Beruflich Dokumente

Kultur Dokumente

OD11 PL Decision Analysis

Hochgeladen von

carolinarvsocnCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

OD11 PL Decision Analysis

Hochgeladen von

carolinarvsocnCopyright:

Verfügbare Formate

OPTIMIZAO E DECISO 10/11

PL #11 Decision Analysis

Alexandra Moutinho

th

(from Hillier & Lieberman Introduction to Operations Research, 8 edition)

Problem 1

Consider a decision analysis problem whose payoffs (in units of thousands of dollars) are given by the

following payoff table:

Alternative

A1

A2

A3

Prior probability

a)

b)

c)

d)

State of Nature

S1

S2

80

25

30

50

60

40

0.4

0.6

Which alternative should be chosen under the maximin payoff criterion?

Which alternative should be chosen under the maximum likelihood criterion?

Which alternative should be chosen under Bayes' decision rule?

Using Bayes' decision rule, do sensitivity analysis graphically with respect to the prior probabilities

to determine the crossover points where the decision shifts from one alternative to another.

Resolution

a) Under the maximin payoff criterion, alternative A3 should be chosen because 40 is the maximum

in the Minimum column.

b) Under the maximum likelihood criterion, alternative A2 should be chosen because it has the

maximum payoff for the state of nature that has the maximum prior probability.

c) Under the Bayes decision rule, alternative A3 should be chosen because it has the maximum

expected payoff:

E[A1]=80*0.4+25*0.6=47

E[A2]=30*0.4+50*0.6=42

E[A3]=60*0.4+40*0.6=48

d) Letting p=prior probability of S1:

E[A1]=80p+25(1-p)=55p+25

E[A2]=30p +50(1-p)= -20p+50

E[A3]=60 p +40(1-p)=20p+40

1 : E[A2]= E[A3]

p=0.25

2 : E[A1]= E[A3]

p 0.43

Therefore, the optimal policy is to

choose A2 when p 0.25, choose A3

when 0.25 p 0.429, and choose A1 when p 0.429.

Problem 2

A new type of photographic film has been developed. It is packaged in sets of five sheets, where each

sheet provides an instantaneous snapshot. Because this process is new, the manufacturer has

attached an additional sheet to the package, so that the store may test one sheet before it sells the

package of five. In promoting the film, the manufacturer offers to refund the entire purchase price of

the film if one of the five is defective. This refund must be paid by the camera store, and the selling

price has been fixed at $2 if this guarantee is to be valid. The camera store may sell the film for $1 if

the preceding guarantee is replaced by one that pays $0.20 for each defective sheet. The cost of the

film to the camera store is $0.40, and the film is not returnable. The store may choose any one of

three actions:

1. Scrap the film.

2. Sell the film for $2.

3. Sell the film for $1.

a) If the six states of nature correspond to 0, 1, 2, 3, 4, and 5 defective sheets in the package,

complete the following payoff table:

Alternative

1

2

3

State of nature

1

2

3

0

-0.40

1.60

0.60

-0.40

0.40

0.00

b) The store has accumulated the following information on sales of 60 such packages.

Quality of

Attached Sheet

Good

Bad

Total

0

10

0

10

State of Nature

1

2

3

4

8

6 4

2

2

4

6 8

10 10 10 10

5

0

10

10

These data indicate that each state of nature is equally likely, so that this prior distribution can be

assumed. What is the optimal decision alternative for a package of film?

c) Now assume that the attached sheet is tested. Use a probability tree diagram to find the

posterior probabilities of the state of nature for each of the two possible outcomes of this testing.

d) What is the optimal expected payoff for a package of film if the attached sheet is tested? What is

the optimal decision alternative if the sheet is good? If it is bad?

Resolution

a) The payoff table is given below.

Alternative

1

2

3

0

-0.40

1.60

0.60

1

-0.40

-0.40

0.40

State of nature

2

3

4

-0.40 -0.40 -0.40

-0.40 -0.40 -0.40

0.20 0.00 -0.20

5

-0.40

-0.40

-0.40

b) Since the data indicate that the states of nature are equally likely, the expected payoff of each

alternative is calculated as follows:

E[payoff(alternative 1)] = -0.40.

E[payoff(alternative 2)] = 1/6*(1.60) + 5/6*(-0.40) = -0.067.

E[payoff(alternative 3)] = 1/6*(0.60 + 0.40 + 0.20 + 0 - 0.20 - 0.40) = 0.10.

