Beruflich Dokumente

Kultur Dokumente

ACTL 4001 - 5100 S1 2015 Mid Semester With Marking

Hochgeladen von

BobOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ACTL 4001 - 5100 S1 2015 Mid Semester With Marking

Hochgeladen von

BobCopyright:

Verfügbare Formate

ID XXX

THE UNIVERSITY OF NEW SOUTH WALES

SEMESTER 2 2014

ACTL4001 /ACTL5100

ACTUARIAL THEORY & PRACTICE B

MID SEMESTER EXAMINATION

1)

2)

3)

4)

5)

6)

TIME ALLOWED - 1 HOUR.

READING TIME 5 MINUTES

THIS EXAMINATION PAPER HAS 3 PAGES

TOTAL NUMBER OF QUESTIONS 3

TOTAL MARKS AVAILABLE 36

ALL ANSWERS MUST BE WRITTEN IN INK. EXCEPT WHERE THEY ARE EXPRESSLY

REQUIRED, PENCILS MAY BE USED ONLY FOR DRAWING, SKETCHING OR GRAPHICAL

WORK

7) THE PAPER MAY BE RETAINED BY THE CANDIDATE.

CANDIDATES MAY BRING IN THEIR OWN CALCULATOR

Question 1

[12 marks]

The Institute of Actuaries of Australia has developed its Capabilities Framework to

provide members of the profession with a guide to planning personal career paths,

and to provide the public with direct knowledge of what might be expected of a

professional. The elements of the framework are:

1. Contribution to Business Strategy

2. Leadership

3. Actuarial Approach to Problem Solving

4. Valuing Uncertain Future Cash Flows

5. Risk Management

6. Professional Governance

7. Product Development Management and Pricing

8. Investment Advice and Governance

a)

b)

c)

For four of these elements, briefly explain what they are and why they are

relevant to the work of some actuaries.

(8)

Indicate which of the elements are most relevant to what you currently see as

your most likely career path.

(2)

Give one example (from one industry in which actuaries practice) of what the

public might expect from actuaries that they might not get from other

professionals.

(2)

Marking guide (one mark per line unless otherwise stated)

a)

For each element one mark for showing understanding and another for

application to the work of actuaries.

Must mention points in italics

1. Contribution to Business Strategy market/capital/M&A strategy

2. Leadership in company/society/team

3. Actuarial Approach to Problem Solving Model and ACC

4. Valuing Uncertain Future Cash Flows Reserving and pricing

5. Risk Management models/capital/ERM/risk appetite

6. Professional Governance standards/ethics.training/participation

7. Product Development Management and Pricing needs/competitive and

profitable

8. Investment Advice and Governance performance measurement

b)

One for choice of element(s) and another for plausible career path. Can get

two if you say you have not yet chosen a path, but then identify most widely useful

elements

c)

One for example and one for comparison with non-actuaries

2

Question 2 [12 marks]

Australian life insurance companies have made significant losses on both group and

individual disability insurance recently. It is reported that Chinese life insurers are

reluctant to begin selling disability insurance because of the subjective nature of the

claims, and the difficulties this causes in ensuring profitability.

a)

Describe the main characteristics of the different types of disability insurance

available in Australia and explain what policyholders needs they fulfil.

(5)

b)

What explanations can be given for the cause of these losses? Explain how

companies should respond to these causes as well the difficulties and risks of

your proposed methods.

(5)

c)

Discuss the extent to which you think that the difficulties and risks you have

raised in part (b) make it uneconomic to write disability insurance business

and that Chinese life insurers would be wise to stay away from the business.

(2)

Marking guide (one mark per line unless otherwise stated)

a) This is book work:

TPD

DI

Group and Individual for both

Workcover .5 as is insurance but policyholder is employer and not life insurance

Yearly renewable term

Inability to work

Need to understand the differences between permanent/temporary total/partial

& when they are paid

b) Need to give a reason why circumstances have changed; this is also a

profitability problem, not liquidity, or one that reinsurance can solve

Poor definitions of disability

Moral hazards

Loose underwriting of group business

Addition of ancillary benefits without extra charges.

Changes to economic environment

Changes to legal environment and willingness to take to court

Increase premiums

selective lapsation

Tighter claims management

Limit benefits

- competitive pressures

c) One mark each for any sensible arguments

Question 3

[12 marks]

Three of the most important secular changes facing the world are in climate (whether

anthropogenic or not), technology and demography in the form of an increasing and

aging population. Discuss the implications of each of these changes to the business

of the general insurance and superannuation industries in Australia.

