Beruflich Dokumente

Kultur Dokumente

Value Added Tax

Hochgeladen von

Nori LolaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Value Added Tax

Hochgeladen von

Nori LolaCopyright:

Verfügbare Formate

12/8/15

TAX

2

VAT

INTRODUCTION

A"y. Terence Conrad H. Bello

A. Features of VAT

A. Features of VAT

1. Essen?al Features of VAT:

a. Tax on consump?on

2. Method of collec?ng VAT through the tax credit

method

Input tax is credited against output tax to arrive at

net VAT payable (net VAT payable is eec?vely the

tax on the value added)

Illustra(on: tax credit method and tax on value

added

Assume there are four rms (1) a logging

concessionaire who also manufactures lumber, (2) a

furniture manufacturer, (3) a furniture wholesaler,

and (4) a furniture retailer who sells furniture to the

end consumer, which is the household

b. Limited to value added

c. It is an indirect tax

A"y. Terence Conrad H. Bello

Slide No. 3

A"y. Terence Conrad H. Bello

Slide No. 4

12/8/15

A. Features of VAT

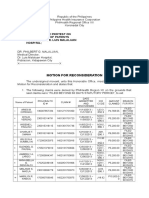

Taxpayer

A. Features of VAT

Sales

Value Output

Price

Added

Tax

Input

VAT

Tax

Payable

Concessionaire

10.00 10.00 1.00

- 1.00

Manufacturer

25.00 15.00 2.50 1.00 1.50

Wholesaler

40.00 15.00 4.00 2.50 1.50

Retailer

50.00 10.00 5.00 4.00 1.00

Household: purchase price (P50) + VAT (P5) = P55

5.00

*

For

illustra,on

purposes

only,

the

VAT

rate

used

in

the

example

is

10%

(the

rate

now

is

12%)

A"y.

Terence

Conrad

H.

Bello

Slide No. 5

3. Output and Input

a. The VAT on the concessionaires sale of lumber is known as

output tax

b. The output tax, when it is passed on the purchaser who

manufactures the lumber into furniture, becomes the

manufacturers input tax

c. The sale of furniture by the manufacturer to the wholesaler

is likewise subject to VAT (output tax); however, he is

en?tled to deduct from such output tax, the input tax which

is shiYed to him by the concessionaire

4. Basic formula:

Output tax (12% or 0%)

Less: input tax_______

VAT Payable

A"y. Terence Conrad H. Bello

Slide No. 6

A. In General

I.

1. Taxable transac?ons covered:

a. Sale of goods or proper?es (in the course of T or

B)

b. Importa?on of goods (W/N in the course of T or

B)

c. Sale of services (in the course of T or B)

2. General requirements (sale of goods and services)

a. There is a sale (of goods or services); AND

b. The sale is made in the course of trade or

business

TAXABLE TRANSACTIONS

A"y. Terence Conrad H. Bello

A"y. Terence Conrad H. Bello

Slide No. 8

12/8/15

A. In General; 1st Requirement; There is a Sale

A. In General; 1st Requirement; There is a Sale

1. In order for a transac?on to be subjected to VAT, it is essen?al

that there is a sale of goods or services

2. Illustra?ve cases

VAT Rul. No. 26-97

TP shares the same building with 2 or more subsidiaries

Being the nominal party-lessee (i.e., lessee-of-record), TP

advances the payment of rent to the lessor, then seeks

reimbursement from its co-lessees (the subs) for their

propor?onate share of the rent, without mark-up or prot

element (i.e., reimbursement-of-cost basis)

Same treatment for other expenses such as security, building

maintenance and u?li?es (TP advances the expenses then

seeks reimbursement from the subs)

Ruling: reimbursements not subject to VAT since TP does not

sell, barter, exchange or lease goods or property or renders

services

A"y. Terence Conrad H. Bello

Slide No. 9

A. In General; 1st Requirement; There is a Sale

A"y. Terence Conrad H. Bello

Slide No. 10

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business

2. Illustra?ve

cases

See,

however,

VAT

Rul.

18-98,

wherein

an

HMO

was

considered as engaged in business as a service

contractor and was held liable to pay VAT although

the actual health care services were rendered by

independent health care providers

In Tourist Trade, the TP therein was neither selling

electricity, water, etc. nor rendering janitorial and

security services

In VAT Rul. 18-98, the TP therein sold health care

services through independent third par?es who

actually performed the service on the TPs behalf

A"y. Terence Conrad H. Bello

2. Illustra?ve

cases

See

also

Tourist

Trade

and

Travel

Corp.

v.

CIR

wherein

reimbursements

received

by

a

mall

owner

for

advances

it

had

made

for

the

payment

of

electric,

water,

and

telephone

bills

and

for

the

janitorial

services

provided

were

held

to

be

not

subject

to

VAT

since

the

TP

was

not

engaged

in

the

business

of

providing

electricity,

water,

security

and

janitorial

services

to

the

lessees

Court

reasoned

that

it

is

not

TP

who

directly

supplied

electricity,

water

and

similar

other

goods

to

the

lessees,

neither

did

it

render

security

and

janitorial

services

Slide No. 11

1. An important requirement for imposi?on of VAT is that

the sale or transac?on has been entered into in the

course of any business carried on by the TP

2. The phrase in the course of trade or business means:

the regular conduct or pursuit of a commercial or an

economic ac?vity

including transac?ons incidental thereto

regardless of W/N the person engaged therein is a

non-stock, non-prot private organiza?on

(irrespec?ve of the disposi?on of its net income and

whether or not it sells exclusively to members or

their guests), or government en?ty ( 105)

A"y. Terence Conrad H. Bello

Slide No. 12

12/8/15

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business

3. Thus the phrase in the course of trade or business connotes

REGULARITY

Thus, a non-stock corpora?on whose primary purpose is to

engage in research ac?vi?es and to provide services (for a fee)

in community organiza?on, development planning and

development livelihood, development communica?on and

rural resource management was held subject to VAT. BIR Rul.

1-94, Jan. 4, 1994

On the other hand, the factor of regularity was absent in BIR

Rul. 98-97, Aug. 28, 1997, which involved a manufacturer and

exporter of goods that received a considera?on for agreeing

to pre-terminate its lease contract and to cancel its purchase

op?on over the leased premises. The BIR ruled that the lease

pre-termina?on and cancella?on of purchase op?on does not

cons?tute a sale, barter or exchange of goods or proper?es in

the course of trade or business of TP which is engaged in the

manufacture and expor?ng of goods

A"y. Terence Conrad H. Bello

Slide No. 13

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business

5. Is prot mo?ve/element essen?al for taxability? No

CIR v. Commonwealth Mgt. & Services Corp.

TP is an aliate of Philamlife organized by the la"er to

perform collec?on, consulta?ve and other technical

services, including func?oning as an internal auditor of

Philamlife and its other aliates

TP assessed by the BIR for deciency VAT

Conten?ons of TP:

It was not engaged in the business of providing services

to its aliates since the services were on a no prot,

reimbursement-of-cost basis only; not prot oriented

= not engaged in business

In fact it did not generate prot but suered a net loss

during the tax year at issue

In the course of T or B requires that the business is

carried on with a view to prot or livelihood

A"y. Terence Conrad H. Bello

Slide No. 15

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business

5. Is prot mo?ve/element essen?al for taxability?

No. Thus, a company that intends to establish a consumer

store for the benet of its employees where there will be no

value added to the goods sold because they will be sold at cost

was held liable to VAT. The absence of prot and value added

to the goods sold does not make a person opera?ng a

consumer store selling basic commodi?es at cost exempt from

VAT. VAT Rul. No. 444-88, Sept. 13, 1988

In BIR Rul. 10-98, Feb. 5, 1998, the BIR ruled that a TP whose

primary purpose as set forth in its AOI is to provide technical,

research, management and personnel assistance to aliates

on a reimbursement-of-cost basis (i.e., no mark-up or prot

element) is subject to VAT

the phrase sale or exchange of services includes, among

others, the supply of technical service, assistance or

services rendered in connec?on with technical mgt or

administra?on of any scien?c, industrial or commercial

undertaking, project or scheme

A"y. Terence Conrad H. Bello

Slide No. 14

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business

5. Is prot mo?ve/element essen?al for taxability? No

CIR v. Commonwealth Mgt. & Services Corp.

