Correlated Fixed Effect: Hausman Test

140

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

STEP 1: Pool vs. FE

Econometrics Estimation

(1)

(2)

(2)

Fixed Effect (FE)

POOL OLS

Decision based on:

Redundant Fixed Effect: Chow-Test

Select

Fixed Effect

STEP 2: FE vs. RE

(FE)

(2)

Fixed Effect

(3)

Random Effect (RE)

(FE)

Decision based on:

Correlated Random Effect: Hausman Test

STEP 3: BEST MODEL: FE

Select

Fixed Effect (FE)

Figure 1.0: Selection Procedures for Best Model

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

Independent Variables

Constant

Z-score (Panel A)

141

NPL (Panel B)

Islamic

Conventional

Islamic

Conventional

(1)

(2)

(3)

(4)

0.680897

0.133812

0.908503

-1.611173

(0.0000)***

(0.0000)***

(0.0000)****

(0.0273)**

Bank Specific

-0.147068

-0.098306

1.476797

-1.314981

(1) LAR

(0.0195)**

(0.0634)*

(0.0000)***

(0.0842)*

(2) CIR

0.038518

0.011706

-0.013158

0.214108

(0.0000)***

(0.2011)

(0.0579)*

(0.7478)

0.022055

0.022765

0.022248

0.020201

(0.0003)**

(0.0000)***

(0.0000)***

(0.0002)***

-0.102110

0.040185

0.208662

0.854856

(0.3095)

(0.0000)***

(0.5209)

(0.0001)**

0.000500

0.000453

-0.000534

-0.000778

(0.0113)**

(0.1723)

(0.0336)**

(0.9221)

Macroeconomics

-0.011792

-0.021459

0.059340

0.705656

(1) SHARE

(0.1479)

(0.0000)***

(0.2800)

(0.0066)**

(2) INF

0.004880

0.002287

-0.053276

0.075542

(0.0433)**

(0.1802)

(0.0000)***

(0.3739)

0.004544

0.000799

0.042137

0.042138

(0.0002)***

(0.0430)**

(0.0000)***

(0.0177)**

0.0000

0.0000

0.0000

0.0000

R-squared

0.300331

0.331482

0.287459

0.209929

Adjusted R-squared

0.223093

0.211926

0.237426

0.206712

S.E.of Regression

1.414270

0.107905

1.863612

2.108415

F-statistic

15.79718***

14.68524***

10.61011***

10.28964***

Sum squared residual

154.0123

140.1772

267.4247

431.2051

Durbin-Watson stat

1.992206

1.872072

2.009188

1.995492

Observations

102

126

102

126

(3) LTA

(4) ID

(5) HI

(3) GDP

Fixed Effect:

Chow-Test (p-value)

Table 6.0: Fixed Effects Panel Model, 2005-2010

142

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

The regression results of Z-score and NPL have been identified as the dependent

variable as a proxy of measuring risk shown in Table 6.0. The diagnostics test

statistics show no evidence of misspecification, no serial correlation, no

multicollinearity and no heterokedasticity. Table 6.0 reported that for the first set of

regressions, the R-squared for Islamic banks were 30.03% while 33.14% for the

conventional banks. These results identify that factors that are significant in

determining Z-score for conventional banks are loan asset ratio, cost income ratio,

total asset, income diversity, Herfindahl Index, market share and real GDP.

Meanwhile, factors that influence Z-score for Islamic banks are cost income ratio,

total assets, Herfindahl Index, market share, inflation and real GDP. To ensure

robustness, we used another proxy for bank stability that is NPL. The results shows,

independent variables that are significant in determining NPL for conventional banks

are loan asset ratio, cost income ratio, total asset, income diversity, Herfindahl Index,

market share and real GDP.

Findings that contradict our initial assumptions are the relationship between size of

the bank and bank stability for conventional banks. The positive relationship implies

that a larger bank is linked with higher NPL, lower bank stability. This findings deny

the too big to fail hypothesis, and is consistent with previous work such as by

Ebrahim (2008) and Berger et al., (1997). Nevertheless, for the Islamic banks, our

result seems to be consistent with the previous findings, which indicate total assets,

confirm positive and significant effect on NPL at 1% significant level. It indicates

that 1% increase in total assets will increase NPL by 0.022%. This positive

relationship between bank size and bank stability indicate that solvency risks obtain

from impairment of assets.

Finally, looking at the macroeconomics perspectives for the Islamic banks, the result

of economic growth has a positive and significant effect on Z-score at 5% significant

level. It indicates that one percent increase in economic growth will increase Z-score

by 0.0045%. According to Shayegani and Arani (2012) real GDP is one of

macroeconomic variable contributing to financial stability. Our result is in line with

the previous research which claims, during economic boom, higher real GDP lead to

higher Z-score and a more stable Islamic bank.

