Beruflich Dokumente

Kultur Dokumente

Former Mayor Bill White's 2009 Tax Return

Hochgeladen von

Texas WatchdogOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Former Mayor Bill White's 2009 Tax Return

Hochgeladen von

Texas WatchdogCopyright:

Verfügbare Formate

~ 1,040

Label (See

inslruc ions on page 14.)

Check only one box.

U.S. Individual Income Tax Return

2009 ~

Last name

• 200G. endlllO

.20

L

~~W~I~L~L~I~AM~~H~.~~ __ ~~~ ~~==~ -+~ ___

E If a joi t return, spouse's first name and Inlli Spcu •••• ICc'al oecuity n~

LrT.AND~~R~EA~~L=.~~~~~~~~~~=IT~E~ -.~~~~~ __ ~_~. __ ~:~~:=-·

H Home address (number and street). II you have a P.O. box, see page 14. ApL no. You must enter

~~l~O~l~S~T~A~B~L~EW~O~O~D~C~O~UR~T~ ~ ~~~yo~u~r~~H(~s)~ab~~~e~.~~

E CIty. tC'IINI or po.l oIIice, sUit •• and ZIP cod .. n)'OU hlv. a lor 'gn ~d:t_. __ H.

77024

Single

Ma led flilng jointly (even If only one had income)

o Mar led filing sepa~ately. Enter spouse's SSN above

and full name here.

Exemptions

It more than fo r dependentsil see

page 17ao D chee here ~

WILLIAM WHITE

ON

ON

AUGHTER

ELENA WHITE

Oup,.".,ts on Gc net ttnt.rld ~

fWd r.umbot>l II

d Total number of exemDtions clalmed.............. . ~:::s~ I 5 I

STEPHEN WHITE

Income Attach Form(s) W-2 here. Also attach Forms W·2G and 1099·R if tax wu wlthh8ld.

If you did no getaW-2, see page 22.

Enclose, but do notattach,any payment Also, please use Form 1040-V.

Adjusted Gross Income

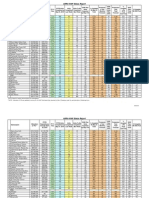

Wages, salaries, tips, etc. Attacll Form{s) W-2 o.F.C............................................................ 1---!.7-+ __ .......:2~3::.l2:::.L.8~6 ~2.!...

8& Ta.uble interest Attach Schedule B If required : T T.................................. 1-:: .• .;.8.7::~ •. "' .. -=l...J...:o5r..:9~4~.

b Tax-exempt interest Do eot include on ne 8a 8b 4 814. :;~.. i

9a Ordinary dMdcnds. Attach Schedule B if required r r............................... . .;:;9&:;... .. +. __ __::3o_:l::...<..1=9-=1c..:....

b Qualified orvioends (see page 22) 9b 2 4 12 5 . A" ~.1

10 Taxable refunds, credits, or offsets of state and local income taxes f--!1,,_0+ _

Alimony rEceived , .. , , : I-"'.;.'+ __ -::-:::-::---:--=-==--

Business Income or (loss). Attach Schedule C 01' C'EZ ·~12~ __ ..::2~8~1~4=6..!.7~.

Gaphal gain 01' (loss). AIIach Sc edule 0 If required. If no rSQuired, check he e ~ D 13 < 3 000. >

Other gaills or (losses). Attacl1 Form 4797 ~ :..... t-'-14.=.......t __ --=1""'7~8::..:.6-=3~.

~:: ~:!~~~~~:~n~ .. ~~· .. :::::::::::: I ~:: I I : ~:~:: :~:~: :::::::::::::::::: f-!!~:~bb+-------

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach SChedule E t-'-17'-1 __ -,1=-5=-=.O..L...!7c...:0,,-7~.

7

11

12

13 14

17 18 19

Farm Income or (loss). Attach Schedule F s :c:«: "., .

lIrIotnploytn01\l """""n1&11 in .. ~". of 12,4OD per '"",poeM

(,"_tTl , , " .

Social security benefits I 20a I I b Taxable amount (see page 27)

Other income. List type and amoun (see page 29), --l::6':;

18

19

20a 21

20b

21

22 Add the amounts in the far rillhl CDlumn for lines 7 thlouoh 21. This is your total income

22

712 684.

23 Educator expenses (see pa.ge 29) " T........................ t-='28~ -;;:1~i,::

24 Certain bUsi ........ _"'1111 01 ,~, p.formi"9 arnall, an _01. govtmr114rTI 24 : '" .. '~

o1fod 5,AlI.a.~2106cr21C8-EZ f--!':!.......1I--------i' .

25 Health savings account deducllon. Attach Form 8889 26 '-)::;;;:

26 MoYlng 8)(penses. Attach Form 3903 26 f.~t~f:i:

One-half of self-employment talC. At1ach Schedule S£ 27 3 922. ;~t<;\~

Self-em loyed SEP, SIMPLE, and qualified plans 28 49 000. 1>/

Self-employed health insurance deductl<>n (see pag B 30) .. r29=....._,t- ., ;::ij:~;

30 Penalty on earlywtthdrawal ofsav.ngs " "....................... 30 :.:::.<'

31a Alimony paJd b Recipient's SS ~ 311 ;~~/~

32 IRA deduction (see page 31) 32 ;~:i; ~~

33 Student loon interest deduction (see page 34) ~38~1- -f~~:~;::

34 Tuhion and fees deduction. Allach Form 8917 ~34:!..-it--------fp.j~1~

36 Domestic roduction activities deduction. Attach Form 8903 35 ~;r-:"':

36 Add lines 23 th ough 31a and 32 through 35 .

37 Subtract IIna 36 from line 22. This is vour adlusted oross income .. 37

27 28 29

36

52 922.

659 762.

LHA For DiSClosure, Privacy Act, and PaperVlor1< Reduction Act Notice, see page 97.

Form 1 040 (200~)

Form 1040 (2009)

Tax and Credits

~dard DeckJotlon 1er·

• Peop~who

... oheck 1/'1)'

bo>toollno 3", Mb.or 40b or .. 0\0 "",btl

.~J cbJmDdul

<IECl<Inden'.

• AI olhoro:

Sing I or

... ...- ~lIn~ oeparatoly. ~5.100 Mamed fIIt1~ loIntly"; OU"iI)Iln~ wtdow(at). '11,_

11.><$" houuhold, sa.350

WILLIAM H. & ANDREA L. WHITE P"9.2

38 Amoun!lrom line 37 (adjusted gross income) ,...=.= = .. = -\--"3 8 rl-_--'6"-=-5.::.9....i..-'7'-'6~2~.

39a Check {D You were born befors January 2. 1945, D Blind.} Total boxes

it D Spouse ViaS bom belore January 2.1945. 0 Blind. ohecked... ~ S9a '-.=.-1'-' .

b "yow ~ It-miua on II ceparat.,.tur'n or you wert • du"slatlJ5 .dian,!!WIe ~9!:I ri and~ hare ~ 39b .;~-

40a Itemized deductions (lrom Schedule A) or your standard deduction (see len margio) .

b Ir)'OU .r. inot.",ng~ __ "Ion ~_ .... I .. 1.1. tallOI, nINI mcI.", vctIloII w nol ~ 4 0

diRllttrloll,.I_ londct1od<h C-p"985l1) Ob

41 Subtract fine 40a Irom fine 38 r.;'-4~1 -;I-_--=<....!...;:w.~'__"_.!..

42 Exemptions. If lilla 38 Is $125,100 or less and you did no pro~de ousino to a Mldwestem displaced Individual, .;;'." ,j

mul'ply $3.650 by tile number on line 60. Otherwise, see page 37 t--=-42"--ir- __ -==...L.=='-"'-~

43 Taxable income. Sublraclline 421r0fTliine 41. If line 42 Is more than line 41, enter -0- t--=-43=---._,1--_---=-==~:....:c..:::...:..

44 Tax, Check If any laX Is from: aD Form{s) 8814 b 0 Form 4972 r44,-+ __ .:...::~'-7-::-':::'':'

45 Alternative minimum lax. AIlach Form 625 1---"45"-ir---~_=_::~7':~~

46 Add lines 44 and 45 ~ !-"46;....,f __ "':";:....!...L..:!c.::.:,,--,-

47 Foreign taxa-edil Attach Fa m 1116 if required. 47 1 321. );:~:{

48 Credit for child and dependent care expenses. Attac Foon2441 48 T::,·.'S

49 Education credits Irom Form SB63, line 29 49 ~f~;~

50 Retilemenl savings contributions credit. Attach Form 8880 50 ):''iW';:

51 CIllid taxcrtdit(see paoe42) 51 ':~:::;

52 C edits lrom Form: a 0 8395 b 08839 cO 5695 52 ~~?L:~

Oilier credits from Form: aD 3800 b 08801 cD 53 .'~~~:::

84 666.

575 096.

12 165.

562 931,

162 563.

5 059.

167 622. 40.

Payments 61 Federal income tax withheld lromFonms W-2and 1099.............................. 6 22 142. ~~i,;

62 2009 estimated tax payments and amount applied from 2008 retum 20 000. ( .. f.~

63 Makiog vlOrk pay and oovemment re' ee credits. AIIach Schedule M :.:r., .. :~{ ;:;

64' Earned Income credit (EIC) e- _ z

b Nontaxable combat pay e'ection ~64::::b...J_ -1

65 Additional child tax credit. Attach Form 6812 ..

66 Refundable education credit Irom Fonm 83l!3, fino 16 1-""'---11-------..,

67 IrsHime hOfTlebuver credil Attach Fonm 5405 , .

68 Amount paid vlitll request for exlenslon to lilo (see page 72) .

69 E~ social security and tier 1 RATA IDXwtthheld (sse pace 72) .

70 Credits rom Form: l 02439 b 04136 c 08801 d 08885 .:.

other Taxes

Refund

:~ ~~::~O:~~;I~~~n~~:~~:: ~·~~~·F·~~;;;;·~·t:1·4137····b·LJ·i;9;·9··::::::::::::::::::::::::::::::::: t-=::::.~-t- .!.7...L.::8~4=:..4:..:...

58 Additional tax 0 lRAs, o1iler qualified tetirement plans, etc. A!tlch Form 5329 If required t--=5..:.8-+- _

59 AddlUonallaxes: 80 ABC payments bOO Ho sehold ernploymen taxes. Attach Schedule H 1-"6 9 +_~~4.~8>=.""1..:..

60 Ad Ilnes 55 throu h 59. This is our Iotal tax ".. . ~ 60 178 986.

71

142 142.

72

Paid Prcpa .... Prep"!rer'salgn.tu .. Use Only ------~~~~~~~~~~~~~--~----~~~~~~--~~L-~~~77~~---

Firm', name (or YOUT5 If Mfr-1!mfllOYW)._", .nd~COdt

.>0002 10.2O-9p

SCHEDULE A (Form 1040)

~"""R""v!:u~'§~ (9':1)

Itemized Deductions

~ Atta.ch to Form 1040.

~ See Instructions for Schadule A (Form 1040).

