Beruflich Dokumente

Kultur Dokumente

Laura Velasco and Greta Acosta

Hochgeladen von

Sor ElleOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Laura Velasco and Greta Acosta

Hochgeladen von

Sor ElleCopyright:

Verfügbare Formate

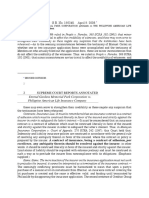

PREMIUMS NECESSARY TO MAKE CONTRACT VALID AND BINDING

43. LAURA VELASCO and GRETA

ACOSTA, petitioners, vs.

HON. SERGIO A. F. APOSTOL and MAHARLIKA

INSURANCE CO., INC., respondents., May 9,

1989

That on November 27, 1973,. plaintiffs were riding in their Mercury car, owned by plaintiff

Laura Velasco, and driven by their driver Guarra, along Quezon Boulevard, toward the

direction of Manila, when, before reaching said corner, an N/S taxicab driven by defendant

Dominador Santos and registered in the name of defendants Alice Artuz, c/o Norberto Santos

collided with their car at the left front part, causing the latter to turn toward the center hitting

a jeepney on its right, which was travelling along their side going toward Manila also; 1

plaintiffs were claiming actual, moral and exemplary damages plus attorney's fees. After an

answer was filed by said defendants, private respondent Maharlika Insurance Co., Inc. was

impleaded as a defendant by the petitioner, with an allegation that the N/S taxicab involved

was insured against third party liability for P20,000.00 with private respondent at the time of

the accident.

respondent Maharlika Insurance Co., Inc. claimed that there was no cause of action against it

because at the time of the accident, the alleged insurance policy was not in, force due to nonpayment of the premium thereon. It further averred that even if the taxicab had been insured,

the complaint would still be premature since the policy provides that the insurer would be

liable only when the insured becomes legally liable. 4

The trial court rendered judgment in favor of the plaintiff finding that the evidence on the

negligence of defendant Dominador Santos was uncontroverted and the proximate cause of

the accident was his negligence. However, Maharlika Insurance Co. was exonerated on the

ground that the policy was not in force for failure of the therein defendants to pay the initial

premium and for their concealment of a material fact.

From the decision of the court a quo, petitioners elevated the case to this Court by a petition

for review on certiorari,

Petitioners fault the respondent-judge for considering private respondent's defense of late

payment of premium when, according to them, "the same was waived at the pre-trial" hence

private respondent's evidence of late payment should be disregarded because, private

respondent had thereby admitted that such fact was not in issue. They theorize that what was

stipulated in the pre-trial order "does not include the issue on whether defendant Maharlika

Insurance Co., Inc. is liable under the insurance policy, even as the premium was paid after

the accident in question."

Issue 1: whether or not private respondent's

defense of late payment of premium was

waived at the pre-trial/

whether or not

private

respondent's

evidence

of

late

payment should be disregarded because

private respondent had thereby admitted

that such fact was not in issue.

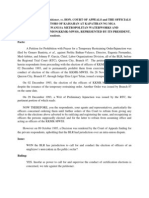

RULING: The records show that at the pre-trial

conference the issues stipulated by the parties for

trial were the following:

1.Whether it was the

driver of the plaintiffs' car or the driver of the

defendants' car who was negligent

2. Whether defendant Maharlika Insurance Co. Inc. is liable under the insurance

policy on account of the negligence of defendant Dominador Santos. 9

Petitioners' position is bereft of merit. We have

carefully examined the pre-trial order but We fail to

discern any intimation or semblance of a waiver or

an admission on the part of Maharlika Insurance

Co., Inc. Although there is no express statement as

to the fact of late payment, this is necessarily

deemed included in or ineluctably inferred from the

issue of whether the company is liable under the

insurance policy it had allegedly issued for the

vehicle involved and on which petitioners seek to

recover. A pre-trial order is not meant to be a

detailed catalogue of each and every issue that is

to be or may be taken up during the trial. Issues

that are impliedly included therein or may be

inferable therefrom by necessary implication are as

much integral parts of the pre-trial order as those

that are expressly stipulated. In fact, it would be

absurd and inexplicable for the respondent

company to knowingly disregard or deliberately

abandon the issue of non-payment of the premium

on the policy considering that it is the very core of

its defense.