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

4.5

Average Z-score and NPL Volatility, 2005-2010

The Average Z-score of the Conventional Banks and Islamic

Banks, 2005-2010

2.28

Islamic Bank

1.67

0.82

0.44

0.34

2005

2006

0.64

0.42

0.38

2007

2008

0.62

0.45

0.60

0.49

2009

2010

The Average NPL of the Conventional Banks

and Islamic Banks, 2005-2010

3.76

3.37

2.88

2.67

2.10

1.89

1.73

1.54

2.02

1.57

1.24

1.43

Islamic Bank

Conventional Bank

2005

2006

2007

2008

2009

Chart 1.0: Average Z-score and NPL, 2005-2010

2010

143

144

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

Higher Z-score obtained for Islamic banks is mainly due to higher return and equity

of Islamic banks as compared to those of conventional banks. Higher Z-score

indicates that Islamic banks are less risky (lower probability to defaults) than

conventional banks. During the year of 2006-2007, the trend shows that Islamic banks

are more resistant during crisis compared to conventional banks.

On examination of NPL, conventional banks have higher NPL than Islamic banks

which indicate that conventional banks have higher risk (higher probability to default)

as compared to Islamic banks. During the year of 2005-2006, the trend shows that

conventional banks are less resistant during crisis due to the higher NPL compared to

Islamic banks. The same results also appears during the crisis 2007-2010, which also

shows that conventional banks have higher NPL (higher probability to default) as

compared to Islamic banks.

5.0

Conclusion

This study examines stability between Islamic and conventional banks from banks

specific and macroeconomics perspectives by focusing on Malaysia scenario. The

findings of the study show that variables that have been identified as the significant

factors towards risk (probability to defaults) for Islamic banks were cost income ratio,

total assets, Herfindahl Index, market share, inflation and real GDP while

conventional bank stability were influence by loan asset ratio, cost income ratio, total

assets, income diversity, Herfindahl Index, market share and real GDP.

In future more comprehensive and effective research on relationships among

variables for both banks needs to be conducted to study the stability of Islamic and

conventional banks from Malaysia banking landscape after financial crisis 2008.

Large pools of secondary data should be collected from all Islamic and conventional

banks in Malaysia in order to have a better representative of our conclusions.

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

145

References

Agusman, A., Monroe, G.S., Gasborro, D., Zumwalt, J.K.. Accounting and Capital Market

measures of Risk: Evidence from Asian Banks during 1998-2003 . Journal of Bank

Finance, Vol. 32 Iss:4, 2008, pp 480-488.

Alaro, A.R., Hakeem, M. Financial Engineering and Financial Stability: The Role of Islamic

Financial System . Journal of Islamic Economics, Banking and Finance, Vol. 7 Iss:1,

2011, pp. 25-38.

Allen, F., Gale, D. (2004) Competition and Financial Stability . Journal of Money, Credit

and Banking, Vol. 36, Iss:3, 2004, pp: 453-480.

Ariff, M. Islamic Banking: A Variation of Conventional Banking? . Monash Business

Review, Vol. 3 Iss:1, 2007, pp 1-8.

Bank Negara Malaysia. 2009. Annual Reports, Kuala Lumpur.

Barr, R., Siems, T. Predicting Bank Failure using DEA to Quantify Management Quality .

Financial Industry Studies Working Paper, No 1-94, 1994.Federal Reserve Bank of

Dallas, Texas.

Beck T., Demirguc-Kunt, A., Merrouche, O. Islamic vs. Conventional Banking: Business

model, Efficiency and Stability . Policy Research Working Paper, No. 5446, 2010.The

World Bank. Washington.

Bekaert, G., Harvey, C.R., Lundblad, C., Siegel, S. Global Growth Opportunities and Market

Integration . Journal of Finance, Vol. 62 Iss:3, 2007, pp 1081-1137.

Berger, P., Ofek, E., Yermack, D. Managerial entrenchment and capital structure decisions .

The Journal of Finance, Vol. 52, Iss:4, 1997, pp 1411-1438.

Chapra, M.U.2000. The Future of Economics: An Islamic Perspective, The Islamic

Foundation, Leicester, United Kingdom.

Choong, Y. V., Thim C. K., Kyzy, B.T. Performance of Islamic Commercial Banks in

Malaysia: An Empirical Study . Journal of Islamic Economics, Banking and Finance,

Vol. 8 Iss: 2, 2012, pp. 67-80.

Cihak, M., Hesse, H. Islamic Banks and Financial Stability: An Empirical Analysis . IMF

Working Paper, WP/08/16, 2008. International Monetary Fund, Washington.

Cihak, M., Maechler, A., Schaeck, K. & Stolz, S. Who disciplines bank managers? . IMF

Working Papers, No.09/272, 2009. International Monetary Fund, Washington.

146

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

Demirguc-Kunt, Asli, Detragiache, E., Thierry Tressel, T. Banking on the Principles:

Compliance with Basel Core Principles and Bank Soundness . Journal of Financial

Intermediation, Vol. 17 Iss:4, 2008, pp 511-542.