WILLIAM H.

& ANDREA L. WHITE

Medical and Dental Expenses

Taxes You Paid

(See

page A·2.)

3 685.

Caution. 00 not Include 8Xjlellses reimbursed or paid by others. ~(':

, Medical and dental expenses (See page A·'.) ···················T······j··· .. · .. ·· .. ·· .. ····· .. ···. "'}:- •. +-------I

2 Enter amount from Form 1040, line 38 l...!:2_,_ I --i-:·:···

3 Multiply line 2 by 7.5% (.075) ""'3"-1 --r--i

4 Subtract liM 3 from line 1. If Hne 3 is more than linB 1 enter·()..... 4 0 •

6 State and local (check only one box):

: ~ :::~ :::';es } S.~~ S.W~,TEME.N'r..JL. t-"6-+-_---=3"-'-'1=-4.:.4~.

6 Real estate taxes (Se& page A,s.) r6"-t _ ___,4:..;6"-L-'7_,4...,2,,_,.

7 New mota vehicle taxes from line 11 01 the worksheet on page 2.

Skip this liM if you checked box 5b 1-7~ -I

8 Other taxes. List type and amount ~ _

Is

9 Add nnes 5 through 8 ..

49 886.

. 9

Interest You Paid (See pagBA·6.)

Note. Personal interest Is not deductible .

Gifts to Charity Hyou made a gilt and got a benefit lor it, see page A-8.

11

10 Home mor'tgage interest and points reported to you on Form 109B 1-1'-=°+_-'2=-.:6'-'-'9......,,0..:0"".'1

11 Home mortgago interest not reported to you on Form 1098. If raid to the person ' ....

from whom you bought the home, see page A·7 and show tha person's name, ;.~:;

Identifying no., and address J.f,·~.l.:tl

~------------------------------------- ...

12 Points not reported to you on Form 109B t-'''''2+------l

13 Qualified mortgage insurance premiums (See page A·7.) t-''''3+-------l

14 Investment Interest. Attach Form 4952 II required. (See page A.a.) J...1L:t.J4 r--l

15 Add lioes 10 throuoh 14 .. 16

26 900.

16 Gifts by cash 0( check S.ij:,ij:, S.TA'l'~'.r: .. L. ~1~6+-_-'9:!....L..:!:.1.!:!.2.:::5-'-1.

17 other than by cash or check. If any gift of $250 or more, see page A·B.

You must attach Form 8283 if over $500 t-1!..!7+ --I

18 Carryover from prlor year L.111..1t.18 ..---!

19 Add lines '6throuoh 18 ..

9 125.

19

Casualty and

Theft Losses 20 Casualty Of'theft Ioss(es). Attach Form 4684JSee pag(l A-10.1

Job E.x.pensos and Certain Miscellaneous Deductions

(Seo pageA·10.)

2' Un reimbursed employee expenses- job travel, union dues, job education, etc.

Attach Form 2106 or 2' 06-EZ if required. (See page A·1 0.)

