Beruflich Dokumente

Kultur Dokumente

NELC Witness Statement - Redact

Hochgeladen von

GotnitCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NELC Witness Statement - Redact

Hochgeladen von

GotnitCopyright:

Verfügbare Formate

Grimsby Magistrates Court

Claimant

North East Lincolnshire Council

V

Defendant

xxxxxxxxxxx

Application for Liability Order

1.

North East Lincolnshire Council application for Liability Order:

2.

The person who is liable to pay Council Tax in respect of any chargeable dwelling

and any day, is the person who falls within the first paragraph of subsection (2) below

to apply, talking paragraph (a) of that subsection first, paragraph (b) next, and so on.

(2) A person falls within this subsection in relation to any chargeable dwelling and

any day if, on that day

(a) He is a resident of the dwelling and has a freehold interest in the whole or any part

of it;

(b) He is such a resident and has a leasehold interest in the whole or any part of the

dwelling which is not inferior to another such interest held by another such resident;

(c) He is both such a resident and a statutory [F1, secure or introductory tenant]of the

whole or any part of the dwelling;

(d) He is such a resident and has a contractual licence to occupy the whole or any part

of the dwelling;

(e) He is such a resident; or

(f) He is the owner of the dwelling.

Section 6, Paragraph (1) & (2) of the Local Government Finance Act 1992.

3.

The Secretary of State may make regulations containing such provisions as he sees fit

in relation to the collection and recovery of amounts persons are liable to pay in

respect of Council Tax; Paragraph 1, Schedule 2 to the Local Government Finance

Act 1992.

4.

(1) Regulations under paragraph 1(1) above may provide that

(a) The authority concerned may apply to a magistrates court for an order (a

liability order) against the person by whom the sum is payable;

(b) the magistrates court shall make the order if it is satisfied that the sum has

become payable by the person concerned and has not been paid.

Paragraph (1)a & b Section 6, Schedule 4 to the Local Government Finance Act

1992.

5.

On the 9th March 2015 the Defendant was issued with a Council Tax Bill (NELC1) for

the period 01st April 2015 to the 31st March 2016 for the property known as

xxxxxxxxxxx

6.

The amount charged for the period being 907.91

7.

At this juncture it is also important to point out that the defendant had a further

amount of 60.00 outstanding in regards costs relating to a Liability order application

granted on the 2nd November 2012.

8.

2.(1) This paragraph applies where the demand notice is issued on or before 31st

December in the relevant year, but has effect subject to paragraph 3 below.

(2) The aggregate amount is to be payable in monthly instalments.

(3) The number of such instalments

(a)where the notice is issued before the beginning of the relevant year or at any time in

the period beginning on the first day of that year and ending on 31st May of that year,

shall be 10;

(a)where the notice is issued before the beginning of the relevant year or at any time in

the period beginning on the first day of that year and ending on 31st May of that year,

shall be 10;

Paragraph 2, Part 1, Schedule 1 to The Council Tax (Administration and

Enforcement) Regulations 1992

9.

The 10 month statutory instalments where set out as so:

10.

First Payment 1st April 2015

9 Payments due thereafter on the first of every month

88.91

91.00

11.

The made payment of 88.91 on the 10th April 2015 and a further payment of 91.00

on the 22nd April 2015. Both payments being for the correct amounts and in adherence

to the first two statutory instalments set out on the Defendants Council Tax Bill.

12.

The Defendants next payment was received on the 29th May 2015 for an amount of

85.00. This amount was not the amount of the statutory instalment on the Council

Tax Bill. Due to this the payment was allocated by North East Lincolnshire Councils

Council Tax database (Northgate) as follows:

13.

60.00 allocated to the 60.00 costs outstanding in from the Liability Hearing in

November 2012.

14.

25.00 allocated to the Current years Council Tax Bill for the period 01st April 2015 to

31st March 2016.

15.

As of the 1st June 2015 25.00 had been paid to the 91.00 statutory instalment,

leaving a 66.00 to be paid.

16.

On the 2nd June 2015 a further 7.00 was paid by the defendant, leaving a further

59.00 still to be paid to the statutory instalment for June 2015.

17.

23.(1) Subject to paragraph (2), where

(a) a demand notice has been served by a billing authority on a liable person, .

