Beruflich Dokumente

Kultur Dokumente

Securities Valuation and Hybrid Financing

Hochgeladen von

Michelle de GuzmanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Securities Valuation and Hybrid Financing

Hochgeladen von

Michelle de GuzmanCopyright:

Verfügbare Formate

FINANCIAL MANAGEMENT PART 2

JRM

RN 11.26.2013

SOURCES OF FINANCING AND HYBRID FINANCING WITH VALUATION ISSUES

CONTENT CAPSULE:

Debt financing

Equity financing

Hybrid financing: Preference shares, leasing, options, warrants, and convertibles

Introduction

Based on the module on financial forecasting, in order to support an increase in assets, we can either resort to internal

financing or external financing. Let us look once more at the formula which we adapted to compute how much more a

company must raise by issuing debt or new stocks for any increase in assets or investments.

EFN =

Assets

Sales

x Sales (P)

Spontaneous Liabilities

Sales

x Sales (P)

PM

x Projected Sales

x (1- d)

Projected Increase in Retained Earnings

OR

Projected Increase in Assets

Projected Increase in Spontaneous Liabilities

Projected Net Income multiplied by

Retention Ratio

Where:

Sales (P)

Spontaneous Liabilities

PM

d

= Projected Change in Sales (Peso value)

= Liabilities that naturally move up and down with sales

= Profit Margin

= Dividend Payout ratio

In this module, the increase in assets will be deemed a response to a proposal to invest and not only a change to support

operation demands. At the same time, the focus will be on external financing and hybrid financing.

ASSETS

ASSETS

INCREASE

in ASSETS

(supported

by

operations)

INCREASE

in ASSETS

(supported

by external

financing)

LIABILITIES

CURRENT

LIABILITIES

LONG-TERM

LIABILITIES

OffBalance

Sheet

Financing

CAPITAL

RETAINED

EARNINGS

ORDINARY

SHARES

PREFERENCE

SHARES

Dependent

on

Retention

Ratio

Proportionate

to Sales

Issuances of

Straight debt

securities

Issuances of new

ordinary shares

Issuances of:

INCREASE

in ASSETS

(supported

by hybrid

financing)

Issuances of:

Convertibles

With

Warrants

APIC

changes:

Warrants

Outstanding,

Conversion

Privileges

Preference

Shares

Convertibles

With

Warrants

Debt financing

Benefits and drawbacks of debt

The following are advantages of issuing debt securities:

1. interest payments are tax deductible to a firm

2. wise use of debt may lower a firms weighted average cost of capital (WACC)

3. during inflation, debt agreements charging a fixed rate is repaid with cheaper pesos

The following are disadvantages of issuing debt securities:

1. interest and principal must always be met when due, regardless of a firms financial position

Leasing

CRC-ACE: Securities Valuation and Hybrid Financing page 2

2. poor use of debt may lower a firms stock price

3. may place burdensome restrictions on the firm

Valuation of Bonds

The value of the bond is simply the present value of all the securitys future cash flows, as shown below:

Present Value of future cash flows related to bonds = Coupon1 + Coupon2 + + Couponn + Face Value

(or Current Bond Issue Price)

(1+YTM)1 (1+YTM)2

(1+YTM)n

Periodic Interest Payments

Effective Rate = Approximate = YTM =

YTM

Principal Payment

Interest Payment +

(Par Value Net Price)

Number of Years to Maturity

(Net Price x 0.60) + (Par Value x 0.40)

Some important notes one has to remember about bond prices:

a) Bond prices are inversely related to bond yields

b) As interest rates in the economy change, the price or value of a bond changes:

i) if the required rate of return increases, the price of the bond will decrease (inverse)

ii) if the required rate of return decreases, the price of the bond will increase (inverse)

Internal Equity Financing: Retained Earnings

For a time, we had been discussing that retained earnings available for investment is determined by dividend policies,

adapting the residual dividend model.

In various stages of business growth, checkout the types of the most appropriate dividends per stage :

Stage I Development

Stage II Growth

Stage III Expansion

Stage IV Maturity

Type of Dividends Distributed

No dividends

Stock dividends, low cash dividends

Stock dividends, low to moderate cash dividends, stock splits

Moderate to high cash dividends

Three Basic Types of Dividend

Policies: (1) constant pay-out (2)

regular dividend (3) low regularand-extra.