~-------------------------------------

21

22 Tax preparation fees , 1o;22~ -!

:~. ~

~

~f.~~

23 Other expenses - investment, safe deposit box, etc. Ust type and amount

~~~~Q~~J~g 1~~~8~~

23 16880.

-------------------------------------

: ~:~I::o~~::~~g;0~.1.040:ij~.~ .. 3B·:::::::::::::::::::::::::::::: .. L~r .. ·6·5·9 .. ;·;i6'2· . :~~~ 16 880.

26 Multiply~ne25by2% (.02) : 26 13--,-195.

V Subtract line 26 from Irne 24. If ~ne 26 is more than line 24 enter-O- . I 27

Other Mlscella.neous Deductions

28 Other- from list on page A·11. List type and amount ':<

~ - - - ---- - - - ---- -- - - - ----- - - - - - --- - ------- - -- - --- I:~!:t

----------------------------------------------- ~

j;:.

Total Itemized Deductions

-----------------------------------------------

28

29 Is Form 1040, line 38, over $166,800 (ovsr $83,400 if married filing ssparately)?

D No. Your deduction is not limited. Add the amounts in the far right column }

for lines 4 through 28. Also, enter this amount on Form 1040, line 40a. S.rr.:Mr;r. ... Z ~ 29 84 666.

[X] Yes. Your deduction may be limited. S88 page A·1 t for the amount to anter. I:~l~f.t~:~;:r.~~~~~~~~t~~;~tl~~

30 II YOU elect to item~ deductions even thou.llh they are lass than your standard deduc-tion clJeck bere .. 0 : ·:;:::tF+jt'T.;Gj::r;~::: .

Schedule A (FO(m :1040) 2009

LHA g111501 '1-OC-Oll For PaperwOl'k Reduction Act Notice, &ee Form 1040 Instructions.

Schedule A (Form 1040) 2009

Page 2

Woc1<sheet Before you begin: .... You cannot take this deduction if the amount on Form 1040. line 38. Is equal to or grealer than $135.000

for Line 7 • ($260.000 if married tiling jointly).

New motor vehicle taxes

Use this worksheet toflgure the amount to enter on line 7.

(Keep a copy focyour records.)

.... See the instructions for line 7 on Page A-6.

Enter the state 0 local sales or excise taxes you paid in 2009 tor the purchase of any neVi motor vehicle(s) after Februwy 16.

2009 (see page A·6) "." ".,', .. ,.,., .

2 Enter the purchase price (before taxes) of the new motor vehicle(s)

3 Is the amount on line 2 morelhan $49.5001

o No, Enter the amount from line 1, DYes. F'lQure the portion 0 the tax fnom fine 1 mat Is attributable to me first $49,500

of the purchase price of each new motor vehicle and enter It here (se8 page A-6).

} ,." .. , , .. , .. , ,.,"' .. ,

I~r.> r~h~:~

3

4 Enter the amount frorn Form 1040, line 38

5 Enter the total of any .

• Amounts from Form 2555. lines 45 and 50; Form 2555·EZ. tine 18; and Form 4563, line 15. and

• Exclusion of Income from Puerto R co

} .

10 Multiply line 3 by line 9 , .

11 Deduction for new motor vehicle taxes. Subtract line 10 from line 3. Enter the result here

aO<! on Schedule A line 7 .. .. .

11

Schedule A (Form 1040) 2009

SCHEDULE B

(Form 1040A or 1040)

a.~ol~s!:v"t":Y (119)

Interest and Ordinary Dividends

~ Attach to Form 1040A or 1040.

~ See Instructions.

WILLIAM H. & ANDREA L. WHITE

OMS No. 5<5-00U

Part I 1 Ust name of payer. If any interest is from a seJler·finanoed mortgaoe and the buyer used the

Interest property as a personal residence, see page B·1 and list this Interest first. Also, show that

buyer's social security number and address-~ _

GOLDMAN SACHS

Note. If you received a Form 1099·INT, Form1~lo, or substitute statement from a brokerage firm. list the firm's name as the payer and enter the total Interest shown on that form.

2 Add the amounts on line 1 ~2"-1 1:!:..L""5:..... 9~4!!...!....

3 Excludable Interest on series EE and I U.S. savings bonds Issued after 1989.

Attach Form 8815 t-'3"--<t---'7"~7"":--

4 Subtract nne 3 from fine 2. Enter the result here and on Form 1040A, or Form 1040, line Sa ~ 4 1 594.

JPMORGAN

MORGAN STANLEY

WELLS FARGO

FROM K-l - ENTERPRISE PRODUCTS PARTNERS

Amount

1 440.

52.

22.

3.

77.

Note. If line 4 Is over $1,500, you must complete Part III.

Part II Ordinary Dividends

Note: Ilyou received a Form 1 099-0 IV or :rubstitute statement from a brokerage firm, bst the fWm's name as the payer and enter the ordinary dividends shown on that form.

5 Ust name of payer ~ GOLDMAN SACHS

Amount

31 184.

7.

5

FROM K-1 - ENTERPRISE PRODUCTS PARTNERS

6 Add the amounts on line 5. Enter1he total here and on Form 1040A or Form 1040 One 9a ... ~ 6

31 191.

Part III Foreign Accounts and Trusts

Note. If line 6 is over $1 500. vou must comotets Part III

You must complete this part if you (a) had over $1,500 of taxable Interest or ordinary dividends; (b) had a foreign account or Ic} received a distribution from or were a arantor of or a transferor to a foreion trust.

G27!1O ,O·20.()g

Yes No

• ,1 •••• :

:.,,!~. I:;' :.' _ . . ~:':;" "'1\';

7a Atany lime during 2009, did you have an interest in ew a Signature or other authority over a financial account in a foreign coontry, such as a bank account, securities account, Oi other financial account? Sge page B-2 for EIlCceptioos and filing

requirements few Fewm TD F 90-22.1 .

b If 'Yes,' entsr the name of ~e loreign country ~ _

8 During 2009, did you receive a dlstrtbution from, or WIIre you the grantor of, or translerorto, a foreign tNS!7

If "Yss," yOU may have to flle Form 3520. See page B-2 ........ . .

LHA For Paper\Y~ Reduction Act Notice. see Form 1040A or 1040 instructions.

x

x

Schedule B (Form 1040A or 1040) 2009

SCHEDULEC (Form 1040)

O_o'theT,"""'-"Y ",,",81 R_nuo _ C1KII

Profit or Loss From Business (Sole Proprietorship)

~ Partnerships,lointvenlllres, etc., generally must fife Form 1066 or 1066-B.

~ Attach to Form 1040, 1040NR, or 1041. ~See InstrucUons for Schedule C (Form 1040).

2009

~~ e. 09

OIll.B No. t546-007'

_ ,.,.my oomblllSSH)

WILLIAM E, WHITE

A Principal business or prol6ssion, Includtng product or service (see page C-2)

BOARD FEES INVESTMENT MANAGEMENT

BEnla"ClldlltV p esC-lI,10,&11 I

~ 541600

C Business name. If no separate business name, leave blank.

BOARD FEES INVESTMENT MANAGEMENT

o Em;>/Oll" 10 num_ (EN). W ony

Business address (including suite or room no.) ~ 101 STABLEWOOD COURT

CI ,townor ost ottice, state and ZIP code HousT"6N- - TX -7702-4- -- -- - - - -- - - --- - - - -- - - - -:- - - --

F Accounting method: (1) Cash (2) Awual (3) other (specify) ~ _

G Did you 'materially participate' in the operation of this business du 'ng 20091 If 'No,' see page (}3 lor Fmlt on losses 00 Yes 0 No

H If vou started or acouired this bllsiness durmn 2009 check here .. '" ..•... . . .. ~ n

I:P;i'i:H'j Income

Q-oss receipts or sales. Caution. Sec page C-4 and check the box It

• T is ir.come was reportad to you 00 Form w-2 and the 'stalutory employee" box on that form was checked, or

• You are a member of a qualified joint venture reporting only rental raales ate income not subject to self-employment tax. Also see pa~e C-3 for Omit on losses.

2 Returns and allowances .

3 Subtract line 2 trom line 1 .

4 Cost 01 goods sold (from Ii e ~2 on PIlO8 2) .

6 Brou prollt. Subtract line 4 from line 3 ..

6 Other income, including federal and state gasorJne or fuel tax credl or refund (see page C-4J .

7 Gross Income. Add linss 5 and 6 ... ..' .. ..............• ~

1~P..a&JI;J Expenses, Enter expenses for business use of your home only on line 30.

6 Advertising :............... 8 18 Office expenso ..

9 Car and truck expenses 19 Pension and profit-sharing plans .

(see page C·4) 9 20 Rent or lease (see page C-6):

10 Commissions and' tees 10 a Vehicles, machmery, and equipment .

11 Contract la or b Other business property ..

(seepage(}4) 11 21 Repalrsandmalntsnance .

12 Depletion 12 22 Supplies (not included in Part III) .

13 DepreciatJon and section 179 23 Taxes and licenses .

expense deduction (not Included In

Part III) (see page C-5L................... 1---!'18~ --I

14 Employee benefit programs (othar

an on Itne 19) : .....,1""4-+- ---1

15 tnsurance (other than health) 1-:-!1~5+ __ ------l

16 IntBrsst: ~f~.r,

a Mortgage (paid to banks, etc.) .

bOther .

17 Legal and profession

Travel, meals, and entertainment

a Travel .

Deductible meals and

entertainment (see page C~) .

Ulillties .

26 26 27

Wages (less employment credRs) ..

Other expenses (from line 4a on

page 2) ..

16a

16b

services " . . 17 8 440.

2

3 287 231.

4

5 287 231.

6

7 287 231.

18

19

;;;:]1

20a

20b

21

22

23

·t1}~m

24&

24b

26

26 31 278 791.

2.7

28

Total expenses before expenses f business use 01 home. Add lines 8 througll27 ~

Tentative profit or (loss). Subtract line 28 fro lina 7 .

Expenses tor business use 01 your home. Atla~h Form 882.9 .

Net prollt or (toss). Subtract line 30 from line 29.

• 11 a profit, enter on bom Form 1040, line 12, and Schedule SE, line 2, or on Form 1040NR, line 13 (if you checked the

box on line 1, see page C-7). Estates and nusts, enter on Form 1041, line 3. ~

• II a loss, you must go to I ne 32.

If you have a loss, chec!l the box that describes your investment in this activity (see page C-7). }

• II you checked 32a. enter the loss on bolh Form 1040, line 12, and Schedule SE, line 2, or on Form 1040tlR,

line IS (ilyou checked the box on line 1, see lite Ine 31 instructions on paoe C-7). ES!ates and trusts, enter

00 Form 1041, line S.

• II you checked 32b, you must anach Form 6198. Your loss may be Omiled.

29

30 31

32

28 8 A.40.

29 278 791.

30

LHA For Paperwork Reduction Act Nolice, see page Co9 01 tile Instructions.

Schedule C (Form 1040) 2009

SCHEDULEC (Form 1040)

Dopor1ment eI tile TIea8Uf)' Inltma RiYtm.M ~ (9Q)

Profit or Loss From Business (Sole Proprietorship)

~ Partnerships. joint ventures, ete., generally must file Form 1065 or 1065-8.

~ Attacb to Form 1040. 1040NR. or 1041. ~See InstruoHons tor SchedulE C (Form 1040).

2009

~No.09

OMBN"'~07'

N ..... or """"*'"

ANDREA L. WHITE

A Principal business or prctesson, Including product or service (see page C-2)

WRITING

B Enlltco:lromIilDIS~.'UIl I

~ 711510

o Employ« 0 IKImber (CIlI). 11l1l1)I

C Bus' ess name. II no separate business name, leave blank.

ANDREA FERGUSON

Accounting method: Accrual (3) O!lleI (specify) ~ _

G D'd you "materially participate" in the operation of this business during 2009? If "No,' see paQs G-a for limit on losses .........................••... 00 Yes D No

H If vou started 01 aCQuired this business dllfina 2009 c~ hllr8 ..•....... . . ~ 0

I~arthl Income

Gross receipts or sales. Caulion. See pago G-4 and chfi:k the box It

