Beruflich Dokumente

Kultur Dokumente

Financial Results, Limited Review Report For December 31, 2015 (Result)

Hochgeladen von

Shyam SunderOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Results, Limited Review Report For December 31, 2015 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

.

symsia I

g:8:674)

CN,157!..Kr I WhTECS

...

KAV+ERI

telecom products limited

Date: 13th February, 2016.

To,

The Secretary,

BOMBAY STOCK EXCHANGE LIMITED,

25th floor,P.J.Towers,

Dalai Street, Mumbai - 400 001.

BSE CODE- 590041

Dear Sir,

Sub: Submission of Unaudited Financial Results and Limited Review Audit Report for the

third quarter ended 31 th December, 2015.

Pursuant to the listing agreement entered into with stock exchange; hereby we are

enclosing the Quarter 3rd Unaudited Financial Results, and Limited Review Audit Report

for the period ended 31th December, 2015.

This is for your Information & Record and request you to acknowledge the receipt of the

same.

Thanking You.

Yours truly,

For Ka 1'ri Telecom P

cCrt

C Sh

ar Redd

Managing Director

mited.

2

\<,

v4

3:170

:7

Plot No. 31 to 36, 1st Main, 2nd Stage, Arakere Mico Layout, Bannerghatta Road, Bangalore-560 076, Karnataka, India.

Tel: +91-80-41215999, 41215960 / 61 / 62 / 64 / 65 / 67 Fax: +91-80-41215966 www.kaveritelecorns.com

Ttl_ TO< I

:;; smoTWAVE

DCI

TRACKCOM I

w q RYMSA

IMIV:ECS

mAsAiry

KAV*IERI

telecom products limited

Kavveri Telecom Products Limited

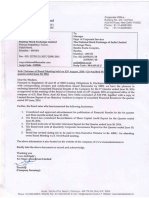

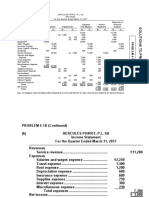

UNAUDITED STANDALONE FINANCIAL RESULTS FOR THE 3rd QUARTER ENDED 31st December 2015

Particulars

Quarter ending

31 12.2015

Corresponding

Preceding

Quarter ending Quarter ending

31.12.2014

30.09.2015

Un-Audited

Un-Audited

Un-Audited

Year to Date

31.12.2015

Year to Date

31.12.2014

(Rs. In Lakhs)

Previous Year

ending 31.03.2015

Un-Audited

Un-Audited

Audited

PART-I

1. Income from Operations

a

7.87

(a) Net Salesilnoorne from Operations

1.13

5.58

9.00

5.59

115.63

tel Other Operating Income

0.01

52.41

0.01

27.12

116.67

Total Income from operations(Net)

7.88

1.13

57.99

9.01

32.70

232.29

2. Expenditure

Increase/decrease in stock in trade and work in progress

(a).Cost of Software Licences ( Material Consumed)

.

4.19

5.59

1.68

5.87

0.53

(b).Purchase of Stock -in-trade

(c).Employee benefits expense

28.45

11.59

10.06

40.04

10.49

70.94

Id ).Depreciation and amortization expense

(e).0ther expenses

Total Expenses

3. Profit /(Loss) from Operations before Other Income, finance costs and Exceptional Items (1-2)

4. Other Income

5. Profit / (Loss) from ordinary activities before Finance costs and Exceptional Items (3+4)

34.14

34_15

34.15

68.29

34.15

353.06

192.11

192.79

41.42

384,90

37.63

445.68

258.90

240.21

85.65

499.11

88.38

869.68

(251.02)

(239.08)

(27.66)

(490.10)

(55.67)

(63739)

(27.66)

(490.11)

(251.03)

(239.08)

(55.67)

(637.39)

336.06

336.01

672.55

1008.08

672.16

1346.22

(587.09)

(575.09)

(70021)

(1,498.19)

(727.84)

(1,983.61)

(587.09)

(575.09)

(700.21)

(1,498.19)

(727.84)

(2,768.68)

(587.09)

(575.09)

(700.21)

(1,498.19)

(727.84)

(2730.81) -

13. Net Profit / (Loss) for the period (11-12)

(587.09)

(575.09)

(700.21)

(1,498.19)