(b) instalments in respect of the council tax to which the notice relates are payable in

accordance with Part I of Schedule 1 or, as the case may be, a Part II scheme, and .

(c) any such instalment is not paid in accordance with that Schedule or, as the case

may be, the relevant scheme, .

the billing authority shall serve a notice (reminder notice) on the liable person

stating

(i) the instalments required to be paid,

(ii) the effect of paragraph (3) below and .

Part 5, Regulations 23, Paragraph 1 to the Council Tax (Administration and

Enforcement) Regulations 1992

18.

(3) If, within the period of 7 days beginning with the day on which a reminder notice

is issued, the liable person fails to pay any instalments which are or will become due

before the expiry of that period, the unpaid balance of the estimated amount shall

become payable by him at the expiry of a further period of 7 days beginning with the

day of the failure.

Part 5, Regulations 23, Paragraph 3 to the Council Tax (Administration and

Enforcement) Regulations 1992

19.

In accordance with the regulations a reminder notice for 59.00 was sent to the

Defendant on the 12th June 2015. The reminder notice sent to the defendant can be

seen as (NELC2).

20.

No communication was received from the Defendant.

21.

A further payment of 90.00 was paid by the defendant on the 2nd July 2015.

22.

This payment cleared the 59.00 arrears on the Reminder notice and allocated a

further amount of 31.00 to the 1st July 2015 statutory instalment.

23.

The amount left outstanding for the 1st July 2015 statutory instalment was 60.00.

24.

23.(1) Subject to paragraph (2), where

(d) a demand notice has been served by a billing authority on a liable person, .

(e) instalments in respect of the council tax to which the notice relates are payable in

accordance with Part I of Schedule 1 or, as the case may be, a Part II scheme, and .

(f) any such instalment is not paid in accordance with that Schedule or, as the case

may be, the relevant scheme, .

the billing authority shall serve a notice (reminder notice) on the liable person

stating

(i) the instalments required to be paid,

(ii) the effect of paragraph (3) below and .

(iii) where the notice is the second such notice as regards the relevant year, the

effect of paragraph (4) below.

Part 5, Regulations 23, Paragraph 1 to the Council Tax (Administration and

Enforcement) Regulations 1992

25.

(4) If, after making a payment in accordance with a reminder notice which is the

second such notice as regards the relevant year, the liable person fails to pay any

subsequent instalment as regards that year on or before the day on which it falls due,

the unpaid balance of the estimated amount shall become payable by him on the day

following the day of the failure.

Part 5, Regulations 23, Paragraph 3 to the Council Tax (Administration and

Enforcement) Regulations 1992

26.

The 2nd Reminder notice in accordance with the regulations was sent to the Defendant

on the 14th July 2015 for the amount of 60.00. The 2nd Reminder sent to the

defendant can be seen as (NELC3)

27.

No Contact was received from the Defendant.

28.

Two separate payments were made by the defendant on the 31st July 2015. The first

payment being for 7.00 and the second for 85.00.

29.

The 7.00 reduced the 60.00 arrears to 53.00.

30.

53.00 of the further 85.00 payment was cleared the outstanding amount of the

arrears.

31.

The 32.00 was then allocated to the 1st August 2015 statutory instalment. Leaving an

overdue amount of 59.00.

32.

No further payment was received in August 2015.

33.

33.(1) Subject to paragraph (3), before a billing authority applies for a liability

order it shall serve on the person against whom the application is to be made a notice

(final notice), which is to be in addition to any notice required to be served under

Part V, and which is to state every amount in respect of which the authority is to make

the application.

(2) A final notice may be served in respect of an amount at any time after it has

become due.

(3) A final notice need not be served on a person who has been served under

regulation 23(1) with a reminder notice in respect of the amount concerned.

Part VI, Regulations 33 to the Council Tax (Administration and Enforcement)

Regulations 1992.

34.

A Final Notice was sent to the defendant on 12th August 2015. The Final Notice

sent to the defendant can be seen as (NELC4)

35.

The amount outstanding being 514.00.

36.

As per the statutory Final Notice the Full Amount wholly or partially paid becomes

payable in full.

37.

No Contact was received from the Defendant.

38.

A further payment was paid by the defendant on the 2nd September 2015 for 90.00.

39.

The payment reduced the outstanding amount of 514.00 to 424.00.

40.