• This income was reported to you on Form W-2 and the" "Statutory employee' box on that 100m was checla!d, or

} ~D

• You are a member of a Q aimed joint venture reporting only rental real estate Income not sub' CI to self-employment tax. Also see page c..a 10( lim' on losses.

2 Returns and alloY/anres .

:I Subtract line 2 from ine 1 ..

4 Cost 01 goods sold (from line 42 on page 2) .

5 Gron profit. Subtract nne 4 from line 3 .

6 OIher income, Including federal and state gasoline or ruel tax credit or refu d (sea paQe C-4) ..

7 Gross Income. AcId lines 5 and 6 . .. .. . ~

2 676.

2

3 2 676.

4

6 2 676.

6

7 2 676. 11P.aii·IIH Expenses. Enter expenSBs for business use of your horne only on line 30.

8 Advertising 8 18 OffICe expense r'8'+-----_

9 Car and truck expMses 19 Pension and profit-sharing plans. r.-:;19~ _

(see page C-4) 9 20 Rent or lease (see page C-6): ~)~~

10 Commissions and fees 10 a Vehicles. machinery, and equipment p2",O,,_a t-------

11 Contract labor b Otiler business p operty p2""O""b t-------

(seB'pageC-4) 11 21 ~pairsanclmaintenance r21'+ _

12 Depletion 12 22 Supplies(nOllncluded In Part III) t-=22'+ _

13 Depreciation and section 179 23 Taxes and licenses I-:-.;:!:!~~'-:-,I- _

expense deduction (not included In 24 Travel, meals, and entertainment ."'~.

Part III) (seepage C·S} !--"'3::.....t -I a Travel .

Employee beneft programs (other Deductible meals and

than on ane 19) 1--"",,4 + --1 entertainment (see page v6) ..

Insurance {other than health} ~1;,6 ,..r--------l 25 UtlITtles ..

Interest ~~=,;L 26 Wages (less employment credll'3) ..

a Mortgage (paid to banks. etc.) 1-'-"6~a+ --j 27 Other expenses (Irom ~ne 48 on

bOther t-'!>!6""b+- --i page2) ..

17 Legal and professional

14

15 16

servIces 17

248

24b

26

26

27

28

Total expenses belore expenses lor business use of home. Add lines 8 through 27 ~

e alive profit or (loss). Sub raet fine 28lrom line 7 ..

Expenses for bus ness use of your home. Attach Form 8829 .

Net profit or (loss). Subtract line 30 from fine 29.

• If a profit. enler on both Form 1040, line 12. and Schedule SE. line 2. or on Form 1040NR. line 18 (II yo checked the }

box on line I, see pallt G-7}. Estates and trusts. enter on Form 1041. line 3.

• "a loss, you mus go to line 32. .

If you have a loss. check the box that describes your investment In thIs activity (see page G-7). }

• "you checked 32a, cnter the loss on both Form 1040, line 12. and Schedule SE. line 2. or on Form 1040NR.

line 13 (if you checked the box on line 1. see the line 31 instructions on page G-7). Estates and trusts, entl!(

on Form 1041, lina 3.

• If you checked 32b, you must attach Form 6198. Your loss may be limited.

29 30

31

32

28 O.

29 2 676.

ao

31 2 676.

32a D:::~t 32b D~::~"'t

LHA For Paperwork Reduction Act Notice, see page G-9 of the Insbuctlona.

Schedule C (form 1040) 2009

Capital Gains and Losses

~ Attach to Form 1040 or Form l040NR. ~ See Instructions for Schedule 0 (Form 1040). ~ Use Schedule 0-1 to list additional transactions for lines 1 and 8.

SCHEDULE 0 (Fonn 1040)

2009

==:"'12

Dep;wtm.nt of tho Trw.a.swy klt.mol R£MIf1UO SoM<;. (GQ

PQme(s)..nown Q1 rebJm

I. Your aoclaI oocu;iIy......m ...

~lILLIAM H. s ANDREA L. WHITE

I.PartIL./ Short-Tenn Capital Gains and Losses - Assets Held One Year or Less

(a) O ....... ·i"" orpro~ny (b) 0... (~cl[o-- Id

(E!<""";;;"oo XvZQ,1 IM~~)'I'.) iMo.::tyr.) (d) SoJca 1>'100

(e) Onl 0<

otncrb;;",

121 332.

68 500.

43 500.

30 444.

53 080. (I) CloIn or (loss)

&Al~'" (0) 1Jom (d)

3 615.

<35 124.>

2 000.

7 056.

<23 128.>

<4 408'.> 1 ENTERPRISE PRODUCTS

* PARTNERS rvARIOUS VARIOUS

JOHNSON CONTROLS INC 04/28/08 01/15/09

NUVEEN MUNICIPAL VALUE

FUND 10/07/0S 01/15/09

NEWMONT MINING

CORPORATION 10/13/0S 01/16/09

JOHNSON CONTROLS INC VARIOUS 01/21/09 124 947.

33 376.

45 500.

37 500.

29 952.

Enter your short-term totals, if any, from Schedule [)'1, line 2 .

Total short-term sales price amounts.

Add lines 1 and 2 in column (d) ..

2 ·3

3 1 092

4 Short·term gain from Form 6252 and snort-term galn or (loss)

from Forms 4684, 6781, and 8824 t-=4y _

5 Net shert-term gain 01' (loss) from partnerships. S corporatlcns, estates, and tl1Jsts

fromSchedule{s)K·1 f-'S'-+ _

6 Short·term capital loss carryover. Enter the amount, If any, from fine 10 of your Capital loss

C a nryover Worksheet in the Instructions r6~(L.- ~

7 Net short-term caDital apin or flossl. Combine fnes 1 tbrouoh 6 in column (fl .

7 <49 989.>

HP.art~II,1 Long-Tenn Capital Gains and Losses - Assets Held More Than One Year

(e) Oocl or (f) Gd1 or ~oo.)

_ bellO SUblracl t.) I\'Cm (<I)

(a) Oosr:ripUon ofPfOl*1Y (b) Oat. (0) Oa,. .ol~

(Example: OOllh.XYZCo..) (M!:~~yr.) \MO., diy, yr.) (d) SoJ .. J>rigo

8

FRONTERA 10000 SHS !VARIOUS 01/08/09

CONOCOPHILLIPS 04/01/05 01/09j09

CHINA TELECOM CORPORATION 06/19/06 01/15/09

CONOCOPHILLIPS Kl'ARIOUS 01/21/09

GENENTECH INC. Kl'ARIOUS 03/11/09 3 395. O. 3 395.

209 290. 217 3S0. <8 090.>

32 905. 31 063. 1 842.

184 002. 265 465. <81 463.>

91 099. 73 85S. 17 241-

89 298. L~~!~ 'i;~/~~~j:~i. j~-::::!~ 5 49S. 9 Enter your long·term totals, If any, from Schedule [).1, line 9 r9'-t---"''''''-''-=.:..:a:.-:.r.~=~~-f-=~==:i~~~

10 Total long-term sales price amounts. 6 0 9 9 8 9 • ~r(#.j~~~m~~~?1~~:~16 ·~i~,@~~jf:;\~lr:~[i~

Add fines 8 arid 9 in ~umn (d) ~10~_""-"'~~~..!J,.....::;_..:..:.,;;,.:.:.:;".~-=:..+=.::"""-......:..:...::..:.-"!;_

11 Gain from Form 4797, Part I; long·term gain from Forms 2439 and 6252; and

Iong·term gain O((loss) from Forms4S84. 6781, and 8824 1--'-11"-+ _

12 Net Iong·term gain or (loss) from partnerships, S corporations, astates, and trusts

from Schedule(s) K·1 f--"12~ __ -=--::-::-:::-_

13 Capital gain distributions S.~~ S.'r.b.'r~.~NT. l.Q..................................... 1-"'13'-t-_--"'6..L...:::;0..:::;5..!.7~.

14 Long·term capital loss carryover. Enter the amount, if any, from Ilne 15 of your Capital Loss

Carryover Worksheet Irl the instructions f-.J.:1'4'-+''-- ~)

15 Net long-term c<lpital gain or ~oss). Combine fines 8 through 14 in column (~. Then go to

Part lit 00 caoe 2 16

<55 520.>

lHA For Paperwork Reduction Act Notice, see Form 1040 or Form 1040NR instructions.

Schedule 0 (Form 1040) 2009

9205" 'Q·2300V

* ENTIRE DISP OF PASSIVE ACTIVITY

_ PaR! 2

16

Combine nnes 7 and 15 and enter the result

If line 16is:

• A gain, enter the amount from line 16 on Form 1040, line 13, or Form 1040NR, line 14. Then go to ne 17 below.

• A loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to compklte tine 22.

• Zero, skip nnes 17 through 21 below and enter·(). on Form 1040, line 13, or Form lQ40NR, line 14. Then go to line 22.

17 Are lines 15 and 16 both g ns?

o Yes. Go to ane 18.

o No. Skip lines 18 throogh 21, and go to line 22.

18 Enter the amount, if any, from line 7 of the 28% Rate Gain Wor1<sheet on page [)'8 of the

instructions '" ~

19 Enter the amount, if any, from line 18 of the Unrecaptured Section 1250 Gain Wor1<sheet on

page [).9 of the instructions ~

20 Ive I nes 18 and 19 both zero or blank?

[XJ Yes. Complete Form 1040 through line 43, or Form 1040NR through line 40. Then complete the Qualified Dividends and Capital Gain Tax Wor1<sheet on page 39 of the Instructions fO( Form 1040 (or In the Instructions for Form l040NR). Do not complete tines 2 and 22 below.

o No. Complete Form 1040 through ~ne 43, or Form l040NR through line 40. Then complete the Schedule 0 Tax Worksheet on page [)'10 of the Instructions. Do not complete lines 21 and 22 below.

21 If ~ne 161s a loss, enter here and on Form 1040, line 13, or Form l040NR, line 14, the smaller of:

• The loss on line 16 or

• ($3,000), or if married fi n9 separately, ($1,500)

} S.&~ S.'l'Nr.ru~ .. .ri ..

Note. When figuring which amount is smaller, treat both amounts as positive numbers.

22 Do you have qualified dividends on Form 1 040, ~ne 9b, or Form 1040NR, tine lOb?

[XJ Yes. Complete Form 1040 through line 43, or Form 1040NR through line 40. Then complete the Qualified Dividends and Capital Gain Tax Worksheet on page 39 of the Instructions for Form 1040 (or in the Instructions for Form 1040 R).

o No. Complete the rest of Form 1040 or Form 1040 R.

920512 10·Z:HlO

SChedule D (Form 1040) 2009

Continuation Sheet for Schedule 0 (Form 1040)

~ See Instructions for Schodule 0 (Form 1(40)..

~ Attach to Schedule 0 to list addlticmal transactions for linGs 1 and 8,

SCHEDULE 0-1 (Form 1040)

2009

o.pa!1menl or ,he ll_y lnI"nat R ..... uo Sorvlcl ('110)

Your soolll se~urity number

Name(s) shawn on retum

WILLIAM H. & ANDREA L. WHITE

I,Part:I'1 Short-Term Capital Gains and Losses - Assets Held One Year or Less

(al Oeacripllcn or p_ty (b) 0... ~Date _, (d) Sal .. price (el COal or (1) G:Un or 0->

""",*,0<1

~Ie< 100 =II. >rrZ CO.) I1>'c"do!',l".) c.,do!',l'I'J clll ... ba* SoJbtr.cl (e)fnrn (d)

NUVEEN MUNICIPAL VALUE FUNt 10/07/08 01/21/09 45 90l. 43 500. 2 401-

NATIONAL OILWELL VARCO INC. IVARIOUS 01/30/09 139 535. 191 405. (51 870. )

JOHNSON CONTROLS INC 110/14/08 03/18/09 9 670. 25 320. ( 15 650. )

NUVEEN MUNICIPAL VALUE FUN!: 0/08/08 03/26/09 44 044. 41 549. 2 495.

NUVEEN SELECT MAT MON PD VARIOUS 06/17/09 29 313. 26 910. 2 403.

SINGAPORE FUND INC VARIOUS 06/17/_09 38 599. 37 475. 1 124.

BERKSHIRE HATHAWAY INC.

CLASS A 10/10/08 09/08/09 98 747. 110 100. (11 353.)

COCA-COLA COMPANY VARIOUS 09/08/09 74 473. 69 29l. 5 182.

GENERAL DYNAMICS

CORPORATION 10/15/08 09/08/09 61 034. 60 790. 244.

NUVEEN SELECT MAT MUN FD IVARIOUS 09/08/09 29 817. 27 800. 2 017.

CISCO SYSTEMS 03/18/08 09/09/09 110 822. 80 650. 30 172.

COCA-COLA COMPANY 03/11/09 11125/09 90 989 .r 74 632. 16 357.

CALL/OWNAR @ 90 EXP

01/17/2009 02/28/08 01/17/09 2 950. O. 2 950.

CALL/BIIB @ 55 EXP

07/18/2009 12/22/08 07/18/09 3 950. O. 3 950.

CALL/COP @ 60 EXP

05/16/2009 111/25/08 01/21/09 20 400. 5 480. 14,920.

CALL/KO @ 50 EXP

05/16/2009 10/21/08 05/16/09 3 150. O. 3 150.

CALL/GO @ 65 EXP 08/22/2009 01/05/09 08/22/09 4 150. O. 4 150.

CALL/EPO @ 25 EXP

09/19/2009 03/25/09 07/28/09 1 640. 1 640. O.

CALL/EPD @ 25 EXP

12/19/2009 04/23/09 07/27/09 2 375. 2 375. O.

CALL/EPD @ 25 EXP

12/19/2009 04123/09 10/27/09 475. 475. O.

CALL/CSCO @ 17.5 .EXP

01/16/2010 03/18/09 09109/09 9 200. 26 250. ( 17 050. )

