Beruflich Dokumente

Kultur Dokumente

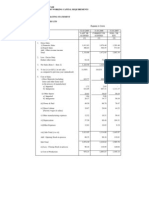

NDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014

Hochgeladen von

junkyOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014

Hochgeladen von

junkyCopyright:

Verfügbare Formate

NDTV ETHNIC RETAIL LIMITED

Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

[400100] Disclosure of general information about company

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

NDTV

ETHNIC

RETAIL

LIMITED

U74900DL2013PLC248812

AAECN3122D

207,

OKHLA

INDUSTRILAL

ESTATE, , PHASE - III , NEW

DELHI , DELHI , INDIA 110020

Commercial

and

Industrial

07/05/2014

01/04/2013

31/03/2014

Standalone

Statement of Profit & Loss

INR

Millions

Name of company

Corporate identity number

Permanent account number of entity

Address of registered office of company

Type of industry

Date of board meeting when final accounts were approved

Date of start of reporting period

Date of end of reporting period

Nature of report standalone consolidated

Content of report

Description of presentation currency

Level of rounding used in financial statements

28/02/2013

to

31/03/2013

28/02/2013

31/03/2013

Disclosure of principal product or services [Table]

..(1)

Unless otherwise specified, all monetary values are in Millions of INR

Types of principal product or services [Axis]

01/04/2013

to

31/03/2014

Disclosure of general information about company [Abstract]

Disclosure of principal product or services [Abstract]

Disclosure of principal product or services [LineItems]

Product or service category (ITC 4 digit) code

Description of product or service category

Turnover of product or service category

Highest turnover contributing product or service (ITC 8 digit) code

Description of product or service

Turnover of highest contributing product or service

Footnotes

(A) Online Selling of apparels

9962

RETAIL TRADE

SERVICES

55.81

99623300

(A)

Textiles,

clothing

and

footwear

55.81

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

[100200] Statement of profit and loss

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

Statement of profit and loss [Abstract]

Disclosure of revenue from operations [Abstract]

Disclosure of revenue from operations for other than finance company

[Abstract]

Revenue from sale of products

Revenue from sale of services

Total revenue from operations other than finance company

Total revenue from operations

Other income

Total revenue

Expenses [Abstract]

Cost of materials consumed

Purchases of stock-in-trade

Changes in inventories of finished goods, work-in-progress and

stock-in-trade

Employee benefit expense

Finance costs

Depreciation, depletion and amortisation expense [Abstract]

Depreciation expense

Amortisation expense

Total depreciation, depletion and amortisation expense

Other expenses

Total expenses

Total profit before prior period items, exceptional items, extraordinary

items and tax

Total profit before extraordinary items and tax

Total profit before tax

Tax expense [Abstract]

Total tax expense

Total profit (loss) for period from continuing operations

Total profit (loss) for period before minority interest

Total profit (loss) for period

Earnings per equity share [Abstract]

Basic earning per equity share

Diluted earnings per equity share

Nominal value of per equity share

28/02/2013

to

31/03/2013

55.81

6.34

62.15

62.15

0.85

63

0

0

0

0

0

0

0

33.46

0

0

-4.54

42.36

2.57

0

0

2.52

1.36

3.88

0

0

0

(A) 231.79

309.52

(B) 2.31

2.31

-246.52

-2.31

-246.52

-246.52

-2.31

-2.31

0

-246.52

-246.52

-246.52

0

-2.31

-2.31

-2.31

[INR/shares] -3,990.69

[INR/shares] -3,990.69

[INR/shares] 10

[INR/shares] -1,356.98

[INR/shares] -1,356.98

[INR/shares] 10

Footnotes

(A) OPERATING AND ADMINISTRATION EXPENSES RS. 105.77 MILLION + MARKETING, DISTRIBUTION AND

PROMOTION EXPENSES RS. 126.02 MILLION

(B) OPERATING AND ADMINISTRATION EXPENSES RS. 2.31 MILLION + MARKETING, DISTRIBUTION AND PROMOTION

EXPENSES RS. NIL

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

[300500] Notes - Subclassification and notes on income and expenses

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

28/02/2013

to

31/03/2013

Subclassification and notes on income and expense explanatory [TextBlock]

Disclosure of revenue from sale of products [Abstract]

Revenue from sale of products [Abstract]

Revenue from sale of products, gross

Total revenue from sale of products

Disclosure of revenue from sale of services [Abstract]

Revenue from sale of services [Abstract]

Revenue from sale of services, gross

55.81

55.81

(A) 6.34

6.34

Total revenue from sale of services

Disclosure of other income [Abstract]

Textual information

[See below]

Disclosure of notes on other income explanatory [TextBlock]

Interest income [Abstract]

Interest income on current investments [Abstract]

Interest on fixed deposits, current investments

Total interest income on current investments

Total interest income

Dividend income [Abstract]

Total dividend income

Total other income

Disclosure of finance cost [Abstract]

Textual information

[See below]

Disclosure of notes on finance cost explanatory [TextBlock]

0

0

0

0

(1)

0.85

0.85

0.85

0

0

0

0

0.85

0

0

(2)

Interest expense [Abstract]

Interest expense short-term loans [Abstract]

Interest expense short-term loans, others

(B) 2.57

2.57

2.57

2.57

Total interest expense short-term loans

Total interest expense

Total finance costs

Employee benefit expense [Abstract]

Salaries and wages

Contribution to provident and other funds [Abstract]

Contribution to provident and other funds for others

Total contribution to provident and other funds

Staff welfare expense

Total employee benefit expense

Breakup of other expenses [Abstract]

