Beruflich Dokumente

Kultur Dokumente

Exxon Mobil Corporation: United States Securities and Exchange Commission FORM 10 Q

Hochgeladen von

Adrian LeeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exxon Mobil Corporation: United States Securities and Exchange Commission FORM 10 Q

Hochgeladen von

Adrian LeeCopyright:

Verfügbare Formate

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

10Q1xom10q3q2015.htmFORM10Q

UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM10Q

QUARTERLYREPORTPURSUANTTOSECTION13OR15(d)OF

THESECURITIESEXCHANGEACTOF1934

ForthequarterlyperiodendedSeptember30,2015

or

TRANSITIONREPORTPURSUANTTOSECTION13OR15(d)OF

THESECURITIESEXCHANGEACTOF1934

Forthetransitionperiodfrom__________to________

CommissionFileNumber12256

EXXONMOBILCORPORATION

(Exactnameofregistrantasspecifiedinitscharter)

NEWJERSEY

135409005

(Stateorotherjurisdictionof

incorporationororganization)

(I.R.S.Employer

IdentificationNumber )

5959LASCOLINASBOULEVARD,IRVING,TEXAS750392298

(Addressofprincipalexecutiveoffices)(ZipCode)

(972)4441000

(Registrant'stelephonenumber,includingareacode)

Indicatebycheckmarkwhethertheregistrant(1)hasfiledallreportsrequiredtobefiledbySection13or15(d)oftheSecuritiesExchangeActof1934duringthe

preceding12months(orforsuchshorterperiodthattheregistrantwasrequiredtofilesuchreports),and(2)hasbeensubjecttosuchfilingrequirementsforthepast

90days.YesNo

IndicatebycheckmarkwhethertheregistranthassubmittedelectronicallyandpostedonitscorporateWebsite,ifany,everyInteractiveDataFilerequiredtobe

submittedandpostedpursuanttoRule405ofRegulationSTduringthepreceding12months(orforsuchshorterperiodthattheregistrantwasrequiredtosubmit

andpostsuchfiles).YesNo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a nonaccelerated filer, or a smaller reporting company. See the

definitionsof"largeacceleratedfiler,""acceleratedfiler"and"smallerreportingcompany"inRule12b2oftheExchangeAct.

Largeacceleratedfiler

Acceleratedfiler

Nonacceleratedfiler

Smallerreportingcompany

Indicatebycheckmarkwhethertheregistrantisashellcompany(asdefinedinRule12b2oftheExchangeAct).YesNo

Indicatethenumberofsharesoutstandingofeachoftheissuer'sclassesofcommonstock,asofthelatestpracticabledate.

Class

OutstandingasofSeptember30,2015

Commonstock,withoutparvalue

4,162,938,512

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

1/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

FORM10Q

FORTHEQUARTERLYPERIODENDEDSEPTEMBER30,2015

TABLEOFCONTENTS

PARTI.FINANCIALINFORMATION

Item1.FinancialStatements

CondensedConsolidatedStatementofIncome

ThreeandninemonthsendedSeptember30,2015and2014

CondensedConsolidatedStatementofComprehensiveIncome

ThreeandninemonthsendedSeptember30,2015and2014

CondensedConsolidatedBalanceSheet

AsofSeptember30,2015andDecember31,2014

CondensedConsolidatedStatementofCashFlows

NinemonthsendedSeptember30,2015and2014

CondensedConsolidatedStatementofChangesinEquity

NinemonthsendedSeptember30,2015and2014

NotestoCondensedConsolidatedFinancialStatements

Item2.Management'sDiscussionandAnalysisofFinancial

ConditionandResultsofOperations

Item3.QuantitativeandQualitativeDisclosuresAboutMarketRisk

Item4.ControlsandProcedures

PARTII.OTHERINFORMATION

Item1.LegalProceedings

Item2.UnregisteredSalesofEquitySecuritiesandUseofProceeds

Item6.Exhibits

Signature

IndextoExhibits

3

4

5

6

7

8

14

22

22

23

24

24

25

26

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

2/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

Item1.FinancialStatements

PARTI.FINANCIALINFORMATION

EXXONMOBILCORPORATION

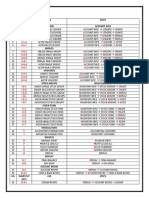

CONDENSEDCONSOLIDATEDSTATEMENTOFINCOME

(millionsofdollars)

Revenuesandotherincome

Salesandotheroperatingrevenue(1)

Incomefromequityaffiliates

Otherincome

Totalrevenuesandotherincome

Costsandotherdeductions

Crudeoilandproductpurchases

Productionandmanufacturingexpenses

Selling,generalandadministrativeexpenses

Depreciationanddepletion

Explorationexpenses,includingdryholes

Interestexpense

Salesbasedtaxes(1)

Othertaxesandduties

Totalcostsandotherdeductions

Incomebeforeincometaxes

Incometaxes

Netincomeincludingnoncontrollinginterests

Netincomeattributabletononcontrollinginterests

NetincomeattributabletoExxonMobil

Earningspercommonshare(dollars)

Earningspercommonshareassumingdilution(dollars)

Dividendspercommonshare(dollars)

(1)Salesbasedtaxesincludedinsalesandother

operatingrevenue

ThreeMonthsEnded

September30,

2015

65,679

1,783

(118)

67,344

32,276

8,614

2,967

4,542

324

78

5,813

6,981

61,595

5,749

1,365

4,384

144

4,240

1.01

1.01

0.73

5,813

2014

103,206

3,211

713

107,130

60,068

9,951

3,169

4,362

319

88

7,519

8,244

93,720

13,410

5,064

8,346

276

8,070

1.89

1.89

0.69

7,519

NineMonthsEnded

September30,

2015

201,797

6,125

1,153

209,075

102,286

26,579

8,511

13,293

1,005

251

17,308

20,504

189,737

19,338

5,617

13,721

351

13,370

3.18

3.18

2.15

17,308

2014

310,237

10,631

324,663

180,144

30,517

12,839

22,806

24,749

281,875

42,788

15,955

26,833

25,950

22,806

TheinformationintheNotestoCondensedConsolidatedFinancialStatementsisanintegralpartofthesestatements.

3

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

3/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

CONDENSEDCONSOLIDATEDSTATEMENTOFCOMPREHENSIVEINCOME

(millionsofdollars)

Netincomeincludingnoncontrollinginterests

Othercomprehensiveincome(netofincometaxes)

Foreignexchangetranslationadjustment

Adjustmentforforeignexchangetranslation(gain)/loss

includedinnetincome

Postretirementbenefitsreservesadjustment

(excludingamortization)

Amortizationandsettlementofpostretirementbenefitsreserves

adjustmentincludedinnetperiodicbenefitcosts

Unrealizedchangeinfairvalueofstockinvestments

Realized(gain)/lossfromstockinvestmentsincludedin

netincome

Totalothercomprehensiveincome

Comprehensiveincomeincludingnoncontrollinginterests

Comprehensiveincomeattributableto

noncontrollinginterests

ComprehensiveincomeattributabletoExxonMobil

ThreeMonthsEnded

September30,

2015

4,384

(4,023)

484

367

(3,162)

1,222

(175)

1,397

2014

8,346

(3,828)

372

289

(21)

(3,188)

5,158

(27)

5,185

NineMonthsEnded

September30,

2015

13,721

(8,379)

1,111

1,075

26

15

(6,152)

7,569

(422)

7,991

2014

26,833

25,067

24,479

TheinformationintheNotestoCondensedConsolidatedFinancialStatementsisanintegralpartofthesestatements.

4

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

4/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

CONDENSEDCONSOLIDATEDBALANCESHEET

(millionsofdollars)

Assets

Currentassets

Cashandcashequivalents

Cashandcashequivalentsrestricted

Notesandaccountsreceivablenet

Inventories

Crudeoil,productsandmerchandise

Materialsandsupplies

Othercurrentassets

Totalcurrentassets

Investments,advancesandlongtermreceivables

Property,plantandequipmentnet

Otherassets,includingintangiblesnet

Totalassets

Liabilities

Currentliabilities

Notesandloanspayable

Accountspayableandaccruedliabilities

Incometaxespayable

Totalcurrentliabilities

Longtermdebt

Postretirementbenefitsreserves

Deferredincometaxliabilities

Longtermobligationstoequitycompanies

Otherlongtermobligations

Totalliabilities

Commitmentsandcontingencies(Note3)

Equity

Commonstockwithoutparvalue

(9,000millionsharesauthorized,8,019millionsharesissued)

Earningsreinvested

Accumulatedothercomprehensiveincome

Commonstockheldintreasury

(3,856millionsharesatSeptember30,2015and

3,818millionsharesatDecember31,2014)

ExxonMobilshareofequity

Noncontrollinginterests

Totalequity

Totalliabilitiesandequity

2015

4,296

22,157

12,249

4,335

4,197

47,234

34,315

250,583

8,530

340,662

Sept.30,

14,473

36,681

3,674

54,828

19,839

24,422

38,210

5,524

21,000

163,823

11,443

412,718

(24,336)

(229,102)

170,723

6,116

176,839

340,662

Dec.31,

2014

4,616

42

28,009

12,384

4,294

3,565

52,910

35,239

252,668

8,676

349,493

17,468

42,227

4,938

64,633

11,653

25,802

39,230

5,325

21,786

168,429

10,792

408,384

(18,957)

(225,820)

174,399

6,665

181,064

349,493

TheinformationintheNotestoCondensedConsolidatedFinancialStatementsisanintegralpartofthesestatements.

