Beruflich Dokumente

Kultur Dokumente

Mathematical and Computer Modelling: K.P. Sapna Isotupa, S.K. Samanta

Hochgeladen von

Diegoorva A. OVOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mathematical and Computer Modelling: K.P. Sapna Isotupa, S.K. Samanta

Hochgeladen von

Diegoorva A. OVCopyright:

Verfügbare Formate

Mathematical and Computer Modelling 57 (2013) 12591269

Contents lists available at SciVerse ScienceDirect

Mathematical and Computer Modelling

journal homepage: www.elsevier.com/locate/mcm

A continuous review (s, Q ) inventory system with priority customers

and arbitrarily distributed lead times

K.P. Sapna Isotupa , S.K. Samanta

School of Business and Economics, Wilfrid Laurier University, Waterloo, Ontario, Canada N2L 3C5

article

info

Article history:

Received 29 August 2011

Received in revised form 28 August 2012

Accepted 7 October 2012

Keywords:

Inventory

Customer differentiation

Lost sales

Positive lead times

Rationing policy

abstract

In this article we analyze a lost sales (s, Q ) inventory system with two types of customers

and stochastic lead times. Demands from each type of customer arrive according to two

independent Poisson processes. A comparative study of the average cost rate for the cases

where there is differentiation between service to customers based on the type of customer

and the case where there is no differentiation between customers is carried out by using

the concepts of rationing. We provide numerical examples where differentiation between

customers yield lower cost and lower shortage rates for both types of customers.

Crown Copyright 2012 Published by Elsevier Ltd. All rights reserved.

1. Introduction

Organizations recognize the need to develop a strategy that will allow them to provide different service levels for different

customers. One of the methods by which companies are addressing this issue is through the practice of rationing inventory

among different customer classes thus giving the company agility in satisfying customer demand.

In this paper we analyze a continuous review inventory system with two types of customers under the lost sales

framework using concepts of rationing. In many cases similar parts are installed in machines of different companies. Rotables

in aeroplanes would be a typical example of such parts. The supplier of rotables may have a contractual agreement with

one company to provide them with their demand immediately, say 95% of the time and have no such agreement with

another company which requires the same part. Hence it is important for the supplier to differentiate between these two

companies and provide better service to the company with which it has a contractual agreement. In these types of situations,

many suppliers have resorted to stocking enough items to meet the demand from both types of customers 95% of the time

and treating both these companies exactly alike. However, if the supplier were to provide differentiated service to these

two companies, they could lower their inventories which would in turn lower their total cost. One method by which the

inventory could be lowered is by reserving some stock for the companies with whom they have contractual agreements and

using some kind of rationing policy which is the policy we use in this paper.

We analyze a continuous review, lost sales, (s, Q ) inventory system with two types of customers, unit Poisson demand

and arbitrarily distributed lead times. The choice of Poisson distribution for demands seems to be a reasonable one and

has been justified in other papers like Isotupa [1]. From here on we refer to companies that the supplier has contractual

agreements with as high priority customers and companies where there is no such contractual agreement as low priority

customers. In this paper we propose a rationing policy by which a supplier can reserve some stock for high priority customers

thus enabling them to meet their contractual obligations. When the stock on-hand drops below a threshold level, k, all

remaining stock is reserved for high priority customers and all demand from low priority customers will result in lost-sales.

Corresponding author.

E-mail addresses: sisotupa@wlu.ca (K.P. Sapna Isotupa), ssamanta@wlu.ca (S.K. Samanta).

0895-7177/$ see front matter Crown Copyright 2012 Published by Elsevier Ltd. All rights reserved.

doi:10.1016/j.mcm.2012.10.029

1260

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

Isotupa [1] noted that in the Markovian case of exponentially distributed lead times, there is a sub-optimal set of values

for k, s and Q in the rationing case where the service levels for both the high and low priority customers are better than

the service levels in the no-rationing case and also the total cost is lower in the rationing case when compared to the norationing case. In this paper we have noted that even in the non-Markovian case, these same results are observed. More

specifically the results are illustrated for the case of Erlang and constant lead times. This result is very counter-intuitive

because when one company has some stock reserved for them, it is expected that the service level for this company will

increase and service level for the other company will decrease if total cost is to decrease when compared to the case of no

differentiation between the companies.

The model studied in this paper has a wide range of fields where it is applicable. Consider for example, a company which

has a central depot in Canada and a regional depot in Mexico. At the central depot there are two types of demand-direct

customer demand and replenishment orders from the regional depot. The inventory control manager at the central depot

knows that these demands are not equally important and may want to set different service levels for different types of

demand, or, in other words, apply some type of rationing policy. Not satisfying a direct customer order will, in general

be more costly than not satisfying the regional depots order and therefore it is desirable to set a higher level for direct

customer demand. Blood inventory, direct market firms with inventory, inventory of spare parts, military operations are

other potential areas of application of our model. In a review of inventory systems with multiple demand classes, Kleijn and

Dekker [2] provide a wide variety of examples where such models are applicable.

The paper is organized as follows. In Section 2, we position our research in relation to the existing literature. Section 3

deals with describing the rationing model in detail and deriving the transient performance measures. Section 4 deals with

the steady state case. Cost analysis of the (k, s, Q ) model is carried out in Section 5. In that section, the models with and

without rationing are compared and the benefits of the rationing policy are emphasized. It also presents numerical results

and discussion. Section 6 provides conclusions, summary and possible extensions of the rationing model.

2. Literature review

The early work on systems with assigning goods to different demand classes is in yield management problems and a

detailed description of these types of problems which are analyzed in the literature is available in the review article by

Kimes [3]. The traditional yield management problems are single period models with perishable items whereas we plan to

analyze a continuous review system with multiple replenishment opportunities for items with infinite lifetimes.

The first traditional inventory control paper on systems with multiple classes of customers was by Veinott [4] who

analyzed a zero leadtime, periodic review system with multiple classes of customers and employed the notion of critical

levels to ration inventory. One noteworthy paper is that by Topkis [5] who proved the optimality of Vienotts policy in

both the lost sales and back ordering cases in the periodic review realm. Kleijn and Dekker [2] present a review of literature

on inventory systems with several demand classes. Isotupa [1] provides details on periodic review inventory systems with

multiple classes of customers which have appeared in the literature since 1998. Since this paper deals with a continuous

review inventory system, we do not delineate the details of periodic review systems with multiple customer classes.