Consumption of stores and spare parts

Power and fuel

Rent

Other cess taxes

2.08

2.08

0.58

42.36

0

0

0

0

0

0.23

0

0

(D) 0.41

0.41

0.98

0.66

0.46

8.1

51.21

0.09

1.39

Total rates and taxes excluding taxes on income

Electricity expenses

Telephone postage

Printing stationery

Travelling conveyance

Legal professional charges

Training recruitment expenses

Vehicle running expenses

3

0

0

0

39.7

(C) 7.99

4.36

0.74

0.74

Repairs to building

Repairs to machinery

Insurance

Rates and taxes excluding taxes on income [Abstract]

0

0

0

0

(E) 0.13

0.13

0

0

0

0

1.98

0

0

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Safety security expenses

Directors sitting fees

Managerial remuneration [Abstract]

Remuneration to directors [Abstract]

Total remuneration to directors

Total managerial remuneration

Books periodicals

Bank charges

Advertising promotional expenses

1.14

0

0

0

0

0

0.44

2.89

0

0

0

0

0

(F) 126.29

Cost information technology [Abstract]

Cost software

Cost communication connectivity

Total cost information technology

Cost insurance

Provision bad doubtful debts created

Provision bad doubtful loans advances created

Write-off assets liabilities [Abstract]

Miscellaneous expenditure written off [Abstract]

Total miscellaneous expenditure written off

Bad debts written off

Bad debts advances written off

Total write-off assets liabilities

Loss on disposal of intangible asset

Loss on disposal, discard, demolishment and destruction of depreciable

tangible asset

Payments to auditor [Abstract]

Payment for audit services

Payment for reimbursement of expenses

Total payments to auditor

Miscellaneous expenses

10.39

2.89

13.28

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0.5

0.02

0.52

0.2

0

0.2

(G) 9.87

Total other expenses

(I) 231.79

(H) 0

(J) 2.31

Footnotes

(A) SALE OF SERVICES RS. 3.28 MILLION + SHARED SERVICE INCOME RS. 3.06 MILLION

(B) INTEREST ON INTER COMPANY LOAN* *INTEREST ON LOAN FROM NDTV LIFESTYLE HOLDINGS LIMITED

AMOUNTING TO RS. 75.00 MILLION

(C) REFER NOTE 26

(D) RATES AND TAXES

(E) RATES AND TAXES

(F) BUSINESS PROMOTION RS. 0.27 MILLION + MARKETING, DISTRIBUTION AND PROMOTION EXPENSES RS. 126.02

MILLION

(G) HOSTING & STREAMING RS. 6.07 MILLION + HIRE CHARGES RS. 0.08 MILLION + MEDICAL RS. 0.20 MILLION +

FOREIGN EXCHANGE LOSS (NET) RS. 0.11 MILLION + BROKERAGE & COMMISSION RS. 0.20 MILLION + OTHERS RS.

0.27 MILLION + MISCELLENOUS RS. 2.94 MILLION

(H) HOSTING & STREAMING RS. NIL + HIRE CHARGES RS. NIL + MEDICAL RS. NIL MILLION + FOREIGN EXCHANGE

LOSS (NET) RS. NIL + BROKERAGE & COMMISSION RS. NIL + OTHERS RS. NIL + MISCELLENOUS RS. NIL

(I) OPERATING AND ADMINISTRATION EXPENSES RS. 105.77 MILLION + MARKETING, DISTRIBUTION AND

PROMOTION EXPENSES RS. 126.02 MILLION

(J) OPERATING AND ADMINISTRATION EXPENSES RS. 2.31 MILLION + MARKETING, DISTRIBUTION AND PROMOTION

EXPENSES RS. NIL

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Textual information (1)

Disclosure of notes on other income explanatory [Text Block]

17.

Other income

In Rs. million

Year ended

March 31, 2014

March 31, 2013

0.85

0.85

Interest income on

-Bank deposits

Textual information (2)

Disclosure of notes on finance cost explanatory [Text Block]

23.

Finance costs

Year ended

March 31, 2014

March 31, 2013

2.57

2.57

Interest on:

-InterCompany Loans*

* Interest on Loan from NDTV Lifestyle Holdings Limited amounting to Rs 75,000,000.

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

[300600] Notes - Additional information statement of profit and loss

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

28/02/2013

to

31/03/2013

Textual information

[See below]

Additional information on profit and loss account explanatory [TextBlock]

Changes in inventories of stock-in-trade

(3)

(A) -4.54

Total changes in inventories of finished goods, work-in-progress and

stock-in-trade

-4.54

Total gross income from services rendered

(B) 6.34

Expenditure on other matters

(C) 5.21

5.21

0

36.98

36.98

36.98

18.83

18.83

36.98

36.98

55.81

6.34

Total expenditure in foreign currency

Total amount of dividend remitted in foreign currency

FOB value of traded goods exported

Total earnings on export of goods calculated on FOB basis

Total earnings in foreign currency

Domestic sale traded goods

Total domestic turnover goods, gross

Export sale traded goods

Total export turnover goods, gross

Total revenue from sale of products

Total revenue from sale of services

Footnotes

(A) STOCK AT THE BEGNNING OF THE YEAR RS. NIL (-) STOCK AT THE END OF THE YEAR RS. 4.54 MILLION

(B) SALE OF SERVICES RS. 3.28 MILLION + SHARED SERVICE INCOME RS. 3.06 MILLION

(C) HOSTING EXPENSES RS. 4.01 MILLION + OTHER EXPENSES RS. 1.20 MILLION

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Textual information (3)

Additional information on profit and loss account explanatory [Text Block]

18.

