Beruflich Dokumente

Kultur Dokumente

2015-08-20 Cihna Bnak

Hochgeladen von

jackCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2015-08-20 Cihna Bnak

Hochgeladen von

jackCopyright:

Verfügbare Formate

CHINA GAS

AUGUST 20, 2015

ENN ENERGY

| 2688 HK

Waiting for a re-rating

Entry point likely to emerge in late 2015F

Neutral (maintained)

Core earnings grew 18% YoY, in line

Current price:

Entry point to emerge in late 2015F. We believe ENN will

continue to face weaker gas volume risk amid Chinas slower IP

activity and consistently lower global oil prices. Gas demand risk

has yet to ease in 2H15F despite the possibility of a September 2015

announcement of a city gate price cut of over RMB0.40/m3 that

would be effective October 2015. Assuming gas operators need oneto-two months to pass through lower costs to end users, we see

volume picking up as early as 1H16F. Late 2015F may offer a better

entry point provided demand visibility improves. On the back of

slower secular gas volume growth and stronger connection figures,

we fine tune our 2016F-2018F earnings forecasts by -3% to +1%

and cut our DCF-based target price from HK$52.00 to HK$46.00.

In our view, the stock would deserve a re-rating if demand surprised

on the upside in late 2015F.

September-December likely the key to full-year performance.

From July to early-August 2015, Chinas gas operators have not

seen a pickup in gas demand from industrial customers. ENN is not

immune to this trend. This leads us to believe that volume has to be

backend loaded in the last four months of 2015F if the company is

to achieve 10-15% ex-wholesale volume growth for 2015F.

Residential and vehicle gas will continue to post faster growth in

2015F while C&I demand remains the swing factor for gas sales

earnings.

1H15 results in line. Headline profit rose a mere 1% to

RMB1.2b. Stripping out non-core items, core profit grew 18% YoY,

in line with our full-year earnings growth rate forecast. Piped gas

sales gross margin expanded a slight 0.4ppt thanks to lower blended

procurement cost. Piped gas and natural gas sales volume rose

10.7% and 10.5%, respectively. Excluding wholesale gas, city gas

volume climbed 8% YoY, just below our expectation. New

household connections came in better-than-expected after growing

22% YoY to 792k in 1H15.

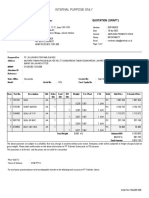

FORECAST AND VALUATION

Year to 31 December

Revenue (RMB m)

YoY (%)

Net profit (RMB m)

YoY (%)

Fully diluted EPS (RMB)

YoY (%)

P/E (x)

DPS (RMB)

Dividend yield (%)

P/B (x)

ROAE (%)

Net debt/equity (%)

2013

22,966

27.4

1,252

-15.5

1.16

-16.2

28.8

0.38

1.1

3.8

13.8

56.2

Target:

42.05

HK$

(as at 20 August 2015)

46.00

HK$

(down from HK$52.00)

TRADING DATA

52-week range

Market capitalization (m)

Shares outstanding (m)

Free float (%)

3M average daily T/O (m share)

3M average daily T/O (US$ m)

Expected return (%) 12 month

HK$40.05 59.95

HK$45,543/US$5,874

1,083

70

3

17

9

Source: Bloomberg, CCBIS

PRICE VS HSCEI

(HK$)

88

80

72

64

56

48

40

32

Aug-14

Oct-14

Dec-14

Feb-15

Apr-15

ENN Energy (2688 HK)

Jun-15

Aug-15

HSCEI

Source: Bloomberg

STOCK PERFORMANCE

2014

29,087

26.7

2,968

137.1

2.06

78.5

16.2

0.66

2.0

3.0

27.4

32.5

2015F

31,559

8.5

2,767

-6.8

2.38

15.3

14.8

0.78

2.2

2.7

21.2

45.7

2016F

35,866

13.6

3,155

14.0

2.91

22.5

12.3

0.89

2.5

2.4

20.9

30.3

2017F

40,483

12.9

3,418

8.3

3.16

8.3

11.4

0.96

2.7

2.1

19.6

15.9

Performance over

Absolute

Relative (%) to HSCEI

1M

-12

-2

3M

-27

-2

12M

-27

-23

Source: Bloomberg

Christeen So

(852) 3911 8242

christso@ccbintl.com

Felix Lam

(852) 3911 8245

felixlam@ccbintl.com

Source: Bloomberg, CCBIS

Analyst certifications and other important disclosures on last page

ENN Energy (2688 HK)

