Beruflich Dokumente

Kultur Dokumente

Solutions Chapter 10 Finance

Hochgeladen von

beatriceOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Solutions Chapter 10 Finance

Hochgeladen von

beatriceCopyright:

Verfügbare Formate

Chapter 10: Venture Capital Valuation Methods

170

Chapter 10

VENTURE CAPITAL VALUATION METHODS

DISCUSSION QUESTIONS AND ANSWERS

1. What is meant by finding the value of a ventures assets is the same as finding the value of a ventures debt

plus equity?

This is just a statement of the accounting identity expressed in market values: Market Value of Assets = Market

Value of Debt + Market Value of Equity.

2. Describe the basic venture capital (VC) method for estimating a ventures value.

Venture capital (VC) method: estimates the ventures value by projecting only a terminal flow to investors at

the exit event.

3. Describe the process for estimating the percentage of equity ownership that must be given up by the founder

when a new equity investment is needed.

Estimate the value of the exit event. Discount that value at the venture capital discount rate to get a present

value. Divide the amount the new investor will contribute by that present value to determine the percentage of

the ventures ownership that must be sold.

4. How does a present value venture valuation pie differ from a future value valuation pie?

The present value valuation pie is the present value of the future valuation pie where the discounting is done at

the venture capital discount rate.

5. What is meant by pre-money valuation? What is post-money valuation?

Pre-money valuation: present value of a venture prior to a new money investment

Post-money valuation: pre-money valuation of a venture plus money injected by new investors.

6. What is staged financing? Describe how the capitalization (cap) rate is calculated.

Staged financing: financing provided in sequences of rounds rather than all at one time

Capitalization (cap) rate: spread between the discount rate and the growth rate of the cash flow in terminal

value period

7. How is multiplying a projected earnings by a P/E ratio similar to discounting a perpetuity of earnings starting

at that level?

Chapter 10: Venture Capital Valuation Methods

171

Both convert a projected earnings number into a present value. The P/E multiple approach does so by

multiplication (P/E*E=P) and the discounting approach does so by division (E/(r-g)). When P/E=1/(r-g), these

give the same answer for a given projected E.

8. How would one expect P/E ratios to vary with a ventures risk and growth opportunities?

P/E should increase with valuable growth opportunities and decrease with risk, other things being equal.

9. What are the common ways to estimate a terminal value for a venture?

A few common ways to estimate terminal value for a venture would be to use a P/E or other multiple or to

divide final cash flow by the cap rate (r-g).

10. What is the difference between the direct comparison method and the direct capitalization method?

Direct comparison applies a direct comparison ratio to the related venture quantity and need not have any

discounting interpretation. Direct capitalization capitalizes earnings by discounting using a cap rate (r-g)

implied by a comparable ratio. There is a direct discounting interpretation. Direct comparison can be used with

stock variables (like dollars per square foot) whereas direct capitalization is really restricted to flow variables

(like earnings, cash flow and dividends).

11. Describe two important motives for having an equity component in employee compensation.

One reason is that the expected deferred and tax-preferred compensation allows the venture to pay a lower

current compensation, thereby lowering the current need for external financing.

A second reason is the substantial impact it can have in motivating employees toward the founders and venture

investors shared goal of a high value for the companys equity.

12. Describe the following terms from the perspective of venture performance: (a) black hole, (b) living dead, and

(c) venture utopia. In what sense is the typical business plan utopian?

A black hole venture is a venture that results in a 100 percent loss to venture investors. A living dead venture is

a venture that provides minimal, if any, returns to venture investors. A venture utopia venture is a venture that

provides phenomenal returns the venture investors.

The typical business plan is utopian because most plans forecast the high end of the possible success spectrum.

In other words, they typically are overly optimistic in their projections.

13.

What is meant by the utopia discount process? Describe how expected PV is calculated.

Utopia discount process: allows the venture investors to value their investment using only the business plans

explicit forecasts.

The PV is calculated by discounting utopian projections at utopian required returns

14. Discuss the type of data and the procedural changes necessary to implement a fivescenario expected PV valuation for a venture investment.

Chapter 10: Venture Capital Valuation Methods

172

To conduct a five scenario expected PV valuation, we would need to start with an idea about what the five

levels of possible success or failure are. To each scenario, we would need to assign a probability (likelihood)

that that scenario would be the outcome. Using a single discount rate for all five scenarios, we would project

and discount the VCFs for each scenario. After multiplying the scenario PV by its likelihood we would sum to

get the expected PV across all five scenarios. Of course, we could just apply the probabilities to each of the

five scenarios periodic VCFs to get an expected cash flow and then discount these amalgamated cash flows by

the single discount rate to arrive at the same value.