5

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

5/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

CONDENSEDCONSOLIDATEDSTATEMENTOFCASHFLOWS

(millionsofdollars)

Cashflowsfromoperatingactivities

Netincomeincludingnoncontrollinginterests

Depreciationanddepletion

Changesinoperationalworkingcapital,excludingcashanddebt

Allotheritemsnet

Netcashprovidedbyoperatingactivities

Cashflowsfrominvestingactivities

Additionstoproperty,plantandequipment

Proceedsassociatedwithsalesofsubsidiaries,property,plantand

equipment,andsalesandreturnsofinvestments

Additionalinvestmentsandadvances

Otherinvestingactivitiesnet

Netcashusedininvestingactivities

Cashflowsfromfinancingactivities

Additionstolongtermdebt

Reductionsinlongtermdebt

Additions/(reductions)inshorttermdebtnet

Additions/(reductions)indebtwiththreemonthsorlessmaturity

CashdividendstoExxonMobilshareholders

Cashdividendstononcontrollinginterests

Taxbenefitsrelatedtostockbasedawards

Commonstockacquired

Commonstocksold

Netcashusedinfinancingactivities

Effectsofexchangeratechangesoncash

Increase/(decrease)incashandcashequivalents

Cashandcashequivalentsatbeginningofperiod

Cashandcashequivalentsatendofperiod

SupplementalDisclosures

Incometaxespaid

Cashinterestpaid

NineMonthsEnded

September30,

2015

13,721

13,293

(1,037)

(13)

25,964

(20,354)

1,604

(412)

662

(18,500)

8,028

(18)

(475)

(2,537)

(9,036)

(127)

(3,285)

(7,450)

(334)

(320)

4,616

4,296

5,594

459

2014

26,833

12,839

(460)

(1,511)

37,701

(24,068)

3,794

(1,269)

3,415

(18,128)

5,503

(514)

(5,413)

(8,644)

(172)

10

(9,865)

10

(19,085)

(170)

318

4,644

4,962

14,338

295

2015NonCashTransactions

An asset exchange resulted in value received of approximately $500 million including $100 million in cash. The noncash portion was not

includedintheProceedsassociatedwithsalesofsubsidiaries,property,plantandequipment,andsalesandreturnsofinvestmentsortheAll

otheritemsnetlinesontheStatementofCashFlows.

Capitalleasesofapproximately$800millionwerenotincludedinAdditionstolongtermdebtorAdditionstoproperty,plantandequipment

linesontheStatementofCashFlows.

TheinformationintheNotestoCondensedConsolidatedFinancialStatementsisanintegralpartofthesestatements.

6

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

6/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

CONDENSEDCONSOLIDATEDSTATEMENTOFCHANGESINEQUITY

(millionsofdollars)

ExxonMobilShareofEquity

Accumulated

Other

Common

Compre

Stock

ExxonMobil

Non

Common

Earnings

hensive

Heldin

Shareof

controlling

Total

Stock

Reinvested

Income

Treasury

Equity

Interests

Equity

BalanceasofDecember31,2013

10,077 387,432

(10,725) (212,781) 174,003

6,492 180,495

Amortizationofstockbasedawards

588

588

Taxbenefitsrelatedtostockbased

awards

10

10

Other

6

6

Netincomefortheperiod

25,950

25,950

883

26,833

Dividendscommonshares

(8,644)

(8,644)

(172)

Othercomprehensiveincome

(1,471)

(1,471)

(295)

Acquisitions,atcost

(9,865)

(9,865)

Dispositions

10

10

BalanceasofSeptember30,2014

10,681 404,738

(12,196) (222,636) 180,587

6,908 187,495

BalanceasofDecember31,2014

10,792 408,384

(18,957) (225,820) 174,399

6,665 181,064

Amortizationofstockbasedawards

647

647

Taxbenefitsrelatedtostockbased

awards

9

9

Other

(5)

(5)

Netincomefortheperiod

13,370

13,370

351

13,721

Dividendscommonshares

(9,036)

(9,036)

(127)

Othercomprehensiveincome

(5,379)

(5,379)

(773)

Acquisitions,atcost

(3,285)

(3,285)

Dispositions

3

3

BalanceasofSeptember30,2015

11,443 412,718

(24,336) (229,102) 170,723

6,116 176,839

NineMonthsEndedSeptember30,2015

NineMonthsEndedSeptember30,2014

Heldin

Heldin

Issued

Treasury Outstanding

Issued

Treasury

Outstanding

CommonStockShareActivity

(millionsofshares)

(millionsofshares)

BalanceasofDecember31

8,019

(3,818)

4,201

8,019

(3,684)

Acquisitions

(38)

(38)

(100)

Dispositions

BalanceasofSeptember30

8,019

(3,856)

4,163

8,019

(3,784)

TheinformationintheNotestoCondensedConsolidatedFinancialStatementsisanintegralpartofthesestatements.

7

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

7/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

NOTESTOCONDENSEDCONSOLIDATEDFINANCIALSTATEMENTS

1.BasisofFinancialStatementPreparation

Theseunauditedcondensedconsolidatedfinancialstatementsshouldbereadinthecontextoftheconsolidatedfinancialstatementsandnotes

thereto filed with the Securities and Exchange Commission in the Corporation's 2014 Annual Report on Form 10K. In the opinion of the

Corporation,theinformationfurnishedhereinreflectsallknownaccrualsandadjustmentsnecessaryforafairstatementoftheresultsfortheperiods

reportedherein.Allsuchadjustmentsareofanormalrecurringnature.Priordatahasbeenreclassifiedincertaincasestoconformtothecurrent

presentationbasis.

TheCorporation'sexplorationandproductionactivitiesareaccountedforunderthe"successfulefforts"method.

2.RecentlyIssuedAccountingStandard

InMay2014,theFinancialAccountingStandardsBoardissuedanewstandard,RevenuefromContractswithCustomers.Thestandardestablishes

a single revenue recognition model for all contracts with customers, eliminates industry specific requirements, and expands disclosure

requirements. The standard is required to be adopted beginning January 1, 2018. ExxonMobil is evaluating the standard and its effect on the

Corporationsfinancialstatements.

3.LitigationandOtherContingencies

Litigation

AvarietyofclaimshavebeenmadeagainstExxonMobilandcertainofitsconsolidatedsubsidiariesinanumberofpendinglawsuits.Management

hasregularlitigationreviews,includingupdatesfromcorporateandoutsidecounsel,toassesstheneedforaccountingrecognitionordisclosureof

thesecontingencies.TheCorporationaccruesanundiscountedliabilityforthosecontingencieswheretheincurrenceofalossisprobableandthe

amountcanbereasonablyestimated.Ifarangeofamountscanbereasonablyestimatedandnoamountwithintherangeisabetterestimatethan

anyotheramount,thentheminimumoftherangeisaccrued.TheCorporationdoesnotrecordliabilitieswhenthelikelihoodthattheliabilityhas

beenincurredisprobablebuttheamountcannotbereasonablyestimatedorwhentheliabilityisbelievedtobeonlyreasonablypossibleorremote.

For contingencies where an unfavorable outcome is reasonably possible and which are significant, the Corporation discloses the nature of the

contingency and, where feasible, an estimate of the possible loss. For purposes of our contingency disclosures, significant includes material

mattersaswellasothermatterswhichmanagementbelievesshouldbedisclosed.ExxonMobilwillcontinuetodefenditselfvigorouslyinthese

matters.Basedonaconsiderationofallrelevantfactsandcircumstances,theCorporationdoesnotbelievetheultimateoutcomeofanycurrently

pending lawsuit against ExxonMobil will have a material adverse effect upon the Corporation's operations, financial condition, or financial

statementstakenasawhole.

OtherContingencies

TheCorporationandcertainofitsconsolidatedsubsidiarieswerecontingentlyliableatSeptember30,2015,forguaranteesrelatingtonotes,loans

and performance under contracts. Where guarantees for environmental remediation and other similar matters do not include a stated cap, the

amountsreflectmanagementsestimateofthemaximumpotentialexposure.Theseguaranteesarenotreasonablylikelytohaveamaterialeffecton

theCorporationsfinancialcondition,changesinfinancialcondition,revenuesorexpenses,resultsofoperations,liquidity,capitalexpendituresor

capitalresources.

Guarantees

Debtrelated

Other

Total

(1)ExxonMobilshare

Equity

AsofSeptember30,2015

Other

Company

ThirdParty

Obligations(1)

Obligations

(millionsofdollars)

85

2,665

2,750

37

4,546

4,583

Total

122

7,211

7,333

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

8/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

Additionally,theCorporationanditsaffiliateshavenumerouslongtermsalesandpurchasecommitmentsintheirvariousbusinessactivities,allof

whichareexpectedtobefulfilledwithnoadverseconsequencesmaterialtotheCorporationsoperationsorfinancialcondition.TheCorporation's

outstandingunconditionalpurchaseobligationsatSeptember30,2015,weresimilartothoseattheprioryearendperiod.Unconditionalpurchase

obligations as defined by accounting standards are those longterm commitments that are noncancelable or cancelable only under certain

conditions,andthatthirdpartieshaveusedtosecurefinancingforthefacilitiesthatwillprovidethecontractedgoodsorservices.

TheoperationsandearningsoftheCorporationanditsaffiliatesthroughouttheworldhavebeen,andmayinthefuturebe,affectedfromtimeto

timeinvaryingdegreebypoliticaldevelopmentsandlawsandregulations,suchasforceddivestitureofassetsrestrictionsonproduction,imports

andexportspricecontrolstaxincreasesandretroactivetaxclaimsexpropriationofpropertycancellationofcontractrightsandenvironmental

regulations.BoththelikelihoodofsuchoccurrencesandtheiroveralleffectupontheCorporationvarygreatlyfromcountrytocountryandarenot

predictable.

