Beruflich Dokumente

Kultur Dokumente

HDFC Life Click 2 Invest - Ulip - GJ - Illustration

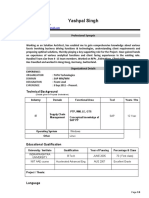

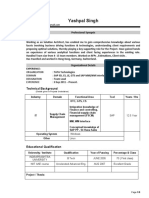

Hochgeladen von

Yashpal SinghOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HDFC Life Click 2 Invest - Ulip - GJ - Illustration

Hochgeladen von

Yashpal SinghCopyright:

Verfügbare Formate

13-Dec-15 14.10.

39

This is the official illustration issued by HDFC Standard Life Insurance Company Limited.

Illustration of any other type is not supported by the company.

Illustration for HDFC Life Click 2 Invest - ULIP (UIN: 101L0100V01)

On 13 December 2015

PERSONAL DETAILS

Name

Age

Gender

gj

32

Life 1

Age is taken as on last birthday

POLICY DETAILS

Date of Policy Commencement:

13-Dec-2015

Policy Term in Year(s):

10

10

Premium Paying Term in Year(s):

Premium Frequency:

Annual

PREMIUM AND BENEFIT DETAILS

Benefit Name

Sum Assured

(in Rs.)

Main Benefit

Benefit Term

(years)

10,00,000

Premium

(in Rs.)

Premium Paying

Term (years)

10

1,00,000

10

Total Premium payable per Frequency:

Next premium Due Date

1,00,000

13-Dec-2016

ILLUSTRATION OF FUTURE BENEFITS

This illustration has been produced by HDFC Standard Life Insurance Company Limited to help you understand the benefits of your HDFC Life Click 2 Invest - ULIP.

These illustrations must be read in conjunction with the sales literature, which describes the features of this product.

The values shown are for illustration only. What you actually receive will depend on what happens over the future lifetime of your policy, particularly investment

returns.The Illustration shows what you could get back using two assumed rates of investment return. These rates have been specified by the Life Insurance Council.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. If your policy offers

guaranteed returns then these will be clearly marked "guaranteed" in the illustration table on this page.

If your policy offers variable returns then the illustrations on this page will show two different rates of assumed investment returns. These assumed rates of return are not

guaranteed and they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment

performance.

Whilst future investment returns would significantly influence policy benefits, other factors such as charges and taxes also have an impact on your benefits.

Guaranteed benefits are available provided all premiums are paid, when they are due. The illustrative benefits below assume that all premiums that are due have been

paid. All amounts are in Indian Rupees.

Illustrative Benefits on Maturity

On the survival of the Life Assured until the Maturity date, the illustrative Maturity benefits are as shown below.

Guaranteed Benefits

Date of Maturity

Click 2 Invest

13-Dec-2025

Non-Guaranteed Benefit

Total Maturity Benefit

Assumed Investment Return

Assumed Investment Return

4% p.a.

11,35,117

8% p.a.

14,16,100

4% p.a.

11,35,117

8% p.a.

14,16,100

Upon this payment, the policy terminates and no further benefit becomes payable.

IN THIS POLICY, THE INVESTMENT RISK IS BORNE BY THE POLICYHOLDER AND THE ABOVE INTEREST RATES ARE ONLY FOR ILLUSTRATION

PURPOSE.

13-Dec-15 14.10.39

Gross Yield

Projected Statement of Premiums, Charges and Fund Value based on Assumed Investment Return of 8% p.a.

(01)

(02)

(03)

(04)

(05)

(06)

(07)

Risk

Policy Annualise Top-up Premium Amount

Allocation available for Charge

d

Year

Charge

Investment

Premium

(08)

Policy

Administrati

on

Charge

FMC

(09)

(10)

(11)

Investment Taxes as

Total

Guarantee applicable* Charges

charge

(12)

Fund

Value

(end of

year)

(13)

(14)

Additio Surrender

Benefit

n

(end of

to Fund

year)

8%

6.55%

Net Yield

(15)

(16)

(17)