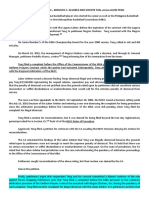

ISSUE 2: Whether defendant Maharlika

Insurance Co., Inc. is liable under the

insurance policy, even if the premium was

paid after the accident in question

RULING 2: It should be noted at the outset that

this controversy arose under the aegis of the old

insurance law, Act No. 2427, as amended.

The accident occurred on November 27, 1973 while

the complaint by reason thereof was filed on July

20, 1974, both before effectivity on December 18,

1974 of Presidential Decree No. 612, the

subsequent insurance law which repealed its

predecessor.

The former insurance law, which applies to the case

under consideration, provided that:

An insurer is entitled to the payment of premium as soon as the thing insured is

exposed to the peril insured against, unless there is clear agreement to grant the

insured credit extension of the premium due. No policy issued by an insurance

company is valid and binding unless and until the premium thereof has been paid. 13

Consequently, the insurance policy in question

would be valid and binding notwithstanding the

non-payment of the premium if there was a clear

agreement to grant to the insured credit extension.

Such agreement may be express or implied.

Petitioners maintain that in spite of this late payment, the policy is nevertheless

binding because there was an implied agreement to grant a credit extension so

as to make the policy effective. To them, the subsequent acceptance of the

premium and delivery of the policy estops the respondent company from

asserting that the policy is ineffective. 15

We see no cogent proof of any such implied

agreement. The purported nexus between the

delivery of the policy and the grant of credit

extension is too tenuous to support the conclusion

for which petitioners contend. The delivery of the

policy made on March 28, 1974 and only because

the premium was had been paid, in fact, more than

three months before such delivery. 16 As found by

the court below, said payment was accepted by the

insurer without any knowledge that the risk insured

against had already occurred since such fact was

concealed by the insured and was not revealed to

the insurer. 17 Thus, the delivery of the policy was

far from being unconditional. Had there really

been a credit extension, the insured would

not have had any apprehension or hesitation

to inform the respondent insurance company

at the time of or before the payment of the

premium that an accident for which the

insurer may be held liable had already

happened. In fact, there is authority to hold that

under such circumstances notice alone is necessary

and the insured need not pay the premium because

whatever premium may have been due may

already be deducted upon the satisfaction of the

loss under the policy. 18

Aside from the supposed unconditional delivery of

the policy, which has been demonstrated to be

baseless, petitioners failed to point out "any other

circumstances showing that prepayment of

premium was not intended to be insisted upon."

They have thus failed to discharge the burden of

proving their allegation of the existence of the

purported credit extension agreement. Indubitably

their insurance claim must fail.

In the present law, Section 77 of the Insurance

Code of 1978 19 has deleted the clause "unless

there is clear agreement to grant the insured credit

extension of the premium due" which was then

involved in this controversy.

There is no need to elaborate on the finding of the

lower court that there was concealment by therein

defendants of a material fact, although legal effects

of pertinence to this case could be drawn

therefrom. The fact withheld could not in any event

have influenced the respondent company in

entering into the supposed contract or in

estimating the character of the risk or in fixing the

rate premium, for the simple reason that no such

contract existed between the defendants and the

company at the time of the accident. Accordingly,

there was nothing to rescind at that point in time.

What should be apparent from such actuations of

therein defendants, however, is the presence of

bad faith on their part, a reprehensible disregard of

the principle that insurance contracts are

uberrimae fidae and demand the most abundant

good faith.

