Beruflich Dokumente

Kultur Dokumente

Impaired Marketable Securities - A Growing Problem

Hochgeladen von

Jill Edmonds, Communications DirectorCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Impaired Marketable Securities - A Growing Problem

Hochgeladen von

Jill Edmonds, Communications DirectorCopyright:

Verfügbare Formate

Impaired

Marketable

Securities:

A Growing Problem in Today’s Economic Environment

By Peter R. Alfele, CPA

T

currently available on a securities exchange

he recent economic downturn and declining investment such as the New York Stock Exchange, or

in the case of mutual funds, the per share

markets have left many companies holding portfolios of price is widely published. The term “mar-

impaired marketable securities. As a result, financial report- ketable securities” is frequently used to refer

to investments that encompass both debt

ing executives must analyze their portfolios to decide how to report securities and equity securities with readily

these losses and to defend their assertion that temporary losses will determinable fair values.

be recovered. Recording and

classification

The purchase of a marketable security

Reporting investments bonds. Equity securities, such as common, is initially recorded at cost. At acquisition,

in securities preferred or other capital stock, gener- companies must classify their marketable

Companies investing in the securities of ally represent an ownership interest in an securities into three groupings, based on

other entities are required to report their enterprise. Equity securities may also take their type (debt vs. equity) and on manage-

holdings based on a variety of factors. First, the form of a right to acquire or dispose of ment’s intent to hold the security. These

an entity must determine the nature of its an ownership interest (e.g., warrants, rights include:

investment by classifying it as either a debt and call or put options). •• Held to maturity: Securities pur-

security or an equity security. Once the nature of a security has been chased with the positive intent and

Debt securities are characterized by a defined, an entity must further analyze its ability to hold to maturity.This category

debtor/creditor relationship and generally equity securities to determine if the fair only applies to debt securities because

include investments such as U.S. Treasury value is “readily determinable.” Generally, equity securities, by definition, do not

securities, U.S. government agency secu- the fair value of an equity security is readily have maturity dates.

rities, municipal securities and corporate determinable if sales prices or quotations are

26 Financial Reporting • Disclosures • March/April

If your company is holding impaired

marketable securities, it’s time to decide

how to report these losses.

•• Trading: Securities bought and held

principally to be sold in the near-term.

Trading securities are held usually by

financial institutions and similar enti-

ties, and typically have a holding period

measured in hours and days rather than

months or years.

cause volatility in an entity’s operating earn-

•• Available for sale: Securities that ings, standard setters directed these “unreal-

do not meet the criterion to be clas- ized holding gains/losses” to be reported in

sified as held to maturity or trading. other comprehensive income (OCI).

OCI is a segregated component of fi-

Classification is important because secu- nancial statements used to capture certain

rities are reported in vastly different ways economic events of unrecognized transac- standards require companies to further

depending on how they are categorized. tions of a period. Because items included analyze their investment securities and dis-

This article focuses on the accounting in OCI are usually excluded from analysis close management’s determination of the

requirements of the “available for sale” cat- of a company’s performance in its core potential to recover the price paid.

egory as the majority of operating businesses activities, management may be inclined to Accounting for impaired marketable

classify their securities as such. report negative results in OCI rather than securities classified as available for sale

As available for sale securities are sold, earnings. involves a determination of whether a

any difference between the purchase price decline is temporary. This determination

and the sales price is reported in earnings. The impairment condition is a critical matter of judgment because

Securities held are adjusted to the fair value A marketable security is considered of the reporting ramifications. If the loss

of the investment on the reporting date. impaired when its fair value is less than its is considered temporary, the adjustment

Recognizing that fair value adjustments may cost. Once impaired, financial reporting is reported in OCI and may be w

Financial Reporting • Disclosures • March/April 27

To avoid unneccessary scrutiny, management

should consistently apply a systemic approach

for classifying impaired securities.

