Beruflich Dokumente

Kultur Dokumente

Religare - India PharmaScope-errclub - Subdued Showing PDF

Hochgeladen von

Rajesh KatareOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Religare - India PharmaScope-errclub - Subdued Showing PDF

Hochgeladen von

Rajesh KatareCopyright:

Verfügbare Formate

Sector Update

INDIA

PHARMACEUTICALS

9 February 2016

India PharmaScope

Subdued showing

As per AIOCD AWACS, Indias pharmaceutical market grew at a subdued rate

of 9.1% YoY in Jan16 vs. 13.2% on average since Apr15 due to weak

volumes, partly offset by healthy price hikes and stable new launches.

Therapy-wise, the respiratory, anti-infective and anti-diabetes segments

posted healthy growth of 9-12%, while the cardiac and vitamin supplement

REPORT AUTHORS

segments have remained sluggish over the past three months. Among key

Praful Bohra

players, GNP, LPC, Cipla and DRRD continue to post robust growth, while

+91 22 6766 3463

praful.bohra@religare.com

SUNP, CDH and TRP remain laggards.

Aarti Rao

5

Jan-16

Dec-15

Oct-15

Nov-15

Sep-15

Jul-15

Aug-15

Jun-15

Apr-15

May-15

Jan-15

Feb-15

Mar-15

Source: AIOCD AWACS

Indian Companies growth YoY

(%)

25

20

15

10

5

Oct-15

Nov-15

Dec-15

Jan-16

Nov-15

Dec-15

Jan-16

Sep-15

Oct-15

Aug-15

Jul-15

Jun-15

Apr-15

Source: AIOCD AWACS

Top MNC's growth YoY

(%)

25

The NLEM list (Dec15) rolled out in Jan16 curtails the prices of 28 additional

drugs. This will lead to a minor loss of sales value in companies like Cipla,

Ranbaxy (SUNP), Zydus and GNP.

20

d) Abbott, Ranbaxy and Natco launched generic versions of Gileads Harvoni

(Sofosbuvir + Ledipasavir) under the brand names of Ledviclear, Sofab LP and

Hepcinat LP.

15

10

Sep-15

Aug-15

Jul-15

Jun-15

Jan-15

c)

10

May-15

b) GNPs revenue grew at a robust 16.3% mainly on the back of Teneligliptin sales

(generating Rs 50mn-60mn every month), followed by LPC, Cipla and DRRD at

13.4%, 11.6% and 10.3% respectively. TRP, SUNP and Zydus have been

underperformers for the last three months with weak sales growth of 7.4%,

5.9% and 3.8% in Jan16 respectively.

15

Apr-15

Jan16 has been a weak month for MNCs which grew at merely 1.5% YoY vs.

17.7% in Jan15, while domestic companies posted flattish growth at 11.4% YoY

(vs. 11% in Jan15). Under the non-NLEM category, Indian companies grew at

12.4% and MNCs at 1.1% (vs. 12.7% and 17.8% in Jan15).

20

May-15

a)

(%)

25

Jan-15

Other highlights:

IPM growth YoY (%)

Feb-15

Mar-15

Key segments outperform: The respiratory segment grew 17.8% YoY followed by

anti-infective and gastrointestinal segments at 11%+, and anti-diabetes segment at

9.4%, together contributing ~42% of the IPM. The cardiac and vitamin supplement

segments reported weak growth at 6-8% (200-300bps below IPM) accounting for

~21% market share. Anti-malarials dropped 20.1% vs. growth of +29% in Jan15.

+91 22 6766 3436

aarti.rao@religare.com

Feb-15

Mar-15

Muted sales: In Jan16, the Indian Pharmaceutical Market (IPM) posted muted

revenue growth of 9.1% YoY (vs. 12.7% in Jan15 & 13.2% on average since Apr15).

Domestic markets witnessed weak volume growth of 1.2% (vs. 4.4% in Jan15 and

5.4% on average over Apr15-Jan16), partially offset by price hikes of ~5.1%. The

revenue contribution from newer introductions remained in line with past trends at

2.8%. Both NLEM (National List of Essential Medicines)/non-NLEM portfolios posted

weak growth of 5.3%/9.8% YoY as against 6.9%/14% YoY in Jan15 and 6.8%/14.6%

on average from Apr15.

Source: AIOCD AWACS

This report has been prepared by Religare Capital Markets Limited or one of its affiliates. For analyst certification and other important disclosures, please refer to the Disclosure and Disclaimer section at the end of

this report. Analysts employed by non-US affiliates are not registered with FINRA regulation and may not be subject to FINRA/NYSE restrictions on communications with covered companies, public appearances, and

trading securities held by a research analyst account.