15. What is the difference between discounting expected cash flows from multiple scenarios at a constant rate and

averaging the scenarios PVs calculated with that single discount rate?

These are the same when a single fixed discount rate is used and all other assumptions are the same.

16.

From the Headlines -- Excaliard: What ingredients would you need to conduct a VCSC valuation for

Excaliard? Does your calculation suggest that a $15.5 million Series A round is reasonable?

Answers will vary: Typical ingredients in a VCSC valuation are a projection of the series of fundraising rounds

necessary prior to a liquidity/terminal event, the size of that liquidity event and the required return for investors

as it applies to business plan (or altered) projections culminating in that liquidity event. Whether a $15.5

million valuation is justified depends entirely on ones subjective beliefs about the size and timing of the

liquidity event and the current and future required returns necessary to entice the projected funding necessary to

reach the liquidity event.

EXERCISES/PROBLEMS AND ANSWERS

1.

[Discount Rates] Calculate the discount rate consistent with a cap rate of 12% and a growth rate of 6%.

Show how your answer would change if the cap rate dropped to 10 percent while the growth rate declined to 5

percent.

Cap Rate = (r g), so r = Cap Rate + g

r = 12% + 6% = 18%

r = 10% + 5% = 15%

2. [Venture Present Values] A venture investor wants to estimate the value of a venture. The venture is not

expected to produce any free cash flows until the end of year 6 when the cash flow is estimated at $2,000,000

and is expected to grow at a 7 percent annual rate per year into the future.

A. Estimate the terminal value of the venture at the end of year 5 if the discount rate at that time is 20 percent.

$2,000,000/(.20 - .07) = $15,384,615.38

B. Determine the present value of the venture at the end of year 0 if the venture investor wants a 40 percent

annual rate of return on the investment.

$15,384,615.38/1.405 = $2,860,529.72

3. [Venture Capital Valuation Method] A venture capitalist wants to estimate the value of a new venture. The

venture is not expected to produce net income or earnings until the end of year 5 when the net income is

estimated at $1,600,000. A publicly-traded competitor or comparable firm has current earnings of

$1,000,000 and a market capitalization value of $10,000,000.

Chapter 10: Venture Capital Valuation Methods

173

A. Estimate the value of the new venture at the end of year 5. Show your answer using both the direct

comparison method and the direct capitalization method. What assumption are you making when using the

current price-to-earning relationship for the comparable firm?

P/E of comparable firm = $10,000,000/$1,000,000 = 10 times

New Venture Value: $1,600,000 net income times 10 = $16,000,000

Assumptions:

1. The comparable firm is really comparable to the new venture.

2. The current price-to-earning relationship of 10 will still be the appropriate multiple to use 5 years from

now.

B. Estimate the present value of the venture at the end of year 0 if the venture capitalist wants a 40 percent

annual rate of return on the investment.

$16,000,000/1.405 = $2,974,950.91

4. [Multiple Financing Rounds] Ratchets.com anticipates that it will need $15,000,000 in venture capital to

achieve a terminal value of $300,000,000 in five years.

A. Assuming it is a seed stage firm with no existing investors, what annualized return is embedded in their

anticipation?

r = (300,000,000/15,000,000)^(1/5)-1 = 82.0564%

B. Suppose the founder wants to have a venture investor inject $15,000,000 in three r-15-15ounds of

$5,000,000 at time 0, 1 and 2 with time 5 exit value of $300,000,000. If the founder anticipates returns of

70%, 50% and 30% for round 1, 2 and 3, respectively, what percent of ownership is sold during the first

round? During the second round? During the third round? What is the founders year-five ownership

percentage?

First Round FV: 5,000,000 x (1.7)^5 = 70,992,850

Second Round FV: 5,000,000 x (1.5)^4 = 25,312,500

Third Round FV: = 5,000,000 x (1.3)^3 = 10,985,000

Total FV = 107,290,350

First Round % of Total FV = 23.66% = 70,992,850/300,000,000

Second Round % of Total FV = 8.44% = 25,312,500/300,000,000

Third Round % of Total FV = 3.66% = 10,985,000/300,000,000)

Founder final ownership = 1 23.66% - 8.44% - 3.66% = 64.24%

= 192,709,650/300,000,000

C. Assuming the founder will have 10,000 shares, how many shares will be issued in rounds 1, 2 and 3 (at

times 0, 1 and 2)?