August 20, 2015

FURTHER DETAILS FROM THE ANALYST BRIEFING

Gas volume. ENN targets 10-15% ex-wholesale gas volume growth in 2015F,

down from 15-20% planned earlier this year. Given 1H15 city gas volume

grew 8% YoY, we estimate the company has to post 12-22% YoY growth in

2H15F in order to meet its full-year target. Management believes this can

be achieved by (1) adding more new customers, (2) directly supplying

more LNG to coastal industrial customers, (3) safeguarding existing C&I

customers, and (4) developing micro-grid and distributed gas projects.

New household connections. The company raised its 2015F new household

connection target from 1.4m to 1.5m-1.6m. It will strive to connect more

old buildings to mitigate the risk of a weaker new residential housing

market. Connection cost is approximately RMB200 per household higher

for old buildings, which resulted in lower gas connection gross margin in

1H15.

Gas refilling stations roll-out plan revised. In 1H15, eleven CNG and eight

LNG stations were constructed and commenced operations. At the

current run rate, the company maintains its 20 new CNG station addition

target but lowers its 2015F LNG station addition target from 50 to 30.

North America refilling business loss-making till 2017F. Gas volume from

North American LNG refilling stations rose 38% YoY to 2.58m DGE (diesel

gallon equivalent), putting the company on track to meet its 2015F 5.0m

DGE target. However, the projects are still making a RMB21m loss at the

gross profit level in 1H15. Management maintains its goal of narrowing its

net loss to no more than US$25m in 2015F. We believe the company will not

be able to engineer a profit turnaround before 2H16F.

Impact of renminbi depreciation. About 79% and 21% of ENNs current

debt is denominated in US dollars and renminbi. Management estimates

that every 1% of renminbi depreciation against the US dollar will translate

to RMB3.79m in additional interest cost for the year. The company does

not have plans to hedge long-term currency rate changes but will

consider securing more onshore loans when appropriate.

Capex. Excluding the RMB4.0b investment in the Sinopec marketing

division, ENNs capex for 1H15 came to RMB1.13b. The company has

budgeted for capex of RMB3.0b in 2015F, with 20% of the total spent on

refilling stations.

ENN Energy (2688 HK)

August 20, 2015

ENN ENERGY INTERIM RESULTS SNAPSHOT

1H14

(RMB m)

1H15

(RMB m)

1H15

YoY (%)

2,122

9,070

1,810

1,139

27

47

136

14,351

-11,413

2,938

2,557

9,625

1,959

1,553

37

58

98

15,887

-12,644

3,243

20.5

6.1

8.2

36.3

37.0

23.4

-27.9

10.7

10.8

10.4

20.5

20.4

-0.1ppt

170

-200

-890

2,018

42

-240

-990

2,055

-75

20

11

2

14.1

12.9

-1.1ppt

Finance costs

Share of results of associates

Share of results of JCEs

Pretax profit

Taxation

Net profit for the year

Minority interest

Net profit attributable to shareholders

Net margin (%)

-204

45

228

2,087

-554

1,533

-319

1,214

8.5

-264

42

297

2,130

-572

1,558

-331

1,227

7.7

29

-7

30

2

3

2

4

1.1

-.0.7ppt

Core earnings

Core margin (%)

1,178

8.2

1,388

8.7

18

+0.5ppt

Basic EPS (RMB)

Diluted EPS (RMB)

DPS (RMB)

1.12

1.00

-

1.13

1.13

-

1

13

N/A

Effective tax rate (%)

Annualized effective interest rate (%)

Net D/E (%)

Opex to sales (%)

