Beruflich Dokumente

Kultur Dokumente

Artifact 5a - Guidelines For Filling PF Withdrawal Form TCS

Hochgeladen von

Amy BradyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Artifact 5a - Guidelines For Filling PF Withdrawal Form TCS

Hochgeladen von

Amy BradyCopyright:

Verfügbare Formate

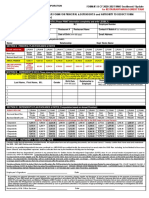

TATA CONSULTANCY S E R V I C E S EMPLOYEES P R O V I D E N T

FUND APPLICATION FOR SETTLEMENT O F PROVIDENT FUND

ACCOUNT (TO BE FILLED BY APPLICANT)

Sample Form

To,

The Trustees,

Tata Consultancy Services Employees Provident

Fund, Mum bai.

Dear Sir,

As I have ceased to be an employee of TCS Limited with effect from 09-Apr-2015, I request you to settle my

Provident Fund account and pay the said amount at an early date.

1. Name: - Mr. Durgesh Rele

2. Fathers / Husbands Name: Mr.Manikant Rele

3. Employee Number

: 315394

Address for correspondence:

4. Date of Joining Service

: 12-Jan-2009

BUILDING No: 11, 2nd FLOOR, 4th

5. Date of cessation of service : 09-Apr-2015

CARPENTER ROAD, CHARNI

ROAD, GIRGAUM, MUMBAI: 400004

6. Period of Service

: 6.24 Years

7. 7. PAN card no.

: ACPAJ2109F

Mobile No. : 9800000000

8. Transferred previous PF to TCS: Yes/ No

Personal Email id: sample@gmail.com

If Yes, Name of Previous employer: NA

9. Bank Account Details: Savings Bank A/c No.: 011011011011011

Name of the Bank: HDFC BANK

Supporting

documents

required: Copy of

PAN Card &

Cancelled Cheque

10. Reason for withdrawal of Provident Fund Accumulations

Tick

Signature

a. Retirement

MICR/IFSC Code No.: HDFC000133

Branch : MUMBAI

Select applicable reason

from below. Put a tick mark

and sign inside the box

Tick

b. Going Abroad \

Permanent migration from India

Supporting documents

required: Copy of PAN Card,

Cancelled Cheque & valid Visa

c. Permanent & total

Disablement \ incapacitation

Supporting documents

required: Copy of PAN Card,

Cancelled Cheque & Doctors

Certificate

Signature

(Please t i c k the applicable reason & sign in the text block)

DECLARATION O F NON-EMPLOYMENT

(This declaration i s not applicable if any of the above reason for withdrawal is selected)

I declare that I have not been employed in any Factory/Establishment to which the Act applies f or a continuous period of not less

than 2 months immediately preceding the date of my application for final withdrawal of my Provident Fund money.

Place: _______

Date: _______

Sign here only if you are

unemployed for more than 2

months. Supporting Documents

required: Copy of PAN Card &

Cancelled Cheque

_

_

Yours faithfully,

(Signature)

Note: - T h e PF withdraw al amount is subject to tax, if contributory service (inclusive of service rendered in

previous employment provided the PF is transferred to TCS) is less than five years.

ADVANCE STAMPED RECEIPT

Received a sum of Rs .______________(Rupees

_______________ Only) from the Trustees of TCS Employees Provident Fund towards full & final

settlem ent of m y Provident Fund account.

Your Signature across the revenue stamp. Revenue stamp

not mandatory in States where it is not available (e.g.

Karnataka) & for employees deputed at Onsite.

Affix.

1 Rs. Revenue

Stamp

(Please sign across the Stamp)

The details given in Item No. 1 to 5 are verified .

Date:

(Signature of Employer)

Instructions for Filling PF withdrawal Form

1. As per Employees Provident Fund and Miscellaneous Provisions Act 1952, you can withdraw your PF only in case of

one of the listed eventuality under Serial No. 9. If none of the 3 reasons for withdrawing PF applies to you, you have

to compulsorily transfer the PF fund to the new organization.