In the continuous review framework, one of the earliest papers is the one by Nahmias and Demmy [6]. They analyze

an (s, Q ) inventory system with backlogging, fixed lead times and two classes of customers. The focus of the paper was

to determine the proportion of time the orders from each type of customer is met. Moon and Kang [7] analyzed the same

situation as the one dealt with by Nahmias and Demmy [6] and generalized their model to one with compound Poisson

demands. Dekker, Kleijn and de Rooij [8] analyzed a system with the same demand, lead time and stock out policy as Nahmias

and Demmy [6] for the lot-for-lot policy and determined the fill rates. Ha [9] showed that in the complete Markovian

case, the lot-for-lot model with two demand classes and backlogging can be formulated as a queueing model. Sivakumar

and Arivarignan [10] analyzed an (s, Q ) inventory system with Markovian arrival process and exponentially distributed

leadtimes for the case of items which are perishable and have an exponentially distributed lifetime. They present a system of

equations which when solved recursively will determine the inventory level distribution and total cost function. Numerical

illustration of determining inventory level distribution and optimal cost is provided.

All the work on continuous review inventory systems with multiple classes of customers deal with the case of backlogging

unmet demand as these systems are mathematically more tractable. However, in this paper we focus on the lost sales case

and build on the existing literature. One of the early papers in the lost sales case is by Ha [11] who studied a make-tostock production system with multiple demand classes under the Markovian framework. He determined conditions under

which a lot-for-lot production policy and a critical level rationing policy are optimal by modeling the system as an M /M /1/S

queueing system. Dekker et al. [12] generalized Ha [11] to multiple demand classes and modeled it as an M /M /S /S queueing

system. However, they did not establish the optimality of the policy. Deshpande et al. [13] compared four different control

policies: priority clearing of backlog, threshold clearing of backlog, hybrid policy and optimal rationing policy for a system

using a threshold rationing policy.

One of the first papers on continuous review (s, Q ) inventory systems with lost sales was by Melchiors et al. [14] who

developed a heuristic for cost optimization for the case of Poisson demands and fixed lead times. Isotupa [15] analyzed a

similar system for the case of exponentially distributed lead times and derived an expression for the long-run expected cost

rate. Isotupa [1] dealt with the same model as that of Isotupa [15] but with a different focus and determined conditions

under which a rationing policy provides better service levels for both types of customers and yields lower costs for the

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

1261

supplier when compared to a policy that treats both types of customers alike. The last two papers are the ones which are

most related to this paper. In this paper we generalize the model analyzed in the earlier papers by assuming that the lead

times are arbitrarily distributed hence making the system non-Markovian.

3. Problem formulation and analysis

We consider a continuous review inventory model with two classes of customershigh priority (HP) and low priority

(LP). Each class of customer generates unit Poisson demand. The arrival rate of demand for the high priority customer class

is 1 and the arrival rate for the low priority customer class is 2 . The (s, Q ) ordering policy is adopted. In this policy the

maximum inventory level is s + Q and whenever on-hand inventory level drops to s, an order for size Q (Q > s) is placed

which arrives after a positive lead time. The restriction Q > s ensures that there are no perpetual shortages. In this paper

we assume that the lead time is arbitrarily distributed and focus on the lost sales case. The lead time probability density

function is denoted by g (t ) and the mean is m. The following rationing policy is used: When inventory level is less than

or equal to a threshold level, k, low priority demand is not satisfied and results in a lost sales situation. The high priority

customer encounters a lost sales situation only when inventory level is zero. We call this new rationing policy an (k, s, Q )

policy with lost sales.

Let I (t ) denote the on-hand inventory at time t. The process {I (t ), t 0} is a semi-regenerative process with state space

E = {0, 1, 2, . . . , Q + s}. We analyze two different situations; Case 1: 1 k s 1; Case 2: s k Q depending

on whether the threshold inventory level at which supply to low priority customers is cut-off is below the reorder level;

between the reorder level and Q . The case where there is no rationing of inventory can be obtained by taking the limit as k

goes to zero in Case 1. We use the following common notation.

I (t ) = Inventory level at time t ,

G(t ) =

g (u)du,

a () = Laplace transform of any arbitrary function a(t ),

a(n) () = n-th derivative of a () with a(0) () = a (),

E = {0, 1, 2, . . . , Q + s},

E1 = {0, 1, 2, . . . , s},

N 0 = {0, 1, 2, . . .}.

Since Q > s, there is at most one order pending at any given instant of time. As such from our assumptions it is clear that the

replenishment epochs constitute a sequence of regeneration epochs for the inventory level process Z = {I (t ); t 0} with

state space E1 . Let 0 = T0 < T1 < be the successive epochs at which replenishment occurs. Let a = 1, 2 represent Cases

1 and 2, respectively. If In = I (Tn ), then (I , T ) = {In , Tn ; n N 0 } is a Markov renewal process with state space E1 [0, ).

Define the inventory level distribution

Pa (i, j, t ) = Pr[I (t ) = j|I0 = i].

We note that once the inventory level at Tn = Supi {Ti < t } is known, the history I (t ) prior to Tn looses its predictive value.

Hence {Tn ; n N 0 } are stopping times and {I (t ); t 0} is a semi-regenerative process with embedded Markov renewal

process (I , T ) (inlar [16]). As such the functions Pa (i, j, t ) satisfy the following Markov renewal equations for i E1 and

jE

Pa (i, j, t ) = Ka (i, j, t ) +

r E1

a (i, r , u)Pa (r , j, t u)du,

(1)

where a (i, j, t ) denotes the derivative of the semi-Markov kernel of the Markov renewal process (I , T ), and where a (i, j, t )

and Ka (i, j, t ) are, respectively, defined as

1

Pr[I1 = j, t < T1 t + |I0 = i],

Ka (i, j, t ) = Pr[I (t ) = j, T1 > t |I0 = i].

a (i, j, t ) = lim

i, j E1

(2)

(3)

The functions a (i, j, t ) and Ka (i, j, t ) are derived using methods similar to those employed in Kalpakam and Sapna [17], and

Berman and Sapna [18]. In order to determine a (i, j, t ) and Ka (i, j, t ), we introduce the auxiliary functions a (i, j, t ) which

are defined between two replenishment epochs or part thereof as follows:

a (i, j, t ) = Pr[I (t + ) = j|I ( ) = i],

Tn < < t + < Tn+1 ;

The functions a (i, j, t ) are determined in the Appendix.

i E ; 0 j i.

1262

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

The functions a (i, j, t ) can now be written as

a (i, j, t ) =

Aa (i, u)Ba (j, t u)du,

i , j E1 ,

(4)

where

Aa (i, t ) = lim

= lim

Pr[a reorder in (t , t + )|I0 = i]

Pr[a demand in (t , t + )|I (t ) = s + 1] Pr[I (t ) = s + 1|I0 = i + Q ]

(1 + 2 )1 (i + Q , s + 1, t ),

= (1 + 2 )2 (i + Q , s + 1, t ),

1 2 (i + Q , s + 1, t ),

Ba (j, t ) = lim

= lim

a = 1;

a = 2, when k = s;

(5)

a = 2, when k > s,

Pr[I (t ) = j, a replenishment in (t , t + )|I0 = i]

Pr[a replenishment in (t , t + )|I (t ) = j, a reorder at 0] Pr[I (t ) = j|I0 = s]

= g (t )a (s, j, t ).