34.(1) If an amount which has fallen due under regulation 23(3) or (4) is wholly or

partly unpaid, or (in a case where a final notice is required under regulation 33) the

amount stated in the final notice is wholly or partly unpaid at the expiry of the period

of 7 days beginning with the day on which the notice was issued, the billing authority

may, in accordance with paragraph (2), apply to a magistrates' court for an order

against the person by whom it is payable.

(2) The application is to be instituted by making complaint to a justice of the peace,

and requesting the issue of a summons directed to that person to appear before the

court to show why he has not paid the sum which is outstanding.

41.

Complaint was laid before the Clerk to the Justices on the 9th September 2015 and

subsequently Summons were issued. The Summons sent to the defendant can be seen

(NELC5).

42.

The Summons states the amount outstanding of 424.00 and 60.00 Summons Costs,

equalling 484.00. It also made the defendant aware there would be a liability hearing

on the 2nd October 2015 at the Grimsby Magistrates Court.

43.

No Contact was received from the Defendant.

44.

A further payment of 91.00 was paid by the defendant on the 30th September 2015.

45.

Therefore the application for a liability order including costs was for 393.00.

46.

The defendant alleges that the recovery notices and subsequent Final Notice and

Summons have occurred die to misallocation of his payments.

47.

It is North East Lincolnshire Councils contention that there has been no misallocation

of payments in this case.

48.

A person who is indebted to another on two several accounts, may, on paying him

money, ascribe it to which account he pleases.And his election may either be

expressed, Or may be inferred from the circumstances of the transaction. But if

the payer does not. pay specifically on one account, the receiver may afterwards

appropriate the payment to the discharge of either of the accounts that he pleases.

And if he sue on each account, semble that he thereby declares his election, and the

Defendant cannot, by a subsequent notice of set-off, elect to which account he will

ascribe the payment.

Peters v Anderson 1814, 823 paragraph 1

49.

The defendant makes reference to the above case however it is noted that the

defendants quote from the Peters V Anderson case is paraphrased and does not

include the full description as set out in the original text. Original text of Peters and

Anderson can be seen as (NELC6)

50.

It clearly states that if the payer does not pay specifically The Northgate system is

set up as per the Peters V Anderson case. It asks for a specific payment is made so

that the allocation can be made correctly. If payment is made as per the statutory

instalment due, the payment will allocate to that instalment plan.

51.

This allocation system also helps if there are further debts owing on the account.

52.

If a person was to have current years bill of 100 per month and arrangement on a

previous years amount for 30 per month then as long as the Debtor makes the correct

payment of the 100.00 and 30.00 the amount will be allocated to the debts which

the Debtor makes his election by the expressed payments made.

53.

The fail-safe of this system is if the payments are not made as per the regulations a

Reminder notice is sent to the payee.

54.

At this point it would be reasonable, as it is the defendants liability, for him to contact

the Council and express his election that the payment be allocated differently.

55.

The defendant made no attempt to make his election after receiving notices in June

July and August and subsequently the Summons and as per Peters V Anderson the

receiver of the payment, North East Lincolnshire Council, appropriated the monies

paid.

56.

Further case law establishes that Northgate allocates unspecified payments correctly.

57.

The case of Peters V Anderson 1814 is one of the earliest cases that deals with the

appropriation of payments, further case laws sets somewhat of a precedent for the

appropriation of payments for creditor and debtors.

58.

The case of Devaynes V Noble 1816 merivale 529 (Claytons Case), it established the

basic rule of 'first-in, first-out'. In further terms payments are presumed to be

appropriated to debts in the order which the debts are incurred. If no election is made

the earliest debts are paid first (NELC7).

59.

It is the first item on the debit side of the account, that is discharged, or reduced, by

the first item on the credit side. Devaynes V Noble 1816 merivale 529 *608

60.

This point is further carried forward in the case of Cory Brothers and Company,

Limited Appellants; V The Owners of the Turkish Steamship "Mecca" Respondents.

The "Mecca" 1897 A.C. 286.(NELC8)

61.

When a debtor pays money on account to his creditor and makes no appropriation to

particular items, the creditor has the right of appropriation and may exercise the right

up to the last moment, by action or otherwise; Cory Brothers and Company, Limited

Appellants; V The Owners of the Turkish Steamship "Mecca" Respondents. The

"Mecca" 1897 A.C. 286

62.

