Beruflich Dokumente

Kultur Dokumente

LTEF

Hochgeladen von

peterCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

LTEF

Hochgeladen von

peterCopyright:

Verfügbare Formate

An extra benefit for an

extra wide smile.

About the Fund

October 2015

The fund looks at opportunities across the market

cap and the portfolio remains balanced between its

large and mid-cap allocations.

Open-ended

Equity-Linked Savings Scheme

with a 3 year lock in

Offers tax benefit under section 80C

of the Income Tax Act, 1961

quality

businesses for the long term

Invests in

The fund is focused on long term earnings growth

prospects and quality as key criteria for stock

selection.

through bottom up stock picking

3 year lock-in eliminates

near term pressure on stock

selection

Can support quality

businesses through their

market cycle

Invests across market cap*

Large caps around 50-100% and

midcaps up to 50%

Note: Current Portfolio Allocation is based on the prevailing market conditions and is subject to changes depending on the fund managers view of the equity markets. *Large Cap: Large cap > Market Cap of 101st stock by market cap in CNX 500 Index

(currently 19,605 crs); Midcap: Market cap of 400th Stock in CNX 500 Index (currently 1,383 crs) < Midcap <= Market Cap of 101st stock by market cap in CNX 500 Index (currently 19,605 crs); Small Cap: Small Cap < = Market cap of 400th Stock in

CNX 500 Index (currently 1,383 crs). The range will be monitored quarterly based on average of last 4 quarters.

Current market cap split

Performance

(% NAV)

(NAV Movement)

30 September 2015

Axis Long Term Equity Fund

59.1%

30,619

S&P BSE 200 Index

29 Dec 2009

1.6%

5.4%

<2,000

crs

2,000 5,000 crs

15.8%

15.5%

5,000 10,000 crs

10,000 30,000 crs

10,000

`

Risk Parameter

Standard Deviation (%)

Beta

13.9

0.8

Tracking Error

Information Ratio

6.1

15,418

>30,000 crs

2.6

Sep 28, 2012

To

Sep 30, 2013

Sep 30, 2013

To

Sep 30, 2014

Sep 30, 2014

To

Sep 30, 2015

Since

Inception

(Absolute) %

(Absolute) %

(Absolute) %

(CAGR) %

Axis Long Term Equity Fund - Growth*

3.26

76.27

17.99

21.46

S&P BSE 200 (Benchmark)

-1.11

42.50

3.08

7.81

Nifty 50 (Additional Benchmark)

0.56

38.87

-0.20

7.69

*Type of Scheme: Open-ended Equity-Linked Savings Scheme with a 3 year lock in. Past performance may or may not be sustained in future. Calculations are based on Growth Option NAV. Since

inception returns are calculated on ` 10 invested at inception. Date of Inception: 29th December 2009. Jinesh Gopani is the fund manager & he manages 2 schemes. Please refer to annexure for

performance of all schemes managed by the fund manager. Current value of Investment if ` 10,000 was invested on inception date ` 30,619, S&P BSE 15,418: ` 16,096 & Nifty 50: `15,322.

Based on 4 years data

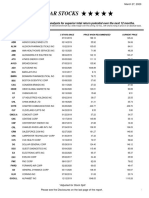

Top 10 stocks

HDFC Bank Ltd

Kotak Mahindra Bank Ltd

Tata Consultancy Services Ltd

HDFC Ltd

Sun Pharmaceuticals Industries Ltd

Maruti Suzuki India Ltd

Tech Mahindra Ltd

Pidilite Industries Ltd

Cummins India Ltd

TTK Prestige Ltd

Weight %

8.3

6.6

6.6

5.6

5.4

4.1

4.1

3.9

3.2

3.1

Top 5 Sectors

29.6%

15.6%

14.3%

12.2%

11.1%

Finance

Consumer

Autos & Logistics

Information

Technology

Healthcare

Current Portfolio Allocation is based on the prevailing market conditions and is subject to changes depending on the fund managers view of the equity markets.

Investing facts

Minimum Application

Entry / Exit Load

Fund Manager

Lumpsum

Jinesh Gopani

500

Inception Date

Dec 29

2009

NIL

multiples of ` 500

SIP

500

multiples of ` 500

Options

Over 14 years of experience in financial markets.

He has been managing this fund since 1st April 2011.

Growth & Dividend

SIP - Systematic Investment Plan

DIVIDEND HISTORY

Option

Dividend (` Per unit)

Individuals/

Others

HUF

2.00

2.00

Record Date

January 22, 2015

Regular Dividend

NAV per unit (Cum Dividend)

24.2942

January 6, 2014

1.00

1.00

14.6918

August 7, 2012

0.80

0.80

12.1041

Please note that after the payment of dividend, the NAV falls to the extent of dividend, distribution tax and cess wherever applicable.