(6)

To obtain Ka (i, j, t ), we first note that when j > s, there is no reorder in (0, t ) and when j s, there is always one order

placed in (0, t ). Hence

a (i + Q , j, t ),

t

Ka (i, j, t ) =

Aa (i, u)Ha (j, t u)du,

s + 1 j i + Q;

(7)

0 j s,

where

Ha (j, t ) = lim

Pr[I (t ) = j, T1 > t | a reorder at 0]

= G(t )a (s, j, t ).

(8)

Now taking the Laplace transform on both sides of Eq. (1), we have for all i E1 and j E

Pa (i, j, ) = Ka (i, j, ) +

a (i, r , )Pa (r , j, ),

(9)

r E1

where a (i, j, ) and Ka (i, j, ) are obtained by taking Laplace transform on (4) and (7), respectively, and are given by

a (i, j, ) = Aa (i, )Ba (j, ),

a (i + Q , j, ),

Ka (i, j, ) =

Aa (i, )Ha (j, ),

(10)

s + 1 j i + Q;

(11)

0 j s.

The functions a (i + Q , j, ), Aa (i, ), Ba (j, ) and Ha (j, ) are determined in the Appendix.

3.1. Shortages and reorders

In order to determine the various operating characteristics, we define the following events

e1 occurrence of a reorder

e2 occurrence of a shortage for the LP

e3 occurrence of a shortage for the HP.

Each of the en (n = 1, 2, 3) events occur at demand epochs and the sequence of such events do not form renewal epochs

for the inventory level process. Let {Mn (t ); t 0} denote the counting process associated with the en events. To obtain the

corresponding mean rates, define

hn (i, t ) = lim

Pr[Mn (t + ) Mn (t ) = 1|I0 = i],

n = 1, 2, 3.

(12)

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

1263

Then, we have

1

h1 (i, t ) = lim

Pr[I (t ) = 0, a demand by a HP customer in (t , t + )|I0 = i]

= Pr[I (t ) = 0|I0 = i] lim

Pr[a demand by a HP customer in (t , t + )|I (t ) = 0, I0 = i]

= 1 Pa (i, 0, t ).

k

1

h2 (i, t ) = lim

(13)

Pr [I (t ) = j, a demand by a LP customer in (t , t + )|I0 = i]

j =0

Pr [I (t ) = j|I0 = i] lim

j =0

= 2

Pr[a demand by a LP customer in (t , t + )|I (t ) = j, I0 = i]

Pa (i, j, t ).

(14)

j =0

h3 (i, t ) = lim

Pr[I (t ) = s + 1, a demand in (t , t + )|I0 = i]

= Pr[I (t ) = s + 1|I0 = i] lim

(1 + 2 )P1 (i, s + 1, t ),

= (1 + 2 )P2 (i, s + 1, t ),

1 P2 (i, s + 1, t ),

Pr[a demand in (t , t + )|I (t ) = s + 1, I0 = i]

when k = s;

(15)

when k > s.

4. Steady state analysis

In order to obtain the various steady state operating characteristics, consider the Markov chain I = {In ; n N 0 } with

state space E1 embedded in the Markov renewal process (I , T ) whose transition probability functions are given by

pa (i, j) =

a (i, j, t )dt = a (i, j, 0),

a = 1, 2.

(16)

From Eq. (10) on taking the limit as 0, we have

(1)sj ( + )sj

1

2

g (sj) (1 + 2 ),

(

s

j

)!

kj r s+j

r s + k (1)r 1 2

g (r ) (1 + 2 ),

p1 (i, j) =

kj

r !(1 + 2 )ks

r

=

s

j r s+kj

r

s+k

r s + k (1)r 1 2

g (r ) (1 + 2 ),

j

r !(1 + 2 )ks

r =s j=k

(1)sj s1j (sj)

g

(1 ),

(s j)!

p2 (i, j) =

s1

(1)r r1 (r )

g

(1 ),

1

r!

r =0

k + 1 j s;

1 j k;

(17)

j = 0.

1 j s;

(18)

j = 0.

The finite Markov chain I is irreducible and hence possesses a unique stationary distribution. From (17) and (18), it can be

seen that pa (i, j) > 0 and is independent of i. Let pa (i, j) = a (j) for all i, j E1 . Since the Markov chain I is irreducible and

positive recurrent, the Markov renewal process (I , T ) is also irreducible and positive recurrent. The Markov renewal process

is also aperiodic since the derivative of the semi-Markov kernel exists. Then we have (inlar [16])

s

Pa (j) =

a (i)Ka (i, j, 0)

i=0

s

i=0

,

a (i)ma (i)

(19)

1264

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

where Ka (i, j, 0) is obtained from (11) by taking the limit as 0, and ma (i) is the mean sojourn time in state i and is

given by

Q +s

ma (i) =

Ka (i, j, 0)

j =0

i+Q s

m + + ,

1

2

=

ks

i+Q k

m +

+

,

1

1 + 2

Let Da =

a = 1;

a = 2.

a (i)ma (i). Then, we have

1

Q s

+

i1 (i),

m+

1 + 2

1 + 2

Da =

i =0

a = 1;

i=1

ks

Q k

1

i2 (i),

m + + + + +

1

1

2

1

2 i =1

a = 2.

When 0 j Q , we note that Ka (i, j, 0) is independent of i in both cases. Hence from (19), we have

Pa (j) =

Ka (i, j, 0)

Da

0 j Q.

Substituting for Ka (i, j, 0) from (11) in the above equation, we obtain

j r s+kj

r

s+k

r s + k (1)r 1 2

(r )

G (1 + 2 )

P1 (0) =

D1 r =s j=k

j

r !(1 + 2 )ks

1

P1 (j) =

P1 (j) =

kj r s+j

r s + k (1)r 1 2

(r )

G (1 + 2 ) ,

kj

r !(1 + 2 )ks

r =sj

D1

1

D1

(1)sj (1 + 2 )sj (sj)

G

(1 + 2 ) ,

(s j)!

1jk

k+1js

, s+1jQ

(1 + 2 )D1

s 1

(1)r r1 (r )

1

m

G (1 )

P2 (0) =

D2

r!

r =0

P1 (j) =

P2 (j) =

P2 (j) =

P2 (j) =

(1)sj s1j (sj)

G

(1 ),

(s j)!D2

1

1 D2

1js

s+1jk

(1 + 2 )D2

k + 1 j Q.

When Q + 1 j Q + s, substituting for Ka (i, j, 0) from (11) in (19), we obtain

Pa (j) =

(1 + 2 )Da

i=jQ

a (i),

Q + 1 j Q + s.

