Beruflich Dokumente

Kultur Dokumente

Article1379417503 - Omisore Et Al

Hochgeladen von

Thanaa LakshimiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Article1379417503 - Omisore Et Al

Hochgeladen von

Thanaa LakshimiCopyright:

Verfügbare Formate

Journal of Accounting and Taxation Vol. 4(2), pp.

19-28, March 2012

Available online at http://www.academicjournals.org/JAT

DOI: 10.5897/JAT11.036

ISSN 2141-6664 2012 Academic Journals

Review

The modern portfolio theory as an investment decision

tool

Iyiola Omisore1, Munirat Yusuf 2* and Nwufo Christopher .I.3

1

Senator, Federal Republic of Nigeria.

Department of Business Administration, University of Abuja, Abuja, Nigeria.

3

Department of Accounting, University of Abuja, Abuja, Nigeria.

Accepted 13 February, 2012

This research paper is academic exposition into the modern portfolio theory (MPT) written with a

primary objective of showing how it aids an investor to classify, estimate, and control both the kind and

the amount of expected risk and return in an attempt to maximize portfolio expected return for a given

amount of portfolio risk, or equivalently minimize risk for a given level of expected return. A

methodology section is included which examined applicability of the theory to real time investment

decisions relative to assumptions of the MPT. A fair critique of the MPT is carried out to determine

inherent flaws of the theory while attempting to proffer areas of further improvement (for example, the

post-modern portfolio theory [PMPT]). The paper is summarised to give a compressed view of the

discourse upon which conclusions were drawn while referencing cited literature as employed in the

course of the presentation.

Key words: Assets, beta coefficient, diversification, expected returns, investment, portfolio, risk, uncertainty.

INTRODUCTION

This paper presentation is an assessment of the modern

portfolio theory as an investment decision tool. In the

investment world, there exist different motives for investment. The most prominent among all is to earn a return

on investment. However, selecting investments on the

basis of returns alone is not sufficient. The fact that most

investors invest their funds in more than one security

suggests that there are other factors, besides return, and

they must be considered. The investors not only like

return but also dislike risk.

The financial market, despite the benefits and rewards,

is a complexly volatile industry which requires critical

analysis to adequately evaluate risks relative to returns to

aid decisions as regards participation in the industry.

Upon such premise, this research work is an academic

insight into some analytics of the financial market. The

presentation is an attempt to create foundation

*Corresponding author. E-mail: drmrsyusuf@yahoo.com.

knowledge to understanding the workings of the financial

market. Despite the span of the research, specific

attention would be accorded to the Modern Portfolio

Theory.

In the course of this discourse, some historical

background to financial market analysis would be

examined, related literature (to Modern Portfolio Theory)

reviewed, its applications, pros and cons of the theory

would equally be examined.

It is intended that this write-up would add to the existing

pool of knowledge on the concept being investigated.

LITERATURE REVIEW

Investment portfolio theories guide the way an individual

investor or financial planner allocates money and other

capital assets within an investing portfolio. An investing

portfolio has long-term goals independent of a market's

day-to-day fluctuations; because of these goals,

investment portfolio theories aim to aid investors or

20

J. Account. Taxation

financial planners with tools to estimate the expected risk

and return associated with investments.

Passive portfolio theories, on one hand, combine an

investor's goals and temperament with financial actions.

Passive theories propose minimal input from the investor;

instead, passive strategies rely on diversification, buying

many stocks in the same industry or market, to match the

performance of a market index. Passive theories use

market data and other available information to forecast

investment performance.

Active Portfolio Theories come in three varieties. Active

portfolios can either be patient, aggressive or conservative. Patient portfolios invest in established, stable

companies that pay dividends and earn revenue despite

economic conditions. Aggressive portfolios buy riskier

stocks, those that are growing, in an attempt to maximize

returns; because of the volatility to which this type of

portfolio is exposed, it has a high turnover rate. As the

name implies, conservative portfolios invest with an eye

on yield and long-term stability.

In any financial market analysis, if the objective of the

analysis involves determination of stocks to buy and at

what price, there are two basic methodologies:

Fundamental analysis, which maintains that markets may

misprice a security in the short run but that the "correct"

price will eventually be reached. Profits can be made by

trading the mispriced security and then waiting for the

market to recognize its "mistake" and re-price the

security. Technical analysis, maintains that all information

is reflected already in the stock price. Trends 'are your

friend' and sentiment changes predate and predict trend

changes. Investors' emotional responses to price

movements lead to recognizable price chart patterns.

Technical analysis does not care what the 'value' of a

stock is. Their price predictions are only extrapolations

from historical price patterns.

Fundamental analysis of a business involves analysing

its financial statements and forexhealth, its management

and competitive advantages, and its competitors and

markets. When applied to futures and, it focuses on the

overall state of the economy, interest rates, production,

earnings, and management.

Fundamental analysis is performed on historical and

present data, but with the goal of making financial

forecasts. There are several possible objectives:

1. To conduct a company stock valuation and predict its

probable price evolution

2. To make a projection on its business performance

3. To evaluate its management and make internal

business decisions

4. To calculate its credit risk

While fundamental analysts examine earnings, dividends,

new products, research and the like, technical analysts

examine what investors fear or thought of these

developments and whether or not investors have the

Where withal to back up their opinions; these two

concepts are called psych (psychology) and supply/

demand.

Technical analysts use market indicators of many sorts,

some of which are mathematical transformations of price,

often including up and down volume, advance/decline

data and other inputs. These indicators are used to help

assess whether an asset is trending, and if it is, the

probability of its direction and of continuation. Also,

relationships between price/volume indices and market

indicators are sought. Examples include the relative

strength index, and MACD. Other avenues of study

include correlations between changes in options (implied

volatility) and put/call ratios with price. Also, important are

sentiment indicators such as put/call ratios, bull/bear

ratios, short interest, implied volatility, etc.

There are many techniques in technical analysis.

Adherents of different techniques (for example,

Candlestick charting, Dow Theory, and Elliott Wave

theory), may ignore other approaches, yet many financial

traders combine elements from more than one technique.

Some technical analysts use subjective judgment to

decide which pattern(s) a particular instrument reflects at

a given time and what the interpretation of that pattern

should be. Others employ a strictly mechanical or

systematic approach to pattern identification and

interpretation.

Technical analysis is frequently contrasted with

fundamental analysis; the study of economic factors that

influence the way investors price financial markets.

Technical analysis holds that prices already reflect all

such trends before investors are aware of them.

