Beruflich Dokumente

Kultur Dokumente

Project Report - On The Job - SWMC

Hochgeladen von

RashiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Project Report - On The Job - SWMC

Hochgeladen von

RashiCopyright:

Verfügbare Formate

On The Job

Project Report

American Housing Mortgage market

Organization: XL Dynamics India Pvt. Ltd.

Submitted By

Name: MOHIT KUMAR

Roll No: PGFA1233

SUBMITTED TO: Dr. Ritika Gugnani

XL DYNAMICS INDIA PVT. LTD

Declaration

I hereby declare that the On Job Training Report entitled "American Housing Mortgage

Market is an authentic record of my own report as a part of my role in the organization from

26th December, 2013 to 28th Feb, 2014 for the award of degree of PGDM (Post Graduate

Diploma in Management), Jaipuria Institute of Management, Noida under the guidance of Dr.

Ritika Gugnani.

Mohit Kumar

Date: 31/03/2014

ii

PGFA1233

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Acknowledgement

A fruitful work is incomplete without paying a word of thanks to all the people who are

directly or indirectly involved in its completion. So I would like to thank my mentor Mr. Ravi

Joya for guiding me through my on the job report.

I would like to thank my faculty mentor Dr. Ritika Gugnani (Faculty JIM, Noida), for guiding

me to complete this project.

I would like to thank a lot to all the staff of XL Dynamics because working with them is just

like a fun and I am learning a lot of things from them.

Mohit Kumar

PGFA1233

iii

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Table of Contents

Declaration ................................................................................................................ ii

Acknowledgement ................................................................................................... iii

Chapter-1 ....................................................................................................................5

Company Description ................................................................................................5

Chapter-2 ..................................................................................................................16

Job Description ........................................................................................................16

Chapter-3 ..................................................................................................................25

Analysis of the Job Done .........................................................................................25

Chapter-4 ..................................................................................................................27

Learning Outcomes ..................................................................................................27

Chapter-5 ..................................................................................................................29

Suggestions and Recommendations.........................................................................29

Bibliography.............................................................................................................30

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Chapter-1

Company Description

XL Dynamics India Pvt. Ltd. (a part of SWMC or Sun West Mortgage Company) is a private

corporation and is headquartered in Cerritos; CA. XL Dynamics India Pvt. Ltd. was founded in

the year 1992 and incorporated in the year 1998. XL Dynamics India Pvt. Ltd.'s team, which

consists of professionals with Mortgage Banking experience and strong technical knowledge,

laid the foundation for a revolutionary organization - one that has been designed by Mortgage

Bankers for Mortgage Bankers. XL Dynamics India Pvt. Ltd., India started operations in 2002

with its wholly owned office located in Mumbai. XL Dynamics India Pvt. Ltd. India provides an

end-to-end solution to the Mortgage Industry to all our clients, from loan processing through

secondary market portfolio management. Our web-based loan origination and servicing systems

is one of the most advanced technology platforms in the industry. Our technology platform has

been fully developed in house and is fully customizable, secure, scalable and reliable.

XL Dynamics India Pvt. Ltd., India conforms to international standards to foster an efficient and

contemporary work environment. XL Dynamics India Pvt. Ltd., India is a customized blend of

onshore and offshore capabilities. These are tailored and coordinated to meet clients' specific

business goals while ensuring that the right resources and skills are available at desired locations.

XL Dynamics India Pvt. Ltd.'s implementation and delivery model leverages capacity,

capabilities, and competencies across geographies to achieve optimal customer satisfaction.

XL Dynamics India Pvt. Ltd. - The Platform for Today - The Pathway to Tomorrow

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

LOCATION

XL Dynamics India Pvt. Ltd. is located in the planned satellite township of Mumbai, Navi

Mumbai, at Millennium Business Park. Millennium Business Park (MBP) is a government

owned IT Park and is one of the biggest industrial hubs in the Navi Mumbai Area.

Millennium Business Park is located in the suburb of Mahape. This is located near Ghansoli

Railway station on the Thane - Vashi Railway on the Harbor route of Mumbai.

Millennium Business Park (MBP) is well connected to Thane, Kalyan, Vashi, Panvel and other

Mumbai suburbs. The closest railway station to Mahape is Ghansoli.

XL Dynamics India Pvt. Ltd.

Block No. 301/302

Building V, Sector II

Millennium Business Park

Mahape, Navi Mumbai

India. 400 701

Phone 91-22-27781211

Email: contact@xldynamics.co.in

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

SERVICES

XL Dynamics India Pvt. Ltd. provides end-to-end solutions to the US Mortgage Banking

Industry. Following are the services offered by XL Dynamics(a) IT solutions to the Mortgage Industry with its cutting-edge Loan Origination Technology;

(b) Operational Support to Mortgage Industry Brokers, Lenders, Servicers and Investors;

(c) Expert analysis and risk assessment of complex financial products;

(d) Execution of complex trades in the capital markets;

(e) Trading and hedging strategy and support;

(f) Financial accounting services;

(g) Regulatory compliance and audit services;

(h) Quality Control services and

(i) Securitization of loan instruments.

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

FUNCTIONS

1. Pre-Risk Analysis

2. Risk Analysis Quality Control

3. Hedging Analysis

4. Collateral Security Instruments Review and Approval

5. Documents Preparation

6. Funding Audit & Process QC

7. Loan Boarding

8. Loan File Coordination

9. Loan File Coordination Quality Control

10. Loan Settlement Analysis and Quality Control

11. Servicing Quality Control

12. Secondary Market

13. Broker Approval and Support

14. Shipping Support

Pre-Risk Analysis

The Pre-Risk Analysis Team assesses the risk associated with complex financial products being

offered to customers by the client by comparing the information in the system with the loan

documents submitted by the client. They analyze documents such as property title reports,

appraisals, income and asset statements, etc. They provide the Risk Analysis Team a summary of

their findings at the client's location in US. This helps the clients to make a better credit decision.