5. Optimal cost analysis

In this section we discuss the problem of minimizing the steady state expected cost rate under the following cost

structure. K is the setup cost per order, c is the purchase price per unit, 1 is the shortage cost per unit shortage demand by

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

1265

Table 1

Deterministically distributed lead times with 1 = 10, 2 = 30, = 1, c = 10, 1 = 20, 2 = 15, K = 200.

h

No rationing

Optimal cost

1

2

3

4

5

C0 (39, 129) = 531.84

Rationing

HP shortage

rate

LP shortage

rate

0.2302

0.6905

0.5181

1.5542

C0 (32, 74) = 624.29

1.0051

3.0153

3.8835

11.6505

C0 (0, 54) = 670.48

4.2553

12.7660

C0 (36, 91) = 585.39

C0 (0, 63) = 653.05

Optimal cost

C1 (1, 39, 129) = 531.68

C1 (1, 35, 91) = 584.89

C1 (5, 20, 73) = 622.40

C2 (11, 5, 61) = 645.37

C2 (11, 0, 51) = 659.84

Sub-optimal cost

HP shortage

rate

C1 (1, 40, 130) = 531.73

0.1192

C1 (1, 37, 92) = 585.13

LP shortage

rate

0.6872

0.2946

1.5466

C1 (1, 33, 75) = 623.51

0.6423

3.0059

1.3766

11.5870

C1 (5, 8, 55) = 666.71

1.9864

12.7478

C1 (6, 10, 63) = 647.27

HP customer, 2 is the shortage cost per unit shortage demand by LP customer, h is the inventory carrying cost per unit per

unit time. Then the long-run expected cost rate is given by

Ca (k, s, Q ) = hI + 1 1 + 2 2 + (K + cQ )3 ,

(20)

where

I =

Q +s

j =0

jPa (j),

1 = 1 Pa (0),

2 = 2

j=0

Pa (j),

3 =

1

Da

Analytical determination of the optimal values for the parameters was not possible. Hence we resorted to numerical

determination of the optimal values of the rationing level, k; the reorder point, s and the order quantity, Q . We compare

the optimal cost of the system with rationing to the optimal cost of a system without rationing. In the no-rationing case,

there is no differentiation between customers. Hence both types of customers are served as long as there is stock on hand.

The no-rationing case is a special case of Case 1 where k tends to 0. Let us denote by C0 (s, Q ) the long-run expected cost

rate in the no-rationing case. Since the long-run expected cost rate in both cases are now determined, the costs in the case

of rationing can be compared to the costs in the case of no rationing. The shortage costs can be interpreted as the selling

price of the items. As such it is only logical that the selling price of the item is greater than the effective cost price of the

item. Hence, 1 > (c + K /Q ) and 2 > (c + K /Q ) for the optimal value of Q in both the rationing and no rationing cases.

Further, the only difference between HP and LP customers in this case is the selling price to each type of customer and hence

we assume that 1 > 2 . Our numerical examples yielded a very interesting result. When we compare our model with a

system with no rationing, we find that the optimal cost is lower in our model than in the models with no-rationing in a

wide selection of cases. Further, when the optimal cost in our model with rationing is lower than the optimal cost in the

model without rationing, we can find a sub-optimal set of parameters (k, s and Q ) such that the cost of the rationing model

is still lower than the no-rationing model. In addition the shortage rates for both high and low priority customers are also

lower in the model with rationing. This is a counter-intuitive result as we would expect the shortage rate for low priority

customers to be higher in the model with rationing. However, we noted that raising the inventory level a little bit in the

rationing model yielded better service levels and lower costs than the no-rationing case. Hence the rationing model would

be socially optimal if the vendors were willing to forgo some profit. We followed the following two steps procedure for our

numerical analysis. Step 1: Optimize the system with no rationing. Step 2: Optimize the system with rationing along the

constraints that (i) Shortage rate for HP in case of rationing less than the shortage rate for HP without rationing. (ii) Shortage

rate for LP in case of rationing less than the shortage rate for LP without rationing.

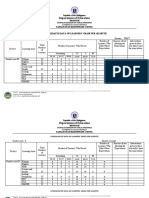

The following two tables present the cases of deterministic and Erlang distributed lead times for 5 different values of

the inventory carrying cost (1st column). The second column gives the optimal cost when there is no rationing as well as

the optimal values of the reorder point and reorder quantity. The third and fourth columns provide the HP and LP shortage

rates in the case where there is no rationing of inventory. The second part of the table deals with the rationing case. The fifth

column gives the optimal cost in the rationing case, the optimal level at which supply is cut off for LP customers, the optimal

reorder point and optimal reorder quantity. The sixth column gives a sub-optimal cost for the system with rationing where

the shortage rates for both types of customers as well as the total cost are lower under the rationing policy when compared

to the case of no rationing. The seventh and eighth columns give the shortage rates for the HP and LP customers under the

sub-optimal rationing policy. From Tables 1 and 2, we see that the inventory carrying cost increases, the difference between

the optimal cost in the no-rationing and rationing models grow. We also note that the order quantity is always lower in the

case of the rationing model. In most cases if the vendor were to give up half the cost savings he obtains by using a rationing

policy, both the high priority and low priority customers would have better service levels than if the no-rationing policy

were employed.

From Tables 1 and 2, we also see that as inventory carrying costs increase to 4 or more, the optimal reorder point in the

no-rationing case is 0. Also, the reorder point and reorder quantity seem to be independent of the lead time distribution

when the inventory carrying cost is at least 4. It appears from all our numerical experience that when the reorder point is

zero, in both the rationing and no-rationing cases, the optimal cost and optimal order quantity are independent of the lead

time distribution. One final observation is that the optimal costs and service levels in the deterministic lead time case are at

1266

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

Table 2

Erlang of order 3 distributed lead times with 1 = 10, 2 = 30, = 3, c = 10, 1 = 20, 2 = 15, K = 200.

h

1

2

3

4

5

No rationing

Rationing

Optimal cost

HP shortage

rate

C0 (32, 137) = 542.95

LP shortage

rate

0.8803

2.6410

C0 (21, 96) = 595.27

1.7666

5.2998

2.6481

7.9444

C0 (0, 63) = 653.05

3.8835

11.6505

4.2553

12.7660

C0 (13, 76) = 629.33

C0 (0, 54) = 670.48

Optimal cost

Sub-optimal cost

C1 (4, 31, 136) = 541.97

C1 (5, 18, 94) = 593.23

C2 (8, 5, 74) = 625.69

C2 (11, 2, 61) = 645.84

C2 (11, 0, 51) = 659.84

C1 (3, 35, 139) = 542.33

C1 (3, 24, 98) = 594.03

C1 (3, 17, 76) = 627.49

C1 (4, 6, 64) = 649.78

C1 (3, 3, 57) = 668.18

HP shortage

rate

LP shortage

rate

0.5281

2.6290

1.1130

5.2954

1.7267

7.9273

2.3826

11.5906

3.0327

12.7473

least as good as or better than the optimal costs and optimal service levels in the case where the lead times have an Erlang

distribution.

6. Conclusions and extensions

In this paper we analyze a non-Markovian continuous review inventory system with two types of customers and lost

sales. In the case of arbitrarily distributed lead times we developed an expression for the total cost. In the special case of

Erlang and constant lead times, the numerical examples illustrated the fact that there are situations where rationing policies

are better than treating both customers alike for both types of customers.