Guarantee

d

Death

Benefit

Total

Death

Benefit

Commissi

on

1,00,000

1,00,000

1,005

1,388

347

2,740

1,05,154

1,05,154

10,00,000

10,00,000

1,00,000

1,00,000

919

2,858

548

4,324

2,17,080

2,17,080

10,00,000

10,00,000

1,00,000

1,00,000

821

4,422

760

6,004

3,36,221

3,36,221

10,00,000

10,00,000

1,00,000

1,00,000

707

6,088

985

7,780

4,63,054

4,63,054

10,00,000

10,00,000

1,00,000

1,00,000

572

7,861

1,223

9,655

5,98,093

5,98,093

10,00,000

10,00,000

1,00,000

1,00,000

408

9,749

1,473

11,629

7,41,891

7,41,891

10,00,000

10,00,000

1,00,000

1,00,000

208

11,759

1,735

13,702

8,95,048

8,95,048

10,00,000

10,00,000

1,00,000

1,00,000

13,901

2,016

15,917

10,58,166

10,58,166

10,00,000

10,58,166

1,00,000

1,00,000

16,179

2,346

18,525

12,31,631

12,31,631

10,00,000

12,31,631

10

1,00,000

1,00,000

18,603

2,697

21,300

14,16,100

14,16,100

10,50,000

14,16,100

* General Sales Tax (GST) in case of Jammu and Kashmir and Taxes include service tax and Swachh Bharat Cess as applicable in all other cases.

Projected Statement of Premiums, Charges and Fund Value based on Assumed Investment Return of 4% p.a.

(01)

(02)

(03)

(05)

(04)

Top-up Premium Amount

Policy Annualise

Allocation available

d

Year

Charge

for

Premium

Investment

(06)

(07)

(08)

Risk

Policy

Charge Administrati

on

Charge

FMC

(09)

(10)

(11)

Investment Taxes as

Total

Guarantee applicable* Charges

charge

(12)

Fund

Value

(end of

year)

(13)

(14)

(15)

(16)

(17)

Addition

to Fund

Surrender

Benefit

(end of

year)

Guarantee

d

Death

Benefit

Total

Death

Benefit

Commis

sion

1,00,000

1,00,000

1,007

1,360

343

2,710

1,01,237

1,01,237

10,00,000

10,00,000

1,00,000

1,00,000

927

2,746

533

4,206

2,05,001

2,05,001

10,00,000

10,00,000

1,00,000

1,00,000

843

4,167

726

5,736

3,11,357

3,11,357

10,00,000

10,00,000

1,00,000

1,00,000

749

5,623

924

7,297

4,20,380

4,20,380

10,00,000

10,00,000

1,00,000

1,00,000

644

7,116

1,125

8,885

5,32,146

5,32,146

10,00,000

10,00,000

1,00,000

1,00,000

522

8,647

1,330

10,499

6,46,741

6,46,741

10,00,000

10,00,000

1,00,000

1,00,000

380

10,216

1,536

12,133

7,64,256

7,64,256

10,00,000

10,00,000

1,00,000

1,00,000

211

11,826

1,745

13,782

8,84,794

8,84,794

10,00,000

10,00,000

1,00,000

1,00,000

10

13,477

1,956

15,443

10,08,463

10,08,463

10,00,000

10,08,463

10

1,00,000

1,00,000

15,170

2,200

17,369

11,35,117

11,35,117

10,50,000

11,35,117

* General Sales Tax (GST) in case of Jammu and Kashmir and Taxes include service tax and Swachh Bharat Cess as applicable in all other cases.

13-Dec-15 14.10.39

Description of Charges

This illustration is based on the following charges:

Premium Allocation Charge

This is a premium-based charge (which may vary by product, policy year, premium size, premium frequency and premium payment method). After deducting this charge

from your premiums, the remainder is invested to buy units. Please read Sales Literature for more details.

Fund Management Charge (FMC)

This is a charge levied as a percentage of the value of assets and deducted at the time of computation of daily unit prices. In the long term, the key to building great

maturity values is a low FMC.The Fund Management Charge is the same across all the fund options.

Policy Administration Charge

This charge is levied to cover regular administration costs. This charge may vary by product & premium size. Please read Sales Literature for more details.