2. PF will be settled post completion of your Full and Final Settlement in TCS.

3. Mandatory required documents are Pan card copy & cancelled Cheque leaflet of India Bank a/c. The Bank account

should be of self and incase of joint account it should be with spouse only. Accepted bank account type is

current/savings or NRO.

4. If you are joining an organization to which Employees Provident Fund Act does not apply, you are required to submit a

letter along with the withdrawal Form stating this fact duly authorized by the said organization. In the PF withdrawal

Form you are required to sign at Advance stamped receipt section without selecting any reason of withdrawal

provided in the Form.

5.

Against Serial No. 1 to 9 of the withdrawal Form, please enter the required details.

6. If you are unemployed for two months post your date of separation ;

(Note: You are required to sign a declaration in this regard, false declaration are tracked by Employees Provident

Fund Organization and you are requested to be careful while giving this declaration. TCS receives Ex-employee

verification / Back ground check enquiries from various organizations. In such instances if employee has selected

the reason for PF withdrawal as Unemployed for 2 months, it will be construed as a false declaration and the PF

withdrawal Form will not be processed).

7. If you are selecting the Going Abroad \ permanent migration from India option then you need to submit the Visa copy

or any other document which shows the validity of stay in the traveling country along with the PF withdrawal Form.

8. If you are selecting the Permanent and total disablement \ incapacitation option then you need to submit the Medical

Certificate from ESI or Medical Officer of the company should be attached along with the PF withdrawal Form

whichever is applicable.

9. Note that if you are currently working in an organization that is covered by Employees Provident Fund and

Miscellaneous Provisions Act 1952, you need to transfer your accumulated PF & Pension accounts. For such Transfer,

you are requested to fill Revised Form 13 issued by your current employer in duplicate or raise the PF transfer request

in OTCP (EPFO Website) and send it to TCS on the address given below in Point 13. For detailed guidelines on

PF/Pension Transfer process you can refer the Separation Kit Document.

10. Note that the PF amount, if withdrawn is subject to applicable taxes (TDS), if your continues service (inclusive of

service rendered in the previous employment provided the PF is transferred to TCS) is less than five years.

11. For the computation of TDS as per 10 above, the details as per Form 16 (Salary TDS certificate) issued by TCS (or any

merged company) for the period of employment are required. If details of Form 16 are not available in our archives,

we will request you to furnish the same at the time of processing your settlement claim.

If Form 16 / TDS certificates are not available / provided, the TDS at the rate applicable as per highest tax slab among

the years of employment period, will be deducted from the payable PF accumulation and TDS certificate will be issued

by PF Trust to that effect.

12. In Advanced Stamped Receipt section, you need to affix a revenue stamp and sign across the stamp affixed. However

your signature is mandatory in Advance Stamped receipt section. Employees residing in the States where Revenue

Stamp is not in use or employees deputed at onsite can submit their withdrawal Form without affixing the Stamp.

13. Please send the dully filled-in Form to the following address.

Retiral Settlement Team,

Tata Consultancy Services Ltd.

Akruti Business Port-Gateway Park,

Table No.4C29, 4th floor,

Road no 13.MIDC,

Andheri East,

Mumbai - 400 093,

Maharashtra. India.

Mail to: retiral.settlements@tcs.com

Das könnte Ihnen auch gefallen

- Joint Declaration Under para 26Dokument1 SeiteJoint Declaration Under para 26Yashika SalujaNoch keine Bewertungen

- Agreement For PlacementDokument3 SeitenAgreement For Placementnishucheeku100% (1)

- Leave Policy Template For Human ResourcesDokument12 SeitenLeave Policy Template For Human Resourcesvignesh RNoch keine Bewertungen

- Exit Interview FormDokument2 SeitenExit Interview FormG. Shri MuruganNoch keine Bewertungen

- Night Shift PolicyDokument5 SeitenNight Shift PolicyGupta Samayamantula100% (1)

- Clearance FormDokument2 SeitenClearance FormselvamuthukumarNoch keine Bewertungen

- Internship LetterDokument1 SeiteInternship Letterraoumer786100% (1)