Risk Analysis Quality Control

The Risk Analysis Quality Control Team at XL Dynamics India Pvt. Ltd. audits the work

completed by the Loan Boarding, Pre-risk Analysis and Risk analysis Team. The functions

involve reviewing the loan decision sent out by the Risk Analyst in US. Once the audit is

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

complete, the findings are sent to the Risk Analyst to take any corrective action, if necessary.

They also verify the system for accuracy of the information in the system.

Hedging Analysis

Hedging Review Team assists the Capital Markets team in managing the financial risk in the

company's mortgage originations. The team performs the daily audits of the locked pipeline to

ensure only active loans are hedged for the financial risk and the sales reporting to the hedging

vendor.

Collateral Security Instruments Review and Approval

The Collateral Security Instruments Review and Approval team ensures that the original loan

security instruments are returned to the Client after them being recorded by the County where the

collateral is located. This involves following up with the Settlement Agents and Attorneys to

ensure the security instruments were sent appropriately to the county for recording. They then

follow up to retrieve the documents once the county has recorded them and review the

instruments to ensure that a lien was properly recorded in the Client's Name and for the correct

amount.

Documents Preparation

The document preparation team ensures that accurate loan data is entered in the document

preparation software, by ensuring the Borrower and Property information is accurate. They

update the fees in the system match the Settlement Statement and ensure all other data in the

Document Preparation software does not have any clerical errors. They prepare packages that

need to be sent for attorney approval whenever necessary.

Funding Audit & Process QC

This team verifies and audits the loans to ensure that all the loans that are funded are in

compliance and without any defects or qualify control issues. This is done in three stages - The

first audit is done before the loan is funded, the second audit is completed after the loan is funded

and the final audit is completed for all the processes in loan's life cycle right from loan

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

origination to funding. All relevant loan documents are reviewed and verified to ascertain that

the loan is in compliance with Federal, State & Investors guidelines. As a part of Process QC,

they review each process of loan cycle for every loan to verify if the loan was in compliance at

each process and provide necessary feedback to the respective teams in case of any qualify

and/or compliance issues.

Loan Boarding

The Loan Boarding department at XL Dynamics India Pvt. Ltd. ensures that loans are accurately

set up into the ERP systems of our clients by thoroughly reviewing the loan files submitted.

After accurately entering the Loan Information in the ERP system, certain important compliance

verifications are done to ensure the loan was originated in compliance and may be submitted for

approval.

Loan File Coordination

The Loan File Coordination Team provides clerical support to the Relationship Manager by way

of splitting and uploading documents to the file storage location. They also assist in ensuring the

documents are sent to the Risk Analysts for review to ensure loan conditions are promptly signed

off.

Loan File Coordination Quality Control

The Loan File Coordination Quality Control Team audits the activities completed by the

Relationship Manager by checking that the timely response was sent by the Relationship

Manager to all Clients or not. They also review that the appropriate comments justifying

condition resolutions were added in the system. When the loan is cleared for closing they ensure

that the process checklists are filled correctly with respect to the data in the system and loan

documents uploaded in the file storage location.

10

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Loan Settlement Analysis and Quality Control

The Loan Settlement Analysis and Quality Control Function at XL Dynamics India Pvt. Ltd.

ensure that the Closing Agent or Attorney has disbursed funds received from the Client as per the

Settlement Statement. This involves reviewing the Settlement Statement prepared by the Closing

Agent or Attorney and verifying all fees charged. If non- allowable fees are found, these are

recommended to the Funding Team in the US to request a refund from the service provider.

Servicing Quality Control

Servicing refers to loan maintenance once the funds are disbursed to the Borrower. The quality

control function is involved in the internal audit of various servicing functions like Monthly

Payment Collection, Default Management, Handling Customer Service Requests, Loss

Mitigation efforts and forbearance, Foreclosure, REO and Claims.

Secondary Market

This team studies the secondary market and prepares the competitive daily rate sheets for clients

and is also responsible for locking the interest rate for lenders and its affiliated clients in the ERP

system. This is done through thorough analysis of secondary market where mortgages are bought

and sold and preparing competitive rate sheets as per the market fluctuation in timely manner

and distributing the updated rate sheets to the client and client's affiliates. They publish the

updated rate sheets in timely manner to client's website whenever there is any change in the

market and integrating the updated rate sheet in the ERP systems to ensure that the most recent

and updated rates are available to the client and client's affiliate..

Broker Approval and Support

The Broker Approval and Support looks after support functions to the B2B customers of the

Client. They review the Business Licenses and Approvals in the state where the B2B Customer's

offices are located. They review the company's status in the Better Business Bureau to verify if

the B2B Client has any customer complaints against it and sending it to the Account's Executive

for review. They also handle B2B customer service queries and their resolution. They also

11

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

perform Annual review and the recertification requests and send them to the Broker Company.

They also facilitate User ID Creation / Deletion of Ids.

Shipping Support

The shipping support Team is responsible for the verification of the loan documents as per the

investor requirement, preparing the document packages and sending them to US Shipping Team

in US which will be further sent to the investors.