subsequently recovered if the value of the in- staff urge that all available evidence should impaired securities. For instance, estab-

vestment returns. However, if management be considered and provided three factors lishing evaluation criteria in advance and

considers the loss other-than-temporary, the that, either individually or in combination, documenting the factors considered in the

loss is charged to operations and subsequent may indicate that a security’s impairment is analysis and the conclusions reached will

recoveries of fair value are not included in other-than-temporary: lend credibility to management’s asser-

operating results until the investment is •• Time and extent of loss: As the tions.

sold. length of time needed for recovery

grows and/or the magnitude of the loss Reporting impairment

The impairment analysis increases, the likelihood that impairment losses

In performing an impairment analysis, is other-than-temporary also increases. Once a loss is considered other-than-

the accounting standards outline a three-step Assertions that securities that have been temporary, the difference between the cost

process to 1.) determine when a security is “underwater” for extensive periods of and fair value of the investment at the bal-

deemed impaired; 2.) determine if the loss time are only temporary would need ance sheet date is reported in earnings. The

is temporary; and 3.) measure and recognize to be supported by more compelling new cost basis is not changed for subsequent

the loss. evidence than those that have recently recoveries in fair value. A recovery in fair

As described above, an investment is declined to a loss position. value is not recorded in earnings until the

generally considered impaired when its security is sold.

fair value is less than its cost. Cost includes •• Issuer’s financial condition: An In addition, accounting standards require

adjustments for accretion, amortization, examination of the fiscal health of the a company to disclose its investments that

any previous impairment losses and hedg- investee may shed some light on when are in a loss position, grouped by those

ing. The review for impaired securities a turnaround in performance could be that have been in a continuous loss for less

must be conducted in each reporting period expected. Investees faced with signifi- than 12 months and those that have been

(including interim periods) at the individual cant changes in technology or who have underwater for more than 12 months.

security level. An analysis of a portfolio or recently reported the discontinuance of Management must also include a narrative

provision of a general allowance is not an certain operations may provide clues that discussion essentially defending its position

acceptable practice. However, separate a recovery is not eminent. that unrealized losses are only temporary.

lots of equity securities bearing the same This narrative should be straightforward

•• Intent and ability of the holder:

Committee on Uniform Security Identifi- and discuss what caused the loss as well as

An introspective look at the investor’s

cation Procedures (CUSIP) number that specific evidence supporting the expected

forecasted cash or working capital de-

were purchased at different dates may be recovery. While this narrative presents

mands may indicate that the company

combined on an average cost basis if the management with an opportunity to elabo-

must sell the securities in question in

company follows this practice to determine rate on its intentions, it should be based on

order to meet its own obligations before

its realized gains and losses. defendable facts and objective viewpoints.

the investment is expected to recover.

Once a company has identified the indi-

In addition, while the determination of

vidual securities that are in a loss position, Income tax

the other-than-temporary impairment is

management must conclude whether the considerations

to be hypothetically made as of the bal-

loss is temporary or other-than-temporary. Although financial reporting standards

ance sheet date, the sale of the security

While the accounting literature does not require companies to write down the basis

subsequent to the balance sheet date and

specifically define the term “other-than- of securities deemed to be other-than-

before the release of the statements is

temporary,” it emphasizes that the phrase temporarily impaired, federal income tax

strong, although not by itself conclusive,

should not be interpreted to mean “per- regulations do not permit a deduction for

indication that an other-than-temporary

manent.” such losses until the security is actually sold.

loss should be recorded.

Absent that guidance, standard-setters As such, securities whose cost basis has been

point to publications of regulators to lend The conclusion that an impaired loss is reduced by an impairment charge produce

some insight. In Securities and Exchange other-than-temporary requires a great deal book-tax differences that result in deferred

Commission (SEC) Staff Accounting Bulletin of judgment. In order to avoid unnecessary tax assets and the corresponding income

No. 59, Other than Temporary Impairment of scrutiny, management should consistently tax provision is allocated to earnings (as

Certain Investments in Equity Securities, the SEC apply a systematic approach for classifying opposed to OCI).

