Beruflich Dokumente

Kultur Dokumente

Group 10 - Sport Obermeyer

Hochgeladen von

Abhishek SahuCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Group 10 - Sport Obermeyer

Hochgeladen von

Abhishek SahuCopyright:

Verfügbare Formate

Case Analysis

Sport Obermeyer

Group 10

Reg No.

M005-14

M122-14

M024-14

M007-14

M084-14

M032-14

M006-14

M085-14

Student Name

ABHISHEK GUPTA

SHAHZEB FEROZ

CHETAN SEHGAL

ABHISHEK SAHU

AZFER SAJJAD

KAUSTAV PAL

ABHISHEK PRAVEEN

BALIBOYANA SRIHARSHA

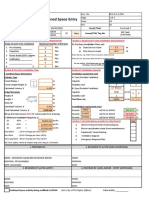

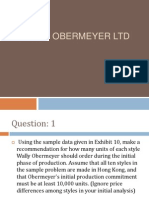

A1) Production Units for different Style (Hong Kong):

Taking the benchmark of 0.2 for the coefficient of Variance. In the cases where the COV is

below 0.2 is considered to be a low risk item.

For low risk items 80 % of the order can be given in the 1st phase itself while for high risk items

only 20% of the order should be made rest 80% can be order after the Vegas show when there

is high certainty.

Now when the order quantity falls below 600 it has be scaled up to 600 since that is the

minimum order size for Hong Kong.

A2) Risk Measures associated with Ordering Policy:

In case of the ordering policy of Sports Obeymeyer there is an associated risk attached to it

which has its root from the following reasons:

Stock outs (-24 % whole sale price) wherein the demand is more than the stock and

hence lost sales takes place

Market downs( -8% of wholesale price)- wherein the demand is less than the stock and

hence overstocking loss takes place

Old designs- since these are fashion based product once the design is old no sales takes

place and hence the risk of old stock exists

High inventory holding cost if higher inventory exist to cater the demand there always

exist an inventory holding cost risk associated with it

Unable to fully profit from hit products there are times wherein due to stock out of a

hit product one cannot fully profit from the hit products

All these risk occur because of the uncertainty in the forecast of demand

Standa

rd

deviati

Sde

viat

Demand

Average

We can assess the forecast certainty as follows:

1. Based on historical data such as past forecast error and variability of demand

2. The coefficient of variation which is standard deviation / mean is a good estimator of forecast

reliability

Form the table we can see that Stephanic has higher risk whereas Assault has the lower risk so

according to this we can go in for planning the production.

A3) Difference between production commitments in China & Hong Kong:

The comparison of operations in China and Hong Kong brings out the following points:

i)

ii)

iii)

iv)

The plants in China are not as fast as Hong Kong in ramping up the production.

The Chinese workers were not trained to do a broader range of tasks as compared

to workers in Hong Kong.

The minimum production quantity in China was twice as compared to Hong Kong

for a particular unit (1200 units in China vs 600 units in Hong Kong)

The output/worker was higher in Hong Kong compared to China.

As a result of this the production commitments required to be made to China would

definitely consist of twice the number of units. For these reasons it is better to produce only

those SKUs in China for which the forecasts are more accurate so that the economies of

scope can be realized by ordering larger quantities.

Taking the benchmark of 0.4 for the coefficient of Variance. In the cases where the COV is

below 0.2 is considered to be a low risk item. For low risk items 80 % of the order can be given

in the 1st phase itself while for high risk items only 20% of the order should be made rest 80%

can be order after the Vegas show when there is high certainty. Now when the order quantity

falls below 1200 it has be scaled up to 1200 since that is the minimum order size for Hong

Kong.

A4) Operational changes to improve performance:

Some of the operational issues which Sport Obermayer faces at the moment are:

Difficulty in forecasting demand due to variability in fashion preferences and also

because of a wide product line with a large number of SKUs

Sourcing, i.e. allocation of production between the Hong Kong and China plants. While

the China plant is more suited to large scale production orders, it is inefficient in terms

of handling a wide variety of products

Large lead times for manufacturing by sub contractors. Given the variability in forecasts

with lack of sales data, early production orders to sub contractors because of the large

lead times is a source of major risk as it can lead to over or under stocking of different

product varieties.

Logistics is another challenge for Sport Obermayer as the company has to provide

matching products well ahead of the season which not only put pressure on the

production process but also on the logistics process as well.

