Beruflich Dokumente

Kultur Dokumente

STATCON Report

Hochgeladen von

RomeoAmanteDescallarJunior0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten19 SeitenThis document discusses rules for interpreting different types of statutes. It explains that statutes imposing taxes or granting tax exemptions are strictly construed against the taxpayer. Penal statutes are also strictly construed in favor of defendants. However, statutes concerning elections or veterans are liberally construed. Statutes involving the sovereign are strictly interpreted as not diminishing public rights unless specifically mentioned. Statutes allowing suits against the state give narrow consent and are strictly interpreted.

Originalbeschreibung:

statcon

Copyright

© © All Rights Reserved

Verfügbare Formate

ODP, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document discusses rules for interpreting different types of statutes. It explains that statutes imposing taxes or granting tax exemptions are strictly construed against the taxpayer. Penal statutes are also strictly construed in favor of defendants. However, statutes concerning elections or veterans are liberally construed. Statutes involving the sovereign are strictly interpreted as not diminishing public rights unless specifically mentioned. Statutes allowing suits against the state give narrow consent and are strictly interpreted.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als ODP, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten19 SeitenSTATCON Report

Hochgeladen von

RomeoAmanteDescallarJuniorThis document discusses rules for interpreting different types of statutes. It explains that statutes imposing taxes or granting tax exemptions are strictly construed against the taxpayer. Penal statutes are also strictly construed in favor of defendants. However, statutes concerning elections or veterans are liberally construed. Statutes involving the sovereign are strictly interpreted as not diminishing public rights unless specifically mentioned. Statutes allowing suits against the state give narrow consent and are strictly interpreted.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als ODP, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 19

Mala in se and Mala prohibita

Actus no facit reum nisi mens sit

Actus me invito factus non meus actus

Where the language is plain and positive, and the

offense is not made to depend upon positive

willful intent and purpose, nothing is left to

interpretation.

Application of rule

There is no crime, when it is not clearly made

so by the statute

The language of penal statutes has been

frequently narrowed where the letter includes

situations inconsistent with the legislative intent

Penal statute shall be construed strictly to

safeguard the rights of the defendat

Limitations

If it would defeat the intent, policy and purpose

of the statute

When capable of 2 interpretations, the one

which will give effect to the intent of the statute

will prevail.

Statutes Strictly Construed

Statutes in derogation of rights

Statutes authorizing expropriations

Statutes granting privileges

Legislative grants to local government

Manila Lodge No. 761 vs Court of Appeals

Removal of officials

Butuan Sawmill, Inc. vs Bayview Theatre Inc.

Lacson vs. Roque

Naturalization laws

Co y Quing Reyes vs . Republic

Statutes liberally construed

Election laws

Amnesty Proclamations (Tolentino vs Catoy)

Statutes prescribing prescriptions of crimes

Adoption Statutes (Malkinso vs Agrava, G.R. No. 36309)

Veteran and Pension laws (Santiago vs Commission on Audit)

Rules of Court

Other statutes: curative, redemption laws, statutes providing

exemptions from execution (Belen vs De Leon, G.R. No. 16412),

laws on attachment, warehouse receipts, probation laws, statute

granting powers to an agency created by the Constitution)

Statutes Imposing Taxes and

Custom Duties

Taxes and Custom Duties

Taxation

An inherent power of the state

Incident of sovereignty

Unlimited in its range

Involves taking away a portion of their property for

the support of the government

Rule

Construed strictly against the government and

liberally in favor of the taxpayer

Tax or customs laws:

may not be extended by implication beyond the clear

import of their language

Nor their operation enlarged so as to embrace matters

not specifically provided

Reason for rule

Taxation is a destructive power

Interferes with the personal and property rights

of the people

Statutes Granting Tax Exemptions

Tax Exemptions

Portions of a tax obligation which, by a

provision of law, allows for a reduction or the

elimination of that obligation to pay taxes

Rule

Statutes granting tax exemptions must be

construed strictly as against the taxpayer and

liberally in favor of the taxing authority

Reason for Rule

Tax

Lifeblood of the government

It is an inherent power of the state

Qualification of Rule

The rule is not absolute

Qualifications:

When the law is clear and unambiguous, the law

must be taken as is

When the law is in favor of the government, a strict

construction is not needed

Statutes Concerning the Sovereign

Rules concerning the sovereign

Restrictive statutes which impose burdens on

the public treasury or which diminish rights and

interests are strictly construed

Do not embrace the sovereign unless the sovereign

is specifically mentioned

Statutes authorizing suits against

the state

Suits against the State

The state may not be sued without its consent

Logical Reason

Practical Reason

Rule

Statutes whereby the state gives its consent to

be sued is strictly construed

Das könnte Ihnen auch gefallen

- Constitution of the State of North Carolina and Copy of the Act of the General Assembly Entitled An Act to Amend the Constitution of the State of North CarolinaVon EverandConstitution of the State of North Carolina and Copy of the Act of the General Assembly Entitled An Act to Amend the Constitution of the State of North CarolinaNoch keine Bewertungen