28 Financial Reporting • Disclosures • March/April

Comparison to Interna- Conclusion

tional Financial Reporting During periods of economic instability,

Standards (IFRS) a financial reporting executive’s judgment

The valuation of marketable securities faces higher scrutiny. Decisions with regard

is an area where U.S. reporting standards to impaired marketable securities require a

differ substantially from the rules followed great deal of care and should be approached

by the global business community. While objectively and systematically in order to

both U.S. reporting requirements and IFRS provide meaningful disclosures about a

require impairment assessments based on company’s investments and lend credibility

relatively subjective criteria at each bal- to the financial statements.

ance sheet date, the IFRS model is quite

different.

For instance, the notion that a holding

loss is “other-than-temporary” is not con- Peter R. Alfele, CPA,

sidered under IFRS. Additionally, the IFRS is a partner at Cherry,

analysis permits assets to be evaluated in Bekaert & Holland, LLP,

groups where U.S. standards require that in Virginia Beach. He

the review be conducted at the security has more than 12 years

level. Further, while U.S. standards point of experience providing

to “indications” of impairment (time and audit and accounting

extent of loss, issuers financial condition, services to a variety of

commercial enterprises and closely

intent and ability of the holder), IFRS gener-

held, middle market businesses.

ally requires certain occurrences before an

Contact him at palfele@cbh.com

impairment loss is recorded. or search and connect with him on

Specifically, recording a loss under IFRS LinkedIn.

requires “objective evidence of impairment

as a result of one or more events” and that

the “loss event (or events) has an impact on

the estimated future cash flows of the finan-

cial asset or group of financial assets that can

be reliably estimated.” Finally, unlike U.S.

principles that restrict the recognition of

the recovery of an impaired security beyond

its adjusted basis until it is actually sold,

IFRS permits subsequent gains under

certain circumstances.

U.S. reporting

standards differ

substantially from

the rules followed by

the global business

community in

the valuation of

marketable securities.

Financial Reporting • Disclosures • March/April 29

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- View From The Next Rung - Moving From Staff To Senior AccountantDokument3 SeitenView From The Next Rung - Moving From Staff To Senior AccountantJill Edmonds, Communications DirectorNoch keine Bewertungen

- The Write Stuff - Improving Accounting Students' Writing SkillsDokument6 SeitenThe Write Stuff - Improving Accounting Students' Writing SkillsJill Edmonds, Communications DirectorNoch keine Bewertungen

- New Fun With Fund Balances - Implementing GASB 54Dokument5 SeitenNew Fun With Fund Balances - Implementing GASB 54Jill Edmonds, Communications DirectorNoch keine Bewertungen

- Dealing With Poor Performers ... Start With The EnablersDokument2 SeitenDealing With Poor Performers ... Start With The EnablersJill Edmonds, Communications DirectorNoch keine Bewertungen

- Career vs. Culture - Do You Have To Choose?Dokument2 SeitenCareer vs. Culture - Do You Have To Choose?Jill Edmonds, Communications DirectorNoch keine Bewertungen

- Cash Is King - Utilize Cost Segregation StudiesDokument5 SeitenCash Is King - Utilize Cost Segregation StudiesJill Edmonds, Communications DirectorNoch keine Bewertungen

- Sarbanes-Oxley - Friend or Foe?Dokument5 SeitenSarbanes-Oxley - Friend or Foe?Jill Edmonds, Communications DirectorNoch keine Bewertungen

- Class Notes - Accounting Education in 2010Dokument6 SeitenClass Notes - Accounting Education in 2010Jill Edmonds, Communications DirectorNoch keine Bewertungen

- Delegation - Dumping or EmpoweringDokument3 SeitenDelegation - Dumping or EmpoweringJill Edmonds, Communications DirectorNoch keine Bewertungen

- Portfolio Diversification - Where It Goes WrongDokument4 SeitenPortfolio Diversification - Where It Goes WrongJill Edmonds, Communications DirectorNoch keine Bewertungen

- Full Speed Ahead - 4 Ways To Set Your CPA Career in MotionDokument2 SeitenFull Speed Ahead - 4 Ways To Set Your CPA Career in MotionJill Edmonds, Communications DirectorNoch keine Bewertungen