Marking guide (one mark per line unless otherwise stated)

Climate higher GI claims and catastrophes (2)

carbon taxes and other restrictions effect relevant investment returns

may also effect economy and investment returns

Technology cheaper and more effective marketing

and administration for both industries (3 in total )

even longer life

creative destruction impact on investments

reduce motor accidents & other events?

Increasing population and limited resources

possible impact on investment returns of mines & capital in general

political instability and GI war/terrorism claims

investment returns on mines higher? industry lower? stranded assets?

Longevity superannuation must last longer > bigger industry

greater need for risk management of annuity products

possible different products for health/disability in GI

only

(not for higher prices for older people as it works the other way and then older

people are not allowed to drive when they become a danger)

I gave half a mark for other good ideas in each area if the idea was well put, but

the aim of the question was to get you say something about each area not give an

essay on just one point.

END OF PAPER

Das könnte Ihnen auch gefallen

- Questions - SI Cases' Questions - All PDFDokument4 SeitenQuestions - SI Cases' Questions - All PDFAnish DalmiaNoch keine Bewertungen

- Result FeedbackDokument3 SeitenResult FeedbackElsie ChangNoch keine Bewertungen

- (A. Thomas Fenik) Strategic Management (Quickstudy PDFDokument4 Seiten(A. Thomas Fenik) Strategic Management (Quickstudy PDFZewdu Tsegaye100% (4)

- Managerial Finance in a Canadian Setting: Instructor's ManualVon EverandManagerial Finance in a Canadian Setting: Instructor's ManualNoch keine Bewertungen

- Roadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideVon EverandRoadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideNoch keine Bewertungen

- Value Creation - The Source of Pricing AdvantageDokument23 SeitenValue Creation - The Source of Pricing AdvantageReymark Mores50% (2)

- CA1 Exams 2010-2014Dokument221 SeitenCA1 Exams 2010-2014Xavier Snowy100% (1)

- 7115 Business Studies: MARK SCHEME For The October/November 2006 Question PaperDokument5 Seiten7115 Business Studies: MARK SCHEME For The October/November 2006 Question Papermstudy123456Noch keine Bewertungen

- 0455 s10 Ms 22Dokument8 Seiten0455 s10 Ms 22Karmen ThumNoch keine Bewertungen

- QA Topic Wise ECDokument233 SeitenQA Topic Wise ECatifNoch keine Bewertungen

- MA922 2017 Assessment1 - Feedback and Specimen Solution IR and PMDokument8 SeitenMA922 2017 Assessment1 - Feedback and Specimen Solution IR and PMrenaldo1976Noch keine Bewertungen

- Review and Revision: Anthony Asher 2015Dokument21 SeitenReview and Revision: Anthony Asher 2015BobNoch keine Bewertungen

- Strategic Business Management November 2018 Mark PlanDokument19 SeitenStrategic Business Management November 2018 Mark PlanWongani KaundaNoch keine Bewertungen

- ASAL Business WB Chapter 8 AnswersDokument4 SeitenASAL Business WB Chapter 8 AnswersElgin LohNoch keine Bewertungen

- 02 Idea Assessment Feasibility Analysis Business ModelDokument4 Seiten02 Idea Assessment Feasibility Analysis Business ModelImaan IqbalNoch keine Bewertungen

- PRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012Dokument4 SeitenPRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012tilshilohNoch keine Bewertungen

- Actuarial Science Consists of Total 15 PapersDokument5 SeitenActuarial Science Consists of Total 15 PapersAkku Chaudhary100% (1)

- The EnvironmentDokument22 SeitenThe EnvironmentShaikh Ahsan AliNoch keine Bewertungen

- Subject CA1 Actuarial Risk Management Syllabus: For The 2013 ExaminationsDokument11 SeitenSubject CA1 Actuarial Risk Management Syllabus: For The 2013 ExaminationsMaina MuhoroNoch keine Bewertungen

- Dwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFDokument35 SeitenDwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFashermats100% (10)

- Entrepreneurship and Business Development: The Association of Business Executives QCFDokument11 SeitenEntrepreneurship and Business Development: The Association of Business Executives QCFhskxxNoch keine Bewertungen

- CT9 Business Awareness Module PDFDokument4 SeitenCT9 Business Awareness Module PDFVignesh SrinivasanNoch keine Bewertungen

- Chapter 5 - External AuditDokument11 SeitenChapter 5 - External AuditJesus ObligaNoch keine Bewertungen

- Examination: Subject SA1 Health and Care Specialist ApplicationsDokument168 SeitenExamination: Subject SA1 Health and Care Specialist Applicationschan chadoNoch keine Bewertungen