(727.84)

(2,730.81)

14. Pad-up equity share capital (Face Value of Rs.10/- each)

15. Reserve excluding Revaluation Reserves as per balance sheet of previous accounting year

2012.43

2012.43

2012.43

2012.43

2012.43

2012.43

6. Finance costs

7. Profit / (Loss) horn ordinary activites after Finance costs but before Exceptional kerns (5-6)

8. Exceptional items

9. Profit / (Loss) from Ordinary Activities before tax (7+8)

10. Tax expense

785.07

11. Net Profit/ (Loss) from Ordinary Activities after tax (9-10)

12. Extraordinary Item (net of tax expense Rs.)

16. Earnings Per Share (EPS)

a) Basic and diluted EPS before Extraordinary items for the period, for the year to date and

for the previous year (not to be annualized)

b) Basic and diluted EPS after Extraordinary items for the period, for the year to date and

for the previous year (not lobe annualized)

(37.87)

0.00

(2.92)

(2.86)

(3.48)

(7.44)

(3.62)

(2.92)

(2.86)

(3.48)

(7.44)

(3.621

(13.57)

Segment wise Standalone financial results for the quarter ended 31st December 2015

Quarter ending

31.12.2015

Preceding

Corresponding

Quarter ending Quarter ending

30,09.2015

31.12.2014

Year to Date

31.12.2015

Year to Date

31.12.2014

Previous Year

ending 31.03.2015

Un-Audited

Un-Audited

Audited

Particulars

Un-Audited

1 Segment Revenue

a) Information Technology, Sofhvare Services

b) Software License

Net Sales / Income from Operations

2 Segment Results

Profit(+)!Loss(-) before tax . Deprn. 8 interest from

a) Information Technology i Software Services

b) Software License

Total

Less: Interest (not allocable)

,

Less: Depredation (not allocable)

Total Profit(Loss) Before Tax

Un-Audited

Un-Audited

0.00

0.00

, 0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0,00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

000

0.00

0.0C

0.0C

OD(

0.00

0.00

0.00

0.00

0.00

0.00

No es:

1 The above financial results have been reviewed by the Audit Committee and taken on record by the Board of Directors of the Company at its meeting held on 13th February, 2016.

2 The Statutory Auditors have carried out a Limited Review of the above results for the quarter ended Dec 31, 201 .

3 These unaudited financial results have been prepared in accordance with the Accounting Standard specified un er Section 133 of the Companies Act'2013 read with Rule 7 of the Companies

(Accounts) Rules 2014, Accounting Standards issued by the Institute of Chartered Accountants of India and other generally accepted accounting principles in India.

4 Previous period's figures have been regrouped/ reclassified wherever necessary to confirm with the current periods classification/disclosure.

By ord

For Na

Place : Bangalore

Date :13.02.2016

ro

of the.Board

f the Company

Ma aging Director

Plot No, 31 to 36, 1st Main, 2nd Stage, Arakere Mico Layout, Bannerghatta Road, Bangalore-560 076, Karnataka, India.

Tel: +91-80-41215999, 41215960 / 61 / 62 / 64 / 65 / 67 Fax: +91-80-41215966 vvww.kaveritelecoms.com

0.00

TrLTEK

I <7 Da

SPOTWAVE I '

5-,1RYM5A

TRAciccoM

0-VAL-

Kavveri Telecom Products Limited

E R I

KAVT+

telecom products limited

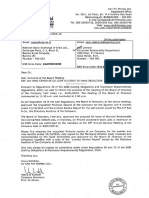

UNAUDITED CONSOLIDATED FINANCIAL RESULTS FOR THE 3rd QUARTER ENDED 31st December 2015

Particulars

PART-I

1.Income from Operations

(a) Net Sales/Income from Operations

Quarter ending

31.12.2015

Preceding Quarter

ending 30.09.2015

Un-Audited

Un-Audited

Corresponding

Quarter encfing

31.12.2014

Un-Audited

Year lo Date

31.12.2015

Year to Date

31.122014

(Rs. In laths)