- Getting in The Financial Planning GameDokument4 SeitenGetting in The Financial Planning GameJill Edmonds, Communications DirectorNoch keine Bewertungen

- Primer On Virginia's Pass-Through Entity Withholding RulesDokument4 SeitenPrimer On Virginia's Pass-Through Entity Withholding RulesJill Edmonds, Communications DirectorNoch keine Bewertungen

- An RX For Health Care Woes - CPAs and Firms Can Manage Health Care Costs NowDokument4 SeitenAn RX For Health Care Woes - CPAs and Firms Can Manage Health Care Costs NowJill Edmonds, Communications DirectorNoch keine Bewertungen

- Are You Ready To Serve On A Nonprofit BoardDokument4 SeitenAre You Ready To Serve On A Nonprofit BoardJill Edmonds, Communications Director100% (1)

- Government Contracting - Look Before You LeapDokument8 SeitenGovernment Contracting - Look Before You LeapJill Edmonds, Communications DirectorNoch keine Bewertungen

- The Virtual CFODokument5 SeitenThe Virtual CFOJill Edmonds, Communications DirectorNoch keine Bewertungen

- Keep Your Head Above The Clouds - Cloud Computing TrendsDokument4 SeitenKeep Your Head Above The Clouds - Cloud Computing TrendsJill Edmonds, Communications DirectorNoch keine Bewertungen

- 5 Ways To Get SuedDokument2 Seiten5 Ways To Get SuedJill Edmonds, Communications DirectorNoch keine Bewertungen

- Manage The Next Generation CPA FirmDokument2 SeitenManage The Next Generation CPA FirmJill Edmonds, Communications DirectorNoch keine Bewertungen

- Communicate Better. Get ResultsDokument2 SeitenCommunicate Better. Get ResultsJill Edmonds, Communications DirectorNoch keine Bewertungen

- Difficult Conversations - How To Destroy Your OpponentDokument2 SeitenDifficult Conversations - How To Destroy Your OpponentJill Edmonds, Communications DirectorNoch keine Bewertungen

- Speak Volumes Without Saying A Word ... Through ListeningDokument2 SeitenSpeak Volumes Without Saying A Word ... Through ListeningJill Edmonds, Communications DirectorNoch keine Bewertungen

- Sketch Your CPA FutureDokument2 SeitenSketch Your CPA FutureJill Edmonds, Communications DirectorNoch keine Bewertungen

- An XBRL Starter GuideDokument4 SeitenAn XBRL Starter GuideJill Edmonds, Communications DirectorNoch keine Bewertungen

- Exploring The Social Media FrontierDokument4 SeitenExploring The Social Media FrontierJill Edmonds, Communications DirectorNoch keine Bewertungen

- Going Green With Recent LegislationDokument4 SeitenGoing Green With Recent LegislationJill Edmonds, Communications DirectorNoch keine Bewertungen

- Forgive & Forget? Decoding Bankruptcy Debt Forgiveness RulesDokument4 SeitenForgive & Forget? Decoding Bankruptcy Debt Forgiveness RulesJill Edmonds, Communications DirectorNoch keine Bewertungen

- Staying Active in The New Year: Having (And Keeping) Your CPA License Unlocks A World of PossibilitiesDokument2 SeitenStaying Active in The New Year: Having (And Keeping) Your CPA License Unlocks A World of PossibilitiesJill Edmonds, Communications DirectorNoch keine Bewertungen

- Chapter 9 Capital Budgeting PDFDokument112 SeitenChapter 9 Capital Budgeting PDFtharinduNoch keine Bewertungen

- Corporation TaxationDokument16 SeitenCorporation TaxationMeg Lee0% (1)

- Rossari Biotech IPO Note Analyzes Specialty Chemical MakerDokument8 SeitenRossari Biotech IPO Note Analyzes Specialty Chemical Makerzeeshan_iraniNoch keine Bewertungen

- Corporation Law Quiz 1Dokument5 SeitenCorporation Law Quiz 1Paul Ryan VillanuevaNoch keine Bewertungen