WHEREFORE, finding no reversible error,

judgment appealed from is hereby AFFIRMED.

the

Das könnte Ihnen auch gefallen

- Insurance Dispute Over Unpaid PremiumDokument3 SeitenInsurance Dispute Over Unpaid PremiummansikiaboNoch keine Bewertungen

- 2 1 InsuranceDokument6 Seiten2 1 InsuranceLeo GuillermoNoch keine Bewertungen

- RCJ Bus Line v. Standard Insurance Comp, GR No. 193629Dokument7 SeitenRCJ Bus Line v. Standard Insurance Comp, GR No. 193629Nikki Rose Laraga AgeroNoch keine Bewertungen

- Royal Crown International vs. NLRC (Case)Dokument7 SeitenRoyal Crown International vs. NLRC (Case)jomar icoNoch keine Bewertungen

- Madrigal, Tiangco & Co., Et Al vs. Hanson, Orth & StevensonDokument4 SeitenMadrigal, Tiangco & Co., Et Al vs. Hanson, Orth & StevensonAaron CarinoNoch keine Bewertungen

- American Home Lns. V Chua, GR 130421 DigestDokument2 SeitenAmerican Home Lns. V Chua, GR 130421 DigestJade Marlu DelaTorreNoch keine Bewertungen

- 48 Philippine American Life Insurance Co. v. PinedaDokument3 Seiten48 Philippine American Life Insurance Co. v. PinedaKaryl Eric BardelasNoch keine Bewertungen

- SECUYA v. VDA. DE SELMA Quieting of Title CaseDokument2 SeitenSECUYA v. VDA. DE SELMA Quieting of Title CaseXing Keet LuNoch keine Bewertungen

- Case DigestDokument2 SeitenCase Digestj guevarraNoch keine Bewertungen

- Insurance 2 - Ong - RCBC V CADokument2 SeitenInsurance 2 - Ong - RCBC V CADaniel OngNoch keine Bewertungen

- Insurance Code SummaryDokument24 SeitenInsurance Code SummaryTherese Diane SudarioNoch keine Bewertungen

- Review Guide Corp Law Part IDokument128 SeitenReview Guide Corp Law Part IMJ MirandaNoch keine Bewertungen

- Insurance Code My ReviewDokument13 SeitenInsurance Code My ReviewPursha Monte CaraNoch keine Bewertungen

- Spouses Fabre v. Court of Appeals, G.R. No. 111127, (July 26, 1996), 328 PHIL 774-793Dokument2 SeitenSpouses Fabre v. Court of Appeals, G.R. No. 111127, (July 26, 1996), 328 PHIL 774-793Al Jay MejosNoch keine Bewertungen

- Rem Rev Cases Full TextDokument20 SeitenRem Rev Cases Full TextaaronjerardNoch keine Bewertungen

- 10) Rizal Surety & Insurance Co. vs. Manila Railroad Company, 23 SCRA 205, No. L-24043 April 25, 1968Dokument4 Seiten10) Rizal Surety & Insurance Co. vs. Manila Railroad Company, 23 SCRA 205, No. L-24043 April 25, 1968Alexiss Mace JuradoNoch keine Bewertungen

- Cases General ProvisionsDokument5 SeitenCases General ProvisionsCarla January OngNoch keine Bewertungen

- (Insurance) Fortune vs. CADokument2 Seiten(Insurance) Fortune vs. CARaphael PangalanganNoch keine Bewertungen

- THE Insurance Code of The Philippines (Pres. Decree No. 1460, As Amended.) General ProvisionsDokument13 SeitenTHE Insurance Code of The Philippines (Pres. Decree No. 1460, As Amended.) General ProvisionsDonna TreceñeNoch keine Bewertungen

- Sps. Cha v. CADokument1 SeiteSps. Cha v. CAJohn Mark RevillaNoch keine Bewertungen

- RA 8291 GSIS ActDokument19 SeitenRA 8291 GSIS ActAicing Namingit-VelascoNoch keine Bewertungen

- Ra - 9285 Adr PDFDokument15 SeitenRa - 9285 Adr PDFAriel MigriñoNoch keine Bewertungen