The optimal decision alternative is alternative 3, selling the film for $1.

Optimizao e Deciso 09/10 - PL #11 Decision Analysis - Alexandra Moutinho

c) The probability tree diagram and the resulting posterior probabilities are given next.

d) If the test is Good, then

E[payoff(alternative 1) | test is Good] = -0.40.

E[payoff(alternative 2) | test is Good] = 1/3* (0.60) + 2/3*(-0.40) = 0.267.

E[payoff(alternative 3) | test is Good] = 1/3* (0.60) + 4/15*(0.40) +1/5* (0.20) + 2/15*(0) +

1/15*(-0.20) = 0.333.

Optimizao e Deciso 09/10 - PL #11 Decision Analysis - Alexandra Moutinho

If the test is Bad, then

E[payoff(alternative 1) | test is Bad] = -0.40.

E[payoff(alternative 2) | test is Bad] = 0(0.60) + 1(-0.40) = -0.40.

E[payoff(alternative 3) | test is Bad] = 0 + 1/15*(0.40) + 2/15*(0.20) + 1/5(0) + /15*(-0.20)

+1/3* (-0.40) = -0.133.

In both cases, the optimal decision alternative is alternative 3, selling the film for $1.

The expected payoff is 0.1.

Problem 3

Consider the decision tree below, with the probabilities at event nodes shown in parentheses and

with the payoffs at terminal points shown on the right. Analyze this decision tree to obtain the

optimal policy.

10

(0.5)

(0.5)

(0.5)

0

30

-10

(0.5)

-5

(0.4)

40

(0.3)

(0.6)

(0.7)

-10

10

Resolution

Using TreePlan, the optimal policy is indicated in the following decision tree by the number inside the

square box at each of the three decision nodes. Since this number is 2 in each case, the optimal

decision at each decision node is the one that corresponds to taking the lower branch out of that

node. This is further emphasized in the following decision tree by having the branch to follow out of

each decision node be the thicker branch. The expected payoff for this optimal policy is 8, as

indicated by the 8 next to the decision node on the left that initiates the decision tree.

Optimizao e Deciso 09/10 - PL #11 Decision Analysis - Alexandra Moutinho

Das könnte Ihnen auch gefallen

- Exercise Bestbooks Publisher Representative - GREENDokument2 SeitenExercise Bestbooks Publisher Representative - GREENakashNoch keine Bewertungen

- Te Twin TownDokument12 SeitenTe Twin TownBlazing RaysNoch keine Bewertungen

- Entrepreneurship Development A4Dokument44 SeitenEntrepreneurship Development A4paroothiNoch keine Bewertungen

- Napkin ProblemDokument10 SeitenNapkin ProblemDian SeptianaNoch keine Bewertungen

- FINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELDokument95 SeitenFINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELRajNoch keine Bewertungen

- MSTC Final Exam 2017Dokument13 SeitenMSTC Final Exam 2017Elis KomariahNoch keine Bewertungen

- Welcome To The Capstone® Business SimulationDokument23 SeitenWelcome To The Capstone® Business SimulationRachel YoungNoch keine Bewertungen

- Multiple Regression: Problem Set 7Dokument3 SeitenMultiple Regression: Problem Set 7ArkaNoch keine Bewertungen

- Conjoint Analysis TutorialDokument24 SeitenConjoint Analysis TutorialMohammad ShayziNoch keine Bewertungen

- Student Help Center - The Paradoxical Twins - Acme and Omega ElectronicsDokument8 SeitenStudent Help Center - The Paradoxical Twins - Acme and Omega ElectronicsNershwn BasumataryNoch keine Bewertungen

- Linear Programming Formulation ExamplesDokument17 SeitenLinear Programming Formulation ExamplesprasunbnrgNoch keine Bewertungen

- Product and Brand Management Project Submission by Group 11Dokument14 SeitenProduct and Brand Management Project Submission by Group 11Er Kashish KathuriaNoch keine Bewertungen

- Karvy IntroductionDokument18 SeitenKarvy Introductionanon_621921597Noch keine Bewertungen

- The WM Wringley JR CompanyDokument3 SeitenThe WM Wringley JR Companyavnish kumarNoch keine Bewertungen

- Strategic Service Vision Framework for Social EntrepreneursDokument18 SeitenStrategic Service Vision Framework for Social EntrepreneursadrielgwNoch keine Bewertungen