Changes in inventory of finished goods

In Rs. million

Year ended

March 31, 2014

Stock at the beginning of the year

Less: stock at the end of the year

4.54

(4.54)

20.

Operations & Administration Expenses

March 31, 2013

In Rs. million

Year ended

March 31, 2014

March 31, 2013

Rent (refer note 26)

7.99

Rates and taxes

0.41

0.13

Electricity and water

0.98

Printing and stationery

0.46

Postage and courier

0.66

Books, periodicals and news papers

0.44

Local conveyance , travelling & taxi hire

8.10

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Business promotion

0.27

- Plant & Machinery

0.74

- Building

4.36

Auditors' remuneration*

0.52

0.20

Insurance

0.74

Hosting & streaming

6.07

Hire Charges

0.08

Communication

2.89

Vehicle

1.39

Medical

0.20

Software expense

10.39

Generator hire and running

0.23

Personnel Security

1.14

Staff Training

0.09

Legal, professional & consultancy

51.21

1.98

Foreign Exchange loss - Net

0.11

Brokerage & commission

0.20

Others

0.27

Bank charges

2.89

Miscellaneous

2.94

Repair and Maintenance

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

105.77

* Auditors' Remuneration

2.31

In Rs. million

Year ended

March 31, 2014

March 31, 2013

0.50

0.20

0.02

0.52

0.20

As auditor:

Audit fee

Reimbursement of expenses

Out of pocket expenses

21.

Marketing, distribution & promotion expense

In Rs. million

Year ended

March 31, 2014

Advertisement expense

78.92

Marketing expenses

42.44

Shipping expense

4.66

126.02

9

March 31, 2013

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

[200800] Notes - Disclosure of accounting policies, changes in accounting policies and estimates

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

Disclosure of accounting policies, change in accounting policies and

changes in estimates explanatory [TextBlock]

Textual

information

[See below]

10

(4)

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Textual information (4)

Disclosure of accounting policies, change in accounting policies and changes in estimates explanatory [Text Block]

1.

Corporate information

The Company was incorporated on February 28, 2013 as NDTV E-Commerce Private Limited and consequent to shareholders resolution dated

March 18, 2013, the name of the Company was changed to NDTV Ethnic Retail Private Limited w.e.f. March 30, 2013 on receipt of approval

from the Registrar of Companies, NCT of Delhi & Haryana. Further, the shareholders have approved, vide their resolution dated April 16, 2013

to convert the status of the Company from ?Private Limited? to ?Public Limited? w.e.f. April 16, 2013. the name of the Company was changed to

NDTV Ethnic Retail Limited w.e.f. July 25, 2013. The Company operates e commerce business of sale of various products on the platform

www.indianroots.com. The company started fulfilling exclusively to the customer outside India starting March 6, 2014 to comply with FDI

guidelines.

2.

2.1

Summary of significant accounting policies

Basis of preparation

These financial statements have been prepared in accordance with the generally accepted accounting principles in India under the historical cost

convention on accrual basis. Pursuant to circular 15/2013 dated 13.09.2013 read with circular 08/2014 dated 04.04.2014, till the Standards of

Accounting or any addendum thereto are prescribed by Central Government in consultation and recommendation of the National Financial

Reporting Authority, the existing Accounting Standards notified under the Companies Act, 1956 shall continue to apply. Consequently, these

financial statements have been prepared to comply in all material aspects with the accounting standards notified under Section 211(3C)

[Companies (Accounting Standards) Rules, 2006, as amended] and other relevant provisions of the Companies Act, 1956.

All assets and liabilities have been classified as current or non-current as per the Company?s normal operating cycle and other criteria set out in

the Schedule VI to the Companies Act, 1956. Based on the nature of services and the time between rendering of services/airing of programmes

and their realisation in cash and cash equivalents, the Company has ascertained its operating cycle as 12 months for the purpose of current ? non

current classification of assets and liabilities.

2.2

Use of estimates

In the preparation of the financial statements, the management of the Company makes estimates and assumptions in conformity with the

applicable accounting principles in India that affect the reported balances of assets and liabilities and disclosures relating to contingent assets and

liabilities as at the date of the financial statements and reported amounts of income and expenses during the period. Examples of such estimates

include provisions for doubtful debts, future obligations under employee retirement benefit plans, income taxes, and the useful lives of fixed

assets and intangible assets.

A provision is recognised when there is a present obligation as a result of a past event in respect of which it is probable that outflow of resources

will be required to settle the obligation and in respect of which a reliable estimate can be made

Contingencies are disclosed when it is possible that a liability will be incurred, and the amount can be reasonably estimated. Where no reliable

estimate can be made, a disclosure is made of the existence of the contingent liability.

2.3

Tangible assets

Tangible assets, except in the cases mentioned below, are stated at the cost of acquisition, which includes taxes, duties, freight, insurance and

other incidental expenses incurred for bringing the assets to the working condition required for their intended use, less depreciation and

impairment.

Fixed assets purchased under barter arrangements are stated at the fair market value as at the date of purchase.

Depreciation on tangible assets is provided using the Straight Line Method based on the useful lives as estimated by the management.

11

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Depreciation is charged on a pro-rata basis for assets purchased/sold during the year. Individual assets costing less than Rs. 5,000 are depreciated

at the rate of 100% on a pro-rata basis. The management?s estimates of useful lives for various fixed assets are given below:

Asset Head

Useful Life (years)

Plant and Machinery

5-12

Computers

3-6

Office Equipment

3-5

Furniture and Fixtures

5-8

Vehicles

2.4

Intangible assets

Intangible assets are recognised if they are separately identifiable and the Company controls the future economic benefits arising out of them. All

other expenses on intangible items are charged to the Statement of Profit and Loss account. Intangible assets are stated at cost less accumulated

amortization and impairment.

