Beruflich Dokumente

Kultur Dokumente

Sub 029

Hochgeladen von

SenateBriberyInquiryOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sub 029

Hochgeladen von

SenateBriberyInquiryCopyright:

Verfügbare Formate

The impairment of customer loans

Submission 29

Sidney Margaret and Terrence Roger

MyttonWatson

TO: PARLIAMENTARIANS CONSIDERING A ROYAL COMMISSION

INTO BANKING FRAUD

Dear Members of Parliament,

We are writing to you to share our horror story of our experience with

Commonwealth Bank and Suncorp Bank. This also encompasses the total

ignorance of the Australian Government. to the plight of thousands of Australians

caught up in the Australian Banking scandal.

Our story begins in 1983 and will outline the Terms of Reference at the end of

this document to which we wish the Parliament to address their enquiries . We

feel that CORPORATe CEOs have been given SUFFIICIENT air to justify their

actions long enough. All we, the Members of the Australian Public feel is that we

have been mocked long enough by the various CEOs of the banks at the expense

of the Australian taxpayer long enough. From watching the scant television

programs on the Interviews by the panel of the CEOSs of the banks, we have

heard their lies and justification of their actions with no ability of response to

counter their claims.

1983-2006 We were a very content family mother and father and family

of four children living in our nearly fully paid out family home of 30 years. We

built the home in 1984 and built it with our own hands. I (Sidney) was carrying

our first born child (

). It was a small, wooden kit home which we

ordered from a Bisley Kit Homes catalogue for $17,000. We had bought the block

that the home was built on to with savings which we had saved years for. It was a

gift from God Himself and we were overjoyed at finding our new home to raise a

new family in. We built it ourselves, with two carpenters to assist and managed

to erect the frames ourselves. This loan was with the NAB , National Australia

Bank , It had assured us that the loan would begin at Lock up stage and not until

we had notified the bank that we were satisfied with the supply of materials.

Well, this was the beginning of our experience of what the banks conglomerate

would do to our family in 30years from the original build. We notified the NAB

that we were NOT satisfied with the supply of the Materials and in actual fact the

builders BIZLEY HOMEs had not supplied HALF OF the timbers as per instructed.

Despite our telling NAB we were not happy, the NAB had paid out the BIZLEY

Homes to the full amount of the loan, $17,000.00,. The end result was we had

only of the materials and had only a built home. This was our first

The impairment of customer loans

Submission 29

experience of the fraud that we were to find would be multiplied 10,000 times

over in 2015. Bisley Homes had declared bankruptcy in 1984, with no apology

from the NAB for their malfiance in practice. This incident was in the pastT AND

WE ARE NOT REFERRING TO IT IN THIS MATTER ,other than you have an

example of NABs track history.

We educated ourselves sufficiently to not trust banks and made sure that we did

not borrow money again until a meeting with a broker at a business meeting in

2005 , The Business group,BNI, swept open the doors to a parliance with him in

a special offer that he offered to us, because we fitted the criteriaof the banks

and we qualified for a loan to invest in property to prepare ourselves for

retirement. Up until we met this broker of the bank, Commonwealth, we had

nearly paid off our simple home. A home that still never had a kitchen installed in

to it, because of the fraud of the NAB bank back in 1983-4 and the subsequent

bankruptcy of Bisley Homes 1983.. We actually did own it outright around 1989.

We have been diligent farmers and saved every penny we earned and kept the

savings and paid cash for everything for years. We chose to pay cash and not to

borrow any money again, due to the treatment of the first bank, NAB. We thought

that this was the way every person conducted their affairs, in Australia. We paid

every bill from our savings as we set ourselves up as a business and ran this for

many years from woodturning sales and selling our products at the local

markets, this was all run with the proper tax being done every year and we grew

our business until we had established a Printing business in the hills of Perth. IN

1991, Sidney had to suddenly look after her aged father . We had no assistance,

as Sidney was unaware there was any available. This caused extreme stress for

the family of young children. Her father died in 2005. It was after his death that

we then had to settle the house and bought the house off the fanily . AS there was

no inheritance we paid for the property by getting a loan from Macquarrie bank.