12

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Types of Mortgages Loan offered by company

XL Dynamics Pvt. Ltd. offers variety of loans that allow borrowers to choose what is best for

them. Whether they come through our mortgage loan officers (LOs) or through one of our broker

partners, Sun West is committed to ensuring that they obtain a mortgage that is affordable and

fulfill HUD guidelines. For instance, in case of a refinance, we will analyze the mortgage

transaction to ensure that there is a positive benefit to borrowers by way of a reduction in

payment or they can receive cash(Cash Out Refinance) that can be used to consolidate debts or

for renovation of their home.

FHA (Federal Home Administration) programs are the most secure and easy because they are

secured by FHA. If borrower is from a veteran family then he/she may be able to take advantage

of VA benefits for a purchase loan or an interest rate reduction refinance program from the

Department of Veteran Affairs. For borrowers who meet certain maximum income limits in rural

zone may qualify for loan programs guaranteed by the USDA-RD (United States Department of

Agriculture - Rural Development).

There are own built Loan Calculators to estimate monthly payments, affordability, or your

refinance options. There are a number of ways to approach an affordability analysis, and these

calculators allow you to assess the effects of different variables when buying a home.

Reverse Mortgage (HECM)

This special type of home loan lets homeowners convert a portion of his or her home equity into

cash providing for a secure financial future. Without selling the home, without giving up title, or

without taking on a new monthly payment senior homeowners have the benefit of maintaining a

lifestyle they have earned. The money from the reverse mortgage provides seniors with the

financial security they need to fully enjoy their retirement years.

Anyone aged 62 and older may choose to consider a reverse mortgage insured by the FHA as a

means to pay off a mortgage or convert the equity in their homes to a positive cash-flow. This

mortgage is also commonly referred to as the Home Equity Conversion Mortgage (HECM,

13

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Pronounced as heckum). In this loan borrowers remain title holders of home while benefitting

from the equity in their home. From loan calculator we can estimate how much mortgage you

may be able to obtain through a Reverse Mortgage.

Wholesale Lending

Company is an FHA, VA and USDA approved full service mortgage banker in business since

1980. With a fully automated, totally integrated, and internet-based system (SunSoft) to carry out

all lending functions, SWMC's technology empowers its clients with up-to-the-minute status on

their loans at anytime from anywhere through the internet. SWMC is an approved FHLMC,

FNMA, GNMA, HUD, and VA lender. It is also an approved HUD Reverse Mortgage

Lender/Servicer. It offers a wide range of jumbo and conventional loan products.

Correspondent Lending

Company is an FHA and VA approved full service mortgage banker. It is also an approved HUD

Reverse Mortgage Lender/Servicer. It offers correspondent customers a complete range of

mortgage products including jumbo and conventional loan products that satisfy the demands of

hard-to-win customers and face of a fiercely competitive mortgage market. Correspondent

Lending Program is built around the belief that customer service is vitally important to success in

the secondary market. If you're not receiving the attention and response times you deserve from

your current investors, you should experience what our lenders have come to expect:

A. Personalized service

B. Operational Support (Outsource services to us)

C. Accessible staff

D. Fast funding

E. A commitment to technology

F. Consistent & aggressive pricing on the products you need the most

14

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Basically SWMC offers three types of loan that are following:

1. PURCHASE PROGRAM

2. REFINANCE PROGRAM

3. HOME IMPROVEMENT PROGRAME

15

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Chapter-2

Job Description

COMPANY: XL Dynamics India Pvt. Ltd.

POSITION: Pre-underwriter

TEAM: Pre-Underwriting

OBJECTIVE OF INCOME ANALYSIS

To verify income used to qualify the borrower for the mortgage is stable.

To verify two year income history of the borrower.

To detect employment gap.

To analyze the future trend of income.

To verify that income documents are within SWMC guidelines and follows

HUD guidelines.

To verify and validate source of income: business income, rental income,

pension income or social security income.

About income analysis for mortgage loans:

Mortgage underwriting in the United States is the process a lender uses to

determine if the risk of offering a mortgage loan to a particular borrower under

certain parameters is acceptable. Most of the risks and terms that underwriters

consider fall under the three Cs of underwriting: credit, capacity and collateral.

To help the underwriter assess the quality of the loan, banks and lenders

create guidelines and even computer models that analyze the various aspects of

the mortgage and provide recommendations regarding the risks involved.

However, it is always up to the underwriter to make the final decision on whether

to approve or decline a loan.

16

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Capacity refers to the borrowers ability to make the payments on the loan. To

determine this, the underwriter will analyze the borrowers employment, income,

their current debt and their assets.

While reviewing the borrowers employment, the underwriter must determine the

stability of the income. People who are employed by a company and earn hourly

wages pose the lowest risk. Self-employed borrowers pose the highest risk, since

they are typically responsible for the debt and well-being of the business in

addition to their personal responsibilities. Commission income also carries similar

risks in the stability of income because if for any reason the borrower fails to

produce business, it directly influences the amount of income produced. Usually if

self-employment or commission income is used to qualify for the mortgage, a two

year history of receiving that income is required. Although a bonus (sometime it is

indicated as "incentive pay" by many corporations) is part of the paystub income, a

two-year employer verification is also required.

Documentation of the income also varies depending on the type of income. Hourly

wage earners who have the lowest risks usually need to supply paystubs and W2 statements. However, self-employed, commissioned and those who collect rent

are required to provide tax returns (Schedule C, Schedule E and K-1). Retired

individuals are required to prove they are eligible for social security and document

the receipt of payments, while those who receive income via cash investments

must provide statements and determine the continuance of the income from those

payments. In short, the underwriter must determine and document that the income

and employment is stable enough to pay the mortgage in years to come.

