Beruflich Dokumente

Kultur Dokumente

U.S. Customs Form: CBP Form 3347 - Declaration of Owner: For Merchandise Obtained in Pursuance of A Purchase or Agreement To Purchase

Hochgeladen von

Customs FormsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

U.S. Customs Form: CBP Form 3347 - Declaration of Owner: For Merchandise Obtained in Pursuance of A Purchase or Agreement To Purchase

Hochgeladen von

Customs FormsCopyright:

Verfügbare Formate

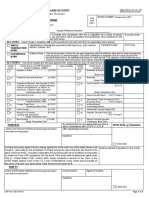

DEPARTMENT OF HOMELAND SECURITY

OMB No. 1651-0093

U.S. Customs and Border Protection Exp. 03-31-2012

DECLARATION OF OWNER

FOR MERCHANDISE OBTAINED (OTHERWISE THAN) IN PURSUANCE

OF A PURCHASE OR AGREEMENT TO PURCHASE

19 CFR 24.11(a)(1), 141.20

This declaration must be presented at the port of entry within 90 days after the date of entry in order to comply with Section 485(d), of the

Tariff Act of 1930. LINE OUT EACH PHRASE SHOWN IN ITALICS NOT APPLICABLE TO THIS DECLARATION.

1. NAME OF OWNER 2. ADDRESS OF OWNER (STREET, CITY, STATE, ZIP CODE) 3. SUPERSEDING BOND SURETY CODE

4. PORT OF ENTRY 5. PORT CODE 6. IMPORTER NUMBER OF AUTHORIZED AGENT (SHOW 7. VESSEL/CARRIER ARRIVED FROM

HYPHENS)

8. IMPORTER NUMBER OF OWNER 9. ENTRY NUMBER 10. DATE OF ENTRY 11. DATE OF ARRIVAL

(SHOW HYPHENS)

I, the undersigned, representing the above named owner in the capacity indicated herein, declare that they are the actual owners for CBP purposes of the

merchandise covered by the entry identified in Blocks 9 and 10 above, and that they will pay all additional and increased duties thereon pursuant to Section

485(d), of the Tariff Act of 1930, and that such entry exhibits a full and complete account of all the merchandise imported by them in the vessel identified in

the entry and obtained by them (otherwise than) in pursuance of a purchase, or an agreement to purchase, except as listed in columns 20-26 below.

I also declare to the best of my knowledge and belief that all statements appearing in the entry and in the invoice or invoices and other documents presented

therewith and in accordance with which the entry was made, are true and correct in every respect; that the entry and invoices set forth the true prices, values,

quantities, and all information as required by the law and the regulations made in pursuance thereof; that the invoices and other documents are in the same

state as when received; that I have not received and do not know of any other invoice, paper, letter, document, or information showing a different currency,

price, value, quantity, or description of the said merchandise; and that if any time hereafter I discover any information showing a different state of facts, I will

immediately make the same known to the Port Director of CBP at the port of entry.

I further declare, if the merchandise was entered by means of a seller's or shipper's invoice, that no CBP invoice for any of the merchandise covered by the

said seller's or shipper's invoice can be produced due to causes beyond my control, and that if entered by means of a statement of the value or the price

paid in the form of an invoice it is because neither seller's, shipper's, nor CBP invoice can be produced at this time.

12. EXCEPTIONS (IF ANY) 13. NOMINAL CONSIGNEE OR AUTHORIZED AGENT

FILED BY:

14. I REQUEST THAT:

BILLS, REFUNDS, AND NOTICES OF LIQUIDATION BILLS ONLY

CHECKS FOR REFUNDS ONLY NOTICES OF LIQUIDATION ONLY

BE ADDRESSED TO ME IN CARE OF THE AUTHORIZED AGENT WHOSE IMPORTER NUMBER IS SHOWN ABOVE.