InaccordancewithanationalizationdecreeissuedbyVenezuelaspresidentinFebruary2007,byMay1,2007,asubsidiaryoftheVenezuelan

NationalOilCompany(PdVSA)assumedtheoperatorshipoftheCerroNegroHeavyOilProject.ThisProjecthadbeenoperatedandownedby

ExxonMobilaffiliatesholdinga41.67percentownershipinterestintheProject.ThedecreealsorequiredconversionoftheCerroNegroProject

into a mixed enterprise and an increase in PdVSAs or one of its affiliates ownership interest in the Project, with the stipulation that if

ExxonMobilrefusedtoacceptthetermsfortheformationofthemixedenterprisewithinaspecifiedperiodoftime,thegovernmentwoulddirectly

assumetheactivitiescarriedoutbythejointventure.ExxonMobilrefusedtoaccedetothetermsprofferedbythegovernment,andonJune27,

2007,thegovernmentexpropriatedExxonMobils41.67percentinterestintheCerroNegroProject.

OnSeptember6,2007,affiliatesofExxonMobilfiledaRequestforArbitrationwiththeInternationalCentreforSettlementofInvestmentDisputes

(ICSID). The ICSID Tribunal issued a decision on June 10, 2010, finding that it had jurisdiction to proceed on the basis of the Netherlands

VenezuelaBilateralInvestmentTreaty.OnOctober9,2014,theICSIDTribunalissueditsfinalawardfindinginfavoroftheExxonMobilaffiliates

andawarding$1.6billionasofthedateofexpropriation,June27,2007,andinterestfromthatdateat3.25%compoundedannuallyuntilthedate

ofpaymentinfull.TheTribunalalsonotedthatoneoftheCerroNegroProjectagreementsprovidesamechanismtopreventdoublerecovery

betweentheICSIDawardandallorpartofanearlierawardof$908milliontoanExxonMobilaffiliate,MobilCerroNegro,Ltd.,againstPdVSA

andaPdVSAaffiliate,PdVSACN,inanarbitrationundertherulesoftheInternationalChamberofCommerce.

OnJune12,2015,theTribunalrejectedinitsentiretyVenezuelasOctober23,2014,applicationtorevisetheICSIDaward.TheTribunalalso

liftedtheassociatedstayofenforcementthathadbeenentereduponthefilingoftheapplicationtorevise.

Still pending is Venezuelas February 2, 2015, application to ICSID seeking annulment of the ICSID award. That application alleges that, in

issuing the ICSID award, the Tribunal exceeded its powers, failed to state reasons on which the ICSID award was based, and departed from a

fundamentalruleofprocedure.AseparatestayoftheICSIDawardwasenteredfollowingthefilingoftheannulmentapplication.OnJuly7,2015,

theICSIDCommitteeconsideringtheannulmentapplicationheardargumentsfromthepartiesonwhethertoliftthestayoftheawardassociated

withthatapplication.OnJuly28,2015,theCommitteeissuedanorderthatwouldliftthestayofenforcementunless,within30days,Venezuela

deliveredacommitmenttopaytheawardiftheapplicationtoannulisdenied.OnSeptember17,2015,theCommitteeruledthatVenezuelahad

complied with the requirement to submit a written commitment to pay the award and so left the stay of enforcement in place. A hearing on

VenezuelasapplicationforannulmentisscheduledforJanuary2527,2016.

TheUnitedStatesDistrictCourtfortheSouthernDistrictofNewYorkenteredjudgmentontheICSIDawardonOctober10,2014.Motionsfiled

byVenezuelatovacatethatjudgmentonproceduralgroundsandtomodifythejudgmentbyreducingtherateofinteresttobepaidontheICSID

awardfromtheentryofthecourtsjudgment,untilthedateofpayment,weredeniedonFebruary13,2015,andMarch4,2015,respectively.On

March9,2015,Venezuelafiledanoticeofappealofthecourtsactionsonthetwomotions.

TheDistrictCourtsjudgmentontheICSIDawardiscurrentlystayeduntilsuchtimeasICSIDsstayoftheawardenteredfollowingVenezuelas

filingofitsapplicationtoannulhasbeenlifted.ThenetimpactofthesemattersontheCorporationsconsolidatedfinancialresultscannotbe

reasonablyestimated.Regardless,theCorporationdoesnotexpecttheresolutiontohaveamaterialeffectupontheCorporationsoperationsor

financialcondition.

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

9/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

AnaffiliateofExxonMobilisoneoftheContractorsunderaProductionSharingContract(PSC)withtheNigerianNationalPetroleumCorporation

(NNPC)coveringtheErhablocklocatedintheoffshorewatersofNigeria.ExxonMobil'saffiliateistheoperatoroftheblockandownsa56.25

percentinterestunderthePSC.TheContractorsareindisputewithNNPCregardingNNPC'sliftingofcrudeoilinexcessofitsentitlementunder

the terms of the PSC. In accordance with the terms of the PSC, the Contractors initiated arbitration in Abuja, Nigeria, under the Nigerian

ArbitrationandConciliationAct.OnOctober24,2011,athreememberarbitralTribunalissuedanawardupholdingtheContractors'positionin

allmaterialrespectsandawardingdamagestotheContractorsjointlyinanamountofapproximately$1.8billionplus$234millioninaccrued

interest.TheContractorspetitionedaNigerianfederalcourtforenforcementoftheaward,andNNPCpetitionedthesamecourttohavetheaward

setaside.OnMay22,2012,thecourtsetasidetheaward.TheContractorsappealedthatjudgmenttotheCourtofAppeal,AbujaJudicialDivision.

InJune2013,theContractorsfiledalawsuitagainstNNPCintheNigerianfederalhighcourtinordertopreservetheirabilitytoseekenforcement

ofthePSCinthecourtsifnecessary.InOctober2014,theContractorsfiledsuitintheUnitedStatesDistrictCourtfortheSouthernDistrictofNew

Yorktoenforce,ifnecessary,thearbitrationawardagainstNNPCassetsresidingwithinthatjurisdiction.NNPChasmovedtodismissthelawsuit.

ProceedingsintheSouthernDistrictofNewYorkarecurrentlystayed.Atthistime,thenetimpactofthismatterontheCorporation'sconsolidated

financialresultscannotbereasonablyestimated.However,regardlessoftheoutcomeofenforcementproceedings,theCorporationdoesnotexpect

theproceedingstohaveamaterialeffectupontheCorporation'soperationsorfinancialcondition.

10

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

10/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

4.OtherComprehensiveIncomeInformation

Cumulative

Post

Foreign

retirement

Unrealized

Exchange

Benefits

Changein

Translation

Reserves

Stock

ExxonMobilShareofAccumulatedOther

Adjustment

Adjustment Investments

Total

ComprehensiveIncome

(millionsofdollars)

BalanceasofDecember31,2013

(846)

(9,879)

(10,725)

Currentperiodchangeexcludingamountsreclassified

fromaccumulatedothercomprehensiveincome

(2,637)

176

(57)

Amountsreclassifiedfromaccumulatedother

comprehensiveincome

163

884

Totalchangeinaccumulatedothercomprehensiveincome

(2,474)

1,060

(57)

BalanceasofSeptember30,2014

(3,320)

(8,819)

(57)

(12,196)

BalanceasofDecember31,2014

(5,952)

(12,945)

(18,957)

(60)

Currentperiodchangeexcludingamountsreclassified

fromaccumulatedothercomprehensiveincome

(7,497)

1,036

26

Amountsreclassifiedfromaccumulatedother

comprehensiveincome

1,041

15

Totalchangeinaccumulatedothercomprehensiveincome

(7,497)

2,077

41

BalanceasofSeptember30,2015

(13,449)

(10,868)

(19)

(24,336)

ThreeMonthsEnded

NineMonthsEnded

AmountsReclassifiedOutofAccumulatedOther

September30,

September30,

ComprehensiveIncomeBeforetaxIncome/(Expense)

2015

2014

2015

(millionsofdollars)

Foreignexchangetranslationgain/(loss)includedinnetincome

(StatementofIncomeline:Otherincome)

Amortizationandsettlementofpostretirementbenefitsreserves

(1,552)

adjustmentincludedinnetperiodicbenefitcosts(1)

(534)

(430)

Realizedchangeinfairvalueofstockinvestmentsincludedin

(23)

netincome(StatementofIncomeline:Otherincome)

(5)

(1)Theseaccumulatedothercomprehensiveincomecomponentsareincludedinthecomputationofnetperiodicpensioncost.

(SeeNote6PensionandOtherPostretirementBenefitsforadditionaldetails.)

ThreeMonthsEnded

NineMonthsEnded

IncomeTax(Expense)/CreditFor

September30,

September30,

ComponentsofOtherComprehensiveIncome

2015

2014

2015

(millionsofdollars)

Foreignexchangetranslationadjustment

82

70

147

Postretirementbenefitsreservesadjustment

(excludingamortization)

(225)

(138)

(527)

Amortizationandsettlementofpostretirementbenefitsreserves

adjustmentincludedinnetperiodicbenefitcosts

(167)

(141)

(477)

Unrealizedchangeinfairvalueofstockinvestments

(3)

11

(14)

Realizedchangeinfairvalueofstockinvestments

includedinnetincome

(2)

(8)

Total

(315)

(198)

(879)

11

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

11/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

5.EarningsPerShare

ThreeMonthsEnded

NineMonthsEnded

September30,

September30,

2015

2014

2015

2014

Earningspercommonshare

NetincomeattributabletoExxonMobil(millionsofdollars)

4,240

8,070

13,370

25,950

Weightedaveragenumberofcommonshares

outstanding(millionsofshares)

4,190

4,267

4,201

Earningspercommonshare(dollars)(1)

1.01

1.89

3.18

(1)Thecalculationofearningspercommonshareandearningspercommonshareassumingdilutionarethesameineach

periodshown.