In lieu of these operational challenges, the following changes are proposed to improve the

operational performance of Sport Obermayer

The company should consider reducing the variety in its product line especially in the

Adult Segment. The product-process matrix for the adult segment is inefficient.

Columbia Sportswear with a high volume -low cost approach has proven to be a lot

more successful as compared to Sport Obermayer. Reducing the product line in the

adult segment would significantly ease the forecasting process.

The company should allocate the high volume-low cost product lines to the China plant

which due to easier forecasting can be done considerably early and allocate the

production of the other varied products primarily to the Hong Kong plant which is more

skilled and more efficient in term of speed of production. Thus the production order to

the Hong Kong plant can be delayed (the Hong Kong plant operates almost twice as

efficient as the China plant) and the order can be based on the updated forecast which

incorporates additional sales data.

In terms of managing the lead times of the suppliers, the company should in the long

run consider vertical integration especially into finished shell and lining fabric which

has very long lead times. The company should ideally attempt to open a plant in China

where the labour costs are low and these operations do not require considerable skill

levels. This can significantly reduce the lead times as the company can now control the

process. Decreased lead times imply additional time availability for delayed production

based on a more well informed forecasting process.

A5) Sourcing Policy

Short-term Operational Changes

The maximum production of 20,000 set by Wally should be increased. For example, because

there is a maximum of 21,000 available units for the production period (3,000 production

capacity x 7 months), extra quantity of Gail could be produced without having to cut into

production of other styles. This would be preferable because sourcing Gail from China would

require 813 more units to be produced than what is forecasted to be sold. However the cost

savings of producing them in China outweigh the cost of selling the extra at an 8% loss. For

our recommendations, Gail was produced in Hong Kong in order to adhere to Wallys 20,000

maximum production guidelines. In reality, the company produces about 200,000 parkas

yearly and has production capacity of 210,000 parkas; therefore, it is more cost efficient to

overproduce from China in cases such as Gail.

Long-term Operational Changes

Train Chinese employees to increase production in China as labour is cheaper in China and

they so accept large orders.

Das könnte Ihnen auch gefallen

- Big Five Personality TestDokument3 SeitenBig Five Personality Testchandu_jjvrpNoch keine Bewertungen

- Sport Obermeyer CaseanswersDokument33 SeitenSport Obermeyer CaseanswersCansu Kapanşahin100% (1)

- Sport ObermeyerDokument3 SeitenSport ObermeyerindupriyaaNoch keine Bewertungen

- 1SM6 2015Dokument63 Seiten1SM6 2015chikoo499Noch keine Bewertungen

- A 10 Minute Book On How To Make ProgressDokument25 SeitenA 10 Minute Book On How To Make ProgressJudette Camba100% (1)

- Executive Shirt CompanyDokument13 SeitenExecutive Shirt CompanySandeep Chowdhury100% (1)

- Sport Obermeyer, LTDDokument11 SeitenSport Obermeyer, LTDsaad107Noch keine Bewertungen

- Design Stress and FatigueDokument30 SeitenDesign Stress and FatigueAshok DargarNoch keine Bewertungen

- SCM Case Reebok NFL Replica Jerseys: A Case For PostponementDokument25 SeitenSCM Case Reebok NFL Replica Jerseys: A Case For PostponementsubhashekNoch keine Bewertungen

- Sport ObermeyerDokument3 SeitenSport ObermeyerSam Liwei Chen80% (5)

- Sport Obermeyer Case SolutionDokument5 SeitenSport Obermeyer Case SolutionSanthosh Selvam75% (4)

- Case SportsDokument2 SeitenCase SportsMickey Haldia50% (2)

- Sport Obermeyer Case Analysis: Forecasting, Production, CompetitionDokument6 SeitenSport Obermeyer Case Analysis: Forecasting, Production, CompetitionMatthew JamesNoch keine Bewertungen

- Case Study - 440Dokument4 SeitenCase Study - 440Rohan ViswanathNoch keine Bewertungen

- 3) QFDDokument30 Seiten3) QFDAbhishek Sahu100% (1)

- Sport Obermeyer Case Solution PDFDokument33 SeitenSport Obermeyer Case Solution PDFsreejuviswanathNoch keine Bewertungen

- Sport Obermeyer (Handout)Dokument24 SeitenSport Obermeyer (Handout)Sajjad AhmadNoch keine Bewertungen

- Sport Obermeyer SolutionDokument7 SeitenSport Obermeyer Solutionsrinathvl100% (2)

