Beruflich Dokumente

Kultur Dokumente

Ratio Analysiszxc

Hochgeladen von

Hassam BalouchCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ratio Analysiszxc

Hochgeladen von

Hassam BalouchCopyright:

Verfügbare Formate

9/29/2015

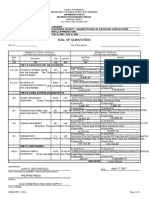

Financial Performance Metrics

Financial Ratios

Financial Performance Metrics

Financial Ratios

Imran Umer

Financial Performance Metrics

Financial Ratios

When we calculate a ratio, all we get is a number. In order for this

number to be meaningful to us, we need to put it into some kind of

context by comparing it with another number. We can make these

comparisons through:

1) Trend analysis of a single company by comparing current ratios to

previous years. Trends can be particularly useful in analyzing a

firms financial condition. If ratios are becoming less favorable

over time, for example, this is an indication of trouble.

2)

3)

Comparison with other companies in the same industry or with

industry averages after any necessary adjustments have been

made to assure that the accounting data is comparable.

Comparison with managements expectations.

Financial ratio analysis is the systematic use of ratios

to interpret financial statements so that the existing

strengths and weaknesses of a firm as well as its

historical performance and current financial condition

can be determined and evaluated.

For Example:

Short-term creditors, such as banks and trade creditors,

use ratios to determine the firms immediate liquidity.

Longer-term creditors such as bondholders use them

to determine its long-term solvency.

Types of Financial Ratios

1. Profitability Ratio

Measures the firms profit in relation to its total revenue, or the amount

of net income from each dollar of sales and its return on invested assets;

2. Assets Utilization Ratio / Efficiency Ratio or Activity

Analysis

Activity ratios, which relate information on a firm's ability to manage its

current assets (accounts receivable and inventory) and current liabilities

(accounts payable) efficiently;

3. Short Term Solvency Ratios / Liquidity Ratio

Measures the ability of the firms cash resources to meet its short-term

cash obligations;

4. Long Term Solvency Ratios / Debt Utilization Ratio

Evaluates the firms ability to satisfy its longer-term debt and investment

obligations by looking at the mix of its financing sources;

9/29/2015

Assets Utilization Ratio / Efficiency

Ratio / Activity Analysis

Profitability Ratio

Profitability ratios allow us to measure the ability of the firm to earn an

adequate return on sales, assets and invested capital.

Under this type, ratios are used to measure the speed at which the firm is

turning over accounts receivable, inventory and long term assets to generate

sales and revenue.

a)

Accounts Receivable Turnover

It is the measure of the efficiency of a firms credit policy. It

estimates the number of days it takes for a dollar in sales to be

collected by the firm.

An increase in the accounts receivable turnover ratio indicates that

receivables are being collected more rapidly. A decrease indicates

slower collections.

Collection Period = 360/Times

The higher ROA & ROE, the better, or more effectively, the company is using its

assets and capital.

Assets Utilization Ratio / Efficiency

Ratio / Activity Analysis

b)

Inventory Turnover

It Indicates how quickly inventory is sold during the year.

If a company has a high inventory turnover ratio,

It may mean the company is using good inventory management and

is not holding excessive amounts of inventories that may be

obsolete, unmarketable goods.

However, it can also mean that the company is not holding enough

inventory and may be losing sales if prospective customers are

unable to make purchases because items are out of stock.

Assets Utilization Ratio / Efficiency

Ratio / Activity Analysis

c)

Fixed Assets Turnover

It indicates how well the investment in long term (fixed) assets is

being managed.

d)

Assets Turnover

The Asset Turnover Ratio measures the amount of sales revenue the

company is generating from the use of all of its assets. It provides a

means to measure the overall efficiency of the companys use of all

of its investments, as represented by both short-term assets and

long-term assets.

9/29/2015

Short Term Solvency Ratio / Liquidity

Ratio

These ratios measure firms ability to pay off short term obligations as they are

due.

a)

Current Ratio

A measure of short term debt paying ability. The norm is 2:1. A

lower ratio indicates a possible liquidity problem.

b)

Quick Ratio / Acid Test Ratio

An improved measurement of short term debt paying ability.

Short Term Solvency Ratio / Liquidity

Ratio

c)

Working Capital

Indicates the cash generated by operations after allowing for cash

payment of expenses and operating liabilities.

Note: Quick Assets = Current Assets Inventories Prepaid

Long Term Solvency Ratio / Debt

Utilization Ratio

It shows the overall debt position of the firm in the light of its assets base and earning power.

a)

Debt Ratio

Percentage of assets financed by creditors, and also indicates relative size of the equity position.

Note: Assets = Liabilities + Shareholders Equity

b)

Debt to Equity Ratio

The Debt to Equity ratio can serve as a screening device for the analyst when looking at capital

structure ratios. If this ratio is extremely low (for instance, 0.1:1), then there is no need to

calculate other capital structure ratios because there is no real concern with this part of the

companys financial situation. The analysts time could be better spent looking at other aspects

of the companys operations.