Risk Charge

This is a charge levied monthly to cover the cost of providing you with the Death Benefit, Extra Health Benefit, Extra Life Benefit, Extra Disability Benefit and any other

Morbidity Benefits, if applicable, on your policy. The amount of the charge taken each month is based on the benefits insured and your age.

Service tax and Swachh Bharat Cess

The Government of India levies a Taxes include service tax and Swachh Bharat Cess as applicable in all other cases. on the amount of any charges deducted from your

policy. We collect this tax along with the charges. The tax rates and its applicability will be as notified by the Government from

NOTES:

1. The Sum Assured stated above is based on the information provided and may vary as a result of underwriting.

2. Please read the sales literature provided.

3. Any statutory levy or charges (Taxes include service tax and Swachh Bharat Cess as applicable) including any indirect tax may be charged to the Policyholder either

now or in future by the Company and such amount so charged shall become due and payable and shall be subject to the same terms and conditions as applicable to

payment of premium.

4. The benefits illustrated assume that all premiums that are due over the premium paying term will be paid and no withdrawals will be made during the policy term. In

case premiums are notpaid for the premium paying term at the original level or withdrawals are made during the policy term, the illustrative benefits will differ.

5. This contract is designed for long term savings and is not designed for short term investment. Should you need to surrender your policy in the short term, any

surrender benefits may be less than the premium(s) you have paid.

6. A policy may be surrendered at any time in the first five years of the policy but the amount payable on surrender will be paid out only on completion of five policy

years, subject to prevailing regulations.

7. In case you do not pay premiums for the full premium paying term, your policy will be discontinued or will become paid-up depending on the premiums paid

previously. Please read the sales literature for more details.

8. There is no commission payable as the illustration has been generated on the basis that this proposal would be sourced through Direct Sales.

9. "Premium Allocation Charge Rates" and "Risk Benefit Charge Rates", if applicable, are guaranteed for the lifetime of the policy. All other charges may be altered

during the lifetime of the policy with prior approval from the regulator.

10. Clawback Additions would be payable at the point of exit after the completion of five years, if and only if, it is required to meet the reduction in yield requirements

prescribed by the regulations. Exit would mean exit by way of death, surrender or maturity whichever is earliest.

I, ......................................................................................., having received the information with respect to the above, have understood the inbuilt features of the policy,

the applicable charges and the investment risks under the policy, before entering into the contract.

Policyholder's Signature:

Date:

Place:

Marketing Official's Signature:

Companys Seal:

Channel Name : Direct - Online

13-Dec-15 14.10.39

Das könnte Ihnen auch gefallen

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingVon EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNoch keine Bewertungen

- The Futures Game: Who Wins, Who Loses, and WhyDokument17 SeitenThe Futures Game: Who Wins, Who Loses, and WhySergio Pereira0% (1)

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Von EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Noch keine Bewertungen

- EWM Table ReferenceDokument20 SeitenEWM Table ReferenceRakesh RaiNoch keine Bewertungen

- B SDokument36 SeitenB SkeithguruNoch keine Bewertungen

- Mr. Yashpal Singh (Adult, Male) : Travel Date Flight No. From/Terminal To/Terminal Dep - Time Arr - Time AirlineDokument2 SeitenMr. Yashpal Singh (Adult, Male) : Travel Date Flight No. From/Terminal To/Terminal Dep - Time Arr - Time AirlineYashpal SinghNoch keine Bewertungen

- 0 - Parikshit SAP MM Resume - PDFDokument3 Seiten0 - Parikshit SAP MM Resume - PDFYashpal SinghNoch keine Bewertungen

- JuanDelaCruz AxeleratorDokument8 SeitenJuanDelaCruz AxeleratorOmar Jayson Siao VallejeraNoch keine Bewertungen

- Pindyck Solutions Chapter 5Dokument13 SeitenPindyck Solutions Chapter 5Ashok Patsamatla100% (1)

- Causation in CrimeDokument15 SeitenCausation in CrimeMuhammad Dilshad Ahmed Ansari0% (1)