Issue: Whether TP was engaged in the sale of service, thus

liable for VAT

Held: Liable for VAT

Even a non-stock, non-prot organiza?on or government en?ty

is liable to pay VAT on the sale of goods or services

VAT is a tax on transac?ons, imposed at every stage of the

distribu?on process on the sale, barter, exchange of goods or

property, and on the performance of services, even in the

absence of prot a"ributable thereto

The term in the course of trade or business requires the

regular conduct or pursuit of a commercial or an economic

ac?vity, regardless of whether or not the en?ty is prot-

oriented

A"y. Terence Conrad H. Bello

Slide No. 16

12/8/15

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business

5. Is prot mo?ve/element essen?al for taxability? No

CIR v. Commonwealth Mgt. & Services Corp.

Hence, it is immaterial whether the primary purpose of a

corpora?on indicates that it receives payments for

services rendered to its aliates on a reimbursement-on-

cost basis only, without realizing prot, for purposes of

determining liability for VAT on services rendered

As long as the en?ty provides service for a fee,

remunera?on or considera?on, then the service rendered

is subject to VAT

The services of TP do not fall within the 109

enumera?on of exempt transac?ons

A"y. Terence Conrad H. Bello

Slide No. 17

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business; Incidental

Transac?on vs. Isolated Transac?on

2. However, the BIR (and even the courts) in certain

instances exempted from VAT the sale of property used

in business supposedly because the sale was an isolated

transac?on

See BIR Rul. 113-98, where the BIR ruled that the

sale by a telecom company of its microwave

backbone transmission network to another wireless

communica?ons carrier is not in the course of the

TPs trade or business of selling telecommunica?on

services

The BIR explained that the sale is not subject to

VAT because it is an isolated transac?on; and

that the transac?on does not necessarily follow

the primary func?on of selling telecom services

A"y. Terence Conrad H. Bello

Slide No. 19

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business; Incidental

Transac?on vs. Isolated Transac?on

1. By express provision of law ( 105), incidental transac?ons are

considered as undertaken in the course of business

Incidental means depending upon or appertaining to

something else as primary; something necessary,

appertaining to, or depending upon another which is termed

the principal

Hence, the sale by a garments manufacturer of a motor

vehicle assigned to its GM is subject to VAT

The sale of the motor vehicle is an incidental transac?on

because the vehicle was purchased and used in

furtherance of the TPs business. CS Garments v. CIR,

CTA Case 6520, Jan. 4, 2007

Posi?on adopted by BIR in RMO 15-2011 when it

revoked rulings exemp?ng sale of company car from VAT

A"y. Terence Conrad H. Bello

Slide No. 18

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business; Incidental

Transac?on vs. Isolated Transac?on

See

also

Magsaysay

Lines,

Inc.

v.

CIR,

CTA

Case

No.

4353,

April

27,

1992,

a.

in

G.R.

No.

146984,

July

28,

2006,

where

the

court

held

that

the

sale

by

a

property

lessor,

a

GOCC,

of

its

vessels

held

out

for

lease

in

line

with

the

governments

priva?za?on

program

is

not

subject

to

VAT

Court

held

that

the

sale

was

an

isolated

transac?on;

the

sale

which

was

involuntary

and

made

pursuant

to

the

declared

policy

of

government

for

priva?za?on

could

no

longer

be

repeated

or

carried

on

with

regularity;

it

should

be

emphasized

that

the

normal

VAT-registered

ac?vity

of

the

TP

is

leasing

personal

property;

the

sale

of

the

vessels

as

such

are

not

necessary

to

carry

out

the

TPs

primary

func?on

of

leasing

personal

proper?es

Without

analysis,

the

court

held

that

the

sale

was

not

incidental

to

the

TPs

normal

business

of

leasing

property

([t]he

act

of

selling

capital

assets

does

not

necessarily

follow

the

act

of

leasing

these

assets)

A"y. Terence Conrad H. Bello

Slide No. 20

12/8/15

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business; Incidental

Transac?on vs. Isolated Transac?on

Lapanday Food Corp. v. CIR

Interest income derived by a parent company

from intercompany loans to aliates, as a form

of nancial assistance, is considered services

incidental to the parents business and, thus,

subject to VAT

A"y. Terence Conrad H. Bello

Slide No. 21

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business; Incidental

Transac?on vs. Isolated Transac?on

3. The mere fact that a transac?on is isolated will not

necessarily disqualify it from being made incidentally in

the course of trade or business

4. Thus, an isolated transac?on -- if at the same ?me is

an incidental transac?on -- will be characterized as

entered into in the course of trade or business,

hence, subject to VAT

A"y. Terence Conrad H. Bello

Slide No. 23

A. In General; 2nd Requirement; Sale is in the Course of Trade or Business; Incidental

Transac?on vs. Isolated Transac?on

Mindanao II Geothermal Partnership v. CIR

However, it does not follow that an isolated transac?on

cannot be an incidental transac?on for purposes of VAT

liability

A reading of Sec?on 105 of the 1997 Tax Code would show

that a transac?on in the course of trade or business

includes transac?ons incidental thereto

Mindanao IIs business is to convert the steam supplied to it

by PNOC-EDC into electricity and to deliver the electricity to

NPC. In the course of its business, Mindanao II bought and

eventually sold a Nissan Patrol. Prior to the sale, the Nissan

Patrol was part of Mindanao IIs property, plant, and

equipment. Therefore, the sale of the Nissan Patrol is an

incidental transac?on made in the course of Mindanao IIs

business which should be liable for VAT

A"y. Terence Conrad H. Bello

Slide No. 22

B. Sale of Goods or Proper?es

1. Sec. 106: there shall be levied, assessed and

collected on every sale, barter or exchange of goods

or proper?es, a value-added tax equivalent to 12%

of the gross selling price

2. What are the taxable transac?ons covered by

106?

a. Actual sales

b. Deemed sale transac?ons

c. Changes in or cessa?on of status of a VAT-

registered person

A"y. Terence Conrad H. Bello

Slide No. 24

12/8/15

B. Sale of Goods or Proper?es: Actual Sale

B. Sale of Goods or Proper?es: Deemed Sale Transac?ons

1. A sale is a transfer of goods to another either (a) for

cash or on credit, or (b) partly for cash and partly for

credit

2. Covers sales, barters and exchanges

3. VAT accrues upon consumma?on of the sale,

regardless of the terms of payment between the

contrac?ng par?es (implicit in the deni?on of gross

selling price, which includes money or money

equivalent which the purchaser is obligated to pay);

unlike sale of services wherein VAT accrues only upon

payment of considera?on (when the gross receipts

are actually or construc?vely received by the seller)

A"y. Terence Conrad H. Bello

Slide No. 25

B. Sale of Goods or Proper?es: Deemed Sale Transac?ons

A"y. Terence Conrad H. Bello

Slide No. 26

B. Sale of Goods or Proper?es: Deemed Sale Transac?ons

3. Ra?onale for taxing deemed sale

transac?ons:

To recapture/recoup claimed input tax

a"ributable to the taxable goods withdrawn for

personal or non-business use

A"y. Terence Conrad H. Bello

1. VAT on goods and proper?es not limited to actual sales; also

covers certain transac?ons which the law deems as if it was an

actual sale, hence, subject to VAT

2. What are the deemed sale transac?ons?

a. Transfer, use or consump?on not in the course of business of

goods or proper?es originally intended for sale or use in the

course of business

b. Distribu?on or transfer to (i) shareholders or investors as

share in the prots of the VAT-registered TP; or (ii) creditors in

payment of debt

c. Consignment of goods if actual sale is not made within 60 days

d. Re?rement from or cessa?on of business with respect to

inventories of taxable goods exis?ng as of such re?rement or

cessa?on ( 106(B))

Slide No. 27

4. Illustra?on of input tax recapture:

TP bought merchandise (say 10 t-shirts) for P1,000; VAT

of P100 was passed on to him by the store that sold him

the t-shirts (total purchase price therefore is P1,100); TP

intends to sell the t-shirts @ P220 each for a total of

P2,200 (VAT inclusive). For the sale of the t-shirts, TP has

a VAT payable of P100 (P200 output less P100 input)