15. SIGNATURE OF PRINCIPAL MEMBER OF FIRM 16. DATE 17. ADDRESS OF PRINCIPAL MEMBER OF FIRM (STREET, CITY,

STATE, ZIP CODE)

X

18. TITLE

19. EXECUTE THIS PORTION ONLY IF OWNER DOES NOT HAVE AN IMPORT NUMBER (I.E., HAS NOT FILED CBP FORM 5106)

IRS EMPLOYER NUMBER OF FIRM OWNER SUFFIX NAME

OR IF NO EMPLOYER NUMBER: SSN OF INDIVIDUAL OWNER ADDRESS (STREET, CITY, STATE, ZIP CODE)

OR IF NEITHER OF THE ABOVE NUMBERS: CUSTOMS SERIAL NUMBER NOTE: IF OWNER HAS NO IRS OR SOCIAL SECURITY NUMBER OR A

CBP SERIAL NUMBER HAS NOT BEEN PREVIOUSLY ASSIGNED, FILE

AN ADDITIONAL COPY OF THIS FORM. THE COPY WILL BE

RETURNED TO OWNER WITH A CBP SERIAL NUMBER ASSIGNED.

SUCH NUMBER SHALL BE USED BY OWNER IN ALL FUTURE CBP

TRANSACTIONS REQUIRING THE IMPORTER NUMBER.

20. 21. 22. 23. 24. 25. 26.

NUMBER OF SELLER OR SHIPPER PLACE AND DATE OF AMOUNT PAID OR TO BE RATE OF ENTERED VALUE ENTERED VALUE

PACKAGES INVOICE PAID IN FOREIGN CURRENCY EXCHANGE (FOREIGN CURRENCY) (U.S. DOLLARS)

CBP Form 3347 (06/09)

Paperwork Reduction Act Statement: An agency may not conduct or sponsor an information collection and a person is not required to respond to this

information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is 1651-0093. The estimated

average time to complete this application is 60 minutes. If you have any comments regarding the burden estimate you can write to U.S. Customs and Border

Protection, Office of Regulations and Rulings, 799 9th Street, NW., Washington DC 20229.

Statement required by 5 CFR 1320.21: The estimated average burden associated with this collection of information is 6 minutes per

respondent or recordkeeper depending on individual circumstances. Comments concerning the accuracy of this burden estimate and

suggestions for reducing this burden should be directed to U.S. Customs and Border Protection, Information Services Branch, Washington DC

20229, and to the Office of Management and Budget, Paperwork Reduction Project (1651-0093), Washington, DC 20503.

Privacy Act Notice: The following information is provided as required by the Privacy Act of 1974 (P.L. 93-579):

1. The disclosure of the social security number on CBP Form 3347 is mandatory.

2. The regulatory authority for requesting the social security number on CBP Form 3347 is 19 CFR 24.5(a).

3. When the importer of record has declared at the time of entry that they are not the actual owner of the merchandise, the social

security number shown on CBP Form 3347 will identify the actual owner and establish liability for any increased duties and taxes.

CBP Form 3347 (BACK)(06/09)

Das könnte Ihnen auch gefallen

- U.S. Customs Form: CBP Form 3347A - Declaration of Consignee When Entry Is Made by An AgentDokument2 SeitenU.S. Customs Form: CBP Form 3347A - Declaration of Consignee When Entry Is Made by An AgentCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7523 - Entry and Manifest of Merchandise Free of Duty, Carrier's Certificate and ReleaseDokument1 SeiteU.S. Customs Form: CBP Form 7523 - Entry and Manifest of Merchandise Free of Duty, Carrier's Certificate and ReleaseCustoms FormsNoch keine Bewertungen

- CBP Form 7523Dokument1 SeiteCBP Form 7523tsusamqyydzudtyfmlNoch keine Bewertungen

- U.S. Customs Form: CBP Form 3461 - Entry/Immediate DeliveryDokument1 SeiteU.S. Customs Form: CBP Form 3461 - Entry/Immediate DeliveryCustoms FormsNoch keine Bewertungen