Chapter 10: Venture Capital Valuation Methods

174

Founder shares = 10,000

Total shares at year 5: =10,000 / .6424 = 15,567

Round one shares = .2366 x 15,567 = 3684

Round two shares = .0844 x 15,567 = 1313

Round three shares = .0366 x 15,567 = 570

D. What is the second round share price derived from the answers in Parts B and C?

Second Round Price = 5,000,000 / 1313 =3808/share

E. How does the answer to part D change if 10% of the year-five firm is set aside for incentive compensation?

How many total shares are outstanding (including incentive shares) by year 5?

Founder final ownership = 1 -23.66% - 8.44% - 3.66% -10% = 54.24%

Total shares at year 5 = 10,000 / .54.24 = 18,438

Round two shares = .0844 x 18,438 = 1556

Round two price = 5,000,000 / 1556 = 3213/share

5. [Rates of Return] Suppose a venture fund wishes to base its required return (used in discounting future terminal

values) on its historical experience and suggests merely averaging the rates on the last three concluded deals.

These deals realized total returns of 67% at the end of 2 years, 50% at the end of 5 years and 70% at the end

of three years, respectively.

A. Assuming no intermediate flows before the terminal payoff, verify that the associated annualized rates are

42.55%, 8.45% and 19.35%.

2 years: (1-.67)^.5 1 = -42.55%

5 years: (1+.50)^.2 -1 = 8.45%

3 years: (1+.7)^(1/3) -1 = 19.35%

B. What is the equally weighted average annualized return?

(-42.55% + 8.45% +19.35%) / 3 = -4.92%

C. Does it make sense to use this as a single discount rate to apply across scenarios involving different

durations?

The returns have been realized over a total of 10 investment years. However, the simple average here is

only dividing by the three outcomes (not their years). Consequently, it is open for debate whether this

simple project averaging is the best way to calibrate a required return for projects of widely varying known

durations. However, at the time the venture is funded, it is not known what the duration will be and if it is

like a small replication of all of the previous funded ventures, it is reasonable to use the hybrid discount rate

for all of the ventures possible outcomes.

2.

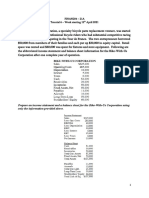

[Multiple Financing Rounds] Rework the two-stage example of section 10.5 with 1,000,000 initial

founders shares (instead of the original 2,000,000 shares). What changes?

Total Shares After Financing

1,000,000

11,851,852.

.084375

Chapter 10: Venture Capital Valuation Methods

175

First Round

Shares Issued .759375 * 11,851,852 9,000,000

Share Price

$1,000,000 / 9,000,000 $.1111 per share

Pre - Money Valuation $.1111 1,000,000 $111,111

Post - Money Valuation $.1111 * 10,000,000 $1,111,111

Founder % Between First and Second Rounds 1,000,000/10,000,000 10%

First Round Investor % Between First and Second Rounds 9,000,000/9,000,000 90%

Second Round

Shares Issued .15625 11,851,852 1,851,852

Share Price

1,000,000 / 1,851,852 $.54 per share

Pre - Money Valuation .54 10,000,000 5,400,000

Post - Money Valuation .54 * 11,851,852 6,400,000

Founder % Between Second Round and Exit 1,000,000/11,851,852 8.4375%

First Round Investor % Betweeen Second Round and Exit 9,000,000/11,851,852 75.9375%

Second Round Investor % Between Second Round and Exit 1,851,852/11,851,852 15.625%

3.

[Multiple Financing Rounds] Rework the two-stage example of section 10.5 with first- and second-round

required returns of 55% and 40% (instead of the original 50% and 25%). Interpret your results as they relate

to the founders ownership and the feasibility of the financing.

I * 1 r

1,000,000 * 1 .40

19.60%

P

10

* E5

* 1,000,000

E

1

T

5

I * 1 r

1,000,000 * 1 .55

First Round Acquired %

89.47%

P

10

* E5

* 1,000,000

E

1

T

Second Round Acquired %

This venture is not financially feasible with these required returns.

4.