6.PensionandOtherPostretirementBenefits

Componentsofnetbenefitcost

PensionBenefitsU.S.

Servicecost

Interestcost

Expectedreturnonplanassets

Amortizationofactuarialloss/(gain)andprior

servicecost

Netpensionenhancementand

curtailment/settlementcost

Netbenefitcost

PensionBenefitsNonU.S.

Servicecost

Interestcost

Expectedreturnonplanassets

Amortizationofactuarialloss/(gain)andprior

servicecost

Netpensionenhancementand

curtailment/settlementcost

Netbenefitcost

OtherPostretirementBenefits

Servicecost

Interestcost

Expectedreturnonplanassets

Amortizationofactuarialloss/(gain)andprior

servicecost

Netbenefitcost

ThreeMonthsEnded

September30,

2015

2014

231

196

(208)

137

117

473

170

206

(268)

198

24

330

42

86

(7)

46

167

September30,

2015

(millionsofdollars)

NineMonthsEnded

156

202

(200)

105

113

376

144

285

(300)

183

312

32

89

(9)

29

141

625

589

(622)

411

351

1,354

518

636

(819)

617

24

976

127

259

(21)

137

502

2014

12

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

12/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

7.FinancialInstruments

Thefairvalueoffinancialinstrumentsisdeterminedbyreferencetoobservablemarketdataandothervaluationtechniquesasappropriate.The

onlycategoryoffinancialinstrumentswherethedifferencebetweenfairvalueandrecordedbookvalueisnotableislongtermdebt.Theestimated

fairvalueoftotallongtermdebt,excludingcapitalizedleaseobligations,was$19,064millionatSeptember30,2015,and$11,660millionat

December31,2014,ascomparedtorecordedbookvaluesof$18,790millionatSeptember30,2015,and$11,278millionatDecember31,2014.

TheincreaseintheestimatedfairvalueandbookvalueoflongtermdebtreflectstheCorporationsissuanceof$8.0billionoflongtermdebtinthe

firstquarterof2015.The$8.0billionoflongtermdebtiscomprisedof$500millionoffloatingratenotesduein2018,$500millionoffloating

ratenotesduein2022,$1,600millionof1.305%notesduein2018,$1,500millionof1.912%notesduein2020,$1,150millionof2.397%notes

duein2022,$1,750millionof2.709%notesduein2025,and$1,000millionof3.567%notesduein2045.

ThefairvalueoflongtermdebtbyhierarchylevelatSeptember30,2015,is:Level1$18,699millionLevel2$303millionandLevel3$62

million.Level1representsquotedpricesinactivemarkets.Level2includesdebtwhosefairvalueisbaseduponapubliclyavailableindex.Level

3involvesusinginternaldataaugmentedbyrelevantmarketindicatorsifavailable.

8.DisclosuresaboutSegmentsandRelatedInformation

ThreeMonthsEnded

NineMonthsEnded

September30,

September30,

2015

2014

2015

2014

(millionsofdollars)

EarningsAfterIncomeTax

Upstream

UnitedStates

(442)

1,257

(541)

NonU.S.

1,800

5,159

6,785

18,386

Downstream

UnitedStates

487

460

1,466

NonU.S.

1,546

564

3,740

Chemical

UnitedStates

526

765

1,866

NonU.S.

701

435

1,589

Allother

(378)

(570)

(1,535)

Corporatetotal

4,240

8,070

13,370

25,950

SalesandOtherOperatingRevenue(1)

Upstream

UnitedStates

2,115

3,773

6,471

11,533

NonU.S.

3,760

5,367

12,268

17,607

Downstream

UnitedStates

18,737

31,367

57,920

94,210

NonU.S.

34,033

52,580

103,691

157,044

Chemical

UnitedStates

2,718

3,920

8,298

11,546

NonU.S.

4,314

6,196

13,143

18,280

Allother

2

3

6

Corporatetotal

65,679

103,206

201,797

310,237

IntersegmentRevenue

Upstream

UnitedStates

NonU.S.

Downstream

UnitedStates

NonU.S.

Chemical

UnitedStates

NonU.S.

Allother

(1) Includessalesbasedtaxes

982

5,266

3,075

5,424

1,858

1,380

74

1,866

10,466

4,390

11,086

2,775

2,328

69

3,386

16,209

9,700

17,224

5,765

4,063

212

31,327

13,446

36,485

13

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

13/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

Item2.Management'sDiscussionandAnalysisofFinancialConditionandResultsofOperations

FUNCTIONALEARNINGSSUMMARY

ThirdQuarter

FirstNineMonths

Earnings(U.S.GAAP)

2015

2014

2015

2014

(millionsofdollars)

Upstream

UnitedStates

(442)

1,257

(541)

NonU.S.

1,800

5,159

6,785

18,386

Downstream

UnitedStates

487

460

1,466

NonU.S.

1,546

564

3,740

Chemical

UnitedStates

526

765

1,866

NonU.S.

701

435

1,589

Corporateandfinancing

(378)

(570)

(1,535)

NetIncomeattributabletoExxonMobil(U.S.GAAP)

4,240

8,070

13,370

25,950

Earningspercommonshare(dollars)

1.01

1.89

3.18

Earningspercommonshareassumingdilution(dollars)

1.01

1.89

3.18

References in this discussion to corporate earnings mean net income attributable to ExxonMobil (U.S. GAAP) from the

consolidated income statement. Unless otherwise indicated, references to earnings, Upstream, Downstream, Chemical and

Corporate and Financing segment earnings, and earnings per share are ExxonMobil's share after excluding amounts

attributabletononcontrollinginterests.

REVIEWOFTHIRDQUARTER2015RESULTS

ExxonMobilsthirdquarter2015earningswere$4.2billion,or$1.01perdilutedshare,comparedwith$8.1billionayearearlier.Significantly

lowerUpstreamrealizationsmorethanoffsethigherDownstreamandChemicalearnings.

TheCorporationmaintainsarelentlessfocusonbusinessfundamentals,includingcostmanagement,regardlessofcommodityprices.Quarterly

resultsreflectthecontinuedstrengthofourDownstreamandChemicalbusinessesandunderscorethebenefitsofourintegratedbusinessmodel.

Upstreamproductionvolumesincreased2.3percent,or87,000barrelsperday,to3.9millionoilequivalentbarrelsperday.Liquidsvolumesof

2.3millionbarrelsperdayrose13percentdrivenbynewdevelopmentsinCanada,Indonesia,theUnitedStates,AngolaandNigeria.

Earningsinthefirstninemonthsof2015were$13.4billion,down$12.6billion,or48percent,from2014.

Earningspershare,assumingdilution,decreased47percentto$3.18.

Capitalandexplorationexpenditureswere$23.6billion,down16percentfrom2014.

Oilequivalentproductionincreased2.7percentfrom2014,withliquidsup10percentandnaturalgasdown5.7percent.

Thecorporationdistributed$11.5billiontoshareholdersinthefirstninemonthsof2015through$9billionindividendsand$2.5billioninshare

purchasestoreducesharesoutstanding.

14

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

14/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

ThirdQuarter

FirstNineMonths

2015

2014

2015

(millionsofdollars)

Upstreamearnings

UnitedStates

(442)

1,257

(541)

NonU.S.

1,800

5,159

6,785

18,386

Total

1,358

6,416

6,244

22,080

Upstreamearningswere$1,358millioninthethirdquarterof2015,down$5,058millionfromthethirdquarterof2014.Lowerliquidsandgas

realizationsdecreasedearningsby$5.1billion,whilevolumeandmixeffects,drivenbynewdevelopments,increasedearningsby$110million.

Allotheritemsdecreasedearningsby$70million.

Onanoilequivalentbasis,productionincreased2.3percentfromthethirdquarterof2014.Liquidsproductiontotaled2.3millionbarrelsperday,

up266,000barrelsperday,withprojectrampupandentitlementeffectspartlyoffsetbyfielddecline.Naturalgasproductionwas9.5billioncubic

feetperday,down1.1billioncubicfeetperdayfrom2014duetoregulatoryrestrictionsintheNetherlandsandfielddecline,partlyoffsetby

projectvolumes.

U.S.Upstreamearningsdeclined$1,699millionfromthethirdquarterof2014toalossof$442millioninthethirdquarterof2015.NonU.S.

Upstreamearningswere$1,800million,down$3,359millionfromtheprioryear.

Upstreamearningswere$6,244millionforthefirstninemonthsof2015,down$15,836millionfrom2014.Lowerrealizationsdecreasedearnings

by$15.1billion.Favorablevolumeandmixeffectsincreasedearningsby$680million.Allotheritems,primarilytheabsenceofprioryearasset

managementgains,decreasedearningsby$1.5billion.

Onanoilequivalentbasis,productionof4millionbarrelsperdaywasup2.7percentcomparedtothesameperiodin2014.Liquidsproductionof

2.3millionbarrelsperdayincreased213,000barrelsperday,withprojectrampupandentitlementeffectspartlyoffsetbyfielddecline.Naturalgas

productionof10.5billioncubicfeetperdaydecreased630millioncubicfeetperdayfrom2014asregulatoryrestrictionsintheNetherlandsand

fielddeclinewerepartlyoffsetbyprojectrampupandentitlementeffects.