MI ratio

26.5

3.4

47.0

7.6

20.8

26.9

3.7

63.3

7.7

21.2

+0.3ppt

+0.3ppt

+16.4ppt

+0.1ppt

+0.4ppt

P&L

Gas connection

Sales of piped gas

Gas refilling stations

Wholesale of gas

Distribution of bottled LPG

Sales of gas appliances

Sales of materials

Turnover

Cost of sales

Gross profit

Gross margin (%)

Other revenue and gains

Selling and distribution expenses

Administrative expenses

Operating profit

Operating margin (%)

Source: Company data, CCBIS

ENN Energy (2688 HK)

August 20, 2015

CHINA GAS UTILITIES PEER VALUATIONS

Company

Stock

code

Market

Share

cap

price

P/E (x)

EPS growth (%)

(US$ b) (local ccy)* 2015F 2016F 2017F 2015F 2016F 2017F

P/B

(x)

2015F

Yield

(x)

ROE (x)

2015F 2015F 2016F 2017F

Hong Kong

Beijing Enterprises

392 HK

8.1

48.95

11.4

9.9

8.5

14.2

15.5

16.1

1.0

2.5

9.3

10.1

10.9

China Gas**

384 HK

8.1

12.68

14.8

12.7

10.9

30.7

17.0

16.0

3.0

1.7

21.9

21.7

21.3

CR Gas

1193 HK

6.0

21.00

16.0

13.9

11.9

15.2

15.2

16.1

2.5

1.4

17.0

17.2

17.4

ENN Energy

2688 HK

5.9

42.05

14.8

12.3

11.4

9.8

20.1

8.3

2.7

2.2

21.2

20.9

19.6

Kunlun Energy

135 HK

6.6

6.37

12.1

8.9

8.4

-24.5

36.6

5.7

0.9

2.4

7.8

10.0

9.8

Tianjin Jinran

1265 HK

0.2

0.99

17.8

12.8

10.5

3.6

39.7

21.7

0.8

4.8

6.3

7.2

Tianlun Gas

1600 HK

0.9

7.08

17.5

14.9

13.8

21.8

17.9

7.5

3.3

20.8

20.2

18.0

Towngas China

1083 HK

2.0

5.87

11.8

10.4

9.6

23.9

13.4

8.5

1.1

2.1

9.5

10.0

10.1

Zhongyu Gas

3633 HK

0.6

1.82

12.1

10.1

9.1

16.7

20.0

11.1

N/A

N/A

15.9

14.9

14.5

Suchuang Gas

1430 HK

0.3

2.40

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Binhai Investment

2886 HK

0.4

2.79

8.6

6.9

5.4

80.6

24.6

27.2

2.3

5.6

29.9

29.6

29.2

13.7

11.3

10.0

19.2

22.0

13.8

2.0

2.0

15.8

16.1

15.8

Sector Average

China

Shenzhen Gas

601139 CH

3.6

10.53

25.6

21.8

18.5

14.2

17.5

17.6

3.5

1.4

14.5

15.9

17.1

Shaanxi Gas

002267 CH

2.9

16.38

26.4

19.3

N/A

25.9

37.1

N/A

N/A

N/A

N/A

N/A

N/A

Chongqing Gas

600917 CH

3.2

13.14

N/A

43.8

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Guanghui Energy 600256 CH

7.1

8.74

28.2

24.8

20.2

-1.2

13.9

22.4

3.1

0.4

10.1

11.4

13.4

Changchun Gas 600333 CH

0.7

9.03

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Datong Gas

000593 CH

2.9

41.80

29.9

25.9

21.5

17.6

15.5

20.0

4.4

0.6

14.7

14.8

14.8

Shenergy

600642 CH

6.5

9.09

16.7

16.3

17.5

19.9

2.6

-6.6

1.7

2.2

10.9

9.6

7.8

25.4

25.3

19.4

15.3

17.3

13.3

3.2

1.2

12.6

12.9

13.3

Sector Average

* Price as at close on 19 August 2015

** FYE 31 March, adjusted for CY

Source: Bloomberg, CCBIS estimates

ENN Energy (2688 HK)

