Beruflich Dokumente

Kultur Dokumente

Investment Management, AIU

Hochgeladen von

joseCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Investment Management, AIU

Hochgeladen von

joseCopyright:

Verfügbare Formate

Investment Management

Final Research Paper

06/04/2015

UD35131BEC43705

Jos Antonio Gil Snchez

Investment Management

Mutual Funds Project

Many people invest their life savings with the desire of increasing and establishing

better strategies in developing their objectives of life. The beginning of XXI century is bringing

anxiety between those who are saving part of their monthly income, due to an economic

recession that is affecting almost all countries in the world. Sadly, they have discovered that

saving accounts or CD (most common investments) are not helping them to build their life

objectives and that those lower risk investments wont convert their savings in bigger profits.

Even if people have literacy in financial education, there is a difficulty (in part based on

the lack of liquidity and the amount of capital) in getting into either money market or derivate

markets. Mutual funds are the answer to those investors, who want to build wealth and

security, who want to give away to charity, save for college education, or develop a stronger

retirement plan.

The aim of this paper is to develop a subjective and personal approach to invest

savings in mutual funds. The deliverables that will come after the investing will be those that

will create physically the objectives stated and desired. The intention is to utilize this

information as the base to start accomplishing my own real goals in life.

It was common listen my parents talking about the importance of saving money and

hard work. I started working to pay my undergraduate education, and also learn how to

manage a strict budget by saving 30% of monthly income. Later on time, a joint venture with

other friends made me invest all my savings into a new business, a bar. After a year struggling

to increase the revenue and get the break-even point, the team had to close operations. I lost

everything, and I had to start saving again. Without feeling annoyed or depressed because of

the drawback, I started again my savings with more responsibility, persistence and pledge. The

lesson, indeed, was already learned, never put all your eggs in the same basket.

Due to this undesired behavior with the big loss, I started thinking how my mindset with

investments was. Some personality tests (business personality, investor personality and

success personality test) started giving my information and description of how well prepared (or

not) I was to enter this enormous and important world of finance. Refer to Appendix 1 for

detailed information about Personality Tests. These tests confirmed information about me that I

already knew with experience. Discipline, planning and organization are high. Right now my

risk aversion present low average due to the lack of experience in investments (and the bad

past experience in business). Regardless this, with time this aversion will be eliminated,

throughout the knowledge acquired in RIT SCB while pursuing the MSF. Because the

immediate gratification is in the lowest grade, It is highly possible that I pursue sooner my

goals; I am of those who prefer invest and then enjoy. This is very important to assure a

sufficient capital amount to enjoy greater results while taking higher rate of returns (and higher

risks). The low emotional vulnerability allows me to stay calm if there is a bear market or a

collapse in economy; my age could allow me to start again with the same strength and more

determination. Also the tests describe me as a person that stays a lot under bear market or bad

economic stages. They state this arguing that I may have fear of selling stocks that will

Investment Management

recover and earn again, as in the past. As this could be possible, regarding that I use to think

all can get better with time, this inconvenience will be eliminated with the knowledge and

practice in this masters, and I dont consider it information to be aware of. With other Financial

Personality Test, the results were obvious, I am hoarder and amasser, which means that I am

always organized, and I work prioritizing goals (View Appendix 2 for more detailed information).

After getting more knowledge how my personality works with investments, business

and finance in general, I started watching my main important goals, which I really want to

accomplish in the time stated. These goals are divided in short term, medium term and long

term basis. Refer to Appendix 3 for a detailed table about these goals.

In the short term (after graduation in 2013, and until 2018) I pretend having different

type of savings, due primarily by work (employee) the fundraising projects and the informal

investments of the savings. The most important is called Business Opportunity. I define this

saving as one liquid investment I would use in case of any chance in investing in a new type of

business or economic situation. There are other short term goals, and are necessary to start

living all by myself (buying a 1 bedroom apartment and a new car). These goals, even I am

writing them in this paper, I dont consider them important goals since I must pursuit them all

after college graduation (its mandatory).

The medium term is very specific. My general goal here is semiretirement. While

retirement is a very familiar word, not everybody gets retired as they wanted to. Because

Retirement Plans (in my country) started in the beginning of 2000s my parent dont have a

high sum saved in retirement plan accounts, and now they also have the constraint of age,

against them. For that, I am planning to help them retire confortable, with my own savings.

In my case, my semi-retirement will consist in paying the monthly bills (electricity,

water, cellphone, cable, gas, gym, other). This will allow me feel more secure about the

present and have more time managing my own portfolio and developing better the dreams I

want to accomplish, having the most profitable Charity Organization in my country.

In the long run, my goals will have a range of different choices. Because raising a kid in

US is approximately $500,000-$650,000 (according to BabyCenter.com, College Board and

Department of Agriculture of USA), certain measures need to be defined before even getting

married. For each kid (pretending to have 3 kids) my intention is to have 1 apartment that will

cover their expenditures in college. Also, paying University Tuition will increase a lot this

investment. Because the house is the dream of every family, my goal for this is investing in

one house that will pay the loan of the house where we pretend to live. Then, acquiring the

first house and then lease / rent the house. With this monthly payment we will then buy our

house with a bank loan. Total income expected is $90,000.00

Investment Management

My personal full retirement will come approximately in 20-25 years. My wife and my

retirement will come just before my kids finish school. The intention is work harder in our first

years of life, and then enjoying them while they are still in home. Monthly income expected is

$2,000.00.

The last goal is for the auto maintenance of my Fundraising Organization. Due to

nonstable monthly revenue of the projects Dulces por una Causa

(www.dulcesporunacausa.org) and Una Vida de Color. Monthly income expected is

$2,000.00

But it is going to be uphill investing in different type of securities and derivates with a

restricted amount of capital collected. The total amount for investment is $100,000, and

divided by all the different types of securities, would be 10-25% for each one. This little capital

to invest wont be enough to have a diversified portfolio. We could, for instance, invest all of it

in just 1 or 2 different types of investments, but I will be again trying to beat the system. The

theory explains clearly that risk decreases as increases the diversification of the entire

portfolio. Since XIX Century the market is enjoying of a diversified portfolio with lower risks

than their individual investments. They became famous in 1980s. Called mutual funds, they

allow a group of investors to get together combining their cash and investing it in different

type of derivates or securities. My decision in using mutual funds is also based in the facility to

get in or out (buying or selling) in comparison with the other types of investments as bonds or

stocks. Because I am middle class student and employee, I wont have time to manage day to

day all the investments, but the mutual fund will manage it for me. Those are sufficient

reasons to find out about this market and investing here my $100,000 capital amount.

For all of the different investments in mutual funds companies, certain general criteria is

observer:

No selection of load funds.

Diversification of Growth in Aggressive, Moderate and Conservative.

Discard in using international mutual funds.

No consideration of inflation (nominal tax rates) and other Law restrictions.

No consideration legal status (inmigrant)

Starting investment in mutual funds: $100,000.00

No tax bracket (in the case the earning goes to a Owned Company.

No consideration of possible extra foreign taxes.