Again it is clear that it is the creditor / payee that should make their election clear at

the point of making payment.

63.

In the case brought before you today the defendant had 3 months to make his election

clear however he did not.

64.

It is also noticeable that on the 16th October 2014 the defendant sent an email to the

Council with regards to expressing his election on a payment made to an earlier Bill

which due to not paying the specific amount was allocated to the earlier amount

outstanding. The email can be seen on as (NELC9).

65.

On that occasion the amount was allocated on the defendants request.

66.

This is also shown by the extract from the 'Bailiff Help' forum, 20th April 2013 to 21st

May 2013,(NELC10) clearly showing an awareness of the need to make an election

of payment .

67.

Further evidenced by 'Legalbeagle' post on 2nd October 2015 (NELC11). This shows

that the defendant is well aware of how the Northgate system works and that he is

aware that he needs to make his election if the payment made is not specifically as set

out in the statutory instalment scheme.

68.

The Council is aware that the defendant has taken matters further with regards to

disputing the 60.00 costs incurred from November 2012.

69.

Correspondence received from the defendant as of 20th November 2013 stated

that he had withdrawn his application for the Judicial review of the costs (NELC12)

70.

Given this the Council no longer held action in attempting to recover the outstanding

amount.

71.

Thus in October 2014 when the defendant made a non-specific payment the amount

was allocated to his costs until the defendant contacted the Council and made his

election clear.

72.

An appropriation of a payment cannot be inferred from an intention in the mind of the

debtor un-communicated to the creditor. It can only be inferred from circumstances

known to both parties. Leeson V Leeson 1936 K.B156 (NELC13).

73.

As of the letter from the Defendant regarding his withdrawal of the Judicial review

North East Lincolnshire Council had no further reason to believe that the costs were

being disputed and the allocation of unspecified amounts was made in accordance

with Peters V Anderson.

74.

It is on these authorities that North East Lincolnshire Council would state that the

monies, have, due to the defendants non-election or expression, been allocated

correctly and that North East Lincolnshire Council, have adhered to the Local

Government Finance Act 1992 and the Council Tax (Administration and

Enforcement) Regulations 1992 in issuing recovery notices and applying for a

Liability Order.

75.

This statement is true to the best of my knowledge and belief.

Signed:

On Behalf of North East Lincolnshire Council

Das könnte Ihnen auch gefallen

- Grimsby and Cleethorpes Magistrates' CourtDokument9 SeitenGrimsby and Cleethorpes Magistrates' CourtPrivate Prosecution Statement of EvidenceNoch keine Bewertungen

- Grounds of Appeal N161Dokument34 SeitenGrounds of Appeal N161LGOComplaintNoch keine Bewertungen

- Recovery of Taxes Under MRA ActDokument8 SeitenRecovery of Taxes Under MRA ActVidoushiNoch keine Bewertungen

- R Ima/ Ir: Schedule 16 - Termination and ExpiryDokument12 SeitenR Ima/ Ir: Schedule 16 - Termination and ExpiryRichard OsbandNoch keine Bewertungen

- PART IV Income TaxDokument9 SeitenPART IV Income TaxRahil SattarNoch keine Bewertungen

- Examination Proper:: Tax Law Review Mid-Term ExaminationDokument9 SeitenExamination Proper:: Tax Law Review Mid-Term ExaminationGRACENoch keine Bewertungen

- Grounds of AppealDokument12 SeitenGrounds of AppealIRTribunalNoch keine Bewertungen

- Cristina Olarita Tax Cases 105-113Dokument6 SeitenCristina Olarita Tax Cases 105-113Maraipol Trading Corp.Noch keine Bewertungen

- KlebeDokument13 SeitenKlebepvtNoch keine Bewertungen

- Lesson 16. Tax Appeals ProcedureDokument15 SeitenLesson 16. Tax Appeals ProcedureTissie MkumbadzalaNoch keine Bewertungen

- Penalty & Appeal (Chapter 19)Dokument13 SeitenPenalty & Appeal (Chapter 19)Fahim Shahriar MozumderNoch keine Bewertungen

- Assessment and Payment of Tax, Interest and Penalties and Making RefundsDokument9 SeitenAssessment and Payment of Tax, Interest and Penalties and Making RefundsMd Nazir HussainNoch keine Bewertungen