- Project Manager SAP GRC AnalyticsDokument10 SeitenProject Manager SAP GRC AnalyticsYashpal SinghNoch keine Bewertungen

- Eep306 Assessment 1 FeedbackDokument2 SeitenEep306 Assessment 1 Feedbackapi-354631612Noch keine Bewertungen

- JAR23 Amendment 3Dokument6 SeitenJAR23 Amendment 3SwiftTGSolutionsNoch keine Bewertungen

- IllustrationDokument3 SeitenIllustrationDevender Singh RautelaNoch keine Bewertungen

- HDFC Life Sanchay(Spl) Policy IllustrationDokument2 SeitenHDFC Life Sanchay(Spl) Policy IllustrationAnkur Mittal100% (1)

- HDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationDokument0 SeitenHDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationAakash MazumderNoch keine Bewertungen

- Vidya DharDokument2 SeitenVidya DharKatie PerryNoch keine Bewertungen

- HDFC Life Super Savings Plan (SPL) IllustrationDokument2 SeitenHDFC Life Super Savings Plan (SPL) IllustrationBrandon WarrenNoch keine Bewertungen

- Illustration of GSIPDokument3 SeitenIllustration of GSIPAjinkya ChalkeNoch keine Bewertungen

- ICICI Benefit IllustrationDokument4 SeitenICICI Benefit Illustrationudupiganesh3069Noch keine Bewertungen

- ENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueDokument3 SeitenENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueGBKNoch keine Bewertungen

- Lakshya Plus v1Dokument10 SeitenLakshya Plus v1Mahadevan VenkatesanNoch keine Bewertungen

- HDFC SL CrestDokument4 SeitenHDFC SL CrestPreetinder Singh BrarNoch keine Bewertungen

- Whole Life Surance Savings Plan 116414681443669413Dokument2 SeitenWhole Life Surance Savings Plan 116414681443669413msneha1Noch keine Bewertungen

- ICICI Pru Assure WealthDokument2 SeitenICICI Pru Assure WealthPavan Kumar RanguduNoch keine Bewertungen

- HDFC LifeDokument1 SeiteHDFC LifefacebookorkutNoch keine Bewertungen

- ICICI Pru LifeTime Super: A regular premium unit-linked planDokument3 SeitenICICI Pru LifeTime Super: A regular premium unit-linked planmniarunNoch keine Bewertungen

- IllustrationForm S000000502723Dokument1 SeiteIllustrationForm S000000502723anand_guruwarNoch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument1 SeiteIllustration For Your HDFC Life Click 2 Protect Plus0001212vivekchauhanNoch keine Bewertungen

- Variable Life Insurance Proposal: 0PROP.07.4Dokument4 SeitenVariable Life Insurance Proposal: 0PROP.07.4Ahmad Israfil PiliNoch keine Bewertungen

- HDFC Life ProGrowth Plus IllustrationDokument3 SeitenHDFC Life ProGrowth Plus IllustrationBullish Guy100% (1)

- MONEY BACK PLAN - (Table No. 75) Benefit IllustrationDokument4 SeitenMONEY BACK PLAN - (Table No. 75) Benefit IllustrationVinayak DhotreNoch keine Bewertungen

- Illustration RapDokument1 SeiteIllustration RapShub KumarNoch keine Bewertungen

- SWG Child Wealth BrochureDokument22 SeitenSWG Child Wealth BrochureBalajiNoch keine Bewertungen

- Illustration PDFDokument0 SeitenIllustration PDFbpshuNoch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument1 SeiteIllustration For Your HDFC Life Click 2 Protect PlusBalachandar SathananthanNoch keine Bewertungen

- PrudentialDokument5 SeitenPrudentialManish RaiNoch keine Bewertungen

- Unit Linked Insurance PlanDokument5 SeitenUnit Linked Insurance Planagarwal13Noch keine Bewertungen

- Illustration PDFDokument3 SeitenIllustration PDFrahulNoch keine Bewertungen

- Met Smart Plus BrochureDokument5 SeitenMet Smart Plus BrochurenivasiNoch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument2 SeitenIllustration For Your HDFC Life Click 2 Protect Plus0001212vivekchauhanNoch keine Bewertungen