Past performance may or may not be sustained in future.

Face Value of units is ` 10

Dividends disclosed above are since the inception of the fund.

Returns of schemes managed by Jinesh Gopani

(as on September 30, 2015)

Sep 28, 2012 to

Sep 30, 2013

Sep 30, 2013 to

Sep 30, 2014

Sep 30, 2014 to

Sep 30, 2015

Since

Inception

Absolute Return

Absolute Return

Absolute Return

CAGR

Current Value of

Investment if ` 10,000

was invested on

inception date

Date of

Inception

29-Dec-09

Axis Long Term Equity Fund - Growth^*

3.26%

76.27%

17.99%

21.46%

30,619

S&P BSE 200 (Benchmark)

-1.11%

42.50%

3.08%

7.81%

15,418

Nifty 50 (Additional Benchmark)

0.56%

38.87%

-0.20%

7.69%

15,322

Axis Long Term Equity Fund - Direct Plan - Growth^*

78.66%

19.47%

31.55%

21,229

S&P BSE 200 (Benchmark)

42.50%

3.08%

12.16%

13,703

38.87%

-0.20%

11.12%

13,358

Axis Income Saver - Growth*

Nifty 50 (Additional Benchmark)

4.22%

20.67%

9.37%

8.99%

15,663

Crisil MIP Blended Fund Index (Benchmark)

3.22%

15.45%

10.72%

8.40%

15,226

Crisil 10 Year Gilt Index (Additional Benchmark)

2.45%

6.85%

13.76%

6.53%

13,904

22.58%

11.00%

12.45%

13,788

Crisil MIP Blended Fund Index (Benchmark)

15.45%

10.72%

9.44%

12,799

Crisil 10 Year Gilt Index (Additional Benchmark)

6.85%

13.76%

6.94%

12,015

Axis Income Saver - Direct Plan - Growth*

1-Jan-13

16-Jul-10

4-Jan-13

^ An open ended equity linked savings scheme with a 3 year lock-in.

*Scheme Performance may not be strictly comparable with that of its additional benchmark in view of hybrid nature of the scheme.

Data as on 30th September 2015. Past performance may or may not be sustained in future. Calculations are based on Growth Option NAV. Above data excludes schemes which have not

completed a year. The above data excludes performance of direct plans of all the schemes as they have not completed a year.

Disclaimer: Past performance may or may not be sustained in the future. Sector(s) / Stock(s) / Issuer(s) mentioned above are for the purpose of disclosure of the portfolio of the Scheme(s) and

should not be construed as recommendation. The fund manager(s) may or may not choose to hold the stock mentioned, from time to time. Investors are requested to consult their financial, tax

and other advisors before taking any investment decision(s).

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to ` 1 lakh). Trustee: Axis Mutual Fund

Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the

scheme. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Distributed by

Riskometer

Axis Long Term Equity Fund

M

ely Moderate ode

rat

e

Hig rate

d

h ly

Mo Low

(an open-ended equity linked savings scheme with a 3 year lock-in)

This product is suitable for investors who are seeking*:

LOW

High

*Investors should consult their financial advisers if in doubt

about whether the product is suitable for them.

Low

Capital appreciation & generating income over long term

Investment in a diversified portfolio predominantly

consisting of equity and equity related instruments

HIGH

Investors understand that their principal will be

at moderately high risk

Das könnte Ihnen auch gefallen

- Should You Invest in PPF or ELSS?: Inflation - EduDokument2 SeitenShould You Invest in PPF or ELSS?: Inflation - EdupeterNoch keine Bewertungen

- Costs Involved in Mutual Fund InvestingDokument3 SeitenCosts Involved in Mutual Fund InvestingpeterNoch keine Bewertungen

- DEFINITION of 'Price-Earnings Ratio - P/E Ratio'Dokument2 SeitenDEFINITION of 'Price-Earnings Ratio - P/E Ratio'peterNoch keine Bewertungen

- Axis Equity Growth: Investment ObjectiveDokument1 SeiteAxis Equity Growth: Investment ObjectivepeterNoch keine Bewertungen

- Key To Tax PlanningDokument20 SeitenKey To Tax PlanningpeterNoch keine Bewertungen

- Lenovo T450: Intel Core I5 2.3 GHZ 14.0" (1600×900) 4.00 Lbs (1.814 KG) 8 GB 256 GB Up To 12 HoursDokument3 SeitenLenovo T450: Intel Core I5 2.3 GHZ 14.0" (1600×900) 4.00 Lbs (1.814 KG) 8 GB 256 GB Up To 12 HourspeterNoch keine Bewertungen