Uncovering those trends is what technical indicators are

designed to do, imperfect as they may be. Fundamental

indicators are subject to the same limitations, naturally.

Some traders use technical or fundamental analysis

exclusively, while others use both types to make trading

decisions.

THE MODERN PORTFOLIO THEORY (MPT)

Harry Markowitz 1991, an American economist in the

1950s developed a theory of "portfolio choice," which

allows investors to analyse risk relative to their expected

return. For this work Markowitz, a professor at Baruch

College at the City University of New York, shared the

1990 Nobel Memorial Prize in Economic Sciences with

William Sharpe and Merton Miller.

Markowitzs theory is today known as the Modern

Portfolio Theory, (MPT). The MPT is a theory of

investment which attempts to maximize portfolio

expected return for a given amount of portfolio risk, or

equivalently minimize risk for a given level of expected

return, by carefully choosing the proportions of various

assets. Although the MPT is widely used in practice in the

financial industry, in recent years, the basic assumptions

Omisore et al.

21

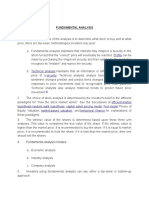

0.01

Capital Market Line (CML)

0.025

0.02

0.015

Markowitz Efficient Frontier

0.01

0.005

0

-0.02

0.02

0.04

0.06

0.08

0.1

0.12

Figure 1. Markouwitz Modern Portfolio theory.

of the MPT have been widely challenged.

The Modern Portfolio Theory, an improvement upon

traditional investment models, is an important advance in

the mathematical modelling of finance. The theory

encourages asset diversification to hedge against market

risk as well as risk that is unique to a specific company.

The theory (MPT) is a sophisticated investment

decision approach that aids an investor to classify,

estimate, and control both the kind and the amount of

expected risk and return; also called Portfolio

Management Theory. Essential to the portfolio theory are

its quantification of the relationship between risk and

return and the assumption that investors must be

compensated for assuming risk. Portfolio theory departs

from traditional security analysis in shifting emphasis

from analysing the characteristics of individual

investments to determining the statistical relationships

among the individual securities that comprise the overall

portfolio (Edwin and Martins 1997).

The MPT mathematically formulates the concept of

diversification in investing, with the aim of selecting a

collection of investment assets that has collectively lower

risk than any individual asset. The possibility of this can

be seen intuitively because different types of assets often

change in value in opposite ways. But diversification

lowers risk even if assets' returns are not negatively

correlated-indeed, even if they are positively correlated.

More technically, the MPT models an asset return as a

normally distributed function (or more generally as an

elliptically distributed random variable), define risk as the

standard deviation of return, and models a portfolio as a

weighted combination of assets so that the return of a

portfolio is the weighted combination of the assets'

returns. By combining different assets whose returns are

not perfectly positively correlated, MPT seeks to reduce

the total variance of the portfolio return. MPT also

assumes that investors are rational and markets are

efficient.

The fundamental concept behind the MPT is that

assets in an investment portfolio should not be selected

individually, each on their own merits. Rather, it is

important to consider how each asset changes in price

relative to how every other asset in the portfolio changes

in price.

Investing is a trade-off between risk and expected

return as shown in Figure 1. Generally, assets with higher

expected returns are riskier (Taleb, 2007). For a given

amount of risk, the MPT describes how to select a

portfolio with the highest possible expected return. Or, for

a given expected return, the MPT explains how to select

a portfolio with the lowest possible risk (the targeted

expected return cannot be more than the highestreturning available security, of course, unless negative

holdings of assets are possible).

Concept of risk and expected return

Return

Return is the basic motivating force and the principal

reward in any investment process. Returns may be

22

J. Account. Taxation

defined in terms of realized return (that is, the return

which has been earned) and expected return (that is, the

return which the investor anticipates to earn over some

future investment period). The expected return is a

predicted or estimated return and may or may not occur.

The realized returns in the past allow an investor to

estimate cash inflows in terms of dividends, interest,

bonus, capital gains, etc., available to the holder of the

investment. The return can be measured as the total gain

or loss to the holder over a given period of time and may

be defined as a percentage return on the initial amount

invested. With reference to investment in equity shares,

return is consisting of the dividends and the capital gain

or loss at the time of sale of these shares.

market risk. The market risk is represented by fluctuation

in the market benchmark, that is, market index. Shares

whose factor is more than 1 are considered less risky. It

may be noted that is a measure of systematic risk

which cannot be diversified away.

The total risk of an investment consists of two

components: diversifiable (unsystematic) risk and nondiversifiable (systematic) risk. The relationship between

total risk, diversifiable risk, and non-diversifiable risk can

be expressed by the following equation:

Total risk = Diversifiable risk + Non diversifiable risk

Assumptions of the modern portfolio theory

Risk

Risk in investment analysis, is the unpredictability of

future returns from an investment. The concept of risk

may be defined as the possibility that the actual return

may not be same as expected. In other words, risk refers

to the chance that the actual outcome (return) from an

investment will differ from an expected outcome. With

reference to a firm, risk may be defined as the possibility

that the actual outcome of a financial decision may not be

same as estimated. The risk may be considered as a

chance of variation in return. Investments having greater

chances of variations are considered more risky than

those with lesser chances of variations.

Risk should be differentiated from uncertainty; Risk is

defined as a situation where the possibility of happening

or non-happening of an event can be quantified and

measured: while uncertainty is a situation where this

possibility cannot be measured. Thus, risk is a situation

where probabilities can be assigned to an event on the

basis of facts and figures available regarding the

decision. Uncertainty, on the other hand, is a situation

where either the facts and figures are not available, or the

probabilities cannot be assigned.

Measurement of risk and the beta coefficient

No investor can predict with certainty whether the income

from an investment will increase or decrease and by how

much. Statistical measures can be used to make precise

measurement of risk about the estimated returns, to

gauge the extent to which the expected return and actual

return are likely to differ. The expected return, standard

deviation and variance of outcomes can be used to

measure risk.

Beta coefficient

There is another measure of risk known as which

measures the risk of one security/ portfolio relative to

The framework of the MPT makes many assumptions

about investors and markets. Some are explicit in MPT

equations; such as the use of Normal distributions to

model returns. Others are implicit, such as the neglect of

taxes and transaction fees. None of these assumptions

are entirely true, and each of them compromises the MPT

to some degree. Predominant among the MPT assumptions is the efficient market theory.