August 20, 2015

ENN ENERGY | 2688 HK FINANCIAL SUMMARY

PROFIT AND LOSS

FYE 31 December (RMB m)

Gas connection fee

Sales of piped gas

Distribution of bottled LPG

Sales of gas appliances

Sales of materials

Revenue

COGS

Gross profit

Other income

Operating expenses

EBIT

BALANCE SHEET

2013

2014

2015F

2016F

2017F

3,843

4,403

5,032

5,118

5,442

18,738 24,232 26,095 30,279 34,540

61

54

67

81

94

108

110

135

157

177

216

288

230

230

230

22,966 29,087 31,559 35,866 40,483

(17,502) (23,018) (25,023) (28,635) (32,644)

5,464

6,069

6,536

7,231

7,839

166

146

155

165

176

(2,818) (1,792) (2,616) (2,842) (3,137)

2,812

4,423

4,075

4,554

4,877

Net financial income (exp.)

JVs & associates

Profit before tax

Tax

Total profit

(495)

443

2,760

(960)

1,800

(305)

629

4,747

(1,127)

3,620

(376)

742

4,441

(1,110)

3,331

(396)

879

5,037

(1,247)

3,790

(390)

962

5,449

(1,346)

4,103

Minority interest

Net profit attributable to

shareholders

Core profit

(548)

1,252

(652)

2,968

(564)

2,767

(634)

3,155

(685)

3,418

1,937

2,343

2,767

3,155

3,418

1.46

1.16

1.79

411

0.38

3.21

2.06

2.01

715

0.66

2.85

2.38

2.38

844

0.78

3.42

2.91

2.91

963

0.89

3.70

3.16

3.16

1,043

0.96

FYE 31 December (RMB m)

Profit before tax

Amortization & depreciation

Net financial charge adj.

Non-cash items adjusted

Change in working capital

Tax paid

Other

Operating cash flow

2013

2,760

729

495

558

928

(1,001)

(985)

3,484

2014

4,747

843

305

(732)

1,686

(1,137)

(981)

4,731

2015F

4,441

938

376

1,601

(1,120)

(1,139)

5,098

2016F

5,037

990

396

1,385

(1,258)

(1,358)

5,191

2017F

5,449

1,028

390

1,256

(1,358)

(1,497)

5,268

Disposal of fixed assets

Capex

Investment

Net interest received (paid)

Other

Investment cash flow

35

(2,941)

(375)

123

(8)

(3,166)

54

(2,507)

(229)

334

(509)

(2,857)

421

(3,000)

(4,000)

241

(6,337)

462

(3,000)

288

(2,250)

493

(2,500)

316

(1,691)

Change in borrowings

Equity issues

Amount due

Dividend paid

Other

Financing cash flow

Change in cash flow

582

389

(362)

(218)

391

709

2,631

131

(414)

(534)

1,814

3,688

498

(715)

(534)

(751)

(1,990)

500

(844)

(600)

(944)

1,997

(200)

(963)

(648)

(1,810)

1,767

Cash & equivalents, begin

Forex

Cash & equivalents, end

6,156

(43)

6,822

6,822

(7)

10,503

10,503

8,513

8,513

10,510

10,510

12,276

543

2,224

2,098

2,191

2,768

Reported EPS (HK$)

Diluted EPS (RMB)

Core EPS (RMB)

Dividend (RMB m)

DPS (RMB)

CASH FLOW

Free cash flow

FYE 31 December (RMB m)