[Pre-money and Post-money Valuations] Suppose you are considering a venture conducting a current

financing round involving an issue of 100,000 new shares at $3. The existing number of shares outstanding is

200,000. What are the related pre-money and post-money valuations?

Share price = $3.

Pre-money = Share Price * Pre-money shares = 3 * 200,000 = 600,000

Post-money = Share Price * Post-money shares = 3 * 300,000 = 900,000

Proceeds = Post-money Pre-money = 900,000 600,000 = 300,000 = 3 * 100,000

5.

[Venture Capital Valuation Method] A venture capitalist firm wants to invest $1.5 million in your NYDeli

dot.com venture that you started six months ago. You do not expect to make a profit until year four when your

net income is expected to be $3 million. The common stock of BioSystems, a comparable firm, currently

trades in the over-the-counter market at $30 per share. BioSystems net income for the most recent year was

$300,000 and the firm has 150,000 shares of common stock outstanding.

A. Apply the VC method to determine the value of the NYDeli at the end of four years.

Chapter 10: Venture Capital Valuation Methods

176

Comparables EPS = $300,000 / 150,000 = 2

Comparables P/E = 30/2 = 15

Ventures projected value at year 4 = 15 * 3,000,000 = 45,000,000

B. If VCs want a 40% compound annual rate of return on similar investments, what is the present value of

your NYDeli venture?

45,000,000 / 1.4^4 = 11,713,869

C. What percentage of ownership of the NYDeli dot.com venture will you have to give up to the VC firm for its

$1.5 million investment?

1,500,000 / 11,713,869 = 12.81%

6.

[Present Values and Investor Ownership] Vail Venture Investors, LLC is trying to decide how much percent

equity ownership in Black Hawk Products, Inc. it will need in exchange for a $5 million investment. Vail

Venture Investors has a target compound rate of return of 25 percent on venture investments like Black Hawk

Products. Depending on the success of products currently under development, Vail Ventures investment in

Black Hawk could turn out to be a complete failure (black hole), barely surviving (living dead), or wildly

successful (venture utopia). Vail Venture assigns probabilities of .20, .50, and .30, respectively, to the three

possible outcomes. Following are the 3 cash flow scenarios or outcomes for the Black Hawk Products

investment that Vail Venture expects to exit at the end of five years.

Outcome

Black Hole

Living Dead

Venture Utopia

Yr1

0

0

0

Yr2

0

0

0

Yr3

0

0

0

Yr4

0

0

0

Yr5

$0

$10 million

$50 million

Part A

A. Calculate the present value of each scenario or outcome for Black Hawk Products.

PV of Black Hole

PV of Living Dead

PV of Venture Uptopia

0

$3,276,800

$16,384,000

B. Calculate the weighted average of the present values for the three scenarios. What is the total equity value

for the Black Hawk Products venture?

Weighted Average Present Value

$6,553,600 (just the value multiplied probabilities)

C. Determine the acquired percentage of final ownership of Black Hawk Products that Vail Venture Investors

would need for its $5 million proposed investment.

Amount Invested

Firm Value

Equity percentage

$5,000,000

$6,553,600

76.29%

Chapter 10: Venture Capital Valuation Methods

7.

177

[Internal Rates of Return] Vail Venture Investors, LLC has recently acquired a 40 percent equity ownership

in Black Hawk Products, Inc. in exchange for a $5 million investment. Vail Venture Investors is interested in

estimating an expected compound rate of return on its investment. Depending on the success of products

currently under development, Vail Ventures investment in Black Hawk could turn out to be a complete failure

(black hole), barely surviving (living dead), or wildly successful (venture utopia). Vail Venture has assigned

probabilities of .20, .50, and .30, respectively, to the three possible outcomes. Following are the 3 cash flow

scenarios or outcomes for the Black Hawk Products investment that Vail Venture expects to exit at the end of

five years.

Outcome

Yr1 Yr2 Yr3 Yr4 Yr5

Black Hole

0

0

0

0

$0

Living Dead

0

0

0

0

$10 million

Venture Utopia

0

0

0

0

$50 million

Part A

A. Calculate the internal rate of return (IRR) for each scenario or outcome for Black Hawk Products. (IRR

makes PV=0. PV= -5 + (10x0,4)/(1+i)5, on Excel: TIR)

Black Hole: -100%

Living Dead: -4.36%

Venture Utopia: 31.95%

B. Calculate the weighted average of the IRRs for the three scenarios. What is the expected IRR for the Black

Hawk Products venture?