Starting with a lump-sum investment, but alter it will be used for a dollar-cost averaging

(buying when are down and selling up).

Investment Management

Selection of one of the top ranked Mutual Funds. Reason: The media is covering them and

analyzing their moves. They cannot take the chance of mistake.

Try to have expenses less than 1% per year.

Expenses less than 0.75

Non currency losses

According to Michael D. Hirsch, in his books Multifund Investing express the

importance of diversification and the importance of a balance portfolio. Appendix 5 is

presenting the Original description of the asset allocation. Financial Advisors in this book or

others like Mutual Funds, for the Utterly Confused strongly advice to divide the portfolio

according to the personality detail and main goals. In Appendix 6 we can observe how we will

divide our complete capital of investment of $100,000.00 (Appendix 6). Of the amount

specified, 60% will be destined to growth, 30% to income, and only 10% for liquid. The reason

is because my youth allows me to work harder and obtain higher responsibility jobs, it is now

when I have to invest in growth. The 10% of liquid will be used for the retirement of my

parents. In that way, I will let 30,000 being utilized in Income.

After deciding the asset allocation in the mutual funds, we need to start continuing

selecting and making decisions, now with the sector allocation. The aggressive growth will

help het the best of food mutual fund decisions, and also to have higher probabilities of higher

rate of returns. In that case, the risk decreases, but also decreases the rate of return,

(Conservative Growth with 25%, Equity Income within 20%, Fixed Income with 10% and Money

market just with 10%. The reason for defragmenting is due to the objectives (the intention of

having a Charity Organization in the midterm that could survive without external donations;

the retirement in 5 years (maybe less than 10) of my parents, and my own personal objectives

of a vehicle and a small apartment (both with value of 60,000 USD). Appendixes 7 and 8 will

show the complete diversification of the Personal Portfolio.

Investment Management

Table 1: Presents the Complete Diversification of the Portfolio.

AOTCX: Allianz Funds, Agic Emerging Markets Opportunities Fund

With a NAV of 25.20 and a YTD Total Return od 18.98, this fund in emerging markets seems

fairly competitive while not going in a long run. The recommendations are not to use more

than 3 years, because wont get competitive against the market. With a Beta of 0.99 is fairly

enough that will develop with the economy. But the economy has not presented any welfare,

and AOTCX has grown this 2012 from 21.11 to 25.19, which means that is not accurate

compare Beta. With 3 year investment, and then change to another in emerging markets.

PPCAX:

All of the investments is allocated in stocks in the American market. The rate of return, even

until 3 years, is 18%. As I stated in AOTCX, it would be inconsistent maintain it after 3 years,

cetirus paribus.

The NAV is 14.49. This company of small growth could be useful to our interests.

VCDAX:

It has a high return in comparison with others within its category. The NAV is almost 40

(39.50). The Yield is 1.1% which means its selling after.

Investment Management

FAZZX:

Is an income fund, non taxable. The Yield is 8.78. The expense ratio is below 1% which is

highly recommended. In certifications is above the average. The mean is 7.04 (share) and The

SD is 4.04, implying that even though could increase to 11 it could also decrease.

EVAZX:

With a NAV of 11.09, it has increasing linearly since 2003. Its a muny, which gives certainity

(recall the graph) more security but less rate of return, but constant in the time. With other

fund bonds they are making average. Born in 2008, the Rate of return of this is fairly enough in

comparison with the market, and present average.

At the end it doesnt matter which company you choose for investing your funds.

Mutual Funds is the best decision used since 70s for investing in any capital regulated market

without having enough funds that could allow that. It responds to the EMH rule, and you are

working under the same conditions that other markets, information is available for everyone.

The only problem is when you choose international investing. There are some markets that

are not regulated as USA, UK or other developed Nation market. For instance, deciding in

investing in one non so regulated market could get me in trouble. Thats why I have made the

best decision since the beginning, organize my capital (100,000) according my expectations.

In my opinion, it does not matter if there are other mutual funds with higher rate of

returns and less risky. My decision is based in my personality test, in what I can handle and in

the trust that small mutual fund firms will develop better that higher mutual funds firm. In this

case, is not my logic who worked to make that decision, but my emotions. I do believe that

small firms work with better efficiency due to their desire in converting one day in one of the

big tier, or USA or the world.

Before finishing, I would highly recommend to understand the Table 1. Charts talk

more than words. The only thing missing in this document is the taxes that I will pay regarding

I am an international student. But I will start looking forward this investing (and obviously, the

amount).

Investment Management

Investment Management

Appendix 1

Investor Personality Test

PERSONALITY FACTORS

Conscientiousness : High

Emotionality : Very Low

Extraversion : High

Openness : Very High

Agreeableness : Above Average

BIAS REPORT

Confidence Biases

Overconfidence : Below Average

Over-Optimism : Above Average

Risk-taking Biases

Risk Aversion : Very Low

Emotional Vulnerability : Low

Impulse-control

Self-discipline : High

Immediate Gratification : Below Average

Excitement-seeking : Low

Intellectualism

Intellectualism : Very High

Herding

Trend-following : Above Average

Investor Personality Test

Investment Management

PERSONALITY FACTORS

Conscientiousness : High

Conscientiousness describes your relative ability to plan and organize towards

achieving goals and to exercise self-control.

You scored in the HIGH range for conscientiousness. Intelligent activity

involves contemplation of long-range goals, organizing and planning routes to

these goals, and persisting toward one's goals in the face of short-lived

impulses to the contrary. You can achieve high levels of success through

purposeful planning and persistence. You are likely to be positively regarded

by others as intelligent and reliable. On the down side, some people may see

you as rigid or perfectionistic.

Emotionality : Very Low

Emotionality is characterized by stress-sensitivity and more frequent

experiences of negative emotions than others.

You scored in the LOW range on emotionality. You are relatively more calm,

emotionally stable, and free from persistent negative feelings when compared

to high scorers. Freedom from negative feelings does not mean that you

experience more positive feelings. You may be reckless in dangerous

situations and take more risks than others (sometimes without knowing that

you are doing so). In general you are probably secure, hardy, and relaxed even

under stressful conditions.

Extraversion : High

Extraversion is characterized by a desire to socialize and a tendency to

optimism. Extraverts derive energy from interactions with others, while

10

Investment Management

introverts' interests are fueled by introspection.

You scored in the HIGH range on extraversion. You probably enjoy being with

people, are full of energy, and often experience positive emotions. In groups

you are likely to talk, assert yourself, and draw attention. In general you are

outgoing, active, and joyful.

Openness : Very High

Openness to new experiences describes a willingness to experiment with

tradition, to seek out new experiences, and to think broadly and abstractly.

You scored in the HIGH range on openness. You are intellectually curious and

tend to be, compared to closed people, more aware of your feelings. You

probably tend to think and act in individualistic and nonconforming ways. Open

and closed styles of thinking are useful in different environments. An open

intellectual style may serve you well as a psychologist, professor or investor.

Research has shown that closed thinking is related to superior job performance

in police work, sales, service occupations, and short-term trading.

Agreeableness : Above Average

Agreeableness reflects a concern with cooperation and social harmony.