Cash & equivalents

Pledge dep., restricted cash

Receivables

Assets held for sale

Inventory

Other current assets

Total current assets

Property, plant & equipment

Intangible assets

JVs & associates

Other non-current assets

Total non-current assets

Total assets

2013

6,822

260

2,829

419

767

11,097

17,531

1,500

3,802

1,975

24,808

35,905

2014

10,503

71

2,883

66

510

969

15,002

19,441

1,993

4,318

2,281

28,033

43,035

2015F

8,513

71

4,075

554

1,366

14,579

21,590

1,931

4,818

2,263

30,602

45,181

2016F

10,510

71

4,738

634

1,381

17,335

23,685

1,871

5,410

2,263

33,228

50,563

2017F

12,276

71

5,672

723

1,423

20,166

25,237

1,815

6,056

2,263

35,370

55,536

Short-term borrowings

Trade & bills payable

Other current liabilities

Total current liabilities

Long-term borrowings

Other non-current liabilities

Total non-current liabilities

Total liabilities

921

6,166

3,782

10,869

11,522

1,622

13,144

24,013

1,530

7,262

4,748

13,540

12,970

1,984

14,954

28,494

1,784

6,344

4,356

12,484

13,214

2,990

16,203

28,687

2,039

8,117

4,239

14,395

13,459

3,989

17,448

31,843

2,293

9,617

4,446

16,356

13,005

5,043

18,047

34,404

113

9,430

113

11,985

113

13,908

113

16,100

113

18,476

9,543

2,349

11,892

35,905

12,098

2,443

14,541

43,035

14,021

2,473

16,494

45,181

16,213

2,507

18,721

50,563

18,589

2,544

21,133

55,536

2013

2014

2015F

2016F

2017F

27.4

(3.2)

(6.8)

(15.5)

21.9

26.7

48.7

57.3

137.1

21.0

8.5

(4.8)

(7.9)

(6.8)

18.1

13.6

10.6

11.7

14.0

14.0

12.9

6.5

7.1

8.3

8.3

23.8

15.4

12.2

5.5

8.4

34.8

20.9

18.1

15.2

10.2

8.1

23.7

20.7

15.9

12.9

8.8

8.8

25.0

20.2

15.5

12.7

8.8

8.8

24.8

19.4

14.6

12.0

8.4

8.4

24.7

8

39

88

7

36

84

8

40

79

8

45

74

8

47

80

3.7

13.8

56.2

7.5

27.4

32.5

6.3

21.2

45.7

6.6

20.9

30.3

6.4

19.6

15.9

1.0

1.0

1.1

1.1

1.2

1.1

1.2

1.2

1.2

1.2

Share capital

Reserves and retained

profits

Shareholders' equity

Minority interest

Total equity

Total equity and liabilities

RATIOS

FYE 31 December

Growth (%)

Revenue

EBITDA

EBIT

Net profit

Core net profit

Profitability (%)

Gross margin

EBITDA margin

EBIT margin

Net margin

Core net margin

Tax rate

Efficiency (days)

Inventory turnover

Trade receivables

Trade payables

Returns & leverage (%)

ROAA

ROAE

Net debt (cash)/equity

Liquidity (x)

Current ratio

Quick ratio

Source: Company data, CCBIS estimates

ENN Energy (2688 HK)

August 20, 2015

Rating definitions:

Outperform (O) expected return > 10% over the next twelve months

Neutral (N) expected return between -10% and 10% over the next twelve months

Underperform (U) expected return < -10% over the next twelve months

Analyst certification:

The author(s) of this document, hereby declare that: (i) all of the views expressed in this document accurately reflect his personal

views about any and all of the subject securities or issuers and were prepared in an independent manner; and (ii) no part of any of

his compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this

document; and (iii) he receives no insider information/non-public price-sensitive information in relation to the subject securities or

issuers which may influence the recommendations made by him. The author(s) of this document further confirm that (i) neither he

nor his respective associate(s) (as defined in the Code of Conduct for Persons Licensed by or Registered with the Securities and

Futures Commission issued by the Hong Kong Securities and Futures Commission) has dealt in or traded in the securities covered in

this document within 30 calendar days prior to the date of issue of this document or will so deal in or trade such securities within 3

business days (as defined in the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) after the date of issue of

this document; (ii) neither he nor his respective associate(s) serves as an officer of any of the companies covered in this document;

and (iii) neither he nor his respective associate(s) has any financial interests in the securities covered in this document.