The model proposed in this paper can be generalized in several directions. First, we could introduce the situation of bulk

demand from one class of customer. This model can then be used in various supply chain situations where a node receives

demand from the end-user and lower echelon suppliers. A second possible extension is to develop a similar model for the

partial backlogging case which will have applications for businesses with online sales. Work in these directions will be

undertaken in the near future.

In addition to the contribution to the body of literature on inventory models with customer differentiation, our model is

simple enough to be useful to the practitioner in the following ways:

1. An understanding of the environment under which customer differentiation is better than no segregation of customers. Our

analysis shows that when the costs of shortage, inventory, ordering and demand and lead time parameters are related in

a certain fashion, the rationing policy is better for the organization selling the items and both types of customers if the

organization is willing to reduce their profit margin a little. This reduction in profit margin will still yield higher profits

than the situation where there is no differentiation between customers.

2. The threshold level at which the inventory control manager should use his discretion in supplying customers with items. When

stock level falls below the threshold level, the inventory control manager is alerted to the need of hoarding stock for

the high priority customer and will supply a low priority customer only after careful consideration of the merits of this

action.

3. A measure of the gains which will be made due to adopting a rationing policy. From the discussion in the numerical

illustration section, it is clear that under certain cost structures there is a huge potential for cost savings if a rationing

policy is employed and that under certain other conditions, rationing does not yield much in terms of cost reductions.

Acknowledgment

This research was performed when Dr. S.K. Samanta was a post doctoral fellow supported by Dr. Sapna Isotupas NSERC

research grant.

Appendix

Determination of the functions a (i, j, t ).

To obtain a (i, j, t ), we note that between two replenishment epochs {I (t ); t 0} is a pure death process and satisfies

the following Kolmogorovs forward differentialdifference equations

1 (s, s, t ) = (1 + 2 )1 (s, s, t ),

(21)

1 (s, j, t ) = (1 + 2 )1 (s, j, t ) + (1 + 2 )1 (s, j + 1, t ),

k + 1 j s 1,

(22)

1 (s, k, t ) = 1 1 (s, k, t ) + (1 + 2 )1 (s, k + 1, t ),

(23)

1 (s, j, t ) = 1 1 (s, j, t ) + 1 1 (s, j + 1, t ),

(24)

1 j k 1,

1 (s, 0, t ) = 1 1 (s, 1, t ),

(25)

2 (s, s, t ) = 1 2 (s, s, t ),

(26)

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

2 (s, j, t ) = 1 2 (s, j, t ) + 1 2 (s, j + 1, t ),

1 j s 1,

1267

(27)

2 (s, 0, t ) = 1 2 (s, 1, t ).

(28)

For Q i Q + s

a (i, i, t ) = (1 + 2 )a (i, i, t ),

(29)

a (i, j, t ) = (1 + 2 )a (i, j, t ) + (1 + 2 )a (i, j + 1, t ),

k + 1 j i 1,

(30)

a (i, k, t ) = 1 a (i, k, t ) + (1 + 2 )a (i, k + 1, t ),

(31)

a (i, j, t ) = 1 a (i, j, t ) + 1 a (i, j + 1, t ),

(32)

1 j k 1,

a (i, 0, t ) = 1 a (i, 1, t ).

(33)

Taking the Laplace Transform on both sides of (21)(25), and solve for 1 (s, j, ) recursively, we obtain

(1 + 2 )sj

, k + 1 j s,

( + 1 + 2 )s+1j

sk

kj

1 + 2

1

1

1 (s, j, ) =

,

+ 1 + 2

+ 1

+ 1

sk

k

1

1

1 + 2

.

1 (s, 0, ) =

+ 1 + 2

+ 1

1 (s, j, ) =

(34)

1 j k,

(35)

(36)

Taking the Laplace Transform on both sides of (26)(28), and solve for 2 (s, j, ) recursively, we obtain

sj

1

1

,

2 (s, j, ) =

+ 1

+ 1

s

1

1

2 (s, 0, ) =

.

+ 1

1 j s,

(37)

(38)

Taking the Laplace Transform on both sides of (29)(33), and solve for a (i, j, ) recursively, we obtain

(1 + 2 )ij

, k + 1 j i,

( + 1 + 2 )i+1j

ik

kj

1

1

1 + 2

a (i, j, ) =

,

+ 1 + 2

+ 1

+ 1

ik

k

1 + 2

1

1

a (i, 0, ) =

.

+ 1 + 2

+ 1

a (i, j, ) =

(39)

1 j k,

Solving Eqs. (34)(36) for 1 (s, j, t ) and are given by

(1 + 2 )sj t sj e(1 +2 )t

, k + 1 j s,

(s j)!

kj r s+j r (1 +2 )t

r s + k 1 2

t e

, 1 j k,

1 ( s, j , t ) =

r

!(

+

2 )ks

k

j

1

r =sj

j r s+kj r (1 +2 )t

r

s+k

r s + k 1 2

t e

1 ( s, 0 , t ) =

.

j

r !(1 + 2 )ks

r =s j=k

1 ( s, j , t ) =

Solving Eqs. (37)(38) for 2 (s, j, t ) and are given by

1sj t sj e1 t

, 1 j s,

(s j)!

s1

r1 t r

2 (s, 0, t ) = 1 e1 t

.

r!

r =0

2 ( s, j , t ) =

(40)

(41)

1268

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

Determination of the functions Aa (i, ).

Taking the Laplace Transform on both sides of (5), we obtain

i +Q s

1 + 2

+ 1 + 2

Aa (i, ) =

i +Q k

ks

1 + 2

1

,

+ +

+ 1

1

2

a = 1;

a = 2.

Determination of the functions Ba (j, ).

Taking the Laplace Transform on both sides of (6), we obtain

(1)sj ( + )sj

1

2

g (sj) ( + 1 + 2 ),

(s j)!

kj r s+j

r s + k (1)r 1 2

g (r ) ( + 1 + 2 ),

B1 (j, ) =

kj

r !(1 + 2 )ks

r

=

s

j r s+kj

r

s+k

r s + k (1)r 1 2

g (r ) ( + 1 + 2 ),

j

r !(1 + 2 )ks

r =s j=k

(1)sj s1j (sj)

( + 1 ),

1 j s;

(s j)! g

B2 (j, ) =

s1

(1)r r1 (r )

g ()

g

( + 1 ), j = 0.

r!

r =0

k + 1 j s;

1 j k;

j = 0.

Determination of the functions Ha (j, ).