Depreciation on intangible assets is provided using the Straight Line Method based on the useful lives as estimated by the management.

Depreciation is charged on a pro-rata basis for assets purchased/sold during the year. Individual assets costing less than Rs. 5,000 are depreciated

at the rate of 100% on a pro-rata basis. The management?s estimates of useful lives for intangible assets are given below:

Asset Head

Useful Life (years)

Computer Software

2.5

Leases

As a lessee :

Assets taken under leases, where the Company assumes substantially all the risks and rewards of ownership are classified as Finance leases. Such

assets are capitalised at the inception of the lease at the lower of fair value or the present value of minimum lease payments and a liability is

created for an equivalent amount. Each lease rental paid is allocated between the liability and the interest cost, so as to obtain a constant periodic

rate of interest on outstanding liability for each period.

Assets taken on leases where significant risks and rewards of ownership are retained by the lessor are classified as operating leases. Lease rentals

are charged to the Profit and Loss Account on a straight line basis over the lease term.

2.6

Impairment of tangible and intangible assets

12

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

The management periodically assesses using external and internal sources, whether there is an indication that an asset may be impaired.

Impairment occurs where the carrying value exceeds the present value of future cash flows expected to arise from the continuing use of the asset

and its eventual disposal. The impairment loss to be expensed is determined as the excess of the carrying amount over the higher of the asset?s net

sales price or present value as determined above.

2.7

Revenue Recognition

Revenue from online sale of goods are recognised when the goods has been delivered and all the risk and rewards of ownership has been

transferred to the buyer.

Revenue for services provided is recognized when persuasive evidence of an arrangement exists; the consideration is fixed or determinable; and

it is reasonable to expect ultimate collection. Such revenues are recognised as the services are provided.

2.8

Investments

Investments that are readily realisable and are intended to be held for not more than one year from the date, on which such investments are made,

are classified as current investments. All other investments are classified as long term investments. Current investments are carried at cost or fair

value, whichever is lower. Long-term investments are carried at cost. However, provision for diminution is made to recognise a decline, other

than tempprary, in the value of the investments, such reduction being determined and made for each investment individually.

2.9

Foreign currency transaction

Transactions in foreign currency are recorded at the rates of exchange in force at the time the transactions are effected. All monetary assets and

liabilities denominated in foreign currency are restated at the year-end exchange rate. All non-monetary assets and liabilities are stated at the rates

prevailing on the date of the transaction.

Gains / (losses) arising out of fluctuations in the exchange rates are recognized as income/expense in the period in which they arise.

2.10

Employee benefits

Short-term employee benefits are recognized as expenses at the undiscounted amounts in the Statement of Profit and Loss account of the year in

which the related service is rendered.

Post employment and other long term employee benefits: The Company?s contribution to State Provident fund is charged to the Statement of

Profit and Loss account. The Company provides for a long term defined benefit scheme of Gratuity on the basis of actuarial valuation on the

balance sheet date based on the projected unit credit method. The actuarial valuation of the liability towards the retirement gratuity benefits of the

employees is made on the basis of assumptions with respect of the variable elements like discount rate, future salary increases, etc affecting the

valuation. The Company recognizes the actuarial gains and losses in the Statement of Profit and Loss account as income and expense in the period

in which they occur.

2.11 Inventories

Stock in trade

Inventories related to stock in trade are stated at the lower of cost or net realisable value. Cost is deteremined using the first in, first out method.

The cost of furnished goods comprises appreals and dresses, Net realisable value is estimated selling price in the ordinary course of business use

the estimated cost to make the sale.

13

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

2.12 Earnings Per Share ( EPS )

Basic EPS

The earnings considered in ascertaining the Company?s basic EPS comprise the net profit/ (loss) after tax. The number of shares used in

computing basic EPS is the weighted average number of shares outstanding during the year.

Diluted EPS

The net profit/ (loss) after tax and the weighted average number of shares outstanding during the year are adjusted for all the effects of

dilutive potential equity shares for calculating the diluted EPS

2.13

Taxes on Income

Tax on income for the period is determined on the basis of taxable income and tax credits computed in accordance with the provisions of the

Income Tax Act, 1961.

Deferred tax is recognised on timing differences between the accounting income and the taxable income for the year and quantified using the tax

rates and laws substantially enacted as on the balance sheet date.

Deferred tax assets in respect of unabsorbed depreciation / brought forward losses are recognised to the extent there is virtual certainty that

sufficient future taxable income will be available against which such deferred tax assets can be realised.

Other deferred tax assets are recognised and carried forward to the extent that there is reasonable certainty that sufficient future taxable income

will be available against which such deferred tax assets can be realised.

2.14

Cash and Cash Equivalents

In the cash flow statement, cash and cash equivalents includes cash in hand, demand deposits with bank, other short-term highly liquid

investments with original maturities of three months or less.

2.15

Segment Reporting

The accounting policies adopted for segment reporting are in conformity with the accounting policies adopted for the Company. Further,

inter-segment revenue have been accounted for based on the transaction price agreed to between segments which is primarily market based.

Revenue and expenses, which relate to the Company as a whole and are not allocable to segments on a reasonable basis, have been included under

"Unallocated corporate expenses".

14

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

[300100] Notes - Revenue

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

Textual

[See below]

Textual

[See below]

Disclosure of revenue explanatory [TextBlock]

Description of accounting policy for recognition of revenue

information

(5)

information

(6)

Textual information (5)

Disclosure of revenue explanatory [Text Block]

16.