- Strict and Liberal - Notes 4qDokument35 SeitenStrict and Liberal - Notes 4qPatrick James TanNoch keine Bewertungen

- Agra Local Government Reviewer 05.04.15Dokument51 SeitenAgra Local Government Reviewer 05.04.15ShyneAmpatuanNoch keine Bewertungen

- Local Government Code of 1991 (Updated)Dokument218 SeitenLocal Government Code of 1991 (Updated)Arahbells100% (2)

- CPC MasterDokument143 SeitenCPC MasterMAHIM GUPTA 1850317Noch keine Bewertungen

- Taxation - Mode 2Dokument8 SeitenTaxation - Mode 2Louise Anne MelanoNoch keine Bewertungen

- Consti FinalsDokument7 SeitenConsti FinalsKarl Lorenzo BabianoNoch keine Bewertungen

- Rules of Construction of Specific StatutesDokument37 SeitenRules of Construction of Specific StatutesAllen AnceroNoch keine Bewertungen

- LLP NotesDokument42 SeitenLLP NotesCipherChelleNoch keine Bewertungen

- Business Law Lecture 1&2Dokument6 SeitenBusiness Law Lecture 1&2Chau NguyenNoch keine Bewertungen

- TAXATIONNNNDokument6 SeitenTAXATIONNNNGracely Calliope De JuanNoch keine Bewertungen

- Taxation Unit 1Dokument6 SeitenTaxation Unit 1Charisma EspinosaNoch keine Bewertungen

- Pimentel v. Aguirre (2000) - DIGESTDokument4 SeitenPimentel v. Aguirre (2000) - DIGESTIsabelle AtenciaNoch keine Bewertungen

- Constitutional Law Ii ReviewerDokument38 SeitenConstitutional Law Ii ReviewerShasharu Fei-fei LimNoch keine Bewertungen

- Inherent Powers of The StateDokument18 SeitenInherent Powers of The StatejohnrhojaynNoch keine Bewertungen

- LGC Reviewer Based On Atty FraganteDokument13 SeitenLGC Reviewer Based On Atty FraganteJanine Prelle DacanayNoch keine Bewertungen

- StatCon - Chapter 7Dokument5 SeitenStatCon - Chapter 7Kath Nacional100% (1)

- Requisites For Municipal Ordinances To Be ValidDokument1 SeiteRequisites For Municipal Ordinances To Be ValidUnsolicited CommentNoch keine Bewertungen

- Police PowerDokument4 SeitenPolice PowerAlbert Azura100% (2)

- Fundametal Principles 1 2Dokument44 SeitenFundametal Principles 1 2HGNoch keine Bewertungen

- General Principles of Taxation Part 1-1Dokument47 SeitenGeneral Principles of Taxation Part 1-1Van TisbeNoch keine Bewertungen

- General Powers and Attributes of LGUDokument18 SeitenGeneral Powers and Attributes of LGULhine KiwalanNoch keine Bewertungen

- AutonomyDokument6 SeitenAutonomyShekel SibalaNoch keine Bewertungen

- Con Law Final CompilationDokument61 SeitenCon Law Final CompilationLaura SkaarNoch keine Bewertungen

- (Pub Corp) Legislative and Corporate PowersDokument29 Seiten(Pub Corp) Legislative and Corporate PowersJoyceNoch keine Bewertungen

- 2023 Completed Separation of Powers Assessment Study Guide 1Dokument9 Seiten2023 Completed Separation of Powers Assessment Study Guide 1api-655369758Noch keine Bewertungen

- Acfrogc9mb7nlbmkbcfuonpkva Vyrnoeit6djnpfc7lg6tcqzyu5ol816zlfbcl1raopr4fsadz2whfjxvv9nnopz-Lpheunvkzhneewx05ytz Fube13x36w Uybxnqntbje9wv-VkaanvllqmDokument48 SeitenAcfrogc9mb7nlbmkbcfuonpkva Vyrnoeit6djnpfc7lg6tcqzyu5ol816zlfbcl1raopr4fsadz2whfjxvv9nnopz-Lpheunvkzhneewx05ytz Fube13x36w Uybxnqntbje9wv-VkaanvllqmCrystal MaeNoch keine Bewertungen