The efficient market theory

The efficient market theory is widely referred to as a

hypothesis, and thus efficient market hypothesis (EMH)

asserts that financial markets are "informationally

efficient". That is, one cannot consistently achieve returns

in excess of average market returns on a risk-adjusted

basis, given the information available at the time the

investment is made.

There are three major versions of the MPT hypothesis:

"weak", "semi-strong", and "strong". The weak EMH

asserts that prices of traded assets (for example, stocks,

bonds, or property) already reflect all past publicly

available information. The semi-strong EMH opines that

prices reflect all publicly available information and that

prices change to reflect new public information. The

strong EMH additionally claims that prices instantly reflect

even hidden or "insider" information. There is evidence

for and against the weak and semi-strong EMHs, while

there is powerful evidence against the strong EMH

(Andrei, 2000).

Extensive researches have revealed signs of

inefficiency in financial markets. Critics have blamed the

belief in rational markets for much of the late-2000s

global financial crisis. In response, proponents of the

hypothesis have stated that market efficiency does not

mean having no uncertainty about the future, rather the

market efficiency is a simplification of the world which

may not always hold true, and that the market is

practically efficient for investment purposes for most

individuals (Chambernan, 1983).

Omisore et al.

Asset returns are (jointly) normally distributed

random variables

Despite this assumption, evidence from frequent

observations shows that returns in equity and other

markets are not normally distributed. Large swings (3 to 6

standard deviations from the mean) occur in the market

far more frequently than the normal distribution

assumption would predict. While the model can also be

justified by assuming any return distribution which is

jointly elliptical, all the joint elliptical distributions are

symmetrical whereas asset returns empirically are not.

Correlations between assets are fixed and constant

forever

Correlations depend on systemic relationships between

the underlying assets, and change when these relationships change. During times of financial crisis, all assets

tend to become positively correlated, because they all

move (down) together. In other words, the MPT fails to

function when investors are most in need of protection

from risk.

23

expectations being biased, causing market prices to be

informationally inefficient. This possibility is studied in the

field of behavioural finance, which uses psychological

assumptions to provide alternatives to the capital asset

pricing model (Owen and Rabinovitch, 1983).

There are no taxes or transaction costs

Real financial products are subject both to taxes and

transaction costs (such as broker fees), and taking these

into account will alter the composition of the optimum

portfolio. These assumptions can be relaxed with more

complicated versions of the model.

All investors are price takers

Their actions do not influence prices. In reality,

sufficiently large sales or purchases of individual assets

can shift market prices for that asset and others (via

cross-elasticity of demand). An investor may not even be

able to assemble the theoretically optimal portfolio if the

market moves too much while they are buying the

required securities.

All investors aim to maximize economic utility

Investors aim to maximize economic utility in order to

make as much money as possible, regardless of any

other considerations. This is a key assumption of the

efficient market hypothesis, upon which the MPT relies.

Any investor can lend and borrow an unlimited

amount at the risk free rate of interest.

In reality, every investor has a credit limit.

All securities can be divided into parcels of any size

All investors are rational and risk-averse

This is another assumption of the efficient market

hypothesis, but we now know from behavioural

economics that market participants are not rational. It

does not allow for "herd behaviour" or investors who will

accept lower returns for higher risk. Even gamblers

clearly pay for risk, and it is possible that some stock

traders will pay for risk as well.

All investors have access to the same information at

the same time

This also comes from the efficient market hypothesis. Infact, real markets contain information asymmetry, insider

trading, and those who are simply better informed than

others.

Investors have an accurate conception of possible

returns

The probability beliefs of investors match the true

distribution of returns. A different possibility is investors'

In reality, fractional shares usually cannot be bought or

sold, and some assets have minimum order sizes.

More complex versions of the MPT take into account a

more sophisticated model of the world (such as one with

non-normal distributions and taxes) but all mathematical

models of finance still rely on many unrealistic premises

as stated previously.

APPLICATION

THEORY

OF

THE

MODERN

PORTFOLIO

The MPT assumes that investors are risk averse,

meaning that given two portfolios that offer the same

expected return, investors will prefer the less risky one.

Thus, an investor will take on increased risk only if

compensated by higher expected returns. Conversely, an

investor who wants higher expected returns must accept

more risk. The exact trade-off will be the same for all

investors, but different investors will evaluate the trade-off

differently based on individual risk aversion characteristics. The implication is that a rational investor will

not invest in a portfolio if a second portfolio exists with

24

J. Account. Taxation

a more favourable risk-expected return profile that is, if

for that level of risk an alternative portfolio exists which

has better expected returns.

The MPT is therefore a form of diversification. Under

certain assumptions and for specific quantitative definitions of risk and return, MPT explains how to find the best

possible diversification strategy.

Applying the theory

The Portfolio theory (MPT) approach has four basic

procedures: Security valuation-describing a universe of

assets in terms of expected return and expected risk;

asset allocation decision- determining how assets are to

be distributed among classes of investment, such as

stocks or bonds; portfolio optimization-reconciling risk

and return in selecting the securities to be included, such

as determining which portfolio of stocks offers the best

return for a given level of expected risk; and performance

measurement-dividing each stocks performance (risk)

into market-related (systematic) and industry/securityrelated (residual) classifications (Brodie, 2009).

Step one: Data collection

Get historical data for all the selected equities. Determine

the average weekly (or daily) returns and corresponding

standard deviation in weekly returns. Find the correlation

between selected assets.

rate per unit of risk for any available portfolio with risky

assets. Or, a portfolio with the maximum Sharpe ratio.

Step four: Create the capital market line

According to capital market theory, investors who allocate

their capital between a riskless security and the risky

portfolio (M) can expect a return equal to the risk-free

rate plus compensation for the number of risk units they

accept. In other words;

Step five: The optimal portfolio

Finally, we are ready for our optimal portfolio. Optimal

portfolio is represented by the point of tangency between

the capital market line and the Markowitz efficient frontier.

The theory is a mathematical model that uses standard

deviation of return as a proxy for risk, which is valid if

asset returns are jointly normally distributed or otherwise

elliptically distributed.

Under the model:

1. Portfolio return is the proportion-weighted combination

of the constituent assets' returns.

2. Portfolio volatility is a function of the correlations ij of

the component assets, for all asset pairs (i, j).

Expected return:

Step two: Create a Markowitz efficient frontier

The portfolio standard deviation is provided by the follow

equation:

Where Rp is the return on the portfolio, Ri is the return on

asset i and wi is the weighting of component asset i (that

is, the share of asset i in the portfolio).