Previous Year ending

31.03.2015

Un-Audited

Un-Audited

Audited

5151,30

1743.03

989.74

1155.81

2942.45

4630.06

78.40

-38.04

224.49

132.65

372.34

545.11

1,821.43

951.71

1,380.30

3,075.30

5.002.41

5,696.41

193.98

171.91

586.40

1,625.80

185.79

233.16

527.91

828.96

1060.38

(c).Employee benefits expense

200.32

(d).Depreciation and amortization expense

388.52

388.02

162.31

1,080.46

1,630.30

1,973.51

541.76

503.76

1.17004

1,197.95

2,528.42

2,111852

(e).0ther expenses

1,324.57

1,249.49

1,574.51

3.392.71

6,602-36

5552.71

496.87

(297.78)

(194.21)

(317.41)

(1,599.96)

(156.31)

496.87

(297.78)

(19021)

(317.41)

(1,599.96)

714.19

561.46

1,070.81

1,654.49

(217.32)

(859-24)

(1,265.02)

(1,971.91)

(0) Other Operating !noodle

Total Income from operations(Net)

2. Expenditure

Increaseldecrease in stock in trade and work in progress

(a).COst of Software Licences ( Material Consumed)

(11.12)

(b).Purchase of Stock -in-trade

Total Expenses

3.Profit/ (Loss) from Operations before Other Income, finance costs and Exceptional Items

(1-2)

4. Other Income

5.Profit I (Loss) from ordinary activities before Finance costs and Exceptional Items (3+4)

6.Finance osst

7.Profs! (Loss) from ordinary activities after Finance costs but before Exceptional Items (5-6)

(3.781.09)

(2,87926)

785.07

206.57

206.57

8. Exceptional items

(156.31)

2,722.95

0189.14

9.Profit! (Loss) from Ordinary Activities before lax (7+8)

(423.89)

(859.25)

(1,265.02)

(2,178.47)

(3,789.09)

(3,684.33)

10.Tax expense

11.Net Profit/ (Loss) from Ordinary Activities after tax (9-10)

(423.89)

(859.25)

(1,265.02)

(2,17847)

(3,789.09)

(3,781.17)

(423.89)

(859.25)

(1,265.02)

(2,178.47)

(3.789.09)

43,781.17)

(423.89)

(859.25)

(1,265.02)

(2,178.47)

(3,789.09)

(3,781.17)

2012.43

2012.43

2012.43

2012.43

2012.43

201243

116.83

12.Extraordinary Item (net of tax expense Rs.)

13.Net Profit/ (Loss) for the period (11-12)

14.Share of Pratt) (Loss) of associates

15.Minority Interest

16.Net Profit/ (Loss) after taxes. Minority interest and share of profit / (loss) of associates

(13+14+15)

17.Paid-up equity share capital (Face Value of Rs10/- each)

18.Reserve endocring Revaluation Reserves as per balance sheet of previous accounting

year

19.Earnings Per Share (EPS)

a) Basic and diluted EPS before Extraordinary items for the period, for the year to date

and for the previous year (not to be annualized)

b) Basic and diluted EPS after Extraordinary items for the period, for the year to date

and for the previous year (not to be annualized)

Se ment wise consolidated financial results for the quarter enoea non inecemoer nvi7

0.00

-2.11

-4.27

-6.29

-10.83

-18.83

-18.79

-2.11

-4.27

-629

-10.83

-18.83

-18.79

Quarter ending

31.12.2015

Preceding Quarter

ending 30.09.2015

Corresponding

Quarter ending

31.12.2014

Year to Date

31.12.2015

Year to Date

31.12.2014

Previous Year ending

31.03.2015

+

Un-Audited

Un-Audited

Un-Audited

Un-Audited

Un-Audited

Audited

Particulars

1. Segment Revenue

a) USA - Information Technology Service / Software Servives

0) India - Information Technology Service / Software Servives

c) Software Licenses

Less: Inter Company Sales

Net Sales !Income frorn Operations

2. Segment Results

Profift+yLoss(-) before tax ,Deprn. & interest from

a)USA - Information Technology Service / Software Servives

b)India - Information Technology Service / Software Servives

c) Software Licenses

Total

Less Interest (not allocable)

Less: Depredation (not allocable)

Total ProfiU(Loss) BOOM Tax

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

(001)

0.00

0.00

0.00

' -

0.00

0.00

0.00

0.00

0.00

0.00

0.00

000

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

(0.01)_

0.00

0.00

0.00

0.00

800

0.00

0.00

0.00

0.00

No es:

1 The above financial results have been reviewed by the Audit Committee and taken on record by the Board o Directors of the Company at its meeting held on 13th February, 2018

2 The Statutory Auditors have carded out a Limited Review of the above results for the quartet ended December 31,2015.

3 These unaudited financial results have been prepared in accordance with the Accounting Standared specified under Section 133 of the Companies Ac82013 read with Rule 7 of Lite Companies (Accounts) Rules 201

Accounting Standards Issued by the Institute of Chartered Accountants of India and other generally accepted accounting principles In India

4 Previous period's figures have been regrouped/ reclassified wherever necessary to confirm with the current periods classification/discloser..

and stock exchanges's websites like smwAseindlacom or

5 Key Standalone Financial Results of the Company for the aforesaid pertodawhich are also available on Company'es website: envw.kaveritelecoms.com

vonvbseindlacom.

Particulars

Turnover

Profit before Tax

Profit after Tax

3112.2015

Un-Audited

1821.43

(423.89L

(423.89)

Quarter ending

30.09.2015

Un-Audited

951.71

(859.251

(859.25k

31.12.2014

Uri-Audited

1380.30

(1265.02)

(1265,02)_

Year to date

31.12.2014

31.12.2015

Un-Audited

Un-Audited

5002.41

3075.30

(3789.09)

(2178.47)

(3789.09)

(2178.4a

....".- n6 r-:.

:::`,

.."

Previous Year

31.032015

Audited

5696.41

(3781.17)

(3781.17)

f p~~Qy~

Forty of TCO~i

Place : Bangalore

Date : 13.02.2016

-` arugln DI coon

.,:1

BANGALORE-1617:

)x

Plot No 31 to 36, 1st Main, 2nd Stage, Arakere Mico Layout Bannerghatta Road, Bangalore-560`0761;Kargateka, India.

Tel: +91-80-41215999, 41215960 / 61 / 62 / 64 / 65 / 67 Fax: +91-80-41215966 www.kaveriteieborris.com

P. MURAL! & CO

Tel.

CHARTERED ACCOUNTANTS

6-3-655/2/3, SOMAJIGUDA,

HYDERABAD - 500 082. INDIA

Fax

E-mail

: (91-40) 2332 6666, 2331 2554

2339 3967, 2332 1470

: (91-40) 2339 2474

: pmurali.co@gmail.com

info@pmurali.com

Website : www.pmurali.com

TO

The Board of Directors

Kavveri Telecom Products Limited

Hyderabad.

Limited Review Report for the quarter ended 31st December, 2015

We have reviewed the accompanying statement of unaudited financial results of Kavveri

Telecom Products Limited for the period ended 31st December 2015. This statement is the

responsibility of the Company's Management and has been approved by the Board of Directors.

Our responsibility is to issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

Engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate

assurance as to whether the financial statements are free of material misstatement. A review is

limited primarily to inquiries of company personnel and analytical procedures applied to

financial data and thus provides less assurance than an audit. We have not performed an audit

and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards and other recognized accounting practices and policies

has not disclosed the information required to be disclosed in terms of Regulation 33 of the SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 2015 including the manner in

which it is to be disclosed, or that it contains any material misstatement.

For P.Murali & Co.

Chartered Accountants

M V Joshi

Partner

M.No. 024784

Place: Hyderabad

Date: 13th February 2016

Das könnte Ihnen auch gefallen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument5 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokument8 SeitenAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Dokument6 SeitenAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument13 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- TTR RRL: LimitedDokument5 SeitenTTR RRL: LimitedShyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Dokument7 SeitenAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- AFR31032019Dokument8 SeitenAFR31032019tamilarasan6382tamilNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokument5 SeitenAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument12 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument3 SeitenFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument12 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Abfa1164 Pyq0522Dokument7 SeitenAbfa1164 Pyq05220130 CrystalaquariusNoch keine Bewertungen

- Understanding Financial StatementsDokument30 SeitenUnderstanding Financial StatementsTeh PohkeeNoch keine Bewertungen