- CBP Form 4457Dokument2 SeitenCBP Form 4457Met AfuckNoch keine Bewertungen

- U.S. Customs Form: CBP Form 6043 - Delivery TicketDokument1 SeiteU.S. Customs Form: CBP Form 6043 - Delivery TicketCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 3485 - Lien NoticeDokument1 SeiteU.S. Customs Form: CBP Form 3485 - Lien NoticeCustoms FormsNoch keine Bewertungen

- Importer ID Record UpdateDokument2 SeitenImporter ID Record UpdateoaifoiweuNoch keine Bewertungen

- U.S. Customs Form: CBP Form 3495 - Application For Exportation of Articles Under Special BondDokument1 SeiteU.S. Customs Form: CBP Form 3495 - Application For Exportation of Articles Under Special BondCustoms FormsNoch keine Bewertungen

- AC8050-2 Updated PAS v4 11-02-2023Dokument3 SeitenAC8050-2 Updated PAS v4 11-02-2023RetroSoaringNoch keine Bewertungen

- 103 NAFTA With InstructionsDokument3 Seiten103 NAFTA With Instructionsvblake0504Noch keine Bewertungen

- U.S. Customs Form: CBP Form 19 - ProtestDokument3 SeitenU.S. Customs Form: CBP Form 19 - ProtestCustoms FormsNoch keine Bewertungen

- Billing Error Notice Template - PDF - Affidavit - Notary PublicDokument5 SeitenBilling Error Notice Template - PDF - Affidavit - Notary Publicslimkat2000Noch keine Bewertungen

- Petrolimex Singapore Pte LTDDokument9 SeitenPetrolimex Singapore Pte LTDPhan KhảiNoch keine Bewertungen

- Binding Sales and Purchase Contract....Dokument6 SeitenBinding Sales and Purchase Contract....Autosale PLCNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7533 - Inward Cargo Manifest For Vessel Under Five Tons, Ferry, Train, Car, Vehicle, Etc.Dokument2 SeitenU.S. Customs Form: CBP Form 7533 - Inward Cargo Manifest For Vessel Under Five Tons, Ferry, Train, Car, Vehicle, Etc.Customs FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 442 - Application For Exemption From Special Landing RequirementsDokument3 SeitenU.S. Customs Form: CBP Form 442 - Application For Exemption From Special Landing RequirementsCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 5106 - Importer ID Input RecordDokument2 SeitenU.S. Customs Form: CBP Form 5106 - Importer ID Input RecordCustoms FormsNoch keine Bewertungen

- Reg 168 ADokument1 SeiteReg 168 AManny TileNoch keine Bewertungen

- 20B AGREEMENT SEADI TYPE S2S - 915B DTC-signed1-7-2020Dokument29 Seiten20B AGREEMENT SEADI TYPE S2S - 915B DTC-signed1-7-2020Mo Snipes67% (3)

- Application For Irrevocable Documentary Letter of CreditDokument4 SeitenApplication For Irrevocable Documentary Letter of CreditDungNoch keine Bewertungen

- Documentary Credit for Eucalyptus LogsDokument3 SeitenDocumentary Credit for Eucalyptus LogsMikol Be50% (2)

- Partnership Agreement Draft IpipDokument17 SeitenPartnership Agreement Draft Ipipsaber rahbar sadatNoch keine Bewertungen

- U.S. Customs Form: CBP Form 442A - OVERFLIGHT Pilot/Crewmember Personal Information ReleaseDokument1 SeiteU.S. Customs Form: CBP Form 442A - OVERFLIGHT Pilot/Crewmember Personal Information ReleaseCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 434 - North American Free Trade Agreement Certificate of OriginDokument2 SeitenU.S. Customs Form: CBP Form 434 - North American Free Trade Agreement Certificate of OriginCustoms FormsNoch keine Bewertungen

- 5106 Form (Impno) PDFDokument2 Seiten5106 Form (Impno) PDFAlicia GarciaNoch keine Bewertungen