- Going Concern Asset Based Valuation Financial ModelDokument4 SeitenGoing Concern Asset Based Valuation Financial ModelJessica PaludipanNoch keine Bewertungen

- Accounting 1 1 Hour 30 Minutes (30 Questions) Answer All QuestionsDokument11 SeitenAccounting 1 1 Hour 30 Minutes (30 Questions) Answer All QuestionsNurin QistinaNoch keine Bewertungen

- Substantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Dokument38 SeitenSubstantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Mej AgaoNoch keine Bewertungen

- Golf club's exclusive voting rights disputeDokument4 SeitenGolf club's exclusive voting rights disputeIsabella RodriguezNoch keine Bewertungen

- Topic 4 - Events After Reporting Period (IAS 10)Dokument15 SeitenTopic 4 - Events After Reporting Period (IAS 10)CavipsotNoch keine Bewertungen

- The Growth in Corporate Governance CodesDokument15 SeitenThe Growth in Corporate Governance CodesSudip BaruaNoch keine Bewertungen

- IB Presentation BMWDokument21 SeitenIB Presentation BMWMayank GaurNoch keine Bewertungen

- 12 Test 2 Aud339 June 2022 SS 1 PDFDokument5 Seiten12 Test 2 Aud339 June 2022 SS 1 PDFNUR LYANA INANI AZMINoch keine Bewertungen

- FAU Questions & Answer PackDokument3 SeitenFAU Questions & Answer PackDawn CaldeiraNoch keine Bewertungen

- Reynaldo Gulane CleanersDokument3 SeitenReynaldo Gulane CleanersshaneemacasiNoch keine Bewertungen

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Dokument23 SeitenAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNoch keine Bewertungen

- FIN254 Project NSU (Excel File)Dokument6 SeitenFIN254 Project NSU (Excel File)Sirazum SaadNoch keine Bewertungen

- Winding Up of A CompanyDokument14 SeitenWinding Up of A CompanyUday KiranNoch keine Bewertungen

- Analysis and Interpretation of Financial StatementsDokument16 SeitenAnalysis and Interpretation of Financial StatementsKimberly FloresNoch keine Bewertungen

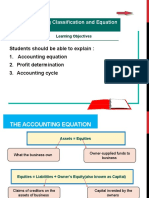

- Accounting Equation and Profit DeterminationDokument19 SeitenAccounting Equation and Profit DeterminationNor LailyNoch keine Bewertungen

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDokument36 SeitenFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (34)

- Free Cash FlowsDokument8 SeitenFree Cash FlowsParvesh AghiNoch keine Bewertungen

- Samsung Understanding FS Tutorial QuestionsDokument5 SeitenSamsung Understanding FS Tutorial QuestionsLim ShawnNoch keine Bewertungen

- Financial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredDokument64 SeitenFinancial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredKoketso MogweNoch keine Bewertungen

- Insurance Business Plan Template SummaryDokument15 SeitenInsurance Business Plan Template SummarygargramNoch keine Bewertungen

- Finanzas Internacionales: Ejercicios de La Tarea 2Dokument8 SeitenFinanzas Internacionales: Ejercicios de La Tarea 2gerardoNoch keine Bewertungen

- 4PPT Financial StatementsDokument21 Seiten4PPT Financial Statements이시연Noch keine Bewertungen

- 8 Source A4: 9706/33/INSERT/O/N/21 © UCLES 2021Dokument2 Seiten8 Source A4: 9706/33/INSERT/O/N/21 © UCLES 2021Ayesha sheikhNoch keine Bewertungen

- Top 10 CFO responsibilities under 40 charactersDokument3 SeitenTop 10 CFO responsibilities under 40 charactersMita Mandal0% (1)

- Audit of Cash and Cash Equivalents Internal ControlsDokument7 SeitenAudit of Cash and Cash Equivalents Internal ControlsmoNoch keine Bewertungen

- SBI@ Your Door StepDokument2 SeitenSBI@ Your Door StepDynamic LevelsNoch keine Bewertungen