You scored in the NEAR AVERAGE range on agreeableness. You are likely to

balance a healthy skepticism about others' motives with a desire to cooperate

and get along. You are willing to extend yourself for others and compromise,

but you may prefer that they first demonstrate good will.

BIAS REPORT

Confidence Biases

Overconfidence : Below Average

"Mutual fund managers, analysts, and business executives at a conference

11

Investment Management

were asked to write down how much money they would have at retirement and

how much the average person in the room would have. The average figures

were $5 million and $2.6 million, respectively. The professor who asked the

question said that, regardless of the audience, the ratio is always

approximately 2:1."

~ Whitney Tilson (Fool.com)

Overconfidence refers to the tendency to see oneself and one's abilities as

better than they actually are. Specifically, overconfident investors misinterpret

the accuracy and importance of their information (what they know) and

overestimate their skill in analyzing it. Additionally, overconfidence results in

a tendency to underestimate investment risk and to have higher turnover.

Men are more likely to be overconfident than women, and young adults are

more likely to be overconfident than older adults. Ironically, "experts" are more

overconfident than lay-people, as they often overweigh the predictive power of

their own models. Additionally, more difficult decisions (e.g. forecasting the

market) inspire more overconfidence in forecasters.

"Who has confidence in himself will gain the confidence of others."

~ Leib Lazarow

Overconfidence can be destructive in investing, where a belief in one's

superiority does not translate into bigger profits. However, overconfident

financial planners have been found to attract more business than lessconfident rivals, even while having lower overall performance than their

colleagues. In many business endeavors, overconfidence both attracts more

clients and leads to greater overall risk-taking. However, in investing,

overconfidence can lead to long-term underperformance if it is not balanced

by experience.

HIGH SCORERS:

"Before you attempt to beat the odds, be sure you could survive the odds beating you."

~ Larry Kersten (author and sociologist)

If you are a high scorer, to balance your potential for overconfidence in investing, you

should:

1. Practice humility. No matter how well you have been investing, you can suffer

losses if you approach the markets with arrogance about past profits or

entitlement to new ones. Every day consider the possible market risks, and

actively seek out new ones.

2. Think before you leap. If you have a problem acting too quickly on your

private information, then deliberately pause for a brief cooling-off period

between having a strong opinion about the market and executing it.

12

Investment Management

Remember, there will always be more opportunities.

3. After a string of wins, be careful of feeling that you're invincible. It's usual,

after a series of wins, to feel "on top of the world." However, beware of taking

on excessive risk or leverage at these times. Overconfident hubris is the result

of a string of wins, and it nearly always leads to big losses.

4. Engage in a more thorough evaluation of your investment plans. In particular,

remember to look at historical parallels and to perform adequate historical

analysis of your investment ideas.

LOW SCORERS:

If you are a low scorer, you are more likely to be realistic about your investment

knowledge and expected returns. However, you may be susceptible to the following if

you are underconfident (In the very low range):

1. Underconfident investors may be too afraid of potential losses to pursue

opportunities. To combat underconfidence, list and be grateful for your

accomplishments. Remind yourself, with evidence, that you are capable and

competent. Sometimes underconfidence is a real result of knowing less than

others about investing. In that case, be sure to gain the appropriate education

and experience before taking risk.

2. Some underconfident investors are hyperaware of risks. In this case, you

should review historical investment information and notice if you are

overweighting negatives and overlooking positives. Your challenge is to

develop a realistic appraisal of risks and your ability to handle them. It is

possible that you have a greater ability to manage risk than you believe.

Over-Optimism : Above Average

"For myself I am an optimist - it does not seem to be much use being anything

else."

~ Sir Winston Churchill, 1954.

Optimism refers to the rose-colored lenses through which high-scorers view

the world. Optimism is associated with "confidence" biases because many

people who are overly optimistic overestimate their chances of success (as in

overconfidence). Yet optimistic people do not typically take excessive risks.

They are likely to take calculated, moderate risks. In fact, optimistic people

would not want to risk losing a sum of money large enough to depress their

13

Investment Management

mood.

Optimistic people often avoid negative information and seek out evidence

confirming their positive outlook. This search for positive confirmation is a type

of denial, On the flip-side of optimism is pessimism, which characterizes lowscorers.

As with the other confidence "biases," optimism benefits businesspeople,

politicians, and other professionals whose ability to attract business often

depends on their attitude. However, in the financial markets, excessive

optimism can lead to superficial analysis and denial of important, negative

evidence. One potential result of over-optimism is not saving adequately for

retirement. One financial planner said: "It's the ornery, suspicious people who

save the most for retirement. The happy ones just figure everything will be

okay, and when they near retirement, they come to me, and I have to help

them ratchet down their expectations."

The optimistic investor may find himself holding excessive risk in his portfolio

while denying evidence of growing dangers. Many optimistic investors who

believed in the "New Economy" and the outstanding growth potential of internet

stocks found themselves over-exposed to the volatile technology sector in late

2000 and 2001. It was common to hear over-optimistic pundits urging investors

to stay the course (or "dollar-cost average") in their technology stock

investments in late 2000 and 2001.

Optimistic people tend to be resilient. Additionally, optimistic people often

believe that "everything is going to work out for the best," which fosters

energetic activity and success in many areas of life.

"For myself I am an optimist - it does not seem to be much use being anything

else."

~ Sir Winston Churchill, 1954.

HIGH SCORERS:

If you are a high scorer, you are optimistic. You tend to see the glass as "half-full,"

and you generally see a positive future ahead for you and the world. Your optimism is,

in general, a great gift. However, in your investing, you should be careful:

1. Don't believe the hype. You are more susceptible to believing a good story.

Remember, a good company does not make a good stock. Only invest when

you can look through the buzz at the underlying fundamental data.

2. Most investors stop paying attention to risks when things are going well.

Because of your higher level of optimism, you are more susceptible to ignoring

investment risks during winning streaks than others. Be sure to seriously

investigate the potential risks of your investments as often as appropriate.

14

Investment Management

3. Budget extra money. Save more than you think you'll need for business

projects and retirement. Youre likely to underestimate the money you'll need in

retirement, and medical studies show that you're likely to live longer than

pessimists.

LOW SCORERS:

"My pessimism extends to the point of even suspecting the sincerity of other

pessimists."

~ Jean Rostand (1894 - 1977)

If you are low scorer, you are generally pessimistic. The following pointers may help

improve your peace-of-mind and profitability:

1. Because of your extra attention to negative details, you may avoid investing

when you perceive signs of danger, regardless of the opportunities that are

present. Try to maintain an awareness of your negative emotions. When you

are more negative, it may actually be a good time to look for opportunities and

to take some risk. Be aware of this paradox, and consider using a journal to

document your mood, the events that affect your mood, and your resulting

mood-related decisions, every day.

2. You may take losses personally. After a series of losses, you may become

excessively pessimistic and risk averse. Be aware of these tendencies. When

you feel like selling out your riskier positions, revisit your plan. Be sure to

review your strategy's historical performance to boost your long-term

confidence.