Thus began the nightmare of our taking on a self proclaimed inheritance for the

family. We knew that there was something not quite right with this loan

within a year but, all of this was never investigated nor did we consider that this

loan might be a problem loan which we would see eventuate in another two

investment properties in the next two years. All that we knew was, there were

things wrong with the loan from MacQuarrie Bank and it was out of our reach to

fathom what the problem was. That loan was taken out in 2006 to purchase my

fathers home . We sold it in 2009 and I do believe that was the beginning of our

nightmare of he doctored low doc loans which we had no knowledge of. We

were ex farmers who trusted people. We took people at their word and this is

the world that we come from. We took out the loan which was in 2006 and had

to clear ourselves of the assumed mistake that we had made. WE did not know

that there was a sinister game that we had somehow got ourselves entangled

with. The GFC was in full swing and I knew that by 2008 we could be in serious

trouble. I kept a close handle on money and made sure that we made every

payment, as by this time, we had three loans which I had specifically told the

broker for the Commonwealth bank had to be kept clear of any connection with

our HOME. He assured me that our home would not be affected. This was a

blatant lie.

The impairment of customer loans

Submission 29

We had tenants in each home while we lived in the house next door to one of the

properties. Sidney managed the accounts and found that there was a problem in

the handling of the payments on the first house mortage payments very early in

the repayments. This is now traced back to the original paperwork which the

Broker did not handle in a professional manner. The broker never sent the loan

application form which he had said he would do. This was not ever received until

2012, six YEARS AFTER WE WERE TOLD IT WOULD BE IN THE MAIL.!

After spending the first year managing the first property next door to us and

coming to the conclusion that the house could not realise a normal rental we

decided to turn the house next door into a short term holiday home. This realised

the ability to be able to make the mortgage payments, with better ease and we

found that we could operate the business with greater ability to make payments..

Sidney, managed the running of the holiday stay with ease and actually enjoyed

the challenge, so it seemed to solve the problem as to why we had excessive

repayment levels which were never accounted for and nobody was forthcoming

to explain to us. By the end of 2007, we had made the purchase of a third house

which we were able to handle with tenants arriving . We had reasonable tenants

and again this property was able to be managed in which the rental paid for the

mortgage. WE kept each property positive geared to avoid any reperussions

ahead.

The GFC and the world was moving so fast and out of control. WE were not

trained for the legal world that we were now facing. Roger and Sidney had

trained as Counsellors with Roger achieving a Bachelors in Counselling with

Sidney achieving a Bachelors and Masters in Counselling and a Workplace

Training and Assessment,certificate IV in 2004. In 2005 they had a established

a counseling practice working at home .Sidney and ROger were not fools and

educated to a level to watch for lies and inaccuracy .The world they now faced

was a quick training ground on how to take on the Massive Bull at the gate of

their home and fight for their home and try to keep the ground for the

inheritance which was their home and their childrens home. This home was the

childrens inherent right. They had worked on the properties, doing painting,,

land scaping, learning trades to bring the properties to a standard suited to

rentals. They have learnt skills which they now use in their own businesses since

they have lost their only home in 2013.

The children were clearly of the understanding that whatever they worked on

with the family property and now the rentals, would be counted as toward their

own future. This is normal for families of the land. There was never any adverse

dialogue but an understanding that it was our intention that the descendents in

the family would inherit the property, so the children happily spent their time

doing the necessary improvements to make the property that we had purchased

for investments. as pleasant homes for tenants to reside in. We only wanted the

best for families.

The impairment of customer loans

Submission 29

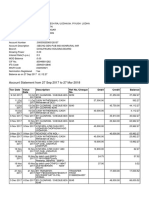

Sidney handled the mortgage repayments, She made sure to her utmost

deliberation, that each mortgage payment was made precisely ON TIME. Which

is why she was persistent in asking why the repayments were excessively high

on the recent purchase of the house next door. Despite enquiries to the broker

and his shrugging of his shoulders, in disinterest, she continued in making the

repayments ON TIME for EACH mortgage. Please be reminded that she was very

alert to the importance of this. Our budget only allowed for us to consider asking

for a loan maximum to purchase a property up to $300,000. WE put down the

deposit of $70,000 . WE never defaulted, despite the accusations

fromCommonwealth Bank and now Suncorp.

To our utmost shock, when we did receive the Loan application forms ( LAF), SIX

years LATER, The LAf revealed extraordinary LOAN amounts to the amount of

$100,000 for a holiday! In the same LAF was revealed we were given anoyjer

loan amount of $54,000 for a boat! None of these things were purchased and

neither of them were asked for. This suddenly explained to us why the

repayments were in excess of the agreed amount that we had signed for.