- Gsip For 15 YrsDokument3 SeitenGsip For 15 YrsJoni SanchezNoch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument1 SeiteIllustration For Your HDFC Life Click 2 Protect PlusKiran MesaNoch keine Bewertungen

- Reliance's Guaranteed Money Back PlanDokument2 SeitenReliance's Guaranteed Money Back PlantrskaranNoch keine Bewertungen

- Tata AIA Life Diamond Savings PlanDokument4 SeitenTata AIA Life Diamond Savings Plansree db2Noch keine Bewertungen

- Fulfil dreams with HDFC Life Super Income PlanDokument8 SeitenFulfil dreams with HDFC Life Super Income PlanSajeed ShaikhNoch keine Bewertungen

- MM AssignmentDokument16 SeitenMM AssignmentRahul ParasharNoch keine Bewertungen

- IDBI Federal Lifesurance Savings Insurance PlanDokument16 SeitenIDBI Federal Lifesurance Savings Insurance PlanKumarniksNoch keine Bewertungen

- Future Benefits and Charges DetailsDokument0 SeitenFuture Benefits and Charges DetailsAnkur MittalNoch keine Bewertungen

- HDFC Life Super Income Plan SHAREDokument6 SeitenHDFC Life Super Income Plan SHARESandeep MookerjeeNoch keine Bewertungen

- Reating Lif: Child Protection Money Back PlanDokument2 SeitenReating Lif: Child Protection Money Back PlanSanjay Ku AgrawalNoch keine Bewertungen

- ICICI Pru Signature plan investment and maturity benefitsDokument6 SeitenICICI Pru Signature plan investment and maturity benefitsSneha Abhash SinghNoch keine Bewertungen

- Bhagyalakshmi Sales Brochure W 4 5in X H 8in SPDokument8 SeitenBhagyalakshmi Sales Brochure W 4 5in X H 8in SPMexico EnglishNoch keine Bewertungen

- Jeevan VriddhiDokument4 SeitenJeevan VriddhihemukariaNoch keine Bewertungen

- Life Gain Premier BrochureDokument12 SeitenLife Gain Premier BrochureNeeralNoch keine Bewertungen

- HDFC Life ProGrowth Plus IllustrationDokument3 SeitenHDFC Life ProGrowth Plus IllustrationSrikanth DornaluNoch keine Bewertungen

- Ko Tak Assured in Come PlanDokument12 SeitenKo Tak Assured in Come Planbvvrao787669Noch keine Bewertungen

- Learn More About Your Participating PolicyDokument6 SeitenLearn More About Your Participating PolicyJessamine LeeNoch keine Bewertungen

- HLA Income Builder GuideDokument3 SeitenHLA Income Builder GuideFarrahAbdullahNoch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument1 SeiteIllustration For Your HDFC Life Click 2 Protect Plusudupiganesh3069Noch keine Bewertungen

- IDBI Federal Incomesurance Plan BenefitsDokument3 SeitenIDBI Federal Incomesurance Plan BenefitsVipul KhandelwalNoch keine Bewertungen

- Receive Payouts Once Every 5 YearsDokument6 SeitenReceive Payouts Once Every 5 YearsSheetal IyerNoch keine Bewertungen

- Wealth GainDokument9 SeitenWealth GainSandeep Varma SagiNoch keine Bewertungen

- LIC's New Endowment Plan AnalysisDokument6 SeitenLIC's New Endowment Plan AnalysisVikrant SinghNoch keine Bewertungen

- Variable Life Insurance Proposal AnalysisDokument4 SeitenVariable Life Insurance Proposal AnalysisJudy DetangcoNoch keine Bewertungen

- PLAN FOR LIFE GOALS WITH ZERO WORRIESDokument21 SeitenPLAN FOR LIFE GOALS WITH ZERO WORRIESshanmugamNoch keine Bewertungen

- Aviva Life Shield Plus1Dokument8 SeitenAviva Life Shield Plus1Anoop NimkandeNoch keine Bewertungen