- Company attendance policy in 40 charactersDokument2 SeitenCompany attendance policy in 40 charactersThanu Suthatharan100% (1)

- Philhealth Payroll System Includes The FollowingDokument5 SeitenPhilhealth Payroll System Includes The FollowingMary Ann MarinoNoch keine Bewertungen

- ANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFDokument1 SeiteANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFRovic OrdonioNoch keine Bewertungen

- Personnel Clearance FormDokument3 SeitenPersonnel Clearance FormRichard R M ThodéNoch keine Bewertungen

- Balanced Scorecard Excel TemplateDokument9 SeitenBalanced Scorecard Excel TemplateNo NamesNoch keine Bewertungen

- Retirement Policy TbgiDokument3 SeitenRetirement Policy TbgiCamille FloresNoch keine Bewertungen

- Sample No Due Certificate FormatDokument2 SeitenSample No Due Certificate Formatdayadss86% (7)

- Exit PolicyDokument9 SeitenExit PolicyiamgodrajeshNoch keine Bewertungen

- Leicester Medical Support: Paternity Policy Paternity - Policy - v1Dokument3 SeitenLeicester Medical Support: Paternity Policy Paternity - Policy - v1stephanieNoch keine Bewertungen

- Bonus PolicyDokument4 SeitenBonus PolicyJacen BondsNoch keine Bewertungen

- HRISDokument11 SeitenHRISJitendra KumarNoch keine Bewertungen

- Non-Disclosure Agreement SummaryDokument5 SeitenNon-Disclosure Agreement SummaryLuigi Marvic FelicianoNoch keine Bewertungen

- Application For Admission To The General Provident FundDokument3 SeitenApplication For Admission To The General Provident FundVenkataramana NippaniNoch keine Bewertungen

- Leave Policy: 3.types and Entitlement of LeaveDokument3 SeitenLeave Policy: 3.types and Entitlement of Leavesana nawazishNoch keine Bewertungen

- 2023form - Impact Evaluation FormDokument11 Seiten2023form - Impact Evaluation FormKram Ynothna BulahanNoch keine Bewertungen

- Code of Conduct PolicyDokument16 SeitenCode of Conduct PolicyAJAY K & ASSOCIATESNoch keine Bewertungen

- Onboarding HRDokument7 SeitenOnboarding HRREDDY TEJANoch keine Bewertungen

- Salary Structure For 2008-2009Dokument28 SeitenSalary Structure For 2008-2009anon-289280Noch keine Bewertungen

- Form - Exit InterviewDokument6 SeitenForm - Exit Interviewjohn sladeNoch keine Bewertungen

- Team Outing Policy 2023-24Dokument3 SeitenTeam Outing Policy 2023-24Tarun SinghNoch keine Bewertungen

- Job Offer TemplateDokument3 SeitenJob Offer TemplateSarmad AhmadNoch keine Bewertungen

- Employee Evaluation FormDokument3 SeitenEmployee Evaluation FormDonalyn AquinoNoch keine Bewertungen

- Cost Benefit AnalysisDokument2 SeitenCost Benefit AnalysisGarvitJainNoch keine Bewertungen

- Change in Authorized SignatoriesDokument3 SeitenChange in Authorized SignatoriesShen OgocNoch keine Bewertungen

- Annual Leave Policy of University of YorkDokument15 SeitenAnnual Leave Policy of University of YorkJohn Son100% (1)

- Separation Policy OverviewDokument2 SeitenSeparation Policy OverviewJeevan rayabarapuNoch keine Bewertungen

- Leave PolicyDokument3 SeitenLeave PolicyAlbert E. HerreraNoch keine Bewertungen

- The Management Functions Are UniversalDokument2 SeitenThe Management Functions Are UniversalRafi RafNoch keine Bewertungen

- 0815 Fire Employee Evaluation FormDokument9 Seiten0815 Fire Employee Evaluation FormXavier Noël DushimimanaNoch keine Bewertungen

- Exit InterviewDokument6 SeitenExit InterviewBhagavanRaj ReddyNoch keine Bewertungen