U.S.Upstreamearningsdeclined$4,235millionfrom2014toalossof$541millionforthefirstninemonthsof2015.EarningsoutsidetheU.S.

were$6,785million,down$11,601millionfromtheprioryear.

15

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

15/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

Upstreamadditionalinformation

ThirdQuarter

FirstNineMonths

(thousandsofbarrelsdaily)

Volumesreconciliation(Oilequivalentproduction)(1)

2014

3,831

3,940

EntitlementsNetinterest

(32)

(26)

EntitlementsPrice/Spend/Other

132

159

Quotas

Divestments

(17)

(27)

Growth/Other

1

2015

3,918

4,047

(1)Gasconvertedtooilequivalentat6millioncubicfeet=1thousandbarrels.

ListedbelowaredescriptionsofExxonMobilsvolumesreconciliationfactorswhichareprovidedtofacilitateunderstandingoftheterms.

EntitlementsNetInterestarechangestoExxonMobilsshareofproductionvolumescausedbynonoperationalchangestovolumedetermining

factors. These factors consist of net interest changes specified in Production Sharing Contracts (PSCs) which typically occur when cumulative

investment returns or production volumes achieve defined thresholds, changes in equity upon achieving payout in partner investment carry

situations,equityredeterminationsasspecifiedinventureagreements,orasaresultoftheterminationorexpiryofaconcession.Onceanetinterest

changehasoccurred,ittypicallywillnotbereversedbysubsequentevents,suchaslowercrudeoilprices.

Entitlements Price, Spend and Other are changes to ExxonMobils share of production volumes resulting from temporary changes to non

operational volumedetermining factors. These factors include changes in oil and gas prices or spending levels from one period to another.

Accordingtothetermsofcontractualarrangementsorgovernmentroyaltyregimes,priceorspendingvariabilitycanincreaseordecreaseroyalty

burdensand/orvolumesattributabletoExxonMobil.Forexample,athigherprices,fewerbarrelsarerequiredforExxonMobiltorecoveritscosts.

These effects generally vary from period to period with field spending patterns or market prices for oil and natural gas. Such factors can also

includeothertemporarychangesinnetinterestasdictatedbyspecificprovisionsinproductionagreements.

QuotasarechangesinExxonMobilsallowableproductionarisingfromproductionconstraintsimposedbycountrieswhicharemembersofthe

OrganizationofthePetroleumExportingCountries(OPEC).Volumesreportedinthiscategorywouldhavebeenreadilyproducibleintheabsence

ofthequota.

DivestmentsarereductionsinExxonMobilsproductionarisingfromcommercialarrangementstofullyorpartiallyreduceequityinafieldorasset

inexchangeforfinancialorothereconomicconsideration.

GrowthandOtherfactorscompriseallotheroperationalandnonoperationalfactorsnotcoveredbytheabovedefinitionsthatmayaffectvolumes

attributable to ExxonMobil. Such factors include, but are not limited to, production enhancements from project and work program activities,

acquisitionsincludingadditionsfromassetexchanges,downtime,marketdemand,naturalfielddecline,andanyfiscalorcommercialtermsthatdo

notaffectentitlements.

16

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

16/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

ThirdQuarter

2015

2014

(millionsofdollars)

FirstNineMonths

2015

Downstreamearnings

UnitedStates

487

460

1,466

NonU.S.

1,546

564

3,740

Total

2,033

1,024

5,206

Downstreamearningswere$2,033million,up$1,009millionfromthethirdquarterof2014.Strongermarginsincreasedearningsby$1.4billion.

Lower refining volumes due to higher maintenancerelated activities decreased earnings by $280 million. All other items, including

maintenancedrivenexpenditurespartlyoffsetbyfavorableforeignexchangeimpacts,decreasedearningsby$110million.Petroleumproductsales

of5.8millionbarrelsperdaywere211,000barrelsperdaylowerthantheprioryear.

Earnings from the U.S. Downstream were $487 million, up $27 million from the third quarter of 2014. NonU.S. Downstream earnings of

$1,546millionwere$982millionhigherthanlastyear.

Downstreamearningsof$5,206millionforthefirstninemonthsof2015increased$2,658millionfrom2014.Strongermarginsincreasedearnings

by$3.5billion.Volumeandmixeffectsdecreasedearningsby$280million.Allotheritems,includinghighermaintenanceexpense,decreased

earningsby$580million.Petroleumproductsalesof5.8millionbarrelsperdaywere107,000barrelsperdaylowerthan2014.

U.S.Downstreamearningswere$1,466million,adecreaseof$153millionfrom2014.NonU.S.Downstreamearningswere$3,740million,up

$2,811millionfromtheprioryear.

ThirdQuarter

2015

FirstNineMonths

2014

2015

(millionsofdollars)

Chemicalearnings

UnitedStates

526

765

1,866

NonU.S.

701

435

1,589

Total

1,227

1,200

3,455

Chemical earnings of $1,227 million were $27 million higher than the third quarter of 2014. Margins increased earnings by $210 million,

benefiting from lower feedstock costs. Volume mix effects increased earnings by $30 million. All other items, primarily unfavorable foreign

exchangeeffects,decreasedearningsby$210million.Thirdquarterprimeproductsalesof6.1millionmetrictonswere167,000metrictonslower

thantheprioryear'sthirdquarter.

Chemicalearningsof$3,455millionforthefirstninemonthsof2015increased$367millionfrom2014.Highermarginsincreasedearningsby

$790million.Favorablevolumemixeffectsincreasedearningsby$130million.Allotheritems,includingunfavorableforeignexchangeeffects

partly offset by asset management gains, decreased earnings by $560 million. Prime product sales of 18.2 million metric tons were down

287,000metrictonsfrom2014.

17

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

17/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

ThirdQuarter

2015

FirstNineMonths

2014

2015

(millionsofdollars)

Corporateandfinancingearnings

(378)

(570)

(1,535)

Corporateandfinancingexpenseswere$378millionforthethirdquarterof2015,down$192millionfromthethirdquarterof2014drivenby

favorabletaxandfinancingitems.

Corporateandfinancingexpenseswere$1,535billioninthefirstninemonthsof2015,down$231millionfrom2014.

18

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

18/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

LIQUIDITYANDCAPITALRESOURCES

ThirdQuarter

2015

2014

FirstNineMonths

2015

2014

(millionsofdollars)

Netcashprovidedby/(usedin)

Operatingactivities

25,964

37,701

Investingactivities

(18,500)

(18,128)

Financingactivities

(7,450)

(19,085)

Effectofexchangeratechanges

(334)

Increase/(decrease)incashandcashequivalents

(320)

Cashandcashequivalents(atendofperiod)

4,296

Cashandcashequivalentsrestricted(atendofperiod)

Totalcashandcashequivalents(atendofperiod)

4,296

Cashflowfromoperationsandassetsales

Netcashprovidedbyoperatingactivities(U.S.GAAP)

9,174

12,396

25,964

37,701

Proceedsassociatedwithsalesofsubsidiaries,property,

plant&equipment,andsalesandreturnsofinvestments

491

127

1,604

Cashflowfromoperationsandassetsales

9,665

12,523

27,568

41,495

Because of the ongoing nature of our asset management and divestment program, we believe it is useful for investors to

consider proceeds associated with asset sales together with cash provided by operating activities when evaluating cash

availableforinvestmentinthebusinessandfinancingactivities,includingshareholderdistributions.

Cashflowfromoperationsandassetsalesinthethirdquarterof2015was$9.7billion,includingassetsalesof$0.5billion,adecreaseof$2.8

billionfromthecomparable2014periodduetolowerearningspartiallyoffsetbyhigherproceedsfromassetsales.

Cashprovidedbyoperatingactivitiestotaled$26.0billionforthefirstninemonthsof2015,$11.7billionlowerthan2014.Themajorsourceof

fundswasnetincomeincludingnoncontrollinginterestsof$13.7billion,adecreaseof$13.1billionfromtheprioryearperiod.Theadjustmentfor

thenoncashprovisionof$13.3billionfordepreciationanddepletionincreasedby$0.5billion.Changesinoperationalworkingcapitaldecreased

cashflowsby$1.0billionin2015and$0.5billionin2014.Allotheritemsnethadnoimpactoncashin2015anddecreasedcashby$1.5billion

in2014.Foradditionaldetails,seetheCondensedConsolidatedStatementofCashFlowsonpage6.

Investingactivitiesforthefirstninemonthsof2015usednetcashof$18.5billion,adecreaseof$0.4billioncomparedtotheprioryear.Spending

for additions to property, plant and equipment of $20.4 billion was $3.7 billion lower than 2014. Proceeds from asset sales of $1.6 billion

decreased$2.2billion.Additionalinvestmentandadvancesdecreased$0.9billionto$0.4billion.Otherinvestingactivitiesnetdecreased$2.7

billionto$0.7billion.

Cashflowfromoperationsandassetsalesinthefirstninemonthsof2015was$27.6billion,includingassetsalesof$1.6billion,anddecreased

$13.9billionfromthecomparable2014periodprimarilyduetolowerearningsandlowerproceedsfromassetsales.

Duringthefirstquarterof2015,theCorporationissued$8.0billionoflongtermdebtandusedpartoftheproceedstoreduceshorttermdebt.Net

cash used in financing activities of $7.5 billion in the first nine months of 2015 was $11.6 billion lower than 2014 reflecting the 2015 debt

issuanceandalowerlevelofpurchasesofsharesofExxonMobilstockin2015.

