Beruflich Dokumente

Kultur Dokumente

Stresses in The System: America's Public Retirement System

Hochgeladen von

The Council of State GovernmentsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stresses in The System: America's Public Retirement System

Hochgeladen von

The Council of State GovernmentsCopyright:

Verfügbare Formate

Stresses in the System:

Trends in Public Retirement

Systems

Sujit M. CanagaRetna

The Council of State Governments

Southern Legislative Conference (SLC)

Testimony Before a Joint Hearing

of the Mississippi Senate & House Finance,

Appropriations and Ways & Means Committees

Mississippi State Capitol

Jackson, Mississippi

April 27, 2005

Five Main Parts

I.

State Fiscal Trends

II.

Different Elements in our Nations

Retirement Infrastructure

III. Public Pension Plans Current Status

IV. Key Emerging Trends Public Pension Plans

V.

Strategies Adopted by Different States

I. State Fiscal Trends

Revenue inflows above forecast in 23 states in

all major categories for FY 2005

Although 33 states closed a cumulative budget

gap of $36.3 billion in enacting their FY 2005

budgets, only 3 (MI, NE and NH) faced new

gaps after year began

This is a marked improvement from recent

years; in FY 2004, 10 faced post fiscal year gaps

and in FY 2003, 31 faced gaps during the year

I. State Fiscal Trends

Since FY 2001, states have bridged budget shortfalls

that exceeded $235 billion

State tax revenue grew almost 8 percent between Oct.

& Dec. 2004 compared to the same period in 2003; this

was the strongest 4th quarter since 1991

I. State Fiscal Trends

In prior years, states solved their budget gaps by

Slashing Spending

Tapping Rainy Day Funds

Deploying Tobacco Settlement Monies

Raising Taxes and User Fees

Hiking Cigarette Taxes

Cutting Funds to Local Governments

Racking Up Debt

Generating Funds via Gaming

I. State Fiscal Trends

Even though state revenues have improved, state

expenditures have exploded at a faster pace

For FY 2005, 31 states report spending overruns

Rising healthcare costs and utilization are causing

Medicaid expenditure to soar; 23 states report

spending overruns in healthcare

States also face higher expenses in corrections (13

states over budget), education, pensions,

transportation and infrastructure

Consequently, 26 states are reporting shortfalls

totaling $25 billion in enacting their FY 2006

budgets

II. Retirement Infrastructure:

Demographics

Elderly population in every state will grow faster

than the total population (3.5 times faster)

Seniors will outnumber school-age children in

10 states in the next 25 years

26 states will double their populations of people

older than 65 by 2030

FL, PA, VT, WY, ND, DE, NW, MT, ME and

WV will all have fewer children than elderly

Ratio of workers to retirees will decline in

coming decades

II. Retirement Infrastructure: Three

Legged Stool Concept

Social Security

Pension Income (Private or Public Sector)

Personal Savings

Unfortunately, all these elements are

currently on shaky ground

II. Retirement Infrastructure: Social Security

At

the end of 2004, 48 million people

were receiving Social Security benefits

Costs will increase rapidly between about

2010 and 2030, due to the retirement of

the large baby-boom generation.

Annual cost will exceed tax income

starting in 2017 at which time the annual

gap will be covered with cash from

redeeming special obligations of the

Treasury, until these assets are exhausted

in 2041

II. Retirement Infrastructure: Private Pensions

In January 2005, the Pension Benefit Guaranty

Corporation (PBGC), the federal organization that

protects the pensions of over 45 million corporate

workers, ran a deficit of $23 billion

The PBGC has been coping with a number of large

pension failures since 2002 and has warned about

its ability to protect private pensions in the future

Last week, the PBGC took over all four of United

Airlines' employee pension plans, with a shortfall of

$9.8 billion, making it the biggest pension failure

since the government began insuring pension

benefits in 1974

The PBGC has warned that its deficit could balloon

to $40 billion by the end of 2005 if it has to take

over more airline pension plans

II. Retirement Infrastructure: Private Savings

Year Disposable Personal Income

(Billions of $)

