Beruflich Dokumente

Kultur Dokumente

Null

Hochgeladen von

api-25889552Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Null

Hochgeladen von

api-25889552Copyright:

Verfügbare Formate

Doubled-Up Worst of Barrier Reverse Convertible on ABBN, Credit Suisse and

Roche

Coupon 7% Guaranteed + 7% Conditional - American Barrier at 69% - 1 Year - CHF

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 15.04.2010 Client pays CHF 1000 (Denomination)

Rating: Fitch A

Underlying ABB LTD-REG CREDIT SUISSE ROCHE HOLDING AG- On 15.04.2011

GROUP AG-REG GENUSSCHEIN

Bbg Ticker ABBN VX Equity CGSN VX Equity ROG VX Equity Scenario 1: if the Underlyings have never traded at or below the Barrier level

Strike Level (100%) CHF 22,36 CHF 52,85 CHF 168,4 a. If all the Underlyings are above their Strike Level on the Valuation Date,

Barrier Level (69%) CHF 15,43 CHF 36,47 CHF 116,20 the Investor will receive a Cash Settlement in CHF equal to:

Conversion Ratio 44,7227 18,9215 5,9382 Denomination + 2 Coupons of 7% (Total return: 114%)

Initial Fixing Date 08,04,2010 b. If at least one Underlying is at or below its Strike Level on the Valuation Date,

Payment Date 15,04,2010 the Investor will receive a Cash Settlement in CHF equal to:

Valuation Date 08,04,2011 Denomination + 1 Coupon of 7% (Total return: 107%)

Maturity Date 15,04,2011

EU Saving Tax Option Premium Component 6,36% p.a. Scenario 2: if one or more Underlyings traded at least once at or below the Barrier

Interest Component 0.64% p.a. a. If all the Underlyings are above their Strike Level on the Valuation Date,

Details Physical Settlement American Barrier the Investor will receive a Cash Settlement in CHF equal to:

ISIN CH0111528060 Denomination + 2 Coupons of 7% (Total return: 114%)

Valoren 11152806 b. If at least one Underlying is at or below its Strike Level on the Valuation Date,

SIX Symbol Not Listed the Investor will receive a predefined round number (i.e. Conversion Ratio) of

the Underlying with the Worst Performance per Denomination + 1 Coupon of

7%

Characteristics

Underlying____________________________________________________________________________________________________________________________________________________________________

- ABB Limited provides power and automation technologies. The Company operates under segments that include power products, power systems, automation products, process automation

and robotics.

- Credit Suisse Group AG is an international financial services group. The Group provides investment banking, private banking, and asset management services to customers located around

the world.

- Roche Holding AG develops and manufactures pharmaceutical and diagnostic products. The Company produces prescription drugs in the areas of cardiovascular, infectious,

autoimmune, and respiratory diseases, dermatology, metabolic disorders, oncology, transplantation, and the central nervous system.

Opportunities_________________________________________________________________ Risks______________________________________________________________________________

1. A guaranteed Coupon of 7% in fine 1. M aximum return limited to 14% in fine

2. Opportunity to double the Coupon if all the Underlyings close abov e their Strike lev el 2. Exposure to v olatility changes

3. Protection against 31% drop in Underlyings' price

4. Low er v olatility than direct equity exposure

5. Secondary market as liquid as a share

6. Optimization of EU Tax components

Best case scenario____________________________________________________________ Worst case scenario_______________________________________________________________

One or more Underlyings traded at least once at or below the Barrier Lev el,

All the Underlyings close abov e their respectiv e Strike lev el

and at least one Underlying closes below its Strike Lev el on the Valuation Date

Redemption: Denomination + 14% in fine ( Tw o coupons of 7%) Redemption: Shares of the Worst performing Underlying + Coupon of 7% in fine

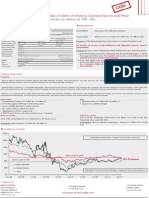

Historical Chart

140%

importer depuis la deuxieme feuille

120% Redemption:

Denomination + Coupon of 14% in fine

Strike: 100% of Spot Reference

100%

31% Protection

Redemption:

80%

Denomination + Coupon of 7% in fine

Barrier: 69% of Strike Level

60%

ABB

Redemption: Shares of the Worst Performing

Credit Suisse Underlying + Coupon of 7% in fine

40%

Roche

20%

Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10

Contacts

Filippo Colombo Christophe Spanier Nat hanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cut uri Live prices at www.efgfp.com

+377 93 15 11 66

This publication serves only fo r info rmatio n purposes and is no t research; it constitutes neither a recommendation fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No responsibility is taken fo r the co rrectness o f this info rmatio n. The financial instruments mentio ned in

this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by the Swiss Financial M arket Superviso ry A uthority

FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efore investing in derivative instruments, Investors are highly recommended to ask their financial adviso r fo r advice specifically focused o n the Investo r´s financial situation; the info rmation co ntained in this do cument do es no t substitute

such advice. This publicatio n does not co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a or 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct documentation can be o btained directly at EFG Financial P ro ducts A G: Tel. +41 (0)58 800 1111, Fax

+41(0)58 800 1010, or via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapore, the USA , US perso ns, and the United Kingdom (the issuance is subject to Swiss

law). The Underlyings´ perfo rmance in the past does not co nstitute a guarantee fo r their future perfo rmance. The financial products' value is subject to market fluctuatio n, what can lead to a partial o r to tal loss o f the invested capital. The purchase o f the financial pro ducts triggers co sts and fees. EFG

Financial P ro ducts A G and/o r ano ther related company may o perate as market maker for the financial products, may trade as principal, and may conclude hedging transactio ns. Such activity may influence the market price, the price mo vement, or the liquidity o f the financial pro ducts. © EFG Financial

P ro ducts A G A ll rights reserved.

Das könnte Ihnen auch gefallen

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDokument1 SeiteCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDokument1 SeiteCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552Noch keine Bewertungen

- Doubled-Up Worst of Barrier Reverse ConvertibleDokument1 SeiteDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Noch keine Bewertungen

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDokument1 SeiteCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552Noch keine Bewertungen

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDokument1 SeiteCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552Noch keine Bewertungen

- Worst of Autocall Certificate With Memory EffectDokument1 SeiteWorst of Autocall Certificate With Memory Effectapi-25889552Noch keine Bewertungen

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Dokument1 Seite86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552Noch keine Bewertungen

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDokument1 SeiteCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552Noch keine Bewertungen

- 6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDDokument1 Seite6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDapi-25889552Noch keine Bewertungen

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDokument1 Seite7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552Noch keine Bewertungen

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDokument1 Seite4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552Noch keine Bewertungen

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDokument1 Seite6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552Noch keine Bewertungen

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDokument1 SeiteCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552Noch keine Bewertungen

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDokument1 SeiteCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552Noch keine Bewertungen

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Dokument1 Seite75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552Noch keine Bewertungen

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDokument1 Seite6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552Noch keine Bewertungen

- 12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURDokument1 Seite12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURapi-25889552Noch keine Bewertungen

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDokument1 SeiteCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552Noch keine Bewertungen

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDokument1 Seite1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552Noch keine Bewertungen

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDokument1 SeiteCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552Noch keine Bewertungen

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDokument1 SeiteCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552Noch keine Bewertungen

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDokument1 Seite67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552Noch keine Bewertungen

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDokument1 SeiteCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552Noch keine Bewertungen

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDokument1 Seite2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552Noch keine Bewertungen

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDokument1 Seite11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552Noch keine Bewertungen

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDokument1 Seite15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Noch keine Bewertungen

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Dokument1 Seite1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552Noch keine Bewertungen

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDokument1 SeiteCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552Noch keine Bewertungen

- Bonus Certificate On The EURO STOXX 50Dokument1 SeiteBonus Certificate On The EURO STOXX 50api-25889552Noch keine Bewertungen

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDokument1 Seite6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552Noch keine Bewertungen

- Capital Protection On EUR/CHF Foreign Exchange RateDokument1 SeiteCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552Noch keine Bewertungen

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Dokument1 Seite98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552Noch keine Bewertungen

- 83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010Dokument1 Seite83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010api-25889552Noch keine Bewertungen

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDokument1 SeiteExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552Noch keine Bewertungen