- U.S. Customs Form: CBP Form 214A - Application For Foreign Trade-Zone Admission And/or Status Designation Continuation SheetDokument2 SeitenU.S. Customs Form: CBP Form 214A - Application For Foreign Trade-Zone Admission And/or Status Designation Continuation SheetCustoms FormsNoch keine Bewertungen

- Sample of International Sale ContractDokument7 SeitenSample of International Sale ContractAngelnolas100% (1)

- U.S. Customs Form: CBP Form 4630 - Petition For Relief From ForfeitureDokument2 SeitenU.S. Customs Form: CBP Form 4630 - Petition For Relief From ForfeitureCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 214 - Application For Foreign-Trade Zone Admission And/or Status DesignationDokument2 SeitenU.S. Customs Form: CBP Form 214 - Application For Foreign-Trade Zone Admission And/or Status DesignationCustoms FormsNoch keine Bewertungen

- CBP Bond Form Completion GuideDokument5 SeitenCBP Bond Form Completion Guideph34rm3Noch keine Bewertungen

- Application For Irrevocable Letter of Credit-EN-VNDokument3 SeitenApplication For Irrevocable Letter of Credit-EN-VNTHU NGUYEN THI MINHNoch keine Bewertungen

- Annexure 3 - BOE CRLDokument1 SeiteAnnexure 3 - BOE CRLReuben WilfredNoch keine Bewertungen

- End User StatementDokument1 SeiteEnd User StatementMax RiosNoch keine Bewertungen

- Mechanic's Lien Foreclosure Form and ProcessDokument2 SeitenMechanic's Lien Foreclosure Form and ProcessToshiba userNoch keine Bewertungen

- Letterhead Irrevocable Corporate Purchase Order: Date: November 2, 2021Dokument4 SeitenLetterhead Irrevocable Corporate Purchase Order: Date: November 2, 2021Elberto Cabusao100% (1)

- Certificate of OriginDokument2 SeitenCertificate of Originvanessa30Noch keine Bewertungen

- CBP Form 301 Customs Bond FormDokument5 SeitenCBP Form 301 Customs Bond FormBou EidNoch keine Bewertungen

- CBP Form 434 - 3Dokument2 SeitenCBP Form 434 - 3Rodolfo Fito PeñaNoch keine Bewertungen

- Certificate FormatDokument1 SeiteCertificate FormatSam FuentesNoch keine Bewertungen

- Ac8050 2 2Dokument3 SeitenAc8050 2 2api-265036265Noch keine Bewertungen

- Binding Sales and Purchase Contract.Dokument6 SeitenBinding Sales and Purchase Contract.Autosale PLCNoch keine Bewertungen

- Securities and Exchange Commission (SEC) - FormmsdwDokument3 SeitenSecurities and Exchange Commission (SEC) - FormmsdwhighfinanceNoch keine Bewertungen

- Copy1 NCNDA IMFPADokument13 SeitenCopy1 NCNDA IMFPAFAHAMI HASHIMNoch keine Bewertungen

- Nafta Certificate of OriginDokument2 SeitenNafta Certificate of Originneftalí_padilla_3Noch keine Bewertungen

- CBP Form 0434 - 15363Dokument3 SeitenCBP Form 0434 - 15363richardNoch keine Bewertungen

- TaxLaw CasesDokument42 SeitenTaxLaw CasesH.A. P.Noch keine Bewertungen

- Sales and Purchase Contract: CONTRACT NUMBER: X0405-HMS-1&2 DateDokument11 SeitenSales and Purchase Contract: CONTRACT NUMBER: X0405-HMS-1&2 DateYamata MotorsNoch keine Bewertungen

- Draft LC 700Dokument5 SeitenDraft LC 700Panda NababanNoch keine Bewertungen

- Buczek 20070506 International Promissory Note To Pay Court Hockey Game CaseDokument5 SeitenBuczek 20070506 International Promissory Note To Pay Court Hockey Game CaseBob HurtNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Dokument2 SeitenU.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Customs FormsNoch keine Bewertungen

- ACH Vendor Payment Enrollment FormDokument2 SeitenACH Vendor Payment Enrollment FormPawPaul MccoyNoch keine Bewertungen