P = sqrt (square(wi). square(i2) + wi .wj.Covij

Portfolio return variance:

Construct different portfolios with given target returns

(0.001, 0.002, etc.) and use the solver in excel to find

weights such that the standard deviation for the portfolio

(expressed previously) is minimized. Then, plot these

portfolios with return on y-axis and risk or standard

deviation on x-axis. The resulting envelope curve is

called the Markowitz efficient frontier. All the portfolios

on this frontier are efficient in the sense that any portfolio

beneath this line will not provide a better risk-return

alternative (either the portfolio will have lower return for

given risk or higher risk for given return) (Markowitz,

1959, 1952).

Where ij is the correlation coefficient between the

returns on assets i and j.

Alternatively the expression can be written as:

,

Where ij = 1 for i = j.

Step three: Create the market portfolio

Market portfolio is defined as the portfolio with risky

assets that provide highest expected return over risk-free

Portfolio return volatility (standard deviation):

Omisore et al.

25

Risk free rate

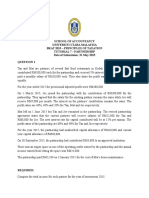

Figure 2. Efficient frontier. The hyperbola is sometimes referred to as the 'Markowitz Bullet', and is the

efficient frontier if no risk-free asset is available. With a risk-free asset, the straight line is the efficient

frontier.

For a two asset portfolio, we have the following:

Portfolio return:

Portfolio variance:

For a three asset portfolio, we have the following:

Portfolio return:

Portfolio variance:

PRACTICAL APPLICATIONS OF THE THEORY IN

INVESTMENT DECISION MAKING

Diversification

An investor can reduce portfolio risk simply by holding

combinations of instruments which are not perfectly

positively

correlated

(correlation

coefficient

). In other words, investors can reduce

their exposure to individual asset risk by holding a

diversified portfolio of assets. Diversification may allow

for the same portfolio expected return with reduced risk.

If all the asset pairs have correlations of 0they are

perfectly uncorrelatedthe portfolio's return variance is

the sum over all assets of the square of the fraction held

in the asset times the asset's return variance (and the

portfolio standard deviation is the square root of this sum)

(Koponen, 2003).

The efficient frontier with no risk-free asset

As shown in Figure 2, every possible combination of the

risky assets, without including any holdings of the riskfree asset, can be plotted in risk-expected return space,

and the collection of all such possible portfolios defines a

region in this space. The left boundary of this region is a

hyperbola, and the upper edge of this region is the

efficient frontier in the absence of a risk-free asset

(sometimes called "the Markowitz bullet"). Combinations

along this upper edge represent portfolios (including no

holdings of the risk-free asset) for which there is lowest

risk for a given level of expected return. Equivalently, a

portfolio laying on the efficient frontier represents the

combination offering the best possible expected return for

given risk level (Kent et al., 2001).

Matrices are preferred for calculations of the efficient

frontier. In matrix form, for a given "risk tolerance"

, the efficient frontier is found by minimizing

the following expression:

wTw q * RTw

26

J. Account. Taxation

Where, w is a vector of portfolio weights and i wi = 1

(The weights can be negative, which means investors

can short a security); is the covariance matrix for the

the loss of the sunk costs (that is, there is little or no

recovery/salvage value of a half-complete project).

returns on the assets in the portfolio;

is a "risk

tolerance" factor, where 0 results in the portfolio with

minimal risk and

results in the portfolio infinitely far out

on the frontier with both expected return and risk

T

unbounded; and Ris a vector of expected returns. w wis

T

the variance of portfolio return. R w is the expected

return on the portfolio.

The foregoing optimization finds the point on the

frontier at which the inverse of the slope of the frontier

would be q if portfolio return variance instead of standard

deviation were plotted horizontally. The frontier in its

entirety is parametric on q.

Many software packages, including Microsoft Excel,

MATLAB, Mathematical and R, provide optimization

routines suitable for the foregoing problem.

An alternative approach to specifying the efficient

frontier is to do so parametrically on expected portfolio

return RTw. This version of the problem requires that we

minimize;

wTw

However, that neither of these cited differences

necessarily eliminates the possibility of using the MPT

and such portfolios. They simply indicate the need to run

the optimization with an additional set of mathematicallyexpressed constraints that would not normally apply to

financial portfolios.

Furthermore, some of the simplest elements of the

modern portfolio theory are applicable to virtually any

kind of portfolio. The concept of capturing the risk

tolerance of an investor by documenting how much risk is

acceptable for a given return may be applied to a variety

of decision analysis problems. MPT uses historical

variance as a measure of risk, but portfolios of assets like

major projects do not have a well-defined "historical

variance". In this case, the MPT investment boundary can

be expressed in more general terms like "chance of a

return on investment (ROI) less than cost of capital" or

"chance of losing more than half of the investment".

When risk is put in terms of uncertainty about forecasts

and possible losses then the concept is transferable to

various types of investment.

Subject to:

Application to other disciplines

R w=

For parameter . This problem is easily solved using a

Lagrange Multiplier (Merton, 1972).

Applications to project portfolios and other "nonfinancial" assets

The MPT is gradually being applied to portfolios of

projects and other assets besides financial instruments.

When applied beyond traditional financial portfolios,

some fundamental differences between the different

types of portfolios must be considered:

1. The assets in financial portfolios are, for practical

purposes, continuously divisible while portfolios of

projects are "lumpy". For example, while we can compute

that the optimal portfolio position for 3 stocks is, say, 47,

30 and 23%, the optimal position for a project portfolio

may not allow us to simply change the amount spent on a

project. Projects might be all or nothing or, at least, have

logical units that cannot be separated. A portfolio

optimization method would have to take the discrete

nature of projects into account.

2. The assets of financial portfolios are liquid; they can be

assessed or re-assessed at any point in time. But

opportunities for launching new projects may be limited

and may occur in limited windows of time. Projects that

have already been initiated cannot be abandoned without

As far back as the early 1970s, concepts from modern

portfolio theory gained relevance in the field of regional

science. In a series of seminal works, researchers, such

as Michael Conroy, modelled the labour force in an

economy using portfolio-theoretic methods to examine

growth and variability in the labour force. This was

followed by an extensive literature on the relationship

between economic growth and volatility.