- DEPRECIATION2Dokument2 SeitenDEPRECIATION2PearlNoch keine Bewertungen

- Module 1 - Cost Concept and Terminology - With AnswersDokument21 SeitenModule 1 - Cost Concept and Terminology - With AnswersKelvin CulajaráNoch keine Bewertungen

- WN Ce1905 en PDFDokument708 SeitenWN Ce1905 en PDFanuagarwal anuNoch keine Bewertungen

- ACT103 - Topic 2Dokument9 SeitenACT103 - Topic 2Juan FrivaldoNoch keine Bewertungen

- Recibo de Transferencia Maraton Castello Ivan EspañaDokument2 SeitenRecibo de Transferencia Maraton Castello Ivan EspañaDoryan William Chavez SalgueiroNoch keine Bewertungen

- CHAPTER 2 EsDokument5 SeitenCHAPTER 2 EsManav GargNoch keine Bewertungen

- Chapter 2Dokument40 SeitenChapter 2ellyzamae quiraoNoch keine Bewertungen

- Bulletin Sep 15Dokument16 SeitenBulletin Sep 15Cryptic LollNoch keine Bewertungen

- (At) 01 - Preface, Framework, EtcDokument8 Seiten(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Cost Accounting Prelims Practice Solving 1 50 1Dokument24 SeitenCost Accounting Prelims Practice Solving 1 50 1Marjorie PalmaNoch keine Bewertungen

- Prospectus 2021-2022Dokument49 SeitenProspectus 2021-2022devika chavanNoch keine Bewertungen

- AT05 Further Audit Procedures (Tests of Controls) PSA 520Dokument4 SeitenAT05 Further Audit Procedures (Tests of Controls) PSA 520John Paul SiodacalNoch keine Bewertungen

- PILA Case Digest MTDokument27 SeitenPILA Case Digest MTMark Lester Lee Aure100% (1)

- Activity No. 3 - Principles of Accounting: AnswersDokument2 SeitenActivity No. 3 - Principles of Accounting: AnswersLagasca Iris100% (1)

- PSA-800 Special Consideration - Audits of FSs Prepared in Accord With Special Purpose FrameworksDokument18 SeitenPSA-800 Special Consideration - Audits of FSs Prepared in Accord With Special Purpose FrameworkscolleenyuNoch keine Bewertungen

- The Small Business ControllerDokument7 SeitenThe Small Business ControllerBusiness Expert Press100% (1)

- Accounting Principles Volume 1 Canadian 7th Edition Geygandt Test BankDokument48 SeitenAccounting Principles Volume 1 Canadian 7th Edition Geygandt Test BankJosephWilliamsostmdNoch keine Bewertungen

- Allowance For Doubtful Accounts - Solutions PDFDokument1 SeiteAllowance For Doubtful Accounts - Solutions PDFPrecious NosaNoch keine Bewertungen

- 5 Major Accounts of AccountingDokument2 Seiten5 Major Accounts of AccountingAnonymous P1iMibNoch keine Bewertungen

- Hilton7e PrefaceDokument37 SeitenHilton7e PrefaceErma WulandariNoch keine Bewertungen

- Chapter 4Dokument10 SeitenChapter 4Chandu SagiliNoch keine Bewertungen

- Hercules Poirpt PDFDokument4 SeitenHercules Poirpt PDFsy yusuf75% (12)

- Accounting Principles 12th Edition Ch01Accounting in ActionDokument71 SeitenAccounting Principles 12th Edition Ch01Accounting in ActionMd Al AminNoch keine Bewertungen

- Receivables Problem 1: Account Is One To Six Months ClassificationDokument4 SeitenReceivables Problem 1: Account Is One To Six Months ClassificationMary Grace NaragNoch keine Bewertungen

- Chapter 4 - Problems - Non-Current Assets Held For Sale and Discontinued OperationsDokument17 SeitenChapter 4 - Problems - Non-Current Assets Held For Sale and Discontinued OperationsVictor TucoNoch keine Bewertungen

- Mark Scheme: Accounting ACC1Dokument11 SeitenMark Scheme: Accounting ACC1SaadArshadNoch keine Bewertungen

- Annual Report of NIBL FY-2078-079Dokument188 SeitenAnnual Report of NIBL FY-2078-079Nitesh Yadav50% (2)

- CH 16Dokument46 SeitenCH 16Kim TranNoch keine Bewertungen