Duringthethirdquarterof2015,ExxonMobilCorporationpurchased6.5millionsharesofitscommonstockforthetreasuryatagrosscostof

$500million.Thesepurchasesweretoreducethenumberofsharesoutstanding.Sharesoutstandingdecreasedfrom4,169millionattheendof

second quarter to 4,163 million at the end of the third quarter 2015. Purchases may be made in both the open market and through negotiated

transactions,andmaybeincreased,decreasedordiscontinuedatanytimewithoutpriornotice.

19

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

19/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

TheCorporationdistributedtoshareholdersatotalof$3.6billioninthethirdquarterof2015throughdividendsandsharepurchasestoreduce

sharesoutstanding.

Totalcashandcashequivalentsof$4.3billionattheendofthethirdquarterof2015comparedto$5.0billionattheendofthethirdquarterof

2014.

Totaldebtof$34.3billioncomparedto$29.1billionatyearend2014.TheCorporation'sdebttototalcapitalratiowas16.2percentattheendof

thethirdquarterof2015comparedto13.9percentatyearend2014.

The Corporation has access to significant capacity of longterm and shortterm liquidity. Internally generated funds are expected to cover the

majorityoffinancialrequirements,supplementedbylongtermandshorttermdebt.

TheCorporation,aspartofitsongoingassetmanagementprogram,continuestoevaluateitsmixofassetsforpotentialupgrade.Becauseofthe

ongoingnatureofthisprogram,dispositionswillcontinuetobemadefromtimetotimewhichwillresultineithergainsorlosses.Additionally,

theCorporationcontinuestoevaluateopportunitiestoenhanceitsbusinessportfoliothroughacquisitionsofassetsorcompanies,andentersinto

suchtransactionsfromtimetotime.Keycriteriaforevaluatingacquisitionsincludepotentialforfuturegrowthandattractivecurrentvaluations.

Acquisitionsmaybemadewithcash,sharesoftheCorporationscommonstock,orboth.

LitigationandothercontingenciesarediscussedinNote3totheunauditedcondensedconsolidatedfinancialstatements.

TAXES

ThirdQuarter

FirstNineMonths

2015

2014

2015

2014

(millionsofdollars)

Incometaxes

1,365

5,064

5,617

15,955

Effectiveincometaxrate

32%

43%

37%

Salesbasedtaxes

5,813

7,519

17,308

22,806

Allothertaxesandduties

7,585

9,060

22,454

27,223

Total

14,763

21,643

45,379

65,984

Income,salesbasedandallothertaxesanddutiestotaled$14.8billionforthethirdquarterof2015,adecreaseof$6.9billionfrom2014.Income

taxexpensedecreasedby$3.7billionto$1.4billionreflectinglowerearningsandalowereffectivetaxrate.Theeffectiveincometaxratewas32

percentcomparedto43percentintheprioryearperiodduetofavorableonetimeitemsandalowershareofearningsinhighertaxjurisdictions

Salesbasedtaxesandallothertaxesanddutiesdecreasedby$3.2billionto$13.4billionasaresultoflowersalesrealizations.

Income,salesbasedandallothertaxesanddutiestotaled$45.4billionforthefirstninemonthsof2015,adecreaseof$20.6billionfrom2014.

Incometaxexpensedecreasedby$10.3billionto$5.6billionasaresultoflowerearningsandalowereffectivetaxrate.Theeffectiveincometax

ratewas37percentcomparedto43percentintheprioryeardueprimarilytoalowershareofearningsinhighertaxjurisdictions.Salesbasedand

allothertaxesdecreasedby$10.3billionto$39.8billionasaresultoflowersalesrealizations.

20

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

20/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

CAPITALANDEXPLORATIONEXPENDITURES

ThirdQuarter

FirstNineMonths

2015

2014

2015

2014

(millionsofdollars)

Upstream(includingexplorationexpenses)

6,374

8,424

19,537

24,082

Downstream

586

780

1,834

2,002

Chemical

669

626

2,151

1,970

Other

41

7

113

19

Total

7,670

9,837

23,635

28,073

Capitalandexplorationexpendituresinthethirdquarterof2015were$7.7billion,down22percentfromthethirdquarterof2014,inlinewith

plan.

Capitalandexplorationexpendituresinthefirstninemonthsof2015were$23.6billion,down16percentfromthefirstninemonthsof2014due

primarilytolowermajorprojectspending.TheCorporationanticipatesanaverageinvestmentprofileofabout$34billionperyearforthenextfew

years.Actualspendingcouldvarydependingontheprogressofindividualprojectsandpropertyacquisitions.

In2014,theEuropeanUnionandUnitedStatesimposedsanctionsrelatingtotheRussianenergysector.ExxonMobilcontinuestocomplywithall

sanctionsandregulatorylicensesapplicabletoitsaffiliatesinvestmentsintheRussianFederation.

21

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

21/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

RECENTLYISSUEDACCOUNTINGSTANDARDS

InMay2014,theFinancialAccountingStandardsBoardissuedanewstandard,RevenuefromContractswithCustomers.Thestandardestablishes

asinglerevenuerecognitionmodelforallcontractswithcustomers,eliminatesindustryspecificrequirementsandexpandsdisclosurerequirements.

The standard is required to be adopted beginning January 1, 2018. ExxonMobil is evaluating the standard and its effect on the Corporations

financialstatements.

FORWARDLOOKINGSTATEMENTS

Statementsrelatingtofutureplans,projections,eventsorconditionsareforwardlookingstatements.Actualresults,includingprojectplans,costs,

timing,andcapacitiescapitalandexplorationexpendituresresourcerecoveriesandsharepurchaselevels,coulddiffermateriallyduetofactors

including:changesinoilorgaspricesorothermarketoreconomicconditionsaffectingtheoilandgasindustry,includingthescopeandduration

of economic recessions the outcome of exploration and development efforts changes in law or government regulation, including tax and

environmentalrequirementstheoutcomeofcommercialnegotiationschangesintechnicaloroperatingconditionsandotherfactorsdiscussed

undertheheading"FactorsAffectingFutureResults"intheInvestorssectionofourwebsiteandinItem1AofExxonMobil's2014Form10K.

Weassumenodutytoupdatethesestatementsasofanyfuturedate.

Thetermprojectasusedinthisreportcanrefertoavarietyofdifferentactivitiesanddoesnotnecessarilyhavethesamemeaningasinany

governmentpaymenttransparencyreports.

Item3.QuantitativeandQualitativeDisclosuresAboutMarketRisk

InformationaboutmarketrisksfortheninemonthsendedSeptember30,2015,doesnotdiffermateriallyfromthatdiscussedunderItem7Aofthe

registrant'sAnnualReportonForm10Kfor2014.

Item4.ControlsandProcedures

AsindicatedinthecertificationsinExhibit31ofthisreport,theCorporationsChiefExecutiveOfficer,PrincipalFinancialOfficerandPrincipal

AccountingOfficerhaveevaluatedtheCorporationsdisclosurecontrolsandproceduresasofSeptember30,2015.Basedonthatevaluation,these

officers have concluded that the Corporations disclosure controls and procedures are effective in ensuring that information required to be

disclosedbytheCorporationinthereportsthatitfilesorsubmitsundertheSecuritiesExchangeActof1934,asamended,isaccumulatedand

communicated to them in a manner that allows for timely decisions regarding required disclosures and are effective in ensuring that such

informationisrecorded,processed,summarizedandreportedwithinthetimeperiodsspecifiedintheSecuritiesandExchangeCommissionsrules

andforms.TherewerenochangesduringtheCorporationslastfiscalquarterthatmateriallyaffected,orarereasonablylikelytomateriallyaffect,

theCorporationsinternalcontroloverfinancialreporting.

22

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

22/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

PARTII.OTHERINFORMATION

Item1.LegalProceedings

FollowingExxonMobilOilCorporations(EMOC)selfreportingofanairemissioneventattheExxonMobilBeaumontChemicalPlantwhich

exceeded provisions of the Texas Administrative Code and Texas Health and Safety Code, the Texas Commission on Environmental Quality

(TCEQ),onSeptember17,2015,notifiedEMOCthatTCEQwasseekingapenaltyof$150,000inconnectionwiththeincident.

AslastreportedintheCorporationsForm10Qforthefirstquarterof2015,ExxonMobilPipelineCompany(EMPCo),theUnitedStatesandthe

StateofArkansasreachedagreementonaConsentDecreetoresolvetheenforcementactionrelatedtothedischargeofcrudeoilfromthePegasus

PipelineinMayflower,FaulknerCounty,Arkansas.UnderthetermsoftheConsentDecree,EMPCowastomakeseveralprocesschangesandto

paya$3.19millioncivilpenaltytotheUnitedStatesand$1.88milliontotheStateofArkansasconsistingofa$1millioncivilpenalty,$600,000

towardsasupplementalenvironmentalprojectand$280,000toreimburseexpensesoftheArkansasAttorneyGeneralsOffice.TheUnitedStates

DistrictCourtfortheEasternDistrictofArkansasapprovedtheConsentDecreeonAugust12,2015andEMPCohasmadeallpaymentsrequired

bytheConsentDecree,withtheexceptionoftheSupplementalEnvironmentalProjectportionwhichcontinuestobeprogressedascontemplated

undertheConsentDecree.InamatterrelatedtothesamedischargeofcrudeoilfromthePegasusPipeline,onOctober1,2015,thePipelineand

HazardousMaterialsSafetyAdministrationissuedaFinalOrderarisingfromaNovember2013NoticeofProbableViolationallegingthatEMPCo

violatedmultiplefederalPipelineSafetyRegulations.TheFinalOrderimposedapenaltyof$2,630,400onEMPCo.EMPCohasfiledaPetitionfor

ReconsiderationoftheFinalOrder.TheFinalOrderanddemandedpenaltyarestayed.