Dridi, J., Hasan, M. Have Islamic Banks Been Impacted Differently than Conventional

Banks During the Recent Global Crisis? . IMF Working Paper Series, No. 10/201,

2010. International Monetary Fund, Washington.

Dridi, J., Hasan, M. Put to the Test Islamic banks were more resilient than conventional

banks during the global financial crisis, Finance & Development . Viewed 4 May 2011

available through http://mepei.com/in-focus/5279-the-islamic-banking-system-fromthe-crisis-threats-to-the-futures-opportunities

Ebrahim, M.S. The Financial Crisis: Comments from Islamic Perspectives . IIUM Journal of

Economics and Management, Vol. 16, Iss:2, 2008, pp 111-138.

El-Gamal, M. The Survival of Islamic Banking: A Macro-Evolutionary Perspective . Islamic

Economic Studies, Vol. 5 Iss:1, 1998, pp 1-19.

Eisenbeis, R., Kwan, S. Bank risk, capitalization and operating efficiency . Journal of

Financial Services Research, Vol. 12 Iss:2, 1997, pp 117-131.

Hassan, M.K. Dicle, M.F. Basel II and Regulatory Framework for Islamic Banks . Journal of

Islamic Economics and Finance, Vol.1, Iss:1, 2005, pp. 17-36.

Hassan, M. K., Kayed, R.N. The Global Financial Crisis and the Islamic Finance Solution .

Paper presented at the Durham Islamic Finance Conference, 14 -15 July, Durham

University, United Kingdom, 2010.

Hussein, K. Bank Level Stability Factors and Consumer Confidence a Comparative Study of

Islamic and Conventional Banks Product Mix . IMF Working Paper Series, No. 3,

2010. International Monetary Fund, Washington.

Imam, K., Kpaodar, K. Islamic Banking: How Has It Diffused? . IMF Working Paper Series,

No.10/195, 2010. International Monetary Fund. Washington.

Levin, A., C. Lin., C. Chu. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample

Properties . Journal of Econometrics, Vol. 108, Iss:1, 2002, pp 1-24.

Loghod, H.A. Kuwait Do Islamic Banks Perform Better than Conventional Banks? Evidence

from Gulf Cooperation Council countries . API Working Paper Series, No. 1011, 2010.

Arab Planning Institute, Saudi Arabia.

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

147

Maechler, A., Mitra,S., Worrell, D, L. Exploring Financial Risks and Vulnerabilities in New

and Potential EU Member States . Second Annual DGECFIN Research Conferences:

Financial Stability and the Convergence Process in Europe, 6-7 October, Brussels,

2005.

Rahman, M. S. Credit Risk Management Practices in Banks: An Appraisal . Journal of

Islamic Economics, Banking and Finance, Vol. 7 Iss: 3, 2011, pp. 37-62.

Shayegani, B., Arani, M.A. A Study on the Instability of Banking Sector in Iran Economy .

Australian Journal of Basic and Applied Sciences, Vol. 6 Iss:1, 2012, pp 213-221.

Verandos, A.M. 2010. Current Issues in Islamic Banking and Finance: Resilience and

Stability in Present System, World Scientific Publishing Co. Pte. Ltd., Singapore.

Willison, B. Technology trends in Islamic Investment Banking Islamic Finance News .

Viewed 6 Jan., 2009 available through http://www.globalislamicfinancemagazine.com

Yee, L.C. 2003. Rising to the Challenges of Globalization: A Study of the Malaysian Banking

Sector. Masters of Economics (MEc.). Dissertation. Faculty of Economics and

Administration. University of Malaya, Kuala Lumpur. (Unpublished).

Zaman, C. 2008. World Financial Crisis: Possible Impact on Developing Economies. CASE

Warsaw.

148

Journal of Islamic Economics, Banking and Finance, Vol. 9 No. 3, July - Sep 2013

APPENDIX

1.0

List of Islamic Bank in Malaysia

No

Name

Ownership

Local Islamic Banks

1.

Affin Islamic Bank Berhad

Local

2.

Alliance Islamic Bank Berhad

Local

3.

AmIslamic Bank Berhad

Local

4.

Bank Islam Malaysia Berhad

Local (Full-fledged)

5.

Bank Muamalat Malaysia Berhad

Local (Full-fledged)

6.

CIMB Islamic Bank Berhad

Local

7.

EONCAP Islamic Bank Berhad

Local

8.

Hong Leong Islamic Bank Berhad

Local

9.

Maybank Islamic Berhad

Local

10.

Public Islamic Bank Berhad

Local

11.

RHB Islamic Bank Berhad

Local

Foreign Islamic Banks

1.

Al Rajhi Banking & Investment Corporation

Foreign

(Malaysia) Berhad

2.

Asian Finance Bank Berhad

Foreign

3.

HSBC Amanah Malaysia Berhad

Foreign

4.

Kuwait Finance House (Malaysia) Berhad

Foreign

5.

OCBC Al-Amin Bank Berhad

Foreign

6.