Aside from the availability of funds and stability of income generation, other factors affecting dividend policy are as

follows:

1. Legal Rules

4. Desire for Control

2. Cash Position of the Firm

5. Tax Position of Shareholders

3. Access to Capital Markets

External Equity Financing: Ordinary Shares

Valuation of Securities: Basic

The value of the stock is simply the present value of all the securitys future cash flows, as shown below:

Present Value of future cash flows related to stocks = Dividends1

(or Current Stock Issue Price)

(1+ks)1

+ Dividends 2 + + Dividends n + Selling Price n

(1+ks)2

(1+ks)n

Periodic Dividend Payments

Affected by growth, g

Proceeds from Selling Stocks,

end of definite holding period

Valuation of Securities: Discounted Cash flow Model

Remembering the discounted cash flow model, we can arrive at a simpler presentation of a computation of the current price

of stocks as follows:

P0

ks = D1/P0 + g

= D1/( ks g)

However this model can readily be used only in pricing single growth rate or one-stage growth stocks. The situation is: not

all common stocks grow perpetually at the same rate. Common stock dividends can actually vary. With non-constant

growth stocks, additional steps will have to be done before the DCF model above can be applied as is.

Valuation of Securities: Pricing Issues on Non-Constant Growth Stocks

Let us look into the following problem on pricing non-constant growth stocks.

Last year, Firm A paid P4.00 in annual dividends. This year, a ten percent increase is expected. What if there is an expected

return from common shares in the amount of 12%, and that the dividends are expected to grow by 10% per year for the next

two years, after which the dividends shall move steadily at 5%, at how much should the stocks be sold initially this year?

Using a time line, let us plot how the events are expected to occur:

g = 10%

Year 0

D0 = 4.40

g = 10%

1

g = 5%

2

g = 5%

3

g = 5%

4

.

5

CRC-ACE: Securities Valuation and Hybrid Financing page 3

In order to determine the price of the stocks at Year 0, we are to predict the Present Value of the future cash flows, using

the dividend growth model. (i.e. ks = D1/P0 + g). However, the g in this model is constant, so what we have to do is

measure the present value of its future cash flows one period at a time until it becomes constant, only then can we use the

DGM conveniently.

Step 1: Compute for the EXPECTED DIVIDENDS, using the expected growth rates

g = 10%

0

D0 = 4.40

g = 10%

1

D1 = 4.84

g = 5%

2

D2 = 5.32

g = 5%

g = 5%

3

4

D3 = 5.59 D4 = 5.87

5

D5 = 6.16

6

D6 = 6.47

Step 2: Identify the HORIZON DATE.

The horizon date is the date when the dividend starts to grow at a constant growth rate. In this case, the horizon date is

g = 10%

0

D0 = 4.40

g = 10%

1

D1 = 4.84

g = 5%

2

D2 = 5.32

g = 5%

g = 5%

3

4

D3 = 5.59 D4 = 5.87

5

D5 = 6.16

6

D6 = 6.47

Step 3: Compute for the present values of the Future Cash flows, since this will approximate the value of the stock, which in

turn is used to establish its price. Use the ks as the discounting rate.

g = 10%

0

D0 = 4.40

g = 10%

1

D1 = 4.84

g = 5%

2

D2 = 5.32

g = 5%

g = 5%

3

4

D3 = 5.59 D4 = 5.87

5

D5 = 6.16

6

D6 = 6.47

CF1=?

????

????

a. Expected dividends at Year 0 PRIOR to the horizon date.

g = 10%

0

D0 = 4.40

g = 10%

1

D1 = 4.84

g = 5%

2

D2 = 5.32

g = 5%

g = 5%

3

4

D3 = 5.59 D4 = 5.87

5

D5 = 6.16

6

D6 = 6.47

0.8929

CF1=4.32

????

????

b. Expected Cash flow at horizon date (or simply, {Expected dividends at horizon date + price of the stocks at horizon

date}) The stocks price at horizon date is equal to the expected future cash flows starting that day onwards.

g = 10%

0

D0 = 4.40

D1=4.32

g = 10%

1

D1 = 4.84

g = 5%

2

D2 = 5.32

g = 5%

g = 5%

3

4

D3 = 5.59 D4 = 5.87

5

D5 = 6.16

6

D6 = 6.47

0.8929

????