Revenue from operations

In Rs. million

Year ended

March 31, 2014

March 31, 2013

Sale of goods

55.81

Sale of services

3.28

Shared service income

3.06

62.15

Revenue from operations

15

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Textual information (6)

Description of accounting policy for recognition of revenue

2.7

Revenue Recognition

Revenue from online sale of goods are recognised when the goods has been delivered and all the risk and rewards of ownership has been

transferred to the buyer.

Revenue for services provided is recognized when persuasive evidence of an arrangement exists; the consideration is fixed or determinable;

and it is reasonable to expect ultimate collection. Such revenues are recognised as the services are provided.

[202200] Notes - Effects of changes in foreign exchange rates

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

Disclosure of notes on effect of changes in foreign exchange rates

explanatory [TextBlock]

Textual

information

[See below]

16

(7)

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Textual information (7)

Disclosure of notes on effect of changes in foreign exchange rates explanatory [Text Block]

2.9

Foreign currency transaction

Transactions in foreign currency are recorded at the rates of exchange in force at the time the transactions are effected. All monetary assets and

liabilities denominated in foreign currency are restated at the year-end exchange rate. All non-monetary assets and liabilities are stated at the rates

prevailing on the date of the transaction.

Gains / (losses) arising out of fluctuations in the exchange rates are recognized as income/expense in the period in which they arise.

30.

Expenditure in foreign currency (accrual basis)

In Rs. million

Year ended

March 31, 2014

March 31, 2013

Hosting Expenses

4.01

Other expenses

1.20

5.21

31.

Earnings in foreign currency (accrual basis)

In Rs. million

Year ended

Sale of goods

March 31, 2014

March 31, 2013

36.98

Total

33.

36.98

Unhedged foreign currency exposure

The foreign currency exposures that are not hedged by a derivative instrument or otherwise are as follows:

17

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

(in Rs million)

Particulars

Year ended

March 31, 2014

March 31, 2013

Amount in Foreign Currency in million

INR Equivalent

Amount in Foreign Currency in million

INR Equivalent

USD

0.05

3.25

Grand Total

0.05

3.25

USD

0.03

2.09

Grand Total

0.03

2.09

Receivables

Payables

[201200] Notes - Employee benefits

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

Textual

[See below]

Disclosure of employee benefits explanatory [TextBlock]

18

information

(8)

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Textual information (8)

Disclosure of employee benefits explanatory [Text Block]

2.10

Employee benefits

Short-term employee benefits are recognized as expenses at the undiscounted amounts in the Statement of Profit and Loss account of the year in

which the related service is rendered.

Post employment and other long term employee benefits: The Companys contribution to State Provident fund is charged to the Statement of Profit

and Loss account. The Company provides for a long term defined benefit scheme of Gratuity on the basis of actuarial valuation on the balance

sheet date based on the projected unit credit method. The actuarial valuation of the liability towards the retirement gratuity benefits of the

employees is made on the basis of assumptions with respect of the variable elements like discount rate, future salary increases, etc affecting the

valuation. The Company recognizes the actuarial gains and losses in the Statement of Profit and Loss account as income and expense in the period

in which they occur.

19.

Employee benefits expense

In Rs. million

Year ended

March 31, 2014

March 31, 2013

Salaries, wages and other benefits

39.70

Contribution to provident and other Funds

2.08

Staff welfare

0.58

42.36

25.

Gratuity and other post-employment benefit plans

The Company provides for long term defined benefit schemes of gratuity on the basis of an actuarial valuation on the Balance Sheet date based on

the Projected Unit Credit Method. The Company recognises the actuarial gains and losses in the Statement of Profit and Loss as income and

expense in the period in which they occur.

The reconciliation of opening and closing balances of the present value of the defined benefit obligations are as below:

In Rs.

million

For

the

Year

ended

Particulars

19

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

March March

31,

31,

2014 2013

Changes in the present value of the Obligation:

Obligations at year beginning

Service Cost Current

0.30

Service Cost Past

Interest Cost

Actuarial (gain) / loss

Benefit Paid

Obligations at year end

0.30

Present value of the defined benefit obligations at the end of the year

0.30

Fair value of the plan assets at the end of the year

Liability recognised in the Balance Sheet

0.30

Service Cost Current

0.30

Service Cost Past

Interest Cost

Expected return on plan assets

Actuarial (gain) / loss

Reconciliation of present value of the obligation and the fair value of

II

the plan assets:

Defined benefit obligations cost for the year

III

20

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Net defined benefit obligations cost

0.30

Investment details of plan assets

IV

100% of the plan assets are lying in the Gratuity fund administered through Life Insurance Corporation of India (LIC)

under its Group Gratuity Scheme.

The principal assumptions used in determining post-employment benefit obligations are shown below :

Discount Rate

9.30% 0.00%

Future salary increases

5%

Expected return on plan assets

0.00% 0.00%

0%

The estimates of future salary increases, considered in the actuarial valuation, take account of inflation, seniority,

promotion and other relevant factors such as supply and demand factors in the employment market. The demographic

assumptions were as per the published rates of "Life Insurance Corporation of India (1994-96) Mortality Table (ultimate),

which is considered a standard table.