Standard Chartered Saadiq Berhad

Foreign

Sources: Bank Negara Malaysia (2011)

Islamic Finance in India: A Study on the Perception of College Teachers in Chennai

2.0

List of Conventional Bank in Malaysia

No

Name

Ownership

Local Conventional Banks

1.

Affin Bank Berhad

Local

2.

Alliance Bank Malaysia Berhad

Local

3.

AmBank (M) Berhad

Local

4.

CIMB Bank Berhad

Local

5.

EON Bank Berhad

Local

6.

Hong Leong Bank Berhad

Local

7.

Malayan Banking Berhad

Local

8.

Public Bank Berhad

Local

9.

RHB Bank Berhad

Local

Foreign Conventional Banks

1.

Bangkok Bank Berhad

Foreign

2.

Bank of China (Malaysia) Berhad

Foreign

3.

Bank of Tokyo-Mitsubishi UFJ (Malaysia) Berhad

Foreign

4.

Citibank Berhad

Foreign

5.

Deutsche Bank (Malaysia) Berhad

Foreign

6.

HSBC Bank Malaysia Berhad

Foreign

7.

Industrial

and

Commercial

Bank

of

China

Foreign

(Malaysia) Berhad

8.

OCBC Bank (Malaysia) Berhad

Foreign

9.

Standard Chartered Bank Malaysia Berhad

Foreign

10. The Bank of Nova Scotia Berhad

Foreign

11. The Royal Bank of Scotland Berhad

Foreign

12. United Overseas Bank (Malaysia) Bhd.

Foreign

Sources: Bank Negara Malaysia (2011)

149

Das könnte Ihnen auch gefallen

- EIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptVon EverandEIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptNoch keine Bewertungen

- 8.islamic Banks and Financial StabilityDokument19 Seiten8.islamic Banks and Financial StabilityHarsono Edwin PuspitaNoch keine Bewertungen

- EIB Working Papers 2019/07 - What firms don't like about bank loans: New evidence from survey dataVon EverandEIB Working Papers 2019/07 - What firms don't like about bank loans: New evidence from survey dataNoch keine Bewertungen

- v11 n1 Article8Dokument24 Seitenv11 n1 Article8Farapple24Noch keine Bewertungen

- Capital Reg and Islamic BankingDokument22 SeitenCapital Reg and Islamic BankingNaili RahmawatiNoch keine Bewertungen

- Factors Influencing The Profitability of Conventional and Islamic Commercial Banks in GCC CountriesDokument26 SeitenFactors Influencing The Profitability of Conventional and Islamic Commercial Banks in GCC CountriesEcho Yang100% (1)

- Islamic Finance ReferencesDokument6 SeitenIslamic Finance ReferencesMuhammad Salim Ullah KhanNoch keine Bewertungen

- 14-Rajhi & Hassairi, 2013) - IslamicDokument29 Seiten14-Rajhi & Hassairi, 2013) - IslamicIbrahim KhatatbehNoch keine Bewertungen

- Literature ActualDokument26 SeitenLiterature Actualnek_akhtar8725Noch keine Bewertungen

- Relationship Between Capital, Risk and Efficiency - A Comparative Study Between Islamic and Conventional Banks in BDDokument28 SeitenRelationship Between Capital, Risk and Efficiency - A Comparative Study Between Islamic and Conventional Banks in BDNahid Md. AlamNoch keine Bewertungen

- Financial Stability of Islamic Banks: Empirical EvidenceDokument8 SeitenFinancial Stability of Islamic Banks: Empirical EvidenceSaifullahNoch keine Bewertungen

- Islamic Bank Capital Structure Hoque2021Dokument18 SeitenIslamic Bank Capital Structure Hoque2021Dedi SupiyadiNoch keine Bewertungen

- Comparative Analysis of Islamic & Conventional BankingDokument39 SeitenComparative Analysis of Islamic & Conventional BankingSharier Mohammad MusaNoch keine Bewertungen

- Global Finance Journal: SciencedirectDokument22 SeitenGlobal Finance Journal: SciencedirectWahyutri IndonesiaNoch keine Bewertungen

- Proposal ExampleDokument11 SeitenProposal ExampleDr AbdulrahmanNoch keine Bewertungen

- Impact of Interest Rates On Profitability of Islamic and Conventional Banks, PakistanDokument22 SeitenImpact of Interest Rates On Profitability of Islamic and Conventional Banks, PakistansyedawwadNoch keine Bewertungen

- Risk and Stability in Islamic BankingDokument47 SeitenRisk and Stability in Islamic Bankingizi25Noch keine Bewertungen

- 33 63 1 SMDokument13 Seiten33 63 1 SMMickey GoodmanNoch keine Bewertungen

- 623-Article Text-2128-2234-10-20190629Dokument18 Seiten623-Article Text-2128-2234-10-20190629CorisytNoch keine Bewertungen

- Bank-Specific and Macroeconomic Determinants of Banks Liquidity in Southeast AsiaDokument18 SeitenBank-Specific and Macroeconomic Determinants of Banks Liquidity in Southeast AsiaGlobal Research and Development ServicesNoch keine Bewertungen