More recently, modern portfolio theory has been used

to model the self-concept in social psychology. When the

self attributes comprising the self-concept constitute a

well-diversified portfolio, then psychological outcomes at

the level of the individual such as mood and self-esteem

should be more stable than when the self-concept is

undiversified. This prediction has been confirmed in

studies involving human subjects.

Recently, the theory has been applied to modelling the

uncertainty and correlation between documents in information retrieval (Chandra and Shadel, 2007).

CRITICISM OF THE THEORY

Despite its theoretical relevance, the MPT has been

highly criticised; its simplistic assumptions being a

predominant bias. Critics question its viability as an

investment strategy, because its model of financial

markets does not match the real world in many ways. In

recent years, basic underlying assumptions of the MPT

have been grossly challenged by fields such as the

Omisore et al.

behavioural economics.

Efforts to translate the theoretical foundation of the

theory into a viable portfolio construction algorithm have

been plagued by technical difficulties stemming from the

instability of the original optimization problem with respect

to available data. Recent research shows that instabilities

of this type disappear when a regularizing constraint or

penalty term is incorporated in the optimization

procedure.

The theory does not really model the market

The risk, return, and correlation measures used by MPT

are based on expected (forecast) values, which means

that they are mathematical statements about the future

(the expected value of returns is explicit in such

equations, and implicit in the definitions of variance and

covariance). In practice, investors must substitute

predictions based on historical measurements of asset

return and volatility for these values in the equations.

Very often, such expected values fail to take account of

new circumstances which did not exist when the historical

data were generated.

More fundamentally, investors are stuck with estimating

key parameters from past market data because the MPT

attempts to model risk in terms of the likelihood of losses,

but says nothing about why those losses might occur.

The risk measurements used are probabilistic in nature,

not structural. This is a major difference as compared to

many engineering approaches to risk management.

The

Theory

does

not

consider

personal,

environmental, strategic, or social dimensions of

investment decisions

It only attempts to maximize risk-adjusted returns, without

regard to other consequences. In a narrow sense, its

complete reliance on asset prices makes it vulnerable to

all the standard market failures such as those arising

from information asymmetry, externalities, and public

goods. It also rewards corporate fraud and dishonest

accounting. More broadly, a firm may have strategic or

social goals that shape its investment decisions, and an

individual investor might have personal goals. In either

case, information other than historical returns (as

suggested by the MPT) is relevant.

The MPT does not take cognisance of its own effect

on asset prices

Diversification eliminates non-systematic risk, but, at the

cost of increasing the systematic risk. Diversification

forces the portfolio manager to invest in assets without

analysing their fundamentals; solely for the benefit of

eliminating the portfolios non-systematic risk (the capital

27

asset pricing investment in all available assets) (Chandra,

2003). This artificially increased demand pushes up the

price of assets that, when analysed individually, would be

of little fundamental value. The result is that the whole

portfolio becomes more expensive and, as a result, the

probability of a positive return decreases (that is, the risk

of the portfolio increases).

The legitimacy of the modern portfolio theory has been

challenged by financial analysts who often cite Warren

Buffett as a rule breaker. Warren Buffett, a major financial

market referral with successful financial takeovers in his

resume, is not a typical investor. Unlike the average

mutual fund manager, Buffet often buys companies and

then manages them. He provides them with economies of

scale, lower cost of capital and the benefits of his

managerial wisdom. And when he takes large portions in

companies, he often gets a board seat. So perhaps his

great returns are more a result of his managerial skills

than his investment skills, or some combination of both.

This, obviously, is not congruent with the line of thought

of MPT proponents (Sabbadini, 2010).

CONCLUSION

This paper presentation sought to review the relevance of

the modern portfolio theory as an investment portfolio tool

in portfolio decision making. In the course of the

research, the relevance and applicability of the MPT was

reviewed, however, it was also established that many

inherent flaws of the theory have marred the efficacy of

the theory. Among other things, its simplistic assumptions

and direct correlation of risks and returns were identified

as significant flaws.

Despite the limitations of the theory, it is still widely

accepted and further research is being carried out on its

principles. The post modern portfolio theory is a

significant advancement of the theory. Post-modern

portfolio theory encourages far greater diversification in

an investment portfolio than does the MPT. By utilizing

the alpha coefficient and the beta coefficient, each of

which gauge an investment's performance, investors can

engineer a portfolio's risk and returns to coincide with

investment objectives. The alpha coefficient measures an

investment's performance relative to its risk; the beta

coefficient measures an investment's return relative to the

market as a whole. The post-modern portfolio theory

(PMPT) separates alpha- and beta-generated revenue,

and then considers each individually to maximize their

performance. The PMPT is more adaptable to the

individual investor and can gauge risk relative to the

investor's minimum acceptable return (MAR) for an asset.

REFERENCES

Andrei S (2000). Inefficient Markets: An Introduction to Behavioral

Finance. Clarendon Lectures in Economics, p. 145.

28

J. Account. Taxation

Brodie DM, Daubechies G, Loris (2009). Sparse and stable Markowitz

portfolios. Proc. Natl. Acad. Sci., pp. 106.

Chambernan G (1983). A characterization of the distributions that imply

mean-variance utility functions, J. Econ. Theory, 29: 185-201.

Chandra S (2003). Regional Economy Size and the Growth-Instability

Frontier: Evidence from Europe". J. Reg. Sci., 43(1): 95-122.

doi:10.1111/1467-9787.00291.

Chandra S, Shadel WG (2007). Crossing disciplinary boundaries:

Applying financial portfolio theory to model the organization of the

self-concept.

J.

Res.

Personal.,

41(2):

346-373.

doi:10.1016/j.jrp.2006.04.007.

Edwin JE, Martin JG (1997). Modern portfolio theory, 1950 to date. J.

Bank. Fin., 21: 1743-1759.

Harry MM (1991). Autobiography, The Nobel Prizes 1990, Editor Tore

Frangsmyr, [Nobel Foundation], Stockholm, pp. 56-70.

Kent D, Daniel DH, Avanidhar S (2001). Overconfidence Arbitrage, and

Equilibrium Asset Pricing. J. F., 56(3): 921-965.

Koponen TM (2003). Commodities in action: measuring embeddedness

and imposing values. Sociol. Rev., 50(4): 543-569.