[300300] Notes - Earnings per share

Unless otherwise specified, all monetary values are in Millions of INR

01/04/2013

to

31/03/2014

Textual information

[See below]

Disclosure of earnings per share explanatory [TextBlock]

Weighted average shares and adjusted weighted average shares [Abstract]

Basic weighted average shares

Diluted weighted average shares

Adjustments of numerator to calculate basic earnings per share [Abstract]

Profit (loss) for period

Adjustments of numerator to calculate diluted earnings per share [Abstract]

Profit (loss) for period

21

28/02/2013

to

31/03/2013

(9)

[shares] 61,774

[shares] 61,774

[shares] 1,699

[shares] 1,699

-246.52

-2.31

-246.52

-2.31

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Textual information (9)

Disclosure of earnings per share explanatory [Text Block]

2.12 Earnings Per Share ( EPS )

Basic EPS

The earnings considered in ascertaining the Company?s basic EPS comprise the net profit/ (loss) after tax. The number of shares used in

computing basic EPS is the weighted average number of shares outstanding during the year.

Diluted EPS

The net profit/ (loss) after tax and the weighted average number of shares outstanding during the year are adjusted for all the effects of

dilutive potential equity shares for calculating the diluted EPS

24.

Earnings per share (EPS)

The following reflects the profit and share data used in the basic and diluted EPS

computations:

In Rs. million ( except per share

data )

Year ended

March 31,

2014

March 31, 2013

Profit / (Loss) attributable to Equity Shareholders

(246.52)

(2.31)

Number of equity shares outstanding as at the beginning of the year (Nos)

60,000

10,000

Add: Fresh issue of equity shares (Nos)

24,910

50,000

Number of equity shares outstanding at year end (Nos)

84,910

60,000

Weighted average number of Equity Shares outstanding during the year for Basic EPS

(Nos.)

61,774

1,699

22

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Weighted average number of Equity Shares outstanding during the year for Diluted EPS

(Nos.)

61,774

1,699

Basic and Diluted Earnings per Equity Share (Rs.)

(3,990.69)

(1,356.98)

Nominal Value per share (Rs)

10

10

[300700] Notes - Director remuneration and other information

Disclosure of directors and remuneration to directors [Table]

..(1)

Unless otherwise specified, all monetary values are in Millions of INR

Directors [Axis]

01/04/2013

to

31/03/2014

01/04/2013

to

31/03/2014

01/04/2013

to

31/03/2014

01/04/2013

to

31/03/2014

Disclosure of directors and remuneration to directors

[Abstract]

Disclosure of directors and remuneration to directors

[LineItems]

VIKRAMADITYA

CHANDRA

01179738

07/01/1967

Director

Name of director

PRANNOY ROY

Director identification number of director

Date of birth of director

Designation of director

00025576

00025625

02729688

15/10/1949

09/07/1949

02/11/1973

Director

Director

Director

Dr. Roy has a

doctorate

in

Master in Economics

Economics from the

from

Delhi

Delhi School of

University.

He

Economics,

Completed

the

bachelors

in

Prestigious

Textual information

Textual information

Economics from the

Advanced

(10) [See below]

(11) [See below]

Queen

Mary

Management

College,

London

Programme at the

University and is a

Harvard Business

Qualified Chartered

School at United

Accountant

from

States.

London.

[shares] 0

[shares] 0

[shares] 6,024

[shares] 0

Qualification of director

Shares held by director

Director remuneration [Abstract]

Salary to director [Abstract]

Total salary to director

Total director remuneration

RADHIKA ROY

0

0

23

SHYATTO RAHA

0

0

0

0

0

0

NDTV ETHNIC RETAIL LIMITED Standalone Statement of Profit & Loss for period 01/04/2013 to 31/03/2014

Disclosure of directors and remuneration to directors [Table]

..(2)

Unless otherwise specified, all monetary values are in Millions of INR

Directors [Axis]

01/04/2013

to

31/03/2014

Disclosure of directors and remuneration to directors [Abstract]

Disclosure of directors and remuneration to directors [LineItems]

SAURAV

BANERJEE

06719699

20/08/1976

Director

Chartered

Accountant

[shares] 0

Name of director

Director identification number of director

Date of birth of director

Designation of director

Qualification of director

Shares held by director

Director remuneration [Abstract]

Salary to director [Abstract]

Total salary to director

Total director remuneration

0

0

Textual information (10)

Qualification of director

Mrs. Radhika Roy is an English (Honours) graduate from Delhi University and a qualified speech pathologist from Oldrey Fleming School in

London. She has also completed a course in television production from the TISCH School of Arts, New York University.

Textual information (11)

Qualification of director

Mr. Vikramaditya Chandra did his Bachelors in Economics from St. Stephen?s College in Delhi and went on to study at Oxford on an Inlaks

Scholarship. He honed his media skills at Stanford University where he did a course in Mass Media.

24

Das könnte Ihnen auch gefallen

- P&L AccountDokument13 SeitenP&L AccountRajneesh SehgalNoch keine Bewertungen

- PNL 2011Dokument7 SeitenPNL 2011Sneha KhuranaNoch keine Bewertungen

- VLCC Profit Loss 2012 PDFDokument45 SeitenVLCC Profit Loss 2012 PDFAnkit SinghalNoch keine Bewertungen

- ANNUAL REPORT 2012 - 2013: Balance Sheet As at 31St March, 2013Dokument2 SeitenANNUAL REPORT 2012 - 2013: Balance Sheet As at 31St March, 2013Sandeep SoniNoch keine Bewertungen

- Afm PDFDokument5 SeitenAfm PDFBhavani Singh RathoreNoch keine Bewertungen

- 2010 Ibm StatementsDokument6 Seiten2010 Ibm StatementsElsa MersiniNoch keine Bewertungen

- ITC Consolidated FinancialsStatement 2015 PDFDokument53 SeitenITC Consolidated FinancialsStatement 2015 PDFAbhishek DuttaNoch keine Bewertungen

- Aftab Automobiles Limited and Its SubsidiariesDokument4 SeitenAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNoch keine Bewertungen