AsreportedintheCorporationsForm10Kfor2014andForm10Qforthesecondquarterof2012,ChalmetteRefiningLLC(CRLLC),atthetime

theowneroftheChalmetteRefinery(thenoperatedbyEMOC),andtheLouisianaDepartmentofEnvironmentalQuality,wereindiscussionsto

resolve selfreported deviations from refinery operations and relating to certain Clean Air Act Title V permit conditions, limits and other

requirements.OnJune17,2015,EMOC,MobilPipeLineCompany,andPDVChalmetteLLC,thethreeholdersofownershipinterestsinCRLLC,

enteredintoanAgreementwithPBFHoldingCompanyLLC(PBF)toselltheirownershipintereststoPBF.Theagreementprovidesthat,atchange

in control, which occurred on November 1, 2015, PBF would assume the environmental liabilities of CRLLC, including any potential fines,

penalties,orenforcementactionrelatingtohistoricalTitleVdeviationsarisingfromtheoperationoftherefinery.

RefertotherelevantportionsofNote3ofthisQuarterlyReportonForm10Qforfurtherinformationonlegalproceedings.

23

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

23/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

Item2.UnregisteredSalesofEquitySecuritiesandUseofProceeds

IssuerPurchaseofEquitySecuritiesforQuarterEndedSeptember30,2015

Period

TotalNumber

ofShares

Purchased

Average

PricePaid

perShare

TotalNumberof

SharesPurchased

asPartofPublicly

AnnouncedPlans

orPrograms

MaximumNumber

ofSharesthatMay

YetBePurchased

UnderthePlansor

Programs

July2015

2,137,699

$81.99

2,137,699

August2015

2,198,427

$75.84

2,198,427

September2015

2,176,981

$73.02

2,176,981

Total

$76.91

(SeeNote1)

6,513,107

6,513,107

Note1OnAugust1,2000,theCorporationannounceditsintentiontoresumepurchasesofsharesofitscommonstockforthetreasurybothto

offset shares issued in conjunction with company benefit plans and programs and to gradually reduce the number of shares outstanding. The

announcementdidnotspecifyanamountorexpirationdate.TheCorporationhascontinuedtopurchasesharessincethisannouncementandto

reportpurchasedvolumesinitsquarterlyearningsreleases.InitsmostrecentearningsreleasedatedOctober30,2015,theCorporationstatedthat

fourthquarter2015sharepurchasestoreducesharesoutstandingareanticipatedtoequal$500million.Purchasesmaybemadeinboththeopen

marketandthroughnegotiatedtransactions,andpurchasesmaybeincreased,decreasedordiscontinuedatanytimewithoutpriornotice.

Item6.Exhibits

Exhibit

Description

31.1

31.2

31.3

32.1

32.2

32.3

101

Certification(pursuanttoSecuritiesExchangeActRule13a14(a))byChiefExecutiveOfficer.

Certification(pursuanttoSecuritiesExchangeActRule13a14(a))byPrincipalFinancialOfficer.

Certification(pursuanttoSecuritiesExchangeActRule13a14(a))byPrincipalAccountingOfficer.

Section1350Certification(pursuanttoSarbanesOxleySection906)byChiefExecutiveOfficer.

Section1350Certification(pursuanttoSarbanesOxleySection906)byPrincipalFinancialOfficer.

Section1350Certification(pursuanttoSarbanesOxleySection906)byPrincipalAccountingOfficer.

InteractiveDataFiles.

24

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

24/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

EXXONMOBILCORPORATION

SIGNATURE

PursuanttotherequirementsoftheSecuritiesExchangeActof1934,theRegistranthasdulycausedthisreporttobesignedonitsbehalfbythe

undersigned,thereuntodulyauthorized.

EXXONMOBILCORPORATION

Date:November4,2015

By:

/s/DAVIDS.ROSENTHAL

DavidS.Rosenthal

VicePresident,Controllerand

PrincipalAccountingOfficer

25

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

25/26

2/2/2016

www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

INDEXTOEXHIBITS

Exhibit

Description

31.1

31.2

31.3

32.1

32.2

32.3

101

Certification(pursuanttoSecuritiesExchangeActRule13a14(a))byChiefExecutiveOfficer.

Certification(pursuanttoSecuritiesExchangeActRule13a14(a))byPrincipalFinancialOfficer.

Certification(pursuanttoSecuritiesExchangeActRule13a14(a))byPrincipalAccountingOfficer.

Section1350Certification(pursuanttoSarbanesOxleySection906)byChiefExecutiveOfficer.

Section1350Certification(pursuanttoSarbanesOxleySection906)byPrincipalFinancialOfficer.

Section1350Certification(pursuanttoSarbanesOxleySection906)byPrincipalAccountingOfficer.

InteractiveDataFiles.

26

http://www.sec.gov/Archives/edgar/data/34088/000003408815000044/xom10q3q2015.htm

26/26

Das könnte Ihnen auch gefallen

- General Motors Company: Form 10 KDokument234 SeitenGeneral Motors Company: Form 10 Kalphawasbeta3104Noch keine Bewertungen

- Fossilfuelassetsinc Secfiling10qDokument6 SeitenFossilfuelassetsinc Secfiling10qapi-259974377Noch keine Bewertungen

- Prosper 10Q November 2014Dokument111 SeitenProsper 10Q November 2014CrowdfundInsiderNoch keine Bewertungen

- Big - 10-QDokument1 SeiteBig - 10-QBenNoch keine Bewertungen

- Coherent, Inc 10-q q1 2016Dokument97 SeitenCoherent, Inc 10-q q1 2016Sundeep NarangNoch keine Bewertungen

- United States Securities and Exchange Commission Form 8-K: Washington, D.C. 20549Dokument1 SeiteUnited States Securities and Exchange Commission Form 8-K: Washington, D.C. 20549CrainsChicagoBusinessNoch keine Bewertungen

- WWW Sec Gov Ix - Doc Archives Edgar Data 1436126 000143612622000013 MG 20211231 HDokument1 SeiteWWW Sec Gov Ix - Doc Archives Edgar Data 1436126 000143612622000013 MG 20211231 HZeenaNoch keine Bewertungen

- Aapl 10k2013Dokument91 SeitenAapl 10k2013juimbNoch keine Bewertungen

- Time Base CircuitDokument3 SeitenTime Base Circuitkaran007_mNoch keine Bewertungen

- EMS Annual Report Provides Financial InsightsDokument181 SeitenEMS Annual Report Provides Financial Insightsibanka100% (1)

- Helmerich & Payne 2003 10-K SEC Filing Provides Business Overview and Financial ResultsDokument29 SeitenHelmerich & Payne 2003 10-K SEC Filing Provides Business Overview and Financial Resultsgustavo rivasNoch keine Bewertungen

- Urban One Exhibits June 2023Dokument492 SeitenUrban One Exhibits June 2023Activate VirginiaNoch keine Bewertungen

- PDF Solutions Annual Report 2017Dokument80 SeitenPDF Solutions Annual Report 2017Ase AtarNoch keine Bewertungen

- Form 10-K StarwoodDokument119 SeitenForm 10-K Starwoodsiebrand982Noch keine Bewertungen

- HEALTHCARE SERVICES GROUP INC 10-K (Annual Reports) 2009-02-20Dokument76 SeitenHEALTHCARE SERVICES GROUP INC 10-K (Annual Reports) 2009-02-20http://secwatch.comNoch keine Bewertungen

- Akamai Technologies, Inc.: United States Securities and Exchange Commission FORM 10 QDokument78 SeitenAkamai Technologies, Inc.: United States Securities and Exchange Commission FORM 10 QstevenNoch keine Bewertungen

- Western Union - 8-K (Current Report Filing) SEC FilingDokument48 SeitenWestern Union - 8-K (Current Report Filing) SEC FilingEudy Alfonso PeñaNoch keine Bewertungen

- Tenaris Sa: FORM 20-FDokument182 SeitenTenaris Sa: FORM 20-FWili Nur RahmanNoch keine Bewertungen

- READERS DIGEST ASSOCIATION INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23Dokument4 SeitenREADERS DIGEST ASSOCIATION INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23http://secwatch.comNoch keine Bewertungen

- Mcdonald'S Corporation: United States Securities and Exchange Commission FORM 10-QDokument1 SeiteMcdonald'S Corporation: United States Securities and Exchange Commission FORM 10-QSaidal MohmandNoch keine Bewertungen

- Principles of MarketingDokument146 SeitenPrinciples of MarketingAlbert WengNoch keine Bewertungen

- EnerSys 10KDokument133 SeitenEnerSys 10KFede TrostdorfNoch keine Bewertungen

- Cameron International Corporation: FORM 10-KDokument31 SeitenCameron International Corporation: FORM 10-KMehdi SoltaniNoch keine Bewertungen

- United States Securities and Exchange Commission: Current ReportDokument10 SeitenUnited States Securities and Exchange Commission: Current Reporteimg20041333Noch keine Bewertungen

- Nyse Cas 2020Dokument141 SeitenNyse Cas 2020chungkiyanNoch keine Bewertungen

- Tyco Form10K 2002 1Dokument10 SeitenTyco Form10K 2002 1TranNoch keine Bewertungen

- 21vianet Group, Inc.: United States Securities and Exchange Commission FORM 20-FDokument462 Seiten21vianet Group, Inc.: United States Securities and Exchange Commission FORM 20-Fgns1234567890Noch keine Bewertungen

- VipshopHoldingsLtd 20F 20170414-1 PDFDokument290 SeitenVipshopHoldingsLtd 20F 20170414-1 PDFFakhri HakimNoch keine Bewertungen