Taking the Laplace Transform on both sides of (8), we obtain

(1)sj ( + )sj

1

2

G(sj) ( + 1 + 2 ),

(s j)!

kj r s+j

r s + k (1)r 1 2

G(r ) ( + 1 + 2 ),

H1 (j, ) =

kj

r !(1 + 2 )ks

r

=

s

r s+k

r j r s+kj

r s + k (1) 1 2

G(r ) ( + 1 + 2 ),

j

r !(1 + 2 )ks

r =s j =k

(1)sj s1j (sj)

( + 1 ),

1 j s;

(s j)! G

H2 (j, ) =

s 1

(1)r r1 (r )

G ()

G ( + 1 ), j = 0.

r!

r =0

k + 1 j s;

1 j k;

j = 0.

References

[1] K.P. Sapna Isotupa, An (s, Q ) inventory system with two classes of customers, International Journal of Operational Research 12 (1) (2011) 119.

[2] M.J. Kleijn, R. Dekker, An overview of inventory systems with several demand classes, Econometric Institute Report 9838/A, Erasmus University,

Rotterdam, The Netherlands, 1998.

[3] S.E. Kimes, Yield management: a tool for capacity-constrained service firms, Journal of Operations Management 8 (4) (1989) 348363.

[4] J.A.F. Veinott, Optimal policy in a dynamic, single product, nonstationary inventory model with several demand classes, Operations Research 13 (5)

(1965) 761778.

[5] D.M. Topkis, Optimal ordering and rationing policies in a nonstationary dynamic inventory model with n demand classes, Management Science 15

(3) (1968) 160176.

[6] S. Nahmias, W.S. Demmy, Operating characteristics of an inventory system with rationing, Management Science 27 (11) (1981) 12361245.

[7] I. Moon, S. Kang, Rationing policies for some inventory systems, Journal of the Operational Research Society 49 (1998) 509518.

[8] R. Dekker, M.J. Kleijn, P.J. de Rooij, A spare parts stocking policy based on equipment criticality, International Journal of Production Economics 5657

(1998) 6977.

[9] A.Y. Ha, Stock rationing policy for a make-to-stock production system with two priority classes and backordering, Naval Research Logistics 44 (5)

(1997) 457472.

[10] B. Sivakumar, G. Arivarignan, A modified lost sales inventory system with two types of customers, Quality Technology & Quantitative Management 5

(4) (2008) 339349.

[11] A.Y. Ha, Inventory rationing in a make-to-stock production system with several demand classes and lost sales, Management Science 43 (8) (1997)

10931103.

K.P. Sapna Isotupa, S.K. Samanta / Mathematical and Computer Modelling 57 (2013) 12591269

1269

[12] R. Dekker, R.M. Hill, M.J. Kleijn, R.H. Teunter, On the (S 1, S ) lost sales inventory model with priority demand classes, Naval Research Logistics 49

(6) (2002) 593610.

[13] V. Deshpande, M.A. Cohen, K. Donohue, A threshold inventory rationing policy for service-differentiated demand classes, Management Science 49 (6)

(2003) 683703.

[14] P. Melchiors, R. Dekker, M.J. Kleijn, Inventory rationing in an (s, Q ) inventory model with lost sales and two demand classes, Journal of the Operational

Research Society 51 (1) (2000) 111122.

[15] K.P. Sapna Isotupa, Continuous review (s, Q ) inventory system with two types of customers, International Journal of Agile Manufacturing 9 (1) (2007)

7985.

[16] E. inlar, Introduction to Stochastic Processes, Prentice-Hall, Englewood Cliffs, NJ, 1975.

[17] S. Kalpakam, K.P. Sapna, (S 1, S ) perishable systems with stochastic leadtimes, Mathematical and Computer Modelling 21 (6) (1995) 95104.

[18] O. Berman, K.P. Sapna, Inventory management at service facilities for systems with arbitrarily distributed service times, Stochastic Models 16 (34)

(2000) 343360.

Das könnte Ihnen auch gefallen

- Portfolio Optimization with Different Information FlowVon EverandPortfolio Optimization with Different Information FlowNoch keine Bewertungen

- Msom InventInventory Pooling To Deliver Differentiated Serviceory Pooling InformalDokument30 SeitenMsom InventInventory Pooling To Deliver Differentiated Serviceory Pooling InformalmarcelojscostaNoch keine Bewertungen

- Onthe (1) Lost Sales Inventory Model With Priority Demand ClassesDokument18 SeitenOnthe (1) Lost Sales Inventory Model With Priority Demand ClassesFelipe VargasNoch keine Bewertungen

- Document 346Dokument14 SeitenDocument 346Syed ShahedNoch keine Bewertungen

- An Inventory-Location ModelDokument32 SeitenAn Inventory-Location ModelEduardo GonzálezNoch keine Bewertungen

- An Inventory-Location Model: Formulation, Solution Algorithm and Computational ResultsDokument24 SeitenAn Inventory-Location Model: Formulation, Solution Algorithm and Computational ResultsAliNoch keine Bewertungen

- Model Multi EchelonDokument13 SeitenModel Multi EchelonLalit KhandelwalNoch keine Bewertungen

- Effects of Slow Moving Inventory in Industries: Insights of Other ResearchersDokument4 SeitenEffects of Slow Moving Inventory in Industries: Insights of Other ResearchersJoshy Joseph KaniyamoozhiyilNoch keine Bewertungen

- Computers & Industrial Engineering: Yongrui Duan, Jiazhen Huo, Yanxia Zhang, Jianjun ZhangDokument8 SeitenComputers & Industrial Engineering: Yongrui Duan, Jiazhen Huo, Yanxia Zhang, Jianjun Zhangaggarwalankit911Noch keine Bewertungen

- Calculation of The Reorder Point For Items With Exponential and Poisson Distribution of Lead Time DemandDokument10 SeitenCalculation of The Reorder Point For Items With Exponential and Poisson Distribution of Lead Time DemandRaj ChauhanNoch keine Bewertungen

- Agent-Based Simulation Model of Single Point Inventory SystemDokument7 SeitenAgent-Based Simulation Model of Single Point Inventory SystemHadiBiesNoch keine Bewertungen

- Two Echleon by JHa JKDokument9 SeitenTwo Echleon by JHa JKaggarwalankit911Noch keine Bewertungen

- MM1 Queue and Lost Sales Inventory ModelDokument12 SeitenMM1 Queue and Lost Sales Inventory Modelmeishuen123Noch keine Bewertungen

- Replenishment Model-Indian ModelDokument11 SeitenReplenishment Model-Indian ModeladeelNoch keine Bewertungen

- Working Paper Series: Inventory Management in A Consumer Electronics Closed-Loop Supply ChainDokument37 SeitenWorking Paper Series: Inventory Management in A Consumer Electronics Closed-Loop Supply ChainSarabjot SinghNoch keine Bewertungen

- Eoq ThesisDokument4 SeitenEoq Thesisdngw6ed6100% (1)

- Adida Perakis NRL 2007Dokument49 SeitenAdida Perakis NRL 2007Santos QuezadaNoch keine Bewertungen

- European Journal of Operational Research: Çerag Pinçe, Rommert DekkerDokument13 SeitenEuropean Journal of Operational Research: Çerag Pinçe, Rommert DekkerYanuar SiscariaNoch keine Bewertungen