- 0 Interpretation Note 15Dokument6 Seiten0 Interpretation Note 15pb41Noch keine Bewertungen

- The County Government of Kiambu Finance Bill.Dokument71 SeitenThe County Government of Kiambu Finance Bill.Kiambu County Government -Kenya.Noch keine Bewertungen

- Answer To Assignment A&bDokument3 SeitenAnswer To Assignment A&bAmbe YanickNoch keine Bewertungen

- VAT Refund ProcessDokument2 SeitenVAT Refund Processamfipolitis100% (1)

- Chapter 3Dokument61 SeitenChapter 3Allaiza Mhel Arcenal EusebioNoch keine Bewertungen

- Summary Notes Topic 3Dokument2 SeitenSummary Notes Topic 3Natasya ZulkifliNoch keine Bewertungen

- Judgment MUHAMMAD MUNIR PERACHA, J. - The Petitioners Were Served With Show-Cause NoticeDokument6 SeitenJudgment MUHAMMAD MUNIR PERACHA, J. - The Petitioners Were Served With Show-Cause NoticeMohammad AhmadNoch keine Bewertungen

- Digests 2Dokument17 SeitenDigests 2Henry LNoch keine Bewertungen

- 21 Allied Banking Corp. v. Quezon City20180322-1159-1qhqio3Dokument4 Seiten21 Allied Banking Corp. v. Quezon City20180322-1159-1qhqio3Sheena MarieNoch keine Bewertungen

- Administrative Guidelines On The Waiver of Penalty and Interest UPDATEDDokument8 SeitenAdministrative Guidelines On The Waiver of Penalty and Interest UPDATEDKomla Atsu TachieNoch keine Bewertungen

- Cta 2D CV 08551 M 2016mar02 AssDokument10 SeitenCta 2D CV 08551 M 2016mar02 AssKathrine Chin LuNoch keine Bewertungen

- Section 137 To 146aDokument11 SeitenSection 137 To 146aSher DilNoch keine Bewertungen

- Assessment DueprocessDokument2 SeitenAssessment DueprocessRester NonatoNoch keine Bewertungen

- Central Azucarera vs. CA, 20 SCRA 344Dokument7 SeitenCentral Azucarera vs. CA, 20 SCRA 344Han SamNoch keine Bewertungen

- HB 4213Dokument5 SeitenHB 4213attilzmaxNoch keine Bewertungen

- Penal Provisions STDokument8 SeitenPenal Provisions STKunalKumarNoch keine Bewertungen

- Income Tax ProjectDokument22 SeitenIncome Tax ProjectGargi UpadhyayaNoch keine Bewertungen

- The Punjab Luxury House Tax Rules, 2014.docDokument11 SeitenThe Punjab Luxury House Tax Rules, 2014.docFaisal FarukiNoch keine Bewertungen

- Bpo AgreementDokument19 SeitenBpo AgreementAnkur NigamNoch keine Bewertungen

- FILE 20200812 175916 Annex B en PDFDokument19 SeitenFILE 20200812 175916 Annex B en PDFThu Tuyen ThaiNoch keine Bewertungen

- Tax - Republic Bank VS CtaDokument2 SeitenTax - Republic Bank VS CtaKath LimNoch keine Bewertungen

- G.R. No. 154126Dokument3 SeitenG.R. No. 154126GraceNoch keine Bewertungen

- 199302-2016-FSM Cinemas Inc. v. Commissioner of Internal20230822-11-Wx3p94Dokument7 Seiten199302-2016-FSM Cinemas Inc. v. Commissioner of Internal20230822-11-Wx3p94bjjwx2h66sNoch keine Bewertungen

- Secretary of Finance Vs Illarde and CabalunaDokument8 SeitenSecretary of Finance Vs Illarde and Cabalunajetzon2022Noch keine Bewertungen

- Taxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationDokument4 SeitenTaxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationKristen StewartNoch keine Bewertungen

- HTML File ProcessDokument10 SeitenHTML File ProcessSuresh SharmaNoch keine Bewertungen

- 65 Luxurty Tax Rule 2009Dokument10 Seiten65 Luxurty Tax Rule 2009shanuNoch keine Bewertungen

- Framework Service ContractDokument20 SeitenFramework Service ContractrpyyeungNoch keine Bewertungen

