Beruflich Dokumente

Kultur Dokumente

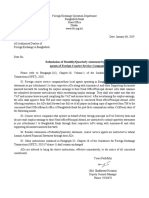

Any Company: Assertions Control Level

Hochgeladen von

rainOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Any Company: Assertions Control Level

Hochgeladen von

rainCopyright:

Verfügbare Formate

Any Company

17

Process Risk Analysis (PRA)

Reviewed by

02 Taxes

02.1 Taxes

Key Control Decreases

Changes Increases

0

Tax fling Tax calcu

R&O V&A P&D

E&O C

5

18

Prepared by

Risk Number R-02.1.1 R-02.1.2

Process Description

Control

Level

On a quarterly basis, a tax completion checklist is used and signed by th Confirm that the quarterly tax completion checklist has been completed Quarterly tax completion checklist used.

Tax Manager and the Financial Controller.

and signed by the Tax Manager and Financial Controller

KEY

KEY

2.1.03

On an annual basis, the Tax Manager performs a "true up". Reconciling Review the annual True up journal entry and agree to supporting

the tax returns as processed with the accounting records.

documentation and ensure it is appropriately authorized.

Annual reconciliation of tax return with accounting

records.

KEY

KEY

2.1.04

An off the shelf tax application package is used to complete tax

calculations on an annual basis.

Retired 2008

KEY

Rtd

2.1.05

On a annual basis, a tax completion checklist is used and signed by the Confirm that the annual tax completion checklist has been completed

Tax Manager and the Financial Controller.

and signed by the Tax Manager and Financial Controller

Annual tax completion checklist used.

KEY

KEY

2.1.06

Parallel run of new FAS TRAC 109 and the prior Excel spreadsheets

used for tax calculations, for the June Quarter

Retired 2008

Std

Rtd

2.1.07

Tax Manager segregated from any GL input initiation or authorization.

Tax Manager cannot approve or book an entry to

G/L

KEY

KEY

The annual state and federal tax returns are prepared by Outside Party Obtain tax returns and cover letter prepared by Outside Party :

accordance with their annual tax engagement. The return is reviewed

and approved by senior financial management prior to signing and filing. 1. Confirm that the return prepared by Outside Party was signed by

senior financial management prior to filing.

2.1.02

02.1 Taxes PRA.xls 2/11/2009 1:03 PM

PRA

This test should be done in conjunction with testing of control # 1.4.04

since it uses the same test documents. Confirm that the Manager Tax

does not have access to General Ledger for data entry

Net Change in Key

Controls

10

Control Activity Short

Key Control Totals

2.1.01

------------------

H

H

Tax calculation error resulting in

exposure.

5

X

Test Procedures

2008

H

H

Tax flings incorrect.

Presentation and Disclosure

5

X

Control Activity

2007

Rights and Obligations

5

KEY

Control #

Reason for Change

Completeness

6

KEY

Describes activities required to accurately

and completely calculate and records the tax

provision and tax assets/liabilities in

accordance with generally accepted

accounting principles, SEC, federal, state and

local tax regulations. This process includes

the calculation of the tax liability for federal

and state.

Existence and Occurrence

Valuation and Allocation

Assertions

Third party expert provides advice and prepares and

files Federal and State returns.

(1)

Other

X

M

Other

X

1 of 2

Any Company

19

Process Risk Analysis (PRA)

02 Taxes

02.1 Taxes

Timing &

R-02.1.3

Process Description

Describes activities required to accurately

and completely calculate and records the tax

provision and tax assets/liabilities in

accordance with generally accepted

accounting principles, SEC, federal, state and

local tax regulations. This process includes

the calculation of the tax liability for federal

and state.

Control #

Control Activity

Test Procedures

2007

2008

H

H

Timing & permanent differences not

identified, or in error.

Control

Level

Control Activity Short

Key Control Totals

12

KEY

KEY

On a quarterly basis, a tax completion checklist is used and signed by th Confirm that the quarterly tax completion checklist has been completed Quarterly tax completion checklist used.

Tax Manager and the Financial Controller.

and signed by the Tax Manager and Financial Controller

KEY

KEY

2.1.03

On an annual basis, the Tax Manager performs a "true up". Reconciling Review the annual True up journal entry and agree to supporting

the tax returns as processed with the accounting records.

documentation and ensure it is appropriately authorized.

Annual reconciliation of tax return with accounting

records.

KEY

KEY

2.1.04

An off the shelf tax application package is used to complete tax

calculations on an annual basis.