- Profit and Loss StatementDokument1 SeiteProfit and Loss StatementClement TanNoch keine Bewertungen

- Financial Analysis of Islami Bank BangladeshDokument5 SeitenFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNoch keine Bewertungen

- 201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFDokument7 Seiten201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFOmer PashaNoch keine Bewertungen

- Myer AR10 Financial ReportDokument50 SeitenMyer AR10 Financial ReportMitchell HughesNoch keine Bewertungen

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Dokument30 SeitenWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNoch keine Bewertungen

- Balance Sheet With Ratios2Dokument1 SeiteBalance Sheet With Ratios2Anonymous AHW3sHNoch keine Bewertungen

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Dokument18 SeitenDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNoch keine Bewertungen

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDokument14 SeitenASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)Noch keine Bewertungen

- Profit&Loss May 2010Dokument2 SeitenProfit&Loss May 2010Andre KjNoch keine Bewertungen

- TCS Ifrs Q3 13 Usd PDFDokument23 SeitenTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNoch keine Bewertungen

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDokument8 SeitenJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNoch keine Bewertungen

- Fsa FinalDokument8 SeitenFsa Finalasifrahi143Noch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Cognizant 10qDokument53 SeitenCognizant 10qhaha_1234Noch keine Bewertungen

- P ('t':'3', 'I':'174619708') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Dokument1 SeiteP ('t':'3', 'I':'174619708') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Jannus PangaribuanNoch keine Bewertungen

- Financial StatementsDokument20 SeitenFinancial Statementswilsonkoh1989Noch keine Bewertungen

- CH 01 Review and Discussion Problems SolutionsDokument11 SeitenCH 01 Review and Discussion Problems SolutionsArman BeiramiNoch keine Bewertungen

- Ual Jun2011Dokument10 SeitenUal Jun2011asankajNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Statements For The Year Ended 31 December 2009Dokument64 SeitenFinancial Statements For The Year Ended 31 December 2009AyeshaJangdaNoch keine Bewertungen

- Nucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003Dokument1 SeiteNucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003nit111Noch keine Bewertungen

- Tute3 Reliance Financial StatementsDokument3 SeitenTute3 Reliance Financial Statementsvivek patelNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument11 SeitenStandalone Financial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Tut 4 - Reliance Financial StatementsDokument3 SeitenTut 4 - Reliance Financial StatementsJulia DanielNoch keine Bewertungen

- LGE 2010 4Q ConsolidationDokument89 SeitenLGE 2010 4Q ConsolidationSaba MasoodNoch keine Bewertungen

- Balance Sheet As at 31 March, 2011: ST STDokument14 SeitenBalance Sheet As at 31 March, 2011: ST STLambourghiniNoch keine Bewertungen

- ICBC Statement of OperationsDokument1 SeiteICBC Statement of OperationsProvinceNewspaperNoch keine Bewertungen

- Interim Condensed: Sanofi-Aventis Pakistan LimitedDokument13 SeitenInterim Condensed: Sanofi-Aventis Pakistan LimitedawaisleoNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Tax ReturnDokument7 SeitenTax Returnsyedfaisal_sNoch keine Bewertungen

- HUL Stand Alone StatementsDokument50 SeitenHUL Stand Alone StatementsdilipthosarNoch keine Bewertungen

- Lead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital RequirementsDokument13 SeitenLead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital Requirementsprateekm176123Noch keine Bewertungen

- Profit and Loss Account For The Year Ended 31 March, 2012Dokument6 SeitenProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNoch keine Bewertungen

- Akhtar Tax ReturnDokument7 SeitenAkhtar Tax Returnsyedfaisal_sNoch keine Bewertungen

- Bil Quarter 2 ResultsDokument2 SeitenBil Quarter 2 Resultspvenkatesh19779434Noch keine Bewertungen

- Adamjee InsuranceDokument80 SeitenAdamjee InsuranceMohsan SheikhNoch keine Bewertungen

- Fs Q2fy13crDokument4 SeitenFs Q2fy13crAisha HusaainNoch keine Bewertungen

- Interim Financial Result For 3rd Quarter Ended 31.01.2013Dokument23 SeitenInterim Financial Result For 3rd Quarter Ended 31.01.2013nickong53Noch keine Bewertungen

- Unaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009Dokument4 SeitenUnaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009James WarrenNoch keine Bewertungen

- Noida Toll Bridge Company Limited: Expenditure CycleDokument38 SeitenNoida Toll Bridge Company Limited: Expenditure CycleArpit ManglaNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Result)Dokument5 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- FordMotorCompany 10Q 20110805Dokument102 SeitenFordMotorCompany 10Q 20110805Lee LoganNoch keine Bewertungen

- CSG 10Q Sep 10Dokument226 SeitenCSG 10Q Sep 10Shubham BhatiaNoch keine Bewertungen

- Consolidated Balance Sheet: Equity and LiabilitiesDokument49 SeitenConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNoch keine Bewertungen

- Acct Specimen 2010Dokument6 SeitenAcct Specimen 2010Abid AhmedNoch keine Bewertungen

- Citigroup Q4 2012 Financial SupplementDokument47 SeitenCitigroup Q4 2012 Financial SupplementalxcnqNoch keine Bewertungen

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Dokument18 SeitenSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNoch keine Bewertungen

- Invast Securities Q3 FinancialsDokument9 SeitenInvast Securities Q3 FinancialsRon FinbergNoch keine Bewertungen

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryVon EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawVon EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Om Swami 2014Dokument42 SeitenOm Swami 2014junkyNoch keine Bewertungen