- BACHRACH Vs BRitish American Assurance G.R. No. L-5715 December 20, 1910Dokument2 SeitenBACHRACH Vs BRitish American Assurance G.R. No. L-5715 December 20, 1910Emrico CabahugNoch keine Bewertungen

- National Union Fire Insurance Company v. NielsenDokument2 SeitenNational Union Fire Insurance Company v. NielsenSab DNoch keine Bewertungen

- 87 - Pro Line Sports Center v. CADokument10 Seiten87 - Pro Line Sports Center v. CARuth Del CastilloNoch keine Bewertungen

- Cases in Insurance Law (Part I)Dokument71 SeitenCases in Insurance Law (Part I)kingofhearts006Noch keine Bewertungen

- G.R. No. 33174Dokument16 SeitenG.R. No. 33174Inter_vivosNoch keine Bewertungen

- CONFLICTSDokument7 SeitenCONFLICTSIrish PrecionNoch keine Bewertungen

- 09 Roa, Jr. Vs CADokument17 Seiten09 Roa, Jr. Vs CAJanine RegaladoNoch keine Bewertungen

- Admin Chap 4Dokument26 SeitenAdmin Chap 4Megan Mateo100% (2)

- Digest of Vda de Gabriel V Ca GR No 103883 PDFDokument2 SeitenDigest of Vda de Gabriel V Ca GR No 103883 PDFXtian HernandezNoch keine Bewertungen

- Insurance Double Policy Ruled VoidDokument1 SeiteInsurance Double Policy Ruled VoidN.SantosNoch keine Bewertungen

- Insurance Case Digests by LuigoDokument3 SeitenInsurance Case Digests by LuigoLuigi JaroNoch keine Bewertungen

- PNB Vs Manila OilDokument1 SeitePNB Vs Manila OiljeninaaningNoch keine Bewertungen

- UCPB vs. MasaganaDokument2 SeitenUCPB vs. MasaganaQuennie Mae ZalavarriaNoch keine Bewertungen

- Insurance Law Notes Unit 2Dokument10 SeitenInsurance Law Notes Unit 2Subham AgarwalNoch keine Bewertungen

- Manila Mahogany v. CA, 1987Dokument2 SeitenManila Mahogany v. CA, 1987Randy SiosonNoch keine Bewertungen

- 072 Insular Life Assurance Co. v. Serafin FelicianoDokument2 Seiten072 Insular Life Assurance Co. v. Serafin FelicianoJovelan V. Escaño100% (1)

- Facts:: Makati Tuscany Condominium Corporation vs. Court of Appeals (GR 95546, 6 November 1992)Dokument2 SeitenFacts:: Makati Tuscany Condominium Corporation vs. Court of Appeals (GR 95546, 6 November 1992)Mary LouiseNoch keine Bewertungen

- 75 South Sea Surety and Insurance Co., Inc. vs. Court of AppealsDokument3 Seiten75 South Sea Surety and Insurance Co., Inc. vs. Court of AppealsMae MaihtNoch keine Bewertungen

- Insurance DigestsDokument4 SeitenInsurance DigestsLesly BriesNoch keine Bewertungen

- Metropolitan Bank and Trust Co Vs CirDokument2 SeitenMetropolitan Bank and Trust Co Vs CirBenjie RoqueNoch keine Bewertungen

- Prudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines Inc, G.R. No. 151890 June 20, 2006 (Full Text and Digest)Dokument14 SeitenPrudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines Inc, G.R. No. 151890 June 20, 2006 (Full Text and Digest)RhoddickMagrataNoch keine Bewertungen

- Personal Liability of Corporate Officers Under Trust ReceiptsDokument7 SeitenPersonal Liability of Corporate Officers Under Trust ReceiptsTrem GallenteNoch keine Bewertungen

- Genaro BautistaDokument2 SeitenGenaro BautistaAlexis Ailex Villamor Jr.Noch keine Bewertungen