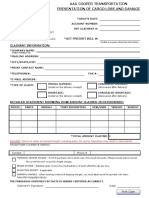

- Act Freight Bill #: Claimant Information:: Aaa Cooper Transportation P.O. BOX 6827 Dothan, Alabama 36302Dokument4 SeitenAct Freight Bill #: Claimant Information:: Aaa Cooper Transportation P.O. BOX 6827 Dothan, Alabama 36302aaaNoch keine Bewertungen

- Dd0250 Material Receiving and Inspection ReportDokument1 SeiteDd0250 Material Receiving and Inspection ReportBelajar MONoch keine Bewertungen

- New Importer Security Filing ISF 10Dokument6 SeitenNew Importer Security Filing ISF 10Jonathan Freitas100% (1)

- Irrevocable Corporate Purchase Order: Date: ToDokument5 SeitenIrrevocable Corporate Purchase Order: Date: ToWilliam JohnsonNoch keine Bewertungen

- Deliverable SampleDokument1 SeiteDeliverable SampleThein Zayar OoNoch keine Bewertungen

- Documents Required for Import LCDokument2 SeitenDocuments Required for Import LCPandi RajaNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- U.S. Customs Form: CBP Form 7551 InstructionsDokument10 SeitenU.S. Customs Form: CBP Form 7551 InstructionsCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7553 - Notice of Intent To Export, Destroy or Return Merchandise For Purposes of DrawbackDokument3 SeitenU.S. Customs Form: CBP Form 7553 - Notice of Intent To Export, Destroy or Return Merchandise For Purposes of DrawbackCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7501 - InstructionsDokument32 SeitenU.S. Customs Form: CBP Form 7501 - InstructionsCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-418 - Passenger List - Crew ListDokument4 SeitenU.S. Customs Form: CBP Form I-418 - Passenger List - Crew ListCustoms Forms0% (1)

- U.S. Customs Form: CBP Form I-775 - Visa Waiver Carrier AgreementDokument2 SeitenU.S. Customs Form: CBP Form I-775 - Visa Waiver Carrier AgreementCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 339A - Annual User Fee Decal Request - AircraftDokument4 SeitenU.S. Customs Form: CBP Form 339A - Annual User Fee Decal Request - AircraftCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7501 - InstructionsDokument5 SeitenU.S. Customs Form: CBP Form 7501 - InstructionsCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-760 - Guam Visa Waiver AgreementDokument1 SeiteU.S. Customs Form: CBP Form I-760 - Guam Visa Waiver AgreementCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-68 - Sample Form For ReferenceDokument2 SeitenU.S. Customs Form: CBP Form I-68 - Sample Form For ReferenceCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-95 - Crewman's Landing PermitDokument1 SeiteU.S. Customs Form: CBP Form I-95 - Crewman's Landing PermitCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-408 - Application To Pay Off or Discharge Alien CrewmanDokument4 SeitenU.S. Customs Form: CBP Form I-408 - Application To Pay Off or Discharge Alien CrewmanCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-92 - Sample Form For ReferenceDokument3 SeitenU.S. Customs Form: CBP Form I-92 - Sample Form For ReferenceCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-193 - Application For Waiver of Passport And/or VisaDokument2 SeitenU.S. Customs Form: CBP Form I-193 - Application For Waiver of Passport And/or VisaCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form I-736 - Guam-CNMI Visa Waiver InformationDokument1 SeiteU.S. Customs Form: CBP Form I-736 - Guam-CNMI Visa Waiver InformationCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form OP-0001 - Event ApplicationDokument1 SeiteU.S. Customs Form: CBP Form OP-0001 - Event ApplicationCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7553 - Notice of Intent To Export, Destroy or Return Merchandise For Purposes of DrawbackDokument1 SeiteU.S. Customs Form: CBP Form 7553 - Notice of Intent To Export, Destroy or Return Merchandise For Purposes of DrawbackCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7512 - Transportation Entry and Manifest of Goods Subject To CBP Inspection and PermitDokument2 SeitenU.S. Customs Form: CBP Form 7512 - Transportation Entry and Manifest of Goods Subject To CBP Inspection and PermitCustoms Forms100% (1)