Disclaimers:

This document is prepared by CCB International Securities Limited. CCB International Securities Limited is a wholly-owned subsidiary

of CCB International (Holdings) Limited (CCBIH) and China Construction Bank Corporation (CCB). Information herein has been

obtained from sources believed to be reliable but CCB International Securities Limited, its affiliates and/or subsidiaries (collectively

CCBIS) do not guarantee, represent and warrant (either express or implied) its completeness or accuracy or appropriateness for

any purpose or any person whatsoever. Opinions and estimates constitute our judgment as of the date of this document and are

subject to change without notice. CCBIS seeks to update its research as appropriate, but various regulations may prevent it from

doing so. Besides certain industry reports published on a periodic basis, the large majority of reports are published at irregular

intervals as appropriate according to the analyst's judgment. Forecasts, projections and valuations are inherently speculative in

nature and may be based on a number of contingencies. Readers should not regard the inclusion of any forecasts, projections and

valuations in this document as a representation or warranty by or on behalf of CCBIS that these forecasts, projections or valuations

or their underlying assumptions will be achieved. Investment involves risk and past performance is not indicative of future results.

Information in this document is not intended to constitute or be construed as legal, financial, accounting, business, investment, tax

or any professional advice for any prospective investors and should not be relied upon in that regard. This document is for

informational purposes only and should not be treated as an offer or solicitation for the purchase or sale of any products,

investments, securities, trading strategies or financial instruments of any kind in any jurisdiction. CCBIS makes no representations on

the availability of the securities covered in this document (or related investment) to the recipients. The securities described herein

may not be eligible for sale in all jurisdictions or to certain categories of investors. Neither CCBIS nor any other persons accept any

liability whatsoever for any loss or damages (whether direct, indirect, incidental, exemplary, compensatory, punitive, special or

consequential) arising from any use of this document or its contents or otherwise arising in connection therewith. Securities, financial

instruments or strategies mentioned herein may not be suitable for all investors. The opinions and recommendations herein do not

take into account prospective investors financial circumstances, investment objectives, or particular needs and are not intended

as recommendations of particular securities, financial instruments or strategies to any prospective investors. The recipients of this

document should consider this document as only a single factor in marking their investment decision and shall be solely responsible

for making their own independent investigation of the business, financial condition and prospects of companies referred to in this

document. Readers are cautioned that (i) the price and value of securities referred to in this document and the income derived

from them may fluctuate; (ii) past performance is not a guide to future performance; (iii) any analysis, ratings and

recommendations made in this document are intended for long-term (at least for 12 months) and is not linked to a near-term

assessment of the likely performance of the securities or companies in question. In any event, future actual results may differ

materially from those set forth in any forward-looking statements herein; (iv) future returns are not guaranteed, and a loss of original

capital may occur; and (v) fluctuations in exchange rates may adversely affect the value, price or income of any security or

related instrument referred to in this document. It should be noted that this document covers only those securities or companies as

specified herein and does not extend to any derivative instruments thereof, the value of which may be affected by many factors

and may not correspond with the value of the underlying securities. Trading in these instruments is considered risky and are not

suitable for all investors. While all reasonable care has been taken to ensure that the facts stated herein are accurate and that the

forward-looking statements, opinions and expectations contained herein are based on fair and reasonable assumptions, CCBIS has

not been able to verify independently such facts or assumptions and CCBIS shall not be liable for the accuracy, completeness or

correctness thereof and no representation or warranty is made, express or implied, in this regard. All pricing referred to in this

document is as of the close of local market for the securities discussed, unless otherwise stated and for information purposes only.

There is no representation that any transaction can or could have been effected at those prices, and any prices do not necessarily

reflect CCBIS internal books and records or theoretical model-based valuations and may be based on certain assumptions.

Different assumptions could result in substantially different results. Any statements which may be contained herein attributed to a

third- party represent CCBIS interpretation of the data, information and/or opinions provided by that third party either publicly or

through a subscription service, and such use and interpretation have not been reviewed or endorsed by the third party.

Reproduction and distribution of these third party contents in any form is prohibited except with the prior written consent of such

third party. The recipients must make their own assessments of the relevance, accuracy and adequacy of the information

ENN Energy (2688 HK)

August 20, 2015

contained in this document and make such independent investigation as they may consider necessary or appropriate for such

purpose.