- Review of Financial Economics: Khawla Bourkhis, Mahmoud Sami NabiDokument10 SeitenReview of Financial Economics: Khawla Bourkhis, Mahmoud Sami Nabiitaa3nurNoch keine Bewertungen

- Ihtisham Sir PapperDokument17 SeitenIhtisham Sir PapperIbrahim MuhammadibrahimNoch keine Bewertungen

- Superiority of Conventional Banks & Islamic Banks of Bangladesh: A Comparative StudyDokument9 SeitenSuperiority of Conventional Banks & Islamic Banks of Bangladesh: A Comparative Studytazim07Noch keine Bewertungen

- 1 Ijafmrjun20181 PDFDokument16 Seiten1 Ijafmrjun20181 PDFTJPRC PublicationsNoch keine Bewertungen

- Shroa NPLDokument25 SeitenShroa NPLPratiwi AndiniNoch keine Bewertungen

- J Ribaf 2016 03 014Dokument41 SeitenJ Ribaf 2016 03 014Putri Gina kusumaNoch keine Bewertungen

- Liquidity Risk and Performance: The Case of Bahrain and Malaysian BanksDokument17 SeitenLiquidity Risk and Performance: The Case of Bahrain and Malaysian BanksAnonymous ed8Y8fCxkSNoch keine Bewertungen

- Efficiency and Performance PDFDokument17 SeitenEfficiency and Performance PDFNadeemNoch keine Bewertungen

- Liquidity RiskDokument17 SeitenLiquidity Riskmostafaali123Noch keine Bewertungen

- Vol 12-1..donsyah Yudistira..Efficiency in Isl Banking.Dokument19 SeitenVol 12-1..donsyah Yudistira..Efficiency in Isl Banking.Nana Adwoa KonaduNoch keine Bewertungen

- GJBR V9N3 2015 3Dokument16 SeitenGJBR V9N3 2015 3IJHRDS SRAKMNoch keine Bewertungen

- 6 Islamic BankDokument24 Seiten6 Islamic BankSofia HaninNoch keine Bewertungen

- 5 - 1 - The Governance, Risk-Taking, and Performance of Islamic Banks - Zscore and ROADokument29 Seiten5 - 1 - The Governance, Risk-Taking, and Performance of Islamic Banks - Zscore and ROAHarsono Edwin PuspitaNoch keine Bewertungen

- Ef Ficiency and Stability: A Comparative Study Between Islamic and Conventional Banks in GCC CountriesDokument14 SeitenEf Ficiency and Stability: A Comparative Study Between Islamic and Conventional Banks in GCC CountriessuhaileresmairNoch keine Bewertungen

- DeterminantDokument10 SeitenDeterminantDeaz Fazzaura PutriNoch keine Bewertungen

- 10.1016@j.ribaf.2020.101242 TKO & Manajemen LabaDokument35 Seiten10.1016@j.ribaf.2020.101242 TKO & Manajemen Labakharis maulanaNoch keine Bewertungen

- Risk Management Practices and Islamic Banks: An Empirical Investigation From PakistanDokument9 SeitenRisk Management Practices and Islamic Banks: An Empirical Investigation From PakistanJoko SiwantonoNoch keine Bewertungen

- Economics - Ijecr - Efects of Capital Adequacy On TheDokument10 SeitenEconomics - Ijecr - Efects of Capital Adequacy On TheTJPRC PublicationsNoch keine Bewertungen

- Islamic vs. Conventional Banks in The GCC Countries: A Comparative Study Using Classification TechniquesDokument25 SeitenIslamic vs. Conventional Banks in The GCC Countries: A Comparative Study Using Classification TechniquesMickey GoodmanNoch keine Bewertungen

- 4 MohanDokument17 Seiten4 MohanZinebNoch keine Bewertungen

- Regulatory Capital and Stability of Islamic and Conventional BanksDokument19 SeitenRegulatory Capital and Stability of Islamic and Conventional BanksYusuf Seto KurniawanNoch keine Bewertungen

- Impact of Interest Rates On Islamic and Conventional Banks: The Case of TurkeyDokument19 SeitenImpact of Interest Rates On Islamic and Conventional Banks: The Case of TurkeyMelson Frengki BiafNoch keine Bewertungen

- 2008 Conventional Vis-A - Vis IslamicDokument23 Seiten2008 Conventional Vis-A - Vis Islamicalfiyan firdausNoch keine Bewertungen

- Bourkhis and Nabi-Islamic and Conventional Banks' Soundness During 2007-2008 Financial Crisis-Rfe-2013Dokument10 SeitenBourkhis and Nabi-Islamic and Conventional Banks' Soundness During 2007-2008 Financial Crisis-Rfe-2013Wana MaliNoch keine Bewertungen

- Journal of Economic Behavior & OrganizationDokument14 SeitenJournal of Economic Behavior & OrganizationSuhail RizwanNoch keine Bewertungen