Personal

Savings

Percent

1973

$978.3

$102.7 10.5%

1983

$2,608.4

$233.6

9.0%

1993

$4,911.9

$284.0

5.8%

2003

$8,202.9

$165.6

2.0%

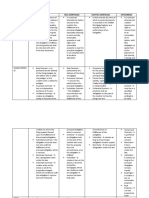

III. Public Pension Plans Cash &

Investment Holdings (Thousand Dollars)

Category

1993

Cash and Short Term Investments

2000

2001

2003

$66,192,708

$121,142,060

$117,392,023

$99,812,059

Government

Securities

$203,452,928

$271,551,952

$246,787,978

$222,534,967

Non-Government

Securities

$571,391,516

$1,602,291,271

$1,620,488,011

$1,669,422,866

Other Investments

$68,813,123

$173,657,750

$172,961,157

$180,231,896

$920,571,814

$2,168,643,033

$2,157,629,168

$2,172,001,788

Total

III. Public Pension Plans Receipts

(Thousand Dollars)

Category

1993

2000

2002

2003

Employee Contributions

$16,137,931

$24,994,468

$27,544,022

$28,843,747

State Government

Contributions

$15,186,886

$17,546,723

$17,182,861

$19,567,749

Local Government

Contributions

$19,804,798

$22,608,391

$21,609,170

$26,644,540

Earnings on Investments

$74,812,951

$231,900,075

($72,456,581)

$72,690,968

$125,942,566

$297,049,657

($6,120,528)

$147,747,004

Total

III. Public Pension Plans Payments

(Thousand Dollars)

Category

Benefits

1993

2000

2002

2003

$48,327,862

$91,274,292

$110,128,411

122,306,460

Withdrawals

$2,477,142

$4,431,876

$4,079,492

4,891,041

Other Payments

$1,793,697

$4,751,715

$7,772,328

7,647,415

$52,598,701 $100,457,883

$121,980,231

134,844,916

Total

IV. Key Trends Public Pension Plans

Shift to Non-Governmental Securities

(corporate stocks, corporate bonds, foreign

stocks)

In 1993, public pension plans had only 62

percent of their total cash and investment

holdings in Non-Governmental Securities

In 2003, this percentage had ballooned to

77 percent

IV. Key Trends Public Pension Plans

Category

Cash and Short-term Investments

1993

2003

7%

5%

Government Securities

22%

10%

Federal Government

22%

10%

State and Local Governments

0%

0%

Non-governmental Securities

62%

77%

Corporate Bonds

19%

15%

Corporate Stocks

33%

37%

Mortgages

2%

1%

Funds Held in Trust

3%

3%

Foreign Investments

0%

12%

Other Non-governmental

8%

8%

Other Investments

7%

8%

Real Property

3%

2%

Miscellaneous Investments

5%

6%

100%

100%

Total

IV. Key Trends Public Pension Plans

Payments have clearly surpassed receipts,

led by healthcare expenditures

Given the flurry of corporate scandals and

the steep drop in asset values, greater

activism by boards, controlling authorities

and legislatures

Vast majority of the plans are unfunded,

i.e., assets less than their accrued liabilities

IV. Key Trends Public Pension Plans

Majority of plans have unfunded liabilities

According to Sept. 2004 NASRA report:

- IL Teachers ($23.8 billion; 49.3%)

- IL SERS ($10.1 billion; 42.6%)

- OK Teachers ($5.5 billion; 54%)

- WV Teachers ($5.1 billion; 19.2%)

- IN Teachers ($8.5 billion; 42.1%)

V. Strategies Adopted: Pension Obligation Bonds

Racking up debt to bridge budget shortfalls

has been a popular strategy among states

recently

According to an April 2004 Moodys report,

state net-tax supported debt rose at the

fastest pace in the 24 years the company

calculated this figure; currently at $305 billion

and expected to rise

Recent bond issues have been very successful

(CA, NJ, OR, IL)