Recipients should seek independent legal, financial, accounting, business, investment and/or tax advice if they have any doubt

about the contents of this document and satisfy themselves prior to making any investment decision that such investment is in line

with their own investment objectives and horizons.

Use of hyperlinks to other internet sites or resources (if any) as referred to in this document is at users own risk. They are provided

solely for the purpose of convenience and information and the content of these internet sites or resources does not in any way form

part of this document. The contents, accuracy, opinion expressed, and other links provided at these sites are not investigated,

verified, monitored, or endorsed by CCBIS. CCBIS expressly disclaims any responsibility for and does not guarantee, represent and

warrant (either express or implied) the completeness, accuracy, appropriateness, availability or security of information found on

these websites. Users of these websites are solely responsible for making all enquiries, investigation and risk assessment before

proceeding with any online or offline access or transaction with any of these third parties. All activities conducted by users via or at

these websites are at their own risk. CCBIS does not guarantee the security of any information users may forward or be requested to

provide to any third parties via these websites. Users are deemed to have irrevocably waived any claims against CCBIS for any loss

or damage suffered as a result of any access to or interaction with any of these websites.

Upon request CCBIS may provide specialized research products or services to certain customers focusing on the prospects for

specific securities as compared with other covered securities over varying time horizons or under differing market conditions. While

the views expressed in these situations may not always be directionally consistent with the long-term views expressed in the analyst's

published research, CCBIS has procedures in place to prevent selective disclosure and will update the relevant readers when our

views has changed. CCBIS also has procedures in place to identify and manage potential conflicts of interest that may arise in

connection with its research business and services. Chinese Wall procedures are also in place to ensure that any confidential

and/or price sensitive information is properly handled. CCBIS will use its best endeavors to comply with the relevant laws and

regulations in this respect. Nevertheless, the recipients should be aware that CCB, CCBIS, their affiliates and/or their officers,

directors and employees may do business with the issuer(s) of the securities covered in this document, including investment banking

business or direct investment business or may hold interest in (and/or later add or dispose) such securities (or in any related

investment) for themselves and/or on behalf of their clients from time to time. As a result, investors should be aware that CCBIS may

have a conflict of interest that could affect the objectivity of this document and CCBIS will not assume any responsibility in respect

thereof. Further, the information contained herein may differ or be contrary to opinions expressed by other associates of CCBIS or

other members of the CCB or CCBIH group of companies.

This document is for the information of the institutional and professional customers of CCBIS only and should not be distributed to

retail customers. This document is not directed at you if CCBIS is prohibited or restricted by any legislation or regulation in any

jurisdiction from making it available to you. You should satisfy yourself before reading it that CCBIS is permitted to provide research

material concerning investments to you and that you are permitted and entitled to receive and read the document under relevant

legislation and regulations. In particular, this document is only distributed to certain US Persons to whom CCBIS is permitted to

distribute according to US securities laws, but cannot otherwise be distributed or transmitted, whether directly or indirectly, into the

US or to any other US person. This document also cannot be distributed or transmitted, whether directly or indirectly, into Japan and

Canada and not to the general public in the Peoples Republic of China (for the purpose of this document, excluding Hong Kong,

Macau and Taiwan) unless under applicable laws.

Any unauthorized reproduction or redistribution by any means to any persons, in whole or in part of this document is strictly

prohibited and CCBIS accepts no liability whatsoever for the actions of third parties in distributing this research report.

If this document has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to

be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

CCBIS therefore does not accept liability for any errors or omissions in the contents of this document, which may arise as a result of

electronic transmission.

The disclosures contained in this document prepared by CCBIS shall be governed by and construed in accordance with the laws of

Hong Kong.

Copyright 2015 CCBIS. The signs, logos and insignia used in this research report and the company name CCB International

Securities Limited are the registered and unregistered trademarks of CCB, CCBIH and/or CCBIS. All rights are hereby reserved. All

material presented in this document, unless indicated otherwise, is under copyright to CCBIS. This document or any portion hereof

may not be reproduced, sold or redistributed without the written consent of CCBIS.