- Union Manufacturing vs. Philippine GuarantyDokument3 SeitenUnion Manufacturing vs. Philippine GuarantyAnonymous 33LIOv6LNoch keine Bewertungen

- Real Estate Broker's Commission UpheldDokument13 SeitenReal Estate Broker's Commission UpheldCamille CruzNoch keine Bewertungen

- Insurance Digest 1Dokument13 SeitenInsurance Digest 1joenelNoch keine Bewertungen

- Eurotech Vs Erwin Cuizon and Edwin Cuizon FactsDokument1 SeiteEurotech Vs Erwin Cuizon and Edwin Cuizon Factsroland deschainNoch keine Bewertungen

- Registration of Land Titles and Deeds Review 2016Dokument24 SeitenRegistration of Land Titles and Deeds Review 2016Janesa LdjmNoch keine Bewertungen

- Valenzuela v. CA Valenzuela v. CA: B2022 Reports Annotated October 19, 1990Dokument3 SeitenValenzuela v. CA Valenzuela v. CA: B2022 Reports Annotated October 19, 1990Rafael HernandezNoch keine Bewertungen

- 01 Sesbreño Vs CA 222 SCRA 466, G.R. No. 89252, May 24, 1993Dokument13 Seiten01 Sesbreño Vs CA 222 SCRA 466, G.R. No. 89252, May 24, 1993Galilee RomasantaNoch keine Bewertungen

- Malayan Insurance Vs CADokument8 SeitenMalayan Insurance Vs CADenise Jane DuenasNoch keine Bewertungen

- Guingona v. City Fiscal of ManilaDokument4 SeitenGuingona v. City Fiscal of ManilaYodh Jamin OngNoch keine Bewertungen

- 4 INSURANCE Part 1 Contracts of InsuranceDokument5 Seiten4 INSURANCE Part 1 Contracts of InsuranceRuby SantillanaNoch keine Bewertungen

- Tax Doctrines in Dimaampao CasesDokument3 SeitenTax Doctrines in Dimaampao CasesDiane UyNoch keine Bewertungen

- Grepa Life CaseDokument2 SeitenGrepa Life CaseopislotoNoch keine Bewertungen

- Digest - Team Energy Corporation V CirDokument2 SeitenDigest - Team Energy Corporation V CirArthur SyNoch keine Bewertungen

- Sunlife Assurance of Canada vs. CA GR No. 105135 June 22 1995Dokument4 SeitenSunlife Assurance of Canada vs. CA GR No. 105135 June 22 1995wenny capplemanNoch keine Bewertungen

- The Young Adult Starter Kit: 12 Steps To Being A Better Person: YA Self-HelpVon EverandThe Young Adult Starter Kit: 12 Steps To Being A Better Person: YA Self-HelpNoch keine Bewertungen

- 0504 JMC Dofdti PDFDokument11 Seiten0504 JMC Dofdti PDFBryan Yee LaborNoch keine Bewertungen

- Republic of The Philippines, Petitioner: vs. MARELYN TANEDO MANALO, ResponsdentDokument3 SeitenRepublic of The Philippines, Petitioner: vs. MARELYN TANEDO MANALO, ResponsdentSor Elle100% (2)

- Joaquin Cunanan & Co: VAT RULING NO. 011-01Dokument2 SeitenJoaquin Cunanan & Co: VAT RULING NO. 011-01Sor ElleNoch keine Bewertungen

- Bir Ruling 418-03 PDFDokument2 SeitenBir Ruling 418-03 PDFSor Elle100% (1)

- RMC No. 18-2020Dokument1 SeiteRMC No. 18-2020preNoch keine Bewertungen

- Bill of Rights (Philippines)Dokument2 SeitenBill of Rights (Philippines)Jen100% (3)

- Batas Pambansa Bilang 68Dokument29 SeitenBatas Pambansa Bilang 68Sor ElleNoch keine Bewertungen