V. Strategies Adopted: Pension Obligation Bonds

Pros:

Interest rates currently at historic lows

Funds raised via bonds relieves immediate

pressures on budget

Opportunity to reduce/eliminate states unfunded

liability level

Cons:

Possibility of investment earnings being lower

than interest rate

Locked into making debt payments

Increases the states net tax-supported debt level

Fiscally dangerous policy of borrowing to meet

ongoing expenditures (possible credit rate

lowering)

V. Strategies Adopted: Pension Obligation Bonds

In 1997, New Jersey borrowed $2.8 billion

to, among other goals, clear its unfunded

liability

Investment earnings that exceeded 7.6

percent required to cover interest payments

In June 2000, pension plan was worth $83

billion; by June 2003, it had plummeted to

$55 billion

City of Pittsburgh suffered similar fate too

V. Strategies Adopted: Trimming Benefits

Moving workers away from DB plans to 401(k)style, DC plans (CA, SC, MA, AK)

Linking annual increases to CPI (IL, RI, NH)

Adjusting age at which retirees paid full benefits

(IL, RI, TX, LA)

Reducing percentage of pay retirees get each year

(RI)

Eliminating DROPs (LA)

Ending practice of employees serving a short

period in a position to boost overall pension (MO)

Placing salary caps on rehired retirees (NM)

V. Strategies Adopted: Other

Increasing

the costs to workers,

counties and cities (AK, MN, TX, KY)

Consolidating retirement boards (WV,

LA, AK)

Matching, i.e., deliberately aiming for

low, but guaranteed, investment

income from conservative bonds (ME)

Unorthodox investments (AL, MA)

Thank You

Stresses in the System:

Trends in Public Retirement Systems

For more information, please contact

Sujit M. CanagaRetna

404/633-1866

Or

scanagaretna@csg.org

www.slcatlanta.org

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Fundamentals of ABM 1Dokument164 SeitenFundamentals of ABM 1Marissa Dulay - Sitanos67% (15)

- Sample SopDokument8 SeitenSample SopRikhil Nair0% (1)

- The Growth of Synthetic Opioids in The SouthDokument8 SeitenThe Growth of Synthetic Opioids in The SouthThe Council of State GovernmentsNoch keine Bewertungen

- Scoot Over: The Growth of Micromobility in The SouthDokument12 SeitenScoot Over: The Growth of Micromobility in The SouthThe Council of State GovernmentsNoch keine Bewertungen

- Surprise Medical Billing in The South: A Balancing ActDokument16 SeitenSurprise Medical Billing in The South: A Balancing ActThe Council of State GovernmentsNoch keine Bewertungen

- Sports Betting in The SouthDokument16 SeitenSports Betting in The SouthThe Council of State GovernmentsNoch keine Bewertungen

- Rural Hospitals: Here Today, Gone TomorrowDokument24 SeitenRural Hospitals: Here Today, Gone TomorrowThe Council of State GovernmentsNoch keine Bewertungen

- Weathering The Storm: Assessing The Agricultural Impact of Hurricane MichaelDokument8 SeitenWeathering The Storm: Assessing The Agricultural Impact of Hurricane MichaelThe Council of State GovernmentsNoch keine Bewertungen

- Issues To Watch 2020Dokument8 SeitenIssues To Watch 2020The Council of State GovernmentsNoch keine Bewertungen

- The Netherlands Model: Flood Resilience in Southern StatesDokument16 SeitenThe Netherlands Model: Flood Resilience in Southern StatesThe Council of State GovernmentsNoch keine Bewertungen

- By Roger Moore, Policy AnalystDokument6 SeitenBy Roger Moore, Policy AnalystThe Council of State GovernmentsNoch keine Bewertungen

- Long-Term Care in The South (Part II)Dokument16 SeitenLong-Term Care in The South (Part II)The Council of State GovernmentsNoch keine Bewertungen