Furthermore, underwriters evaluate the capacity to pay the loan using a

comparative method known as the debt-to-income ratio. This is calculated by

adding the monthly liabilities and obligations(mortgage payments, monthly credit

and loan payments, child support, alimony, etc.) and dividing it by the monthly

income. For an example, if a borrower has a $500 car payment, $100 in credit and

loan payments, pays $500 in child support and wants a mortgage with payments

$1,000 per month, her total monthly obligations is $2100. If she makes $5,000 a

month, her debt to income ratio is 42%. Typically the ratio must be below

anywhere from 32% for the most conservative loans to 65% for the most

aggressive loans.

17

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Assets are also considered when evaluating capacity. Borrowers who have an

abundance of liquid assets at the time of closing statistically have lower rates

of default on their mortgage. This is termed as reserves by the industry. For

example, with a total mortgage payment that is $1,000 a month and the borrower

has $3,000 left after paying the down payment and closing costs, the borrower has

three months reserves. Underwriters also look closely at bank statements for

incidences of NSF's (non-sufficient funds). If this happens regularly, this is a red

flag with the underwriter because this indicates that the borrower doesn't know

how to manage his or her finances.

When a borrower receives a gift for the down payment the assets need to be

verified. Any large deposits, in fact, showing on bank statements will require an

explanation from the borrower.

Furthermore, if the borrowers employment is interrupted for any reason, the

borrowers would have enough cash in reserve to pay their mortgage. The amount

of cash reserves is qualified by the number of payments the borrower can make on

his or her total housing expenditure (the total of the principal and interest

payment, taxes, insurance, homeowners insurance, mortgage insurance, and any

other applicable charges) before the reserves are completely exhausted. Often

lenders will require anywhere from two to twelve months of payments in reserve.

If a borrower is applying for an FHA (Federal Housing Administration), there are

no reserves required.

The most typical asset is a borrowers checking and savings account. Other sources

include

retirement

funds

(401K, Individual

Retirement

Account), investments (stocks, mutual funds, CDs) and any other liquid source of

funds. Funds that have penalties for withdrawing must be considered

conservatively and are evaluated at 70% or less of their value. Accounts such

as pensions and other accounts and personal property that lack liquidity may not be

used as assets.

18

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Automated underwriting:

Fanie Mae and Freddie Mac are the two largest companies that purchase mortgages

from other lenders in the United States. Many lenders will underwrite their files

according to their guidelines, but to ensure the eligibility to be purchased by

Fannie Mae and Freddie Mac, underwriters will utilize what is called automated

underwriting. This is a tool available to lenders to provide recommendations on the

risk of a loan and borrower and it provides the amount of documentation needed to

verify the risk.

It is important to remember that the approval and feedback is subject to the

underwriter's review. It is also the responsibility of the underwriter to evaluate the

aspects of the loan that is beyond the scope of automated underwriting. In short, it

is the underwriter that approves the loan, not the automated underwriting.

On the other hand, automated underwriting has streamlined the mortgage process

by providing analysis of credit and loan terms in minutes rather than days. For

borrowers it reduces the amount of documentation needed and may even require no

documentation of employment, income, assets or even value of the property.

Automated underwriting tailors the amount of necessary documentation in

proportion to the risk of the loan.

Approval decisions:

After reviewing all aspects of the loan, it is up to the underwriter to assess the risk

of the loan as a whole. Each borrower and each loan is unique and many borrowers

may not fit every guideline. However, certain aspects of the loan may compensate

for the lack in other areas. For an example, the risk of high LTVs can be offset by

the presence of a large amount of assets. Low LTVs can offset the fact that the

borrower has a high debt to income ratio and excellent credit can overcome the

lack of assets.

In addition to compensating factors, there is a concept known as layering of risk.

For an example, if the property is a high rise condo, occupied as an investment,

with a high LTV and a borrower who is self-employed, the cumulative effect of all

19

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

these aspects yields higher risk. Though the borrower may meet all requirements

under the guidelines of the loan program, the underwriter must exercise caution.

There is an old saying in lending: If your portfolio does not have one foreclosure,

you are not accepting enough risk. Underwriters should review a loan from

a holistic point of view; otherwise they may turn down a loan that is high risk in

one aspect but low risk as a whole.

Income documents:

W2 Form

The form that an employer must send to an employee and the IRS at the end of the

year. The W-2 form reports an employee's annual wages and the amount of taxes

withheld from his or her paycheck.

Every employer engaged in a trade or business who pays remuneration, including

noncash payments of $600 or more for the year (all amounts if any income, social

security, or Medicare tax was withheld) for services performed by an employee

must file a Form W-2 for each employee (even if the employee is related to the

employer) from whom:

Income, social security, or Medicare tax was withheld. Income tax would have

been withheld if the employee had claimed no more than one withholding

allowance or had not claimed exemption from withholding on Form W-4,

Employee's Withholding Allowance Certificate.

1040 Form

The standard Internal Revenue Service (IRS) form that individuals uses to file their

annual income tax returns. The form contains sections that require taxpayers to

disclose their financial income status for the year in order to ascertain whether

additional taxes are owed or whether the taxpayer is due for a tax refund. 1040

forms

need

to

be

filed

with

the

IRS

by

April

15.

20

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Also known as the "U.S. individual income tax return" or the "long form". While

the 1040 form is composed of only a couple of pages, taxpayers may need to fill

out extra sections called schedules. For example, if a taxpayer received dividends

that totaled more than $1,500, he or she will need to fill out Schedule B, which is

the

section

for

reporting

interest

and

ordinary

dividends.

There are several variations of the 1040 depending on your individual tax situation.

For example, taxpayers that possess very simple taxation circumstances can fill out

the Form 1040EZ, which is a less comprehensive form.