- U.S. Customs Form: CBP Form 7507 - General Declaration Agriculture, Customs, Immigration and Public HealthDokument2 SeitenU.S. Customs Form: CBP Form 7507 - General Declaration Agriculture, Customs, Immigration and Public HealthCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7552 - Delivery Certificate For Purposes of DrawbackDokument2 SeitenU.S. Customs Form: CBP Form 7552 - Delivery Certificate For Purposes of DrawbackCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7551 - Drawback EntryDokument2 SeitenU.S. Customs Form: CBP Form 7551 - Drawback EntryCustoms Forms100% (1)

- U.S. Customs Form: CBP Form 6043 - Delivery TicketDokument1 SeiteU.S. Customs Form: CBP Form 6043 - Delivery TicketCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7533 - Inward Cargo Manifest For Vessel Under Five Tons, Ferry, Train, Car, Vehicle, Etc.Dokument2 SeitenU.S. Customs Form: CBP Form 7533 - Inward Cargo Manifest For Vessel Under Five Tons, Ferry, Train, Car, Vehicle, Etc.Customs FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7552 - InstructionsDokument6 SeitenU.S. Customs Form: CBP Form 7552 - InstructionsCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7553 - Notice of Intent To Export, Destroy or Return Merchandise For Purposes of DrawbackDokument3 SeitenU.S. Customs Form: CBP Form 7553 - Notice of Intent To Export, Destroy or Return Merchandise For Purposes of DrawbackCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7512A - Transportation Entry and Manifest of Goods Subject To CBP Inspection and PermitDokument2 SeitenU.S. Customs Form: CBP Form 7512A - Transportation Entry and Manifest of Goods Subject To CBP Inspection and PermitCustoms Forms100% (1)

- U.S. Customs Form: CBP Form 7501 - Document/Payment Transmittal TestDokument1 SeiteU.S. Customs Form: CBP Form 7501 - Document/Payment Transmittal TestCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7501 - InstructionsDokument5 SeitenU.S. Customs Form: CBP Form 7501 - InstructionsCustoms FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Dokument2 SeitenU.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Customs FormsNoch keine Bewertungen

- U.S. Customs Form: CBP Form 7509 - Air Cargo ManifestDokument2 SeitenU.S. Customs Form: CBP Form 7509 - Air Cargo ManifestCustoms FormsNoch keine Bewertungen

- Port Terminal Operator Liability Insurance by Mr. Ahmed SalaDokument49 SeitenPort Terminal Operator Liability Insurance by Mr. Ahmed SalaMurat Yilmaz0% (1)

- Rule: International Services Surveys: BE-11 U.S. Direct Investment Abroad Annual SurveyDokument3 SeitenRule: International Services Surveys: BE-11 U.S. Direct Investment Abroad Annual SurveyJustia.comNoch keine Bewertungen

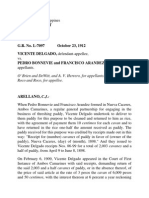

- Delgado Vs BonnevieDokument7 SeitenDelgado Vs BonnevieCLark BarcelonNoch keine Bewertungen

- 02 February 1990Dokument108 Seiten02 February 1990Monitoring TimesNoch keine Bewertungen

- Copy Wright LawsDokument4 SeitenCopy Wright LawsOgochukwu OmenkukwuNoch keine Bewertungen

- Regulation and Small Firm Performance and Growth: A Review of Literature-2005Dokument20 SeitenRegulation and Small Firm Performance and Growth: A Review of Literature-2005dmaproiectNoch keine Bewertungen

- Code of ConductDokument5 SeitenCode of ConductAyaz MeerNoch keine Bewertungen

- Post Graduate Diploma in Intellectual Property Rights (Pgdipr)Dokument6 SeitenPost Graduate Diploma in Intellectual Property Rights (Pgdipr)eruditeramanaNoch keine Bewertungen