- Blown Away: Wind Energy in The Southern States (Part II)Dokument16 SeitenBlown Away: Wind Energy in The Southern States (Part II)The Council of State GovernmentsNoch keine Bewertungen

- Opioids and Organ Donations: A Tale of Two CrisesDokument20 SeitenOpioids and Organ Donations: A Tale of Two CrisesThe Council of State GovernmentsNoch keine Bewertungen

- 2017 Education Comparative Data ReportDokument69 Seiten2017 Education Comparative Data ReportThe Council of State GovernmentsNoch keine Bewertungen

- Body-Worn Cameras: Laws and Policies in The SouthDokument24 SeitenBody-Worn Cameras: Laws and Policies in The SouthThe Council of State GovernmentsNoch keine Bewertungen

- Ensuring Federal Consultation With The StatesDokument3 SeitenEnsuring Federal Consultation With The StatesThe Council of State GovernmentsNoch keine Bewertungen

- By Roger Moore, Policy AnalystDokument16 SeitenBy Roger Moore, Policy AnalystThe Council of State GovernmentsNoch keine Bewertungen

- 2017 Medicaid Comparative Data ReportDokument125 Seiten2017 Medicaid Comparative Data ReportThe Council of State GovernmentsNoch keine Bewertungen

- By Roger Moore, Policy AnalystDokument16 SeitenBy Roger Moore, Policy AnalystThe Council of State GovernmentsNoch keine Bewertungen

- SLC Report: Wind Energy in Southern StatesDokument8 SeitenSLC Report: Wind Energy in Southern StatesThe Council of State GovernmentsNoch keine Bewertungen

- Reducing The Number of People With Mental IllnessesDokument16 SeitenReducing The Number of People With Mental IllnessesThe Council of State GovernmentsNoch keine Bewertungen

- Emerging State Policies On Youth ApprenticeshipsDokument3 SeitenEmerging State Policies On Youth ApprenticeshipsThe Council of State GovernmentsNoch keine Bewertungen

- Transportation Performance ManagementDokument6 SeitenTransportation Performance ManagementThe Council of State GovernmentsNoch keine Bewertungen

- CSG Capitol Research: Workforce Development Efforts For People With Disabilities: Hiring, Retention and ReentryDokument4 SeitenCSG Capitol Research: Workforce Development Efforts For People With Disabilities: Hiring, Retention and ReentryThe Council of State GovernmentsNoch keine Bewertungen

- 2016 Medicaid Comparative Data ReportDokument185 Seiten2016 Medicaid Comparative Data ReportThe Council of State GovernmentsNoch keine Bewertungen

- Corrections and Reentry, A Five-Level Risk and Needs System ReportDokument24 SeitenCorrections and Reentry, A Five-Level Risk and Needs System ReportThe Council of State GovernmentsNoch keine Bewertungen

- The Case For CubaDokument24 SeitenThe Case For CubaThe Council of State GovernmentsNoch keine Bewertungen

- Long-Term Care in The South (Part 1)Dokument20 SeitenLong-Term Care in The South (Part 1)The Council of State GovernmentsNoch keine Bewertungen

- Commuter Rail in The Southern Legislative Conference States: Recent TrendsDokument12 SeitenCommuter Rail in The Southern Legislative Conference States: Recent TrendsThe Council of State GovernmentsNoch keine Bewertungen

- CSG Capitol Research: Child Care ConclusionDokument5 SeitenCSG Capitol Research: Child Care ConclusionThe Council of State GovernmentsNoch keine Bewertungen

- 6th NLIU Trilegal Summit 2021 BrochureDokument11 Seiten6th NLIU Trilegal Summit 2021 Brochuremihir khannaNoch keine Bewertungen

- David WintersDokument8 SeitenDavid WintersRui BárbaraNoch keine Bewertungen

- English For Stock Exchange: Summary of 4 Meetings Boy Satya Graha Saragih 1904421053Dokument13 SeitenEnglish For Stock Exchange: Summary of 4 Meetings Boy Satya Graha Saragih 1904421053Boy satyaNoch keine Bewertungen