- Picking Sorting Labeling Packing Loading Units Bill of LadingDokument3 SeitenPicking Sorting Labeling Packing Loading Units Bill of LadingRamanRoutNoch keine Bewertungen

- Inventory Control (PPIC)Dokument15 SeitenInventory Control (PPIC)exsiensetyoprini100% (1)

- The Value of Information in An Inventory Model: Fred Janssen, Ruud Heuts, Ton de KokDokument20 SeitenThe Value of Information in An Inventory Model: Fred Janssen, Ruud Heuts, Ton de KokSumant SethiNoch keine Bewertungen

- Paper 1Dokument19 SeitenPaper 1Aisha sheikh HassanNoch keine Bewertungen

- Research Article: A Price-Dependent Demand Model in The Single Period Inventory System With Price AdjustmentDokument11 SeitenResearch Article: A Price-Dependent Demand Model in The Single Period Inventory System With Price Adjustmentletthereberock448Noch keine Bewertungen

- A Joint Location-Inventory Model: Zuo-Jun Max Shen - Collette Coullard - Mark S. DaskinDokument16 SeitenA Joint Location-Inventory Model: Zuo-Jun Max Shen - Collette Coullard - Mark S. Daskina_classic2010Noch keine Bewertungen

- Price, ReplishmentDokument34 SeitenPrice, ReplishmentNafiz AlamNoch keine Bewertungen

- 06 Chapter 2Dokument10 Seiten06 Chapter 2Muthu RajanNoch keine Bewertungen

- Centralization Versus Decentralization: Risk Pooling, Risk Diversification, and Supply Uncertainty in A One-Warehouse Multiple-Retailer SystemDokument28 SeitenCentralization Versus Decentralization: Risk Pooling, Risk Diversification, and Supply Uncertainty in A One-Warehouse Multiple-Retailer SystemStephen HartantoNoch keine Bewertungen

- Measuring and Mitigating The Costs of StockoutsDokument13 SeitenMeasuring and Mitigating The Costs of StockoutsCharlie KebasoNoch keine Bewertungen

- Ijiec 2020 25Dokument14 SeitenIjiec 2020 25ajid kosNoch keine Bewertungen

- A37-Article 1697789030Dokument10 SeitenA37-Article 1697789030SafiyeNoch keine Bewertungen

- Inventory Model For DeterioratingDokument20 SeitenInventory Model For DeterioratingorajjournalNoch keine Bewertungen

- EOQ and EPQ Production-Inventory Models With Variable Holding Cost: State-of-the-Art ReviewDokument39 SeitenEOQ and EPQ Production-Inventory Models With Variable Holding Cost: State-of-the-Art ReviewConsumer DigitalProductNoch keine Bewertungen

- Perishable Inventory System With A Finite Population and Repeated AttemptsDokument15 SeitenPerishable Inventory System With A Finite Population and Repeated AttemptsinventionjournalsNoch keine Bewertungen

- Literature Review On Eoq ModelDokument5 SeitenLiterature Review On Eoq Modelgw0he255100% (1)

- An Inventory Model For Slow Moving Items Subject To ObsolescenceDokument39 SeitenAn Inventory Model For Slow Moving Items Subject To ObsolescenceChita LestariNoch keine Bewertungen

- Multi-Item Inventory Control: A Multicriteria ViewDokument8 SeitenMulti-Item Inventory Control: A Multicriteria ViewJaya PatelNoch keine Bewertungen

- Inventory ManagementDokument5 SeitenInventory Managementmickaellacson5Noch keine Bewertungen

- Supply Chain Optimization & Category Management: Empirical Study On An Online GrocerDokument25 SeitenSupply Chain Optimization & Category Management: Empirical Study On An Online GrocerAartiNoch keine Bewertungen

- Inventory Management: Answers To QuestionsDokument9 SeitenInventory Management: Answers To Questionsjinu220Noch keine Bewertungen

- 1 s2.0 S0895717705005170 MainDokument11 Seiten1 s2.0 S0895717705005170 MainWawan WawanNoch keine Bewertungen

- Sustainability 11 05059Dokument22 SeitenSustainability 11 05059HENRY MARIANO LOPEZ DAMIANNoch keine Bewertungen

- Instructor Manual For Designing and Managing The Supply Chain 3e by David Simchi Levi Philip Kaminsky Edith Simchi LeviDokument29 SeitenInstructor Manual For Designing and Managing The Supply Chain 3e by David Simchi Levi Philip Kaminsky Edith Simchi Levigleesomecystideagpdm100% (11)

- A Project Work On: Submitted To - Dr. Rupesh KumarDokument19 SeitenA Project Work On: Submitted To - Dr. Rupesh KumarSumit TomarNoch keine Bewertungen

- An Inventory-Dependent Demand Model With DeterioraDokument7 SeitenAn Inventory-Dependent Demand Model With Deterioraአንድ ለእናቱNoch keine Bewertungen

- Chen Et Al 2016 Balancing Inventory and Stockout Risk in Retail Supply Chains Using Fast ShipDokument13 SeitenChen Et Al 2016 Balancing Inventory and Stockout Risk in Retail Supply Chains Using Fast ShipvaloruroNoch keine Bewertungen

- Solution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviDokument5 SeitenSolution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviRamswaroop Khichar100% (1)

- Intro To Logis - Quynh Tram - Sem1-2014Dokument40 SeitenIntro To Logis - Quynh Tram - Sem1-2014Chip choiNoch keine Bewertungen

- Simulation Model of Supermarket Queuing SystemDokument5 SeitenSimulation Model of Supermarket Queuing SystemAnoop DixitNoch keine Bewertungen

- On The Use of Break Quantities in Multi (Echelon Dis-Tribution SystemsDokument17 SeitenOn The Use of Break Quantities in Multi (Echelon Dis-Tribution SystemspostscriptNoch keine Bewertungen

- A Joint Economic Production Lot Size Model For A Deteriorating Item With Decreasing Warehouse Rental OvertimeDokument14 SeitenA Joint Economic Production Lot Size Model For A Deteriorating Item With Decreasing Warehouse Rental Overtimerizqi afrizalNoch keine Bewertungen

- 214 1499019336 - 02-07-2017 PDFDokument11 Seiten214 1499019336 - 02-07-2017 PDFEditor IJRITCCNoch keine Bewertungen

- LeslyDokument3 SeitenLeslymickaellacson5Noch keine Bewertungen

- Demand Sensing in E-BusinessDokument35 SeitenDemand Sensing in E-BusinesssunnyNoch keine Bewertungen

- Two-Warehouse Fuzzy Inventory Model With K-Release RuleDokument17 SeitenTwo-Warehouse Fuzzy Inventory Model With K-Release RuleScience DirectNoch keine Bewertungen

- The Value of Switching CostsDokument37 SeitenThe Value of Switching CostsJacques CrémerNoch keine Bewertungen