- Direct Tax Vivad Se Vishwas Scheme 2020 - Detailed Analysis - Taxguru - inDokument12 SeitenDirect Tax Vivad Se Vishwas Scheme 2020 - Detailed Analysis - Taxguru - inrkndroidNoch keine Bewertungen

- The Value Added Tax and Supplementary Duty Rules, 2016Dokument61 SeitenThe Value Added Tax and Supplementary Duty Rules, 2016Naimul KaderNoch keine Bewertungen

- MitsubishiDokument7 SeitenMitsubishiCris Margot LuyabenNoch keine Bewertungen

- Proclamation No 136 2008 Excise Tax Amendment - 2Dokument2 SeitenProclamation No 136 2008 Excise Tax Amendment - 2tatekNoch keine Bewertungen

- Assessment Objection and AppealsDokument13 SeitenAssessment Objection and AppealsisackoelleNoch keine Bewertungen

- Docket No. 39 July 13, 2009: MotionDokument6 SeitenDocket No. 39 July 13, 2009: MotionChapter 11 DocketsNoch keine Bewertungen

- Council Tax Charges Connected With DistressDokument2 SeitenCouncil Tax Charges Connected With Distressphoebe_62002239Noch keine Bewertungen

- Income Tax Notification No - SO858 25-03-2009Dokument25 SeitenIncome Tax Notification No - SO858 25-03-2009Sanjay AjudiaNoch keine Bewertungen

- Tax 1 Valencia Solman For Chap 2Dokument12 SeitenTax 1 Valencia Solman For Chap 2Yeovil Pansacala100% (1)

- Agenda Item 2 (2) - ITC RulesDokument9 SeitenAgenda Item 2 (2) - ITC Rulesfintech ConsultancyNoch keine Bewertungen

- Samar-I Electric Cooperative vs. CirDokument2 SeitenSamar-I Electric Cooperative vs. CirRaquel DoqueniaNoch keine Bewertungen

- 7 Allied BankingDokument11 Seiten7 Allied BankingGracia SullanoNoch keine Bewertungen

- 2) CIR Vs COVANTA ENERGY - J. Reyes J Jr.Dokument6 Seiten2) CIR Vs COVANTA ENERGY - J. Reyes J Jr.Stalin LeningradNoch keine Bewertungen

- IEC 1956: General SpecificationsDokument4 SeitenIEC 1956: General SpecificationsdhananjaybaraikNoch keine Bewertungen

- Deutsche Bank V CIR (Digest)Dokument2 SeitenDeutsche Bank V CIR (Digest)Cecille Mangaser67% (9)

- Kuwait IncomeTax Decree PDFDokument8 SeitenKuwait IncomeTax Decree PDFChristian D. Orbe100% (1)

- 3 TdsDokument14 Seiten3 TdssugasenthilNoch keine Bewertungen

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersVon EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNoch keine Bewertungen

- Misconduct in Public Office 24 Feb 2017Dokument25 SeitenMisconduct in Public Office 24 Feb 2017GotnitNoch keine Bewertungen

- PHSO Complaint 13 May 2017 - RedactDokument39 SeitenPHSO Complaint 13 May 2017 - RedactParliamentary Ombudsman (PHSO) TravestyNoch keine Bewertungen

- Appeal CO 461-15 and Associated PapersDokument104 SeitenAppeal CO 461-15 and Associated PapersGotnitNoch keine Bewertungen

- Letter Before Action 14 June 2019 - RDokument65 SeitenLetter Before Action 14 June 2019 - RParliamentary Ombudsman (PHSO) TravestyNoch keine Bewertungen

- Oxby 10 March 2017 RedactDokument2 SeitenOxby 10 March 2017 RedactGotnitNoch keine Bewertungen

- IOPC Appeal Ref 2022 - 169555 RedactDokument13 SeitenIOPC Appeal Ref 2022 - 169555 RedactGotnitNoch keine Bewertungen

- 18 August IPCC Response - RedactDokument1 Seite18 August IPCC Response - RedactGotnitNoch keine Bewertungen

- Case Stated Final 18 Dec 13 Received 3 Jan 17Dokument5 SeitenCase Stated Final 18 Dec 13 Received 3 Jan 17GotnitNoch keine Bewertungen