CCB International Securities Limited

12/F, CCB Tower, 3 Connaught Road, Central, Hong Kong

Tel: (852) 3911 8000 / Fax: (852) 2537 0097

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Signature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Dokument36 SeitenSignature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Ganesh PrasadNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- As Unnit 5 Class NotesDokument38 SeitenAs Unnit 5 Class NotesAlishan VertejeeNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Philip Fisher Screen That Fishes Quality StocksDokument3 SeitenThe Philip Fisher Screen That Fishes Quality StocksMartinNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Model Asset and Liability Affidavit D. VDokument12 SeitenModel Asset and Liability Affidavit D. VsavagecommentorNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- deeganAFA 7e ch28 ReducedDokument19 SeitendeeganAFA 7e ch28 Reducedmail2manshaaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- CHAPTER 6 - Handouts For StudentsDokument4 SeitenCHAPTER 6 - Handouts For StudentsErmiasNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 52patterns - 7 Chart PatternsDokument64 Seiten52patterns - 7 Chart PatternspravinyNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Additional Bank Recon QuestionsDokument4 SeitenAdditional Bank Recon QuestionsDebbie DebzNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Capstone (M&a IN BANKS IN INDIA)Dokument13 SeitenCapstone (M&a IN BANKS IN INDIA)Mandeep SinghNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- MERS Southeast Legal Seminar (11.10.04) FinalDokument26 SeitenMERS Southeast Legal Seminar (11.10.04) FinalgregmanuelNoch keine Bewertungen

- Partnership & ClubsDokument8 SeitenPartnership & ClubsGary ChingNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Government Finance Statistics (GFSX) : Valuation of TransactionsDokument2 SeitenGovernment Finance Statistics (GFSX) : Valuation of TransactionsKhenneth BalcetaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- ADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsDokument6 SeitenADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsFahad33% (3)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- For Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEADokument21 SeitenFor Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEAFilip PopovicNoch keine Bewertungen

- Balance B/F 0.00 Payments/RefundsDokument2 SeitenBalance B/F 0.00 Payments/RefundssharonNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Affirm Buy Now Pay Later Case StudyDokument9 SeitenAffirm Buy Now Pay Later Case StudyTrader CatNoch keine Bewertungen

- Lesson 29 - General AnnuitiesDokument67 SeitenLesson 29 - General AnnuitiesAlfredo LabadorNoch keine Bewertungen

- Allux Indo 8301385679Dokument2 SeitenAllux Indo 8301385679Ardi dutaNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ADVANCED FA Chap IIIDokument7 SeitenADVANCED FA Chap IIIFasiko Asmaro100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Collins Apple PDFDokument1 SeiteCollins Apple PDFGh UnlockersNoch keine Bewertungen

- 1059 155846588 Fab's Verified Response To Defendants Claims of ExemptionDokument17 Seiten1059 155846588 Fab's Verified Response To Defendants Claims of Exemptionlarry-612445Noch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Ipo 2Dokument99 SeitenIpo 2Abhilash Mishra100% (1)

- FY23 Maximus Investor Presentation - AugDokument15 SeitenFY23 Maximus Investor Presentation - AugMarisa DemarcoNoch keine Bewertungen

- Answers To End of Chapter QuestionsDokument59 SeitenAnswers To End of Chapter QuestionsBruce_scribed90% (10)

- Doing Business in BrazilDokument164 SeitenDoing Business in BrazilVarupNoch keine Bewertungen

- Associated Bank Vs CADokument1 SeiteAssociated Bank Vs CATine TineNoch keine Bewertungen

- Day CareDokument21 SeitenDay CareSarfraz AliNoch keine Bewertungen

- Slm-Strategic Financial Management - 0 PDFDokument137 SeitenSlm-Strategic Financial Management - 0 PDFdadapeer h mNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Collateral Document Delivery Request Form v2Dokument1 SeiteCollateral Document Delivery Request Form v2Teena BarrettoNoch keine Bewertungen

- EMBA ResumeBookDokument221 SeitenEMBA ResumeBooknikunjhandaNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)