Beruflich Dokumente

Kultur Dokumente

Doubled-Up Worst of Barrier Reverse Convertible On

Hochgeladen von

api-25889552Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Doubled-Up Worst of Barrier Reverse Convertible On

Hochgeladen von

api-25889552Copyright:

Verfügbare Formate

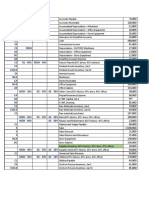

Doubled-Up Worst of Barrier Reverse Convertible on NESTLE, HOLCIM and CREDIT

SUISSE

Coupon 8% Guaranteed + 8% Conditional - American Barrier at 69% - 1 Year - CHF

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 22.03.2010 Client pays CHF 1000 (Denomination)

Rating: Fitch A

Underlying NESTLE SA-REG HOLCIM LTD-REG CREDIT SUISSE GROUP AG- On 22.03.2011

REG

Bbg Ticker NESN VX Equity HOLN VX Equity CSGN VX Equity Scenario 1: if the Underlyings have never traded at or below the Barrier level

Strike Level (100%) CHF 53.85 CHF 75.45 CHF 53.1 a. If all the Underlyings are above their Strike Level on the Valuation Date,

Barrier Level (69%) CHF 37.46 CHF 52.06 CHF 36.64 the Investor will receive a Cash Settlement in CHF equal to:

Conversion Ratio 18.5701 13.2538 18.8324 Denomination + 2 Coupons of 8% (Total return: 116%)

Initial Fixing Date 15.03.2010 b. If at least one Underlying is at or below its Strike Level on the Valuation Date,

Payment Date 22.03.2010 the Investor will receive a Cash Settlement in CHF equal to:

Valuation Date 15.03.2011 Denomination + 1 Coupon of 8% (Total return: 108%)

Maturity Date 22.03.2011

EU Saving Tax Option Premium Component 7.52% p.a. Scenario 2: if one or more Underlyings traded at least once at or below the Barrier

Interest Component 0.48% p.a. a. If all the Underlyings are above their Strike Level on the Valuation Date,

Details Physical Settlement American Barrier the Investor will receive a Cash Settlement in CHF equal to:

ISIN CH0111080658 Denomination + 2 Coupons of 8% (Total return: 116%)

Valoren 11108065 b. If at least one Underlying is at or below its Strike Level on the Valuation Date,

SIX Symbol Not Listed the Investor will receive a predefined round number (i.e. Conversion Ratio) of

the Underlying with the Worst Performance per Denomination + 1 Coupon of

8%

Characteristics

Underlying____________________________________________________________________________________________________________________________________________________________________

- Nestle SA is a multinational packaged food company that manufactures and markets a wide range of food products. The Company's product lines include milk, chocolate, confectionery,

bottled water, coffee, creamer, food seasoning and pet foods.

- Holcim Ltd. produces building materials. The Company produces and markets ready-mixed concrete, cement, clinker, and admixtures. The Company also provides consulting and

engineering services in all areas of the cement manufacturing process. Holcim, through subsidiaries, operates cement manufacturing facilities around the world.

- Credit Suisse Group AG is an international financial services group. The Group provides investment banking, private banking, and asset management services to customers located around

the world.

Opportunities_________________________________________________________________ Risks______________________________________________________________________________

1. A guaranteed Coupon of 8% in fine 1. Maximum return limited to 16% in fine

2. Opportunity to double the Coupon if all the Underlyings close abov e their Strike lev el 2. Exposure to v olatility changes

3. Protection against 31% drop in U nderlyings' price

4. Low er v olatility than direct equity exposure

5. Secondary market as liquid as a share

6. Optimization of EU Tax components

Best case scenario____________________________________________________________ Worst case scenario_______________________________________________________________

One or more Underlyings traded at least once at or below the Barrier Lev el,

All the Underlyings close abov e their respectiv e Strike lev el

and at least one Underlying closes below its Strike Lev el on the Valuation Date

Redemption: Denomination + 16% in fine ( Tw o coupons of 8%) Redemption: Shares of the Worst performing Underlying + Coupon of 8% in fine

Historical Chart

140%

importer depuis la deuxieme feuille

120% Redemption:

Denomination + Coupon of 16% in fine

Strike: 100% of Spot Reference

100%

31% Protection

Redemption:

80%

Denomination + Coupon of 8% in fine

Barrier: 69% of Strike Level

60%

Nestle

Redemption: Shares of the Worst Performing

Holcim Underlying + Coupon of 8% in fine

40%

Credit Suisse

20%

Feb-08 Jun-08 Oct-08 Feb-09 Jun-09 Oct-09 Feb-10

Contacts

Filippo Colombo Christ ophe Spanier Nathanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

Stanislas Perromat +41 22 918 70 05

Alejandro Pou Cut uri Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No respo nsibility is taken fo r the co rrectness o f this info rmatio n. The financial instruments mentio ned in

this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by the Swiss Financial M arket Superviso ry A utho rity

FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial adviso r fo r advice specifically fo cused o n the Investo r´s financial situatio n; the info rmatio n co ntained in this do cument do es no t substitute

such advice. This publicatio n do es no t co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct do cumentatio n can be o btained directly at EFG Financial P ro ducts A G: Tel. +41 (0)58 800 1111, Fax

+41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapo re, the USA , US perso ns, and the United Kingdo m (the issuance is subject to Swiss

law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial pro ducts triggers co sts and fees. EFG

Financial P ro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity o f the financial pro ducts. © EFG Financial