- Case Stated Signed Received 16 Jan 17Dokument5 SeitenCase Stated Signed Received 16 Jan 17GotnitNoch keine Bewertungen

- IPCC 4 October 16 Outcome RedactDokument3 SeitenIPCC 4 October 16 Outcome RedactGotnitNoch keine Bewertungen

- Police Response 19 Nov 2016 RedactDokument1 SeitePolice Response 19 Nov 2016 RedactGotnitNoch keine Bewertungen

- Action Fraud Response - RedactDokument1 SeiteAction Fraud Response - RedactGotnitNoch keine Bewertungen

- Case Stated Cover Letter Date 13 Jan 17Dokument1 SeiteCase Stated Cover Letter Date 13 Jan 17GotnitNoch keine Bewertungen

- Case Stated Freedom of Information RedactDokument35 SeitenCase Stated Freedom of Information RedactGotnitNoch keine Bewertungen

- Investigating Officers Report JACO RedactDokument5 SeitenInvestigating Officers Report JACO RedactGotnitNoch keine Bewertungen

- Misconduct in Public Office 10 Aug 2016Dokument62 SeitenMisconduct in Public Office 10 Aug 2016GotnitNoch keine Bewertungen

- 11 August 2016 Oxby - RedactDokument1 Seite11 August 2016 Oxby - RedactGotnitNoch keine Bewertungen

- CO 150461 Local Resolution 13 Jan 16 RedactDokument2 SeitenCO 150461 Local Resolution 13 Jan 16 RedactGotnitNoch keine Bewertungen

- Police Complaint - 16 June 2016 RedactDokument6 SeitenPolice Complaint - 16 June 2016 RedactGotnitNoch keine Bewertungen

- 1 Aug 2016 Complaint CC Email and Attach - RedactDokument4 Seiten1 Aug 2016 Complaint CC Email and Attach - RedactGotnitNoch keine Bewertungen

- Provisional Conduct Ombudsman JACO Report 23 May 16 RedactDokument3 SeitenProvisional Conduct Ombudsman JACO Report 23 May 16 RedactGotnitNoch keine Bewertungen

- Appeal To Crown Court Refusal RedactDokument1 SeiteAppeal To Crown Court Refusal RedactGotnitNoch keine Bewertungen

- Conduct Ombudsman Jaco Report 29 March 16 RedactDokument6 SeitenConduct Ombudsman Jaco Report 29 March 16 RedactGotnitNoch keine Bewertungen

- Police & Crime Reply 10 August 2016 RedactDokument2 SeitenPolice & Crime Reply 10 August 2016 RedactGotnitNoch keine Bewertungen

- Appeal Outcome 8 June 16 RedactDokument6 SeitenAppeal Outcome 8 June 16 RedactGotnitNoch keine Bewertungen

- Section 1 Magistrates Court Complaint - Draft RedactDokument5 SeitenSection 1 Magistrates Court Complaint - Draft RedactGotnitNoch keine Bewertungen

- Appeal To Crown Court RedactDokument8 SeitenAppeal To Crown Court RedactGotnitNoch keine Bewertungen

- NELC Costs - 14 Jan 16 RedactDokument5 SeitenNELC Costs - 14 Jan 16 RedactGotnitNoch keine Bewertungen

- Action Fraud Crime Document 1 - RedactDokument4 SeitenAction Fraud Crime Document 1 - RedactGotnitNoch keine Bewertungen

- Appeal Outcome of Local Resolution - Perjury RedactDokument11 SeitenAppeal Outcome of Local Resolution - Perjury RedactGotnitNoch keine Bewertungen

- Tarra Dixit Kumar - Offer Letter - ACP - FSDDokument6 SeitenTarra Dixit Kumar - Offer Letter - ACP - FSDDixit KumarNoch keine Bewertungen

- Xplore (Pre-Post) - XP: MD Mahmud Hasan Baliadangi Thakurgaon Baliadangi 5140 ThakurgaonDokument54 SeitenXplore (Pre-Post) - XP: MD Mahmud Hasan Baliadangi Thakurgaon Baliadangi 5140 Thakurgaonmst taiyabaNoch keine Bewertungen

- Automatic Receipts and RemittanceDokument43 SeitenAutomatic Receipts and Remittancemymle1Noch keine Bewertungen