Weighted average IRR = 0.2*(-100%)+0.5*(-4.36%)+0.3*(31.95%) = -12.6%

C. What would be Vail Venture Investors expected IRR if its $5 million investment in Black Hawk Products

bought only a 35 percent interest in the venture?

Black Hole: -100%

Living Dead: -6.89%

Venture Utopia: 28.47%

Weighted average IRR = .2*(-100%)+0.5*(-6.89%)+.3*(28.47%) = -14.9%

D. Show how your answer in Part C would change if Vail Ventures received a 51 percent ownership stake in

the Black Hawk Products venture for $5 million.

Black Hole: -100%

Living Dead: 0.40%

Venture Utopia: 38.52%

Weighted average IRR = .2*(-100%)+.5*(0.40%)+.3*(38.52%) = -8.24%

MINI CASE: R.K.MAROON COMPANY

R.K. Maroon is a seed-stage web-oriented entertainment company with important intellectual property. RKMs

founders, all technology experts in the relevant area, are anticipating a quick leap to dot-com fortune and believe

Chapter 10: Venture Capital Valuation Methods

178

that their unique intellectual property will allow them to achieve a subsequent (year 3) $100,000,000 venture value

with a one-time initial $2,000,000 in venture financing.

In contrast, similar dot-commers in their niche are currently seeking multistage financing amounting to

$10,000,000 to achieve comparable results. The founders have organized with 1,000,000 shares and are willing to

grant venture investors a 100% return on their business plan projections.

A. What percent of ownership must be sold to grant the 100% three-year return?

2,000,000*(1+100%)^3=16,000,000 (terminal value)

Percent owned by investors = 16,000,000 / 100,000,000 = 16%

B. What is the resulting configuration of share ownership (starting from the 1,000,000 founders shares?

1,000,000 / 0.84 = 1,190,476 total shares (0,84= 1-16%)

190,476 new shares issued to investors

1,000,000 founder shares

C. Suppose the venture investors dont buy the business plan predictions and want to price the deal assuming a

second round in year 2 of $8,000,000 with a 40% return. What changes?

8,000,000*(1.4)^1=11,200,000

Second round investor final ownership = 11,200,000 / 100,000,000 = 11.2%

Founder final ownership = 1 - 0.16 -0.112 = 0.728 (100% - 1st round 2nd round)

Total shares outstanding at exit = 1,000,000 / 0.728 = 1,373,626

Second round shares = 153,846; final ownership = 0.112

First round shares = 219,780 ; final ownership = 219,780 / 1,373,626 = 0.16

Founder shares = 1,000,000; final ownership = 1,000,000 / 1,373,626 = 0.728

D. Suppose the venture investors agree with the founders assessment, price the deal accordingly (as in Part B)

and turn out to be wrong (an additional $8,000,000 at 40% must be injected for the final year).

1. What is the impact on the founders and round one investors final ownership assuming the second round is

funded by outsiders?

Founder shares + First Round Shares = 1,000,000 + 190,476 = 1,190,476

Shares percent owned by Founder + First Round = 1 - 0.112 = 0.888

Total shares at exit = 1,190,476 / 0.888 = 1,340,626

Second Round final ownership = 0.112

First Round final ownership = 190,476 / 1,340,626 = 0.1421

Founder final ownership = 1,000,000 / 1,340,626 = 0.7459

The %s of ownership decrease for everybody, not just the owner, there is a change in the methodology. In part

C the investment that was already forecasted, the only one who looses is the founder (whenever the 2 nd round of

financing is planned ahead). While if it is not planned and it turns out to be wrong, everybody looses.

Whenever the investor makes a mistake, both the funder and the investor loose percentage of control.

2. Compare these to your results for Part C.

First round investors get less shares. Founders retain more percent ownership.

Chapter 10: Venture Capital Valuation Methods

179

3. Who bears the dilution from an anticipated round?

Founders bear the costs of all rounds anticipated by the first round investor.

4. Who bears the dilution from an unanticipated round?

Instead of shifting second round dilution entirely onto the founders, the first round investors failure to

anticipate a second round causes the first round investor to bear some of the dilution costs.

E. Suppose that the deal is priced assuming the second round (as in Part C) and it turns out to be unnecessary.

Comment on the final ownership percentages at exit (year 3). What do you conclude about the impact of

anticipated but unrealized subsequent financing rounds?