This was the first time that we saw these documents, (2011) in fact, the

documents sent by the Commonwealth bank came after much harassing to FOS

six years after we purchased the investment property . The documents were

more than the three pages which we had first only seen when the broker first

came with the papers to our house . He arrived with three papers, not the 27

pages which arrived in the mail from the Commonwealth Bank, as requested by

FOS. AT the initial meeting I queried the broker as to why we were being

offered a Credit card application NOT a home loan to purchase the house next

door, HE JUST REPLIED, THAT IS HOW THE BANK DOES IT, DONT WORRY ABOUT

IT. MY GOD, THIS WAS THE FIRST WARNING THAT THERE WAS SOMETHING

ILLEGAL GOING ON. WE MISSED THE CUE.

It was not discovered until 6 years later, when we had our loan application forms

sent to us after demanding them from FOS. That we discovered the horror of our

captivity. We were trapped into a clever warp of lies and manipulation. We had

no friends either side of the trap. FAMILY was doubting our truth in the matter.

IN 2011, now with Sidney becoming extremely ill and needing specialist

treatment with a still undiagnosed illness, we could only put down to stress and

not professionally diagnosed for another 5 years, we continued with the now

mounting paperwork of letters saying that we were in default. This was a shock,

because she was adamant that she kept all the payments to date. We had to

demand FOS to act in our best interests, despite their reluctance to help in any

way. Commonwealth Bank had refused, for 4 years, to send the LAF to us depite

numerous requests. They had clearly breached the Credit and Consumer credit

Acts by never sending us any evidence of our loans, despite the numerous

requests.

It was upon opening the Loan application form now, referred to as the LAF, that

we discovered the most horrific game that we had been rued into. That of bank

fraud. We noted signatures which were not ours, We could not obtain original

copies of our contracts, they has been destroyed by the digitalization of the

The impairment of customer loans

Submission 29

documents by the bank.s, Commonwealth and Suncorp. We contacted Ms Denise

Brierley of the BFCSA and at that point we began to find out the depth of the

fraud we only suspected, but knew by the scent OF THE ROTTING FLESH of the

decomposing family home.

We had purchased two properties between 2007 and 2008 which was when we

were unware of the GFC raging across the USA. I believe that Australia was

gagged by the government of the day, so we the Australian Public were

desensitized as to any serious imminent global financial crisis, GFC. The first I

began to realise that something serious was happening was when the phone

stopped ringing for businesss and buyers for second hand goods we had

reclaimed and had for sale to help toward the payments of the mortgages

disappeared. We were in total oblivion about the depth of the GFC until 2009,

and that was when I KNEW IT WAS GOING TO BE VERY DIFICULT TO GET OUT

of the snare of the trap. Sidney became ill with stress and severe illness, trying to

fathom what was going on. The confusions just unfolded every aspect of our

futile attempts to find a way out of the excessive repayments which we

calculated to be OVER $1,500 /month. $1,500 MORE than we had agreed upon

between My husband and myself AND THE BROKER. WE NEVER received the

quote from the bank, which we were promised by the broker. WE were flung

into the purchase of the house next door to us, with narry a phone call from the

bank to assess if we were able to pay the mortgage. Had we received a phonecall

to tell us the repayments were going to be well over what we had calculated, WE

WOULD HAVE STOPPED THE CONTRACT. We were totally oblivious to the

DEECPTION WE WERE NOW UNDER. We received NO information which we

were told we would receive.

We decided to sell one of the properties, so I rang he broker, who unbeknown to

us was the enemy in the camp, In 2011, Sidney rang the broker for the bank, to

say we wished to sell the property. His reply shocked me the bank wont allow

the sale. I wondered why not?

If he was a supposed Independent broker as he had introduced himself as when

we first met why did he seem to expound personal knowledge of the banks

knowledge of our affairs? IF HE WASNT WORKING FOR THE

COMMONWEALTH BANK who was he working for??. I WAS IMMEDIATELY

ARROUSED AND MY SUSPICIONs BEGAN . TO gain ground as to the deception we

were under. I began to suspect foul play when he rang me back within a day and

said that the Commonwealth Bank, would be able to join the other property,

purchased in 2007 with Suncorp bank, so we could have all the properties

amalgamated .

I was stunned. The broker told me that he had spoken to the bank on such terms.

I had told him at the beginning of the relationship as broker to us that the

properties were to be kept separated to avoid any such entanglements. I became

worried about the trust of this broker. So I said no..