- Australian School of Business Actuarial Theory & Practice ADokument28 SeitenAustralian School of Business Actuarial Theory & Practice ABobNoch keine Bewertungen

- Expenses WP 1988Dokument48 SeitenExpenses WP 1988aditikhanal.135Noch keine Bewertungen

- Chapter-2 MarketDokument13 SeitenChapter-2 MarketMea CostasNoch keine Bewertungen

- C2A October 2011 Exam PDFDokument8 SeitenC2A October 2011 Exam PDFJeff GundyNoch keine Bewertungen

- Assignemnt 1 Brief From Jan 2024Dokument6 SeitenAssignemnt 1 Brief From Jan 2024hoangnnngbs220355Noch keine Bewertungen

- CP1 - Syllabus - Final ProofDokument9 SeitenCP1 - Syllabus - Final ProofMoon MoonNoch keine Bewertungen

- IandF CT7 201509 ExaminersReportDokument13 SeitenIandF CT7 201509 ExaminersReportPatrick MugoNoch keine Bewertungen

- P3 Revision NotesDokument28 SeitenP3 Revision NotesTripleFireWingsNoch keine Bewertungen

- The Resource-Based ModelDokument3 SeitenThe Resource-Based ModelMulazim HussainNoch keine Bewertungen

- Smu 4th Sem Finance AssignmentsDokument13 SeitenSmu 4th Sem Finance AssignmentsProjectHelpForuNoch keine Bewertungen

- CA1 Actuarial Risk Management PDFDokument9 SeitenCA1 Actuarial Risk Management PDFVignesh Srinivasan50% (2)

- May-June Paper 1 AnswersDokument5 SeitenMay-June Paper 1 AnswersIsrael AyemoNoch keine Bewertungen

- 2281 Economics: MARK SCHEME For The October/November 2007 Question PaperDokument4 Seiten2281 Economics: MARK SCHEME For The October/November 2007 Question Papermstudy123456Noch keine Bewertungen

- MO CH 2Dokument10 SeitenMO CH 2IceTea Wulan ArumitaNoch keine Bewertungen

- Organizational ManagementDokument14 SeitenOrganizational ManagementNidaa KabbajNoch keine Bewertungen

- Full Download At:: Operations Management Operations and Supply Chain Management 14th Edition JacobsDokument12 SeitenFull Download At:: Operations Management Operations and Supply Chain Management 14th Edition JacobsHoàng Thiên LamNoch keine Bewertungen

- Subject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamsDokument11 SeitenSubject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamszubboNoch keine Bewertungen

- ACC311 Week 1 NotesDokument8 SeitenACC311 Week 1 NotesCynthia LautaruNoch keine Bewertungen

- Segmentation 1Dokument10 SeitenSegmentation 1Govish Kumar MenonNoch keine Bewertungen

- Case Questions Spring 2012Dokument2 SeitenCase Questions Spring 2012Refika TetikNoch keine Bewertungen

- Consultancy Project SEPTEMBER 2021 Updated V3 For DexiotisDokument12 SeitenConsultancy Project SEPTEMBER 2021 Updated V3 For DexiotisJshadekNoch keine Bewertungen

- A311-2 October 2019 ExamDokument5 SeitenA311-2 October 2019 ExamElsjeLabuschagneNoch keine Bewertungen

- Institute of Actuaries of India Examinations: 08 November 2007Dokument4 SeitenInstitute of Actuaries of India Examinations: 08 November 2007YogeshAgrawalNoch keine Bewertungen

- 20210514T225931BPSM Set 1 UsedDokument6 Seiten20210514T225931BPSM Set 1 UsedJayraj JajuNoch keine Bewertungen

- Agency ReportDokument99 SeitenAgency ReportAnant JainNoch keine Bewertungen

- Tutorial 3 Ans Tutorial 3 AnsDokument3 SeitenTutorial 3 Ans Tutorial 3 AnsShoppers CartNoch keine Bewertungen

- Business Simulation Experiential Learning Case Brief ModelDokument4 SeitenBusiness Simulation Experiential Learning Case Brief ModelMayank SoniNoch keine Bewertungen

- An organisation's environmentDokument4 SeitenAn organisation's environmentElma SusantyNoch keine Bewertungen

- Strama MGT Week 5Dokument13 SeitenStrama MGT Week 5Ailene GapoyNoch keine Bewertungen

- BSBRHS501 Manage RiskDokument13 SeitenBSBRHS501 Manage Risknavtej2213100% (34)

- CT9Dokument4 SeitenCT9Vishy BhatiaNoch keine Bewertungen

- 144 - 23 Tender SubmissionDokument31 Seiten144 - 23 Tender SubmissionChujja ChuNoch keine Bewertungen