- SMMD: Practice Problem Set 6 Topic: The Simple Regression ModelDokument6 SeitenSMMD: Practice Problem Set 6 Topic: The Simple Regression ModelArkaNoch keine Bewertungen

- 1st Assignment - Volvo TrucksDokument4 Seiten1st Assignment - Volvo Trucksbubai sahaNoch keine Bewertungen

- MKTG ExamDokument14 SeitenMKTG ExamSaad KapadiaNoch keine Bewertungen

- Cell2Cell Data DocumentationDokument2 SeitenCell2Cell Data DocumentationJayesh PatilNoch keine Bewertungen

- New Solutions For MichiganDokument28 SeitenNew Solutions For MichiganJustin HinkleyNoch keine Bewertungen

- Strategic DissonanceDokument29 SeitenStrategic DissonanceDamian Flori AlinaNoch keine Bewertungen

- KCHRDokument3 SeitenKCHRAftab AhmeedNoch keine Bewertungen

- STWS Business Model ArchetypesDokument1 SeiteSTWS Business Model ArchetypesManjit SinghNoch keine Bewertungen

- Aub Medical Center: Achieving 2020 Vision (B) : "Lebanon Facts and Figures 2013," Bank Audi, 2013Dokument14 SeitenAub Medical Center: Achieving 2020 Vision (B) : "Lebanon Facts and Figures 2013," Bank Audi, 2013Hounaida El Jurdi100% (1)

- Blue Ocean Strategy - 1Dokument34 SeitenBlue Ocean Strategy - 1Tani AshNoch keine Bewertungen

- Solutions Manual Managing Business Process Flows 3rd Edition by Ravi Anupindi SampleDokument12 SeitenSolutions Manual Managing Business Process Flows 3rd Edition by Ravi Anupindi Sampleمحمد مصطفى0% (1)

- Conjoint AnalysisDokument51 SeitenConjoint AnalysisAarij TanveerNoch keine Bewertungen

- OPIM 615: Managing The Productive Core of The Firm: Operations Strategy Simone Marinesi 562 JMHH Marinesi@wharton - Upenn.eduDokument9 SeitenOPIM 615: Managing The Productive Core of The Firm: Operations Strategy Simone Marinesi 562 JMHH Marinesi@wharton - Upenn.eduRewat FageriaNoch keine Bewertungen

- Turnaround Plan For Linens N ThingsDokument15 SeitenTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- Excel Ahp ProcessDokument2 SeitenExcel Ahp Processdc080888100% (1)

- LakshmiY 12110035 SolutionsDokument10 SeitenLakshmiY 12110035 SolutionsLakshmi Harshitha YechuriNoch keine Bewertungen

- MOS PGPM Individual Assignment 2Dokument1 SeiteMOS PGPM Individual Assignment 2Sukanta JanaNoch keine Bewertungen

- Gyaan Kosh Term 4 MGTODokument25 SeitenGyaan Kosh Term 4 MGTOYash NyatiNoch keine Bewertungen

- An Empirical Examination of Supply Chain Performance Along Several Dimensions of RiskDokument19 SeitenAn Empirical Examination of Supply Chain Performance Along Several Dimensions of RiskDivom SharmaNoch keine Bewertungen

- Orlicky's Material Requirements Planning 第一章 CHAPTER 1 OverviewDokument7 SeitenOrlicky's Material Requirements Planning 第一章 CHAPTER 1 OverviewWill JinNoch keine Bewertungen

- Why Good Matters Governance: Relevant Business KnowledgeDokument78 SeitenWhy Good Matters Governance: Relevant Business Knowledgeprameyak1100% (1)

- Base of Capstone StrategyDokument2 SeitenBase of Capstone StrategySagar SabnisNoch keine Bewertungen

- Littlefield Assignment - Introduction PDFDokument3 SeitenLittlefield Assignment - Introduction PDFPavan MalagimaniNoch keine Bewertungen

- Van Leer Packaging Worldwide - The TOTAL AccountDokument15 SeitenVan Leer Packaging Worldwide - The TOTAL AccountAgarwala Ashesh100% (1)

- Sample Final Exam (SMMD) : Part A: Each Question in This Part Is Worth 1pointDokument9 SeitenSample Final Exam (SMMD) : Part A: Each Question in This Part Is Worth 1pointemma marxNoch keine Bewertungen

- Value Stream Mapping at SysIntegDokument16 SeitenValue Stream Mapping at SysIntegAsher RamishNoch keine Bewertungen