- Corporate Governance and Financial Stability in Islamic BankingDokument16 SeitenCorporate Governance and Financial Stability in Islamic BankingYusuf Seto KurniawanNoch keine Bewertungen

- Future Business Journal: Jelmiati - AmbanaDokument27 SeitenFuture Business Journal: Jelmiati - AmbanaRiwan RapitanNoch keine Bewertungen

- RM ModuleDokument8 SeitenRM ModuleEPSONNoch keine Bewertungen

- An Analysis of Loan Portfolio Management On Organization Profitability: Case of Commercial Banks in KenyaDokument13 SeitenAn Analysis of Loan Portfolio Management On Organization Profitability: Case of Commercial Banks in Kenyashubham roteNoch keine Bewertungen

- Sample of ResearchDokument3 SeitenSample of ResearchMr. PathanNoch keine Bewertungen

- Business Model, Efficiency and StabilityDokument44 SeitenBusiness Model, Efficiency and StabilityadeNoch keine Bewertungen

- National Institute of Bank Management: by Roll No.-R1801034 PGDM (B&FS) Batch 2018-20Dokument6 SeitenNational Institute of Bank Management: by Roll No.-R1801034 PGDM (B&FS) Batch 2018-20KomalDewanandChaudharyNoch keine Bewertungen

- Risk in Islamic Banking MAY 3 - PreDokument61 SeitenRisk in Islamic Banking MAY 3 - PreAhmad Shoaib WahideeNoch keine Bewertungen

- Determinants of Bank Profitability in A Developing Economy: Empirical Evidence From The PhilippinesDokument22 SeitenDeterminants of Bank Profitability in A Developing Economy: Empirical Evidence From The PhilippinesAnnisa ViradilaNoch keine Bewertungen

- Malik Liquidity PakistanDokument16 SeitenMalik Liquidity PakistanTalha AhmedNoch keine Bewertungen

- Do Islamic Banks More Stable Than Conventional Banks? Evidence From IndonesiaDokument16 SeitenDo Islamic Banks More Stable Than Conventional Banks? Evidence From IndonesiaHeri Sudarsono S.E., M.Ec. Sudarsono S.E., M.Sc.Noch keine Bewertungen

- Economic Uncertainty and Bank Stability - Conventional vs. Islamic BankingDokument40 SeitenEconomic Uncertainty and Bank Stability - Conventional vs. Islamic Bankingalfiyan firdausNoch keine Bewertungen

- Ahmad 2008 Determinant CARDokument20 SeitenAhmad 2008 Determinant CARGufranNoch keine Bewertungen

- The Bank-Specific Factors Affecting The Profitability of Commercial Banks in Bangladesh: A Panel Data AnalysisDokument8 SeitenThe Bank-Specific Factors Affecting The Profitability of Commercial Banks in Bangladesh: A Panel Data AnalysisAbdu MohammedNoch keine Bewertungen

- Monetary Policy Shocks and Islamic Banks' Deposits in A Dual Banking System: Empirical Evidence From Malaysia and BahrainDokument26 SeitenMonetary Policy Shocks and Islamic Banks' Deposits in A Dual Banking System: Empirical Evidence From Malaysia and Bahrainfatinah izzatiNoch keine Bewertungen

- Presentation Riba and MaysirDokument31 SeitenPresentation Riba and Maysirgeena1980Noch keine Bewertungen

- Product Disclosure Sheet: Personal Financing-I For Civil Sector Via AngkasaDokument4 SeitenProduct Disclosure Sheet: Personal Financing-I For Civil Sector Via Angkasageena1980Noch keine Bewertungen

- Consider A Simple Loan ExampleDokument2 SeitenConsider A Simple Loan Examplegeena1980Noch keine Bewertungen

- Strength Training For Young Rugby PlayersDokument10 SeitenStrength Training For Young Rugby Playersgeena1980Noch keine Bewertungen

- Essentials of Quality Management: Pn. Norkisme Zainal Abidin 019 620 8585 Norkisme@ukm - Edu.myDokument32 SeitenEssentials of Quality Management: Pn. Norkisme Zainal Abidin 019 620 8585 Norkisme@ukm - Edu.mygeena1980Noch keine Bewertungen

- Effectiveness of AgilityDokument24 SeitenEffectiveness of Agilitygeena1980Noch keine Bewertungen

- Physical Fitness Evaluation of MARA Junior Science Collage Rugby PlayerDokument1 SeitePhysical Fitness Evaluation of MARA Junior Science Collage Rugby Playergeena1980Noch keine Bewertungen

- Influence of The Marketing Environment On The Toy Market: Case StudyDokument7 SeitenInfluence of The Marketing Environment On The Toy Market: Case Studygeena1980Noch keine Bewertungen

- Characteristics of The SportDokument2 SeitenCharacteristics of The Sportgeena1980Noch keine Bewertungen

- A Series of Studies On Professional Rugby League Players.Dokument419 SeitenA Series of Studies On Professional Rugby League Players.geena1980Noch keine Bewertungen