Verification of employment (VOE)

Verification of Employment is a process used by banks and mortgage lenders in

the United States to review the employment history of a borrower, to determine

the borrower's job stability and cross-reference income history with that stated on

the Uniform Residential Loan Application (Form 1003). Lenders require complete

VOE declaring all positions held for the last two years of employment history.

Pay stub

A pay stub or paystub is a document that an employee receives as a notice that the

direct deposit transaction has gone through. It is a piece of paper that is given to an

employee with each paycheck and that shows the amount of money that the

employee earned and the amount that was removed for taxes, insurance costs, etc

Tax transcripts

A tax return transcript shows most line items from your tax return (Form 1040,

1040A or 1040EZ) as it was originally filed, including any accompanying forms

and schedules. In most cases, your transcript includes all the information a lender

or government agency needs. It does not show any changes you, your

representative or we made after you filed. Ask your financial institution to be sure

a return transcript will meet their requirements. The tax return transcript is

generally available for the current and past three years.

21

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

We can also provide a tax account transcript. The tax account transcript, which is

also free, shows basic data from your return, including marital status, type of return

filed, adjusted gross income and taxable income. It also includes any adjustments

you or we made after you filed your return. Like the tax return transcript, the tax

account transcript is generally available for the current and past three years.

W2 Transcripts

1. Wage and income transcripts show earnings reported to IRS by payers.

Income documents are derived from information returns, including, but not

limited to:

W-2 Series Forms

Form W-3, Transmittal of Wage and Tax Statements

2. This transcript is ordered when the taxpayer wants income documentation.

Some reasons may include, but are not limited to:

Answer a notice

File their tax return

Personal record of income

Employment verification

3. The information displayed on the wage and income transcript contains, but

is not limited to::Wage and salary income, Federal income tax withholding,

Mortgage interest paid, Distributions from retirement income, Gross

proceeds from stock/bond transactions, Gross income from non-employee

compensation, Interest income and Dividend income.

22

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Process of Underwriting:

As an Underwriter we (underwriters) have to take care of major responsibilities which are related

to loan processing. Underwriting means a process that a mortgage lender bank, insurer or a

investment house uses to assess the eligibility of a customer to receive their products (equity

capital, insurance, mortgage, or credit). Overall Process In loan processing in the company

1) Loan boarding Team

2) Pre Underwriting Team

3) Underwriting Team

4) RM Team

5) Docs Team

6) Funding Team

7) Shipping Team

Roles and Responsibilities

The job done by me as a financial analyst in XL Dynamics India Pvt. Ltd. is totally different

from the financial analyst of the other finance companies. It is because XL Dynamics India Pvt.

Ltd. is in mortgage industry so I as a financial analyst do more of compliance analysis over here.

I use to work on test loan files because I am still in training. But I go through the same process

which is followed by a pre-underwriter on live loans. There are number of checklists and

conditions and for these checklists and conditions there are documents which needed to be there

to fill checklist and resolve condition. If correct documents are not provided by broker, loan

cannot be processed further so as a pre-underwriter I need to find out that which document is not

present in loan file and the provided documents are fulfilling the HUD, FHA and SWMC

guidelines. Below are the major roles and responsibilities which are performed by me

1. We have to timely check that the timely response was sent to the Relationship Managers or

UW RMs to call Clients and inform them about discrepancy and shortcoming in loan file and ask

23

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

them for correct documents. We also review that the appropriate comments justifying condition

resolutions were added in the system for the documents which are missing in the loan docs or for

the replacement of incorrect documents.

2. To make sure that risk is mitigated before the preparation of loan documents.

3. To remain in contact with the UW RMs and broker/client till the loan not cleared to close.

4. To make sure information is flowing through each department in the company for the loan.

5. To push the loan toward the funding as soon as possible.

6. To make sure broker/client is providing documents that are needed for closing the loan.

7. To make sure RMs is regularly calling broker/clients and borrower for the documents.

8. To follow up the mails regularly to keep ourselves updated.

9. To make sure loan is being properly handed over to docs drawing department after submitting

to prior to Doc or PTD requested.

10. When the loan is cleared for close then we ensure that the process checklists are filled

correctly by UW-RMs with respect to the data in the system and loan documents uploaded in

the file storage which is called Broker Inbox or BI.

11. To make sure loan is being dispatched for borrower to sign as soon as possible so that loans

queue could be effectively handled by ARM team for better quality and satisfactory service of

borrowers.

24

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Chapter-3

Analysis of the Job Done

The job done by me as a financial analyst in XL Dynamics India Pvt. Ltd. is totally different

from the financial analyst of the other finance companies. It is because XL Dynamics India Pvt.

Ltd. is in mortgage industry so I as a financial analyst do more of compliance analysis over here.

I use to work on test loan files because I am still in training.

Working as a pre-underwriter in the company for two months I have learned and understand many

things which built a firm base for me to go further in the company.

Below are the few points which I have done and come to know

1. There are so many types of loan on which we work

Purchase loans

HECM Purchase loans

Refinance loans

FHA loans

Conventional loans

USDA

Veteran Affairs (VA) loans

2. Turnaround time on loan to get fully executed depend upon the origination type of loan, because

everything get changed as per the origination type. Following are the origination types of loan

B** Wholesale loans (The loan is originated by Broker)

A** Retail loans (The loan is Originated by SWMC)

C** Correspondent loans (The loan is purchased from correspondents)

25

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

W** Warehouse loans (The loan is originated by Other lenders and sold to us)

S** Servicing loan (The loan on which we just do servicing)

3. We work at night, so we use o interact with U.S staff, Broker/client and borrowers.

4. I come to know how to mitigate and reduce risk by using appropriate underwriting techniques and

conditions which are being imposed on loans for mandatory checkpoints to close the loan.

