Beruflich Dokumente

Kultur Dokumente

Revision in Credit Rating (Company Update)

Hochgeladen von

Shyam SunderOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Revision in Credit Rating (Company Update)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

12/14/2015

:CRISILRatings:

December04,2015

Mumbai

OmkarSpecialityChemicalsLimited

Ratingsdowngradedto'CRISILBB+/Stable/CRISILA4+'

TotalBankLoanFacilitiesRated

Rs.2550Million

LongTermRating

CRISILBB+/Stable(Downgradedfrom'CRISIL

BBB+/Negative')

ShortTermRating

CRISILA4+(Downgradedfrom'CRISILA2')

(RefertoAnnexure1forFacilitywisedetails)

CRISIL has downgraded its ratings on the bank facilities of Omkar Speciality Chemicals Ltd (OSCL, part of the

Omkargroup)to'CRISILBB+/Stable/CRISILA4+'from'CRISILBBB+/Negative/CRISILA2'.

The downgrade reflects deterioration in the Omkar group's liquidity because of largerthanexpected, capital

expenditure(capex)ofoverRs.900millionundertakenin201415(referstofinancialyear,April1toMarch31)

thecapexwaslargelyfundedthroughshorttermresources,leadingtomismatchincashflowsandtighteningof

liquidity.Furthermore,commencementofoperationsofUnit5(organicmanufacturingfacility,withatotalcapital

outlay of around Rs.750 million) has been delayed significantly on account of environmental clearance issues.

Delaysinexpectedaccrualfromthisunithavefurtherconstrainedthegroup'sliquidity.Thebanklimitutilisation

levelswerehigh,averagingover95percentforthe12monthsthroughSeptember2015.Thecurrentratioalso

deteriorated to 0.84 time as of March 2015, from 1.08 times as on March 2014. CRISIL expects the Omkar

group'sliquiditytopartiallyeaseoverthemediumterm,backedbyreductioninworkingcapitalrequirementdue

toasubstantialdropintheinventoryholdingperiodtoaround100daysasofSeptember2015,from152daysas

ofMarch2015.Thegroup'scurrentratioalsoimprovedbutremainedmoderateat1.04timesasonSeptember

2015. CRISIL believes, that the group's ability to sustain its working capital requirement, and any largerthan

expected,debtfundedcapexoverthemediumterm,willremainkeyratingsensitivityfactors.

The rating continues to reflect the Omkar group's healthy business risk profile, marked by diversified product

profile and healthy operating profitability in the speciality chemical compound business, and its above average

financialriskprofile,markedbymoderategearingandhealthydebtprotectionmetrics.Theseratingstrengthsare

partially offset by the large workingcapitalrequirements and exposure to risks related to significant forex rate

volatility.

Forarrivingatitsratings,CRISILhascombinedthebusinessandfinancialriskprofilesofOSCLanditssubsidiaries,

Urdhva Chemicals Company Pvt Ltd (UCPL), Lasa Laboratory Pvt Ltd (LLPL), Risichem Research Ltd (RRL), and

DeshChemicalsPvtLtd(DCPL).Thisisbecausealltheseentities,togetherreferredtoastheOmkargroup,arein

thesamelineofbusinessandhavecommonpromotersandsignificantfungiblecashflowsamongthem.

Outlook:Stable

CRISILbelievestheOmkargroupwillbenefitoverthemediumtermfromitsdiversifiedandestablishedproduct

profile. The outlook may be revised to 'Positive' if liquidity improves backed by prudent working capital

management or any large equity infusion, or if the group successfully stabilises new capacities. Conversely, the

outlookmayberevisedto'Negative'ifliquidityweakensonaccountofanyfurtherstretchinworkingcapitalcycle,

orincaseofalargerthanexpected,debtfundedcapexordelaysinstabilisationofnewcapacities.

AbouttheGroup

OSCL, set up in 1983, manufactures speciality chemicals, organic and inorganic chemicals, and inorganic

intermediatessuchasiodine,selenium,molybdenum,andtheirderivatives.Thecompany'smanagingdirector,Mr.

Pravin Herlekar, has nearly 35 years of experience in the speciality chemicals business. The company

manufacturesawiderangeofproductsforanestablishedclientele,includingDr.Reddy'sLaboratoriesLtd,Cipla

Ltd, Biocon Ltd (rated 'CRISIL AA+/Stable/CRISIL A1+'), Asahi India Glass Ltd, Jubilant Organosys Ltd, Cadila

HealthcareLtd(rated'CRISILAA+/Stable/CRISILA1+'),andLupinLtd.Thecompanyhassubsequentlyacquireda

100percentstakeinUCPL,DCPL,andLLPL.OSCLalsohasa99percentstakeinRRL.

TheOmkargroup'sconsolidatedprofitaftertax(PAT)rosetoRs.242.8milliononanoperatingincomeofRs.2.65

billionin201415,fromaPATofRs.135.6milliononanoperatingincomeofRs.2.41billionin201314.Thegroup

achieved a PAT of Rs.171.8 million on an operating income of Rs.1.92 billion for the six months through

September2015.