3. Avoid checking your investment performance, except at predefined intervals.

Frequent checking leads to negative emotional reactions (and resulting bad

decisions) when positions are going against you (which they often will be).

Risk-taking Biases

Risk Aversion : Very Low

Risk Aversion

"You get recessions, you have stock market declines. If you don't understand that's

going to happen, then you're not ready, you won't do well in the markets."

~ Peter Lynch

15

Investment Management

Risk aversion refers to an excessive fear of risk-taking. Risk aversion can

trigger investor hesitation, indecision, and analysis paralysis. Many investors

with high risk aversion experience difficulty "pulling the trigger" in volatile

markets.

Some investors experience risk aversion as waiting for confirmation.

Unfortunately, waiting for expected price movement erodes profits. Indulging

the inclination to delay can precede impulsive entries and exits later on.

When investing without adequate due diligence, risk aversion is appropriate.

Investors should do background research to gain confidence. Sometimes

losses are due to random events, and in those cases it is helpful to understand

the laws of probability and the inevitability of draw-downs (an understanding

derived from having a solid investment philosophy).

HIGH SCORERS

1. High risk aversion can be managed in several ways. Amateur investors who

have high risk aversion should probably entrust their money to a trusted

professional (such as a financial advisor). Most advisors will take an

appropriate amount of risk for the long-term growth of your portfolio, and high

scorers will not have to worry about the best course of action to take with their

assets.

2. As with many of the volatility-sensitive profiles above, risk averse investors

should check the value of their portfolios as infrequently as possible.

3. Confidence can be built with market experience, gradual exposure to market

risk, education, and the constructive challenging of one's fears.

LOW SCORERS:

1. Very Low scorers should beware of taking excessive risk. But in combination

with adequate self-discipline, education, historical knowledge, experience,

and preparation, a low score on risk aversion is usually beneficial for

investors.

Emotional Vulnerability : Low

"Success in investing doesn't correlate with I.Q. once you're above the level of

25. Once you have ordinary intelligence, what you need is the temperament to

control the urges that get other people into trouble in investing.

16

Investment Management

~ Warren Buffett

The Buffett quote above indicates that the ability to manage your impulses,

particularly those stemming from emotion, leads to greater investment

success than intelligence alone.

If you are a high scorer on emotional vulnerability, you are likely to experience

panic, confusion, and helplessness when under pressure or experiencing

stress. If you are a low scorer, you feel more poised, confident, and clearthinking during stressful times.

"We simply attempt to be fearful when others are greedy and to be greedy only

when others are fearful."

~ Warren Buffett

Buffet can maintain a long-term perspective during emotional periods in

the markets. As a result, he can go against the prevailing market sentiment

(and thus take advantage of mis-pricings). Such emotional stability is essential

in order to find bargains during periods of market volatility.

HIGH SCORERS:

1. Practice self-awareness. It is important for high-scorers to know when they

are in a negative emotional state without awareness, they cannot take action

to halt the destructive effects of negative emotions or take advantage of

negativity in the markets. Meditation and yoga help practitioners identify and

objectively reflect on reactive emotional states. Vigorous exercise can also

increase your stress tolerance.

2. Check your investment prices as infrequently as possible. Checking position

progress too frequently stimulates emotional reactions without giving useful

information.

3. Stick to a defined money management plan. Know your entry and exit points

in advance. Have clearly defined buy and sell signals. (These concepts are

easy to acknowledge, but during periods of market volatility you will have

trouble following them - know this).

4. Avoid short-term trading if possible. You are vulnerable to emotional burnout from rapid trading. You will probably benefit from using an investment style

that fits your more stress-sensitive personality.

LOW SCORERS:

1. 1. You are probably more calm than most during market volatility. Nonetheless,

become aware of the triggers for negative emotional states during investing. If

emotions are a problem for you, then see the recommendations above and

17

Investment Management

consider whether you can adapt your investing style to accommodate.

Cutting winners short : Below Average

"Selling companies that are doing well and purchasing ones that are faring poorly is like

watering the weeds and cutting the flowers."

~ Peter Lynch, Fidelity Investments

"Our favorite holding period is forever."

~ Warren Buffett

J.R. Simplot is an 8th grade drop-out and a self-made multi-billionaire. He

made his fortune through saavy investments in potato farming and french fry

production. Currently he owns the largest ranch in the United States, the ZX

Ranch in southern Oregon. His ranch is larger than the state of Delaware.

Despite his tremendous wealth, Simplot is a modest man. He describes his

accumulation of wealth to Eric Schlosser (author of Fast Food Nation):

"Hell, fellow, I'm just an old farmer got some luck," Simplot said, when I asked

about the keys to his success. "The only thing I did smart, and just remember

this - ninety-nine percent of people would have sold out when they got their first

twenty-five or thirty million. I didn't sell out. I just hung on." [bold added]

In general, most people sell their winning investments too soon ("cutting

winners short"). According to some experts, selling winning investments too

soon is a result of "seeking pride." Others believe that cutting winners short is

related to obsessiveness. The truth is a mix of both. Everyone is susceptible

to this bias to some extent.

If you are a HIGH SCORER or are guilty of cutting your winners short, you

should:

1. When you feel yourself becoming worried about a winning position,

don't impulsively sell. Instead re-evaluate your selling criteria. Did

the investment meet your profit target? Has something fundamental

changed about the security that indicates you should sell now?

2. Be prepared for your short-term winners to give back some of

their gains. Reversals are very common after a rapid, large price rise,

especially when it is unsupported by news.

18

Investment Management

Impulse-control

Self-discipline : High

"One trait that was shared by all the traders is discipline."

~ From "Wizard Lessons", Stock Market Wizards

Self-discipline is what many people call will-power. Self-discipline refers to

one's ability to persist at difficult or unpleasant tasks until they are

completed. People who possess high self-discipline are able to overcome

their reluctance to begin tasks and can stay on track despite distractions.

Low scorers are more likely to procrastinate and show poor follow-through

on their plans. Impulsive trading, erratic performance monitoring and ignoring

investment positions for long periods are all characteristic of traders with very

low scores.

In a survey of 200 currency traders in continental Europe, self-discipline was

rated the second most important factor in trader success. (The most

important factor was quick reaction time). In a study of the psychological

factors correlated with financial success, self-control (a close relative of

discipline) was the most significant factor.

Self-discipline supports many of the habits that together contribute to success.

One of those habits is the ability to meticulously analyze ones performance.

What factors led to a successful business decision? What happened to cause

an unanticipated loss? Self-discipline is necessary for collecting and organizing

this information.

Disorganized investors can often compensate for low self-discipline by hiring

disciplined professionals to work with, or for, them.

LOW SCORERS can understand the value of self-discipline using the following

techniques:

1. In order to build self-discipline, start by getting motivated. Notice the

importance of discipline in your life and the areas where a lack of selfdiscipline has come between you and your goals. For example, if there

is little consistency between your stated intentions and actions (E.g.,

you dont meet confirmed deadlines), then you may be considered

unreliable and even untrustworthy by others.

2. Practice being "your word." When you say you that will do

something, then you have made a commitment. Keep your

19

Investment Management

commitments. A good way to start is to always be on time. A hallmark

of undisciplined people is being late to appointments.