2 Totals, Add tho amounts in column (d), Also, combine the j{~~l,]~i10fr~~:~i;l~;;

amounts in column (I). Enter here and on Schedule 0, line 2 A .••• ~2 821 234. <4 408. I '

I :

LHA For PaperwOl1c: Reduction Act Notice, see Form 1O<Wor Fonn 1040NR Instructions,

Schedule 0·1 (Form 1O<W) 2009

>

Sohedule ()'1 (Form 1040) 2009

Attachmenl Sequence No. 12A

Page 2

WILLIAM H. &

REA L. WRITE

Your social securilJ' number

Name(s sIlown on return. Do not enter name an social security number If shown on page 1.

f[P.ar:LI.i,I Long-Term Capital Gains and Losses - Assets Held More Than One Year

(a) OellCripllon or property (Example; '00 oil. XYZ co.)

(b)D ... ",~Irod (Mo., dlY. yr.)

(d) Sal .. """"

(e) Co.;", otnlH" beela

(f) Olin orOOOll &JblrBo1 (0) ~om (d)

(e) Dol. oolC! (Mo .• day. yrJ

BERKSHIRE HATHAWAY INC. CLASS A

08/08/05 04/08L09

89 298.

83 800.

5 498.

9 Totals. Add the amounts In column (d). Also, combine the amounts in column (fI, Enter here and on Schedule D line 9.

5 498.

89

Schedule 0-1 (Form 1040) 2009

SCHEDULE E (Form 1040)

Supplemental Income and Loss

(From rental real estate, royalties, partnorships, 5 cor-porations, estates, trusts, REMICs, etc.)

~ Mach to Form 1040, 1040NR, or Form 1041. ~ See Instruellons for Schedule E (Form 1040).

2009

Oepa1:rnent or the ne3:SUrY

"'ornll A"""""o S.,vfoe ('9Q)

=~.13

OMB No. 1545-0074

"ame(s) shown on return

Your S1Jcial security number

WILLIAM H. & ANDREA L. WHITE

~ Income or Loss From Rental Real Estate and Royalties Note. If you are In the business oj renting personal property, use Schedule C or C·ez (see page E·S). If you are an individual, report farm rental Income or loss from Form 4835 on page 2, ~ne 40.

List tile type and address of each rental real estate property: 2 For each rental real estate propei1'j lisled Yos No

A RENTAL PROPERTY 00 nne l,didyouoryourlamjlyuse~

134 N. 100 WEST MOAB UTAH during the tax year far personal purposes A X

B RENTAL PROPERTY or more than Ihe greater of: • 14 days or

156 N. 100 WEST MOAB UTAH • 10% Of the total days rented at flW B X

C ental value?

(See page E'3) C

Income:

10 325.

3 Rents received ...................•......................

4 Royalties received.... .. . ...

Properties

Totals

(Add columns A. B, and C.)

B

c

A

4

723.

13 ';';:Z:':

h-'-~-----:-:--+----- ...... -i---__;----I;fj~lTI 1-"'14-+-_---'1!:.L...!2"-"8'-!:6~.+- __ -'5~7!..:9"_'.'+_----__i~~;.;,:.

f-!'::=--t-----:-::-:-+-----::-:--::-t--------i·;lj(~

1--"'17+ ....:4:..::0:...::4:..:.+- __ __:::8:...::3'-"6'-'·+- ___i~:1:~

~------~~-+------------+- ---- ~~~~

18 ~-- -4~5~5~·t----- ..... -4~8~3-.+- -- __,ij{~

f-- ----+------+---------I:1t~£:

.~&~~

-------------------------+--,_----~~~+---~~~~~--------___i

19 Add fines 5ttlrough 18 pI9'_t_---72-'-::1":4":5:....:.+---'=1~8..::9-'!8~.'i_-----_+_.:..:19'_t_----=4~0_=4~3~.

20 Depreciation expense or depletion (see page E'5) ~204- ..... ~2W...;5==-1~9.!..+-- ..... ::.3~0:..;:4~O~. '- __ +=2~0'+ -"5CL..:5<..:5~9~.

21 Total expenses. Add lines 19 and 20 i--!'-21~---=4.L.:=6C!:6:...::4'-!.~--.;:;4..t.=:9-"3~8:....:.1_-----_I~~:;i:':

22 Income or (loss) f om rental real estate i~ji~t:s;

or royalty properties. Subtracl line 21 . ,:,:ji .:i

from Ene 3 (rents) or line 4 (royalties).

;.:~:~~ If ttle result is a (loss), see j}aga E·5 to

find out jf you must liIe Form 6198.................. 22 361 • 362 • .;j~~1:

~~-- ..... --"-'<-=.-'t------==~~t--- ..... ----i ,.",. ,

.1 :;~;::; ':

23 Deductible renlal real estate loss. Caution. ,.;. -;£

Your rental real estate loss on line 22 may '"(

be limfied. See paoe E·5 to find ou1 if you :i~:;r.~~

must file Folrmt Blin5824.3Real estate professionals ."'.:,.'.~.'~.~ __ :.;.;

must camp a e e on palJe 2 ...."2,,,3 ~-----__.---- - ------4 ..

24 Income. Add positive amounts shown on a~ 22. Do nol include any losses r24-'--1:--_...:_ _ __,:7~2::..:3~.

25 Losses. Add royalty losses from linc.22 and rental real estate losses Irom line 23. Enter t.olallosses here t-=-26"-+(:.... ---=.)

26 Total rental real esbte and royalty income or (loss). Combine lines 24 and 25. Entar the resu hera.

"Parts II, Ill, IV, and line 40 on page 2 do 110 apply to you, also enter this amount on Form 1040. line 17, or Form _1040t~R, nne 18. Otherwise, include this amount In the total on line 41 on page 2

Expenses:

5 AdVertising .

6 Aulo and trawt (see paJ}B E-4) ..

7 Clean g and maintenance .

8 COmmissions .

9 lnsuranca .

10 legal and other professional lees .

11 Management fees ..

12 Mortgace interest paid 10 banks, etc.

(see page E-S) ..

13 Other Interest........ .. ..

14 Repairs .

16 Suppr s ..

16 TaKes ..

17 UtUHies .

18 Other (IISI) ~ ,-:- _

SEE STATEMENT 12

SEE STATEMENT 13

5 300.

5 025.

3

~~t~~~~~

I-':'-I-------+-------i--------I~!i*l~

~7_,---------- ..... -r .......... ---- .......... +- ..... -- ..... ------i~~~~

r-"8-+-------t-------;.-------j:f!~i~~: r9'-......j-------+------t--------i~1·.~Ht} 1--'-:0=-1 +---------'f--------+-------i~i~~

i~;f~il

12

12

26

QZ14QI Wl-23·0Q LHA For Paperwort; Reduotion Act Notice, see Instructions.

Scbedule E (Form 1040) 2009

A!~ment 5eQu«lc1 No. 13 I'lojje 2

Name(a) .nown on r':Lm. Do no, en111' ~e and IOd.lltcUlty nurrt.' if snD'Wn on pope 1,

Your sooill aecuity number

1:P.ar:tll; H Income or Loss From Partnerships and S Corporations Note. If yOtJ report a loss from an at-risk activity rOf which any amount is not at risk, you must cMck column (e) on line 28 and attach Form 6198. S99 pag9 E·1.

27 Are you reporting any foss not allowed In a prior year due to the at·rlsk or basis limitations, a poor year unallowed loss from a

passive actMty (H mat loss was not reported on Form 8582), or unreimbursed par1nersttip upenses? 0 Yes [XJ No

It yOU answered "Yes' see naoe E-7 before comolBtina this section.

BTEC INVESTMENTS LLC

P

(e) Check Ir

-1l)I amount Js nCC 81 ".k

(b) EoI" P lor (~GII_ (d) Employer

,~~:;'~n ~:~p identification number

28

(a) Name

c

(h) Nonpassive loss (il Section 179 expense (j) Nonpassive Income

from Schedule K-l ~eductlon from Form 4662 from Sohedule K-l

A

ENTERPRISE PRODUCTS PARTNERS

P

76-0568219

*

g

o

Passive Income and Loss

Nonpassive Income and Loss

32 149 984.

(n Passive loss allowed (g) Passive income

(att3Ch Form 858211 requi"ed) trom Schedule K·l

o

163 000.

A

PTP~8~ -=1~3~0~1~6,. ,_----------r_--------~--------------

c

29bZ TTOotala~ II:}'<'''~''':' ··:1··c3:·\':,:0~i~1: '6':":.\.;' .. " ,,'. ' '.~'" 1,.-: •• 6 .: ,,;~ ...•.•. _-.0 ..• :., .. ~.-, .. :?.:':.: ....••••.• ~:';il .. :.",",:',,,::,,; .• /:/':,; F:1f.F\if.~~2:ii:":":2;:';'.

Rt • - .. ;~: .. - E. _.,.- - i!;~f:i.!::,:.. ~:::~::.:::. L. ;A;:: :~;r.i:~i·:ri

30 Add columns (g) and (D Clf Rne 29a .

31 Add columns (n, (h), and (I) 01 line 29b .

32 Total partnership and S corporalio income or (loss). Combl e ~nes 30 and 31. Enter the

result here and include In the total on line 41 below .

30 163 000.

91 13 016.)

l'Par'M II 'I Income or Loss From Estates and Trusts

(b) ElIljlloyer Identification number

38

(I) Name

A

B

(e) Deduction or loss (f) Other Income trom

from Sched~le K-1 Schedule K-l

Passive Income and Loss

Nonpasslve Income and Loss

A

(e) Passive deduction or klss allowed (attach Form 8582 If requlned)

(d) Passive Income from Schedule K-1

8

34a Totals .. , I:Jh:::.::·~:;:...~:~~~~~:~~l~·~~~1+J.~-'";~i ~11~!~j~i~~f~~?rIi::1~~·§ngA~:~~~~~·

b Totals : l ~~~m:;~f~·;~:~~t~~r:!·:~~..;.~~~T,~ :';hk·~n· ~r: f-j!~~::\::/?;.~:~~:~.:r:~;

35 Add columns (d) and (Q 01 Ene 34a 1--"'35,,-;- -:-

36 Add columns (c) and (e) of line 34b :..... t--='36~,.:._ -"-

37 Total estate and trust income or (loss). Combine lines 35 and 3S. Enter tile result here and include In tile total 00 fine 41 belCIW 37

1;P.ar±W 1 Income or Loss From Real Estate Mortgage Investment Condui1s (REMICs) - Residual Holder

(b) ElIljlloyer (c) Excess Inclusion from Id) Taxable income (net (e) Income Irom

38 (a) ame idenlilitatio number Bchedules Q, line 2c oss) from Sc.h~dules Q, Schedules Q line 3b

line II!. '

39 Combine cojumns (d) and (9) nnlv. Enter the result hl!lB and Include in Ihe total on line 41 belCIW ••....

39

~P.art;\1·:1 Summary * ENTIRE DISPOSiTION OF PASSIVE ACTIVITY

40 41 42

Ne fanm rental income or (loss) Irom Form 4895. Also, complete line 42 beloVi t-'4 .. 0+_--:--=-:~-:::-:::-=- __

Total income or (loss). co_ ...... 2&. 32,31, M. and 40. Enter I"" .oouit h ... "don Fam 10<10, 11. or F"", '040NR.II"" 15 ~ 41 150 707.

~~::~I~~I;~r~ ~~~,nl~n:~~ :~~~~n~~~;Fo~te;~o~: ::&8 4~~::e~B~~~::~~: ~~me ~~~t;~~~~~i~1~~:lli~~~1l:~:;j;{;{ -. ~:·qf~:·1:i~jJ.:::· •.. iit:.:~~.:':~1~f~.

(Fonm 11205), box 17, code U; and Schedule K-1 (Fonm 1041), 5ne 4, code F (see page E-.'l) 42;'1' . ;·.-\~;~~:~;f~,(:::i;:~;:~>~·:;:;··>

=:i:::=:~:.:~~:::~:~:~:E::=~~:~~:::;:.~:.t. ·~~~1~j!~1~i.~f6~~~~[~1l!W::-:~~::~ ;~:I:~!~1:i:~~lj:~t···~;;·i~~:,~t:~~J~~

48

02:1&01 0·23-011

Sc adule E (Form 1040) 2009

SCHEDULESE (Form 1040)

OMBNa. \500~74

Self-Employment Tax

200'9

o.p"""""'l 01 !he T-....y

"'l"",,1 R.v....., ~ IQII)

~ Attach to Form 1040. ~ See Instructions for Schedule SE (Form 1040).

Name of person with self-employment Income (as shown on Form 1040)

Social security number of person with self-employment income .... ~

ANDREA L. WHITE

Who Must File Schedule SE You must file Schedule SE if:

• You had net earnings from self-employment from other than church employee income ~ine 4 of Short Schedule SE or line 4c of Long Schedule SE) 01 $400 Of more, or

• You had church employee income of $108.28 or more. Income from services you performed as a minister or a member of a t Ilgious erdor is not church omployeelncome (see page SE·1).

Note. Even if yo had a loss or a small amount of income from self·employment, it may be to your benefit to me Schedule SE and use either "optional method' In Part II of Long Schedule SE (see page S&4).

Exception. If your only self·employment income was from eamlngs as a minister, member of a reUgious order, or Christian Science practitioner and you filed Form 4361 and received IRS approval not to be taxed on those eamlngs, do not file Schedule SE. Instead, write 'Exempt·Form 4361" on Form 1040, line 56.

May I Use Short Schedule SE or Must I Use Long Schedule SE?

Note. Use this flowchart only 11 you must file Schedule SE. If unsure, see Who Must File Schedule SE, above.