When first round investors get a share allocation that protects them from second round dilution, the founders

bear the cost of the first round investors hedging. Consequently, if the second round never arrives, the first

round investors greatly benefit from not bearing the anticipated dilution. While the founders would also not

like to have the second round unless they have to, the deal is not as sweet as it would have been had they been

able to convince the first round investor that a second round would not be needed. First round investors and the

founders have an incentive to enter into a bonus or incentive arrangement for avoiding a second round.

Perhaps this incentive will move the allocation of shares back closer to what t it would have been had the

founders convinced the first round investors that a second round was not needed.

Das könnte Ihnen auch gefallen

- Chap 11 SolutionsDokument6 SeitenChap 11 SolutionsMiftahudin Miftahudin100% (2)

- Chap 10 SolutionsDokument10 SeitenChap 10 SolutionsMiftahudin Miftahudin100% (1)

- Practice ProblemsDokument12 SeitenPractice ProblemsJonathan BohbotNoch keine Bewertungen

- Chap 14 SolutionsDokument10 SeitenChap 14 SolutionsMiftahudin Miftahudin100% (1)

- FINAN204-21A - Tutorial 8 QuestionsDokument4 SeitenFINAN204-21A - Tutorial 8 QuestionsDanae YangNoch keine Bewertungen

- Chap 7 SolutionsDokument8 SeitenChap 7 SolutionsMiftahudin MiftahudinNoch keine Bewertungen

- Harvesting The Business Venture Investment FocusDokument31 SeitenHarvesting The Business Venture Investment FocusMuhammad Qasim A20D047F100% (1)

- Chapter 11 ExerciseDokument5 SeitenChapter 11 ExerciseJoe DicksonNoch keine Bewertungen

- CH 6Dokument16 SeitenCH 6Miftahudin Miftahudin100% (3)

- FINAN204-21A - Tutorial 6 Week 7Dokument10 SeitenFINAN204-21A - Tutorial 6 Week 7Danae YangNoch keine Bewertungen

- Chap 9 Solutions-2Dokument15 SeitenChap 9 Solutions-2Miftahudin Miftahudin100% (1)

- Profitability Index (PI), Also Known As ProfitDokument4 SeitenProfitability Index (PI), Also Known As ProfitParas GadaNoch keine Bewertungen

- Chapter 9-STOCK VALUATION-FIXDokument33 SeitenChapter 9-STOCK VALUATION-FIXRacing FirmanNoch keine Bewertungen

- Chapter 14Dokument1 SeiteChapter 14Rhap SodyNoch keine Bewertungen

- Dividend Discount ModelDokument17 SeitenDividend Discount ModelNirmal ShresthaNoch keine Bewertungen

- Cash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsDokument13 SeitenCash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsRapitse Boitumelo Rapitse0% (1)

- Chap 017Dokument88 SeitenChap 017limed1Noch keine Bewertungen

- Solutions. Chapter. 9Dokument6 SeitenSolutions. Chapter. 9asih359Noch keine Bewertungen

- Case Solutions For Case Studies in Finance 7th Edition by BrunerDokument1 SeiteCase Solutions For Case Studies in Finance 7th Edition by BrunerbhaskkarNoch keine Bewertungen

- Shapiro Chapter 20 SolutionsDokument13 SeitenShapiro Chapter 20 SolutionsRuiting ChenNoch keine Bewertungen

- Chap 009Dokument127 SeitenChap 009limed1100% (1)

- Chapter 7 SolutionsDokument4 SeitenChapter 7 Solutionshassan.murad33% (3)

- EFim 05 Ed 3Dokument23 SeitenEFim 05 Ed 3mahnoor javaidNoch keine Bewertungen

- Chap 007Dokument113 SeitenChap 007limed1100% (1)

- Cost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Dokument7 SeitenCost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Trung NguyenNoch keine Bewertungen

- Ch10 Thomson Answers To QuestionsDokument6 SeitenCh10 Thomson Answers To Questionsgeorgeterekhov100% (1)

- FINAN204-21A - Tutorial 7 Week 10Dokument6 SeitenFINAN204-21A - Tutorial 7 Week 10Danae YangNoch keine Bewertungen

- Mini CaseDokument9 SeitenMini CaseJOBIN VARGHESENoch keine Bewertungen

- CH 4Dokument12 SeitenCH 4Miftahudin Miftahudin0% (1)