3. Don't get ahead of yourself. If you have low self-discipline, then

address this problem with small, do-able steps. It takes time to

become more disciplined, and it will only happen if you truly feel that it

is a priority.

4. In business, its important to be able to understand and plan for various

contingencies before becoming committed. Practice thinking in this

way.

Immediate Gratification : Below Average

""Business opportunities are like buses, there's always another one coming."

~ Richard Branson

Immediate gratification is the preference for small, immediate rewards over

larger, more distant rewards. People who eat dessert first are giving in to

immediate gratification urges. Impatience and impulsiveness are characteristic

of high-scorers.

Greed is a close cousin of excitement-seeking. Greed is often described as

"excessive desire" for money or valuables. Anyone who has experienced the

feeling of greed can relate to that pressured, desperate need to get more

money NOW. People who are high in immediate gratification are more likely to

engage in gambling behavior (taking inappropriate risks), and they are more

likely to experience a greedy state of mind when evaluating potential

investments.

Bill Miller, Chairman of Legg Mason Capital Management, beat the S&P 500

index every year for 15 consecutive years (from 1991-2005). When interviewed

by the Wall Street Journal in January 2005, "Bill Miller Dishes on His Streak

and His Strategies," he attributed his success to a very simple concept: "The

biggest opportunity for investors is really thinking out longer term... So we tried

to adjust the construction of our portfolio to reflect the neglect that analysts and

portfolio managers have given to those factors. Our turnover rate has dropped

significantly as we've tried to lengthen our time horizon."

Investors who score highly here should try to perform adequate up-front

research and cultivate patience when investing.

HIGH SCORERS may find the following helpful:

1. 1. Remember Bill Miller and Richard Bransons quotes above. Patience

is a cardinal virtue of investors. Another perfect stock or setup will

always come along. It is financially unhealthy to chase performance.

2. 2. As Bill Miller describes, widen your time-perspective. This is

20

Investment Management

especially useful when feeling a need to perform. Looking ahead at

farther horizons or larger-scale charts can diminish your urge to make

impulsive decisions now.

Excitement-seeking : Low

"The individual investor should act consistently as an investor and not as a speculator.

This means... that he should be able to justify every purchase he makes and each price

he pays by impersonal, objective reasoning that satisfies him that he is getting more

than his money's worth for his purchase."

~ Benjamin Graham

Excitement-seeking describes the tendency to pursue emotionally arousing

activities. Excitement-seeking is seen in investors who make large bets more

for the thrill of the gain than an understanding of the game. Note that

prudent, calculated excitement-seeking is seen in most successful investors.

The difference between successful and unsuccessful excitement-seekers is

that the successful ones are more excited by a good decision than a large

financial outcome. They realize that excellent research, organization,

management, and execution lead to profit. They value the game more than the

material rewards that will accrue from playing it well.

Richard Branson, the Billionaire British entrepreneur, is well known for his

adrenaline-raising antics to promote his various businesses. He argues that fun

is necessary to his work:

"A business has to be involving, it has to be fun, and it has to exercise your

creative instincts."

~ Richard Branson

A problem arises when your investing is all about fun, with profits only

secondary. It is important that you enjoy investing, but it is also crucial that you

not invest purely for the sake of that enjoyment. Rather, you ought to enjoy

making profits as a result of following your investment plan.

Intellectualism

Intellectualism : Very High

21

Investment Management

"An intellectual is a man who takes more words than necessary to tell more than he

knows."

Dwight D. Eisenhower (1890 - 1969)

Intellectual investors enjoy investigating complex concepts and abstractions.

In general, intellectualism is a good thing for investors. High intellect underlies

ones curiosity about new investment ideas, and most great investors are

intellectual.

However, without a disciplined and experienced mind, high intellectualism may

lead to gathering "too much information" and "over-thinking." A hallmark of

the excessively intellectual investor is the use of unnecessarily complex

assumptions and methodologies.

Psychological research demonstrates that gathering more than 3 pieces of

relevant information about any one decision leads to deteriorating decision

quality. Apparently, analyzing too many independent details leads to eroded

profitability.

Investors who are low scorers on intellectualism can more easily remain

focused and without distractions or tangents in their thinking, but they are less

sensitive to new ideas and opportunities. In contrast to investors, many

successful traders score below average on intellectualism.

Very low scorers may not feel curiosity about new business ideas, which can

reduce their performance if market conditions change.

HIGH SCORERS:

"Nothing contributes so much to tranquilizing the mind as a steady purpose - a point on

which the soul may fix its intellectual eye."

Mary Wollstonecraft Shelley (1797 - 1851)

1. Highly intellectual investors may have trouble with mind wandering. Their

endless curiosity about new business concepts or models may hamper the

disciplined management of their investments.

2. Notice if you are "missing the forest for the trees." Successful business

doesn't have to be difficult or complicated. Many people consistently profit with

businesses that appear simple, but which are based on tried-and-true

principles.

LOW SCORERS:

22

Investment Management

1. Consider using investment strategies developed around simple concepts that

make sense to you. Low scorers perform best when methodically studying

tried-and-true methods.

2. Cultivate curiosity about the investment universe. Remember to be aware of

the larger economic trends that may impact your investment specialty.

Herding

Trend-following : Above Average

"Men, it has been well said, think in herds; it will be seen that they go mad in herds,

while they only recover their senses slowly, and one by one."

~ Charles MacKay (1841) Extraordinary Popular Delusions And The Madness Of

Crowds

Trend-following refers to one's tendency to follow the crowd, relying on others

for leadership and critical thinking. Trend-following can be profitable for

investors (though many contrarians would disagree), provided that they

recognize signs of trend formation and dissipation. Momentum investors are

an example of trend-followers.

"Never, Ever Listen to Other Opinions.

To succeed in the markets, it is essential to make your own decisions.

Numerous traders cited listening to others as their worst blunder. Walton and

Minervini lost their entire investment stake because of this misjudgement."

~ Jack Schwager, Stock Market Wizards, Wizard Lessons #29

Contrarians score low on trend-following. Contrarians tend to bet against

current trends or opinion when they are identifiably incorrect. Contrarians

typically view the market consensus with suspicion, and are sometimes

described in the same sentence as value investors.

Because the many market opportunities are created by the misbehavior of the

mass of investors, an understanding of crowd psychology is useful for

investors.

"If your mind is not in gear with the markets, or if you ignore changes in mass

psychology of crowds, then you have no chance of making money trading." ~

Alexander Elder (1993) Trading for a Living

HIGH SCORERS:

23

Investment Management

1. Consider using a trend-following strategy in your investing, such as

momentum or growth strategies, since these may be more congruent with

your personality.

2. Avoid listening to financial media, colleagues, or market gurus (such as on

CNBC) for investment ideas. High scorers are more susceptible than most to

chasing the media or stock tip bandwagon (which is typically a very bumpy

ride).

LOW SCORERS:

1. You have the innate advantage of searching for opportunities away from the

crowd. Investing in overlooked markets or sectors may fit your personality.

Low scorers are often value investors.