- CITY of ManilaDokument4 SeitenCITY of ManilaSor ElleNoch keine Bewertungen

- RMC No. 18-2020Dokument1 SeiteRMC No. 18-2020preNoch keine Bewertungen

- Ignacio Barzaga v. CADokument2 SeitenIgnacio Barzaga v. CASor ElleNoch keine Bewertungen

- RMC No. 18-2020Dokument1 SeiteRMC No. 18-2020preNoch keine Bewertungen

- Ohio vs. RobinetteDokument2 SeitenOhio vs. RobinetteSor ElleNoch keine Bewertungen

- Sun LifeDokument4 SeitenSun LifeSor ElleNoch keine Bewertungen

- Land Lease Dispute Over First Priority to PurchaseDokument2 SeitenLand Lease Dispute Over First Priority to PurchaseSor Elle100% (1)

- Negros SlashersDokument4 SeitenNegros SlashersSor ElleNoch keine Bewertungen

- Paterno v. PaternoDokument2 SeitenPaterno v. PaternoSor Elle100% (1)

- Land Lease Dispute Over First Priority to PurchaseDokument2 SeitenLand Lease Dispute Over First Priority to PurchaseSor Elle100% (1)

- Naldoza, V. RepublicDokument2 SeitenNaldoza, V. RepublicSor ElleNoch keine Bewertungen

- Yaptinchay vs. TorresDokument2 SeitenYaptinchay vs. TorresSor ElleNoch keine Bewertungen

- Disbarment of Atty. Terre for Bigamous MarriageDokument2 SeitenDisbarment of Atty. Terre for Bigamous MarriageSor ElleNoch keine Bewertungen

- Court Rules Against Forfeiture of Husband's Share in PropertyDokument2 SeitenCourt Rules Against Forfeiture of Husband's Share in PropertySor ElleNoch keine Bewertungen

- Rule 70 MCQDokument7 SeitenRule 70 MCQSor ElleNoch keine Bewertungen

- BOC 2015 Civil Law Reviewer (Final)Dokument602 SeitenBOC 2015 Civil Law Reviewer (Final)Joshua Laygo Sengco88% (17)

- International Covenant On Civil and Political RightsDokument92 SeitenInternational Covenant On Civil and Political Rightsaudzgusi100% (1)

- Pedro de Guzman Vs CaDokument11 SeitenPedro de Guzman Vs CaSor ElleNoch keine Bewertungen

- Katarungang Pambarangay: A HandbookDokument134 SeitenKatarungang Pambarangay: A HandbookCarl92% (101)

- Civil Law Rev Le Belle NotesDokument10 SeitenCivil Law Rev Le Belle NotesSor ElleNoch keine Bewertungen

- ESSENTIAL ELEMENTS AND CHARACTERISTICS OF SALES CONTRACTSDokument33 SeitenESSENTIAL ELEMENTS AND CHARACTERISTICS OF SALES CONTRACTSSor ElleNoch keine Bewertungen

- Forcible Entry and Unlawful Detainer Applicable LawsDokument10 SeitenForcible Entry and Unlawful Detainer Applicable LawsSor ElleNoch keine Bewertungen

- Primer On GrievanceDokument67 SeitenPrimer On Grievanceymervegim02Noch keine Bewertungen

- Republic Vs Nolasco - G.R. No. 155108. April 27, 2005Dokument16 SeitenRepublic Vs Nolasco - G.R. No. 155108. April 27, 2005Ebbe DyNoch keine Bewertungen

- (D.E. 21) Notice of Unavailability Henry H. Bolz, III. Schneider V First American 17-80728Dokument2 Seiten(D.E. 21) Notice of Unavailability Henry H. Bolz, III. Schneider V First American 17-80728larry-612445Noch keine Bewertungen

- Today Is Friday, January 04, 2019: Supreme CourtDokument5 SeitenToday Is Friday, January 04, 2019: Supreme CourtYeyen M. EvoraNoch keine Bewertungen

- Family IIDokument8 SeitenFamily IIUllas KrishnanNoch keine Bewertungen

- Evidence ReviewerDokument42 SeitenEvidence Reviewercmv mendoza100% (2)