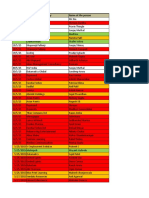

Annexure1Detailsofvariousbankfacilities

Currentfacilities

Previousfacilities

Facility

Amount

(Rs.Million)

Rating

Facility

Amount

(Rs.Million)

Rating

CashCredit

710

CRISIL

BB+/Stable

CashCredit

710

CRISIL

BBB+/Negative

https://www.crisil.com/Ratings/RatingList/RatingDocs/Omkar_Speciality_Chemicals_Limited_December_04_2015_RR.html

1/5

12/14/2015

:CRISILRatings:

External

Commercial

Borrowings

LetterofCredit

367

CRISIL

BB+/Stable

External

Commercial

Borrowings

367

CRISIL

BBB+/Negative

600

CRISILA4+

LetterofCredit

600

CRISILA2

849

CRISIL

BBB+/Negative

ProposedLong

TermBankLoan

Facility

863

CRISIL

BB+/Stable

ProposedLong

TermBankLoan

Facility

TermLoan

10

CRISIL

BB+/Stable

TermLoan

24

CRISIL

BBB+/Negative

Total

2550

Total

2550

MediaContacts

TanujaAbhinandan

MediaRelations

CRISILLimited

Phone:+912233421818

Email:tanuja.abhinandan@crisil.com

JyotiParmar

MediaRelations

CRISILLimited

Phone:+912233421835

Email:jyoti.parmar@crisil.com

AnalyticalContacts

AdityaSarda

DirectorCRISILRatings

Phone:+911246722000

Email:aditya.sarda@crisil.com

CustomerServiceHelpdesk

Timings:10.00amTO7.00pm

TollfreeNumber:18002671301

Email:CRISILratingdesk@crisil.com

MahendhiranChinnappa

AssociateDirectorCRISILRatings

Phone:+912233428051

Email:

mahendhiran.chinnappa@crisil.com

https://www.crisil.com/Ratings/RatingList/RatingDocs/Omkar_Speciality_Chemicals_Limited_December_04_2015_RR.html

2/5

Das könnte Ihnen auch gefallen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Engagement LetterDokument3 SeitenEngagement Lettermary louise maganaNoch keine Bewertungen

- 222Dokument24 Seiten222Jagadamba RealtorNoch keine Bewertungen

- History of Apple Inc.Dokument127 SeitenHistory of Apple Inc.Aditya PrakashNoch keine Bewertungen

- FinanceDokument23 SeitenFinanceAbdulbasit EhsanNoch keine Bewertungen

- 090617000053Dokument5 Seiten090617000053Shyamsunder SinghNoch keine Bewertungen

- Tata Corus PPT Group 5Dokument37 SeitenTata Corus PPT Group 5Abhay Thakur100% (1)

- Internal CheckDokument14 SeitenInternal CheckAasir NaQviNoch keine Bewertungen

- Fria PDFDokument4 SeitenFria PDFTinny Flores-LlorenNoch keine Bewertungen

- Running Head: GREEDDokument22 SeitenRunning Head: GREEDmixpam83Noch keine Bewertungen

- Merchant BankingDokument25 SeitenMerchant BankingmanyasinghNoch keine Bewertungen

- Clarifies On News Item (Company Update)Dokument1 SeiteClarifies On News Item (Company Update)Shyam SunderNoch keine Bewertungen

- Assignment MGT162Dokument20 SeitenAssignment MGT162Syahrul Amirul65% (20)

- Wo-Ec546wod7000042 Stay CableDokument3 SeitenWo-Ec546wod7000042 Stay CableJkkhyhNoch keine Bewertungen

- Uploads/Sponsors/84/Aditya Birla GroupDokument4 SeitenUploads/Sponsors/84/Aditya Birla GroupsatishNoch keine Bewertungen

- Adaptation in General BusinessDokument21 SeitenAdaptation in General BusinessneetamoniNoch keine Bewertungen

- 26 Mactan v. MarcosDokument1 Seite26 Mactan v. MarcosNN DDLNoch keine Bewertungen

- Q1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDokument18 SeitenQ1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDhaval LagwankarNoch keine Bewertungen

- Camels Model AnalysisDokument11 SeitenCamels Model AnalysisAlbert SmithNoch keine Bewertungen

- Outstanding Application PDFDokument1.170 SeitenOutstanding Application PDFAkbar Danu0% (1)

- Annex ThesisDokument29 SeitenAnnex ThesisrahulNoch keine Bewertungen

- SBI Nov PDFDokument5 SeitenSBI Nov PDFbinduNoch keine Bewertungen

- Whitepaper - Quantfury Help CenterDokument3 SeitenWhitepaper - Quantfury Help CenterProbertoecnNoch keine Bewertungen

- Spam Shop EcoDokument234 SeitenSpam Shop EcoVăn Năm NguyễnNoch keine Bewertungen

- Strategic Financial Decision-Making FrameworkDokument25 SeitenStrategic Financial Decision-Making FrameworkRamya Gowda100% (1)

- Apollo: Retreading Material and Retreaded TyresDokument5 SeitenApollo: Retreading Material and Retreaded TyresghdbakjdNoch keine Bewertungen

- Stability Calculations For Hydraulic TransportersDokument5 SeitenStability Calculations For Hydraulic Transporters无时差Noch keine Bewertungen

- Imperialism and Multinational Corporations: A Case Study of Nigeria (Bade Onimode 1978)Dokument27 SeitenImperialism and Multinational Corporations: A Case Study of Nigeria (Bade Onimode 1978)Nigeria Marx LibraryNoch keine Bewertungen

- COA Circular 95-008Dokument3 SeitenCOA Circular 95-008Maricon AspirasNoch keine Bewertungen

- Notice: Formations Of, Acquisitions By, and Mergers of Bank Holding CompaniesDokument2 SeitenNotice: Formations Of, Acquisitions By, and Mergers of Bank Holding CompaniesJustia.comNoch keine Bewertungen

- Participants - Green Cementech 2013Dokument16 SeitenParticipants - Green Cementech 2013Pratik SinghNoch keine Bewertungen