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Dokument1 Seite153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552Noch keine Bewertungen

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDokument1 SeiteCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552Noch keine Bewertungen

- Bonus CertificateDokument7 SeitenBonus Certificateaderajew shumetNoch keine Bewertungen

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Dokument1 Seite61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552Noch keine Bewertungen

- 94% Strike - 98% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EUR-CHF X-RATEDokument1 Seite94% Strike - 98% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EUR-CHF X-RATEapi-25889552Noch keine Bewertungen

- Worst of Autocall Certificate With Memory EffectDokument1 SeiteWorst of Autocall Certificate With Memory Effectapi-25889552Noch keine Bewertungen

- Product Agreement - Credit Linked Note: Final Documentation May 03, 2016Dokument12 SeitenProduct Agreement - Credit Linked Note: Final Documentation May 03, 2016Keval ShahNoch keine Bewertungen

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDokument1 SeiteCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Noch keine Bewertungen

- 111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEDokument1 Seite111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEapi-25889552Noch keine Bewertungen

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDokument1 SeiteCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552Noch keine Bewertungen

- 14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDDokument1 Seite14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDapi-25889552Noch keine Bewertungen

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDokument1 SeiteCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Noch keine Bewertungen

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPDokument1 SeiteCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552Noch keine Bewertungen

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDokument1 SeiteCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552Noch keine Bewertungen

- 107% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On GBP-AUD Exchange RateDokument1 Seite107% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On GBP-AUD Exchange Rateapi-25889552Noch keine Bewertungen

- 94% Strike - 99% Stop Loss - 5.5 Months - CHF: Bullish Mini-Future On EUR-CHF X-RATEDokument1 Seite94% Strike - 99% Stop Loss - 5.5 Months - CHF: Bullish Mini-Future On EUR-CHF X-RATEapi-25889552Noch keine Bewertungen

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDokument3 SeitenExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNoch keine Bewertungen

- xs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLDokument6 Seitenxs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLvmakeienkoNoch keine Bewertungen

- 108% Strike - 105% Stop Loss - 6 Months - EUR: Bullish Mini-Future On AUD-USD X-RATEDokument1 Seite108% Strike - 105% Stop Loss - 6 Months - EUR: Bullish Mini-Future On AUD-USD X-RATEapi-25889552Noch keine Bewertungen

- Termsheet Ch1261616994 enDokument5 SeitenTermsheet Ch1261616994 entomerNoch keine Bewertungen

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFDokument1 SeiteCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552Noch keine Bewertungen

- CG European Capital Growth Fund: StrategyDokument2 SeitenCG European Capital Growth Fund: Strategyapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument37 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- CG European Income Fund: StrategyDokument2 SeitenCG European Income Fund: Strategyapi-25889552Noch keine Bewertungen

- Global Financial Centres: March 2010Dokument41 SeitenGlobal Financial Centres: March 2010api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument30 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDokument65 SeitenUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552Noch keine Bewertungen

- Morning News 28 May 2010Dokument3 SeitenMorning News 28 May 2010api-25889552Noch keine Bewertungen

- Morning News 1 June 2010Dokument3 SeitenMorning News 1 June 2010api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument33 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Guy Butler Limited: AUD NZD CAD Denominated BondsDokument1 SeiteGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552Noch keine Bewertungen

- Daily Market Update: EquitiesDokument3 SeitenDaily Market Update: Equitiesapi-25889552Noch keine Bewertungen

- Worldwide Real Estates: Gibraltar LettingsDokument8 SeitenWorldwide Real Estates: Gibraltar Lettingsapi-25889552Noch keine Bewertungen

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Dokument1 Seite1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument36 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Dokument1 Seite1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552Noch keine Bewertungen

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDokument1 Seite97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552Noch keine Bewertungen

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDokument1 SeiteCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Noch keine Bewertungen

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDokument1 SeiteCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552Noch keine Bewertungen

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDokument1 Seite62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552Noch keine Bewertungen

- Morning News 12 May 2010Dokument3 SeitenMorning News 12 May 2010api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument37 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- CG European Income Fund: April 2010Dokument2 SeitenCG European Income Fund: April 2010api-25889552Noch keine Bewertungen