- Business Analytics Modeling and PredictionsDokument4 SeitenBusiness Analytics Modeling and PredictionsVidehi BajajNoch keine Bewertungen

- AHP-based Approach To ERP System Selection AHP-based Approach To ERP System SelectionDokument13 SeitenAHP-based Approach To ERP System Selection AHP-based Approach To ERP System SelectionDiv_nNoch keine Bewertungen

- Applications and Solutions of Linear Programming Session 1Dokument19 SeitenApplications and Solutions of Linear Programming Session 1Simran KaurNoch keine Bewertungen

- Case Study 2.1 Meridian Water PumpsDokument2 SeitenCase Study 2.1 Meridian Water PumpsMammen VergisNoch keine Bewertungen

- CIS1Dokument12 SeitenCIS1Sunil SharmaNoch keine Bewertungen

- ISM and MICMAC Analysis for Supply Chain Complexity FactorsDokument26 SeitenISM and MICMAC Analysis for Supply Chain Complexity FactorsGirish Ranjan Mishra100% (1)

- Case Study CreoScitexDokument10 SeitenCase Study CreoScitexAnand SukumarNoch keine Bewertungen

- How to add value as a product manager at DellDokument14 SeitenHow to add value as a product manager at DellAditya GhamandeNoch keine Bewertungen

- Lit MotorsDokument11 SeitenLit MotorsJohnson7893Noch keine Bewertungen

- Managing A Global Team - Greg James at Sun Microsystems, Inc. Case Study Solution For Harvard HBR Case StudyDokument5 SeitenManaging A Global Team - Greg James at Sun Microsystems, Inc. Case Study Solution For Harvard HBR Case StudyKai TekiNoch keine Bewertungen

- Paytm's journey, products, services & future prospectsDokument2 SeitenPaytm's journey, products, services & future prospectsSwayam SahooNoch keine Bewertungen

- Louis Vuitton - Final SlidesDokument32 SeitenLouis Vuitton - Final SlideszeeshanNoch keine Bewertungen

- Decision Analysis With Payoff TablesDokument20 SeitenDecision Analysis With Payoff Tableswaleed aka wbtNoch keine Bewertungen

- Freemark Abbey Winery Homework AssignmentDokument7 SeitenFreemark Abbey Winery Homework Assignmentluong_hong_3Noch keine Bewertungen

- ECON 1203 Tutorial Sample Solutions Semester 1 2016 Weeks 3 and 4Dokument8 SeitenECON 1203 Tutorial Sample Solutions Semester 1 2016 Weeks 3 and 4Antonio GorgijovskiNoch keine Bewertungen

- Abbey WineDokument7 SeitenAbbey WineSanjeetKumarSinghNoch keine Bewertungen

- Tugas 4 Anrek FauzanDokument11 SeitenTugas 4 Anrek FauzanMuhamad Fauzan GhassaniNoch keine Bewertungen

- Partial Exam - 2021 - 1 - SolutionDokument15 SeitenPartial Exam - 2021 - 1 - SolutionScribdTranslationsNoch keine Bewertungen

- MGS3100 Sample Exam Questions #3Dokument6 SeitenMGS3100 Sample Exam Questions #3api-25888404Noch keine Bewertungen

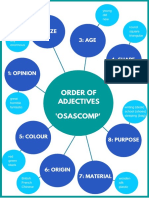

- Order of Adjectives InfographicDokument2 SeitenOrder of Adjectives InfographiccarolinarvsocnNoch keine Bewertungen

- List of 616 English Irregular VerbsDokument21 SeitenList of 616 English Irregular Verbsمحمد طه المقطري67% (3)

- Poster Access-Web PDFDokument1 SeitePoster Access-Web PDFŠime ČavkaNoch keine Bewertungen

- Business and CA 2012 12 DecDokument86 SeitenBusiness and CA 2012 12 DecEduardo RivasNoch keine Bewertungen

- BPM OracleDokument8 SeitenBPM OracleMichaelNoch keine Bewertungen

- B.gs1 Grammar Summary 2ascdDokument27 SeitenB.gs1 Grammar Summary 2ascdcarolinarvsocnNoch keine Bewertungen

- List of 616 English Irregular VerbsDokument21 SeitenList of 616 English Irregular Verbsمحمد طه المقطري67% (3)

- OD Transport Assignment 2010Dokument17 SeitenOD Transport Assignment 2010carolinarvsocnNoch keine Bewertungen