The impairment of customer loans

Submission 29

How did the bank assume it could control another loan mortagage unless they

had control OF SUNCORP BANK as well? THE BROKER HAD NOT INFORMED

ME THAT COMMONWEALTH BANK HAD CONTROL OVER SUNCORP BANK.

Amid our mass of confusion as to why we were receiving letters of default from

now the Commonwealth bank and Suncorp Metcorp BAnk. I KNEW that we were

NOT in default, there was something going on of which we had no control. WE

stopped making payments to the Suncorp bank and Commonwealth bank in

about 2011 when I knew that there was an illigal manipulation in the working of

the banks taking place. I have been an avid watcher of the world economy for

many years, and became aware of the real fact that money is created from thin

air. It is created by the banks own computor systems and I have been personally

involved with the details of a QUEENSLAND famer who had fought in the courts

and won successfully with the Judge dismissing his case over a $7,000,000 7M

property stating that there never was any money, it was created in thin air by

ANZ bank. The people are fast awakening to the greatest scandal of he 20th and

21st century.

AS the fight intensified with our sons making application to the Commonwealth

bank to purchase the family home, the lawyers for Commonwealth bank had a

seemingly vested interest in this application and said, that they would not

consider this!! This was an exact similar scenario of a family in Beverley,

Western Australia ,who were trying to save their farming property from the

foreclosure by the Banks, the lawyers refused to let their son purchase their

farm. We assisted this couple to fight this in the courts, which they successfully

did. They have been physically exhausted and could not face another court

appearance which is why they have not submitted their documents to the

enquiry. The lies and brutal intimidation of the banks, the lawyers have shown

that hundreds of people in our situation have had mental breakdowns yet, still

work on their properties, .

WE are in the fight to save the future for our young people who are hoodwinked

from the truth.

This heinous crime of manipulation of monies paid out of our hard work to the

banks IE: Commonwealth and Suncorp, has resulted in my husband of 40 years

having a massive cerebral hemorrhage resulting in 6 hours brain surgery and

permanent disability. This happened 3 weeks of being removed from our HOME

OF 30 YEARS. I AM NOW HIS CARER AND AM SERIOSLY IMPINGED in MY

ABILITIY TO HELP HIM as I have a disability requiring intervention

This is NOT what we ever envisaged for our retirement. I remember the broker

swinging the term of ARIP to us in the speeches he regularly shared to the

members of the Business Network International group at every Wednesday

morning meeting, I only recently discovered what it means, The Asset Rich,

Income Poor. US. WE were set up by the banks. We were their sought after

honey to keep their money traps well fed.

The impairment of customer loans

Submission 29

We have chosen to hunt the banks down to the very end,* WE have lost our

business of landscaping and counsellingp** WE have lost our reputation. Our

children think of us as OLD FARTS= of no intelligence, eg; we cant mange our

business ,books etc. I have two grandchildren which Sidney , their grandmother

is not allowed to see, Some Psychiatrist has deemed me as unsuitable. Funny

that, In the profession No psychiatrist , counselor or psychologist can make any

judgements, without having the Offending party present, SO I have another fight

to see justice won. I have never met the psychiatrist that claims to know all

about me!

NO Australian government member has stood to fight for our justice. I

approached Sen. Don Randall (now deceased) when we first began this fight,

back in 2012 in the courts. We approached him with another gentleman who was

evicted in August 2012.We took his entire family of 6 children into our home for

4 months, at the same time as we were fighting our own case in the courts. HE

has lost any hope of seeking any help. Although he is registered with BFCSA he is

under serious family stress and cannot go through the harassment again. He lost

his wife 20 years ago and has been on his own bringing up the children now

mature.,. With no help, people in our situation have massive stress and find it

difficult to retain some normalcy. I have been working very closely with

hundreds of families in the same situation as ourselves, that of illegal

foreclosure. and they ALL TELL THE SAME STORY. AS A COUNSELLOR, I WORK

WITH THEM TO DIRECT THEM TO BFCSA. NO charge. NO government agency

for these families to find homes. With the black mark which we all have on our

credit details, no-one wants us. Many families live in the bush, which we have

also endured. AND OTHERS SIMPLY try to walk on in their own strength, I have

counseled numerous people considering suicide. I have conducted long distance

calls to desperate people in NSW, Queensland , Western Australia, We have

turned up to their homes to lend support in such irrational situations of massive

BULLYING and FRAUD by the cowards of the banking cartel, yes those of the

bailiffs, sherrifs etc, which have been asked by us, the homeownersto to do their

due diligence in the matter of foreclosure, to check the documents for accuracy.