Instead of selling everything, TP withdraws for his

personal use 3 t-shirts and sold the remaining 7 t-shirts;

without the deemed sale provisions, TP has a VAT

payable only of P40 (output of P140 less input of P100)

Without deemed sale provisions, government foregoes

P60 of VAT revenue

With the deemed sale provisions, government is

restored to P100 VAT posi?on

A"y. Terence Conrad H. Bello

Slide No. 28

12/8/15

B. Sale of Goods or Proper?es: Deemed Sale Transac?ons

B. Sale of Goods or Proper?es: Changes in or Cessa?on of Status of VAT-Registered TP

5. Examples of deemed sale transac?ons:

106(B)(1) Mr. K sells household furniture; he removes from

his store a living room set for use in his residen?al house

106(B)(2)(a) J Co. declared a property dividend out of

inventory

106(B)(2)(b) M Co. is indebted to N Co. for raw materials;

when M Co. could not pay in money, N Co. agreed to a dacion

of the nished goods in payment of the indebtedness

106(B)(3) TP sold goods on consignment to A, with ?tle to

the goods passing only upon sale to a buyer; 65 days aYer

consignment, goods s?ll unsold by A

106(B)(4) - P & Co. was a taxable partnership; P & Co. was

dissolved and Q & Co. was formed to con?nue the business of

P & Co; at the ?me that P & Co. was dissolved, its books of

accounts showed a merchandise inventory of P100,000; the

inventory is deemed sold by P & Co. upon dissolu?on

A"y. Terence Conrad H. Bello

Slide No. 29

B. Sale of Goods or Proper?es: Taxable Base; Gross Selling Price

A"y. Terence Conrad H. Bello

Slide No. 30

B. Sale of Goods or Proper?es: Taxable Base; Gross Selling Price

1. Taxable base means the amount or the value on which

the VAT rate will be applied in compu?ng the output tax

For a taxable person who sells goods or proper?es,

the taxable base is the gross selling price

Gross selling price means the total amount of

money or its equivalent which the purchaser pays or

is obligated to pay to the seller in considera?on of

the sale, barter or exchange of the goods or

proper?es, excluding VAT. The excise tax, if any, on

such goods or proper?es shall form part of the gross

selling price.

Special rules for sale of real property (FMV or zonal

value, whichever is higher; taxable base for VAT may

be accounted for under the instalment method)

A"y. Terence Conrad H. Bello

1. VAT also applies to goods disposed of or exis?ng under certain

circumstances

Example: change of business ac?vity from VAT-taxable

status to VAT-exempt status

Illustra?on: VAT-registered person engaged in a taxable

ac?vity like wholesaler or retailer who decides to

discon?nue such ac?vity and engages instead in life

insurance business or in any other business not subject

to VAT

Goods exis?ng as of the change in status from VATable

to VAT-exempt become subject to VAT even in the

absence of an actual sale

Ra,onale: same as deemed sale transac?ons (input tax

recapture)

Slide No. 31

2. Timing issues; when VAT accrues computa?on of

taxable base for sales of goods or proper?es is

dierent from that of supply of services

Sale of goods or proper?es generally requires the

use of the accrual method on the basis of the

statutory deni?on of gross selling price (total

amount of money or its equivalent that the

purchaser pays or is obligated to pay to the seller)

Sale of services cash method of accoun?ng,

which means the considera?on is taxable only

upon actual or construc?ve receipt, regardless of

W/N the service has been rendered (see statutory

deni?on of gross receipts)

A"y. Terence Conrad H. Bello

Slide No. 32

12/8/15

B. Sale

of

Goods

or

Proper?es:

Taxable

Base;

Gross

Selling

Price;

Sales

Discount,

Returns,

&

Allowance

1. Sales

discounts

and

returns

and

allowances

as

allowable

deduc?ons

from

gross

selling

price

a. For

sales

discounts

discount

must

be

indicated

in

the

invoice

at

the

?me

of

sale,

the

grant

of

which

is

not

dependent

upon

the

happening

of

a

future

event

Illustra,on:

TP

grants

discounts

to

ice

cream

houses

in

the

form

of

rebates

for

mee?ng

monthly

sales

quota;

rebates

are

determined

only

at

the

end

of

the

month

Answer:

Deduc?on

not

allowed.

Discounts

condi?oned

upon

the

subsequent

happening

of

an

event

or

fulllment

of

certain

condi?ons,

such

as

prompt

payment

or

a"ainment

of

sales

goals,

shall

not

be

allowed

as

deduc?ons.

Only

discounts

granted

and

determined

at

the

?me

of

sale

which

are

indicated

in

the

invoice

are

allowed

as

deduc?ons

from

the

gross

selling

price.

BIR

Rul.

No.

204-90

b. For

sales

returns

and

allowances

proper

credit

or

refund

was

made

during

the

month

or

quarter

to

the

buyer

for

sales

previously

recorded

as

taxable

sales

A"y.

Terence

Conrad

H.

Bello

Slide No. 33

C. Importa?on of Goods

1. Transac?ons deemed sale - output tax shall be based on

the market value of the goods deemed sold as of the

?me of the occurrence of the deemed sale transac?ons

enumerated in Sec. 4.106-7(a)(1),(2), and (3)

2. Re?rement or cessa?on of business - tax base shall be

the acquisi?on cost or the current market price of the

goods or proper?es, whichever is lower

3. Sale where the gross selling price is unreasonably lower

than FMV - the actual market value shall be the tax base

Meaning of unreasonably lower - if GSP is lower by

more than 30% of the actual market value of the

same goods of the same quan?ty and quality sold in

the immediate locality on or nearest the date of sale

A"y. Terence Conrad H. Bello

Slide No. 34

C. Importa?on of Goods

1. In general - VAT is imposed on goods brought into the

Philippines, whether for use in business or not

2. Tax base VAT is based on the total value used by the

BOC in determining tari and customs du?es, plus

customs du?es, excise tax, if any, and other charges,

such as postage, commission, and similar charges, prior

to the release of the goods from customs custody

3. If du?es based on volume or quan?ty - landed cost shall

be the basis for compu?ng VAT. Landed cost consists of

the invoice amount, customs du?es, freight, insurance

and other charges. If the goods imported are subject to

excise tax, the excise tax shall form part of the tax base

A"y. Terence Conrad H. Bello

B. Sale of Goods or Proper?es: Taxable Base; Deemed Sales, Re?rement and

Cessa?on, Below Market GSP

Slide No. 35

4. Importa?on of 109(1) exempt goods no VAT

5. Time for payment prior to release from customs

custody

A"y. Terence Conrad H. Bello

Slide No. 36

12/8/15

D. Sale of Services; Meaning of Sale or Exchange of Services

D. Sale of Services; Requirements for Taxability

1. Sale or exchange of services - means the

performance of:

all kinds of services

in the Philippines

for others for a fee, remunera?on or

considera?on, whether in kind or in cash

including those performed or rendered by certain

persons and those involving certain transac?ons

enumerated under the law (see enumera?on;

enumera?on is not exclusive; see Lhuiller v. CIR)

and similar services regardless of whether or not

the performance thereof calls for the exercise or

use of the physical or mental facul?es

A"y. Terence Conrad H. Bello

Slide No. 37

D. Sale of Services; Requirements for Taxability; Place of Performance Rule

1. As a statutory principle, all kinds of services performed in

the Philippines are subject to VAT at the rate of 12% or 0%

2. Services performed outside the Philippines, even if

undertaken in the course of business, are beyond the

scope of VAT, therefore, not subject to VAT

The place where the service is performed determines

the jurisdic?on to impose VAT (place of payment is

immaterial since the situs of the service is determined

by the place where the service is performed)

Thus, marke?ng ac?vi?es of a realty broker in the U.S.

to en?ce OFWs to buy condo units in the Philippines

held not subject to VAT since services were rendered

outside the Philippines. BIR Rul. 110-97

A"y. Terence Conrad H. Bello

Slide No. 39

What are the requirements for the taxability of sale of

services?