- Short Con Law OutlineDokument7 SeitenShort Con Law OutlineShadi MahmoudiNoch keine Bewertungen

- Public Corporation NotesDokument77 SeitenPublic Corporation NotesJamellen De Leon BenguetNoch keine Bewertungen

- Taxation ReviewerDokument8 SeitenTaxation ReviewerabrakazakNoch keine Bewertungen

- LMC ReviewerDokument10 SeitenLMC ReviewerspecialsectionNoch keine Bewertungen

- Political Law Reviewer Prelims: The Constitution: Parts of A Written ConstitutionDokument12 SeitenPolitical Law Reviewer Prelims: The Constitution: Parts of A Written ConstitutionKarl MatthewNoch keine Bewertungen

- Taxation LawDokument106 SeitenTaxation Lawjohnanthony201Noch keine Bewertungen

- ARt 9 17Dokument9 SeitenARt 9 17Lourds ReyesNoch keine Bewertungen

- Taxation: Basic Concepts and PrinciplesDokument47 SeitenTaxation: Basic Concepts and PrinciplesMaybelleNoch keine Bewertungen

- 2017 SC Cases-Political LawDokument86 Seiten2017 SC Cases-Political LawMatthew Witt100% (1)

- Local Government Code Reviewer Based On Atty Fragante SyllabusDokument14 SeitenLocal Government Code Reviewer Based On Atty Fragante SyllabusDon SumiogNoch keine Bewertungen

- State Succession: Submitted by Akhil Babu 18DBLBT002 4 Semester LLBDokument4 SeitenState Succession: Submitted by Akhil Babu 18DBLBT002 4 Semester LLBanon_909832531Noch keine Bewertungen

- Tax Notes-MidtermsDokument64 SeitenTax Notes-MidtermsCyDacerNoch keine Bewertungen

- Delegation of PowersDokument3 SeitenDelegation of PowersjuliaembuscadoNoch keine Bewertungen

- SCON - Chapter 4Dokument6 SeitenSCON - Chapter 4PrinsesaJuuNoch keine Bewertungen

- General Principles of Taxation (Cont'd)Dokument108 SeitenGeneral Principles of Taxation (Cont'd)Stephen Jay RioNoch keine Bewertungen

- Con Law Lean SheetDokument3 SeitenCon Law Lean SheetJames HutchinsNoch keine Bewertungen

- 01 Introduction To Taxation - BigskyDokument6 Seiten01 Introduction To Taxation - BigskyAbigail Espiritu SantoNoch keine Bewertungen

- Few Consti NotesDokument4 SeitenFew Consti NotesXela GumafelixNoch keine Bewertungen

- CONSTITUTIONAL LIMITATIONS - Those Limitations On The State's Exercise of TheDokument6 SeitenCONSTITUTIONAL LIMITATIONS - Those Limitations On The State's Exercise of TheMaybielynDavidNoch keine Bewertungen

- Income Taxation - Activity1 - DelacruzDokument3 SeitenIncome Taxation - Activity1 - DelacruzKaye L. Dela CruzNoch keine Bewertungen

- Stat Con NotesDokument5 SeitenStat Con NotesCristina NaldoNoch keine Bewertungen

- Agra Local Government Reviewer 10.29.2019 PDFDokument66 SeitenAgra Local Government Reviewer 10.29.2019 PDFdyosaNoch keine Bewertungen

- Introduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPADokument35 SeitenIntroduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPAKyla Marie HubieraNoch keine Bewertungen

- Parens Patriae, The State Has The Inherent Right and Duty To Aid Parents in The Moral Development of Their ChildrenDokument4 SeitenParens Patriae, The State Has The Inherent Right and Duty To Aid Parents in The Moral Development of Their ChildrenSuzy NaeNoch keine Bewertungen

- Outline CruzDokument8 SeitenOutline CruzdNoch keine Bewertungen

- TaxationDokument250 SeitenTaxationJohn MarstonNoch keine Bewertungen

- Construction of Specific StatutesDokument37 SeitenConstruction of Specific StatutesAnime UniverseNoch keine Bewertungen

- Module 3Dokument123 SeitenModule 3anushreeNoch keine Bewertungen

- Const Law - Rule StatementsDokument4 SeitenConst Law - Rule StatementsMarlene MilgramNoch keine Bewertungen

- Income Taxation: College of Business and Management Pamantasan NG Lungsod NG PasigDokument31 SeitenIncome Taxation: College of Business and Management Pamantasan NG Lungsod NG PasigRobert Labe JrNoch keine Bewertungen