To substitute,

P2 =

g = 10%

0

D0 = 4.40

P2 =

CF2 =

D2 + 1

0.12 -0.05

g = 10%

1

D1 = 4.84

Expected + Constant growth rate of 5%

Dividend

= P 5.59

0.07

g = 5%

2

D2 = 5.32

0.8929

CF1=4.32

P2 =79.86

= P 79.86 Price at end of Year 2

g = 5%

g = 5%

3

4

D3 = 5.59 D4 = 5.87

5

D5 = 6.16

6

D6 = 6.47

CRC-ACE: Securities Valuation and Hybrid Financing page 4

CF2=67.91

0.7972

CF2 =85.18

Step 4: Compute for the PRICE OF THE STOCK at Year 0 by adding the present values of the Future Cash flows.

g = 10%

0

D0 = 4.40

g = 10%

1

D1 = 4.84

g = 5%

2

D2 = 5.32

g = 5%

g = 5%

3

4

D3 = 5.59 D4 = 5.87

5

D5 = 6.16

6

D6 = 6.47

0.8929

CF1=

4.32

CF2=

67.91

CF2=72.23

0.7972

P2 =79.86

CF2 =85.18

Note to the Candidate: What if for example, the question is to compute for the price of the stocks at end of Year 1, instead

of Year 0, can you now compute for the stocks price?(0.12(5.32/ (0.12-0.05)-0.05)) = P 76

Summary of Points on Non-constant growth stocks:

To find the value of a stock with non-constant growth, follow these four steps:

1. Partition the dividend stream into a beginning period of non-constant growth followed by a period of permanent

constant growth.

2. Find the present value of the dividends during the period of non-constant growth.

3. Find the expected value of the stock at the end of the non-constant growth period (the beginning of the constant growth

phase), and then find the present value.

4. Add these two components to determine the present value of the stock, P o.

Valuation of Securities: Price-Earnings Model

Price-Earnings ratio is in substance the reciprocal of return on investment. Given a P/E ratio at a respective point in time

and predicting the EPS will allow estimation of stocks price:

P0= EPS0 x P0/EPS0

Remember that when a high P/E ratio is registered:

1. It is an indication of positive expectations for the future of the company

2. It means the stock is more expensive relative to earnings

3. It typically represents a successful and fast-growing company

4. The companys stock is called a growth stock

However, a stock with a low P/E ratio:

1. It indicates negative expectations for the future of the company

2. It may suggest that the stock is a better value or buy

3. The companys stock is called value stock

Valuation of Securities: Effects of Splits and Repurchases

Method

Description

Stock split

More than one new share are

exchanged for an old share

Reverse Stock split

Less number of new shares are

exchanged for several old shares

Buying back formerly issued shares

Stock Repurchases

Effect On

Number of Outstanding

Stock Price

Shares

Increase

Lower, though increasing

slightly immediately after

split

Lower

Increase

Lower

Increase

Spread in Security Issuances

Whether the company issues debt or equity securities, it usually incurs cost in issuances, or spread.

Spread = [(Price to Public Amount Paid to Issuing Firm) / Amount Paid to Issuing firm] x 100

= compensation to those who are participating in the distribution

Bid-Ask spread = [(Ask price Bid price) / Ask price] x 100

Notes on Spreads

1. The lower a party falls in the distribution hierarchy, the lower the portion of the spread received.

2. Usually, the larger the pesos value of an issue, the smaller the spread.

3. The spread on equity issues is greater than on debt issues because of the greater price uncertainty.

CRC-ACE: Securities Valuation and Hybrid Financing page 5

Hybrid financing: Preference shares, leasing, options, warrants, and convertibles

Hybrid securities are either debt or equity financing that possesses characteristics of both debt and equity.

Preference share

A comparison of ordinary stock and bond issuances to preferred shares:

Ordinary Stock

Bonds

Ownership and control of

With voting rights and

Limited rights in case of

the firm

residual claim to income

default

Obligations to provide

return

None

Contractual obligations

Claim to assets in

bankruptcy

Lowest

Highest claim

Preference Shares1

Limited rights when

dividends are

missed

Must receive before

ordinary

shareholders

After creditors

Cost of distribution

Highest

Lowest

Moderate

Risk-return trade off

Highest risk, highest return

Lowest risk, Lowest return

Moderate risk,

Moderate return

Tax status of payment by

issuing entity

Not deductible

Tax- deductible

Not deductible

Leasing

The process by which a firm can obtain the use of certain fixed assets for which it must make a series of contractual,

periodic, tax deductible payments.

Potential benefits from leasing

1. Firm need not to have to borrow or use its liquid resources to purchase the asset

2. Provisions of a lease obligation may be less restrictive than a bond indenture

3. There may be no down payment requirement (generally required when purchasing an asset).

4. Firm avoids cost of obsolescence.

Types of Leases

1. Capital Lease (or Financing Lease):

a. a purchase rather than a lease

b. firm actually buys the property

c. must be shown on a firms balance sheet

d. examples include: oil drilling equipment and airplanes

2.