The service must be in the course of trade or

business;

Note: services rendered in the Philippines by non-

resident foreign persons are considered as having

been rendered in the course of trade or business

The service must be performed in the Philippines;

and

The considera?on is actually or construc?vely

received

A"y. Terence Conrad H. Bello

Slide No. 38

D. Sale of Services; Requirements for Taxability; Place of Performance Rule

Legal services performed by a U.K. law rm in

the U.K. and in the U.S. for the Republic of the

Philippines in an arbitra?on case in Washington,

DC not subject to VAT. ITAD Rul. 154-02

A"y. Terence Conrad H. Bello

Slide No. 40

10

12/8/15

D. Sale of Services; Taxable Base; Gross Receipts Actually & Construc?vely Received

D. Sale of Services; Taxable Base; Gross Receipts Actually & Construc?vely Received

1. Deni?on of gross receipts

refers to the total amount of money or its equivalent

represen?ng the contract price, compensa?on,

service fee, rental or royalty,

including the amount charged for materials supplied

with the services and deposits applied as payments

for services rendered and advance payments

actually or construc?vely received during the taxable

period

for the services performed or to be performed for

another person,

excluding VAT

2. Although taxable transac?on is past, present, or future

performance of service tax accrues upon actual or

construc?ve receipt

3. Tax accoun?ng cash method (not accrual method)

4. Construc?ve receipt occurs when the money

considera?on or its equivalent is placed at the control of

the person who rendered the service without

restric?ons by the payor. Examples:

Deposit in banks which are made available to the

seller of services without restric?ons;

Issuance by the debtor of a no?ce to oset any debt

or obliga?on and acceptance thereof by the seller as

payment for services rendered; and

Transfer of the amounts retained by the payor to the

account of the contractor

A"y. Terence Conrad H. Bello

Slide No. 41

A"y. Terence Conrad H. Bello

Slide No. 42

D. Sale

of

Services;

Taxable

Base;

Gross

Receipts

Actually

&

Construc?vely

Received;

Inclusions

and

Exclusions

D. Sale

of

Services;

Taxable

Base;

Gross

Receipts

Actually

&

Construc?vely

Received;

Inclusions

and

Exclusions

1. Includes:

Contract

price,

compensa?on,

service

fee,

rentals

or

royal?es

Amount

charged

for

materials

supplied

with

the

services

Deposits

and

advance

payments

2. Thus,

gross

receipts

includes

amounts

billed

to

clients

intended

to

recover

costs

and

expenses

(e.g.,

salaries

and

wages

due

to

employees,

due

the

government,

deprecia?on

of

equipment,

supplies,

overhead,

etc.)

as

well

as

the

prot

mark-up.

VAT

Rul.

No.

111-88

3. Includes

management

fee

(based

on

prots

of

managed

company),

expenses

incurred

in

connec?on

with

services

rendered,

and

reimbursement

by

managed

company

of

salaries

and

fringe

benets

of

seconded

employee.

VAT

Rul.

No.

205-90

4. Excludes, however, receivables (i.e., por?on of the

contract price not yet actually or construc?vely

received). BIR Rul. No. 195-89

5. Also excludes amounts earmarked for payment to third

par?es as well as reimbursement of out-of-pocket

expenses (under certain condi?ons)

Thus, amounts received by a local travel agent from

foreign tourist agencies which formed part of the

package fee paid by the tourists but were intended

or earmarked for hotel room accommoda?ons and

accordingly paid by the local travel agency to the

hotels not subject to VAT

Gross receipts do not include monies or receipts

entrusted to the TP which do not belong to them

and do not redound to the TPs benet. CIR v. Tours

Specialists, Inc.

A"y. Terence Conrad H. Bello

Slide No. 43

A"y. Terence Conrad H. Bello

Slide No. 44

11

12/8/15

A. Zero Ra?ng vs. Exemp?on

1. Basic principle: a seller who is directly and legally liable

for the payment of VAT on goods and services is not

necessarily the person who ul?mately bears the burden

of the tax

It is the nal purchaser or consumer of such goods

and services who ul?mately bears the burden of the

VAT (VAT being an indirect tax)

2. From the perspec?ve of the nal consumer, VAT zero-

ra?ng and VAT exemp?on both oer some relief from

the burden of taxa?on, but the degree or extent of

relief is dierent

3. VAT exemp?on oers par?al relief from the VAT

incidence, while VAT zero-ra?ng oers total relief from

the VAT incidence (see CIR v. Seagate Tech.)

II. RELIEF FROM VAT

A"y. Terence Conrad H. Bello

45

A. Zero Ra?ng vs. Exemp?on

Slide No. 46

A. Zero Ra?ng vs. Exemp?on

4. Why is the degree of relief dierent?

a. VAT exemp?on (par?al relief)

the transac?on is not subject to VAT (output tax)

but the seller is not allowed any tax credit of VAT

(input tax) on purchases

b. VAT zero-ra?ng (total relief)

the zero-rated sale of goods or services (by a

VAT-registered person) is a taxable transac?on

for VAT purposes, but shall not result in any

output tax (because the output tax rate is 0%)

However, the input tax on purchases of goods,

proper?es or services related to such zero-rated

sale shall be available as tax credit or refund

5. Illustra?on: assume there are 3 sellers A, B, C and a nal

purchaser, D

A"y. Terence Conrad H. Bello

A"y. Terence Conrad H. Bello

Slide No. 47

EXEMPT

VAT

on

selling

price

ZERO-RATED

0

VAT

on

selling

price

Purchase Price

100 Purchase Price

100

VAT passed on

12 VAT passed on

12

Total amt. charged

A"y. Terence Conrad H. Bello

112 Total amt. charged

112

Refund

(12)

Net amount

100

Slide No. 48

12

12/8/15

B. Zero-Rated Transac?ons

B. Zero-Rated Transac?ons

Objec?ve of zero-ra?ng: to make exporters

compe??ve interna?onally through VAT relief

Two ways to grant relief:

Exporters sale is subject to 0% rate and is

allowed a refund or credit of input tax passed

on to exporter by his supplier (automa?c

zero ra?ng)

Supplier of exporter is eec?vely zero-rated

where his sale to the exporter is subject to

0% rate

A"y. Terence Conrad H. Bello

Slide No. 49

B. Zero-Rated Transac?ons

Supplier

VAT

Total

amt.

charged

to

exporter

Exporter

Customer

100 VAT on sale to

Customer

0 Purchase price

0 Purchase price

100 VAT passed on

100 VAT passed on

Total amt. charged

by supplier

Refund

200

0

0 Total amt. charged

by exporter

200

100

-

Eec?vely, the privilege of zero-ra?ng is extended to

suppliers of the exporter

A"y. Terence Conrad H. Bello

Supplier

Selling

Price

VAT

Total

amt.

charged

to

exporter

Exporter

Customer

100 VAT on sale to

Customer

0 Purchase price

12 Purchase price

100 VAT passed on

112 VAT passed on

A"y. Terence Conrad H. Bello

200

0

12 Total amt. charged

by exporter

Total amt. charged

by supplier

112

Refund

(12)

Net amount

100

200

Slide No. 50

B. Zero-Rated Transac?ons

Eec?ve

zero-ra?ng:

Selling

Price

Automa?c

zero-ra?ng:

Slide No. 51

Sale

of

Goods:

1. Actual

export

sale

(

106(A)(2)(a)(1))

considera?on

in

FX,

accounted

for

in

accordance

with

BSP

rules

and

regs.

2. Sale

of

raw

materials

or

packaging

materials

to

a

nonresident

buyer

for

delivery

to

a

resident

local

export-oriented

enterprise

(

106(A)(2)(a)(2))

considera?on

in

FX,

accounted

for

in

accordance

with

BSP

rules

and

regs.

3. Sale

of

raw/packaging

materials

to

export-oriented

enterprises

(

106(A)(2)(a)(3))

export

sales

must

exceed

70%

of

total

annual

prodn

4. Sale

of

gold

to

BSP

(

106(A)(2)(a)(4))

5. Those

considered

export

sales

under

the

Omnibus

Investments

Code

(

106(A)(2)(a)(5))

A"y.

Terence

Conrad

H.