- An Improved Demand Forecasting Model Using PDFDokument16 SeitenAn Improved Demand Forecasting Model Using PDFArun KumarNoch keine Bewertungen

- Ondemand Warehousing2Dokument52 SeitenOndemand Warehousing2Gaurav SinghNoch keine Bewertungen

- Clasificacion DemandaDokument10 SeitenClasificacion DemandaPaulina PilarNoch keine Bewertungen

- An Inventory Control Project in A MajorDokument34 SeitenAn Inventory Control Project in A Majorfaisal jawadNoch keine Bewertungen

- Stats ch6Dokument16 SeitenStats ch6Narayan NandedaNoch keine Bewertungen

- 1 s2.0 S0360835298000412 MainDokument4 Seiten1 s2.0 S0360835298000412 MainDiegoorva A. OVNoch keine Bewertungen

- Mercury Athletic SlidesDokument28 SeitenMercury Athletic SlidesTaimoor Shahzad100% (3)

- Supply Chain Inventory ControlDokument8 SeitenSupply Chain Inventory ControlDiegoorva A. OVNoch keine Bewertungen

- Energy Efficiency in A Steel Plant Using Optimization-SimulationDokument8 SeitenEnergy Efficiency in A Steel Plant Using Optimization-SimulationDiegoorva A. OVNoch keine Bewertungen

- Discrete Event Simulation - A First Course - Lemmis ParkDokument538 SeitenDiscrete Event Simulation - A First Course - Lemmis ParkThomas MuntoniNoch keine Bewertungen

- 04341383Dokument4 Seiten04341383Diegoorva A. OVNoch keine Bewertungen

- Simulation Modeling in Arena For BU385Dokument22 SeitenSimulation Modeling in Arena For BU385ubuyukduru100% (1)

- 04722034Dokument4 Seiten04722034Diegoorva A. OVNoch keine Bewertungen

- Managing Volatility Through Inventory OptimizationDokument4 SeitenManaging Volatility Through Inventory OptimizationDiegoorva A. OVNoch keine Bewertungen

- Puma PypDokument20 SeitenPuma PypPrashanshaBahetiNoch keine Bewertungen

- Applications of Wireless Sensor Networks: An Up-to-Date SurveyDokument24 SeitenApplications of Wireless Sensor Networks: An Up-to-Date SurveyFranco Di NataleNoch keine Bewertungen

- Consecration of TalismansDokument5 SeitenConsecration of Talismansdancinggoat23100% (1)

- Exploring-Engineering-And-Technology-Grade-6 1Dokument5 SeitenExploring-Engineering-And-Technology-Grade-6 1api-349870595Noch keine Bewertungen

- str-w6754 Ds enDokument8 Seitenstr-w6754 Ds enAdah BumbonNoch keine Bewertungen

- .CLP Delta - DVP-ES2 - EX2 - SS2 - SA2 - SX2 - SE&TP-Program - O - EN - 20130222 EDITADODokument782 Seiten.CLP Delta - DVP-ES2 - EX2 - SS2 - SA2 - SX2 - SE&TP-Program - O - EN - 20130222 EDITADOMarcelo JesusNoch keine Bewertungen

- Ficha Técnica Panel Solar 590W LuxenDokument2 SeitenFicha Técnica Panel Solar 590W LuxenyolmarcfNoch keine Bewertungen

- Class 12 Physics Derivations Shobhit NirwanDokument6 SeitenClass 12 Physics Derivations Shobhit Nirwanaastha.sawlaniNoch keine Bewertungen

- Dog & Kitten: XshaperDokument17 SeitenDog & Kitten: XshaperAll PrintNoch keine Bewertungen

- ABS Service Data SheetDokument32 SeitenABS Service Data SheetMansur TruckingNoch keine Bewertungen

- Scrum Exam SampleDokument8 SeitenScrum Exam SampleUdhayaNoch keine Bewertungen

- Department of Education: Consolidated Data On Learners' Grade Per QuarterDokument4 SeitenDepartment of Education: Consolidated Data On Learners' Grade Per QuarterUsagi HamadaNoch keine Bewertungen

- Ficha Tecnica Bomba Inyeccion MiniFlex EDokument1 SeiteFicha Tecnica Bomba Inyeccion MiniFlex Ejohn frader arrubla50% (2)

- Cap1 - Engineering in TimeDokument12 SeitenCap1 - Engineering in TimeHair Lopez100% (1)

- Homework 9Dokument1 SeiteHomework 9Nat Dabuét0% (1)

- Marking Scheme For Term 2 Trial Exam, STPM 2019 (Gbs Melaka) Section A (45 Marks)Dokument7 SeitenMarking Scheme For Term 2 Trial Exam, STPM 2019 (Gbs Melaka) Section A (45 Marks)Michelles JimNoch keine Bewertungen

- Board of Technical Education (Student Marksheet)Dokument2 SeitenBoard of Technical Education (Student Marksheet)Manoj SainiNoch keine Bewertungen

- Log and Antilog TableDokument3 SeitenLog and Antilog TableDeboshri BhattacharjeeNoch keine Bewertungen

- BSS Troubleshooting Manual PDFDokument220 SeitenBSS Troubleshooting Manual PDFleonardomarinNoch keine Bewertungen

- PDS DeltaV SimulateDokument9 SeitenPDS DeltaV SimulateJesus JuarezNoch keine Bewertungen

- Expression of Interest (Eoi)Dokument1 SeiteExpression of Interest (Eoi)Mozaffar HussainNoch keine Bewertungen

- Cash Flow July 2021Dokument25 SeitenCash Flow July 2021pratima jadhavNoch keine Bewertungen

- Peter Szekeres-Solutions To Problems of A Course in Modern Mathematical Physics - Groups, Hilbert Space and Differential Geometry PDFDokument382 SeitenPeter Szekeres-Solutions To Problems of A Course in Modern Mathematical Physics - Groups, Hilbert Space and Differential Geometry PDFMed Chouaybi0% (1)

- A Short Survey On Memory Based RLDokument18 SeitenA Short Survey On Memory Based RLcnt dvsNoch keine Bewertungen

- 2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - LibroDokument82 Seiten2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - Librovallejo13Noch keine Bewertungen

- Ultra Electronics Gunfire LocatorDokument10 SeitenUltra Electronics Gunfire LocatorPredatorBDU.comNoch keine Bewertungen

- BPS C1: Compact All-Rounder in Banknote ProcessingDokument2 SeitenBPS C1: Compact All-Rounder in Banknote ProcessingMalik of ChakwalNoch keine Bewertungen

- Modern Construction HandbookDokument498 SeitenModern Construction HandbookRui Sousa100% (3)

- Calculating Free Energies Using Adaptive Biasing Force MethodDokument14 SeitenCalculating Free Energies Using Adaptive Biasing Force MethodAmin SagarNoch keine Bewertungen

- 2007 ATRA Seminar ManualDokument272 Seiten2007 ATRA Seminar Manualtroublezaur100% (3)