- Leitax Case Analysis: Digital Camera MarketDokument9 SeitenLeitax Case Analysis: Digital Camera MarketAshfaq Shaikh50% (2)

- Le Club Francais CaseDokument8 SeitenLe Club Francais CaseTushar GoelNoch keine Bewertungen

- Sport Obermeyer Case SolutionDokument33 SeitenSport Obermeyer Case Solutionsharadkumar0378% (9)

- Adjusted Individual Forecasts and Production in China and Hong KongDokument2 SeitenAdjusted Individual Forecasts and Production in China and Hong KongKim Seto50% (4)

- Sport Obermeyer Presentation SlidesDokument39 SeitenSport Obermeyer Presentation Slidesapi-262786574Noch keine Bewertungen

- Grocery Gateway (Ivey 902D03)Dokument1 SeiteGrocery Gateway (Ivey 902D03)First SpotifyNoch keine Bewertungen

- Sport Obermeyer: Written Analysis of CaseDokument9 SeitenSport Obermeyer: Written Analysis of CaseIzzahIkramIllahiNoch keine Bewertungen

- Sport ObermeyerDokument4 SeitenSport ObermeyerGui NunesNoch keine Bewertungen

- Sport ObermeyerDokument3 SeitenSport ObermeyerAshutosh Mishra100% (2)

- Maximizing Profits Through Strategic Production PlanningDokument14 SeitenMaximizing Profits Through Strategic Production Planninge3testerNoch keine Bewertungen

- PreviewpdfDokument50 SeitenPreviewpdfMarcosGouvea100% (1)

- Sport Obermeyer CaseDokument2 SeitenSport Obermeyer CaseklubnikaN69% (13)

- Sport Obermeyer Supply Chain ChallengesDokument16 SeitenSport Obermeyer Supply Chain ChallengesAnup John ManiNoch keine Bewertungen

- Air Blue E-TicketDokument1 SeiteAir Blue E-TicketMuneeb Ahmed100% (3)

- Solution To Sport Obermeyer Case Study: IntroductionDokument5 SeitenSolution To Sport Obermeyer Case Study: IntroductionZeen khan100% (1)

- Operation Management Sports Obermeyer, LTDDokument3 SeitenOperation Management Sports Obermeyer, LTDSachin BalahediNoch keine Bewertungen

- Group 1 - Sports ObermeyerDokument8 SeitenGroup 1 - Sports ObermeyerSuyash BajpaiNoch keine Bewertungen

- Scientific Glass IncDokument17 SeitenScientific Glass IncSakshi Sharda100% (1)

- Plaza Case StudyDokument6 SeitenPlaza Case Studyramiritosilvosa88Noch keine Bewertungen

- PlazaDokument7 SeitenPlazaUmair Chishti0% (3)

- Optimize HP Inkjet Supply ChainDokument10 SeitenOptimize HP Inkjet Supply Chainmatt_dellinger12Noch keine Bewertungen

- Study Case Obermeyer LTD12Dokument4 SeitenStudy Case Obermeyer LTD12Adelua HutaraNoch keine Bewertungen

- Ventilation Plan For Confined Space EntryDokument9 SeitenVentilation Plan For Confined Space EntryMohamad Nazmi Mohamad Rafian100% (1)

- Irizar Case MASTERDokument13 SeitenIrizar Case MASTERKarthik PittsburghNoch keine Bewertungen

- Sport Obermeyer Final PDFDokument10 SeitenSport Obermeyer Final PDFpiyushNoch keine Bewertungen

- WAC of Mcleod Motors OperationsDokument8 SeitenWAC of Mcleod Motors OperationsMohsin JalilNoch keine Bewertungen

- Sport ObermeyerDokument12 SeitenSport ObermeyerAhsan JalalNoch keine Bewertungen

- Scientific GlassDokument9 SeitenScientific GlassLajwanti M JethwaniNoch keine Bewertungen

- Improve Grocery Gateway Delivery with RIMMS UpgradeDokument7 SeitenImprove Grocery Gateway Delivery with RIMMS UpgradeAbdullah Sulaiman AlorainiNoch keine Bewertungen

- Spare Parts Manual (HB2200-2000DP)Dokument20 SeitenSpare Parts Manual (HB2200-2000DP)drmasster100% (1)

- AGITAN Defoamer Technologies PDFDokument15 SeitenAGITAN Defoamer Technologies PDFMarco Lopez100% (1)