5. I come to know how to identify borrowers credibility whether the borrower would be able to pay

regularly installments or not and if not then how we ask for more legal documents (e.g. bank

statements, any liens if have, other credits) to verify whether the borrower would be able to pay in

the future.

6. If as a result of my fault or delay in the loan process broker cancels the loan with company this

would result as loss for the company as well as for me as it would definitely impact the overall

growth of mine.

7. Even a small mistake could result in a big loss for the company .So I could say it a more technical

and risky job.

8. We decide when to sell the loans as MBS or mortgage based security to big banks like WELLS

FARGO.

26

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Chapter-4

Learning Outcomes

As I have mentioned earlier that the job done by me as a financial analyst in XL Dynamics India

Pvt. Ltd. is totally different from the financial analyst of the other finance companies and I have

also mentioned that XL Dynamics is in mortgage industry. So I learned a totally new concept

over here. During these two months on the job, I have learned lot of things, which are related to

mortgage industry. Following are the points that I have learned on job are

Learned about AML- Anti Money Laundering and passed Anti Money Laundering quiz

which is a compulsory requirement for working in XL Dynamics or any US finance

company.

I worked on following mortgage tools.

SunSoft

Financial(Mortgage) Calculator

MOL

DU- Desktop Underwriter

LP- Loan Prospector

Applied concept of U.S Mortgage basics on test loans which I had learned from the initial

training assessment for 10 days. Basics learned in training helped me to apply the right

concept to review the loans in easier way.

I come to know that how the U.S mortgage industry works. What the different types of loans

and loan programs are there in the U.S.

Learned how to analyze a credit report of any person.

Applied the concept of credit report, property valuation and appraisal.

I learned how to add conditions and resolve/ waive them. It means how to resolve particular

issue with the use of documents which is provided by the broker/client.

27

Applied concept of conditions in the SunSoft software.

Leaned to work on the MOL software.

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Leaned to work on the documents which is sent by the broker at night and with knowledge of

expertise learned how and where those documents should be processed or used to resolve

condition.

I learned to work in hectic schedule.

I prepared myself to work in night. For some days it was unbearable to awake at night and

work efficiently but now I do not find any difficult to remain active during night shift.

28

I learned how to handle situation efficiently.

I learned to remain efficient and active during the 9 hours to 11 hours shift.

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Chapter-5

Suggestions and Recommendations

After working in XL Dynamics India Pvt. Ltd. or I should say SWMC (Because it is the parent

company and all the operations are controlled by it) for 2 months, there are some suggestions

which I would like to give to the company. Following are the suggestions1. Training duration of new comers is very short (10-12 days only) but content which they

deliver in the training is very big. It should be at least three weeks long so that new comers get

enough time to understand the concept.

2. Conditions should be grouped into different groups as per origination types so that each of the

issue of different loan products could be handled separately and executed quickly and efficiently.

3. There are so many issues in the SunSoft software of the company. Sometimes it works

properly but sometime it does not work which result in data loss. Some time it works very slow.

This issue needs to be fixed as soon as possible so the work could be handled efficiently and

quickly.

4. There should be more coordination of work between the teams. As I found that because of

other teams loan get stuck for few days. If this problem is resolved then speed of the processing

of the loan could be enhanced.

5. In spite of using Libra Office which is very slow, they should use MS Office package because

it is easy, fast, reliable and convenient and we are familiar with it also. If they do this then the

speed of reviewing documents could be improved,

29

Jaipuria Institute of management, Noida

XL DYNAMICS INDIA PVT. LTD

Bibliography

1. http://www.firstresearch.com/Industry-Research/Mortgage-Banking.html

2. https://www.fas.org/sgp/crs/misc/R42995.pdf

3. http://www.swmc.com/swmc/

4. http://www.xldynamics.com/

5. http://www.xldynamics.co.in/

30

Jaipuria Institute of management, Noida

Das könnte Ihnen auch gefallen

- Financial Analysis of WiproDokument23 SeitenFinancial Analysis of WiproVishal RebelsNoch keine Bewertungen

- Tata Motors Nano To Roll OutDokument4 SeitenTata Motors Nano To Roll OutSymon StefenNoch keine Bewertungen

- InternshepDokument19 SeitenInternshepVineet ShahNoch keine Bewertungen

- Income Tax ReturnDokument96 SeitenIncome Tax ReturnKapil SalujaNoch keine Bewertungen

- Financial Planning and Tax Savings Strategies in SuratDokument3 SeitenFinancial Planning and Tax Savings Strategies in SuratMr. Khan100% (1)

- CaDokument37 SeitenCaKunal NagNoch keine Bewertungen

- Dissolution of a Partnership FirmDokument46 SeitenDissolution of a Partnership FirmPadmalochan NayakNoch keine Bewertungen

- Panchal KeyurDokument42 SeitenPanchal KeyurRohil MistryNoch keine Bewertungen

- Project Report On TaxationDokument51 SeitenProject Report On TaxationsnehalNoch keine Bewertungen

- Analysis of Financial Statement: Project Report OnDokument36 SeitenAnalysis of Financial Statement: Project Report OnMayur KundarNoch keine Bewertungen

- Sample Sip Report ADokument46 SeitenSample Sip Report AJagrati KanojiyaNoch keine Bewertungen

- Internship ProjectDokument57 SeitenInternship ProjectVIKAS AGNIHOTRINoch keine Bewertungen

- Audit, Tax, Assurance, Management Services, Financial Management System Design ServicesDokument1 SeiteAudit, Tax, Assurance, Management Services, Financial Management System Design ServicesBizness Zenius HantNoch keine Bewertungen