- 7 Amazing Cisco Benefits You Won't BelieveDokument12 Seiten7 Amazing Cisco Benefits You Won't BelieveamaranthNoch keine Bewertungen

- Salary Advance PolicyDokument5 SeitenSalary Advance PolicyHAbbunoNoch keine Bewertungen

- Mid-Year Manager EvaluationDokument3 SeitenMid-Year Manager Evaluationprojectrik roomNoch keine Bewertungen

- Balanced Scorecard For Healthcare Example: - Mercy HospitalDokument2 SeitenBalanced Scorecard For Healthcare Example: - Mercy HospitalLucy AnajwalaNoch keine Bewertungen

- Transfer LetterDokument3 SeitenTransfer LetterUr's GopinathNoch keine Bewertungen

- Employee Referral Incentive ProgramDokument3 SeitenEmployee Referral Incentive ProgramMelchNoch keine Bewertungen

- Executive Administrative Assistant Job DescriptionDokument2 SeitenExecutive Administrative Assistant Job DescriptionAmyfarhana91Noch keine Bewertungen

- VPF FormDokument1 SeiteVPF Formraghu obulNoch keine Bewertungen

- Vacation, Sick and Bereavement LeaveDokument4 SeitenVacation, Sick and Bereavement LeaveCherry AldayNoch keine Bewertungen

- Candidate Screening TrackerDokument15 SeitenCandidate Screening TrackerFeisalNoch keine Bewertungen

- CS Form No. 7 Clearance Blank FormDokument5 SeitenCS Form No. 7 Clearance Blank FormNachoNoch keine Bewertungen

- Tax Mapping Checklist.Dokument1 SeiteTax Mapping Checklist.Anoj LlebNoch keine Bewertungen

- HR Exit Clearance ChecklistDokument2 SeitenHR Exit Clearance ChecklistImc Ayurved50% (2)

- SBMA Omnibus Policy On Performance BondDokument17 SeitenSBMA Omnibus Policy On Performance BondmysubicbayNoch keine Bewertungen

- Understanding Compensation PolicyDokument24 SeitenUnderstanding Compensation Policykishorinaren100% (1)

- HMO Enrollment FormDokument1 SeiteHMO Enrollment FormJoshuaBatisla-onSorianoNoch keine Bewertungen

- Sample Self Certification FormDokument1 SeiteSample Self Certification FormSai PastranaNoch keine Bewertungen

- Confirmation LetterDokument1 SeiteConfirmation LetterNirali RupareliyaNoch keine Bewertungen

- FBP Policy DocumentDokument67 SeitenFBP Policy Documentuditgarg734Noch keine Bewertungen

- Wipro Offer LetterDokument12 SeitenWipro Offer LetterSimran KaurNoch keine Bewertungen

- C0009 Contractual Employment ContractDokument1 SeiteC0009 Contractual Employment ContractAndrea R. LageraNoch keine Bewertungen

- HR Scope of WorkDokument2 SeitenHR Scope of WorkJenn Torrente50% (2)

- Artifact 3 - Instructions For Filling PF Withdrawal FormDokument1 SeiteArtifact 3 - Instructions For Filling PF Withdrawal FormSiva chowdaryNoch keine Bewertungen

- SAP Integrated Business Planning - 3rd Sep 2023Dokument8 SeitenSAP Integrated Business Planning - 3rd Sep 2023Amy BradyNoch keine Bewertungen

- Multi Level PackagingDokument15 SeitenMulti Level PackagingAmy BradyNoch keine Bewertungen

- Cloud ComputingDokument61 SeitenCloud ComputingAmy BradyNoch keine Bewertungen

- Terp01 - Sap Erp: Introduction: Course Version: 062 Duration: Delivery TypeDokument2 SeitenTerp01 - Sap Erp: Introduction: Course Version: 062 Duration: Delivery TypeAmy BradyNoch keine Bewertungen

- Administering SAP R3 - Production & Planning ModuleDokument468 SeitenAdministering SAP R3 - Production & Planning ModuledtatunNoch keine Bewertungen