- OD Linear Programming 2010Dokument38 SeitenOD Linear Programming 2010carolinarvsocnNoch keine Bewertungen

- OD Nonlinear Programming 2010Dokument39 SeitenOD Nonlinear Programming 2010carolinarvsocnNoch keine Bewertungen

- OD Transport Assignment 2010Dokument17 SeitenOD Transport Assignment 2010carolinarvsocnNoch keine Bewertungen

- OD Metaheuristics 2010Dokument57 SeitenOD Metaheuristics 2010carolinarvsocnNoch keine Bewertungen

- OD Network Models 2010Dokument33 SeitenOD Network Models 2010carolinarvsocnNoch keine Bewertungen

- OD Nonlinear Programming 2010Dokument39 SeitenOD Nonlinear Programming 2010carolinarvsocnNoch keine Bewertungen

- OD Network Models 2010Dokument33 SeitenOD Network Models 2010carolinarvsocnNoch keine Bewertungen

- OD Integer Programming 2010Dokument34 SeitenOD Integer Programming 2010carolinarvsocnNoch keine Bewertungen

- OD Metaheuristics 2010Dokument57 SeitenOD Metaheuristics 2010carolinarvsocnNoch keine Bewertungen

- OD Linear Programming 2010Dokument38 SeitenOD Linear Programming 2010carolinarvsocnNoch keine Bewertungen

- OD Decision Analysis 2010Dokument19 SeitenOD Decision Analysis 2010carolinarvsocnNoch keine Bewertungen

- OPTIMIZAÇÃO E DECISÃODokument15 SeitenOPTIMIZAÇÃO E DECISÃOcarolinarvsocnNoch keine Bewertungen

- OPTIMIZAÇÃO E DECISÃODokument15 SeitenOPTIMIZAÇÃO E DECISÃOcarolinarvsocnNoch keine Bewertungen

- 1415 OD Metaheuristics BC-2008-2Dokument9 Seiten1415 OD Metaheuristics BC-2008-2carolinarvsocnNoch keine Bewertungen

- OD Dynamic Programming 2010Dokument29 SeitenOD Dynamic Programming 2010carolinarvsocnNoch keine Bewertungen

- OD Integer Programming 2010Dokument34 SeitenOD Integer Programming 2010carolinarvsocnNoch keine Bewertungen

- OD Game Theory 2010Dokument18 SeitenOD Game Theory 2010carolinarvsocnNoch keine Bewertungen

- OD Game Theory 2010Dokument18 SeitenOD Game Theory 2010carolinarvsocnNoch keine Bewertungen

- OD Dynamic Programming 2010Dokument29 SeitenOD Dynamic Programming 2010carolinarvsocnNoch keine Bewertungen

- 1415 OD Metaheuristics BC-2008-2Dokument9 Seiten1415 OD Metaheuristics BC-2008-2carolinarvsocnNoch keine Bewertungen

- OD Decision Analysis 2010Dokument19 SeitenOD Decision Analysis 2010carolinarvsocnNoch keine Bewertungen

- 16 OD Decision Analysis-2008-2Dokument6 Seiten16 OD Decision Analysis-2008-2carolinarvsocnNoch keine Bewertungen

- Birthday Paradox - A Simulation of Shared Birthday ExperimentsDokument13 SeitenBirthday Paradox - A Simulation of Shared Birthday Experimentsdatalore100% (1)

- Quantum Perturbation Theory of Infinite Square WellDokument19 SeitenQuantum Perturbation Theory of Infinite Square WellShailendra AgarwalNoch keine Bewertungen

- Linear Algebra Lecture Notes Ch3Dokument10 SeitenLinear Algebra Lecture Notes Ch3Abdiqani Mohamed AdanNoch keine Bewertungen

- Cox Proportional Hazard ModelDokument34 SeitenCox Proportional Hazard ModelRIZKA FIDYA PERMATASARI 06211940005004Noch keine Bewertungen

- Survey: Image Encryption Using A5/1 and W7Dokument7 SeitenSurvey: Image Encryption Using A5/1 and W7Journal of Computing100% (1)

- Using Machine Learning To Locate Support and Resistance Lines For Stocks - by Suhail Saqan - The Startup - Jan, 2021 - MediumDokument14 SeitenUsing Machine Learning To Locate Support and Resistance Lines For Stocks - by Suhail Saqan - The Startup - Jan, 2021 - MediumFabioSantosNoch keine Bewertungen