- Grocery Gateway QuestionsDokument1 SeiteGrocery Gateway QuestionsPankaj RaiNoch keine Bewertungen

- Analysis of The Sport Obermeyer Case EXECUTIVE SUMMARYDokument1 SeiteAnalysis of The Sport Obermeyer Case EXECUTIVE SUMMARYAmisha SinghNoch keine Bewertungen

- Case-Sports ObermeyerDokument56 SeitenCase-Sports ObermeyerSiddharth MehtaNoch keine Bewertungen

- Sports Obermeyer's Sourcing StrategyDokument12 SeitenSports Obermeyer's Sourcing Strategyharsh0322Noch keine Bewertungen

- Sport Obermeyer (Handout)Dokument24 SeitenSport Obermeyer (Handout)06818908d100% (2)

- Case Discussion: Obermeyer Paraka Production RisksDokument3 SeitenCase Discussion: Obermeyer Paraka Production RisksClaire ZhengNoch keine Bewertungen

- Sport Obermeyer Case SEO-Optimized TitleDokument4 SeitenSport Obermeyer Case SEO-Optimized TitleNamita DeyNoch keine Bewertungen

- Initial Production Decision HK & ChinaDokument7 SeitenInitial Production Decision HK & ChinaAndy VibgyorNoch keine Bewertungen

- Sports Obermeyer WACCDokument10 SeitenSports Obermeyer WACCAyesha TahirNoch keine Bewertungen

- Sport Obermeyer Supply Chain RedesignDokument19 SeitenSport Obermeyer Supply Chain RedesigngbpiepenburgNoch keine Bewertungen

- LSCM Group 2 Scientific Glass Case AnalysisDokument10 SeitenLSCM Group 2 Scientific Glass Case AnalysisArshpreet SinghNoch keine Bewertungen

- Sports ObermeyerDokument13 SeitenSports Obermeyermaulikparekh09100% (3)

- Case 1 Sport ObermeyerDokument2 SeitenCase 1 Sport Obermeyervabs81Noch keine Bewertungen

- ObermeyerDokument4 SeitenObermeyerTim RosenbergNoch keine Bewertungen

- Supply Chain Management: Sport ObermeyerDokument4 SeitenSupply Chain Management: Sport ObermeyerDilipSamantaNoch keine Bewertungen

- WAC On Sport Obermeyer, LTD.: 1) IntroductionDokument3 SeitenWAC On Sport Obermeyer, LTD.: 1) IntroductionNimrah ZubairyNoch keine Bewertungen

- RSM311Dokument7 SeitenRSM311sch123321Noch keine Bewertungen

- Kool King - A7Dokument10 SeitenKool King - A7ankit_tulsianNoch keine Bewertungen

- CASE STUDY-1 and 2 - WORDDokument7 SeitenCASE STUDY-1 and 2 - WORDAbdul Khaliq Choudhary100% (1)

- SUnwind A BDokument5 SeitenSUnwind A BChetan Duddagi0% (1)

- Required:: Difficulty: Objective: Terms To Learn: Inventory Management, Economic Order Quantity (EOQ)Dokument6 SeitenRequired:: Difficulty: Objective: Terms To Learn: Inventory Management, Economic Order Quantity (EOQ)Maha HamdyNoch keine Bewertungen

- Principles: Idiot Can Run - Because Sooner or Later, Any Idiot Is Probably Going To Run It."Dokument5 SeitenPrinciples: Idiot Can Run - Because Sooner or Later, Any Idiot Is Probably Going To Run It."Abhishek SahuNoch keine Bewertungen

- The Bubble Act EnglandDokument18 SeitenThe Bubble Act EnglandAbhishek SahuNoch keine Bewertungen

- PPFAS Long Term Value Fund: (An Open Ended Equity Scheme)Dokument4 SeitenPPFAS Long Term Value Fund: (An Open Ended Equity Scheme)Abhishek SahuNoch keine Bewertungen

- Look For GDP Growth of Your Trading PartnersDokument3 SeitenLook For GDP Growth of Your Trading PartnersAbhishek SahuNoch keine Bewertungen

- Industry Analysis - PorterDokument10 SeitenIndustry Analysis - PorterAbhishek SahuNoch keine Bewertungen

- 1.1 CF PGDM IntroductionDokument12 Seiten1.1 CF PGDM IntroductionAbhishek SahuNoch keine Bewertungen