- Week 1 ICA - 2019 - Time Value of MoneyDokument2 SeitenWeek 1 ICA - 2019 - Time Value of MoneyMira0% (1)

- Report On Foreign Exchange Practice of ICB Islamic BankDokument122 SeitenReport On Foreign Exchange Practice of ICB Islamic BankMahadi HasanNoch keine Bewertungen

- Types and Costs of Financial Capital: True-False QuestionsDokument8 SeitenTypes and Costs of Financial Capital: True-False Questionsbia070386Noch keine Bewertungen

- Entrepreneurial FinanceDokument2 SeitenEntrepreneurial FinanceO Lupita Díaz García100% (1)

- Unit 3 Strategic ManagementDokument9 SeitenUnit 3 Strategic ManagementKarenJoy KJ Navarro OcampoNoch keine Bewertungen

- Chapter 20 - IPO, Investment Bank, Financial RestructionDokument20 SeitenChapter 20 - IPO, Investment Bank, Financial RestructionFariza SiswantiNoch keine Bewertungen

- Chapter 4-FinanceDokument14 SeitenChapter 4-Financesjenkins66Noch keine Bewertungen

- Chapter 10Dokument42 SeitenChapter 10LBL_LowkeeNoch keine Bewertungen

- Chapter 16Dokument23 SeitenChapter 16JJNoch keine Bewertungen

- BKM Chapter14Dokument5 SeitenBKM Chapter14Vishakha DarbariNoch keine Bewertungen

- Kumpulan Latihan Lab Sesi 12Dokument5 SeitenKumpulan Latihan Lab Sesi 12ultra oilyNoch keine Bewertungen

- Assignment On: Managerial Economics Mid Term and AssignmentDokument14 SeitenAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNoch keine Bewertungen

- Chapter 1 Problems Working PapersDokument5 SeitenChapter 1 Problems Working PapersZachLovingNoch keine Bewertungen

- Chap 014Dokument87 SeitenChap 014limed1100% (1)

- Answers To Practice Questions: How Much Should A Firm Borrow?Dokument8 SeitenAnswers To Practice Questions: How Much Should A Firm Borrow?Cecilia MontessoroNoch keine Bewertungen

- HorngrenIMA14eSM ch13Dokument73 SeitenHorngrenIMA14eSM ch13Piyal Hossain100% (1)

- Chap 016Dokument77 SeitenChap 016limed1100% (1)

- Chap 021Dokument41 SeitenChap 021saud1411Noch keine Bewertungen

- Capital BudgetingDokument25 SeitenCapital Budgetingaramsiva100% (1)

- Solution Manual CH 12 Multinational Financial ManagementDokument1 SeiteSolution Manual CH 12 Multinational Financial Managementariftanur0% (1)

- B7110-001 Financial Statement Analysis and Valuation PDFDokument3 SeitenB7110-001 Financial Statement Analysis and Valuation PDFLittleBlondie0% (2)

- Valuation Models: Aswath DamodaranDokument47 SeitenValuation Models: Aswath DamodaranSumit Kumar BundelaNoch keine Bewertungen

- Actividad 8 en ClaseDokument2 SeitenActividad 8 en Claseluz_ma_6Noch keine Bewertungen

- Multiple Choice at The End of LectureDokument6 SeitenMultiple Choice at The End of LectureOriana LiNoch keine Bewertungen

- Assignment 3Dokument3 SeitenAssignment 3低調用戶929Noch keine Bewertungen

- 02 Present Value and The Opportunity Cost of CapitalDokument10 Seiten02 Present Value and The Opportunity Cost of Capitalddrechsler9Noch keine Bewertungen

- Entrepreneurial Finance 5th Edition Leach Solutions ManualDokument26 SeitenEntrepreneurial Finance 5th Edition Leach Solutions Manualherbistazarole5fuyh6100% (17)

- The Venture Capital MethodDokument3 SeitenThe Venture Capital Methodsidthefreak809100% (1)

- Finance - Cost of Capital TheoryDokument30 SeitenFinance - Cost of Capital TheoryShafkat RezaNoch keine Bewertungen

- Investment Appraisal LectureDokument19 SeitenInvestment Appraisal Lectureviettuan91Noch keine Bewertungen

- UNIT-4 Capital BudgetingDokument36 SeitenUNIT-4 Capital BudgetingSupriyaSehgalNoch keine Bewertungen