We have discovered that the eviction notices which we were all evicted on are

Illegal. We have found out the they are not the stamped (embossed) court

orders but a copy of them stamped with a red rubber stamp on copies printed by

the lawyers themselves. The dates were clearly way past the official date of

foreclosure. They were dated two years earlier in our case. This is how the legal

profession have been clearing houses for quick sale all around Australia. ALL of

this is illegal.

Our home of 30 years had been sold to known drug dealers and a known dealer

of guns, of which one had been used a year previously in a murder of a drug

dealer in Perth. The house was sold for $200,000 less than the house was valued

at, and,for a year after it had been left empty and water damaged. What we were

to discover on our other property which had also been sold was the

surreptitious, possible fraud warranting a Fraud Squad intervention. I went into

Landgate to find out who bought the property . I was shocked to discover that

the lawyers working for the Suncorp bank had the house transferred directly to

their names, and sold the house themselves. IS this a ruse of the bank ? Is the

The impairment of customer loans

Submission 29

ATO aware of this trick to move property around without detection., no

Parliamentary Senator or Prime minister turns up to find out what is really

happening.

We the members of the Australian public, and innocent home owners, have had

to do our own investigations at great cost to ourselves trying to uncover the

maze of lies to help bring our massive claim to light.. I have found out that the

Lenders Mortgage Insurance , LMI,, which is lodged by the bank, had false

valuations and no identification of the assessor . I have discovered false and

fraudulent incomes which we never disclosed to the broker at ANY TIME... I

never had any assessor come to value any of our properties. Yet when I obtained

the LMI, at great reluctance from

,I found assed valuations were well

over valuations I was aware of. We have been chased by

to pay

money they claim we owe the bank! $330,000. They have since been

made bankrupt. I wrote to

to say we would not pay on fraud . Who

from the Government is ready to listen to OUR SIDE OF THE STORY??

We have lost everything. MY FAMILY HAVE LOST EVERYTHING, we have lost our

dreams of being able to retire with pride, instead we have been brought down to

eat humble pie. We had dreams of being settled in our home and resting and

being at peace with our God. But our dreams have been wounded. We had

planned our retirement well, we had thought, BUT FOR THE LIES OF THE

BANKING CARTEL, OUR LIVES HAVE BEEN DRAGGED TO UTTER CONEMPT. NOONE IN THE OUTSIDE WORLD HAS HEARD OF THIS BECAUSE OF THE

SUPRESSION ORDERS Of THIS GOVERNMENT, NO_ONE KNOWS. I STAND IN

BANK CUES AND I TELL EVERY TOM, DICK AND HARRY WHAT

COMMONWEALTH BANK AND SUNCORP HAVE DONE TO US, EVERYONE MUST

KNOW WHAT THIS GOVERNMENT HAS ALLOWED. IT IS A NATIONAL

DISGRACE.

Instead, we get orders from the Prime Minister to further gag us, the ,AUStralian

Public and suppress us like we are mushrooms. Is this healthy?

Is this Agenda 21,New World Order in operation globally? I suspect it is. I will

finish with a Bible scripture, which is what our Government should be

honouring.

Leviticus 19; 35-36. Thou shalt do no unrightous judgement in weight or in

measure..

Proverbs 20;23

The LORD detests differing weights, and dishonest scales do not please him.

THIS CAN BE INTERPRETTED AS, BANKS AND

GOVERNMENTS, You are bringing judgements by your

unbalanced weights and measures. Take heed

The impairment of customer loans

Submission 29

The reason for this letter to you is for you to do the job that you

were elected to do.

TERMS OF REFERENCE

*Bring the Banks to justice for us, the people, ie those who have

suffered great loss such as described in the afore letter,

* ARREST ALL THE BANKING CEO S AND SET THEM TO

TRIAL FOR A JUDGEMENT BY A JURY OF ORDINARY MEN

AND WOMEN.

* DEMAND FOR BANKING reform IMMEDIATELY.

*Stop the report to credit agencies, this has been set up by the

Banking cartel for their own benefit..