- Lifetime Super Pension: Benefits in DetailDokument4 SeitenLifetime Super Pension: Benefits in DetailSathish KumarNoch keine Bewertungen

- Exide Life Secured Income Insurance RPDokument10 SeitenExide Life Secured Income Insurance RPrahul sarmaNoch keine Bewertungen

- Practical Guide To SAP GTS: Preference and Customs ManagementDokument12 SeitenPractical Guide To SAP GTS: Preference and Customs Managementiqbal1439988Noch keine Bewertungen

- Gts Batch 14.03.2020Dokument1 SeiteGts Batch 14.03.2020Yashpal SinghNoch keine Bewertungen

- SAP Requirement Type Determination in Sales OrdersDokument1 SeiteSAP Requirement Type Determination in Sales OrdersAbhay parhiNoch keine Bewertungen

- Glassdoor Resume Yashpal ProfileDokument8 SeitenGlassdoor Resume Yashpal ProfileYashpal SinghNoch keine Bewertungen

- Comp Appraisal Form ExemptDokument7 SeitenComp Appraisal Form ExemptMiriam Alvarez ZárateNoch keine Bewertungen

- Krypt GTS Consultant Yashpal SinghDokument8 SeitenKrypt GTS Consultant Yashpal SinghYashpal Singh100% (2)

- Yashpal Profile SD GTSDokument9 SeitenYashpal Profile SD GTSYashpal SinghNoch keine Bewertungen

- SAP SD Syllabus: - Enterprise Structure (With Configuration & Assignment)Dokument6 SeitenSAP SD Syllabus: - Enterprise Structure (With Configuration & Assignment)MaddyNoch keine Bewertungen

- Yashpal Profile SAP MM WM FDokument9 SeitenYashpal Profile SAP MM WM FYashpal SinghNoch keine Bewertungen

- Fit Gap Questions - Nordics - MadhuriDokument6 SeitenFit Gap Questions - Nordics - MadhuriYashpal SinghNoch keine Bewertungen

- Yashpal Profile May 2020 EWM TMDokument8 SeitenYashpal Profile May 2020 EWM TMYashpal SinghNoch keine Bewertungen

- Yashpal Singh's Professional Synopsis and ProjectsDokument9 SeitenYashpal Singh's Professional Synopsis and ProjectsYashpal SinghNoch keine Bewertungen

- Yashpal Singh's SAP GTS and Supply Chain ExperienceDokument11 SeitenYashpal Singh's SAP GTS and Supply Chain ExperienceYashpal SinghNoch keine Bewertungen

- GTS Consultant - Yashpal SinghDokument9 SeitenGTS Consultant - Yashpal SinghYashpal SinghNoch keine Bewertungen

- SAP Production Planning SyllabusDokument2 SeitenSAP Production Planning SyllabusYashpal SinghNoch keine Bewertungen

- Resume Experience SummaryDokument7 SeitenResume Experience SummaryYashpal SinghNoch keine Bewertungen

- Yashpal Singh 01 Apr 2020 Tata Technologies LTD MEMBER8051Dokument1 SeiteYashpal Singh 01 Apr 2020 Tata Technologies LTD MEMBER8051Yashpal SinghNoch keine Bewertungen

- SAP QM SyllabusDokument1 SeiteSAP QM SyllabusYashpal SinghNoch keine Bewertungen

- Category: Master Appraisal FormDokument1 SeiteCategory: Master Appraisal FormPDLNoch keine Bewertungen

- Anup CV ManagerDokument3 SeitenAnup CV ManagerYashpal SinghNoch keine Bewertungen

- Anup CV ManagerDokument3 SeitenAnup CV ManagerYashpal SinghNoch keine Bewertungen

- DttaDokument1 SeiteDttaYashpal SinghNoch keine Bewertungen

- VivekKumar ABAP Mumbai - April19Dokument5 SeitenVivekKumar ABAP Mumbai - April19Yashpal SinghNoch keine Bewertungen

- Required DetailsDokument1 SeiteRequired DetailsYashpal SinghNoch keine Bewertungen