- Ts Lawcet SyllabusDokument2 SeitenTs Lawcet Syllabussupersrikanth5304Noch keine Bewertungen

- PCGG V CojuangcoDokument24 SeitenPCGG V CojuangcoJan Igor GalinatoNoch keine Bewertungen

- Duties of Safety Officers and EmployersDokument1 SeiteDuties of Safety Officers and EmployershafiszulhamzahNoch keine Bewertungen

- Video Games Presentation (PDF Format)Dokument36 SeitenVideo Games Presentation (PDF Format)Adam Thierer71% (7)

- Draft Translation of Decentralisation ActMaldivesDokument75 SeitenDraft Translation of Decentralisation ActMaldivesAbdullah KhaleelNoch keine Bewertungen

- PCFI v. National Telecommunications Commission G.R. No. L-63318 August 18, 1984Dokument9 SeitenPCFI v. National Telecommunications Commission G.R. No. L-63318 August 18, 1984jake31Noch keine Bewertungen

- Condo: Status Certificate Omission MTCC1056Dokument57 SeitenCondo: Status Certificate Omission MTCC1056condomadness13Noch keine Bewertungen

- Increasing The Investment Bucket For Anchor Investor and Regulations Concerning The Preferential Issue NormsDokument2 SeitenIncreasing The Investment Bucket For Anchor Investor and Regulations Concerning The Preferential Issue NormsShyam SunderNoch keine Bewertungen

- PAGCOR vs. BIR, 645 SCRA 338, G.R. No. 172087 March 15, 2011Dokument28 SeitenPAGCOR vs. BIR, 645 SCRA 338, G.R. No. 172087 March 15, 2011Alfred GarciaNoch keine Bewertungen

- World's Fair Corporation: Executive Committee Meeting Minutes 2Dokument210 SeitenWorld's Fair Corporation: Executive Committee Meeting Minutes 2JohnWilliams86Noch keine Bewertungen

- Disclosure Practices of Banking CompaniesDokument9 SeitenDisclosure Practices of Banking CompaniesYashika DamodarNoch keine Bewertungen

- Thome Group News Corporate Issue 58 1Dokument28 SeitenThome Group News Corporate Issue 58 1Prastyo BimoNoch keine Bewertungen

- Ccs - Conduct - Rules - 1964 - Details Revised 2000Dokument201 SeitenCcs - Conduct - Rules - 1964 - Details Revised 2000api-20002381Noch keine Bewertungen

- Tax Review Part 1Dokument29 SeitenTax Review Part 1JImlan Sahipa IsmaelNoch keine Bewertungen

- Vacancy Chief Executive Officer CEO Tanzania Premier League Board TPLBDokument2 SeitenVacancy Chief Executive Officer CEO Tanzania Premier League Board TPLBJackson M AudifaceNoch keine Bewertungen

- Basic Diffrence Between Functional & Operational ManagerDokument3 SeitenBasic Diffrence Between Functional & Operational Managerzakaawan100% (2)

- Types of Business Organizations (Principles of Management)Dokument5 SeitenTypes of Business Organizations (Principles of Management)Mushima Tours & TransfersNoch keine Bewertungen

- CAO 1-2022Dokument21 SeitenCAO 1-2022Sophia SocorroNoch keine Bewertungen

- B.A. (Hons.) Economics Introductory Microeconomics SEM-I (7025)Dokument6 SeitenB.A. (Hons.) Economics Introductory Microeconomics SEM-I (7025)Gaurav VermaNoch keine Bewertungen

- Becg LongDokument16 SeitenBecg LongBhaskaran BalamuraliNoch keine Bewertungen

- 20 Transport Verification Protocol JUNE 2021Dokument11 Seiten20 Transport Verification Protocol JUNE 2021César LGNoch keine Bewertungen

- Petition For Review On CertiorariDokument53 SeitenPetition For Review On CertiorariDu Baladad Andrew Michael0% (2)