*Remove the FOS. Financal Ombudsman Services which we can

prove have worked for the banks and closed MOST OF THE

CASES of those who have relied on them to help us. WE have

proof of their lack of professional care and even their direct lack of

professional interest in all our requests for assistance. FOS

IGNORED OUR REQUEST TO GET THE LAF after requesting

the banks ie: Commonwealh and Suncorp,to secure them for us

and SEND them to us. This process took upwards of 6 weeks to

get any answers not counting the 5-6 years from when the

properties were first purchased

*Remove the ASIC who has proven their incapability of

responsibility for the oversight of the financial institutions and

security of bank customers..

*Remove the COSL WHO SHOWED no interest in our

conglomerate group of victims. And the remainder of those matters

which have been disclosed to your parliament for removal from the

banking world.The list is endless.

* remove the banks control of credit reporting. Remove the records

that stain our names.

The impairment of customer loans

Submission 29

*We demand compensation for the loss of homes and property,

land, farms, etc and ungainful profiteering BY the banking

cartel..

We have lost $1.3 million of assets, we demand

compensation.FOR ALL DAMAGES TO OUR HEALTH AND WELL

BEING.

WE WISH TO BE PLACED IN A POSITION AS IF WE HAD NEVER

MET THE BANK. SUNCORP AND COMMONWEALTH banks WITH

FULL COMPENSATION for loss of a home and shelter and travel

costs to doctors and lawyers. WE DEMAND THE RIGHTFUL

RETURN OF ALL LOST POSSESSIONS AND LAND TO PROVIDE US

A SUSTAINABLE WAY OF LIFE, SUCH AS WE ENJOYED PRIOR TO

MEETING THE LIARS OF THE BANKING CARTEL.

We hold you, our representatives to

Holy accountability and you will

our bidding. SO HELP ME GOD.

TERRENCE AND SIDNEY

MYTTON-WATSON

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Rely on Internal Audit WorkDokument4 SeitenRely on Internal Audit WorkFahmi Abdulla100% (3)

- 150324-Filed Clinton RICO ComplaintDokument59 Seiten150324-Filed Clinton RICO ComplaintDeanna Lutz100% (1)

- Elliot Sgargetta To Dear MR Martin PakulaDokument5 SeitenElliot Sgargetta To Dear MR Martin PakulaSenateBriberyInquiryNoch keine Bewertungen

- The Commonwealth Bank Case Keith Hunter Jon Waldron Eic Pulier Bradley Twynham Hans Gyllstrom Andrew Goldstein CSC CaseDokument18 SeitenThe Commonwealth Bank Case Keith Hunter Jon Waldron Eic Pulier Bradley Twynham Hans Gyllstrom Andrew Goldstein CSC CaseSenateBriberyInquiryNoch keine Bewertungen

- Rental Agreement-Bouncy RentalsDokument2 SeitenRental Agreement-Bouncy RentalsZury MansurNoch keine Bewertungen

- APC P7 Notes 2017Dokument336 SeitenAPC P7 Notes 2017Muhammad Imran100% (3)

- Carnell Inquiry 030217-ASBFEO - ReportDokument85 SeitenCarnell Inquiry 030217-ASBFEO - ReportSenateBriberyInquiryNoch keine Bewertungen

- LSBC Jeannie Pakula To Waldron SgargettaDokument2 SeitenLSBC Jeannie Pakula To Waldron SgargettaSenateBriberyInquiryNoch keine Bewertungen

- Park City Jenni Smith 2012 0815 Redacted 2nd Dec Jenni Smith Without ExhibitsDokument5 SeitenPark City Jenni Smith 2012 0815 Redacted 2nd Dec Jenni Smith Without ExhibitsSenateBriberyInquiryNoch keine Bewertungen

- Spencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1Dokument2 SeitenSpencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1SenateBriberyInquiryNoch keine Bewertungen

- Referral To IRS by Marsha Blackburn To Clinton Foundation July 15 LetterDokument7 SeitenReferral To IRS by Marsha Blackburn To Clinton Foundation July 15 LetterSenateBriberyInquiryNoch keine Bewertungen

- Australia and Clinton Foundation Memorandum of Understanding in Child Welfare ProgramsDokument10 SeitenAustralia and Clinton Foundation Memorandum of Understanding in Child Welfare ProgramsBeverly TranNoch keine Bewertungen

- Mastercardantitrust 711replyMTVDokument36 SeitenMastercardantitrust 711replyMTVSenateBriberyInquiryNoch keine Bewertungen

- Whistleblowers QLD Submission 23 - Whistleblowers Action Group QueenslandDokument8 SeitenWhistleblowers QLD Submission 23 - Whistleblowers Action Group QueenslandSenateBriberyInquiryNoch keine Bewertungen

- Spencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1Dokument2 SeitenSpencer Murray's Submission To Parliament's Inquiry Into Whistleblowers Sub - 016-1SenateBriberyInquiryNoch keine Bewertungen

- Clinton Foundation-Charles Ortel Letter 1 May 2016Dokument8 SeitenClinton Foundation-Charles Ortel Letter 1 May 2016BigMamaTEANoch keine Bewertungen

- Did CBA Lawyer David Cohen Act Ethically With ParliamentDokument10 SeitenDid CBA Lawyer David Cohen Act Ethically With ParliamentSenateBriberyInquiryNoch keine Bewertungen

- Victorian-Ombudsman Submission by PsychiatristsDokument8 SeitenVictorian-Ombudsman Submission by PsychiatristsSenateBriberyInquiryNoch keine Bewertungen

- IBAC's Limitations by Stephen O'Bryan QC Sub - 042Dokument4 SeitenIBAC's Limitations by Stephen O'Bryan QC Sub - 042SenateBriberyInquiryNoch keine Bewertungen

- Garaufis Permanent Injunction Order May 19 2015 After Amex Execs Share SaleDokument19 SeitenGaraufis Permanent Injunction Order May 19 2015 After Amex Execs Share SaleSenateBriberyInquiryNoch keine Bewertungen

- Letter by Email To Fred Lester at Clarke & GeeDokument2 SeitenLetter by Email To Fred Lester at Clarke & GeeSenateBriberyInquiryNoch keine Bewertungen

- Sperm Donor Site Recruits Only Gay and Bisexual Donors - Porters Lawyers Evidence at The Royal Commission Ctjh.053.12001.1886 - RDokument5 SeitenSperm Donor Site Recruits Only Gay and Bisexual Donors - Porters Lawyers Evidence at The Royal Commission Ctjh.053.12001.1886 - RSenateBriberyInquiryNoch keine Bewertungen

- Letter by Email To Fred Lester at Clarke & GeeDokument2 SeitenLetter by Email To Fred Lester at Clarke & GeeSenateBriberyInquiryNoch keine Bewertungen

- Nick Kudeweh Letter Regarding Elliot SgargettaDokument2 SeitenNick Kudeweh Letter Regarding Elliot SgargettaSenateBriberyInquiryNoch keine Bewertungen

- Melvin Feliz Charges With Keila RaveloDokument11 SeitenMelvin Feliz Charges With Keila RaveloSenateBriberyInquiryNoch keine Bewertungen

- Jeff Sessions Responses To Whitehouse QFRs - Poltical Campaign Funding and Foreign BriberyDokument15 SeitenJeff Sessions Responses To Whitehouse QFRs - Poltical Campaign Funding and Foreign BriberySenateBriberyInquiryNoch keine Bewertungen

- Before 7news Broadcast Arrests On CBA IT Bribery Executive Keith HunterDokument2 SeitenBefore 7news Broadcast Arrests On CBA IT Bribery Executive Keith HunterSenateBriberyInquiryNoch keine Bewertungen

- LSBC Jeannie Pakula To Waldron SgargettaDokument2 SeitenLSBC Jeannie Pakula To Waldron SgargettaSenateBriberyInquiryNoch keine Bewertungen

- Sonterra Anz Macquarie SIBOR-ComplaintDokument59 SeitenSonterra Anz Macquarie SIBOR-ComplaintSenateBriberyInquiryNoch keine Bewertungen

- Tolling Ombudsman Arbitration Geneva, Michael Fraser Arbitration Ip AuDRP-ComplaintDokument18 SeitenTolling Ombudsman Arbitration Geneva, Michael Fraser Arbitration Ip AuDRP-ComplaintSenateBriberyInquiryNoch keine Bewertungen

- DNC Fraud Suit Email AvocadosforJustice@Gmail - ComDokument3 SeitenDNC Fraud Suit Email AvocadosforJustice@Gmail - ComSenateBriberyInquiryNoch keine Bewertungen

- Jaynes Et Al V Amex - Antitrust - Complaint March 2015Dokument43 SeitenJaynes Et Al V Amex - Antitrust - Complaint March 2015SenateBriberyInquiryNoch keine Bewertungen

- Mytton Watson's Report On Michael McGarvie's Legal Services Board of Victoria AustraliaDokument1 SeiteMytton Watson's Report On Michael McGarvie's Legal Services Board of Victoria AustraliaSenateBriberyInquiryNoch keine Bewertungen