Operating Lease:

a. a conventional rental agreement

b. firm doesnt expect to own property

a) is not shown on a firms balance sheet

b) examples include: automobiles and office equipment

Convertibles

A conversion feature is an option included as part of either a bond or preferred stocks issue and allows its holder to change

the security into a specific number of shares of common stocks.

Convertibles usually have a call feature of convertibles allowing issuers to retire or force conversion paying a call price to

holders usually lower by 10 to 15% than the conversion value of the security. Convertibles that cannot be forced into

conversion are known as overhanging issue.

Ideally, the cost of convertibles are lesser than that of straight equity, but higher than straight debt. (kd < kc < ke )

Valuation of convertibles

Naturally, convertibles can be sold higher than straight securities.

VPackage = VStraight security + VConversion

Conversion Price = Pc = Par value of convertible Number of shares received per conversion

= Pc = Par value of convertible Conversion Ratio (CR)

= Pc = usually higher than the price of the ordinary share in the convertible issuance date

Conversion value = Ct = CR(P0)(1 + g)t

Conversion value = Market Price of Ordinary Share Conversion Price

Primary purchasers are corporate investors, insurance companies, and pension funds; Primary issuers are public utility

companies, acquiring firms, and firms experiencing losses.

CRC-ACE: Securities Valuation and Hybrid Financing page 6

Floor price

= The floor value is the higher of the straight security value and the conversion value

= The floor value is the minimum price at which the convertible would be traded

Advantages of issuing convertible securities:

1. Issuer can include lower interest rate than on a straight bond and still the convertible security will be attractive.

2. Issuer can include more relaxed covenants than on a straight bond and still the convertible security will be attractive.

3. Issuer does not have to give up immediate control.

4. It may be the only means for a small corporation to gain access to the bond market.

Disadvantages of issuing convertible securities:

1. Size of a convertible offering is usually very small.

2. A potential dilution of EPS may happen.

3. Conversion brings in no new funds.

Warrants

Warrant is an option of the holder to buy a stated number of shares of stock at a specified price over a given time period (a

long-term option to buy stock). The specified exercise price is typically set at 10% to 30% above the current stock price on

the issue date.

Although it appears that warrants sweetens a bond offering, it still has a cost (i.e. equal to the opportunity cost from

selling at a higher price than the exercise or striking price).

1.

2.

3.

is usually detachable from the bond issue

is highly speculative, as its value is dependent on the market movement of the stock

has a large potential for appreciation if the price of the stock goes up

Uses of warrants:

1. Enhances a debt issue by allowing for the issuance of debt under difficult circumstances

2. May be included as an add-on in a merger or acquisition agreement

3. Can be issued in a corporate reorganization or bankruptcy to offer shareholders a chance to recover some of their

investment

4. Traditionally has been associated with speculative real estate companies, airlines, and conglomerates

Valuation of warrants

Naturally, securities with warrants can be sold higher than straight securities.

VPackage = VStraight debt + VWarrants

Conversion value = Market Price of Ordinary Share Striking Price

VWarrants

= Conversion value + Premium

Theoretical value of a warrant = TVW = (P0 - E) x N

Where:

P0 = Current Market price of stock

E = Exercise price

N = Number of ordinary shares acquired with one warrant.

Options

Options provide the holder with an opportunity, but not the obligation, to purchase or sell a specified asset at a stated price

on or before a set expiration date. Three basic options are rights, warrants, and calls and puts.

Call option is an option to buy securities at a stated price on or before a set expiration date. Put option is an option to sell

securities at a stated price on or before a set expiration date. They are hybrid securities but they are not a source of fund for

the company. The presence of call and put options may stabilize the firms share price by increasing trading activity, but

one must understand, many factors affect share price in the market.