- Chap14 UNIXShellDokument1 SeiteChap14 UNIXShellpeterNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Icomm Tele Ltd.Dokument433 SeitenIcomm Tele Ltd.adhavvikasNoch keine Bewertungen

- Unilink BSDokument10 SeitenUnilink BSIshita shahNoch keine Bewertungen

- Goutham Mallela (201144) - SIP ReportDokument54 SeitenGoutham Mallela (201144) - SIP Reportmohan subhash sunkaraNoch keine Bewertungen

- Ades LKDokument82 SeitenAdes LKdwi amaliaNoch keine Bewertungen

- Partnership FormationDokument8 SeitenPartnership FormationAira Kaye MartosNoch keine Bewertungen

- 2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1Dokument3 Seiten2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1misonim.eNoch keine Bewertungen

- Functions OF DepositoryDokument32 SeitenFunctions OF DepositoryShakti ShivanandNoch keine Bewertungen

- Assets: Aditional InformationDokument16 SeitenAssets: Aditional Informationleeyaa aNoch keine Bewertungen

- 21 Financial Instruments s22 - FINALDokument95 Seiten21 Financial Instruments s22 - FINALAphelele GqadaNoch keine Bewertungen

- Capital Struture Analysis Oman CompaniesDokument9 SeitenCapital Struture Analysis Oman CompaniesSalman SajidNoch keine Bewertungen

- Test Bank For Mergers Acquisitions and Corporate Restructurings 7th Edition Patrick A GaughanDokument4 SeitenTest Bank For Mergers Acquisitions and Corporate Restructurings 7th Edition Patrick A Gaughandominicmaximus44uNoch keine Bewertungen

- Makalah Manajemen Dana (BRI)Dokument7 SeitenMakalah Manajemen Dana (BRI)23253018Noch keine Bewertungen

- IAS Plus: IFRS 8 Operating SegmentsDokument4 SeitenIAS Plus: IFRS 8 Operating SegmentsScarlet FoxNoch keine Bewertungen

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDokument2 SeitenInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASPatricia ReyesNoch keine Bewertungen

- 5110u1-Financial TRDokument4 Seiten5110u1-Financial TRapi-372394631Noch keine Bewertungen

- Unit I: Audit of Investment PropertyDokument11 SeitenUnit I: Audit of Investment PropertyMarj ManlagnitNoch keine Bewertungen

- Five Star StocksDokument5 SeitenFive Star StocksJeff SturgeonNoch keine Bewertungen

- Quiz 4 Vat Business Tax 1322 - CompressDokument3 SeitenQuiz 4 Vat Business Tax 1322 - CompressChris MartinezNoch keine Bewertungen

- CB Annual Report 2012 FINALDokument76 SeitenCB Annual Report 2012 FINALcrystalmckenzie941Noch keine Bewertungen

- 5 6161346545657577683 PDFDokument6 Seiten5 6161346545657577683 PDFShivam GoyalNoch keine Bewertungen

- Algae Dynamics: Questionable IPODokument8 SeitenAlgae Dynamics: Questionable IPOChris PineNoch keine Bewertungen

- Dividend PolicyDokument51 SeitenDividend PolicyMmonower HosenNoch keine Bewertungen

- Chapter 4, 5, 6 AssignmentDokument23 SeitenChapter 4, 5, 6 AssignmentSamantha Charlize VizcondeNoch keine Bewertungen

- INSOLVENCY AND BANKRUPTCY ACT - FinalDokument32 SeitenINSOLVENCY AND BANKRUPTCY ACT - FinalDivya RaunakNoch keine Bewertungen

- VHINSON - Intermediate Accounting 3 (2023 - 2024 Edition) - 35Dokument1 SeiteVHINSON - Intermediate Accounting 3 (2023 - 2024 Edition) - 35Alyssa NacionNoch keine Bewertungen

- Adjudication Order in Respect of Vinod Shares Ltd. in The Matter of Maharashtra Polybutenes Ltd.Dokument17 SeitenAdjudication Order in Respect of Vinod Shares Ltd. in The Matter of Maharashtra Polybutenes Ltd.Shyam SunderNoch keine Bewertungen

- Literature Review EditedDokument8 SeitenLiterature Review EditedAnil Kumar SankuruNoch keine Bewertungen

- Module 2Dokument41 SeitenModule 2Sujata SarkarNoch keine Bewertungen

- Rajaneesh Company - Cash FlowsDokument3 SeitenRajaneesh Company - Cash FlowsAyushi Aggarwal0% (2)

- ACC 211 Bonds Payable - AKDokument4 SeitenACC 211 Bonds Payable - AKglrosaaa cNoch keine Bewertungen