Did you receive wages or tips in 2009?

No

Yes

Ase you a minister, member of a religious order, or Christian Science practitioner who receivad IRS approval not to be taxed on earnings from these sources, but you owe self~mployment tax on other earnings?

Was the total of your wages and tips subject to social security or railroad retirement (tier 1) tax plul your net earnings from self·employment more than $106,8001

No

No

Are you using one of tile optional methods to figure your net earnings (see page SE"",)?

Did you receive lips subject to social security or Medicare tax that you did not report to your employer?

No

No

Section A-Short Schedule SE. Caution. Read above to see If you can use Short Schedule SE.

1a Net farm profit or ~oss) from Schedule F, line 36, and farm partnerships, Schedule K·'

(Form 1065), box 14, code A 1--1"'6'+ _

b If you received social securlty retirement Of disability benefits, enter the amount of Consorvation Reserve

Program payments included on Schedule F. line Sb. or fisted on Schedule K·1 (Rlrm 1065), box 20, code Y ...... 1-1.:..:b"+ _

2 Ne profit or (loss) from Schedule C, Une 31; Schedule ~ lilIe 3; Schedule K·1 (Form 1065), box 14, code A

(other than farming); and Schedule K·l (Form 1065·S), eex 9, code Jl. inisters and members of religious orders,

see pg SE·1 for types of Income to report on this line. See pg SE-3 for other income 0 report s:rm l~ 1--'2,._1-- ~2'-'-'6~7~6_._.

3 Combine lines 1 a, 1 b, and 2 !--'3'-j ..:2,_,_6 7..=6_._.

4 Net earnings from self~mployment Multiply line 3 by 92.35% (.9235). If less than S400.do not

file this schedule; you do not owe self-employment tax ~ j-:4:I.....+- --'2~..;:4~7~1c..!...

5 Self-employment tax. If the amount on line 4 is:

• $106,800 or less, multiply line 4 by 15.3% (.153). Enter the result here and on Form 1040, line 56.

• More than $106,800, multiply fine 4 by 2.9% (.029). Then, add $13,243.20 to the result.

Enter the total here and on Form 1040, line 56 5 378 •

6 g~t~~~:~e:~tohne~;h:~~0~:~~~mfc:~i~:t;x .. ~ultiPlyllne5by50% (.50). 16 I 189. ~;n~~;f~:-~·W~~f;:~~:;.:m~~~r;~!~:

LHA For Paperwork Reduction Act Notice, see Form 1040 Instructions.

Schedule SE (Form 1040) 2009

Pogo 2

Name of person with self-emplcyrnent income (as shown on Form 1040)

Soolal securlty number of person with self-employment income ~

WILLIAM H. WHITE

Section B - Long Schedule SE

;P...art~ Self-Employment Tax

Note. If your only Income subject to self·employment tax is church employee income, Skip fines 1 through 40. ElIte ·0· on Gne 4c and go to line 5a Income from services you performed as a minister 0( a member of a religious order Is not church employee income. See page SE·1.

A If yoo are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or

more of other net eamings fro self-employment, check here and continue with Part I .. ~ D

1 a Net farm profl1 or (toss) from Schedule F. line 36. and farm partnerships. Schedule K·1 (Form 1(65).

box 14, code A. Note. Skip I nes ra and 1 b it you use the farm optional method (see Page SE-4) f-'l"'u+ _

b It you received social security retirement or disability benefits, enter the amount of Conservation Reserve

Program payments Included on Schedule F. line 6:). or listed on Schedule K·1 (Form 1(65). box 20. code Y 1-'1::.b+ _

2 Net profit or (loss) from Schedule C,line 31; Schedule eEl, line 3; Schedule K·1 (Form 065). box 14. code A (othor than farming); and Schedule K·1 (Form 1065·8), box 9, code Jl. Ministers and members of religious orders, see pg SE-1 for types of income to report on this line. See pg SE·3 for other income to report,

Note. Skip this line If you use the nonfarm optional method (see page SE-4) S.~~ .. ,S.'rAT.B.M'B.N'l' lS. I-.Ii... 2+- __ ..o!2!..o7w8~.!..7.=!.9-=1~.

3 Combine lines ta, 1 b, and 2 1---'3~ __ ~2!..o7~8:w..7.!...=!.9-=1;..!..

4 a If line 3 Is more than zero, multiply line 3 by 92.35% (.9235). Otherwise. enter amount from fine 3 ~4a~f- __ _.2'-'5:<..7.!....L..::4'-'6:<..3~.

b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here t--= 4b+ _

e Combine I 88 4a and 4b. If less than S4OO, stop; you do not owe self-employment tax. Exception.

4e

257 463.

If less than $400 and you had church employee income, enter o and contlnue"I". "'r" ~

5 a Enter your church employee Income from Form W-2. See page SE·1 ;~:a~;:;

;~(:~~:R

for definition of church employee income '-"5&:::...1.- -; ~ .. ,;:"

b Multiply fine Sa by 92.35% (.9235). If less than $1 00. enter -0- .

Net earnings from self-employment. Add lines 4c and 5b ..

Maximum amount of combinad wages and self· employment earnings subject to social security tax or

the 62% portion of tha 7.65% railroad retirement (tlar 1) tax for 2009 ..

." , ••• '1

8 a Total social security wages and tips (total of boxes 3 and 7 on Form{s) i;;~~~

W·2) and raliroad retirement (tier 1) compansation. If $106,800 or more, skip ::.,~".;"

b ~::~::;;:; :0~j:t~0~:II::;:~~';'~'(i~~'F~~'413:;:'i~'1'oi"'::::::::::: 1 0 6 8 0 0 . ~t.Thi

c Wages subject to social security tax (from Form 8919, line 10) ,_,SC"""'.L. ---liJify

d Add lines 8a, 8b, and Sc : .

9 Subtract line 8d from line 7. If zero or less, enter·(J. here and on line 10 and go to line 11 ~

10 Muitlplythe smaller of line 6 arline 9 by 12.4% (:124) ..

11 Multiply line 6 by 2.9% (.029) .

12 Self-employment tax. Add lines 10 and 11. Enter here and on Form 1040, line 56 .

13 ~:U;~:~~e~;~~:~~t~:~-:n7~~~~t:-O~~n~P~line12by ....... 1131 3 733. ;R~3~llij~~~W.~·~X~~~~~1~

5b

6

257 463.

6

7

7

106,800.00

8d

9

10

11

7 466.

12

7 466.

"Ra~.I!I· Optional Methods To Figure Net Eamings (see page SE-4)

4.360.00

Farm Optional Method. You may use this method only if (a) your gross farm Income' was not more than $6,540. or (b) your net farm profits 2 were less than $4,721.

14 Maximum income for optional methods ..

15 Entarthe smaller of: two-thlrds (213) of gross farm Income 1 (no IGSS than zero) 0( $4,360. so include this amount on line 4b above

14

15

Nonf..-m Optional Method. You may use this method only if (a) your net nonfarm profits 9 Vlere less than $4,721 and also less than 72.189% of your gross nonfarm Income!' and (b) you had net eamlngs from self-employment of at

least $400 in 2 of the prior 3 years.

Caution. You may use this method no more than five times.

16 Subtract line 15 from line 14 f-'-16"'-l _

17 Enter the smaller of: two-thirds (213) of gross nonfarm Income 4 (not less than zero) or the amount on

fine 16. Also include this amount on line 4b above '-'1.:..7_,_ _

1 From Sch. F,lins 1 • and Sch. K-l (Form 1065), box 14, code B. 3 From Sc . C , 11rl6 31; Sell. <rEZ,line 3; Si:I1. K- (Form 1065). box 14. co<ls A; and

2 F om Sch. F,line 36, and Sch. K-l (Form 1065), box 14, code Sch. K-l (Form 1065-8), box 9. code Jl.

A - minus the amount YOU would have entered online lb had you 4 From Sch. C .11rl6 7; Sch. C-EZ,I,ne ; sen, K·1 (Form 1065), box 14, code C; and

not used the optional method. . Sch. K -1 (Form 1065-8), box 9, code J2.

Schedule SE (Form 1040) 2009.

Fum 1116

Foreign Tax Credit

(Individual, Estate, or Trust)

~ Attach to Form 1040, 1040NR, 1041, or 99().. T.

OMS No. 11145-0'2'

2009

Name

Identifying number .. "'"'

on pig< 1 01 you' lax mum

WILLIAM H. & ANDREA L. ~~ITE

Use a separate 1'00111116 tOf each category of income listed below. See Cateoories 01 Income beginning on page 3 of the instructions. Check only one box on each Form 1116. Report al amounts In U.S. dollars e.xcep vhere specifled In Part II below.

I [XJ Passive category income c D Section 901(0 income e 0 Lump-sum distributions

b D General category irli:ome d D Cer1a!n Income re-seurced by trealy

1 Residemof(namaotcountry) ~ UNITED STATES

Note: If you paid t~es to only one foreign country or U.S. possession, use column A in Part I and line A in Part 11. If you paid taxes to more than one foreign country or U.S. possession, use 8 separate column and line for each country or possession.

Forei~ n Country or U.S. Possession

p:~ar:t~t.;q Taxable Income or Loss From Sources Outside the United States (for Category Checked Above)

ABC

Enter the name of tho foreign country or U.S.

pess ssion ~ VARIOUS %f

ta ::f::.~=:::"'ooOry ,.""~ i~i~7~[%~;1~~~fli[lt1 ~~lk~'l~~ ~

4 838.. 18

d Gloss foreign source iooome ..

e Gross lneorne from all sources ..

Dillide na 3d by line 3e ..

g Mult4>ly line 3c by fine 3f .

Pro rata share of Interest expanse:

orne mortgage int~rest (use WOOO; eet on paga 14

o the instructions) ..

b Other interest eJCpenS6 .

5 losses from loreig sources .

Add lines 2.. 30. 4a, 4b. and 5

4

a

277.

6

Total

{Add eols. A B and C.l

4 838.

6

277 .

7 Subtract line 6 from line ta. Enter the result here and on line 14 oaoe 2

, ~ 7

4 561.

Credit is claimed Foreign taxes paid or accrued

for taxes t---------:--------~.;;.;..;-';';;..;.;;;;.;.;..;;...:;.;;:..::.....::.c....::.:..:.;_::..:;_;;--..,....,..,.-:--:--::------------

(you must In foreign currency In U.S. doUars

~ cbecl: one) C (h) [XJP.;d

8 III D_'''d

OJ ~";;~~ (k) [)lyjdend. III ~~~~d (m) Intorwt

I,Rar:t-Il:1 Foreign Taxes Paid or Accrued

Taxes withheld at source on:

Taxes withheld at source on:

(r) Other oreign taxes paid Of iIOCI"ued

(0) Other fore cn taxes paid or accrued

B

(q) ~tor ... t

(s)TotaJ 100elcn taxes paid or aeerued (add cots, (0) lhrough (f»

1 392.

1 392.

A12/31/09

C

8 Add tines A throuah C column (s). Enter the total here and on line 9. page 2

................. ~ 8

Form 1116 (2OOV)

LHA For Paperwork Reduction Act Notioe, see seplll'ste Instruotions.

1 392 .

Form 1116(2009) WILLIAM H. & ANDREA L. WHITE

Page 2

p~a'rHII;1 Figuring the Credit

9 Enter the amount from Iina 8. These are your total foreign taxes paid or accrued

for the category 01 inoome checked abOVl! Part I 9

1 392. >:;

;:~:.1

10 Garryba or carryover (attach de1ailed computation) 1-1"'°+---------1. r-:

...

1 392. :::;::

11 Addanes9and 10 11

.',

12 Reduction in forsign taxes 1""2 --1(: 'i

13 Subtract line 12 from line 11. This Is the tolal amount of !oleig taxes available for credit ...,1=3T- -=1'-'-'3'-'9<...2~.

14 Enter the amount from line 7. This is your taxable Income or (loss) from sources oulside tile .:~;?

Un'ted Slates (b~lore adjrsiments) 10 !h'e category ofincome checked above Part I 14 4 561. 'It