Bello

Slide No. 52

13

12/8/15

B. Zero-Rated Transac?ons

B. Zero-Rated Transac?ons

Sale

of

Goods:

6. Sale

of

goods,

supplies,

equipment

and

fuel

to

interna?onal

vessels

or

air

carriers

(

106(A)(2)(a)(6))

7. Foreign currency denominated sale ( 106(A)(2)(b))

Sale of goods assembled or manufactured in the Phil. For

delivery to a Phil. resident

e.g., sale of locally manufactured car to OFWs for

delivery to Philippine residents (e.g., family of OFWs in

the Phils.)

8. Sales to persons or en??es whose exemp?on under

special laws or intl agreements eec?vely subjects

such sales to 0% rate ( 106(A)(2)(c)) (e.g., SMBA,

PEZA, ADB, IRRI)

A"y. Terence Conrad H. Bello

Slide No. 53

B. Zero-Rated Transac?ons

A"y. Terence Conrad H. Bello

Slide No. 54

B. Zero-Rated Transac?ons; Accounted for in Accordance with BSP Regs.

Sale

of

Services:

4. Services

rendered

to

interna?onal

vessels

or

air

carriers,

including

leases

of

property

(

108(B)(4))

5. Services

performed

by

contractors

or

subcontractors

in

processing,

conver?ng,

or

manufacturing

goods

for

export-oriented

enterprises

(

108(B)(5))

-

export

sales

must

exceed

70%

of

total

annual

prodn

6. Transport

of

passengers

and

cargo

by

interna?onal

carriers

(

108(B)(6))

7. Sale

of

power

or

fuel

generated

through

renewable

sources

of

energy

(

108(B)(7))

A"y.

Terence

Conrad

H.

Bello

Sale

of

Services:

1. Processing,

mfg.

or

repacking

goods

for

other

persons

doing

business

outside

the

Philippines

which

goods

are

subsequently

exported

(

108(B)(1))

-

considera?on

in

FX,

accounted

for

in

accordance

with

BSP

rules

and

regs.

2. Services

other

than

those

men?oned

in

no.

1

rendered

to

nonresidents

(

108(B)(2))

-

considera?on

in

FX,

accounted

for

in

accordance

with

BSP

rules

and

regs.

CIR

v.

AMEX

CIR

v.

Burmeister

&

Wain

Scandinavian

3. Services

rendered

to

persons

or

en??es

whose

exemp?on

under

special

laws

or

intl

agreements

eec?vely

subjects

such

services

to

0%

rate

(

108(B)(3))

Slide No. 55

1. What is meant by accounted for in accordance with

the rules and regs. of the BSP?

a. Per CB Circ. No. 1389, not required that

considera?on is inwardly remi"ed and converted to

Php (required under old VAT law)

b. At TPs op?on, FX may be

sold for Php to AABs or outside the banking

system, or

retained, or deposited in foreign currency

accounts, whether in the Philippines or abroad

and may be used freely for any purpose. BIR Rul.

No. 176-94, VAT Rul. No. 47-00

A"y. Terence Conrad H. Bello

Slide No. 56

14

12/8/15

C. Exempt Transac?ons

C. Exempt Transac?ons

1. See enumera?on under 109(1) (memorize!)

Sale or importa?on of marine or food products in their

original state

Sale or importa?on of fer?lizers; seeds, seedlings and

ngerlings; etc.

Importa?on of personal and household eects of returning

residents

Services subject to percentage tax

Medical, dental, hospital and veterinary services, except

those rendered by professionals (e.g., doctors, den?sts, vet,

etc.)

Educa?onal services rendered by private educa?onal

ins?tu?ons

Services rendered by RHQ

Transac?ons exempt under special law

Sale of low cost housing, etc.

A"y. Terence Conrad H. Bello

Slide No. 57

2. What is the coverage of the exemp?on?

a. General rule:

Exemp?on covers only taxes for which party favored

by the exemp?on is directly liable; exemp?on does

not extend to indirect taxes like VAT

Being an indirect tax, once VAT is shiYed to the

buyer, it is no longer a tax but an addi?onal cost

which becomes a part of the amount of the contract

price to be paid by the buyer. Phil. Acetylene Co., Inc.

v. CIR; Phil. Natl Police Mul(-Purpose Coopera(ve,

Inc. v. CIR; BIR Rul. No. 155-98; BIR Rul. No. 47-99

A"y. Terence Conrad H. Bello

Slide No. 58

C. Exempt Transac?ons

2. What is the coverage of the exemp?on?

b. Excep?ons:

When the law itself provides for exemp?on

from indirect taxes. CIR v. John Gotamco &

Sons, Inc. (involving the exemp?on of the WHO

from indirect taxes)

When the history of statutes clearly indicates

the grant of indirect tax exemp?on. Maceda v.

Macaraig, Jr. (conrming NPCs exemp?on

from direct and indirect taxes following an

examina?on of the evolu?on of NPCs charter)

A"y. Terence Conrad H. Bello

Slide No. 59

IV. TAX CREDITS AND REFUNDS

A"y. Terence Conrad H. Bello

60

15

12/8/15

A. Input Tax Credit

A. Input Tax Credit

1. What is input tax?

Means the VAT due on or paid by a VAT-registered

person on importa?on of goods or local purchases of

goods, proper?es, or services, including lease or use of

proper?es, in the course of his trade or business.

Also includes the transi?onal input tax and the

presump?ve input tax determined in accordance with

Sec. 111 of the Tax Code

Must be evidenced by a VAT invoice or VAT O/R issued by

a VAT-registered person

2. Who can avail of input tax credit?

VAT-registered importer of goods

VAT-registered purchaser of local goods or proper?es

VAT-registered purchaser of services or lessee or licensee

A"y. Terence Conrad H. Bello

Slide No. 61

A. Input Tax Credit; Excess Output Tax or Input Tax

A"y. Terence Conrad H. Bello

Slide No. 62

A. Input Tax Credit; Amor?za?on of Input Tax on Capital Goods

1. Basic

formula:

Output

tax

(12%

or

0%)

Less:

input

tax_______

VAT

Payable

2. Per

110(B),

if

at

the

end

of

the

taxable

quarter,

output

tax

exceeds

input

tax

VAT-registered

person

pays

the

excess

3. On

the

other

hand,

if

input

tax

exceeds

output

tax:

a. General

rule:

carry-over

excess

input

to

the

succeeding

quarter

or

quarters

b. Excep?on:

if

the

unu?lized

input

is

a"ributable

to

zero-

rated

sales,

the

VAT-registered

TP

has

3

op?ons:

Carry-over

excess

input

tax

Refund

unu?lized

input

tax

Credit

unu?lized

input

tax

vs.

other

internal

revenue

taxes

(i.e.,

TCC)

A"y.

Terence

Conrad

H.

Bello

3. What types of input tax are creditable?

a. Purchase or importa?on of goods:

for sale

for conversion into or intended to form part of a nished

product for sale, including packaging materials

for use as supplies in the course of business

for use as raw materials supplied in the sale of services

for use in trade or business for which deduc?on for

deprecia?on or amor?za?on is allowed

b. Purchase of real proper?es for which a VAT has actually been

paid

c. Purchase of services for which a VAT has actually been paid

d. Transac?ons deemed sale

e. Transi?onal input tax

f. Presump?ve input tax

Slide No. 63

1. Input tax on purchase or importa?on of depreciable goods

must be spread evenly over the month of acquisi?on and the

59 succeeding months if the aggregate acquisi?on cost,

excluding the VAT component, exceeds P1M

2. If the es?mated useful life of the capital good is less than 5

years, the input VAT shall be spread over such shorter period

3. The aggregate acquisi?on cost of a depreciable asset in any

calendar month refers to the total price agreed upon for one

or more assets acquired and not on the payments actually

made during the calendar month. Thus, an asset acquired on

installment for an acquisi?on cost of more than P1M will be

subject to the amor?za?on of input tax despite the fact that

the monthly payment/installment does not exceed P1M

A"y. Terence Conrad H. Bello

Slide No. 64

16

12/8/15

B. Transi?onal Input Tax

C. Presump?ve Input Tax

1. Who is en?tled to the transi?onal input tax?

A person who becomes liable to VAT or any

person who elects to be a VAT-registered person

(e.g., TPs who exceed the P1.5 M threshold or

TPs who elect VAT coverage even if their

turnover does not exceed P1.5 M)

2. How much is the transi?onal input tax?

Transi?onal input tax credit is 2% of the value of

the beginning inventory on hand as of the

eec?vity of the VAT-registra?on, or the actual

VAT paid, whichever is higher

A"y. Terence Conrad H. Bello

Slide No. 65

D. Final Withholding VAT

A"y. Terence Conrad H. Bello

Slide No. 66

E. Claims for Refund or Tax Credit

1. When does it apply?

The 5% nal withholding VAT applies to sales of goods or

services to the government or to GOCCs

2. When does the obliga?on to withhold arise?

Before making payment on account of the purchase, the

government en?ty or the GOCC shall deduct and

withhold the 5% nal VAT based on the gross payment

thereof

3. What does the 5% nal withholding VAT represent?

It represents the net VAT payable of the seller

4. What is the eect of the 5% nal withholding VAT on the

sellers input tax a"ributable to the sale to the government

or the GOCC?