- Industrial Market SegmentationDokument8 SeitenIndustrial Market SegmentationnisargoNoch keine Bewertungen

- MGMT 1063 - Strama Module 3Dokument8 SeitenMGMT 1063 - Strama Module 3Kay AbawagNoch keine Bewertungen

- Thesis ProposalDokument7 SeitenThesis ProposalAndika RivaiNoch keine Bewertungen

- Emerging FinTech: Understanding and Maximizing Their BenefitsVon EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNoch keine Bewertungen

- 01 7.1 Distributions 13-14Dokument33 Seiten01 7.1 Distributions 13-14BobNoch keine Bewertungen

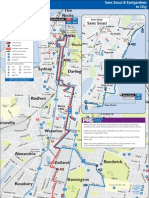

- Maroubra Beach to City bus timetable via RandwickDokument19 SeitenMaroubra Beach to City bus timetable via RandwickBobNoch keine Bewertungen

- Calc 1141 2Dokument27 SeitenCalc 1141 2BobNoch keine Bewertungen

- 10 FM 1 TN 1ppDokument101 Seiten10 FM 1 TN 1ppBobNoch keine Bewertungen

- 301 302 303 X03mapDokument1 Seite301 302 303 X03mapKyungJun ShinNoch keine Bewertungen

- Maroubra Beach to City via RandwickDokument1 SeiteMaroubra Beach to City via RandwickBobNoch keine Bewertungen

- ch19 3Dokument40 Seitench19 3BobNoch keine Bewertungen

- 01 7.1 Distributions 13-14-0 PDF Week 7 New VersionDokument21 Seiten01 7.1 Distributions 13-14-0 PDF Week 7 New VersionBobNoch keine Bewertungen

- ACTL4001 Lecture 11Dokument12 SeitenACTL4001 Lecture 11BobNoch keine Bewertungen

- Linear Algebra Done WrongDokument231 SeitenLinear Algebra Done WrongS NandaNoch keine Bewertungen

- History of The Actuarial ProfessionDokument3 SeitenHistory of The Actuarial ProfessionBobNoch keine Bewertungen

- Maroubra Beach to City via RandwickDokument1 SeiteMaroubra Beach to City via RandwickBobNoch keine Bewertungen

- ch19 5Dokument6 Seitench19 5BobNoch keine Bewertungen

- 301 302 303 X03mapDokument1 Seite301 302 303 X03mapKyungJun ShinNoch keine Bewertungen

- Linear Algebra Done WrongDokument231 SeitenLinear Algebra Done WrongS NandaNoch keine Bewertungen

- Global Financial Crisis Actuary PerspectiveDokument3 SeitenGlobal Financial Crisis Actuary PerspectiveBobNoch keine Bewertungen

- (Carmona R.a.) Interest Rate ModelsDokument58 Seiten(Carmona R.a.) Interest Rate ModelsBobNoch keine Bewertungen

- Chapter 4 Exercise Solutions SpreadsheetDokument5 SeitenChapter 4 Exercise Solutions SpreadsheetBobNoch keine Bewertungen

- Takaful: An Islamic Alternative To Conventional Insurance Sees Phenomenal GrowthDokument3 SeitenTakaful: An Islamic Alternative To Conventional Insurance Sees Phenomenal GrowthBobNoch keine Bewertungen

- Maroubra Beach to City bus timetable via RandwickDokument19 SeitenMaroubra Beach to City bus timetable via RandwickBobNoch keine Bewertungen

- International: 2020 VisionDokument5 SeitenInternational: 2020 VisionBobNoch keine Bewertungen

- It's Time To Abolish Retirement (And Here's How To Do It) .: Work, Learn and Play Till You DropDokument47 SeitenIt's Time To Abolish Retirement (And Here's How To Do It) .: Work, Learn and Play Till You DropBobNoch keine Bewertungen

- ch4 5Dokument37 Seitench4 5BobNoch keine Bewertungen

- Is Insurance A Luxury?Dokument3 SeitenIs Insurance A Luxury?BobNoch keine Bewertungen

- Signs of Ageing: HealthcareDokument2 SeitenSigns of Ageing: HealthcareBobNoch keine Bewertungen

- DRAFT STANDARDS FOR DEVELOPING SPREADSHEETSDokument5 SeitenDRAFT STANDARDS FOR DEVELOPING SPREADSHEETSBobNoch keine Bewertungen

- Pension Benefit Design: Flexibility and The Integration of Insurance Over The Life CycleDokument43 SeitenPension Benefit Design: Flexibility and The Integration of Insurance Over The Life CycleBobNoch keine Bewertungen