- Talent Acquisition StrategiesDokument42 SeitenTalent Acquisition Strategiesshaifali chauhanNoch keine Bewertungen

- Job Analysis of BFSI SectorDokument11 SeitenJob Analysis of BFSI SectorHarshada ChavanNoch keine Bewertungen

- Sip Report (1) All India ITRDokument67 SeitenSip Report (1) All India ITRGagan BhatiaNoch keine Bewertungen

- A Project Report On Taxation in IndiaDokument59 SeitenA Project Report On Taxation in IndiaYash Bhagat100% (1)

- Financial Planning and Tax Savings StrategiesDokument16 SeitenFinancial Planning and Tax Savings StrategiesShyam KumarNoch keine Bewertungen

- ReportDokument33 SeitenReportKap's KumarNoch keine Bewertungen

- ITR Project File 71Dokument43 SeitenITR Project File 71Venu100% (1)

- Ca P GirirajDokument15 SeitenCa P GirirajSugunasugiNoch keine Bewertungen

- Audit Engagement Letter for SBI Bank BranchesDokument12 SeitenAudit Engagement Letter for SBI Bank Brancheskishor kumarNoch keine Bewertungen

- Various Type of Heads of IncomeDokument76 SeitenVarious Type of Heads of Incomejesal makwana100% (1)

- Accouting, Tax Management & Audit Vouchering UNDER CA ReportDokument95 SeitenAccouting, Tax Management & Audit Vouchering UNDER CA ReportsalmanNoch keine Bewertungen

- Padhi - Sip ADokument62 SeitenPadhi - Sip AAsish Kumar PradhanNoch keine Bewertungen

- A Report On Analysis of Published Financial Statement of Mahindra and Mahindra Limited.Dokument44 SeitenA Report On Analysis of Published Financial Statement of Mahindra and Mahindra Limited.HarshNoch keine Bewertungen

- Tax Planning for Business and IndividualsDokument109 SeitenTax Planning for Business and IndividualsrahulNoch keine Bewertungen

- TDSDokument18 SeitenTDSPratik NaikNoch keine Bewertungen

- A Summer Internship Project Report ONDokument64 SeitenA Summer Internship Project Report ONSachin PacharneNoch keine Bewertungen

- Study of tax planning & investment behaviourDokument9 SeitenStudy of tax planning & investment behaviourMukesh GiriNoch keine Bewertungen

- LPGDokument11 SeitenLPGRobinvarshneyNoch keine Bewertungen

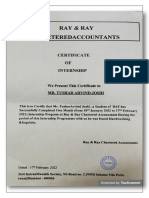

- Internship Report at Ray & Ray Chartered AccountantsDokument52 SeitenInternship Report at Ray & Ray Chartered AccountantsYashwant ShigwanNoch keine Bewertungen

- A Comparision Between Bse and Nasdaq (Kshitij Thakur)Dokument35 SeitenA Comparision Between Bse and Nasdaq (Kshitij Thakur)Kshitij Thakur0% (1)

- Regulatory Framework of Mutual Funds in IndiaDokument14 SeitenRegulatory Framework of Mutual Funds in Indiaayushi guptaNoch keine Bewertungen

- Technical and Fundamental Analysis of Forex MarketsDokument54 SeitenTechnical and Fundamental Analysis of Forex MarketsManju ReddyNoch keine Bewertungen

- Project Report on Comparative Study of CENVAT V/S M-VATDokument53 SeitenProject Report on Comparative Study of CENVAT V/S M-VATrani26oct100% (4)

- TCS - in Income TaxDokument8 SeitenTCS - in Income TaxrpsinghsikarwarNoch keine Bewertungen

- Impact of GST On Real Estate SectorDokument22 SeitenImpact of GST On Real Estate SectorjunaidNoch keine Bewertungen

- Accounting Standard 1Dokument27 SeitenAccounting Standard 1Sid2875% (4)

- Mcom Research PaperDokument63 SeitenMcom Research PaperKhushbu MishraNoch keine Bewertungen

- Unit III Personal Tax Planning Bcom HonsDokument38 SeitenUnit III Personal Tax Planning Bcom Honshimanshi25gNoch keine Bewertungen

- Advantages of Stock Exchange QuotationsDokument7 SeitenAdvantages of Stock Exchange QuotationsSenelwa AnayaNoch keine Bewertungen

- Introduction of Kotak Mahindra GroupDokument10 SeitenIntroduction of Kotak Mahindra GroupAbhi JainNoch keine Bewertungen

- Audit Reports and Professional EthicsDokument20 SeitenAudit Reports and Professional EthicsMushfiq SaikatNoch keine Bewertungen

- DineshDokument62 SeitenDineshDinesh KumarNoch keine Bewertungen

- Roll No.15, Tybbi 2010-11Dokument101 SeitenRoll No.15, Tybbi 2010-11Amey Kolhe67% (3)

- LIC Swot AnalysisDokument3 SeitenLIC Swot AnalysisGOVIND JANGIDNoch keine Bewertungen

- MComDokument32 SeitenMComTuki DasNoch keine Bewertungen

- Regulatory Framework For Financial Services in IndiaDokument25 SeitenRegulatory Framework For Financial Services in IndiaBishnu PhukanNoch keine Bewertungen

- Implimantation of GSTDokument43 SeitenImplimantation of GSTManoj BeheraNoch keine Bewertungen

- Internship ReportDokument7 SeitenInternship ReportSOURAV GOYALNoch keine Bewertungen

- Steps in A Pre and Post Public IssueDokument8 SeitenSteps in A Pre and Post Public Issuearmailgm100% (1)