However, if the Debt to Equity ratio is in the neighbourhood of 2:1 or higher, it would be

important to do some extended analysis that focuses on other ratios such as profitability, as well

as the companys future prospects.

Long Term Solvency Ratio / Debt

Utilization Ratio

c) Coverage Ratios

Coverage ratios measures the degree to which fixed payments are covered

by operating profits. we use earnings coverage ratios to focus on the

companys earning power, because that will be the source of interest

payments, as well as the source for the principal repayments.

I. Times Interest Earned / Interest Coverage Ratio

Indicator of a company's ability to meet its interest payment obligations.

The Interest Coverage ratio compares the funds available to pay interest. This ratio

gives an indication of how much the company has available for the payment of its

fixed interest expense.

A high ratio is desirable. An interest coverage ratio of greater than 3.0 is excellent.

When the interest coverage ratio gets down to 1.5, a company has a heightened risk

of default, which becomes higher the further the ratio declines below 1.5.

9/29/2015

Other Important Ratios

a)

Earnings Per Share (EPS)

Other Important Ratios

c)

Dividend Payout Ratio

EPS is essentially the measure of the amount of income that each share of common stock would have

earned if the profit of the company had been paid (distributed) to all of the common shares

outstanding.

The dividend payout ratio measures the proportion of earnings paid out as dividends to common

stockholders.

b)

Generally, a new company or a company that is growing will have a low or no dividend payout,

because it is retaining earnings in the company to finance its growth.

Price Earnings Ratio (P/E)

The P/E ratio gives an indication of what shareholders are paying for continuing Earnings Per Share.

Investors view it as an indication of what the market considers to be the firms future earning power.

The P/E ratio is greatly influenced by where a company is in its cycle. A company in a growth stage

will usually have a high P/E ratio because of the markets expectations of future profits (which

makes the market price higher) despite the fact that at the current time, profits may be low.

Companies with low growth generally have lower P/E ratios.

This ratio is meaningless when a company is experiencing losses (the P/E would be negative

because earnings are negative)

Thank You

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- List of Foreign Venture Capital Investors Registered With SEBISDokument19 SeitenList of Foreign Venture Capital Investors Registered With SEBISDisha NagraniNoch keine Bewertungen

- Walt Disney Case AnalysisDokument9 SeitenWalt Disney Case AnalysisHassam BalouchNoch keine Bewertungen

- Network PlanningDokument59 SeitenNetwork PlanningVignesh ManickamNoch keine Bewertungen

- DF L3251A3-T22-930-012CA - Dongfeng Truck Parts CatalogDokument255 SeitenDF L3251A3-T22-930-012CA - Dongfeng Truck Parts CatalogLifan Cinaautoparts Autoparts100% (1)

- Harshad Mehta ScamDokument17 SeitenHarshad Mehta ScamRupali Manpreet Rana0% (1)

- PRESENTATION: Myth or Magic Singapore Health SystemDokument45 SeitenPRESENTATION: Myth or Magic Singapore Health SystemADB Health Sector Group100% (1)

- About ReweDokument1 SeiteAbout ReweHassam BalouchNoch keine Bewertungen

- ME 3602 Control Systems Lab Manual TasksDokument4 SeitenME 3602 Control Systems Lab Manual TasksHassam BalouchNoch keine Bewertungen

- Wi-Fi Settings For MT-Link WR760N: Proprietary & ConfidentialDokument9 SeitenWi-Fi Settings For MT-Link WR760N: Proprietary & ConfidentialHassam BalouchNoch keine Bewertungen

- Job Ad. Account AssistantDokument2 SeitenJob Ad. Account AssistantHassam BalouchNoch keine Bewertungen

- DIR-600 Ds Revc 03 All en 20110125Dokument2 SeitenDIR-600 Ds Revc 03 All en 20110125cbetterNoch keine Bewertungen

- Panasonic KX-TES824 Installation ManualDokument90 SeitenPanasonic KX-TES824 Installation Manualddaagg100% (2)

- Mechatronics EngineeringDokument24 SeitenMechatronics EngineeringUsman ShehryarNoch keine Bewertungen

- Fluid Mechanics Formula-SheetDokument1 SeiteFluid Mechanics Formula-SheetsmartyskyNoch keine Bewertungen

- Proengineer 2Dokument1 SeiteProengineer 2Hassam BalouchNoch keine Bewertungen

- Section5 2Dokument7 SeitenSection5 2Hassam BalouchNoch keine Bewertungen

- HowtoDokument1 SeiteHowtoDoroteja MarkovicNoch keine Bewertungen

- Lect Position AnalysisDokument158 SeitenLect Position AnalysisHassam Balouch100% (1)

- CH12Dokument60 SeitenCH12soniasharmakuk100% (1)

- Ruttab ProfpracDokument14 SeitenRuttab ProfpracHassam BalouchNoch keine Bewertungen