/jrm

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- FR - MID - TERM - TEST - 2020 CPA Financial ReportingDokument13 SeitenFR - MID - TERM - TEST - 2020 CPA Financial ReportingH M Yasir MuyidNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Heizer Operation Management Solution CH 1Dokument9 SeitenHeizer Operation Management Solution CH 1Michelle de GuzmanNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

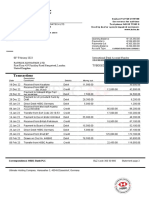

- HSBC Bank StatemeDokument1 SeiteHSBC Bank StatemeHamad Falah100% (1)

- Philippine Accounting Standards 1: PAS 1Dokument11 SeitenPhilippine Accounting Standards 1: PAS 1yvetooot50% (4)

- New AssigmentDokument4 SeitenNew AssigmentShazia TunioNoch keine Bewertungen

- Handout ManAcc2 PDFDokument16 SeitenHandout ManAcc2 PDFmobylay0% (1)

- Alternative Strategies As of Nov 3 2016Dokument78 SeitenAlternative Strategies As of Nov 3 2016Michelle de GuzmanNoch keine Bewertungen

- At Lecture 16 Other Assurance Non Assurance ServicesDokument13 SeitenAt Lecture 16 Other Assurance Non Assurance ServicesMichelle de GuzmanNoch keine Bewertungen

- Mgt 2070 Assignment 2 - Forecasting SolutionsDokument5 SeitenMgt 2070 Assignment 2 - Forecasting SolutionsAhmad Sabree Abdul BasitNoch keine Bewertungen

- OM Internal Analysis Part 1 As of September 26 2016 For AllDokument16 SeitenOM Internal Analysis Part 1 As of September 26 2016 For AllMichelle de GuzmanNoch keine Bewertungen

- The New Central Bank ActDokument12 SeitenThe New Central Bank ActMichelle de GuzmanNoch keine Bewertungen

- Secrecy and UnclaimedDokument10 SeitenSecrecy and UnclaimedMichelle de GuzmanNoch keine Bewertungen

- CPA Board Operations Dates Oct 2016Dokument1 SeiteCPA Board Operations Dates Oct 2016Michelle de GuzmanNoch keine Bewertungen

- Board Operations Dates: October - &Dokument1 SeiteBoard Operations Dates: October - &Michelle de GuzmanNoch keine Bewertungen

- Intellectual Property LawDokument37 SeitenIntellectual Property LawMichelle de GuzmanNoch keine Bewertungen

- ACCREV1 MIDTERM EX-InTEGRATED 2016 - Answer Keys in Audit PracticeDokument1 SeiteACCREV1 MIDTERM EX-InTEGRATED 2016 - Answer Keys in Audit PracticeMichelle de GuzmanNoch keine Bewertungen

- Banking Laws: Materials in Commercial Law, Jorge Miravite, 2002 Ed.)Dokument22 SeitenBanking Laws: Materials in Commercial Law, Jorge Miravite, 2002 Ed.)Michelle de GuzmanNoch keine Bewertungen

- Anti Money LaunderingDokument69 SeitenAnti Money LaunderingMichelle de GuzmanNoch keine Bewertungen

- Answer KeysDokument4 SeitenAnswer KeysMichelle de GuzmanNoch keine Bewertungen

- 01 Error Correction Answer KeyDokument4 Seiten01 Error Correction Answer KeyNile Alric AlladoNoch keine Bewertungen

- Partnership essentials under 40 charsDokument26 SeitenPartnership essentials under 40 charskat perezNoch keine Bewertungen

- Counterbalancing ErrorDokument18 SeitenCounterbalancing Errorbluesparkles013Noch keine Bewertungen

- Evaluation Form For OJTDokument3 SeitenEvaluation Form For OJTMichelle de GuzmanNoch keine Bewertungen

- Paul Ponce - Eucharistic CongressDokument2 SeitenPaul Ponce - Eucharistic CongressMichelle de GuzmanNoch keine Bewertungen

- AudtheosyllabusDokument12 SeitenAudtheosyllabusMichelle de GuzmanNoch keine Bewertungen

- PSA 210 & 700 Audit Engagement TermsDokument17 SeitenPSA 210 & 700 Audit Engagement TermsMichelle de Guzman100% (1)

- 161701-E04 - Audit of Cash - Answer KeysDokument6 Seiten161701-E04 - Audit of Cash - Answer KeysMichelle de GuzmanNoch keine Bewertungen

- Socio HermeneuticsDokument1 SeiteSocio HermeneuticsMichelle de GuzmanNoch keine Bewertungen

- Social InjusticeDokument1 SeiteSocial InjusticeMichelle de GuzmanNoch keine Bewertungen

- Cultural VariabilityDokument16 SeitenCultural VariabilityMichelle de GuzmanNoch keine Bewertungen

- Risk and ReturnDokument36 SeitenRisk and ReturnMichelle de GuzmanNoch keine Bewertungen