- Absl Fy 2015Dokument20 SeitenAbsl Fy 2015junkyNoch keine Bewertungen

- Reckitt Benckiser (India) Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014Dokument112 SeitenReckitt Benckiser (India) Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014junkyNoch keine Bewertungen

- Greenply Industries LimitedDokument6 SeitenGreenply Industries LimitedjunkyNoch keine Bewertungen

- Payu Payments Private Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014Dokument74 SeitenPayu Payments Private Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014junkyNoch keine Bewertungen

- 515057Dokument233 Seiten515057junkyNoch keine Bewertungen

- Shibendu Lahiri ProgramDokument2 SeitenShibendu Lahiri ProgramjunkyNoch keine Bewertungen

- Message Nava Rat Ri 2015Dokument4 SeitenMessage Nava Rat Ri 2015junkyNoch keine Bewertungen

- Merisis - Consumer Newsletter - Q2 FY 2016Dokument11 SeitenMerisis - Consumer Newsletter - Q2 FY 2016Sathish GanesanNoch keine Bewertungen

- Nutrition Science by B Srilakshmi PDFDokument6 SeitenNutrition Science by B Srilakshmi PDFRohan Rewatkar46% (35)

- Contoh DVDokument5 SeitenContoh DVHiruma YoishiNoch keine Bewertungen

- Research Poster 1Dokument1 SeiteResearch Poster 1api-662489107Noch keine Bewertungen

- WLP Math Week 4 Q4Dokument4 SeitenWLP Math Week 4 Q4JUDELYN O. DOMINGONoch keine Bewertungen

- Amazon PrimeDokument27 SeitenAmazon PrimeMohamedNoch keine Bewertungen

- The Identification of Prisoners Act, 1920Dokument5 SeitenThe Identification of Prisoners Act, 1920Shahid HussainNoch keine Bewertungen

- Chenrezi Sadhana A4Dokument42 SeitenChenrezi Sadhana A4kamma100% (7)

- Frugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiDokument9 SeitenFrugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiGisselle RomeroNoch keine Bewertungen

- Alternate History of The WorldDokument2 SeitenAlternate History of The WorldCamille Ann Faigao FamisanNoch keine Bewertungen

- 00664-Hepting Excerpts of RecordDokument240 Seiten00664-Hepting Excerpts of RecordlegalmattersNoch keine Bewertungen

- GOUSGOUNIS Anastenaria & Transgression of The SacredDokument14 SeitenGOUSGOUNIS Anastenaria & Transgression of The Sacredmegasthenis1Noch keine Bewertungen

- Safety Management in Coromandel FertilizerDokument7 SeitenSafety Management in Coromandel FertilizerS Bharadwaj ReddyNoch keine Bewertungen

- 9 - Report & NarrativeDokument1 Seite9 - Report & NarrativeTri WahyuningsihNoch keine Bewertungen

- Grade12 Rigel Group4 Assesing The Solid Waste Management Off Small Foos Store in Gingoog CityDokument31 SeitenGrade12 Rigel Group4 Assesing The Solid Waste Management Off Small Foos Store in Gingoog CityMa. Joan ApolinarNoch keine Bewertungen

- Tour Preparations Well Under WayDokument1 SeiteTour Preparations Well Under WayjonathanrbeggsNoch keine Bewertungen

- Syllabus Spring 2021Dokument17 SeitenSyllabus Spring 2021Eden ParkNoch keine Bewertungen

- IGCSE-Revision-Booklet-Part-1-2018-2019 - (New-Spec)Dokument69 SeitenIGCSE-Revision-Booklet-Part-1-2018-2019 - (New-Spec)MaryamNoch keine Bewertungen

- Kenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Dokument8 SeitenKenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Scribd Government DocsNoch keine Bewertungen

- LTE Principle and LTE PlanningDokument70 SeitenLTE Principle and LTE PlanningShain SalimNoch keine Bewertungen

- Dbms QuoteDokument2 SeitenDbms QuoteAnonymous UZFenDTNMNoch keine Bewertungen

- BA Thesis Linguistics 4Dokument102 SeitenBA Thesis Linguistics 4volodymyrNoch keine Bewertungen

- A Descriptive-Comparative StudyDokument32 SeitenA Descriptive-Comparative StudyJanelle DionisioNoch keine Bewertungen

- Parts of The Guitar QuizDokument2 SeitenParts of The Guitar Quizapi-293063423100% (1)

- BY DR Muhammad Akram M.C.H.JeddahDokument32 SeitenBY DR Muhammad Akram M.C.H.JeddahMuhammad Akram Qaim KhaniNoch keine Bewertungen

- DIN EN 16842-1: in Case of Doubt, The German-Language Original Shall Be Considered AuthoritativeDokument23 SeitenDIN EN 16842-1: in Case of Doubt, The German-Language Original Shall Be Considered AuthoritativeanupthattaNoch keine Bewertungen

- Rule 108 Republic Vs TipayDokument1 SeiteRule 108 Republic Vs TipayShimi Fortuna100% (1)

- CV BTP AhokDokument2 SeitenCV BTP AhokDiah Purwati N.Noch keine Bewertungen

- Unit 25 Sound Recording Lab LacDokument16 SeitenUnit 25 Sound Recording Lab Lacapi-471521676Noch keine Bewertungen

- Handbook For Inspection of Ships and Issuance of Ship Sanitation CertificatesDokument150 SeitenHandbook For Inspection of Ships and Issuance of Ship Sanitation CertificatesManoj KumarNoch keine Bewertungen

- Paras Vs ComelecDokument2 SeitenParas Vs ComelecAngel VirayNoch keine Bewertungen