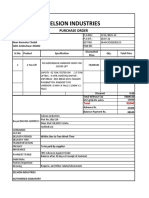

- 11 - PO No - Kohinoor Fabricators - 28.07.21Dokument1 Seite11 - PO No - Kohinoor Fabricators - 28.07.21Vipul RathodNoch keine Bewertungen

- Socio Economic Impact of Women EntrepreneurshipDokument20 SeitenSocio Economic Impact of Women EntrepreneurshipAsaduzzaman PolashNoch keine Bewertungen

- Transformation of Consumer Buying Behaviour From Unorganised To Organised RetailingDokument87 SeitenTransformation of Consumer Buying Behaviour From Unorganised To Organised Retailingshipra kalaNoch keine Bewertungen

- United States Statutes at LargeDokument33 SeitenUnited States Statutes at Largewealth2520100% (5)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Abhay ThakurNoch keine Bewertungen

- Signature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampDokument2 SeitenSignature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampVISHNU RAJ V67% (3)

- Income Taxation Practice ExerciseDokument6 SeitenIncome Taxation Practice ExerciseJames Bryle GalagnaraNoch keine Bewertungen

- Sales Process OverviewDokument16 SeitenSales Process OverviewkagbabuNoch keine Bewertungen

- Narayana Group of Schools: Bill of Supply OriginalDokument1 SeiteNarayana Group of Schools: Bill of Supply OriginalSk NurhasanNoch keine Bewertungen

- 9Dokument4 Seiten9Benidick PascuaNoch keine Bewertungen

- Case #10: Pascual v. Commissioner of Internal Revenue G.R. No. 78133 October 18, 1988 FactsDokument2 SeitenCase #10: Pascual v. Commissioner of Internal Revenue G.R. No. 78133 October 18, 1988 FactsLAW10101Noch keine Bewertungen

- 132.fitness by Design Vs CIRDokument6 Seiten132.fitness by Design Vs CIRClyde KitongNoch keine Bewertungen

- Undergraduate Prospectus 2Dokument49 SeitenUndergraduate Prospectus 2Esther DalamuNoch keine Bewertungen

- CT Onboarding Research Results and Datasheet - Cathcart RailDokument52 SeitenCT Onboarding Research Results and Datasheet - Cathcart RailAdrian Christopher JuntillaNoch keine Bewertungen

- Lecture Note For Elements of Economic Analysis IV1Dokument140 SeitenLecture Note For Elements of Economic Analysis IV1Federico Perez CusseNoch keine Bewertungen

- TestbankDokument33 SeitenTestbankBhavneet Sachdeva100% (2)

- A Project On Ratio Analysis of Financial Statements & Working Capital Management at HVTL, Tata Motors, JamshedpurDokument88 SeitenA Project On Ratio Analysis of Financial Statements & Working Capital Management at HVTL, Tata Motors, Jamshedpurgopalagarwal238780% (30)

- The Courts ACT PassageDokument2 SeitenThe Courts ACT PassageimmabebigNoch keine Bewertungen

- TY Sem 5&6 New PDFDokument34 SeitenTY Sem 5&6 New PDFPrathmesh UpadhyeNoch keine Bewertungen

- Business Studies Past PaperDokument4 SeitenBusiness Studies Past Paperbereket tesfayeNoch keine Bewertungen

- CompanyDokument2 SeitenCompanyhusse fokNoch keine Bewertungen

- Scope of Cyber LawsDokument4 SeitenScope of Cyber Lawsrajat kanoiNoch keine Bewertungen

- Trumbull Answerbook 2011Dokument63 SeitenTrumbull Answerbook 2011Hersam AcornNoch keine Bewertungen

- Economics: Question Bank Solution Q.2.B Distinguish BetweenDokument13 SeitenEconomics: Question Bank Solution Q.2.B Distinguish Betweenshruti gaware100% (8)

- Austrilia Health CareDokument23 SeitenAustrilia Health CarePandaman PandaNoch keine Bewertungen

- MM ApproachDokument5 SeitenMM ApproachParihar Babita100% (1)

- Maximum Available Resources & Human Rights: Analytical ReportDokument28 SeitenMaximum Available Resources & Human Rights: Analytical ReportUrbanYouthJusticeNoch keine Bewertungen

- RMC - 2013-5 - DOF-DBM-BOCJoint CircularDokument4 SeitenRMC - 2013-5 - DOF-DBM-BOCJoint CircularCkey ArNoch keine Bewertungen

- Street of Walls - Private Equity Training GuideDokument54 SeitenStreet of Walls - Private Equity Training GuideJamesNoch keine Bewertungen

- Labuan TrustDokument41 SeitenLabuan TrustShahrani KassimNoch keine Bewertungen