- NFJPIA - Mockboard 2011 - P2 PDFDokument6 SeitenNFJPIA - Mockboard 2011 - P2 PDFSteven Mark MananguNoch keine Bewertungen

- Financial ManagementDokument14 SeitenFinancial ManagementsangeethamadanNoch keine Bewertungen

- 14 Important Steps Taken by SEBI For Regulating Mutual Funds in IndiaDokument3 Seiten14 Important Steps Taken by SEBI For Regulating Mutual Funds in IndiaBasappaSarkar0% (1)

- Project On Technical AnalysisDokument32 SeitenProject On Technical AnalysisShubham BhatiaNoch keine Bewertungen

- Freeport-McMoRan Annual Report 2018Dokument136 SeitenFreeport-McMoRan Annual Report 2018kennygNoch keine Bewertungen

- DELL Well Fargo Segment Data PDFDokument52 SeitenDELL Well Fargo Segment Data PDFAnonymous 45z6m4eE7pNoch keine Bewertungen

- A Study On Role of Gold Portfolio AllocationDokument6 SeitenA Study On Role of Gold Portfolio AllocationNITINNoch keine Bewertungen

- ADR/GDRDokument10 SeitenADR/GDRKopal TandonNoch keine Bewertungen

- Goldman Sachs Report by Richard BoveDokument3 SeitenGoldman Sachs Report by Richard BoveDealBookNoch keine Bewertungen

- Business2018 10 24810245Dokument12 SeitenBusiness2018 10 24810245Dedy MuhajirNoch keine Bewertungen

- 1 1 The Forex Market PDFDokument5 Seiten1 1 The Forex Market PDFMan ZealNoch keine Bewertungen

- December 2003 ACCA Paper 2.5 QuestionsDokument10 SeitenDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- Eastboro Case SolutionDokument22 SeitenEastboro Case Solutionuddindjm100% (2)

- Bus Combination 2Dokument8 SeitenBus Combination 2Angelica AllanicNoch keine Bewertungen

- 726 Various Hedge Fund LettersDokument13 Seiten726 Various Hedge Fund Lettersapi-3733080100% (3)

- Assignment On Financial Analysis of Tata MotorsDokument35 SeitenAssignment On Financial Analysis of Tata MotorsGovind N VNoch keine Bewertungen

- The Value Relevance and Reliability of Intangible Assets Evidence From Australia Before and After Adopting IFRSDokument36 SeitenThe Value Relevance and Reliability of Intangible Assets Evidence From Australia Before and After Adopting IFRSAna ElbrachtNoch keine Bewertungen

- Ratio Analysis of TafeDokument56 SeitenRatio Analysis of TafeGourav AoliyaNoch keine Bewertungen

- Examples of Inherent RiskDokument6 SeitenExamples of Inherent Riskselozok1Noch keine Bewertungen

- Blaine Kitchenware IncDokument4 SeitenBlaine Kitchenware IncChrisNoch keine Bewertungen

- Francisco Ibasco CVDokument1 SeiteFrancisco Ibasco CVfranciscoibascoNoch keine Bewertungen

- Mutual Fund Review: Equity MarketDokument15 SeitenMutual Fund Review: Equity MarketHariprasad ManchiNoch keine Bewertungen

- Gold Exchange Traded Funds Global ScenarioDokument14 SeitenGold Exchange Traded Funds Global ScenarioarcherselevatorsNoch keine Bewertungen

- Nitin BhatiaDokument132 SeitenNitin BhatiaKailash Chandra PradhanNoch keine Bewertungen

- 14 Chapter 4Dokument29 Seiten14 Chapter 4Abhijeet Arvind KatkarNoch keine Bewertungen

- Advanced Financial Statement AnalysisDokument5 SeitenAdvanced Financial Statement AnalysisGhazanfar AbbasNoch keine Bewertungen

- Kanwal Parveen (7207 (Submitted To: Sharique Ayubi Submitted On: 7 of April 2008 Course:Financial InstitutionsDokument28 SeitenKanwal Parveen (7207 (Submitted To: Sharique Ayubi Submitted On: 7 of April 2008 Course:Financial Institutionsfakhar11Noch keine Bewertungen

- TDI Pro User ManualDokument36 SeitenTDI Pro User ManualMichael Mario80% (5)

- Internship Report TemplateDokument2 SeitenInternship Report TemplateBilal FakharNoch keine Bewertungen