- ch4 1Dokument42 Seitench4 1BobNoch keine Bewertungen

- THE PROPERTY MANAGEMENT PROCESSDokument1 SeiteTHE PROPERTY MANAGEMENT PROCESSFirst Capital AdvisoryNoch keine Bewertungen

- Quiz 4Dokument2 SeitenQuiz 4Romell Ambal Ramos100% (1)

- New Microsoft Office Word DocumentDokument4 SeitenNew Microsoft Office Word DocumentMilan KakkadNoch keine Bewertungen

- Literature ReviewDokument3 SeitenLiterature ReviewKenneth Aldrin JoseNoch keine Bewertungen

- Unit One: Introduction To The Study of Consumer BehaviourDokument53 SeitenUnit One: Introduction To The Study of Consumer BehaviourMr. Padmanabha BNoch keine Bewertungen

- Supplier ScorecardDokument1 SeiteSupplier ScorecardJoe bilouteNoch keine Bewertungen

- JamaicaDokument10 SeitenJamaicaMake khanNoch keine Bewertungen

- TempDokument46 SeitenTemp17viruNoch keine Bewertungen

- Steps in Registering Your Business in The PhilippinesDokument5 SeitenSteps in Registering Your Business in The PhilippinesSherie Joy MercadoNoch keine Bewertungen

- A Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerDokument11 SeitenA Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerBryan AdamsNoch keine Bewertungen

- Stock Controller Cover LetterDokument7 SeitenStock Controller Cover Letterafmqqaepfaqbah100% (1)

- SAP T-Codes Module IS - DFPS Defense Forces and Public SecurityDokument39 SeitenSAP T-Codes Module IS - DFPS Defense Forces and Public Securityharisomanath100% (1)

- Risk-Based AuditingDokument16 SeitenRisk-Based AuditingMohammed JabbarNoch keine Bewertungen

- Sai Khant Kyaw Za - Task 2Dokument4 SeitenSai Khant Kyaw Za - Task 2Lean CosmicNoch keine Bewertungen

- The Four Pillars of DCIM IntegrationDokument25 SeitenThe Four Pillars of DCIM IntegrationHarumNoch keine Bewertungen

- Audit planning and internal control reviewDokument6 SeitenAudit planning and internal control reviewJeth Mahusay100% (1)

- Mock Test Paper - II for Intermediate (New) Group - II Paper 8A: Financial ManagementDokument6 SeitenMock Test Paper - II for Intermediate (New) Group - II Paper 8A: Financial ManagementHarsh KumarNoch keine Bewertungen

- IT Strategy For BusinessDokument37 SeitenIT Strategy For Businesssaurabh_1886Noch keine Bewertungen

- Entrep PPT 1 StudentDokument15 SeitenEntrep PPT 1 StudentShaina LuisNoch keine Bewertungen

- Planning and Delivering Customer Value Through Marketing: Dr. Sunil SahadevDokument19 SeitenPlanning and Delivering Customer Value Through Marketing: Dr. Sunil SahadevPranav ShenoyNoch keine Bewertungen

- Operations and Supply StrategiesDokument5 SeitenOperations and Supply StrategiesTanu Trivedi100% (1)

- HRM Exam QuestionsDokument1 SeiteHRM Exam QuestionsMani MaranNoch keine Bewertungen

- AFM 2021 BatchDokument4 SeitenAFM 2021 BatchDhruv Shah0% (1)

- Ohsas 18001Dokument2 SeitenOhsas 18001InnoviaNoch keine Bewertungen

- Chapter 1 - Technology Management: Course Contents: Introduction To Technology Management, TM Activities andDokument16 SeitenChapter 1 - Technology Management: Course Contents: Introduction To Technology Management, TM Activities andbakiz89Noch keine Bewertungen

- WEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFDokument29 SeitenWEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFMoca ΔNoch keine Bewertungen

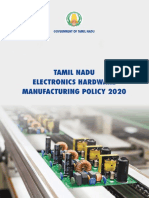

- Tamil Nadu Electronics Policy ObjectivesDokument28 SeitenTamil Nadu Electronics Policy ObjectivesArunVenkatachalamNoch keine Bewertungen

- Leading Global Online Food Delivery PlayerDokument12 SeitenLeading Global Online Food Delivery PlayerClaudiuNoch keine Bewertungen

- Fast Track To PRPC v5 5-09-21-09 FinalDokument2 SeitenFast Track To PRPC v5 5-09-21-09 FinalfuckreshukreNoch keine Bewertungen