- GST Internship TrainingDokument12 SeitenGST Internship Trainingsandeep kumarNoch keine Bewertungen

- Section 1: Case Study Topic: Merger of Flipkart and Myntra Strategy: Merger and AcquisitionDokument8 SeitenSection 1: Case Study Topic: Merger of Flipkart and Myntra Strategy: Merger and AcquisitionMuskan MannNoch keine Bewertungen

- ABOUT XL DynamicsDokument5 SeitenABOUT XL DynamicsSujeetpatilNoch keine Bewertungen

- About XL DynamicsDokument7 SeitenAbout XL DynamicsBHUPIENoch keine Bewertungen

- JD - Financial Analyst-XL Dynamics India Pvt. Ltd.Dokument2 SeitenJD - Financial Analyst-XL Dynamics India Pvt. Ltd.shaileshbhoi100% (1)

- Manage all NBFC operations with ISO certified loan management softwareDokument23 SeitenManage all NBFC operations with ISO certified loan management softwareSaurabh SinghNoch keine Bewertungen

- Recruitment and SelectionDokument49 SeitenRecruitment and SelectionNeha Anand75% (4)

- Financial AccountingDokument10 SeitenFinancial AccountingNumber ButNoch keine Bewertungen

- Credit Midterm Reviewer - Loan and DepositDokument12 SeitenCredit Midterm Reviewer - Loan and Depositviva_33Noch keine Bewertungen

- 3E System Brochure v1 (1) .00Dokument2 Seiten3E System Brochure v1 (1) .00Pratik PatelNoch keine Bewertungen

- RBI Grade B 2023 Guide Book Updated SyllabusDokument22 SeitenRBI Grade B 2023 Guide Book Updated SyllabusPunith kumarNoch keine Bewertungen

- BDO Equity FundDokument4 SeitenBDO Equity FundKurt YuNoch keine Bewertungen

- GmailDokument4 SeitenGmailmoNoch keine Bewertungen

- Insurance Company Operations: By:Marya SholevarDokument40 SeitenInsurance Company Operations: By:Marya SholevarSaad MajeedNoch keine Bewertungen

- MGMT E-2030 - Syllabus - Fall 2014 - 8 - 1 - 14Dokument20 SeitenMGMT E-2030 - Syllabus - Fall 2014 - 8 - 1 - 14smey0% (1)

- HSBC Feb STTMNTDokument2 SeitenHSBC Feb STTMNTShelvya ReeseNoch keine Bewertungen

- Comparison of loan and deposit schemes of Indian Overseas Bank and Development Credit Bank of IndiaDokument13 SeitenComparison of loan and deposit schemes of Indian Overseas Bank and Development Credit Bank of IndiaKaran GujralNoch keine Bewertungen

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDokument8 Seiten(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalsaymtrNoch keine Bewertungen

- MSU-IIT Cooperative ArticlesDokument5 SeitenMSU-IIT Cooperative ArticlesMariver LlorenteNoch keine Bewertungen

- ESL Banking Reading ComprehensionDokument3 SeitenESL Banking Reading Comprehensionkardostundevvgmail.comNoch keine Bewertungen

- Dollar-Consolidated Routing Detail of FundDokument1 SeiteDollar-Consolidated Routing Detail of Fundcedar1015Noch keine Bewertungen

- Accounting and Auditing in The PhilippinesDokument15 SeitenAccounting and Auditing in The Philippinesman leeNoch keine Bewertungen

- Travel and Expense PolicyDokument6 SeitenTravel and Expense PolicyLee Cogburn100% (1)

- Lotto Payment Release Order Form 1Dokument1 SeiteLotto Payment Release Order Form 1baloo020379100% (2)

- Jackson V AndersonDokument31 SeitenJackson V AndersonTHROnline100% (2)

- Impact of Financial Inclusion on Daily Wage EarnersDokument8 SeitenImpact of Financial Inclusion on Daily Wage EarnersDevikaNoch keine Bewertungen

- Pragathi Krishna Gramin Bank, Access To Banking & Financial ServicesDokument2 SeitenPragathi Krishna Gramin Bank, Access To Banking & Financial ServicesShivakumar PanshettyNoch keine Bewertungen

- Legal & Taxation Aspect of LeaseDokument7 SeitenLegal & Taxation Aspect of Leasesouvik.icfaiNoch keine Bewertungen

- Strategic Paper Chap 1 7Dokument40 SeitenStrategic Paper Chap 1 7Lauren RefugioNoch keine Bewertungen

- RENTALAPPLICATION Doc-1 PDFDokument2 SeitenRENTALAPPLICATION Doc-1 PDFBhaumik BhedaNoch keine Bewertungen

- Court rules on validity of insurance policy transfer clauseDokument28 SeitenCourt rules on validity of insurance policy transfer clausemar corNoch keine Bewertungen

- Eduque V OcampoDokument1 SeiteEduque V OcampoGlads SarominezNoch keine Bewertungen

- Central New York NY April 20XX: Sample Accounts Sheet-Congregation Bank VersionDokument2 SeitenCentral New York NY April 20XX: Sample Accounts Sheet-Congregation Bank VersionAbel ServinNoch keine Bewertungen

- The Transfer of Property Act, 1882Dokument10 SeitenThe Transfer of Property Act, 1882Atif RehmanNoch keine Bewertungen

- Useofagrmnt PDFDokument20 SeitenUseofagrmnt PDFBonaventure NzeyimanaNoch keine Bewertungen

- Gramin BankDokument8 SeitenGramin BankSayan SahaNoch keine Bewertungen

- Internship Report Al BarakaDokument38 SeitenInternship Report Al BarakaIrsa Khan100% (2)