- M&a Project ListDokument1 SeiteM&a Project ListAbhishek SahuNoch keine Bewertungen

- Sport Obermeyer (Handout)Dokument62 SeitenSport Obermeyer (Handout)Abhishek SahuNoch keine Bewertungen

- THE THIRSTY CROW-IIM Ranchi Quiz League Rules and RegulationsDokument1 SeiteTHE THIRSTY CROW-IIM Ranchi Quiz League Rules and RegulationsAbhishek SahuNoch keine Bewertungen

- How To Solve Case StudyDokument12 SeitenHow To Solve Case Studyburhan_qureshiNoch keine Bewertungen

- Market Participants o Issuers o Investors: NcdexDokument18 SeitenMarket Participants o Issuers o Investors: NcdexAbhishek SahuNoch keine Bewertungen

- Project 1.3 - Weather DerivativesDokument1 SeiteProject 1.3 - Weather DerivativesAbhishek SahuNoch keine Bewertungen

- Project 1.1 - PMSDokument4 SeitenProject 1.1 - PMSAbhishek SahuNoch keine Bewertungen

- Project 1.2 - BDIDokument1 SeiteProject 1.2 - BDIAbhishek SahuNoch keine Bewertungen

- How To AIFDokument2 SeitenHow To AIFmukeshranaNoch keine Bewertungen

- Water Is EnergyDokument96 SeitenWater Is EnergyRadu BabauNoch keine Bewertungen

- Usg Sheetrock® Brand Acoustical SealantDokument3 SeitenUsg Sheetrock® Brand Acoustical SealantHoracio PadillaNoch keine Bewertungen

- ProjectDokument5 SeitenProjectMahi MalikNoch keine Bewertungen

- Local Materials Used in Creating Art and TechniquesDokument29 SeitenLocal Materials Used in Creating Art and TechniquesAnne Carmel PinoNoch keine Bewertungen

- Book 3 - Revised 2017-2Dokument41 SeitenBook 3 - Revised 2017-2sales zfNoch keine Bewertungen

- IEC 60793-1-30-2001 Fibre Proof TestDokument12 SeitenIEC 60793-1-30-2001 Fibre Proof TestAlfian Firdaus DarmawanNoch keine Bewertungen

- Line BalancingDokument21 SeitenLine Balancingarno6antonio6spinaNoch keine Bewertungen

- No Curfew for College Dorm StudentsDokument2 SeitenNo Curfew for College Dorm Students陳玟蓁Noch keine Bewertungen

- Mock Examination Routine A 2021 NewDokument2 SeitenMock Examination Routine A 2021 Newmufrad muhtasibNoch keine Bewertungen

- Maths ReportDokument3 SeitenMaths ReportShishir BogatiNoch keine Bewertungen

- Troubleshooting Lab 1Dokument1 SeiteTroubleshooting Lab 1Lea SbaizNoch keine Bewertungen

- Bruxaria e Historia Cultural PDFDokument25 SeitenBruxaria e Historia Cultural PDFGeorge Henri FernandoNoch keine Bewertungen

- Essential Guide VLSI Aspirants FAQ Physical DesignDokument3 SeitenEssential Guide VLSI Aspirants FAQ Physical DesignRohith RajNoch keine Bewertungen

- Job Order Costing ExplainedDokument43 SeitenJob Order Costing ExplainedZovia Lucio100% (1)

- The Art of Grooming - 230301 - 222106Dokument61 SeitenThe Art of Grooming - 230301 - 222106ConstantinNoch keine Bewertungen

- Cahyadi J Malia Tugas MID TPODokument9 SeitenCahyadi J Malia Tugas MID TPOCahyadi J MaliaNoch keine Bewertungen

- How To Review A Book in Up To 5,000 Words: First StepsDokument3 SeitenHow To Review A Book in Up To 5,000 Words: First StepsAnnaNoch keine Bewertungen

- The Reference Frame - Nice Try But I Am Now 99% Confident That Atiyah's Proof of RH Is Wrong, HopelessDokument5 SeitenThe Reference Frame - Nice Try But I Am Now 99% Confident That Atiyah's Proof of RH Is Wrong, Hopelesssurjit4123Noch keine Bewertungen

- English Test 03Dokument6 SeitenEnglish Test 03smkyapkesbi bjbNoch keine Bewertungen

- Spatial data analysis with GIS (DEMDokument11 SeitenSpatial data analysis with GIS (DEMAleem MuhammadNoch keine Bewertungen