It essen?ally limits the amount of input VAT that the

seller may credit against the 12% output tax to only 7%

(12% output - 5% net VAT payable = 7% standard input)

A"y. Terence Conrad H. Bello

1. Who is en?tled to the presump?ve input tax?

Persons or rms engaged in the processing of

s a r d i n e s , m a c k e r e l , a n d m i l k , a n d i n

manufacturing rened sugar, cooking oil and

packed noodle-based instant meals

2. How much is the presump?ve input tax?

4% of the gross value in money of the TPs

purchases of primary agricultural products which

are used as inputs to their produc?on

Slide No. 67

1. When can a VAT-registered TP claim a refund

or tax credit for unu?lized input VAT?

In only 2 instances:

Zero-rated or eec?vely zero-rated sales (

112(A)) unu?lized input VAT must be

a"ributable to the zero-rated sales (i.e., either

directly a"ributable or allocable to zero-rated

sales)

Cancella?on of VAT registra?on ( 112(B)) - due

to re?rement from or cessa?on of business, or

due to changes in or cessa?on of status under

106(C)

A"y. Terence Conrad H. Bello

Slide No. 68

17

12/8/15

E. Claims for Refund or Tax Credit

E. Claims for Refund or Tax Credit

2. What

is

the

period

within

which

the

CIR

should

act

on

the

claim?

Within

120

days

from

submission

of

complete

documents

in

support

of

the

applica?on

3. What

is

the

prescrip?ve

period

for

ling

the

claim

for

refund

or

TCC?

a. In

the

case

of

zero-rated

sales:

Administra?ve

claim

must

be

made

within

2

years

from

from

the

close

of

the

taxable

quarter

when

the

relevant

sales

were

made

(CIR

v.

Mirant

Pagbilao

Corp.,

GR

172129,

Sept.

12,

2008)

Judicial

claim

Within

30

days

from

denial

of

claim

or

from

the

lapse

of

the

120

day

period

without

any

ac?on

from

the

BIR

(

112(A))

(CIR

v.

Aichi

Forging,

GR

184823,

Oct.

6,

2010)

CIR

v.

San

Roque

Power

Corp.,

GR

187485,

Feb.

12,

2013

Upon

the

lapse

of

the

120-day

period,

may

TP

await

instead

for

an

actual

denial?

Rohm

Apollo

Semiconductor

Phil.

v.

CIR

A"y.

Terence

Conrad

H.

Bello

Slide No. 69

3. What is the prescrip?ve period for ling the claim

for refund or TCC?

b. In the case of cancella?on of VAT registra?on:

Administra?ve claim must be made within 2

years from the date of cancella?on

Judicial claim same

A"y. Terence Conrad H. Bello

Slide No. 70

A. BIR Registra?on

1. Mandatory registra?on generally, any person

whose sale of goods and services are subject to VAT

is required to register as a VAT taxpayer with the

appropriate RDO (and pay annual registra?on fee of

P500). VAT registra?on is mandatory if:

TPs gross sales or receipts for the past 12 mos.

(other than exempt sales) exceed P1,919,500

TP has reasonable grounds to believe that his

gross sales or receipts for the next 12 mos.

(other than exempt sales) will exceed P1,919,500

V. COMPLIANCE REQUIREMENTS

A"y. Terence Conrad H. Bello

71

A"y. Terence Conrad H. Bello

Slide No. 72

18

12/8/15

A. BIR Registra?on

A. BIR Registra?on

2. Op?onal registra?on TP may elect to register as a

VAT taxpayer in the following instances:

TPs annual gross sales or receipts do not exceed

P1,919,500

TP with mixed transac?ons (taxable and

exempt), may elect that exempt transac?ons be

subject to VAT

Franchise grantees of radio and TV broadcas?ng

whose annual gross receipts of the preceding

year do not exceed P10M

A"y. Terence Conrad H. Bello

Slide No. 73

A. BIR Registra?on

A"y. Terence Conrad H. Bello

Slide No. 74

B. Record Keeping Requirement

4. Cancella?on of VAT registra?on

TP is previously VAT-registered but whose annual

gross sales or receipts fall below P1,919,500

Re?rement from business subject to VAT

A"y. Terence Conrad H. Bello

3. Consequences

of

non-registra?on

TP

liable

for

VAT

But

disqualied

to

claim

input

VAT

credits

Slide No. 75

Requirement to keep subsidiary sales journal

and subsidiary purchase journal

A"y. Terence Conrad H. Bello

Slide No. 76

19

12/8/15

C. Invoices and Receipts

C. Invoices and Receipts

Issue VAT invoice for sale of goods

Issue VAT O/R for sale of services

Informa?on contained in VAT invoice/OR

TIN-V

Total

amount

due

(inclusive

of

VAT)

VAT

as

a

separate

item

Zero-rated

sale

wri"en

or

printed

prominently

Break

down

for

mixed

transac?ons

Date,

quan?ty,

unit

cost

and

descrip?on/nature

If

sale

is

P1,000

or

more,

indicate

name,

address

and

TIN

of

VAT-registered

buyer

A"y. Terence Conrad H. Bello

Slide No. 77

Consequence or erroneous issuance of VAT invoice/OR

If TP is not VAT-registered and issues invoice/OR

indica?ng TIN-V:

Liable for VAT in addi?on to percentage tax

Disqualied from input VAT credit a"ributable to

the sale

50% surcharge

Purchaser, however, eligible to claim input VAT

Break down for mixed transac?ons

If TP is VAT-registered and issues VAT invoice/OR for

exempt transac?on liable for VAT as if not exempt

A"y. Terence Conrad H. Bello

Slide No. 78

20

Das könnte Ihnen auch gefallen

- Legal Opinion On Naturalization FinalDokument4 SeitenLegal Opinion On Naturalization FinalKitem Kadatuan Jr.Noch keine Bewertungen

- Mother of Perpetual Help Funeral Homes financial statement notesDokument9 SeitenMother of Perpetual Help Funeral Homes financial statement notesSally SiaotongNoch keine Bewertungen

- Summary of Significant CTA Decisions (February 2011)Dokument2 SeitenSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNoch keine Bewertungen

- Cta 1D CV 08726 D 2017sep14 AssDokument115 SeitenCta 1D CV 08726 D 2017sep14 AssdoookaNoch keine Bewertungen

- ITAD BIR RULING NO. 026-18, March 5, 2018Dokument10 SeitenITAD BIR RULING NO. 026-18, March 5, 2018Kriszan ManiponNoch keine Bewertungen

- 4 - Rizal Provincial Government v. BIRDokument17 Seiten4 - Rizal Provincial Government v. BIRCarlota VillaromanNoch keine Bewertungen

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDokument29 Seiten209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNoch keine Bewertungen

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDokument4 SeitenBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNoch keine Bewertungen

- CIR v. CA (Jan. 20, 1999)Dokument14 SeitenCIR v. CA (Jan. 20, 1999)Crizza RondinaNoch keine Bewertungen

- LifeBlood - Assessment Process Tax 2Dokument17 SeitenLifeBlood - Assessment Process Tax 2Monjid AbpiNoch keine Bewertungen