2. Beware of betting against powerfully trending markets. Fading trends may be

appealing to low scorers, but doing it well requires patience, vigilance, and

knowledge of the signs of market reversals. Timing is key.

Business Personality Test

PERSONALITY FACTORS

Conscientiousness : High

Conscientiousness describes your relative ability to plan and organize

towards achieving goals and to exercise self-control.

You scored in the HIGH range for conscientiousness. Intelligent activity

involves contemplation of long-range goals, organizing and planning

routes to these goals, and persisting toward one's goals in the face of

short-lived impulses to the contrary. You can achieve high levels of

success through purposeful planning and persistence. You are likely to

be positively regarded by others as intelligent and reliable. On the down

side, some people may see you as rigid or perfectionistic.

Emotionality : Low

24

Investment Management

Emotionality is characterized by stress-sensitivity and more frequent

experiences of negative emotions than others.

You scored in the LOW range on emotionality. You are relatively more

calm, emotionally stable, and free from persistent negative feelings when

compared to high scorers. Freedom from negative feelings does not

mean that you experience more positive feelings. You may be reckless in

dangerous situations and take more risks than others (sometimes without

knowing that you are doing so). In general you are probably secure,

hardy, and relaxed even under stressful conditions.

Extraversion : High

Extraversion is characterized by a desire to socialize and a tendency to

optimism. Extraverts derive energy from interactions with others, while

introverts' interests are fueled by introspection.

You scored in the HIGH range on extraversion. You probably enjoy being

with people, are full of energy, and often experience positive emotions. In

groups you are likely to talk, assert yourself, and draw attention. In

general you are outgoing, active, and joyful.

Openness : Above Average

Openness to new experiences describes a willingness to experiment with

tradition, to seek out new experiences, and to think broadly and

abstractly.

You scored in the NEAR AVERAGE range on openness. You are

probably practical but willing to consider new ways of doing things. You

may seek a balance between the old and the new. You are able to

balance a comfort with habit, routine, and certainty with a desire for

25

Investment Management

novelty and ambiguity.

Agreeableness : Above Average

Agreeableness reflects a concern with cooperation and social harmony.

You scored in the NEAR AVERAGE range on agreeableness. You are

likely to balance a healthy skepticism about others' motives with a desire

to cooperate and get along. You are willing to extend yourself for others

and compromise, but you may prefer that they first demonstrate good will.

BIAS REPORT

Confidence Biases

Overconfidence : Below Average

Overconfidence refers to the tendency to see oneself and one's abilities

as better than they actually are. For businesspeople, there are both

drawbacks and benefits to overconfidence.

On the downside, overconfidence results in a tendency to

underestimate financial risks and to get into financial commitments

(such as debt) that are more difficult to get out of than originally assumed.

High scorers may accumulate debts that are unmanageable, invest in

multiple schemes that never pay out, and spend money under the

assumption that they will be able to cover their expenses (even when

they have no idea how).

On the upside, high levels of confidence can be reassuring to potential

customers. Overconfident financial planners attract more clients than

less-confident rivals, even while having lower investment performance

than their colleagues. Additionally, entrepreneurs are typically

overconfident about their own abilities and likelihood of success, yet that

overconfidence is often balanced by a more realistic appraisal of the risks

that they are undertaking. In many business endeavors, overconfidence

both attracts more clients and leads to greater overall risk-taking.

Low scorers are more likely to be realistic about their financial knowledge

26

Investment Management

and expected returns. Low scorers are likely to engage in less

speculative spending and are likely to have less debt. At the extreme,

underconfident people may be excessively risk-avoidant with their

money.

"Before you attempt to beat the odds, be sure you could survive the odds

beating you."

~ Larry Kersten (author and sociologist)

HIGH SCORERS:

1. Pay extra attention to potential risks - you have a tendency to avoid

acknowledging these. In particular, remember to look at historical

parallels, perform adequate due diligence, and do background

research on your business plans, partners, and competitors.

2. Think before you leap: Deliberately pause for a cooling-off period

between having a bright idea and beginning to execute it. Remember that

there will always be more opportunities.

3. Practice self-awareness: Notice where a high level of confidence helps

your business (for example, with clients and customers), and where it

impairs your long-term performance (for example, in taking on excessive

debt).

LOW SCORERS:

If you are low scorer, you may be susceptible to the following if you are

underconfident (In the very low range):

1. Underconfident businesspeople may be too afraid of loss to take

necessary risks. To combat underconfidence, remind yourself of how you

have demonstrated capability and competence in the past. Your

humility is an asset in business, as you are less likely to become overextended or mis-represent your abilities.

2. Some underconfident businesspeople are hyperaware of risks. If this

describes you, then reviewing historical decisions to see if you have been

overweighting negatives and overlooking positives can help you

become more realistic. Your challenge is to develop a realistic appraisal

of both risks and your capability in managing them. It is possible that you

have a greater ability to manage risk than you believe.

Over-Optimism : Above Average

27

Investment Management

"For myself I am an optimist - it does not seem to be much use being

anything else."

~ Sir Winston Churchill, 1954.

Optimism refers to the "rose-colored lenses" through which some

people view the world.

High scorers generally see a positive future ahead for themselves and

the world. Low scorers expect more negative events to unfold and may

feel less effective than high scorers.

In business, high levels of optimism facilitate success. Optimism and

enthusiasm reflect a focus on opportunity, both in relationships and

business. Further, most people like being around optimists, and their

positive attitude is contagious. Optimists are more comfortable taking

small and moderate risks, but they take fewer high-stakes gambles than

pessimists. Optimistic people tend to be resilient. They see possibility

even after a financial catastrophe, which may explain why they are more

financially successful overall (according to researchers). Additionally,

optimistic people believe that "everything is going to work out for the

best," which facilitates goal-directed activity.

Optimism can have pitfalls. High scorers are more likely to overspend

budgets and may be overly optimistic about time management (thus

missing deadlines). People who feel positive tend to avoid information

that is negative, since it may pull them out of their good feeling state. As

a result, optimists are more susceptible to denial.

Pessimists are more attentive to details, maintain a greater focus on

potential risks than potential opportunities. They can often "overlook the

forest for the trees" (missing the big picture while they are working on

detailed problems). Additionally, low scorers may be timid about

engaging in business ventures.

HIGH SCORERS:

If you are a high scorer, you generally see a positive future ahead for you and

the world. Your optimism is, in general, a great gift. However, in your business,

you should be careful to:

1. Dont Deny the Negative. Learn to seek out and understand the logic of

all opinions (including contrary opinions) about a business plan, potential

28

Investment Management

investment, or relevant economic events.

2. Don't believe the hype. A good story or a good company does not make

a good business. Only start or invest in a business after you have done

detailed due diligence.

3. Dont stop paying attention to risk when things are going well. You

are more susceptible to ignoring business risk during good times.

LOW SCORERS:

"My pessimism extends to the point of even suspecting the sincerity of other

pessimists."

~ Jean Rostand (1894 - 1977)

If you are low scorer, you are more pessimistic than average.

1. Maintain an objective, nonjudgmental awareness of your negative

emotions. Because of your extra attention to negative details, you may

see more threats to your wealth than opportunities.