- DaddaddDokument32 SeitenDaddaddAmy BradyNoch keine Bewertungen

- On Demand Scan LogDokument1 SeiteOn Demand Scan LogAmy BradyNoch keine Bewertungen

- Main IndexDokument1 SeiteMain IndexAmy BradyNoch keine Bewertungen

- DSDDSDDokument13 SeitenDSDDSDAmy BradyNoch keine Bewertungen

- Cource Overview About This Module: Test Your KnowledgeDokument2 SeitenCource Overview About This Module: Test Your KnowledgeAmy BradyNoch keine Bewertungen

- Appendix: Appendix About This ModuleDokument1 SeiteAppendix: Appendix About This ModuleAmy BradyNoch keine Bewertungen

- 220Dokument2 Seiten220Amy BradyNoch keine Bewertungen

- Process Instruction Types Structure of Process Instructions Process Instruction Categories and Characteristics ContentsDokument19 SeitenProcess Instruction Types Structure of Process Instructions Process Instruction Categories and Characteristics ContentsAmy BradyNoch keine Bewertungen

- Active Ingredient Management and Batch BalancingDokument24 SeitenActive Ingredient Management and Batch Balancingmrivo100% (1)

- C TS420 1610 Study GuideDokument6 SeitenC TS420 1610 Study Guideshekhar guptaNoch keine Bewertungen

- R/3 System: Functions in Detail - PP-PIDokument1 SeiteR/3 System: Functions in Detail - PP-PIAmy BradyNoch keine Bewertungen

- PP PI-Resource SelectionDokument4 SeitenPP PI-Resource SelectionAmy BradyNoch keine Bewertungen

- Borrar MaterialDokument13 SeitenBorrar MaterialmoralestorresNoch keine Bewertungen

- Tasks of Process ManagementDokument8 SeitenTasks of Process ManagementAmy BradyNoch keine Bewertungen

- TTDokument2 SeitenTTAmy BradyNoch keine Bewertungen

- Larry's Twelve Ways To Go From Getting by To Getting AheadDokument1 SeiteLarry's Twelve Ways To Go From Getting by To Getting AheadAmy BradyNoch keine Bewertungen

- Product Positioning: Vertical and Horizontal IntegrationDokument2 SeitenProduct Positioning: Vertical and Horizontal IntegrationAmy BradyNoch keine Bewertungen

- ExDokument13 SeitenExAmy BradyNoch keine Bewertungen

- Ppi 10 eDokument5 SeitenPpi 10 eAmy BradyNoch keine Bewertungen

- Contents:: Process Messages - ProcessingDokument15 SeitenContents:: Process Messages - ProcessingAmy BradyNoch keine Bewertungen

- Environement Health and SafetyDokument11 SeitenEnvironement Health and Safetyapi-3859679100% (1)

- Sap Ag Neurottstraße 16 69190 Walldorf Germany Ids Prof. Scheer GMBH Altenkesseler Straße 17 Geb. C2 66115 Saarbrücken GermanyDokument5 SeitenSap Ag Neurottstraße 16 69190 Walldorf Germany Ids Prof. Scheer GMBH Altenkesseler Straße 17 Geb. C2 66115 Saarbrücken GermanyAmy BradyNoch keine Bewertungen

- Batch ManagementDokument7 SeitenBatch ManagementAmy BradyNoch keine Bewertungen

- Industrial Relations, Labour La - Meenakshi BaruaDokument104 SeitenIndustrial Relations, Labour La - Meenakshi BaruaShaivy VarshneyNoch keine Bewertungen

- PF Transfer FormsDokument9 SeitenPF Transfer FormsSampatmaneNoch keine Bewertungen

- Employees' Provident Funde Scheme, 1952 (Paragraph 34 & 57) & Employees' Pension T5Cheme, 1995 (Paragraph 24)Dokument2 SeitenEmployees' Provident Funde Scheme, 1952 (Paragraph 34 & 57) & Employees' Pension T5Cheme, 1995 (Paragraph 24)ManojNoch keine Bewertungen