Markowitz HM (1952). Portfolio Selection. J. Fin., pp. 120-131

Markowitz HM (1959). Portfolio Selection: Efficient Diversification of

Investments. New York: John Wiley Sons, pp. 95-112. (reprinted by

Yale University Press, 1970, ISBN 978-0-300-01372-6; 2nd ed. Basil

Blackwell, 1991, ISBN 978-1-55786-108-5)

Merton R (1972). An analytic derivation of the efficient portfolio frontier,

J. Fin. Quant. Anal., September, 7: 1851-1872.

Owen J, Rabinovitch R (1983). On the class of elliptical distributions

and their applications to the theory of portfolio choice, J. Fin. 38: 745752.

Sabbadini T (2010). Manufacturing Portfolio Theory. International

Institute for Advanced Studies in Systems Research and Cybernetics.

pp.120-160.

Taleb NN (2007). The Black Swan: The Impact of the Highly

Improbable, Random House, pp. 80-120.

Das könnte Ihnen auch gefallen

- The Modern Portfolio Theory As An Investment Decision Tool: ReviewDokument10 SeitenThe Modern Portfolio Theory As An Investment Decision Tool: Reviewjulius muthiniNoch keine Bewertungen

- Technical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesVon EverandTechnical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesBewertung: 4.5 von 5 Sternen4.5/5 (39)

- PORTFOLIO SELECTION by HARRY MARKOWITZDokument5 SeitenPORTFOLIO SELECTION by HARRY MARKOWITZPrashanth PBNoch keine Bewertungen

- Chapter 5Dokument14 SeitenChapter 5elnathan azenawNoch keine Bewertungen

- Behavioral Finance Modern Portfolio Theory and The Efficient Market HypothesisDokument11 SeitenBehavioral Finance Modern Portfolio Theory and The Efficient Market HypothesisMUSA AHMED ABDULLAHI ALINoch keine Bewertungen

- Traditional Portfolio TheoryDokument5 SeitenTraditional Portfolio Theorykritigupta.may1999Noch keine Bewertungen

- Executive Summary: Security Analysis Which Focuses On Assessing The Risk and Return Characteristics of The AvailableDokument2 SeitenExecutive Summary: Security Analysis Which Focuses On Assessing The Risk and Return Characteristics of The AvailableDharmendra VermaNoch keine Bewertungen

- Portfolio Theory and Modern Portfolio Management TechniquesDokument3 SeitenPortfolio Theory and Modern Portfolio Management TechniquesJarir ibn ilyusNoch keine Bewertungen

- Tseng - Behavioral Finance, Bounded Rationality, Traditional FinanceDokument12 SeitenTseng - Behavioral Finance, Bounded Rationality, Traditional FinanceMohsin YounisNoch keine Bewertungen

- Behavioral Finance: Learning From Market Anomalies and Psychological FactorsDokument58 SeitenBehavioral Finance: Learning From Market Anomalies and Psychological FactorsAlejandra SalinasNoch keine Bewertungen

- Activity On Stock Markets CAED102 Financial MarketsDokument4 SeitenActivity On Stock Markets CAED102 Financial MarketsRico Jr. PeñaredondoNoch keine Bewertungen

- Term Paper: Submitted By: Samir Thakkar, PHD Registration No. 8141 Parul Institute of Management, VadodaraDokument8 SeitenTerm Paper: Submitted By: Samir Thakkar, PHD Registration No. 8141 Parul Institute of Management, VadodarafaizalpatelNoch keine Bewertungen

- Disadvantages of The Modern Portfolio TheoryDokument2 SeitenDisadvantages of The Modern Portfolio TheorySudipta Das100% (1)

- Formulation of Portfolio Strategy - IMDokument9 SeitenFormulation of Portfolio Strategy - IMKhyati KhokharaNoch keine Bewertungen

- Formulation of Portfolio Strategy - IMDokument9 SeitenFormulation of Portfolio Strategy - IMKhyati Khokhara100% (1)

- Fabozzi Gupta MarDokument16 SeitenFabozzi Gupta MarFernanda RodriguesNoch keine Bewertungen

- Lecture ThreeDokument9 SeitenLecture ThreeDenzel OrwenyoNoch keine Bewertungen

- Derivative Market AnalysisDokument96 SeitenDerivative Market AnalysisMaza StreetNoch keine Bewertungen

- Greed and Fear in Stock Market: Area-Behavioral FinanceDokument2 SeitenGreed and Fear in Stock Market: Area-Behavioral FinanceManuj PareekNoch keine Bewertungen

- SAPM1Dokument5 SeitenSAPM1Shaan MahendraNoch keine Bewertungen

- Manajemen Investasi Summary Chapter 11: Dr. Vinola Herawaty, Ak.,MscDokument7 SeitenManajemen Investasi Summary Chapter 11: Dr. Vinola Herawaty, Ak.,Mscmutia rasyaNoch keine Bewertungen

- 123 Review of LiteratureDokument31 Seiten123 Review of LiteratureHari PriyaNoch keine Bewertungen

- Financial Markets Topic 2 Market Analysis and Investment StrategiesDokument10 SeitenFinancial Markets Topic 2 Market Analysis and Investment StrategiesShungangaNoch keine Bewertungen

- MF0001Dokument19 SeitenMF0001Brijesh SalianNoch keine Bewertungen

- Final Thesis ProposalDokument12 SeitenFinal Thesis ProposalMahesh Tiwari75% (4)

- Modern Portfolio TheoryDokument6 SeitenModern Portfolio TheoryRahul PillaiNoch keine Bewertungen

- Tema 10 PDFDokument9 SeitenTema 10 PDFAlina NarcisaNoch keine Bewertungen

- Executive Summary: Performance of PortfolioDokument65 SeitenExecutive Summary: Performance of PortfolioManjesh KumarNoch keine Bewertungen

- Chapter 1 Financial Behavior An OverviewDokument33 SeitenChapter 1 Financial Behavior An OverviewАртём ПрудкийNoch keine Bewertungen

- Evolution of Financial EconomicsDokument38 SeitenEvolution of Financial EconomicsSoledad PerezNoch keine Bewertungen

- Me and YouDokument8 SeitenMe and YouLaffin Ebi LaffinNoch keine Bewertungen

- What Is An Investment PhilosophyDokument10 SeitenWhat Is An Investment PhilosophyArafat DreamtheterNoch keine Bewertungen

- AR1b Perilaku Individu Dan Intitusi - 2012Dokument12 SeitenAR1b Perilaku Individu Dan Intitusi - 2012UllaIbanezNoch keine Bewertungen

- CAPMDokument56 SeitenCAPMraghavan swaminathanNoch keine Bewertungen

- Portfolio Management NotesDokument25 SeitenPortfolio Management NotesRigved DarekarNoch keine Bewertungen