~~~

15 Adjustments to lille 14 w1~5.L- --I:;:~~

16 CQmblae the amounts on lines 14 and 15. This Is your net foreign source taxable in corm. ':;,i

(If the rlfsuH is zero or less. you have no foreign tax credit for the category of income I I

~~ ~~~~ke~~.o~u~~~~~~~I~e~~~)Ug~.~.l:.~~~~:.~.~.~.~.r.~.~li~~.~~.~~~........... 16

17 Individnls: Enter the amount from Fonn 1040,I1ne 41 (minus any amount on Form 8914, line 6~ J you are a nonresident alien, enter tile amo nt from Form 1 40NR, line 38 (minus any amount on Form 8914,IIn8 6). Estates and trusts: Enter yo r taxable

Income without the deduction fo your exemption S.~~ S.~~~~~ 1.§. 17

561 311. '.:~~~

Caution: If you figured your tax using the lower rates on queJified dividends orcapllal gains, see instructions.

18 Divide line 16 by line 17. II line 161s more than line 17. en er' • 1-1",,8,_ .:... ""0 0..,8<..:1"'2=6

19 Individuals: Enter the amount from Form 1040,1Ine 44.lfyau ate a nanresl ent alien, enter the amount

from Form 1040NR. fine 4 •

Estales and trusts: Enter the amou t from Form 1041, Schedule G, line ta, or !he to 01 Form 99O-T.

liiles 36 and 37 r1!."-9+-_--=1:..:6""'2"'-'-'5:::..6"-'='.3-'..

Caution: If you 8re completing line 19 for separate categorye (lump-sum dlstrlbtltfons). see pg. 19 of the instructions.

20 Multiply line 19 by line 18 (maximum amount 01 credit) ~2O~ -=1!:..l..3::!.!;!2::1:..!-.

21 Enter the smaller of line 13 or Ime 20.11 this is tile only Form 1116 you are filing, skip Ones 22 through 26 and enter this

amount on line 27. Otherwise. complete the appropriate nne In Part IV .~ 21

1 321.

I'PartIY;1 Summary of Credits From Separate Parts '"

1 321.

22 Credit for taxes on passive cateoory Income 22 !~~.~

p+--------i;;:::.

23 Credit for taxes on general category Income , ,......... 23 ~Jt~

24 Credit for la1<6S on certain Income ra-sourcsd by treaty ...................................................= n~.;

25 Credit lor taxes on lump-sum dislributiollS ,. 1

26 Add lines 22 through 25 1-'26=t------ __ -

27 Enter the smaller o line 190rllne26 1"''Z7...,. .=1'"'-'3~2:::..1~.

28 Reduction 01 credit lor International boycon operations 1-'28=t--------

29 Subtract line 28 from II e 27. This Is your foreion tax credit. Enter here and on Form 1040, ~ne 47;

Form 1040NR ane 44: Form 1041 Schedule G, line_2a: or Form gg(}-T line 4(1a . .. . _._. __ .. _ _._ .. _.... ~ 29

Form 1116 (Wog)

~11511 12-otHH1

Form 4797

Sales of Business Property

(Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(bX2))

~ Attach to your tax return. .~ &e separate instructions.

2009

~'='~o;27

WILLIAM H. & ANDREA L. WHITE

1 Enter the gross proceeds from sales or exchanges reported to you for 2009 on Form{s) 1099·8 or 1099-5

(or substitute statement) that you are Including on ~ne 2. 10. or 20 .

............ 11

Fpa~;I.1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions)

ENTERPRISE PRODUCTS

<306.>

(e) Oop_don allowed or ,Ik>wable since ocqu;altlon

(f) CoM Of othl>" t ,I, plus lnpr ..... mante and 8JCpen.tlolaatt

(g) Gain or (loss) SYbnct (J)tum .he sum of (e!).nd (e)

(b) ~ .cqu~.d (e) Ool,salcI

(mo •• day.!'".) tno .. cloy.!,".)

(d) Gr __ plica

2

* PARTNERS

<306.>

9

Gain, if any. from Form 4684. line 43 .

Section 231 gain from Instanmen sales from Form 6252. ~ne 26 0( 37 .

Section 1231 gain or (loss) from like-l<ind exchanges from Form 8824 .

Gain. If any. from Ine 32. from other than casualty or theft ..

Combine lines 2 through 6. Enter tha gain or (loss) here and on the appropriate Sne as follows: .

Partnerships (except electin9 large partnerships) and S corporations. Report the gain or (loss) to lowing the lnstruetons for Form 1065. Schedule K. line 10. or Form 1120$. Schedule K. r e 9. Skip lines 8. 9. 11. and 12 below.

Individuals, partners, S corporation snareholders, and all others. If ~ne 7 Is zero or a loss, enter the amount from line 7 on line 11 below and skip lines 8 and 9. II line 7 is a gain and you did not have any prior year section 1231 losses. or they were recaptured in an earlier year. enter the gain from line 7 as a long·term capital gain on the Schedule D filed with your return and sldp lines 8. 9. 11, and 12 below.

Nonrecaptured net section 1231 losses from prior years (see instJlJctloos) .

SUbtrect line 8 from Una 7. If zero or less. enter.o.. If line 9 is zero. enter the gain from ne 7 on line 12 below. If

line 9 Is more than zero. enter the amount from line 8 on rile 12 below and enter the gain from line 9 as a long·term capital aaln on the Schedule D filed with your return (see InstJlJctions)

3 4 5 6 7

3

4

5

6.

7

8

8 9

I:Rar.t<!11

Ordinary Gains and Losses (see instructions)

10 Ordinary gains and losses not included on lines 11 through 16 (include property held 1 year or less):

ENTERPRISE PRODUCTS

18 169.

* PARTNERS WARIOUS WARIOUS

<306.>

11 Loss.1fany, from line 7 11

12 Gain. if any. from line 7 or amount from line 8. if applicable 1--'1"'2+ _

13 Gain. If any. from line 31 f-'1""3-+ _

14 Net gain or (loss) from Form 4684. lines 35 and 42a f--!1;;l:4+ _

15 Ordinary gain from installment sales from Form 6252. rne 25 or 36 f--!1~5+ _

16 Ordinary gain or 0055) from "ke-kind exchanges from Form 8824 t- 1116_~ __ -:'-=--:-~_

17 Combine lines 10 through 16 1--"'17;"..J",.,.-,.,.,...;:;1,...:7..,<-:.8:,.;6:.;3:,.;,.

1~·~~~~~~~~t]~:

For all except Individual returns. enter the amount from line 17 on the appropriate fine of your retum and skip lines a and b below. For individual returns. complete lines a and b below:

a If the loss on ijne 11 includes a ass from Form 4684. line 39. column (b){iI), enter that part of the loss here. Enter the part of the loss from Income-producing property on Schedule A (Form 1040). line 28. and the part of the loss from property used as an employee on Schedule A (Form 1040). line 23. Identify as from 'Form 4797, line 183.'

See InstJlJctions .

b Redetermine the gain or (loss) on line 17 excluding the loss. If any. on fine 18a. Enter here and on

Form 1040 line 14 .

18

18a

18b 17 863.

LHA For Paperwork Reduction Act Notice, see separate instructions.

Foon 4797 (2009)

*ENTlRE DISP OF PAS ACT

118011 10-22·09

FoI1ll4797(2009)WILLIAM H. & ANDREA L. WHITE

Page 2

l;p-ai't:J1I1 Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions)

19 (a) Description of section 1245. 1250. 1252, 1254. or 1255 property: (b) Date acquired (el Date sold

(mo, day. yr.) (me, day. yr.)

A

B

C

0

These columns relate to the properties on

lines 19A through 190. ... Property A Property B PropertyC Property 0

20 Gross sales price (Note: See iine 1 before completino.) 20

21 Cost 01 other basis plus expense of sale ............ 21

22 Depreciation (or depletion) anowed or allowable •.. 22

23 Adjusted basis. Subtract line 22 from line 21 ...... 23

24 Total gain. Subtract line 23 from line 20 ........ 24

25 If section 1245 property:

e Depreciation allowed or allowable from line 22 ... 25a

bErner the small .... of line 24 or 25a ........ , .. 26b

26 If section 1250 property: If· straight line depreciation

VIas used, enter .0- on I ne 26g, except for a corporatlon

subject to section 291.

a Addltlonal depreciation alter 1975 (see Instructions) ... 26a

b Applicable percentage rroltiplied by the smaller

of line 24 or line 26a (S89 Ins1ructlons) ............... 26b

e Subtract line 26a from ne 24. If residential rental

property or tine 24 is not mere than ~ne 26a, skip 26c

lines 26d and 269 .............................................

d Additional depreciatlon after 1969 and before 1976 ...... 26d

e Enter the smaller of loe 26c Of 26d .................. 26e

f Section 291 amount (corporatio s only) .... , ....... 26f

a Add fines 2Gb 269 and 261 ... ...... . ..... 26a

27 If section 1252 ~rorrty: Skip this section If you did not

dispose of farm n or if Itlis form is being complet8d for

a partnership (otller IIlan an electing large partnership).

a Soil, water, and land clearing expenses ............... 27a

b Line 27a multiplied by applicable percentage ............... 27b

c Enter the smaller of line 24 or 27b ....... 27c

28 If section 1254 prop«ty:

a Intangible drimno and develOpment costs, expenditures

for development of mines and other natural deposits,

mining ellj)loration costs, and depletion (see tnstructions) 28a

b Enter 100 srnetler of line 24 or 28a ...... ............ 28b

29 If section 1255 property:

a Applicable percentage of payments excluded 29a

from Income under section 126 (see ilstruclions)

b Enter the smaller of line 24 or 2~ (see instructions) 29b Summary of Part III Gains. Complete property oolumns A through D through Line 2gb before going 10 line 30.

30 Total gains for properties. Add property columns A through D. line 24 ............................................................... 30

31 Add property columns A through D, ~nes 25b, 26g, 27c, 28b. and 29b. Enter here and on ne 13 ........................... 31

32 Subtract ~ne 31 from Hne 30. Enter the pOltion from casualty or theft on Fonn 4684, tine 37. Ente( the portion

from otMl'than easuaftv or theft 00 Form 4797 fine 6 32

~P.artU(J Recapture Amounts Under Sections 179 and 280F(b)'(2)'When Bu~i~;;~~ u~e 'D~~p'~ to 500/0 or Less (S9Q Instructions)

(al Section (b) Section

179 280F(b){2)

33 Sect 100 179 expense deduction or depreciation allowable in prior years ................................. 33

34 Reoomputed depreciation (see instnx:tions) 34

35 B.ec.aoture amount. Subtract nrlf~ 34 from line 33:·S~~~;;~·~t';:;ctk;~~·i~;~;h~~~·~~·~~~~rt .... ·· .. 35 Form 4797 (2009)

I. I

1

~6251 OMS No. 15~5-007~

Alternative Minimum Tax - Individuals 2009

OIJ)4lJ1n'1ont ef tn. Treas..ry ~ ~032

kltem.lil A.venue Service (VV) Attach to Form 1040 or Form 1040NR.