P ro ducts A G A ll rights reserved.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 9 Investing Secrets of Warren BuffettDokument31 Seiten9 Investing Secrets of Warren BuffettTafadzwa96% (26)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Options Strategies PDFDokument66 SeitenOptions Strategies PDFsrinivas_urv100% (3)

- Online BankingDokument46 SeitenOnline BankingNazmulHasanNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Money and Banking: Chapter - 8Dokument32 SeitenMoney and Banking: Chapter - 8Kaushik NarayananNoch keine Bewertungen

- PMS Agreement SampleDokument9 SeitenPMS Agreement SamplesureshvgkNoch keine Bewertungen

- Partnership: Basic Considerations and Formation: Advance AccountingDokument53 SeitenPartnership: Basic Considerations and Formation: Advance AccountingZyrah Mae Saez100% (1)

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDDokument74 SeitenPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBNoch keine Bewertungen

- Yu v. NLRCDokument3 SeitenYu v. NLRCMaria Lourdes DatorNoch keine Bewertungen

- Account Statement PDF 1620001413032 12 April 2019Dokument57 SeitenAccount Statement PDF 1620001413032 12 April 2019elisgretyNoch keine Bewertungen

- CG European Capital Growth Fund: StrategyDokument2 SeitenCG European Capital Growth Fund: Strategyapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- CG European Income Fund: StrategyDokument2 SeitenCG European Income Fund: Strategyapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument37 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Global Financial Centres: March 2010Dokument41 SeitenGlobal Financial Centres: March 2010api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument30 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Guy Butler Limited: AUD NZD CAD Denominated BondsDokument1 SeiteGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552Noch keine Bewertungen

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDokument65 SeitenUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument33 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDokument1 Seite62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552Noch keine Bewertungen

- Morning News 1 June 2010Dokument3 SeitenMorning News 1 June 2010api-25889552Noch keine Bewertungen

- Morning News 28 May 2010Dokument3 SeitenMorning News 28 May 2010api-25889552Noch keine Bewertungen

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Dokument1 Seite1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument36 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDokument1 Seite97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552Noch keine Bewertungen

- Worldwide Real Estates: Gibraltar LettingsDokument8 SeitenWorldwide Real Estates: Gibraltar Lettingsapi-25889552Noch keine Bewertungen

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Dokument1 Seite1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552Noch keine Bewertungen

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDokument1 SeiteCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Noch keine Bewertungen

- Daily Market Update: EquitiesDokument3 SeitenDaily Market Update: Equitiesapi-25889552Noch keine Bewertungen

- Morning News 12 May 2010Dokument3 SeitenMorning News 12 May 2010api-25889552Noch keine Bewertungen

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDokument1 SeiteCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552Noch keine Bewertungen

- CG European Income Fund: April 2010Dokument2 SeitenCG European Income Fund: April 2010api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument37 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- RODGEN Fs Subject For SofboundDokument40 SeitenRODGEN Fs Subject For SofboundMara Jean Marielle CalapardoNoch keine Bewertungen

- Principle MaterialDokument35 SeitenPrinciple MaterialHay JirenyaaNoch keine Bewertungen

- Introduction To Accounting For Construction ContractsDokument4 SeitenIntroduction To Accounting For Construction ContractsJohn TomNoch keine Bewertungen

- luyện tập IFRSDokument6 Seitenluyện tập IFRSÁnh Nguyễn Thị NgọcNoch keine Bewertungen

- POB Standardized Group Project 2021Dokument7 SeitenPOB Standardized Group Project 2021christopher phillipsNoch keine Bewertungen

- 1&2 PDFDokument24 Seiten1&2 PDFNoorullah Patwary ZubaerNoch keine Bewertungen

- Authority For Expenditures (AFE)Dokument4 SeitenAuthority For Expenditures (AFE)Hacene Lamraoui100% (1)

- Module 3 - Topic 3 - Topic NotesDokument38 SeitenModule 3 - Topic 3 - Topic NotesHa Vi TrinhNoch keine Bewertungen

- Preeti Singh PDF Final ProjectDokument113 SeitenPreeti Singh PDF Final Project0911Preeti SinghNoch keine Bewertungen

- CH 04Dokument4 SeitenCH 04Nusirwan Mz50% (2)

- Nisha Summer Project ReportDokument302 SeitenNisha Summer Project ReportSaransh Singh67% (3)

- Notes For Audit by ChaptersDokument7 SeitenNotes For Audit by ChaptersFarah KhattabNoch keine Bewertungen

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDokument1 SeiteACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNoch keine Bewertungen

- TLC Investment PrintedDokument6 SeitenTLC Investment PrintedDewi RenitasariNoch keine Bewertungen

- Bir RMC No 81-2012-Tax Treatment On Interest From Financial InstrumentDokument4 SeitenBir RMC No 81-2012-Tax Treatment On Interest From Financial InstrumentDuko Alcala EnjambreNoch keine Bewertungen

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDokument12 SeitenCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNoch keine Bewertungen

- BBTX4203 Taxation II - Eaug20Dokument296 SeitenBBTX4203 Taxation II - Eaug20MUHAMMAD ZAKI BIN BASERI STUDENTNoch keine Bewertungen

- Henry C K LiuDokument158 SeitenHenry C K Liuantix8wnNoch keine Bewertungen

- Sample Test HP4 2020Dokument6 SeitenSample Test HP4 2020Nguyễn Thanh ThủyNoch keine Bewertungen

- Himalayan Bank Limited Internship ReportDokument152 SeitenHimalayan Bank Limited Internship ReportAbhisheshBamNoch keine Bewertungen

- Akdas Brief Dan SelfDokument18 SeitenAkdas Brief Dan SelfAwun Sukma100% (1)