2. Consider using a journal to document your mood, and the events that

affect your mood, every business day. It can be helpful to cultivate

optimism by deliberately re-focusing on the positive when you find

yourself dwelling on the negative. Optimism can be learned using such

techniques.

3. You may take losses personally. After a business disappointment, you

may become excessively pessimistic and risk averse. Yet though

perseverance you can prove your pessimism wrong. If you continue to

pursue opportunities, you will find success sooner rather then later.

Risk-taking Biases

Risk Aversion : Below Average

"You get recessions, you have stock market declines. If you don't understand

that's going to happen, then you're not ready, you won't do well in the markets."

~ Peter Lynch

Risk aversion refers to an excessive fear of risk-taking. Risk aversion

usually results in hesitation, indecision, low confidence, and analysis

paralysis. Many businesspeople with high risk aversion experience

difficulty in execution. It is common among businesspeople who have

29

Investment Management

recently suffered large losses or setbacks.

Sometimes risk aversion is appropriate, especially when one has little

information or experience in a high-stakes business decision. In these

cases, doing more due diligence, looking at historical parallels, and

discussing the situation with experts can help one better understand the

risk.

Very Low scorers should beware of taking excessive risk. But in

combination with adequate education, historical knowledge, experience,

and preparation, a low score on risk aversion can be beneficial for

businesspeople.

Emotional Vulnerability : Low

High scorers on emotional vulnerability experience panic, confusion,

and helplessness when under pressure or experiencing stress. Low

scorers feel more poised, confident, and clear-thinking during stressful

times.

People who are emotionally vulnerable are more likely to experience

impulsive financial decision-making. Emotionally vulnerable people

are more susceptible to impulsive shopping sprees and unaffordable

luxury purchases.

Low scorers are able to control their emotional reactions to

disappointment better then high scorers. They are more likely to make

clear plans to address setbacks that they successfully follow.

HIGH SCORERS:

1. Practice self-awareness. It is important for high-scorers to know when

they are in a negative emotional state without awareness, they cannot

take action to halt the destructive effects of negative emotions. Meditation

and yoga help practitioners identify and release reactive emotional states.

Vigorous exercise can also be beneficial.

2. Thinking about, ruminating, or checking on negative business information

only worsens the problem. Prepare a plan to address potential negative

information in advance, otherwise you are more likely to react to it, even if

it was expected. Advance-plans reduce impulsive decisions.

3. Stick to a defined money management plan. Know your entry and exit

30

Investment Management

points in a business endeavor in advance.

4. Avoid a business that is rapid pace or high-stress, if possible. You will do

your best thinking, strategizing, and planning in a relaxed atmosphere.

LOW SCORERS:

1. Become aware of the triggers for negative emotional states during

business dealings. If emotions are a problem for you, then see the

recommendations above.

Impulse-control

Self-discipline : High

Self-discipline is what many people call will-power. Self-discipline refers

to one's ability to persist at difficult or unpleasant tasks until they are

completed. Researchers have found that an individuals level of selfcontrol (a measure of self-discipline) is correlated with their wealth level

that is, higher wealth and higher self-control go hand-in-hand. When

undisciplined people are financially successful, it is often because they

have a disciplined person supporting them (an employee, spouse, or

assistant).

Low scorers tend to procrastinate and to show poor follow-through in

their chosen activities. Impulsive deal-making, erratic performance

monitoring, and ignoring business plans for long periods are all

characteristic of people with low scores.

Self-discipline supports many of the habits that together contribute to

success. One of those habits is the ability to meticulously analyze ones

performance. What factors led to a successful business decision? What

happened to cause an unanticipated loss? Self-discipline is necessary for

collecting and organizing this information.

LOW SCORERS can understand the value of self-discipline using the

following techniques:

1. In order to build self-discipline, start by getting motivated.

Notice the importance of discipline in your life and the areas

where a lack of self-discipline has come between you and your

goals. For example, if there is little consistency between your

stated intentions and actions (E.g., you dont meet confirmed

31

Investment Management

deadlines), then you may be considered unreliable and even

untrustworthy by others.

2. Practice being "your word." When you say you that will do

something, then you have made a commitment. Keep your

commitments. A good way to start is to always be on time. A

hallmark of undisciplined people is being late to appointments.

3. Don't get ahead of yourself. If you have low self-discipline, then

address this problem with small, do-able steps. It takes time to

become more disciplined, and it will only happen if you truly feel

that it is a priority.

4. In business, its important to be able to understand and plan for

various contingencies before becoming committed. Practice

thinking in this way.

Immediate Gratification : Below Average

"Business opportunities are like buses, there's always another one coming."

~ Richard Branson

Immediate gratification is the preference for small, immediate

rewards over larger, more distant rewards. People who eat dessert first

and those who binge are giving in to immediate gratification urges.

Impatience is characteristic of high-scorers. Businesspeople who score

highly here should beware of impulsively pursuing opportunities before

doing adequate research.

HIGH SCORERS

1. Remember Richard Bransons quote above. Patience is a

cardinal virtue of businesspeople.

2. Look at how impulsive acts are affecting your business

success. If you see real damage, then you are more likely to be

motivated to change. If needed, consider professional help, such

as from a cognitive-behavioral therapist, to help deal with this

issue.

3. Widen your time-perspective when feeling impulsive, and reorient yourself to your original plan. Looking ahead can diminish

your urge to make impulsive decisions now.

32

Investment Management

Excitement-seeking : Low

Excitement-seeking describes the tendency to pursue emotionally

arousing activities. Excitement-seeking is seen in risk-takers who

make large bets more for the thrill of the gain than an understanding of

the game. Prudent excitement-seeking is seen in most successful

business people.

The difference between successful and unsuccessful excitement-seekers

is that the successful ones are more excited by a good decision than a

large financial outcome. They realize that excellent research,

organization, management, and execution lead to profit. Nonetheless,

they value the game more than the material rewards that will accrue from

playing it well.

Richard Branson, the Billionaire British entrepreneur, is well known for his

adrenaline-raising antics to promote his various businesses. He argues

that fun is necessary to his work:

"A business has to be involving, it has to be fun, and it has to exercise

your creative instincts."

~ Richard Branson

Intellectualism

Intellectualism : High

"An intellectual is a man who takes more words than necessary to tell more than

he knows."

Dwight D. Eisenhower (1890 - 1969)

Intellectual businesspeople enjoy investigating complex concepts and

abstractions. In business, high intellectualism may lead to gathering "too

much information" and "over-thinking." A hallmark of the intellectual

businessperson is the use of complex analytic techniques and the

recruitment of experts for consultations.

Intellectual curiosity can be helpful, but an over-reliance on details is

distracting and potentially dangerous. Psychological research

33

Investment Management

demonstrates that gathering more than 3 pieces of decision-relevant

information can lead to deteriorating decision quality. Apparently,

analyzing too many independent details detracts from the overall quality

of the intuitive decision.

Businesspeople who are low scorers on intellectualism can more easily

remain focused and without distractions or tangents in their thinking.