Name(s) snown on Form 1040 or Form 1040NR Your social securilY number

WILLIAM H. & ANDREA L. WHITE

HP-a'rt'L'1 Altemative Minimum Taxable Income

1 ~"lIn~ scn_,eA lForm 100<0), enlor "'oem""n' lTom Form 1040. "'o41(m"- ony .... unton F",m 89 ~,Inoe). and 00 '0 "'.2. 0"' .... , ...

e.nter the amount .om Fortn 1040, line a& C"*"U3 any amount Wl Form eo141 no 6). iU'ld go t h7.Pf_1han_"" ... as.n~ .. _q ... 1 575 096.

2 Moc:tlcal and d",taI, Elller1h8 smaller ofSdlodul,AtFc.m 1040~ in e e, or 2_5* ~025)ClRlIm 1040, 308. If l«O or 100" Clt\1Cf -o- ............... 2

3 Taxes from Schedule A (Form 1040), lines 5,6. and 8 ....................................................................................... 3 49 886.

4 Enter the home mortgage Interest adJustlMnt. if any, from line 6 of the wor1<sheet on page 2 of the Instructions ... 4

5 MlscellaJ\eOus deductions from Schedule A (Form 1040). line 27 ...... , ..................... "_ ..... __ ._ .. """" ... _ .. _ ... _ ........... 5 3 685.

6 If Form 1040, line 38. Is over $166,800 (over $83,400 if manied f~lng separately), enter the amount from line 11

of the Iteml~ed Deductions Worksheet on page A-11 of the Instructions for Schedule A (Form 1040) ............... 6 <4 930.

7 If nllng Schedule L (RJrm 1040A or 1040). enter as a negative amount the sum of lines 6 and 20 from that schedule "".:._ ... _ .. _ 7

8 Tax refund from Form 1 040. line 1 0 or line 21 ................................................................................................... 8

9 Investment Interest expense (difference between regUlar tax and AMI) ................ " .......................................... 9

10 Depletion (difference between regular tax and AMl) __ .. _ ...... _ ... _ ....... _" .. """."." ... ".,. __ ~._. __ ... _ ..... ,._"" .. _ ..... _._, .... __ 10

11 Net operating loss deduction from Form 1 040. line 21. Enter as a positive amount ................................. _ ........... 1t

12 Alternative tax net opei3ting loss deduction "." ..... " ... "" .... _ ... ____ . __ ._ .. _ ... _ .. __ .. __ .. _ ..... __ ........ _. __ ._ ... __ .. _."_,,, ............ 12

13 lmersst from specified private activity bonds exempt from e regular tax ___ . __ .,.S.~.~ .. ,S,'l'~'r.~,_.l,S, 13 455.

14 Qualified smal business stock (7% of galn excUded under section 1202)." .. "." .. "."".""." ......... _ .. __ ... _ ... _._ ... ",._. 14

15 Exercise of incentive stock options (excess of AMT income over regular tax iocome) __ .... _ .... _. __ ... _., ... , ... ,. ___ . __ ._ .... 15

16 Estates and trusts (amount from Schedule K-1 (Form 1041). box 12, code AI ".,._. ___ . __ .. _ .. _._ .. _._ .... _ .. " .. __ ... __ ... _. ____ . 16

17 Electing large partnerships (amount from Schedule K-1 (Form 1065-B). box 6) ................................................... 17

18 Djsposition of property (diffetence between AMT and regular tax gain Q( loss) ...................................................... 18 <2 607.

19 Depreciation on assets placed in service after 1986 (dlffe ence bet Vgen regUlar tax and AMl) ........................... 19

20 Passive activities (difference between AMI and regular tax inoome or loss) .. " .. S.i~".s.'r~'r.~lm'l'._ .. l.:z. 20 787.

21 Loss limitations (difference between AMT and regular tax Income or loss) ......................................................... 21

22 Circulation costs (difference between regular ax and AMl) .............................................................................. 22

23 Long-term contracts (difference between AMT and regular tax Income) ............................................................ 23

24 Mining costs (difference between regular tax and AMl) ..................................................................................... 24

25 RllSearch and experimen costs (difference between regular tax and AMl) ...................................................... 25

26 Income from certafn InstaDment sales before January 1.1987 ........................................................................... 26

TI Intangible driJrng costs preference .................................................................................................................. TI

28 Other adjustments, including income-based related adJustments .. ,._ ... _. __ .. __ .. __ ..... _ ... __ ._ .. _. __ . __ ._ ... _ ... _ ... _. ___ ._ .. " ...... 28

29 Alternative minimum taxable income. Combine lines 1 through 28, (If man1ed filing separately and fine

29 Is more than $216,900. see Instructions.) ......................................................................................... .... \. .... 29 622 372.

I'Par'f!Jrq Alternative Minimum Tax (AMn

30 Exemption. (If you Vlere under age 24 at the end or 2009. see instructions.) :; ~.:;: . ~.

~. ,( ..

IF your filing status is_ .. AND Ifne 29ls not over THEN enter on line 3D '.~.::- .

--. ._- ~i L~~~f

Single or head of household ._ .. __ ._ .. _ .. _" .. " .. " .. " .. $112,500 ........................ $46.700 } :.: ~. ::

Manied filing jointly or qualifying widow(erj ...... __ . 150,000 70.950 !:.~~. ~::'

........................ 30 O •

Manied filing separately .-.-- .... -- ..... - ... " .. ",."""" 75,000 ........................ 35,475 .............................. ,t::;

If line 29 is over the amount shown above for your Ing status. see inst ctions.

31 Subtract line 30 from line 29, If more than zero, go to line 32. If zero or less. enter-e- here and on Hnes ~:.A~~:

34 and 36 and skip the rest of Part " ...................................................... 40 ....................................................... 31 622 372.

32 • • you w ..... F_ 2555 ,,255HZ, see pog. 9 ¢ ... lnstruct •• ,, for the amount to enter, } I::~;/;i

• If you reported capital gain distrbutions directly on Form 1040. line 13; you reported qualified dividends

on Form 1040, line 9b; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured 1·_····

,., 32 167 628.

for the AMT, if necessary), complete Part JJI on page 2 and enter the amount from line 55 here. ,~~f~~J

• All others; If line 31 is $175.000 or less ($87,500 or less if married fiJ'ng separatefy). multiply Ilne 31 by

26% (.26). Otherwise, multiply line 3 by 28% (,28) and subtract $3.500 ($1.750 If manied filing

separately) from the result,

33 Altematlve minimum tax foreign tax credit (see ins uctlons) 33 1 327.

..............................................................................

34 Tentative minimum tax. Subtract fine 33 from nne 32 34 166 301.

..........................................................................................

35 Tax from Forf)11040, line 44 (minus any tax from Form 4972 and any foreign tax credit from Form 1040. line 47l-

If you used Sch J to figure your tax. the amount from line 44 of Form 1040 must be refigured without sing sen 35 161 242.

36 AMT. Subtract line 35 from tjne 34, If zero or less enter ·0·. Enter here and on Form 1040 line 45 ....... 36 5 059.

GIG4S1 >

>

12-11-09 LHA For Pap rwork ReductIon Act Notice, see Instructtons.

Form 6251 (2009)

Form 6251 (2009) WILLIAM H. & ANDREA L. WRITE

I(Partlll;'1 Tax Computation Using Maximum Capital Gains Rates

Page 2

37

622 372.

38

24

167 628.

37 Enter the amount from Form 6251, line 31. If you are ruing Form 2555 or 2555-EZ, enter the amount from

line 3 of the worksheet in the Instructions .

38 Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the nstructions for Form 1040, line 44, or the amount from

line 13 of the Schedule D Tax Wor1<sheel on page 0..10 of the instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if

necessary) (s&e the i structions). If you are fiJi 9 Form 2555 0 2555-EZ,

see Instructions for the amount to enter .

39 Enter the amount from Schedule D (Form 1040), linD 19 (as refigured for the AMT, if necessary) (see instructions). If you are ling Form 2555 or 2555-EZ,

see instructions for the amount to enter .

40 If you did not complete a Schedule D Tax Worksheet for the regular tax or the AMT, ente the amount from line 38. OthelWlse, add lines 38 and 39, and enter

the smaller of that re$ult or the amount from line 10 ot the Schedule DTax

Worksheet (as refigured for the AMT, If necessary). If you are filing Form 2555

or 2555·EZ, see instructions for the amount to ente .

41 Enterthesm811erofline370rline40 r-=4'-'1+ __ ~~2~4 1~2~5'-!...

42 Subtract line ~1 from line 37 1-"4""2-+- __ -"'5..:::9..::8~2=4-'-7-'-.

43 If Ine 42 is S175,OOO or less ($87,500 or less If married fiOng separately), multiply line 42 by 26% (.26).

otherwise, multiply line 42 by 28% (.28) and subtract $3.500 (~1,750 If married filing separately) from

the result ~ ~437.:t- __ ...:1"-'6::..;4=..L..;0~0~9~.

1'<"'.<',:

i~~;~~t 67 900. :dj~:::

f:~~

44 Ente.

• $67,900 if marrfed filing jointly or qualifying wldow(er), }

• $33,950 if single or married filing separately. or .

• $45,500 If head of household.

45 Enter the amount from line 7 of the Qualified Dividends and Capital Gain

Tax- Wor1<sheet in the instn.lctlons for Form 1040, line 44. or the amount from line 14 of the Schedule D Tax- Worksheet on page 0..10 otthe Instructions for Schedule D (Form 1040), whichever applies (as figured for the regular tax). If

you did not complete either worksheet for the regular tax, enter ·0· ..

46 Sublract line 45 fro line 44. If zero or less, enter ·0· .

47 Enter the smaller of 5n9 37 or line 38

48 Enter the smaller of fine 46 or line 47

49 Subtract line 48'from Ii e 47

50 Multiply line 49 by 15% (.15) ••.. ~ t-=50.=,.+- -'3"-'-..::;6..=1""9:....:..

I~;:~;:~ 2 4 12 5 • t:fW::t

125 • -::~;~::j ::;::;i/

. : ..' -t

1-"39=<--j~ --l::(h:

, ~';.:' ~ ;

40

44

If line 39 is zero or blank, skip lines 51 and 52 and'go to line 53. Othorwise, go to line 51. ;1~1?J~

51 Subtract line 47 from Ine 41 1L-:6"'1 1 --lCT/

52 M Itlply line 51 by 25% (.25) ~ 1- 52+- _

53 Add fines 43.-50, and 52 1-"5:::<.3+- __ ..:1::..;6 7:_r.....::;6"'2""8~.

54 If line 37 is $175,000 or less ($87,500 or less if married fiting separately), multiply line 37 by 26% (.26). otherwise, multiply rne 37 by 28% (.28) and subtract $3,500 ($1,750 if married filing separately) from

54

170 764.

the result .

55 Enter tho smaller of line 53 or line 54 here and on fine 32. If you are filing Form 2555 or 2555·EZ. do not enter

this amount 00 line 32. Instead enter it on line 4 of the worksh&et in the instruC'lions .

55

Form 6251 (2009)

OMI! Nt>. 15~H'121

ALTERNATIVE MINIMUM TAX Foreign Tax Credit (Individual, Estate, or Trust)