- Adj.+ Er+ Than: Short Adjectives Long AdjectivesDokument3 SeitenAdj.+ Er+ Than: Short Adjectives Long Adjectivesgeena1980Noch keine Bewertungen

- A Series of Studies On Professional Rugby League Players.Dokument419 SeitenA Series of Studies On Professional Rugby League Players.geena1980Noch keine Bewertungen

- Study On The Competitiveness of The Toy Industryecsip - enDokument96 SeitenStudy On The Competitiveness of The Toy Industryecsip - enAbhishek SharmaNoch keine Bewertungen

- EnterpreneurshipDokument84 SeitenEnterpreneurshipgeena1980100% (2)

- ControllingDokument23 SeitenControllinggeena1980Noch keine Bewertungen

- Topic 4:: Decision MakingDokument28 SeitenTopic 4:: Decision Makinggeena1980Noch keine Bewertungen

- BBA and MurabahDokument26 SeitenBBA and Murabahgeena1980Noch keine Bewertungen

- Basics of Financial Accounting BDAW2103Dokument7 SeitenBasics of Financial Accounting BDAW2103geena1980Noch keine Bewertungen

- TFT SDK ManualDokument107 SeitenTFT SDK ManualRenier ServenNoch keine Bewertungen

- Section 3 Quiz, Database Design ORACLEDokument8 SeitenSection 3 Quiz, Database Design ORACLEMostragNoch keine Bewertungen

- Abbott 2021 ApJL 915 L5Dokument24 SeitenAbbott 2021 ApJL 915 L5Manju SanthakumariNoch keine Bewertungen

- Dell XPS 17 Quanta GM7 Rev D SchematicsDokument39 SeitenDell XPS 17 Quanta GM7 Rev D SchematicsvcompumatikNoch keine Bewertungen

- Instant Download Trauma Contemporary Directions in Theory Practice and Research 1st Edition Ebook PDF PDF FREEDokument33 SeitenInstant Download Trauma Contemporary Directions in Theory Practice and Research 1st Edition Ebook PDF PDF FREErichard.rosas835100% (41)

- Grade 9 Cells and Cell Movements Formative WorksheetDokument8 SeitenGrade 9 Cells and Cell Movements Formative WorksheetHari PatelNoch keine Bewertungen

- Crane Wheels-General InformationDokument3 SeitenCrane Wheels-General InformationArvind VaishNoch keine Bewertungen

- HP Proliant DL380 G6 Server - Step by StepDokument9 SeitenHP Proliant DL380 G6 Server - Step by StepBoss100% (1)

- Direct Synthesis of Sodalite From Kaolin: The Influence of AlkalinityDokument7 SeitenDirect Synthesis of Sodalite From Kaolin: The Influence of AlkalinityIsye RahmaenaNoch keine Bewertungen

- Analytic Geometry Parabola ProblemsDokument14 SeitenAnalytic Geometry Parabola ProblemsOjit QuizonNoch keine Bewertungen

- LogDokument7 SeitenLogHerdi YantoNoch keine Bewertungen

- Measurement of Earthing Systems: Central Networks Earthing Manual Section E4Dokument45 SeitenMeasurement of Earthing Systems: Central Networks Earthing Manual Section E4ahmed_k7117Noch keine Bewertungen

- Final Formula SheetDokument1 SeiteFinal Formula SheetFaryalNoch keine Bewertungen

- 7 Market EquilibriumDokument4 Seiten7 Market EquilibriumAdeeba iqbalNoch keine Bewertungen

- Concrete Mix DesignDokument11 SeitenConcrete Mix DesignV Vinoth Edac100% (1)

- Python ProgramDokument3 SeitenPython ProgramGOKUL BNoch keine Bewertungen

- Inorganic Chemistry - Lab Report 5Dokument7 SeitenInorganic Chemistry - Lab Report 5AlpNoch keine Bewertungen

- The Role of Virtual Reality Simulation in Surgical Training in The Light of COVID-19 PandemicDokument13 SeitenThe Role of Virtual Reality Simulation in Surgical Training in The Light of COVID-19 PandemicIván Hernández FloresNoch keine Bewertungen

- Microsoft WordDokument79 SeitenMicrosoft Wordthamel_09Noch keine Bewertungen

- Unit 10 Lesson 3 Activity Guide - Unreasonable TimeDokument2 SeitenUnit 10 Lesson 3 Activity Guide - Unreasonable Timetrivediom427Noch keine Bewertungen

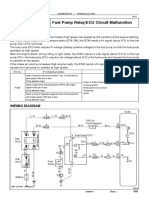

- DTC P1200 Fuel Pump Relay/ECU Circuit MalfunctionDokument4 SeitenDTC P1200 Fuel Pump Relay/ECU Circuit MalfunctiononealNoch keine Bewertungen

- What Is Lincdoc?Dokument2 SeitenWhat Is Lincdoc?Daniel O'Leary0% (1)