Very low scorers may not feel curiosity about new business ideas,

which can reduce their performance if market conditions change.

HIGH SCORERS:

"Nothing contributes so much to tranquilizing the mind as a steady purpose - a

point on which the soul may fix its intellectual eye."

Mary Wollstonecraft Shelley (1797 - 1851)

1. Intellectual businesspeople may have trouble with mind wandering.

Their endless curiosity about new business concepts or models may

hamper the disciplined operation of their business.

2. Stop yourself if you think youre smarter than others (as many

intellectuals do) remember to maintain a sense of humility.

3. Notice if you are "missing the forest for the trees." Successful business

doesn't have to be difficult or complicated. Many people consistently profit

with businesses that appear simple, but which are based on tried-andtrue principles.

LOW SCORERS:

1. Use business strategies developed around simple concepts that make

sense to you. Low scorers perform best when methodically studying and

executing on basic methods.

2. Cultivate curiosity about your business environment. Maintain an

awareness of the larger economic trends that may impact your space,

as you have a tendency to overlook these until they have adversely

affected your way of doing things.

Herding

Trend-following : High

"Men, it has been well said, think in herds; it will be seen that they go mad in

34

Investment Management

herds, while they only recover their senses slowly, and one by one."

~ Charles MacKay (1841) Extraordinary Popular Delusions And The Madness Of

Crowds

Trend-following is a term often used in stock trading and investment. It

refers to one's tendency to follow the crowd, relying on others for

leadership and critical thinking. Trend-following can be profitable for

businesspeople, especially if they can identify a trend early in its

formation and subsequently adapt their business to the changing

demands of the marketplace. Contrarians those who bet against the

conventional wisdom often do well in the financial markets. In the

business world they can be excellent analysts, finding opportunities

where others have not thought to look.

35

Investment Management

Appendix 2

Amasser

If you tend to be a money amasser, you are happiest when you have large amounts of

money at your disposal to spend, to save, and/or to invest. If you are not actually

spending, saving, or investing, you may feel empty or not fully alive. You tend to

equate money with self-worth and power, so a lack of money may lead to feelings of

failure and even depression. If you hire an investment advisor or financial planner, your

major concern will be finding investments with high rates of return, since you hope to

make as much money as you can, as quickly as possible. You probably enjoy making

your own financial decisions, so it may be quite difficult for you to give up much

control to money professionals. If, on the other hand, you tend to be a worrier, too, and

if you are tired of being overly obsessed with your money, you may actually welcome

the opportunity to assign some of the details of your money life to a trustworthy

financial advisor.

Hoarder

If you tend to be a hoarder, you like to save money. You also like to prioritize your

financial goals. You probably have a budget and may enjoy the processes of making up

a budget and reviewing it periodically. You most likely have a hard time spending

money on yourself and your loved ones for luxury items or even practical gifts. These

purchases would seem frivolous to you. You might very well view spending money on

entertainment and on vacations - and even on clothing - as largely unnecessary

expenses. If you think about investing your money, you tend to be concerned not with

liquidity but with future security, especially during retirement. "Saving for a rainy day"

appeals to your orderly nature. If you are an extreme hoarder, you may want to keep

your money so close to you that you avoid putting it even in conservative investments

such as money markets, bonds, or mutual funds. Some hoarders have been known to

keep their money hidden under mattresses and in other secret places rather than put it in

a bank. However, these cases are relatively rare. Depending on how extreme your

hoarder tendencies are, you might exhibit some, most, or all of these traits.

36

Investment Management

Appendix 3

Investing of 100,000

Name

Description

Time

Specific Time

Business Opportunity

Capital Available for Market Opportunities and Investments

Short

1-5 years

Buy a Car

Buy a Car

Short

1-5 years

Buy a 1 Bedroom Apartment

Short

1-5 years

Medium

5 - 8 Years

Buy a 1 Bedroom

Apartment

Retirement of my parents (2 parents, 70 and 60 years old

Parents Retirements

Personal Semiretirement

now)

Monthly basic expenses (Bills (electricity, water, phones,

Medium

cable, gas, house monthly payment)

5 - 8 years

House of Family

Family permanent house

Long

10 years

3 Kids College Education

University in my country (Dominican Republic)

Long

20 years

3 Apartments for Kids Allowances during their College Time

Long

20 years

Monthly Loan Payment, Food, Gas)

Long

20 years

Monthly Expenses

Long

10 years

3 Apartments (for Kids

Allowances)

Monthly Basic Expenses + Monthly Other Expenses (Car

Personal Full Retirement

Self-Maintenance of

Charity Organization

37

Investment Management

Appendix 4

Name

Description

Time

Specific

Time

Managerial

Tenure

Growth

Diversity

Yes

Aggressive

No

Yes

Moderate

No

Yes

Aggressive

No

Yes

Conservative

Yes

years

Yes

Conservative

No

Long

10 years

Yes

Conservative

Yes

Long

20 years

Yes

Conservative

Yes

Long

20 years

Yes

Conservative

Yes

Capital Available for Market

1-5

Opportunities and

Business Opportunity

Investments

Short

years

1-5

Buy a Car

Buy a Car

Buy a 1 Bedroom

Buy a 1 Bedroom

Apartment

Apartment

Short

years

1-5

Short

years

Retirement of my parents (2

5-8

parents, 70 and 60 years old

Parents Retirements

now)

Medium

Years

Monthly basic expenses (Bills

Personal

(electricity, water, phones,

Semiretirement

cable, gas, house monthly

Medium

payment)

House of Family

Family permanent house

3 Kids College

University in my country

Education

(Dominican Republic)

5-8

3 Apartments for Kids

3 Apartments (for Kids

Allowances during their

Allowances)

College Time

Monthly Basic Expenses +

Monthly Other Expenses (Car

Personal Full

Monthly Loan Payment, Food,

Retirement

Gas)

Long

20 years

Yes

Moderate

Yes

Monthly Expenses

Long

10 years

Yes

Conservative

Yes

Auto Maintenance of

Charity Organization

38

Investment Management

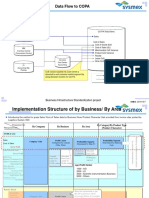

Appendix 5

Asset Allocation

10%

Growth

Income

30%

60%

Liquid

39

Investment Management

Appendix 7

Sector Allocation of Portfolio in Mutual

Funds

Aggressive Growth

Conservative Growth

Fixed Income

Money Market

10%

10%

35%

20%

25%

Equity Income

40

Investment Management

Bibliography

Fearless Investing Series: MUtual Funds Workbook 1, Find the Right Mutual Funds, NJ, 2005

Hirsch, Michael D., Multifund Investing, DOw-Jones Irwin, Illinois, 1987

Petillo, Paul, Mutual Funds for the Utterly Confused, Mc Graw-Hill, NY, 1009

Mutual Funds, A quick-Start Guide, WI, USA, 2007

Rugg, Donald, New Strategies for Mutual Fund Investing, Dow Jones-Irwing, 1989, USA

Fearless Investing Series: Mutual Funds Workbook 3: Maximize Your Fund Returns, Wiley,

2005, USA

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)