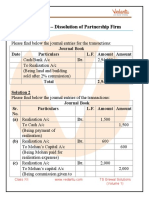

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDokument17 SeitenTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (1)

- 12-09-2012Dokument32 Seiten12-09-2012El Rinos100% (5)

- Law 2Dokument32 SeitenLaw 2Sisay HailegebriealNoch keine Bewertungen

- Role of It in Knowledge ManagementDokument11 SeitenRole of It in Knowledge ManagementShaik Mohamed ThafreezNoch keine Bewertungen

- MyTW Bill 900072184274 28 09 2023Dokument4 SeitenMyTW Bill 900072184274 28 09 20239c8py69t2q100% (2)

- Business Studies Scheme of Work For Junior Secondary School JSS 3Dokument8 SeitenBusiness Studies Scheme of Work For Junior Secondary School JSS 3mohammednurali4Noch keine Bewertungen

- ACTIVITYDokument5 SeitenACTIVITYGabz FerrenNoch keine Bewertungen

- Recuerdo Vs PeopleDokument9 SeitenRecuerdo Vs PeopleGlorious El DomineNoch keine Bewertungen

- Example Open Items Via Direct InputDokument8 SeitenExample Open Items Via Direct InputSri RamNoch keine Bewertungen

- Customer Perception About Product Services of Canara BankDokument62 SeitenCustomer Perception About Product Services of Canara Bankprashun ChoudharyNoch keine Bewertungen

- DJB Bill Payment OptionsDokument1 SeiteDJB Bill Payment Options44abcNoch keine Bewertungen

- A Beginner's Guide To Starting An Import - Export Business With ChinaDokument8 SeitenA Beginner's Guide To Starting An Import - Export Business With ChinaVincent SerNoch keine Bewertungen

- 535 - I, BLDH No 4, Govardhan Nagar, Poisur Gymkhana Road, Opp Poisar Gymkhana, Kandivali (W), Mumbai, 400067Dokument2 Seiten535 - I, BLDH No 4, Govardhan Nagar, Poisur Gymkhana Road, Opp Poisar Gymkhana, Kandivali (W), Mumbai, 400067chetankvoraNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDokument2 SeitenCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaskiezer agrudaNoch keine Bewertungen

- Fee Structure For 2023 24 RenewalsDokument2 SeitenFee Structure For 2023 24 RenewalsshanmukhsagarNoch keine Bewertungen

- Dr. Filemon C. Aguilar Memorial College of Las Pinas: Golden Gate Subdivision, Talon III, Las Pinas, 1747 Metro ManilaDokument18 SeitenDr. Filemon C. Aguilar Memorial College of Las Pinas: Golden Gate Subdivision, Talon III, Las Pinas, 1747 Metro ManilaOliver AbordoNoch keine Bewertungen

- Taena Eto Na Ang SagotDokument7 SeitenTaena Eto Na Ang SagotGerald Noveda RomanNoch keine Bewertungen

- Taxation Sammary Ranjan SirDokument76 SeitenTaxation Sammary Ranjan SirWahid100% (2)

- Exercise-1 Merchandising Melanie-RodilDokument13 SeitenExercise-1 Merchandising Melanie-RodilShiela RengelNoch keine Bewertungen

- BTLPDokument282 SeitenBTLPBijay PoudelNoch keine Bewertungen

- Summit BankDokument53 SeitenSummit BankJaved Iqbal50% (2)

- Monopoly Money: The Effect of Payment Coupling and Form On Spending BehaviorDokument13 SeitenMonopoly Money: The Effect of Payment Coupling and Form On Spending BehaviorpelelemanNoch keine Bewertungen

- Protocol and Command Manual - PanamaDokument73 SeitenProtocol and Command Manual - PanamaRoman Vielma JuniorNoch keine Bewertungen

- DefintionsDokument2 SeitenDefintionsAdam EssamNoch keine Bewertungen

- Central Public Works Account CODE FORMSDokument243 SeitenCentral Public Works Account CODE FORMSbharanivldv978% (23)

- UBL AMEEN DRIVE (Diminishing Musharakah) - Tentative Payment ScheduleDokument1 SeiteUBL AMEEN DRIVE (Diminishing Musharakah) - Tentative Payment ScheduleRandom videos100% (1)

- Problem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer ADokument37 SeitenProblem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer AAldrin Lozano87% (15)