- 2Dokument2 Seiten2satheshNoch keine Bewertungen

- UPSC EPFO Syllabus Exam PatternDokument4 SeitenUPSC EPFO Syllabus Exam PatternData CollectionNoch keine Bewertungen

- SC - Tasty Nut IndustriesDokument8 SeitenSC - Tasty Nut Industriesrupesh srivastavaNoch keine Bewertungen

- The Employees' Pension SchemeDokument2 SeitenThe Employees' Pension SchemeH C Aasif LoneNoch keine Bewertungen

- Higher Pension As Per SC Decision With Calculation - Synopsis1Dokument13 SeitenHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNoch keine Bewertungen

- Black Book Project FinalDokument106 SeitenBlack Book Project Finalsanjaysharma1779Noch keine Bewertungen

- .trashed-1684222721-NTPC Process Note Prepaired by Wallet4wealthDokument12 Seiten.trashed-1684222721-NTPC Process Note Prepaired by Wallet4wealthjvnraoNoch keine Bewertungen

- EPF Passbook Details for Member ID RJRAJ19545850000014181Dokument3 SeitenEPF Passbook Details for Member ID RJRAJ19545850000014181Parveen SainiNoch keine Bewertungen

- PF & Esi Challan ExcelDokument12 SeitenPF & Esi Challan ExcelNitin KumarNoch keine Bewertungen

- EFEA FORM 4 Working EmployeesDokument1 SeiteEFEA FORM 4 Working Employeessharma ramNoch keine Bewertungen

- Sample Filled EPF Composite Declaration Form 11Dokument2 SeitenSample Filled EPF Composite Declaration Form 11Varalakshmi SharanNoch keine Bewertungen

- ProvidentFund Form 13Dokument2 SeitenProvidentFund Form 13Kiran TRNoch keine Bewertungen

- Instruction To Fill Form 10C (Without Aadhar)Dokument1 SeiteInstruction To Fill Form 10C (Without Aadhar)prasadNoch keine Bewertungen

- Composite Declaration FORM 11Dokument4 SeitenComposite Declaration FORM 11Yaswanth ChallaNoch keine Bewertungen

- Bolt May 201592181742354Dokument103 SeitenBolt May 201592181742354Debasish RauloNoch keine Bewertungen

- Epfo Sample Study MaterialsDokument47 SeitenEpfo Sample Study Materialsrahul0% (1)

- LL Group 5 SectionADokument8 SeitenLL Group 5 SectionAAkash PanigrahiNoch keine Bewertungen

- Employees Provident Fund Act 1952Dokument43 SeitenEmployees Provident Fund Act 1952Manojkumar MohanasundramNoch keine Bewertungen

- RTI Online - Online RTI Information SystemDokument2 SeitenRTI Online - Online RTI Information SystemNoneNoch keine Bewertungen

- Handwritten NotesDokument45 SeitenHandwritten NotesHimanshu SikarwarNoch keine Bewertungen

- Industrial Disputes Act, 1947Dokument110 SeitenIndustrial Disputes Act, 1947ritwikprakash1799Noch keine Bewertungen

- Online Transfer Claim FormDokument2 SeitenOnline Transfer Claim FormManda RaghuramuluNoch keine Bewertungen

- A Dissertation Report ON Employee'S Pension OF Tata Steel LimitedDokument19 SeitenA Dissertation Report ON Employee'S Pension OF Tata Steel LimitedSimran SrivastavaNoch keine Bewertungen

- ENGLISH Dec 16Dokument104 SeitenENGLISH Dec 16deepanshuy389653Noch keine Bewertungen

- MHBAN02112730000650555 NewDokument2 SeitenMHBAN02112730000650555 Newanaparthi naveenNoch keine Bewertungen

- UPPCL Internship Report on GPF Contributory Provident FundDokument59 SeitenUPPCL Internship Report on GPF Contributory Provident FundBasheer HaiderNoch keine Bewertungen

- Team LeaseDokument2 SeitenTeam LeaseRahulNoch keine Bewertungen