- Audit Liabilities Accounts Receivable PayableDokument18 SeitenAudit Liabilities Accounts Receivable PayableClarize R. Mabiog100% (1)

- Raoul S.V. Bonnevie and Honesto v. Bonnevie vs. The Honorable Court of AppealsDokument2 SeitenRaoul S.V. Bonnevie and Honesto v. Bonnevie vs. The Honorable Court of AppealsVin LacsieNoch keine Bewertungen

- Mercer-Capital FinTech 18Q1 PDFDokument13 SeitenMercer-Capital FinTech 18Q1 PDFGabriel Fioravanti CantuNoch keine Bewertungen

- Building A Better BetaDokument15 SeitenBuilding A Better BetaMeghna MehtaNoch keine Bewertungen

- Mergers and AcquisitionsDokument4 SeitenMergers and AcquisitionsSamin SakibNoch keine Bewertungen

- BIDC Registration Form 2011 p1Dokument1 SeiteBIDC Registration Form 2011 p1andre_duvenhageNoch keine Bewertungen

- Paata Giorgashvili's ResumeDokument3 SeitenPaata Giorgashvili's ResumePaata GiorgashviliNoch keine Bewertungen

- Account statement details for Mr. Chandresh Raj LodhaDokument3 SeitenAccount statement details for Mr. Chandresh Raj LodhaHemlata LodhaNoch keine Bewertungen

- Study online at quizlet.com/_1lwdnhDokument3 SeitenStudy online at quizlet.com/_1lwdnhPatriciaNoch keine Bewertungen

- Your Reliance Communications BillDokument2 SeitenYour Reliance Communications BillDilli SrinivasanNoch keine Bewertungen

- Why Hayek Was Wrong On Concurrent CurrenciesDokument12 SeitenWhy Hayek Was Wrong On Concurrent CurrenciesKrzysiek RembiaszNoch keine Bewertungen

- 0130 G.R. No. 150197 July 28, 2005 Prudential Bank Vs Don A. AlviarDokument5 Seiten0130 G.R. No. 150197 July 28, 2005 Prudential Bank Vs Don A. AlviarrodolfoverdidajrNoch keine Bewertungen

- Vai Final Excel Cashbook With Links 2010Dokument24 SeitenVai Final Excel Cashbook With Links 2010sreekanthNoch keine Bewertungen

- MERIDIAN TEXTILES INC v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintDokument9 SeitenMERIDIAN TEXTILES INC v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintACELitigationWatchNoch keine Bewertungen

- Research MethodologyDokument34 SeitenResearch MethodologySangeetaLakhesar80% (5)

- SFI Regional Coordinator ManualDokument38 SeitenSFI Regional Coordinator ManualMorgan JohnstoneNoch keine Bewertungen

- Usage of Atm CardDokument5 SeitenUsage of Atm CardLokesh SPNoch keine Bewertungen

- Lead Banks - Districtwise27!06!2016Dokument4 SeitenLead Banks - Districtwise27!06!2016HarsimranSinghNoch keine Bewertungen

- Marketing of Banking Services Through TechnologyDokument21 SeitenMarketing of Banking Services Through TechnologyGaurav AgarwalNoch keine Bewertungen

- Dela Cruz Vs Capital Insurance & Surety CoDokument1 SeiteDela Cruz Vs Capital Insurance & Surety CoKelsey Olivar MendozaNoch keine Bewertungen

- R BC AddressDokument2 SeitenR BC AddressPatrick AdamsNoch keine Bewertungen

- Hang Seng Index: FeaturesDokument2 SeitenHang Seng Index: FeaturesHaroon GorayaNoch keine Bewertungen

- Central Bank Act MCQDokument12 SeitenCentral Bank Act MCQJemima LalaweNoch keine Bewertungen

- JPM Default RecoveryDokument19 SeitenJPM Default Recoverymarmaud2754Noch keine Bewertungen

- The Bottom Line July 2023Dokument25 SeitenThe Bottom Line July 2023Vinayak ChaturvediNoch keine Bewertungen

- Andhra Pradesh DCCB Directory 2012-13Dokument149 SeitenAndhra Pradesh DCCB Directory 2012-13SumitNoch keine Bewertungen

- Inv BLN 7fixDokument12 SeitenInv BLN 7fixherry blackNoch keine Bewertungen