- SAP SD SyllabusDokument3 SeitenSAP SD SyllabusYashpal SinghNoch keine Bewertungen

- NAME: Abhijeet Patil 9833721120: Name Module / Modules Designation/Grade Country ExperienceDokument3 SeitenNAME: Abhijeet Patil 9833721120: Name Module / Modules Designation/Grade Country ExperienceYashpal SinghNoch keine Bewertungen

- Vivarium - Vol 37, Nos. 1-2, 1999Dokument306 SeitenVivarium - Vol 37, Nos. 1-2, 1999Manticora VenerabilisNoch keine Bewertungen

- Lesson 2 The Chinese AlphabetDokument12 SeitenLesson 2 The Chinese AlphabetJayrold Balageo MadarangNoch keine Bewertungen

- Language Teacher Educator IdentityDokument92 SeitenLanguage Teacher Educator IdentityEricka RodriguesNoch keine Bewertungen

- Department of Education: Sergia Soriano Esteban Integrated School IiDokument2 SeitenDepartment of Education: Sergia Soriano Esteban Integrated School IiIan Santos B. SalinasNoch keine Bewertungen

- Action Plan for Integrated Waste Management in SaharanpurDokument5 SeitenAction Plan for Integrated Waste Management in SaharanpuramitNoch keine Bewertungen

- Christ The Redemers Secondary SchoolDokument36 SeitenChrist The Redemers Secondary Schoolisrael_tmjesNoch keine Bewertungen

- SH-3 Sea King - History Wars Weapons PDFDokument2 SeitenSH-3 Sea King - History Wars Weapons PDFchelcarNoch keine Bewertungen

- Sana Engineering CollegeDokument2 SeitenSana Engineering CollegeandhracollegesNoch keine Bewertungen

- Winny Chepwogen CVDokument16 SeitenWinny Chepwogen CVjeff liwaliNoch keine Bewertungen

- Emanel Et - Al Informed Consent Form EnglishDokument6 SeitenEmanel Et - Al Informed Consent Form English4w5jpvb9jhNoch keine Bewertungen

- Chap1 HRM581 Oct Feb 2023Dokument20 SeitenChap1 HRM581 Oct Feb 2023liana bahaNoch keine Bewertungen

- True or FalseDokument3 SeitenTrue or FalseRB AbacaNoch keine Bewertungen

- RIZAL Childhood ScriptDokument3 SeitenRIZAL Childhood ScriptCarla Pauline Venturina Guinid100% (2)

- 1) Anuj Garg Vs Hotel Association of India: Article 15Dokument26 Seiten1) Anuj Garg Vs Hotel Association of India: Article 15UriahNoch keine Bewertungen

- Place of Provision of Services RulesDokument4 SeitenPlace of Provision of Services RulesParth UpadhyayNoch keine Bewertungen

- Pub. 127 East Coast of Australia and New Zealand 10ed 2010Dokument323 SeitenPub. 127 East Coast of Australia and New Zealand 10ed 2010joop12Noch keine Bewertungen

- Olsson Jah ResilienceDokument12 SeitenOlsson Jah ResilienceANA ZABRINA PERDOMO MERLOSNoch keine Bewertungen

- Account statement for Rinku MeherDokument24 SeitenAccount statement for Rinku MeherRinku MeherNoch keine Bewertungen

- Lecture 1 - Introduction - A2LDokument40 SeitenLecture 1 - Introduction - A2LkhawalmannNoch keine Bewertungen

- Human Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksDokument25 SeitenHuman Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksExtreme TronersNoch keine Bewertungen

- Customer Based Brand EquityDokument13 SeitenCustomer Based Brand EquityZeeshan BakshiNoch keine Bewertungen

- ALDI Growth Announcment FINAL 2.8Dokument2 SeitenALDI Growth Announcment FINAL 2.8Shengulovski IvanNoch keine Bewertungen

- Ncaa Financial Report Fy19 AlcornDokument79 SeitenNcaa Financial Report Fy19 AlcornMatt BrownNoch keine Bewertungen

- Mixed 14Dokument2 SeitenMixed 14Rafi AzamNoch keine Bewertungen