- COCA COLA ENTERPRISES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-24Dokument3 SeitenCOCA COLA ENTERPRISES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-24http://secwatch.comNoch keine Bewertungen

- 2019 01 Tesla Informe Comision de Valores EeuuDokument79 Seiten2019 01 Tesla Informe Comision de Valores EeuuJuan GutierrezNoch keine Bewertungen

- 2019 Tesla Informe Comision de Valores EeuuDokument159 Seiten2019 Tesla Informe Comision de Valores EeuuJuan GutierrezNoch keine Bewertungen

- Kellogg 2015 AR 10 K v3Dokument124 SeitenKellogg 2015 AR 10 K v3Anik BasuNoch keine Bewertungen

- Nyse Ahc 2018Dokument68 SeitenNyse Ahc 2018gaja babaNoch keine Bewertungen

- 10-K Edgar Data 1028215 0001564590-18-023790 1Dokument208 Seiten10-K Edgar Data 1028215 0001564590-18-023790 1jeetNoch keine Bewertungen

- Square Inc - 2016 Annual Report (Form 10-K)Dokument172 SeitenSquare Inc - 2016 Annual Report (Form 10-K)trung ducNoch keine Bewertungen

- Form 20-F For 2017Dokument208 SeitenForm 20-F For 2017Anonymous dgRAlFj8zNoch keine Bewertungen

- FORM 10-K: United States Securities and Exchange CommissionDokument153 SeitenFORM 10-K: United States Securities and Exchange CommissionjessacaNoch keine Bewertungen

- 2013 Annual Report - Chipotle PDFDokument164 Seiten2013 Annual Report - Chipotle PDFJames BrownNoch keine Bewertungen

- Imaging Diagnostic Systems, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 Form 8-KDokument3 SeitenImaging Diagnostic Systems, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 Form 8-KAnonymous Feglbx5Noch keine Bewertungen

- FORM 10-K: Securities and Exchange CommissionDokument265 SeitenFORM 10-K: Securities and Exchange Commissiond_abdosNoch keine Bewertungen

- Pinduoduo - 2020 Annual ReportDokument492 SeitenPinduoduo - 2020 Annual ReportNicolas Montore RosNoch keine Bewertungen

- OdysseyDokument2 SeitenOdysseyWilliam HarrisNoch keine Bewertungen

- UMPQUA HOLDINGS CORP 8-K (Events or Changes Between Quarterly Reports) 2009-02-24Dokument3 SeitenUMPQUA HOLDINGS CORP 8-K (Events or Changes Between Quarterly Reports) 2009-02-24http://secwatch.comNoch keine Bewertungen

- Delta Annual 2005 PDFDokument136 SeitenDelta Annual 2005 PDFzekiNoch keine Bewertungen

- Apple Inc.: FORM 10-QDokument52 SeitenApple Inc.: FORM 10-Qalphawasbeta3104Noch keine Bewertungen

- Apple Inc.: Form 10-KDokument88 SeitenApple Inc.: Form 10-KgigiNoch keine Bewertungen

- United States Securities and Exchange Commission FORM 10-K: Washington, D.C. 20549Dokument150 SeitenUnited States Securities and Exchange Commission FORM 10-K: Washington, D.C. 20549VP88Noch keine Bewertungen

- Nyse Cas 2018Dokument80 SeitenNyse Cas 2018gaja babaNoch keine Bewertungen

- Oracle Corporation Annual ReportDokument129 SeitenOracle Corporation Annual ReportMuhammad FaisalNoch keine Bewertungen

- United States Securities and Exchange Commission Form 8-K: Current ReportDokument3 SeitenUnited States Securities and Exchange Commission Form 8-K: Current ReportVerónica SilveriNoch keine Bewertungen

- Nasdaq Tsla 2018 PDFDokument418 SeitenNasdaq Tsla 2018 PDFsrinivas nallakuntaNoch keine Bewertungen

- Casa Systems Inc: FORM 10-QDokument50 SeitenCasa Systems Inc: FORM 10-QtmaillistNoch keine Bewertungen

- ITT EDUCATIONAL SERVICES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-24Dokument3 SeitenITT EDUCATIONAL SERVICES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-24http://secwatch.comNoch keine Bewertungen

- Nasdaq Amrk 2016Dokument249 SeitenNasdaq Amrk 2016gaja babaNoch keine Bewertungen

- PURE BIOSCIENCE 8-K (Events or Changes Between Quarterly Reports) 2009-02-20Dokument3 SeitenPURE BIOSCIENCE 8-K (Events or Changes Between Quarterly Reports) 2009-02-20http://secwatch.comNoch keine Bewertungen

- WASHINGTON, D.C. 20549: Date of Report (Date of Earliest Event Reported) : September 27, 2016Dokument54 SeitenWASHINGTON, D.C. 20549: Date of Report (Date of Earliest Event Reported) : September 27, 2016Ankur MathurNoch keine Bewertungen

- ONYX PHARMACEUTICALS INC 10-K (Annual Reports) 2009-02-25Dokument129 SeitenONYX PHARMACEUTICALS INC 10-K (Annual Reports) 2009-02-25http://secwatch.comNoch keine Bewertungen

- Carrizo 2010 Q3 10QDokument70 SeitenCarrizo 2010 Q3 10Qreedny1Noch keine Bewertungen

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerVon EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNoch keine Bewertungen

- Additional Probllems For Service Cost Allocation PDFDokument9 SeitenAdditional Probllems For Service Cost Allocation PDFsfsdfsdfNoch keine Bewertungen

- Retail Management BbaDokument8 SeitenRetail Management BbaSkylar RingtonesNoch keine Bewertungen

- Chapter 12 Marketing Channels and Supply Chain ManagementDokument32 SeitenChapter 12 Marketing Channels and Supply Chain ManagementWilliam Zhang100% (1)

- MOS Marketing of Services Study MaterialsDokument31 SeitenMOS Marketing of Services Study MaterialsTrần Hoàng TrinhNoch keine Bewertungen

- Anchor SwitchesDokument12 SeitenAnchor SwitchesAnusha PaulNoch keine Bewertungen

- Genjrl 1Dokument1 SeiteGenjrl 1Tiara AjaNoch keine Bewertungen

- Special Journals - SsDokument2 SeitenSpecial Journals - SsEsther FanNoch keine Bewertungen

- NP EX19 8a JinruiDong 2Dokument14 SeitenNP EX19 8a JinruiDong 2Ike DongNoch keine Bewertungen

- 11i Period End Processing StepsDokument4 Seiten11i Period End Processing StepsNarasimhan RamanujamNoch keine Bewertungen

- Sales Forecast and Pricing Strategy Impact on Battery BusinessDokument11 SeitenSales Forecast and Pricing Strategy Impact on Battery BusinessMuhammad Izzudin Kurnia Adi100% (1)

- MBA 512 Chapter 1: Introduction to Operations ManagementDokument56 SeitenMBA 512 Chapter 1: Introduction to Operations ManagementAnik BhowmickNoch keine Bewertungen

- CIMA 2010 Qualification Structure and SyllabusDokument80 SeitenCIMA 2010 Qualification Structure and SyllabusMuhammad AshrafNoch keine Bewertungen

- Basics of Retail MerchandisingDokument38 SeitenBasics of Retail MerchandisingRishabh SharmaNoch keine Bewertungen

- DHL Supply Chain Market Leader in Contract LogisticsDokument2 SeitenDHL Supply Chain Market Leader in Contract LogisticsJindalNoch keine Bewertungen

- ZOZO General Info, Financials, and Business ModelDokument4 SeitenZOZO General Info, Financials, and Business ModelÁi Thi DươngNoch keine Bewertungen

- Peta 1&2Dokument3 SeitenPeta 1&2Jolito FloirendoNoch keine Bewertungen

- 15Dokument12 Seiten15RamiesRahmanNoch keine Bewertungen

- Print Chapter 2 Mcqs BankDokument7 SeitenPrint Chapter 2 Mcqs BankMohammedAlmohammedNoch keine Bewertungen

- 1465815374Dokument22 Seiten1465815374NeemaNoch keine Bewertungen

- Preparing Financial StatementsDokument18 SeitenPreparing Financial StatementsAUDITOR97Noch keine Bewertungen

- mcq1 PDFDokument15 Seitenmcq1 PDFjack100% (1)

- REFERENCESDokument2 SeitenREFERENCESjessrylmae belza100% (1)

- Assignment 11 Managerial AccountingDokument9 SeitenAssignment 11 Managerial AccountingFaisal AlsharifiNoch keine Bewertungen

- A Day in The Life of Yolanda ValdezDokument1 SeiteA Day in The Life of Yolanda ValdezAmit PandeyNoch keine Bewertungen

- Exercise 2 - CVP Analysis Part 1Dokument5 SeitenExercise 2 - CVP Analysis Part 1Vincent PanisalesNoch keine Bewertungen

- Tally Shortcut Keys GuideDokument2 SeitenTally Shortcut Keys Guideradha ramaswamyNoch keine Bewertungen

- Memo 2023 003 Scope of Qualifying ExamsDokument4 SeitenMemo 2023 003 Scope of Qualifying ExamsSara ChanNoch keine Bewertungen

- FEU-MarkMan Lec 02 Strategic-PlanningDokument19 SeitenFEU-MarkMan Lec 02 Strategic-PlanningMlb T. De TorresNoch keine Bewertungen

- Tradewind Brochure 11x17Dokument2 SeitenTradewind Brochure 11x17JAckNoch keine Bewertungen

- SyllabusDokument5 SeitenSyllabusBalbeer SinghNoch keine Bewertungen