Retired 2008

KEY

Rtd

2.1.05

On a annual basis, a tax completion checklist is used and signed by the Confirm that the annual tax completion checklist has been completed

Tax Manager and the Financial Controller.

and signed by the Tax Manager and Financial Controller

Annual tax completion checklist used.

KEY

KEY

2.1.06

Parallel run of new FAS TRAC 109 and the prior Excel spreadsheets

used for tax calculations, for the June Quarter

Retired 2008

Std

Rtd

2.1.07

Tax Manager segregated from any GL input initiation or authorization.

Tax Manager cannot approve or book an entry to

G/L

KEY

KEY

2.1.01

The annual state and federal tax returns are prepared by Outside Party Obtain tax returns and cover letter prepared by Outside Party :

accordance with their annual tax engagement. The return is reviewed

and approved by senior financial management prior to signing and filing. 1. Confirm that the return prepared by Outside Party was signed by

senior financial management prior to filing.

2.1.02

02.1 Taxes PRA.xls 2/11/2009 1:03 PM

PRA

This test should be done in conjunction with testing of control # 1.4.04

since it uses the same test documents. Confirm that the Manager Tax

does not have access to General Ledger for data entry

Third party expert provides advice and prepares and

files Federal and State returns.

2 of 2

Das könnte Ihnen auch gefallen

- EXCEL BibleDokument210 SeitenEXCEL BibleĐỗ Đen Đổ Đỏ75% (4)

- Excel Formulas With ExamplesDokument140 SeitenExcel Formulas With ExamplesAshish SaxenaNoch keine Bewertungen

- Income Taxes ProgramDokument14 SeitenIncome Taxes ProgramGodfrey JathoNoch keine Bewertungen

- Pivot Table Complete GuideDokument93 SeitenPivot Table Complete GuideNimish MadananNoch keine Bewertungen

- Internal Audit Report SampleDokument34 SeitenInternal Audit Report SampleAvishek Agarwal80% (5)

- Month End Closing Procedures 0Dokument9 SeitenMonth End Closing Procedures 0narasi64Noch keine Bewertungen

- Supplier Audit Checklist ExampleDokument68 SeitenSupplier Audit Checklist Exampleprabha_1100% (1)

- Hotel Accounting SOP-AdminstrationDokument52 SeitenHotel Accounting SOP-AdminstrationMuhammad Al-Askari88% (33)

- Accrued Expenses NarrativeDokument3 SeitenAccrued Expenses NarrativeCaterina De LucaNoch keine Bewertungen

- Accounting ExerciseDokument14 SeitenAccounting ExerciseDima Abboud100% (2)

- BIR Audit ManualDokument89 SeitenBIR Audit ManualRivera RwlrNoch keine Bewertungen

- Audit of Income and Expenditure Account 1.1Dokument27 SeitenAudit of Income and Expenditure Account 1.1Akshata Masurkar100% (1)

- Final AccountsDokument65 SeitenFinal AccountsAmit Mishra100% (1)

- Module 6 - Worksheet and Financial Statements Part IDokument12 SeitenModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Von EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Noch keine Bewertungen

- Sage 50 User GuideDokument386 SeitenSage 50 User GuideVicenteCarrascoPozuelo100% (1)

- Month-End Walkthrough Diagnostic QuestionnaireDokument3 SeitenMonth-End Walkthrough Diagnostic QuestionnaireMaria Danice AngelaNoch keine Bewertungen

- Chapter FourDokument88 SeitenChapter FourHay Jirenyaa100% (3)

- FabmDokument68 SeitenFabmAllyzza Jayne Abelido100% (1)

- My BudgetDokument6 SeitenMy Budgetapi-458902916Noch keine Bewertungen

- T101 Intro To Powerpoint 9.10.08Dokument67 SeitenT101 Intro To Powerpoint 9.10.08Robertas Kupstas100% (1)

- ICAPS Engineering Manual R3 10 PDFDokument19 SeitenICAPS Engineering Manual R3 10 PDFAnyanele Nnamdi FelixNoch keine Bewertungen

- Mumbai Doctors Directory - Database - List (.XLSX Excel Format) 8th EditionDokument2 SeitenMumbai Doctors Directory - Database - List (.XLSX Excel Format) 8th EditionBox RealtyNoch keine Bewertungen

- SpreadsheetDokument14 SeitenSpreadsheetdotrongnhanNoch keine Bewertungen

- The Elements of An Audit ReportDokument1 SeiteThe Elements of An Audit ReportCovertNeo100% (1)

- Statement of Management ResponsibilityDokument1 SeiteStatement of Management ResponsibilityLecel Llamedo100% (1)