- A Study On Parliamentary Privileges and The Need For Its CodificationDokument16 SeitenA Study On Parliamentary Privileges and The Need For Its CodificationAtharva PhanjeNoch keine Bewertungen

- Employee TerminationDokument18 SeitenEmployee TerminationDhifa AprilianaNoch keine Bewertungen

- Doe v. United States Air Force Et Al - Document No. 20Dokument23 SeitenDoe v. United States Air Force Et Al - Document No. 20Justia.comNoch keine Bewertungen

- FEA V DOD No. 2015-3173Dokument29 SeitenFEA V DOD No. 2015-3173FedSmith Inc.100% (2)

- Fbla Bylaws PDFDokument2 SeitenFbla Bylaws PDFKyleNoch keine Bewertungen

- Abatement of SuitDokument7 SeitenAbatement of SuitfreakedwithcollegeliNoch keine Bewertungen

- Intro 3RDDokument26 SeitenIntro 3RDEveryday ShufflinNoch keine Bewertungen

- Douglas Badger HearingDokument1 SeiteDouglas Badger HearingDianne JacobNoch keine Bewertungen

- Civil Rights Lecture NotesDokument3 SeitenCivil Rights Lecture NotesCool VibesNoch keine Bewertungen

- Moot ProblemDokument3 SeitenMoot ProblemAditya AnandNoch keine Bewertungen

- Case Digests PersonsDokument5 SeitenCase Digests PersonsRobehgene Atud-JavinarNoch keine Bewertungen

- Contemporary Policing Assignmnt 2 DANGADokument7 SeitenContemporary Policing Assignmnt 2 DANGARichar MadhaureNoch keine Bewertungen

- Former LA County Sheriff Lee Baca Trial Brief For Appeal With 9th CircuitDokument69 SeitenFormer LA County Sheriff Lee Baca Trial Brief For Appeal With 9th CircuitCeleste FremonNoch keine Bewertungen

- Dumpson SettlementDokument27 SeitenDumpson SettlementAnonymous hCWS5dCpauNoch keine Bewertungen

- Evid Cases 2Dokument238 SeitenEvid Cases 2Francis Mico E. BobilesNoch keine Bewertungen

- Aquino v. QuiazonDokument3 SeitenAquino v. QuiazonMARIA KATHLYN DACUDAONoch keine Bewertungen

- John Hay vs. Lim .Dokument1 SeiteJohn Hay vs. Lim .BoenYatorNoch keine Bewertungen

- Reservation Types in IndiaDokument6 SeitenReservation Types in IndiaAnil ChoudharyNoch keine Bewertungen

- Sex Related Offences and Their Prevention and Control Measures: An Indian PerspectiveDokument18 SeitenSex Related Offences and Their Prevention and Control Measures: An Indian PerspectiveHrishikeshNoch keine Bewertungen

- NCNDA - IMFPA Template CDokument9 SeitenNCNDA - IMFPA Template CFadelousNoch keine Bewertungen

- Extrajudicial Settlement of Estate Damaso AtienzaDokument1 SeiteExtrajudicial Settlement of Estate Damaso AtienzaGlenn Lapitan CarpenaNoch keine Bewertungen

- Trial court cannot interfere with decision of co-equal administrative bodyDokument1 SeiteTrial court cannot interfere with decision of co-equal administrative bodyShaira Mae CuevillasNoch keine Bewertungen

- Cicil Litigation Management ManualDokument220 SeitenCicil Litigation Management ManualS11830rsNoch keine Bewertungen

- 11 Sta. Rosa Realty Dev't Corp. vs. Court of AppealsDokument25 Seiten11 Sta. Rosa Realty Dev't Corp. vs. Court of AppealsJanine RegaladoNoch keine Bewertungen

- Adlawan Vs PeoplDokument2 SeitenAdlawan Vs PeoplRobertNoch keine Bewertungen