- Pagong BagalDokument1 SeitePagong Bagaljuliet_emelinotmaestroNoch keine Bewertungen

- Cta 2D CV 09224 M 2019feb12 AssDokument17 SeitenCta 2D CV 09224 M 2019feb12 AssMelan YapNoch keine Bewertungen

- Coral Bay Vs CIR Cross Border DoctrineDokument7 SeitenCoral Bay Vs CIR Cross Border DoctrineAira Mae P. LayloNoch keine Bewertungen

- A. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesDokument7 SeitenA. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesRovi Anne IgoyNoch keine Bewertungen

- Pbcom V CirDokument9 SeitenPbcom V CirAbby ParwaniNoch keine Bewertungen

- Azerbaijan Excise Tax Calculation and RatesDokument15 SeitenAzerbaijan Excise Tax Calculation and RatesQedew ErNoch keine Bewertungen

- Tax Bulletin by SGV As of Oct 2014Dokument18 SeitenTax Bulletin by SGV As of Oct 2014adobopinikpikanNoch keine Bewertungen

- The Philippines: Tax Assessment, Appeal and Dispute ResolutionDokument29 SeitenThe Philippines: Tax Assessment, Appeal and Dispute ResolutionJBNoch keine Bewertungen

- 1601EDokument7 Seiten1601EEnrique Membrere SupsupNoch keine Bewertungen

- RFBT Material 1Dokument14 SeitenRFBT Material 1Blessy Zedlav LacbainNoch keine Bewertungen

- Revenue Regulations on Minimum Corporate Income TaxDokument5 SeitenRevenue Regulations on Minimum Corporate Income TaxKayzer SabaNoch keine Bewertungen

- BTAC Course Provides Tax Basics for New BIR EmployeesDokument7 SeitenBTAC Course Provides Tax Basics for New BIR EmployeesRommel Cabalhin100% (1)

- RMC No. 3-2022Dokument2 SeitenRMC No. 3-2022Shiela Marie MaraonNoch keine Bewertungen

- TaxxxxDokument3 SeitenTaxxxxfaye gNoch keine Bewertungen

- VAT ReviewDokument10 SeitenVAT ReviewRachel LeachonNoch keine Bewertungen

- Estate Tax: Bantolo, Javier, MusniDokument31 SeitenEstate Tax: Bantolo, Javier, MusniPatricia RodriguezNoch keine Bewertungen

- Tax Syllabus 2019Dokument6 SeitenTax Syllabus 2019Diding BorromeoNoch keine Bewertungen

- 62983rmo 5-2012Dokument14 Seiten62983rmo 5-2012Mark Dennis JovenNoch keine Bewertungen

- COA Central Office ClearanceDokument2 SeitenCOA Central Office ClearanceHoven MacasinagNoch keine Bewertungen

- PAGCOR v. BIRDokument26 SeitenPAGCOR v. BIRAronJamesNoch keine Bewertungen

- Taguig City expands anti-smoking ordinanceDokument12 SeitenTaguig City expands anti-smoking ordinanceJovelan V. EscañoNoch keine Bewertungen

- PhilHealth denied claims appealDokument4 SeitenPhilHealth denied claims appealEvan LaronaNoch keine Bewertungen

- Practice Test - Financial ManagementDokument6 SeitenPractice Test - Financial Managementelongoria278100% (1)

- Court Rules in Favor of Advertising Firm in Tax Refund CaseDokument38 SeitenCourt Rules in Favor of Advertising Firm in Tax Refund CaseHerzl Hali V. HermosaNoch keine Bewertungen

- Withholding Taxes 2Dokument20 SeitenWithholding Taxes 2hildaNoch keine Bewertungen

- 35090rmc No. 39-2007Dokument6 Seiten35090rmc No. 39-2007Printet08Noch keine Bewertungen

- Samar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Dokument18 SeitenSamar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Maria Nicole Vaneetee100% (1)

- DEDUCTIONS FROM INCOMEDokument12 SeitenDEDUCTIONS FROM INCOMEVillage GourmetNoch keine Bewertungen

- RR 9-89Dokument6 SeitenRR 9-89papepipupoNoch keine Bewertungen

- The Judicial Affidavit RuleDokument8 SeitenThe Judicial Affidavit RuleLucky Cristian TabilNoch keine Bewertungen

- Classroom Notes On DSTDokument6 SeitenClassroom Notes On DSTLalaine ReyesNoch keine Bewertungen

- Affidavit of Cancellation of Business NameDokument1 SeiteAffidavit of Cancellation of Business NamemarvieNoch keine Bewertungen

- CIR V Fortune TobaccoDokument16 SeitenCIR V Fortune TobaccoOlivia JaneNoch keine Bewertungen

- BIR Ruling No 455-93 DigestDokument2 SeitenBIR Ruling No 455-93 DigestJason CertezaNoch keine Bewertungen

- Joson V COA Full TextDokument4 SeitenJoson V COA Full TextLuz Celine CabadingNoch keine Bewertungen

- Donor's Tax Rates and ExemptionsDokument5 SeitenDonor's Tax Rates and ExemptionsKim EspinaNoch keine Bewertungen

- Articles of Incorporation (Sample)Dokument8 SeitenArticles of Incorporation (Sample)jeni mae pillotesNoch keine Bewertungen

- Tax Alert (December 2020)Dokument10 SeitenTax Alert (December 2020)Rheneir MoraNoch keine Bewertungen

- Rmo 15-03 - Car and OnettDokument81 SeitenRmo 15-03 - Car and OnettHomerNoch keine Bewertungen

- Maceda V. Macaraig Summary: The Petition Seeks To Nullify Certain Decisions, Orders, Rulings, and ResolutionsDokument3 SeitenMaceda V. Macaraig Summary: The Petition Seeks To Nullify Certain Decisions, Orders, Rulings, and ResolutionsTrixie PeraltaNoch keine Bewertungen

- Tax Doctrine on Willful BlindnessDokument4 SeitenTax Doctrine on Willful BlindnessKatNoch keine Bewertungen

- Revalida - Fria - 2. Viva Shipping Lines Vs Keppel PhilippinesDokument4 SeitenRevalida - Fria - 2. Viva Shipping Lines Vs Keppel PhilippinesACNoch keine Bewertungen

- Impact of The TRAIN Law by PICPA Taxation CPALEDokument46 SeitenImpact of The TRAIN Law by PICPA Taxation CPALEJohn LuNoch keine Bewertungen

- VAT Refund Denied for Lack of "Zero-RatedDokument1 SeiteVAT Refund Denied for Lack of "Zero-RatedKaren Mae ServanNoch keine Bewertungen

- 2-Cir Vs HantexDokument3 Seiten2-Cir Vs HantexWill Pass D BarNoch keine Bewertungen

- CTA Case No. 6191Dokument11 SeitenCTA Case No. 6191John Kenneth JacintoNoch keine Bewertungen

- Bir Ruling No. 108-93Dokument2 SeitenBir Ruling No. 108-93saintkarriNoch keine Bewertungen

- Guidelines and Conduct of TCVD RMO09-2006Dokument45 SeitenGuidelines and Conduct of TCVD RMO09-2006Kris CalabiaNoch keine Bewertungen

- Understanding VAT Taxation in the PhilippinesDokument13 SeitenUnderstanding VAT Taxation in the Philippinestokitoki24Noch keine Bewertungen

- Tax 2Dokument14 SeitenTax 2Nash Ortiz LuisNoch keine Bewertungen

- Evolution of DeathDokument5 SeitenEvolution of DeathNori LolaNoch keine Bewertungen

- A Structural Analysis of The Physician-Patient Relationship in No-Code Decision-MakingDokument24 SeitenA Structural Analysis of The Physician-Patient Relationship in No-Code Decision-MakingNori LolaNoch keine Bewertungen

- Legal OpinionDokument3 SeitenLegal OpinionNori Lola100% (1)

- Compensation Q&ADokument2 SeitenCompensation Q&ANori LolaNoch keine Bewertungen

- POEA V Principalia Management, Sep 2, 2015Dokument1 SeitePOEA V Principalia Management, Sep 2, 2015Nori LolaNoch keine Bewertungen