- Learning Activity Sheet LAS in ICT 6Dokument30 SeitenLearning Activity Sheet LAS in ICT 6TWEETTV GAMING100% (2)

- 02.1 Taxes RCMDokument6 Seiten02.1 Taxes RCMacasumitchhabraNoch keine Bewertungen

- Detail ReportDokument8 SeitenDetail ReportMayuri SanadirajahNoch keine Bewertungen

- Audit Programme TaxDokument6 SeitenAudit Programme Taxaah_mundrawalaNoch keine Bewertungen

- Accounting For Income TaxesDokument10 SeitenAccounting For Income TaxesEunice WongNoch keine Bewertungen

- Closing An AP Accounting PeriodDokument4 SeitenClosing An AP Accounting PeriodtalupurumNoch keine Bewertungen

- The Basic Purpose of Accounting IsDokument10 SeitenThe Basic Purpose of Accounting IsJesicca JungNoch keine Bewertungen

- © Ncert Not To Be Republished: Accounts From Incomplete RecordsDokument38 Seiten© Ncert Not To Be Republished: Accounts From Incomplete RecordsJaffer SadiqNoch keine Bewertungen

- VAT Report PubDokument7 SeitenVAT Report PubAna-Maria ZampaNoch keine Bewertungen

- Riza Kristine D. Dayto - BSBA FM3C - FRA - Activity 1Dokument2 SeitenRiza Kristine D. Dayto - BSBA FM3C - FRA - Activity 1ch0k3 iiiNoch keine Bewertungen

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Dokument14 SeitenACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNoch keine Bewertungen

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDokument15 SeitenREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNoch keine Bewertungen

- Statement of Management's ResponsibilityDokument1 SeiteStatement of Management's ResponsibilityMark LiganNoch keine Bewertungen

- Chapter Four Monthly ReportsDokument34 SeitenChapter Four Monthly ReportsGirmaNoch keine Bewertungen

- 1Q15 Quarterly Information (ITR)Dokument117 Seiten1Q15 Quarterly Information (ITR)MPXE_RINoch keine Bewertungen

- TaxesDokument1 SeiteTaxesJan Roger YunsalNoch keine Bewertungen

- Miscellaneous Transactions, Trial Balance and FSDokument13 SeitenMiscellaneous Transactions, Trial Balance and FSCalvin Cempron80% (5)

- Trial Balance and FSDokument58 SeitenTrial Balance and FSMubarrach MatabalaoNoch keine Bewertungen

- VAT Return 2015 SAP LibraryDokument17 SeitenVAT Return 2015 SAP LibraryTatyana KosarevaNoch keine Bewertungen

- Chap 10-Preparing Financial StatementDokument4 SeitenChap 10-Preparing Financial Statementsyuhada zakiNoch keine Bewertungen

- MD Abid Rahaman Roll:-18241054 Section:-B Lecture:-14Dokument2 SeitenMD Abid Rahaman Roll:-18241054 Section:-B Lecture:-14Md Abid RahamanNoch keine Bewertungen

- MIDTERMDokument14 SeitenMIDTERMSoremn PotatoheadNoch keine Bewertungen

- Single EntryDokument38 SeitenSingle EntryAbhishek MlshraNoch keine Bewertungen

- The Conceptual Framework of AccountingDokument34 SeitenThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- 12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsDokument7 Seiten12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsKasiguruhan AuroraNoch keine Bewertungen

- E211 Income Taxes - Provision To Return PolicyDokument4 SeitenE211 Income Taxes - Provision To Return PolicyRY NaNoch keine Bewertungen

- Completing The Accounting CycleDokument9 SeitenCompleting The Accounting CycleTikaNoch keine Bewertungen

- CH 4Dokument59 SeitenCH 4ad_jebbNoch keine Bewertungen

- Statement of Submissin of Audit Report in Form-704Dokument704 SeitenStatement of Submissin of Audit Report in Form-704Suruchi Kejriwal GoyalNoch keine Bewertungen

- Ac101 ch3Dokument21 SeitenAc101 ch3Alex ChewNoch keine Bewertungen

- Answers March2012 f1Dokument10 SeitenAnswers March2012 f1kiransookNoch keine Bewertungen

- DocxDokument16 SeitenDocxzakiatalhaNoch keine Bewertungen

- MS - Draft IA Report - Q2Dokument66 SeitenMS - Draft IA Report - Q2Christen CastilloNoch keine Bewertungen

- AvianCorp Fall 2013Dokument2 SeitenAvianCorp Fall 2013braveusmanNoch keine Bewertungen

- Submission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesDokument8 SeitenSubmission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesBijiNoch keine Bewertungen