- Effectiveness of Nifty Stocks and Options Strategy Introduced by National Stock ExchangeDokument9 SeitenEffectiveness of Nifty Stocks and Options Strategy Introduced by National Stock ExchangeMohammadimran ShaikhNoch keine Bewertungen

- Modern Portfolio Theory (MPT) and What Critics SayDokument6 SeitenModern Portfolio Theory (MPT) and What Critics SayEvans MandinyanyaNoch keine Bewertungen

- Behavioral Finance Bounded Rationality Neuro-FinanDokument13 SeitenBehavioral Finance Bounded Rationality Neuro-FinanLaksheya KhannaNoch keine Bewertungen

- Investment & Portfolio MG - Module 1.1Dokument11 SeitenInvestment & Portfolio MG - Module 1.1MARY JUDIELL VILLANUEVANoch keine Bewertungen

- Investors Preferences Towards Equity Indiabulls 2011Dokument81 SeitenInvestors Preferences Towards Equity Indiabulls 2011chaluvadiin100% (2)

- Sip ReportDokument56 SeitenSip ReportAli tubeNoch keine Bewertungen

- Portfolio TheoryDokument6 SeitenPortfolio TheorykrgitNoch keine Bewertungen

- Fundamental AnalysisDokument3 SeitenFundamental AnalysisWaqar AbdullahNoch keine Bewertungen

- Project Dated 4-A STUDY OF RETAIL INVESTOR BEHAVIOR ON INVESTMENT DECISIONDokument124 SeitenProject Dated 4-A STUDY OF RETAIL INVESTOR BEHAVIOR ON INVESTMENT DECISIONSharanya SvNoch keine Bewertungen

- As I Studied and Experienced All Investments Carry Risk in Some Form or TheDokument50 SeitenAs I Studied and Experienced All Investments Carry Risk in Some Form or TheLeeladhar KushwahaNoch keine Bewertungen

- Investment ManagementDokument173 SeitenInvestment Managementvikramthevictor100% (1)

- Fundamental Analysis Black BookDokument46 SeitenFundamental Analysis Black Bookwagha25% (4)

- Foundations of Factor InvestingDokument33 SeitenFoundations of Factor Investingnamhvu99Noch keine Bewertungen

- Mordern Portfolio TheoryDokument4 SeitenMordern Portfolio TheoryromanaNoch keine Bewertungen

- The Behavioural Finance: A Challenge or Replacement To Efficient Market ConceptDokument5 SeitenThe Behavioural Finance: A Challenge or Replacement To Efficient Market ConceptthesijNoch keine Bewertungen

- Mohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)Dokument39 SeitenMohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)EVERYTHING FOOTBALLNoch keine Bewertungen

- Full Project NewDokument66 SeitenFull Project NewSandra sunnyNoch keine Bewertungen

- MPT PaperDokument13 SeitenMPT PaperAna ShehuNoch keine Bewertungen

- Lit ReveiwDokument29 SeitenLit ReveiwSarikaNoch keine Bewertungen

- Master of Business AdministrationDokument16 SeitenMaster of Business AdministrationMOHAMMED KHAYYUMNoch keine Bewertungen

- Ia Unit 1Dokument18 SeitenIa Unit 121ubha116 21ubha116Noch keine Bewertungen

- Synopsis On Volatile Market ConDokument8 SeitenSynopsis On Volatile Market ConVenky K VenkyNoch keine Bewertungen

- Pair Trading - Clustering Based On Principal Component Analysis Cardoso - 2015Dokument30 SeitenPair Trading - Clustering Based On Principal Component Analysis Cardoso - 2015alexa_sherpyNoch keine Bewertungen

- Problems .Dokument5 SeitenProblems .Thanaa LakshimiNoch keine Bewertungen

- Investigating Theft Acts and Concealment: (2016/2017) 1 Semester - Topic 6Dokument21 SeitenInvestigating Theft Acts and Concealment: (2016/2017) 1 Semester - Topic 6Thanaa LakshimiNoch keine Bewertungen

- Tutorial Questions: BKAS 3063 (A142) Accounting Systems Analysis Dan DesignDokument2 SeitenTutorial Questions: BKAS 3063 (A142) Accounting Systems Analysis Dan DesignThanaa LakshimiNoch keine Bewertungen

- Role of Internal Audit in Risk ManagementDokument29 SeitenRole of Internal Audit in Risk ManagementThanaa LakshimiNoch keine Bewertungen

- Coetsee - The Role of Accounting Theory - HighlightDokument17 SeitenCoetsee - The Role of Accounting Theory - HighlightThanaa LakshimiNoch keine Bewertungen

- School of Accountancy Universiti Utara Malaysia Bkat 2013 - Principles of Taxation Tutorial 7 - Partnership Date of Submission: 31 May 2015Dokument3 SeitenSchool of Accountancy Universiti Utara Malaysia Bkat 2013 - Principles of Taxation Tutorial 7 - Partnership Date of Submission: 31 May 2015Thanaa LakshimiNoch keine Bewertungen

- QUIZ (5%) Business Income Suggested Solution RM RM Less: Non Business IncomeDokument2 SeitenQUIZ (5%) Business Income Suggested Solution RM RM Less: Non Business IncomeThanaa LakshimiNoch keine Bewertungen

- BAB 7organizational Change and Stress Management Bab 7Dokument23 SeitenBAB 7organizational Change and Stress Management Bab 7Thanaa LakshimiNoch keine Bewertungen

- Responsible Organizational DisobedienceDokument8 SeitenResponsible Organizational DisobedienceThanaa LakshimiNoch keine Bewertungen

- Chapter 11 Leadership: Essentials of Organizational Behavior, 11e (Robbins/Judge)Dokument6 SeitenChapter 11 Leadership: Essentials of Organizational Behavior, 11e (Robbins/Judge)Thanaa LakshimiNoch keine Bewertungen

- Project Guideline (25%) : Bka2013 Audit & Assurance Services Project SECOND SEMESTER 2014/2015 (A142)Dokument3 SeitenProject Guideline (25%) : Bka2013 Audit & Assurance Services Project SECOND SEMESTER 2014/2015 (A142)Thanaa LakshimiNoch keine Bewertungen

- Artikel MS in ChinaDokument14 SeitenArtikel MS in ChinaThanaa LakshimiNoch keine Bewertungen

- Audit Principles: A. Have Integrity and Be ProfessionalDokument19 SeitenAudit Principles: A. Have Integrity and Be ProfessionalThanaa LakshimiNoch keine Bewertungen