- People Vs Sea Lion Fishing CorpDokument7 SeitenPeople Vs Sea Lion Fishing CorpNori LolaNoch keine Bewertungen

- INC Shipmanagement v. Camporedondo (2015)Dokument1 SeiteINC Shipmanagement v. Camporedondo (2015)Nori LolaNoch keine Bewertungen

- Supreme Court Holds Doctors and Hospital Liable for Death of Dengue Patient Due to NegligenceDokument2 SeitenSupreme Court Holds Doctors and Hospital Liable for Death of Dengue Patient Due to NegligenceNori Lola100% (1)

- Philippine Airlines v. Bichara, Sep 2, 2015Dokument1 SeitePhilippine Airlines v. Bichara, Sep 2, 2015Nori LolaNoch keine Bewertungen

- Statement of Facts DefendantDokument15 SeitenStatement of Facts DefendantNori LolaNoch keine Bewertungen

- Career Awareness AssignmentDokument4 SeitenCareer Awareness AssignmentNori LolaNoch keine Bewertungen

- Experiment No 3 Full ReportDokument4 SeitenExperiment No 3 Full ReportNori LolaNoch keine Bewertungen

- People Vs Sea Lion Fishing CorpDokument7 SeitenPeople Vs Sea Lion Fishing CorpNori LolaNoch keine Bewertungen

- Alternative Obligations Q&ADokument2 SeitenAlternative Obligations Q&ANori Lola80% (44)

- Agrarian ReformDokument18 SeitenAgrarian ReformNori Lola100% (1)

- Benevolent Neutrality TheoryDokument1 SeiteBenevolent Neutrality TheoryNori LolaNoch keine Bewertungen

- Principles of Intl Environmental LawDokument23 SeitenPrinciples of Intl Environmental LawNori LolaNoch keine Bewertungen

- Brain Death: Legal ObligationsDokument5 SeitenBrain Death: Legal ObligationsNori LolaNoch keine Bewertungen

- Labor RelationsDokument3 SeitenLabor RelationsNori LolaNoch keine Bewertungen

- Estj Extraverted Sensing Thinking JudgingDokument2 SeitenEstj Extraverted Sensing Thinking JudgingNori LolaNoch keine Bewertungen

- Accountancy LawDokument10 SeitenAccountancy LawNori LolaNoch keine Bewertungen

- Fungiform Papillae Mushroom: Stratified Squamous EpitheliumDokument2 SeitenFungiform Papillae Mushroom: Stratified Squamous EpitheliumNori LolaNoch keine Bewertungen

- Commission On Audit Circular NoDokument7 SeitenCommission On Audit Circular NojeceyNoch keine Bewertungen

- Commissioner Internal Revenue v. Fortune Tobacco CorporationDokument4 SeitenCommissioner Internal Revenue v. Fortune Tobacco CorporationEdward Kenneth KungNoch keine Bewertungen

- PP of BIR ORGDokument26 SeitenPP of BIR ORGNori LolaNoch keine Bewertungen

- 124 160Dokument17 Seiten124 160monique_noaNoch keine Bewertungen

- Commission On Audit Circular 2012-004Dokument3 SeitenCommission On Audit Circular 2012-004Che Poblete CardenasNoch keine Bewertungen

- Crim Pro AddendumDokument12 SeitenCrim Pro AddendumNori LolaNoch keine Bewertungen

- PP of BIR ORGDokument26 SeitenPP of BIR ORGNori LolaNoch keine Bewertungen

- Problems of Vat AdiministrationDokument74 SeitenProblems of Vat AdiministrationZelalemNoch keine Bewertungen

- Prepared By. Diana TamesgenDokument30 SeitenPrepared By. Diana TamesgenmikeNoch keine Bewertungen

- UNWTO 2020 Tourism Satellite Account (TSA) Around The WorldDokument193 SeitenUNWTO 2020 Tourism Satellite Account (TSA) Around The WorldNathalia GamboaNoch keine Bewertungen

- National Income New PDFDokument25 SeitenNational Income New PDFLaksh SahniNoch keine Bewertungen

- Romania Tax Guide for Short-Term RentalsDokument6 SeitenRomania Tax Guide for Short-Term RentalscelmailenesNoch keine Bewertungen

- Macroeconomics A Contemporary Approach 10th Edition McEachern Test Bank DownloadDokument90 SeitenMacroeconomics A Contemporary Approach 10th Edition McEachern Test Bank DownloadDolores Tobias100% (16)

- 801 Value Added TaxDokument4 Seiten801 Value Added TaxHarold Cedric Noleal OsorioNoch keine Bewertungen

- Macro Unsolved Numericals English PDFDokument18 SeitenMacro Unsolved Numericals English PDFNindoNoch keine Bewertungen

- Eco Project GulshanDokument21 SeitenEco Project GulshanAman BajajNoch keine Bewertungen

- Macro FinalDokument198 SeitenMacro FinalpitimayNoch keine Bewertungen

- Value Added Tax NotesDokument12 SeitenValue Added Tax NotesAimeeNoch keine Bewertungen

- Eco Marathon Notes by Ca Nitin GuruDokument103 SeitenEco Marathon Notes by Ca Nitin GuruShivam GoyalNoch keine Bewertungen

- Production and Trade of Knowledge-And Technology - Intensive IndustriesDokument66 SeitenProduction and Trade of Knowledge-And Technology - Intensive IndustriesDiego Murillo ContrerasNoch keine Bewertungen

- Summary of Quantities: Item No. Description Unit Quantity RemarksDokument31 SeitenSummary of Quantities: Item No. Description Unit Quantity RemarksFlormin LumbaoNoch keine Bewertungen

- ERC Regulation and Electricity Price Structure by Engr. Alvin Jones Ortega ERC PDFDokument28 SeitenERC Regulation and Electricity Price Structure by Engr. Alvin Jones Ortega ERC PDFJoyNoch keine Bewertungen

- National Income AnalysisDokument27 SeitenNational Income AnalysisSantosh AcharyaNoch keine Bewertungen

- Mobilization DUPA AnalysisDokument76 SeitenMobilization DUPA AnalysisCed LucasNoch keine Bewertungen

- Measuring Economic Activity: Measuring Economic ActivityDokument42 SeitenMeasuring Economic Activity: Measuring Economic ActivityWAC_BADSECTORNoch keine Bewertungen

- Assessing The Economic Impact of Transportation ProjectsDokument34 SeitenAssessing The Economic Impact of Transportation ProjectsMiaNoch keine Bewertungen

- XamIdea Economics Class 12Dokument462 SeitenXamIdea Economics Class 12Aastha Sagar68% (25)

- National Income - TMKDokument3 SeitenNational Income - TMKKuthubudeen T MNoch keine Bewertungen

- Ch1 - Operations Management by William J StevensonDokument21 SeitenCh1 - Operations Management by William J StevensonNasser Shelil100% (1)

- 8.) Chapter 4Dokument32 Seiten8.) Chapter 4CA Chhavi GuptaNoch keine Bewertungen

- Estimates OF State Domestic Product, Odisha: (Both at Basic Prices and Market Prices)Dokument24 SeitenEstimates OF State Domestic Product, Odisha: (Both at Basic Prices and Market Prices)naina saxenaNoch keine Bewertungen

- Allmacroeconomicsppts 130321114704 Phpapp02Dokument291 SeitenAllmacroeconomicsppts 130321114704 Phpapp02infoeduNoch keine Bewertungen

- Forecasting Business Value of AI - 2025Dokument22 SeitenForecasting Business Value of AI - 2025Carolina AguilaNoch keine Bewertungen

- VAT DiscussionDokument39 SeitenVAT DiscussionCheenee Nuestro SantiagoNoch keine Bewertungen

- Svprecis Book Num 2 Macro Economics NumericalDokument62 SeitenSvprecis Book Num 2 Macro Economics Numericalapi-252136290Noch keine Bewertungen

- DUPA, Building - RepairDokument19 SeitenDUPA, Building - RepairRoger DinopolNoch keine Bewertungen

- ProductivityDokument13 SeitenProductivityVarun MehrotraNoch keine Bewertungen