- Design and Implementation of Audio Transceiver Using Infrared Laser For Audio Signal DetectionDokument4 SeitenDesign and Implementation of Audio Transceiver Using Infrared Laser For Audio Signal DetectionGoitom HaileNoch keine Bewertungen

- Precima Frenos FDW ATEX Operating InstructionsDokument6 SeitenPrecima Frenos FDW ATEX Operating InstructionsToni RenedoNoch keine Bewertungen

- CNS - Types of CiphersDokument47 SeitenCNS - Types of Ciphersmahesh palemNoch keine Bewertungen

- AKA5510EXADokument2 SeitenAKA5510EXAСтоил СемерджиевNoch keine Bewertungen

- Hemoglobin A1c: A) MES 2-Morpholinoethane Sulfonic Acid B) TRIS Tris (Hydroxymethyl) - AminomethaneDokument6 SeitenHemoglobin A1c: A) MES 2-Morpholinoethane Sulfonic Acid B) TRIS Tris (Hydroxymethyl) - Aminomethanejoudi.jou95Noch keine Bewertungen

- GENERAL PHYSICS 2 - Q3 - Week 2Dokument22 SeitenGENERAL PHYSICS 2 - Q3 - Week 2vrejie46Noch keine Bewertungen

- Net Work Survey VehicleDokument26 SeitenNet Work Survey VehiclegurvinderkumarNoch keine Bewertungen

- Here, Right Matters: An American StoryVon EverandHere, Right Matters: An American StoryBewertung: 4 von 5 Sternen4/5 (24)

- Perversion of Justice: The Jeffrey Epstein StoryVon EverandPerversion of Justice: The Jeffrey Epstein StoryBewertung: 4.5 von 5 Sternen4.5/5 (10)

- For the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoVon EverandFor the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoBewertung: 4 von 5 Sternen4/5 (97)

- Hunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossVon EverandHunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossBewertung: 3.5 von 5 Sternen3.5/5 (6)

- Summary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisVon EverandSummary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisBewertung: 4 von 5 Sternen4/5 (2)

- Free & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageVon EverandFree & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageBewertung: 2 von 5 Sternen2/5 (3)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (98)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismVon EverandReading the Constitution: Why I Chose Pragmatism, not TextualismBewertung: 4 von 5 Sternen4/5 (1)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesVon EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNoch keine Bewertungen

- Lady Killers: Deadly Women Throughout HistoryVon EverandLady Killers: Deadly Women Throughout HistoryBewertung: 4 von 5 Sternen4/5 (155)

- The Law of the Land: The Evolution of Our Legal SystemVon EverandThe Law of the Land: The Evolution of Our Legal SystemBewertung: 4.5 von 5 Sternen4.5/5 (11)

- All You Need to Know About the Music Business: Eleventh EditionVon EverandAll You Need to Know About the Music Business: Eleventh EditionNoch keine Bewertungen

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemVon EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemBewertung: 4 von 5 Sternen4/5 (25)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- We Were Once a Family: A Story of Love, Death, and Child Removal in AmericaVon EverandWe Were Once a Family: A Story of Love, Death, and Child Removal in AmericaBewertung: 4.5 von 5 Sternen4.5/5 (53)

- The Edge of Innocence: The Trial of Casper BennettVon EverandThe Edge of Innocence: The Trial of Casper BennettBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Dean Corll: The True Story of The Houston Mass MurdersVon EverandDean Corll: The True Story of The Houston Mass MurdersBewertung: 4 von 5 Sternen4/5 (29)

- Chokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackVon EverandChokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackBewertung: 5 von 5 Sternen5/5 (20)

- Insider's Guide To Your First Year Of Law School: A Student-to-Student Handbook from a Law School SurvivorVon EverandInsider's Guide To Your First Year Of Law School: A Student-to-Student Handbook from a Law School SurvivorBewertung: 3.5 von 5 Sternen3.5/5 (3)

- The Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterVon EverandThe Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterBewertung: 4.5 von 5 Sternen4.5/5 (456)

- The Articulate Advocate: Persuasive Skills for Lawyers in Trials, Appeals, Arbitrations, and MotionsVon EverandThe Articulate Advocate: Persuasive Skills for Lawyers in Trials, Appeals, Arbitrations, and MotionsBewertung: 5 von 5 Sternen5/5 (5)

- The Internet Con: How to Seize the Means of ComputationVon EverandThe Internet Con: How to Seize the Means of ComputationBewertung: 5 von 5 Sternen5/5 (6)

- Learning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectVon EverandLearning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectNoch keine Bewertungen

- The Law Says What?: Stuff You Didn't Know About the Law (but Really Should!)Von EverandThe Law Says What?: Stuff You Didn't Know About the Law (but Really Should!)Bewertung: 4.5 von 5 Sternen4.5/5 (10)

- A Contractor's Guide to the FIDIC Conditions of ContractVon EverandA Contractor's Guide to the FIDIC Conditions of ContractNoch keine Bewertungen