- European Indices: Technically SpeakingDokument22 SeitenEuropean Indices: Technically SpeakingmanuNoch keine Bewertungen

- Comprehensive Exam BDokument14 SeitenComprehensive Exam Bjdiaz_646247Noch keine Bewertungen

- Accounting & Finance Assignment 1 - Updated 1.0Dokument15 SeitenAccounting & Finance Assignment 1 - Updated 1.0lavania100% (1)

- Forward ContractsDokument20 SeitenForward ContractsNeha ShahNoch keine Bewertungen

- CashTOa JPDokument11 SeitenCashTOa JPDarwin LopezNoch keine Bewertungen

- 2 - AccentForex Competitive Analysis No ScreenshotsDokument1 Seite2 - AccentForex Competitive Analysis No ScreenshotsTanveer HussainNoch keine Bewertungen

- ICICI Bank Ltd. Versus Official Liquidator of APS StarDokument17 SeitenICICI Bank Ltd. Versus Official Liquidator of APS StarAman Kumar YadavNoch keine Bewertungen

- Bài 12 - Bài tập thực hànhDokument2 SeitenBài 12 - Bài tập thực hànhDuyên BùiNoch keine Bewertungen

- Joint Venture Agreement TemplateDokument3 SeitenJoint Venture Agreement Templategwynette12Noch keine Bewertungen

- Acc311 2021 2Dokument4 SeitenAcc311 2021 2hoghidan1Noch keine Bewertungen

- Project Report On NurseryDokument6 SeitenProject Report On NurseryManju Mysore100% (1)

- ICICIDokument61 SeitenICICISukanya DeviNoch keine Bewertungen

- Harvard Risk Management Career OpportunityDokument7 SeitenHarvard Risk Management Career OpportunityLeo Kolbert100% (1)

- Employee Details Payment & Leave Details: Arrears Current AmountDokument1 SeiteEmployee Details Payment & Leave Details: Arrears Current AmountBalajiNoch keine Bewertungen

- GGP Ackman Presentation Ira Sohn Conf 5-26-10Dokument89 SeitenGGP Ackman Presentation Ira Sohn Conf 5-26-10fstreet100% (2)

- UntitledDokument6 SeitenUntitledAnand LuharNoch keine Bewertungen

- Linda Umwali: XX@XXXXX - XXXDokument1 SeiteLinda Umwali: XX@XXXXX - XXXapi-357628808Noch keine Bewertungen

- Sseagt 1 Aw Final Low en (2) Tcm78-355169 SCANIADokument17 SeitenSseagt 1 Aw Final Low en (2) Tcm78-355169 SCANIAVinay TigerNoch keine Bewertungen

- Private Equity & Venture Capital: in The Middle East & AfricaDokument16 SeitenPrivate Equity & Venture Capital: in The Middle East & AfricaLewoye BantieNoch keine Bewertungen

- Hindalco-Novelis: Case StudyDokument27 SeitenHindalco-Novelis: Case StudyRaj KauravNoch keine Bewertungen

- IIPC Report Morocco Luetjens Scheck FinalDokument58 SeitenIIPC Report Morocco Luetjens Scheck Finalhubba180Noch keine Bewertungen

- Capital Mortgage Insurance - Position PaperDokument4 SeitenCapital Mortgage Insurance - Position Papersouthern2011100% (1)

- Pledge Real Mortgage Chattel Mortgage AntichresisDokument12 SeitenPledge Real Mortgage Chattel Mortgage AntichresisKATHERINEMARIE DIMAUNAHANNoch keine Bewertungen

- Strategic Finance February 2015 PDFDokument9 SeitenStrategic Finance February 2015 PDFSailesh VenkatramanNoch keine Bewertungen

- PN RemDokument3 SeitenPN RemBing Subiate-De GuzmanNoch keine Bewertungen