- Surname, First Name Middle Initial.: (Address) (Mobile Number) (E-Mail Address)Dokument2 SeitenSurname, First Name Middle Initial.: (Address) (Mobile Number) (E-Mail Address)Michelle de GuzmanNoch keine Bewertungen

- Wilson Reyes Jr Construction Scheduling ResumeDokument5 SeitenWilson Reyes Jr Construction Scheduling ResumeMichelle de GuzmanNoch keine Bewertungen

- Surname, First Name Middle Initial.: (Address) (Mobile Number) (E-Mail Address)Dokument2 SeitenSurname, First Name Middle Initial.: (Address) (Mobile Number) (E-Mail Address)Michelle de GuzmanNoch keine Bewertungen

- GoogleFinance APIDokument1 SeiteGoogleFinance APIViral BakhadaNoch keine Bewertungen

- FinanceDokument558 SeitenFinanceok shortsNoch keine Bewertungen

- Walter's Model Formula: Unit - Iv Part - C Problems and SolutionsDokument3 SeitenWalter's Model Formula: Unit - Iv Part - C Problems and SolutionsHarihara PuthiranNoch keine Bewertungen

- L2-Formula SheetDokument4 SeitenL2-Formula SheetShumaila FurqanNoch keine Bewertungen

- Financial ManagementDokument6 SeitenFinancial ManagementDaniel HunksNoch keine Bewertungen

- SY BAF Mid-Sem III - Corporate Accounting IDokument2 SeitenSY BAF Mid-Sem III - Corporate Accounting Isid pjNoch keine Bewertungen

- Audit RTP NOV 23Dokument45 SeitenAudit RTP NOV 23Kartikeya BansalNoch keine Bewertungen

- Sebi Report ZeeDokument16 SeitenSebi Report Zeesaikat boseNoch keine Bewertungen

- Finman 01 Short-Term FinancingDokument13 SeitenFinman 01 Short-Term FinancingDoromal, Jerome A.Noch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument4 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Actg 4 Actg 4Dokument39 SeitenActg 4 Actg 4Dexanne BulanNoch keine Bewertungen

- Income Tax Semifinals ExamDokument5 SeitenIncome Tax Semifinals ExamFeelingerang MAYoraNoch keine Bewertungen

- c13-T2-IfRS2 - Key Bai Tap Sach - Gui SVDokument2 Seitenc13-T2-IfRS2 - Key Bai Tap Sach - Gui SVDuongHaNoch keine Bewertungen

- E 191 Annual Report 2017-2018Dokument224 SeitenE 191 Annual Report 2017-2018Malvin TanNoch keine Bewertungen

- Board Resolution 2022 - Bagtas PlantersDokument3 SeitenBoard Resolution 2022 - Bagtas Planterscharles bautistaNoch keine Bewertungen

- Vossmann Industrial Sdn. Bhd. - DennisDokument6 SeitenVossmann Industrial Sdn. Bhd. - Dennisnishio fdNoch keine Bewertungen

- QuizDokument8 SeitenQuizSudha AgarwalNoch keine Bewertungen

- UGBA 120AB Chapter 17 Without Solutions Spring 2020Dokument122 SeitenUGBA 120AB Chapter 17 Without Solutions Spring 2020yadi lauNoch keine Bewertungen

- Ind As 20Dokument12 SeitenInd As 20RITZ BROWNNoch keine Bewertungen

- Ifrs III - c2 - Ifrs 3 - SVDokument56 SeitenIfrs III - c2 - Ifrs 3 - SVPHUC TRAN TRIEU NGUYENNoch keine Bewertungen

- Corporate Governance in Zimbabwe The ZimcodeDokument11 SeitenCorporate Governance in Zimbabwe The Zimcodetinashe chavundukatNoch keine Bewertungen

- Type of AuditingDokument28 SeitenType of AuditingSreekarNoch keine Bewertungen

- Fundamentals of Accounting CH 1-Chapter 7Dokument90 SeitenFundamentals of Accounting CH 1-Chapter 7Dave DaveNoch keine Bewertungen

- Handout PP R. Roumen ATAD3Dokument14 SeitenHandout PP R. Roumen ATAD3bacha436Noch keine Bewertungen

- Final Ko To Umayos KaDokument37 SeitenFinal Ko To Umayos Kakenjie krisNoch keine Bewertungen

- Tahlia Kaleas S5093903 1006GBS Why Money MattersDokument6 SeitenTahlia Kaleas S5093903 1006GBS Why Money MattersTahlia KaleasNoch keine Bewertungen