- BAB 7organizational Change and Stress Management Bab 7Dokument23 SeitenBAB 7organizational Change and Stress Management Bab 7Thanaa LakshimiNoch keine Bewertungen

- Chap 7 MoreDokument11 SeitenChap 7 MorezzakirNoch keine Bewertungen

- Financial Structure Analysis of Indian Companies: A Review of LiteratureDokument9 SeitenFinancial Structure Analysis of Indian Companies: A Review of LiteratureVįňäý Ğøwđã VįñîNoch keine Bewertungen

- QUANTITATIVE METHODS - Common Probability Distribution Test QuestionsDokument28 SeitenQUANTITATIVE METHODS - Common Probability Distribution Test QuestionsEdlyn KooNoch keine Bewertungen

- Chapter 10 StocksDokument8 SeitenChapter 10 Stocksbiserapatce2Noch keine Bewertungen

- Question and Answer - 7Dokument30 SeitenQuestion and Answer - 7acc-expertNoch keine Bewertungen

- Fin202 Sem.2 2019 MCQ New QDokument31 SeitenFin202 Sem.2 2019 MCQ New QEy B0ssNoch keine Bewertungen

- F2 Past Paper - Question12-2003Dokument15 SeitenF2 Past Paper - Question12-2003ArsalanACCANoch keine Bewertungen

- Time Value of Money Discounting and Compounding: Required Rate of ReturnDokument8 SeitenTime Value of Money Discounting and Compounding: Required Rate of ReturnGiddy KenduiwaNoch keine Bewertungen

- FinanceDokument5 SeitenFinancePiyushNoch keine Bewertungen

- Ross Chapter 9 NotesDokument11 SeitenRoss Chapter 9 NotesYuk Sim100% (1)

- MG6863 - ENGINEERING ECONOMICS - Question BankDokument19 SeitenMG6863 - ENGINEERING ECONOMICS - Question BankSRMBALAANoch keine Bewertungen

- Stock Market Trends and Investment PatternDokument112 SeitenStock Market Trends and Investment PatternArvind MahandhwalNoch keine Bewertungen

- Cost of Capital: - Concept & SignificanceDokument23 SeitenCost of Capital: - Concept & SignificancenawabrpNoch keine Bewertungen

- Mutual Fund RatiosDokument9 SeitenMutual Fund RatiosAamir Ali ChandioNoch keine Bewertungen

- Finance pt2 QB NEWDokument71 SeitenFinance pt2 QB NEWBharath BMNoch keine Bewertungen

- HW3 Managerial FinanceDokument13 SeitenHW3 Managerial FinanceAndrew HawkinsNoch keine Bewertungen

- Chapter 32 - AnswerDokument11 SeitenChapter 32 - AnswerKathleen LeynesNoch keine Bewertungen

- Chapter 6 Security AnalysisDokument46 SeitenChapter 6 Security AnalysisAshraf KhamisaNoch keine Bewertungen

- Norman Hallet - The Disciplined Trader - My - Trading - Plan PDFDokument71 SeitenNorman Hallet - The Disciplined Trader - My - Trading - Plan PDFJerome Siegel100% (1)

- Value Added Statement - A Critical AnalysisDokument23 SeitenValue Added Statement - A Critical AnalysisJanani MarimuthuNoch keine Bewertungen

- Question Paper Portfolio Management: Theory and Practice (MB3G2F) : October 2008Dokument18 SeitenQuestion Paper Portfolio Management: Theory and Practice (MB3G2F) : October 2008aslam_m2Noch keine Bewertungen

- BMA 12e SM CH 04 FinalDokument14 SeitenBMA 12e SM CH 04 FinalShyamal VermaNoch keine Bewertungen

- Fact Sheet January 2018Dokument52 SeitenFact Sheet January 2018esivaks2000Noch keine Bewertungen

- Security Valuation CA FinalDokument1 SeiteSecurity Valuation CA FinalAzru KhanNoch keine Bewertungen

- Name: - Second Midterm Exam MBAC 6060 Fall 2007 Please Read This: This Exam Will Serve As The Answer Sheet. There Are 4Dokument5 SeitenName: - Second Midterm Exam MBAC 6060 Fall 2007 Please Read This: This Exam Will Serve As The Answer Sheet. There Are 4Joven CastilloNoch keine Bewertungen

- Group Assignment Ukff3283 201910Dokument12 SeitenGroup Assignment Ukff3283 201910Jayden YapNoch keine Bewertungen

- Business Economics Question BankDokument52 SeitenBusiness Economics Question BankDiuNoch keine Bewertungen

- 2-4 2006 Dec ADokument13 Seiten2-4 2006 Dec AAjay Takiar50% (2)

- Investment ProjectDokument30 SeitenInvestment ProjectRaj YadavNoch keine Bewertungen

- ReasoningDokument80 SeitenReasoningwork workNoch keine Bewertungen

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNoch keine Bewertungen

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceVon EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceBewertung: 4 von 5 Sternen4/5 (1)

- Corporate Finance Formulas: A Simple IntroductionVon EverandCorporate Finance Formulas: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (8)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamVon EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNoch keine Bewertungen

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 5 von 5 Sternen5/5 (2)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthVon EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthBewertung: 4 von 5 Sternen4/5 (20)

- Creating Shareholder Value: A Guide For Managers And InvestorsVon EverandCreating Shareholder Value: A Guide For Managers And InvestorsBewertung: 4.5 von 5 Sternen4.5/5 (8)

- The Value of a Whale: On the Illusions of Green CapitalismVon EverandThe Value of a Whale: On the Illusions of Green CapitalismBewertung: 5 von 5 Sternen5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsVon EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsBewertung: 4.5 von 5 Sternen4.5/5 (21)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Product-Led Growth: How to Build a Product That Sells ItselfVon EverandProduct-Led Growth: How to Build a Product That Sells ItselfBewertung: 5 von 5 Sternen5/5 (1)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyVon EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyBewertung: 3 von 5 Sternen3/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressVon EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressNoch keine Bewertungen

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistVon EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistBewertung: 4 von 5 Sternen4/5 (32)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Mind over Money: The Psychology of Money and How to Use It BetterVon EverandMind over Money: The Psychology of Money and How to Use It BetterBewertung: 4 von 5 Sternen4/5 (24)

- Financial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessVon EverandFinancial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessBewertung: 4 von 5 Sternen4/5 (2)