- A Parsimonious Neural Network Approach To Solve Portfolio Optimization Problems Without Using Dynamic ProgrammingDokument35 SeitenA Parsimonious Neural Network Approach To Solve Portfolio Optimization Problems Without Using Dynamic ProgramminglarareNoch keine Bewertungen

- Goal Programming PresentationsDokument26 SeitenGoal Programming PresentationsAashrith ParvathaneniNoch keine Bewertungen

- Visit Civildatas Blogspot for Numerical Methods QuestionsDokument12 SeitenVisit Civildatas Blogspot for Numerical Methods QuestionsAmitava SarderNoch keine Bewertungen

- Import Java - Io. Class RectangleDokument7 SeitenImport Java - Io. Class RectangleGanesh KumarNoch keine Bewertungen

- INDUSTRIAL MANAGEMENT PROJECT MANAGEMENTDokument34 SeitenINDUSTRIAL MANAGEMENT PROJECT MANAGEMENTsunitaNoch keine Bewertungen

- Design and Analysis of AlgotihmsDokument8 SeitenDesign and Analysis of AlgotihmsBONALA HEMANTH KUMAR CSE-J-2020 BATCHNoch keine Bewertungen

- Binomial DistributionDokument15 SeitenBinomial DistributionNelsonMoseMNoch keine Bewertungen

- Find the average marks of studentsDokument2 SeitenFind the average marks of studentsJaZz SFNoch keine Bewertungen

- Unit 4 Assignment 4.2Dokument8 SeitenUnit 4 Assignment 4.2arjuns AltNoch keine Bewertungen

- Algoritma Naive Bayes & K-NN (Efy Yosrita)Dokument15 SeitenAlgoritma Naive Bayes & K-NN (Efy Yosrita)efyNoch keine Bewertungen

- Temperature Control of Electric Furnace Using Genetic Algorithm Based PID ControllerDokument5 SeitenTemperature Control of Electric Furnace Using Genetic Algorithm Based PID ControllervisNoch keine Bewertungen

- Codeforce Problems RoundupDokument17 SeitenCodeforce Problems RoundupKusmakar Pathak 4-Yr B.Tech. Chem. Engg. & Tech., IIT(BHU), VaranasiNoch keine Bewertungen

- 13 Tabel Pengujian Z T F Chi-2 PDFDokument6 Seiten13 Tabel Pengujian Z T F Chi-2 PDFMargaretha Febrina GintingNoch keine Bewertungen

- Hidden Variables, The EM Algorithm, and Mixtures of GaussiansDokument58 SeitenHidden Variables, The EM Algorithm, and Mixtures of GaussiansDUDEKULA VIDYASAGARNoch keine Bewertungen

- Unsupervised K-Means Clustering Algorithm Finds Optimal Number of ClustersDokument17 SeitenUnsupervised K-Means Clustering Algorithm Finds Optimal Number of ClustersAhmad FaisalNoch keine Bewertungen

- Confidence Intervals: Vocabulary: Point Estimate - Interval Estimate - Level of Confidence - Margin of ErrorDokument8 SeitenConfidence Intervals: Vocabulary: Point Estimate - Interval Estimate - Level of Confidence - Margin of ErrorEmeril WilliamsNoch keine Bewertungen

- Cryptography and Network SecurityDokument2 SeitenCryptography and Network SecurityJithu ShajiNoch keine Bewertungen

- Artificial Neural Network and Its ApplicationsDokument21 SeitenArtificial Neural Network and Its ApplicationsHImanshu DabralNoch keine Bewertungen

- Tugas 11 Manpro Daniel Tjeong 1806232824Dokument3 SeitenTugas 11 Manpro Daniel Tjeong 1806232824Daniel TjeongNoch keine Bewertungen

- DX Dy: Order To Estimate y (0.1) and y (0.2) When y (X)Dokument4 SeitenDX Dy: Order To Estimate y (0.1) and y (0.2) When y (X)Paridhi BabelNoch keine Bewertungen

- EC304PC Signals & Systems Question BankDokument3 SeitenEC304PC Signals & Systems Question BankNarendra YenagandulaNoch keine Bewertungen

- NumerPDEs LectureDokument406 SeitenNumerPDEs Lecture李軒Noch keine Bewertungen

- 15CS421E - Natural Language ProcessingDokument2 Seiten15CS421E - Natural Language ProcessingPujan AgarwalNoch keine Bewertungen

- Question Bank NMODokument4 SeitenQuestion Bank NMOSwapvaibNoch keine Bewertungen