- Deffgh Fill inDokument5 SeitenDeffgh Fill inaleah de jesusNoch keine Bewertungen

- 03 Correction of Error CTDIDokument15 Seiten03 Correction of Error CTDIAiden PatsNoch keine Bewertungen

- Aj Salam Training Center: Statement of Management'S ResponsibilityDokument1 SeiteAj Salam Training Center: Statement of Management'S ResponsibilityJheza Mae PitogoNoch keine Bewertungen

- Statement of Managements ResponsibilityDokument1 SeiteStatement of Managements ResponsibilityDonnie Ray DistajoNoch keine Bewertungen

- RCM FSCPDokument16 SeitenRCM FSCPvikrant durejaNoch keine Bewertungen

- Principles of Accounting in New Accounting ModelDokument43 SeitenPrinciples of Accounting in New Accounting ModelMudassar Nawaz100% (1)

- Form 704Dokument179 SeitenForm 704navnath13146720Noch keine Bewertungen

- Completion of The Accounting PDFDokument10 SeitenCompletion of The Accounting PDFZairah HamanaNoch keine Bewertungen

- Flamen, Inc.: Statement of Management Responsibility For Annual Income Tax ReturnDokument2 SeitenFlamen, Inc.: Statement of Management Responsibility For Annual Income Tax Returndaryl canozaNoch keine Bewertungen

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsVon EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNoch keine Bewertungen

- COMBO ALL ODISHA PREVIOUS YEAR QUESTION ANSWER OSSSC OSSC POLICE CT BED OtherDokument118 SeitenCOMBO ALL ODISHA PREVIOUS YEAR QUESTION ANSWER OSSSC OSSC POLICE CT BED Othernirajnishad1432Noch keine Bewertungen

- Mobility Tool+ Guide For BeneficiariesDokument75 SeitenMobility Tool+ Guide For BeneficiariesOdette Müller-DoganNoch keine Bewertungen

- Instructions SC EX365 2021 8aDokument5 SeitenInstructions SC EX365 2021 8ajsgiganteNoch keine Bewertungen

- Important Tables in Sap BW 7.X: Sap Netweaver Business Warehouse Bw-Whm-Awb - Data Warehousing WorkbenchDokument15 SeitenImportant Tables in Sap BW 7.X: Sap Netweaver Business Warehouse Bw-Whm-Awb - Data Warehousing WorkbenchJohn SmithNoch keine Bewertungen

- Fall 3050 SyllabusDokument6 SeitenFall 3050 Syllabustaher91Noch keine Bewertungen

- RFS User ManualDokument91 SeitenRFS User ManualDeepNarula007Noch keine Bewertungen

- Using Stata: The Opening DisplayDokument16 SeitenUsing Stata: The Opening DisplaysakiaslamNoch keine Bewertungen

- Kanban Tool User ManualDokument66 SeitenKanban Tool User ManualManishNoch keine Bewertungen

- Toyota IntroductionDokument20 SeitenToyota IntroductionaravindaNoch keine Bewertungen

- Visual Basic For Applications (VBA)Dokument16 SeitenVisual Basic For Applications (VBA)JonahJuniorNoch keine Bewertungen

- 3002-1635158086243-SelfStudy - 2.2 ExcelDokument2 Seiten3002-1635158086243-SelfStudy - 2.2 ExcelQuantum MusicsNoch keine Bewertungen

- TMS Grid Pack GuideDokument195 SeitenTMS Grid Pack GuideLolaca DelocaNoch keine Bewertungen

- Appendix B DAX ReferenceDokument174 SeitenAppendix B DAX ReferenceTomislav Mališ100% (1)

- Laboratory Exercise 4 - Preparation of Isolated Plans Using CADDokument15 SeitenLaboratory Exercise 4 - Preparation of Isolated Plans Using CADCahulogan KateNoch keine Bewertungen

- Microsoft Excel: Instructors: Connie Hutchison & Christopher MccoyDokument33 SeitenMicrosoft Excel: Instructors: Connie Hutchison & Christopher MccoyGianJyrellAlbertoCorlet100% (1)

- Excel IF Function and IF StatementsDokument7 SeitenExcel IF Function and IF StatementsLITTLE HEARTS JOHNNoch keine Bewertungen

- Solving Sudoku Using ExcelDokument8 SeitenSolving Sudoku Using ExcelShaswat RaiNoch keine Bewertungen

- Readme RCC WorksDokument3 SeitenReadme RCC Worksvaibhavlibra21Noch keine Bewertungen

- HW#10 PresscoDokument2 SeitenHW#10 PresscoSherry SNoch keine Bewertungen