- Public Class Square Extends Rectangle (Public Square (Double Le, Double BR) (Super (3,5) ) )Dokument1 SeitePublic Class Square Extends Rectangle (Public Square (Double Le, Double BR) (Super (3,5) ) )Hassam BalouchNoch keine Bewertungen

- Application FormDokument2 SeitenApplication FormRabia SiddiquiNoch keine Bewertungen

- Tauheed 1177 12365 1-1. Pakisn Legal SystemtDokument22 SeitenTauheed 1177 12365 1-1. Pakisn Legal SystemtHassam BalouchNoch keine Bewertungen

- Employement Application Form PDFDokument2 SeitenEmployement Application Form PDFSyed Zulqarnain HaiderNoch keine Bewertungen

- Market Flyer 8 Till 12 September 2014Dokument2 SeitenMarket Flyer 8 Till 12 September 2014Hassam BalouchNoch keine Bewertungen

- Chapter 03 Equilibrium - 2D ExerciseDokument21 SeitenChapter 03 Equilibrium - 2D ExerciseHassam Balouch50% (2)

- Microeconomics Chapter 1 IntroDokument28 SeitenMicroeconomics Chapter 1 IntroMc NierraNoch keine Bewertungen

- Position Description WWF Serbia Operations ManagerDokument3 SeitenPosition Description WWF Serbia Operations ManagerMilica Lalovic-BozicNoch keine Bewertungen

- Accounting Standard Setting and Its Economic ConsequencesDokument18 SeitenAccounting Standard Setting and Its Economic ConsequencesFabian QuincheNoch keine Bewertungen

- Dana Molded Products Webcast/Onsite Auction BrochureDokument5 SeitenDana Molded Products Webcast/Onsite Auction BrochureHilco IndustrialNoch keine Bewertungen

- Dgcis Report Kolkata PDFDokument12 SeitenDgcis Report Kolkata PDFABCDNoch keine Bewertungen

- Application For Leave: Salawag National High SchoolDokument3 SeitenApplication For Leave: Salawag National High Schooldianna rose leonidasNoch keine Bewertungen

- Nluj Deal Mediation Competition 3.0: March 4 - 6, 2022Dokument4 SeitenNluj Deal Mediation Competition 3.0: March 4 - 6, 2022Sidhant KampaniNoch keine Bewertungen

- IFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TDokument10 SeitenIFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TomprakashNoch keine Bewertungen

- Foregin Policy IndiaDokument21 SeitenForegin Policy IndiaJeevandeep Singh DulehNoch keine Bewertungen

- The Impact of Rapid Population Growth On Economic Development in Ethiopia - 045539Dokument51 SeitenThe Impact of Rapid Population Growth On Economic Development in Ethiopia - 045539ABAYNEGETAHUN getahunNoch keine Bewertungen

- Tax Invoice: Smart Lifts & ElectricalsDokument1 SeiteTax Invoice: Smart Lifts & ElectricalsYours PharmacyNoch keine Bewertungen

- Analysis of Mutual Fund PerformanceDokument7 SeitenAnalysis of Mutual Fund PerformanceMahaveer ChoudharyNoch keine Bewertungen

- Botswana Review 2010Dokument176 SeitenBotswana Review 2010BrabysNoch keine Bewertungen

- PPE0045 MidTest T3 1112Dokument6 SeitenPPE0045 MidTest T3 1112Tan Xin XyiNoch keine Bewertungen

- The New Progressive Agenda: Peter MandelsonDokument8 SeitenThe New Progressive Agenda: Peter MandelsonLoriGirlNoch keine Bewertungen

- HDFC Fact SheetDokument1 SeiteHDFC Fact SheetAdityaNoch keine Bewertungen

- AcpcDokument21 SeitenAcpcapi-293268314Noch keine Bewertungen

- Elasticity of SupplyDokument11 SeitenElasticity of Supply201222070% (1)

- Income Statement Template For WebsiteDokument5 SeitenIncome Statement Template For WebsiteKelly CantuNoch keine Bewertungen

- Income Measurement and Reporting Numerical Questions SolvedDokument2 SeitenIncome Measurement and Reporting Numerical Questions SolvedKBA AMIR100% (2)

- 17FG0045 BoqDokument2 Seiten17FG0045 BoqrrpenolioNoch keine Bewertungen

- 790 Pi SpeedxDokument1 Seite790 Pi SpeedxtaniyaNoch keine Bewertungen

- Quan Tri TCQTDokument44 SeitenQuan Tri TCQTHồ NgânNoch keine Bewertungen

- INFORME FINALlllllllllllllllllllDokument133 SeitenINFORME FINALlllllllllllllllllllAnonymous Rr3py6jdCpNoch keine Bewertungen

- Peraturan Presiden Nomor 16 Tahun 2018 - 1001 - 1Dokument174 SeitenPeraturan Presiden Nomor 16 Tahun 2018 - 1001 - 1Bambang ParikesitNoch keine Bewertungen