India PharmaScope

Sector Update

Subdued showing

PHARMACEUTICALS

INDIA

IPM snapshot: Jan16

Fig 1 - IPM growth Key drivers

Volumes GR

(%)

25

Price Increases

New launches

20.9

IPM growth YoY (%) (R)

(%)

24

21.8

21

18.9

20

3.2

17.2

3.3

18

14.8

3.2

15

12.7

3.2

5.6

11.0

5.6

10

3.1

5.2

12.0

10.1

13.0

3.1

3.1

4.8

4.8

5.5

9.9

8.6

4.8

2.9

4.7

6.5

4.4

5.2

6

5.1

1.2

4.0

2.3

9

2.8

5.0

5.2

5.0

3.0

12

9.1

2.8

2.7

13.2

4.9

8.8

15

11.9

3.4

5.2

3.2

12.9

1.0

Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16

Source: AIOCD AWACS

Fig 2 - IPM: Therapy-wise growth trend (Jan16)

Fig 3 - IPM: Therapy-wise market share (Jan16)

(%)

Anti-malarials

0.3%

17.8

11.9

11.7

9.4

7.3

8.1

5.9

10.6

Gynac

5%

9.0

Derma

6%

3.1

Antiinfectives

15%

Others

11%

Cardiac

13%

Neuro/ CNS

7%

Antimalarials

Gynac

Derma

Neuro/ CNS

Pain/

Analgesics

Anti-diabetic

Respiratory

Vitamins

+Minerals

Gastrointestinal

Cardiac

(20.1)

Antiinfectives

Pain/

Analgesics

7%

Anti-diabetic

8%

Gastrointestinal

11%

Vitamins

+Minerals

8%

Respiratory

9%

Source: AIOCD AWACS

Source: AIOCD AWACS

Fig 4 - Overall NLEM growth trend

Fig 5 - Overall non-NLEM growth trend

(%)

(%)

25

17.6

18.4

20

13.9

22.9

21.7

20.0

15.4

16.2

11.1

15

14.2 14.5

14.0

12.1

5.1

2.8

9.8

9.3

10

Jan-16

Dec-15

Nov-15

Oct-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Feb-15

0

Jan-15

Jan-16

Dec-15

Nov-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Feb-15

3.3

Source: AIOCD AWACS

5.3

4.8

Oct-15

5.6

Sep-15

5.3

12.7

10.9

7.5

6.9

Jan-15

20

18

16

14

12

10

8

6

4

2

0

Sep-15

20

15

10

5

0

(5)

(10)

(15)

(20)

(25)

Source: AIOCD AWACS

9 February 2016

Page 2 of 8

India PharmaScope

Sector Update

Subdued showing

PHARMACEUTICALS

INDIA

Fig 6 - Volume growth trends

NLEM

(%)

13.6

14.1

12.8

1.0

1.2

0.8

5.7

1.1

1.6

1.0

Source: AIOCD AWACS

Fig 8 - Growth reported by Domestic companies (Jan16)

Fig 9 - Growth reported by MNCs (Jan16)

Jan-16

Dec-15

Aug-15

(0.3)

Source: AIOCD AWACS

(%)

(%)

18

15

16.3

11.9

16

12

5.8

0

(1)

Jul-15

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

1.3 1.2

0.8

0.5

Mar-15

1.8

Nov-15

3.5 3.7

2.3

Oct-15

3.5

14

5.6

3.5

Jun-15

2.8 2.8

Feb-15

5.6

Sep-15

4.9 5.2

3.4

1.9

1.8 1.8

3.8

Jan-15

5.7

2.8

May-15

3.7

6.4

4.5

3.5

5.7

5.6

8.7

8.2

8

6

Non-NLEM

6.3

6.0

Apr-15

10.0

6.2

Mar-15

9.8

NLEM

6.2

5.8

11.6

12

10

Feb-15

14

(%)

Non-NLEM

14.5

Jan-15

16

Fig 7 - Pricing growth trends

13.4

10

11.6

6.1

10.3

10

7.4

3.6

5.9

3.8

4

2

(5)

(3.4)

0

Cipla

Dr.

Reddys

Glenmark

Lupin

Sun

Pharma

Torrent

Pharma

Zydus

Cadila

(7.3)

(10)

Abbott HC

Glaxo

Merck

Pfizer

Source: AIOCD AWACS

Source: AIOCD AWACS

Fig 10 - Market share of top Indian companies (Jan16)

Fig 11 - Market share of top MNCs (Jan16)

(%)

7

9.1

6.1

6

5

5.2

3.5

0.6

Merck

Astrazeneca

Sanofi India

Cadila

0.6

Pfizer

2.3

Torrent

Dr.

Reddys

Glenmark

Lupin

Zydus +

Biochem

2.9

2.3

Macleods

2.3

0.7

Cipla

3.0

Glaxo

2.5

Source: AIOCD AWACS

3.2

Abbott +

Abbott HC +

Novo

4.1

Sun +

Ranbaxy

(%)

10

9

8

7

6

5

4

3

2

1

0

Sanofi India

Source: AIOCD AWACS

9 February 2016

Page 3 of 8

India PharmaScope

Sector Update

Subdued showing

PHARMACEUTICALS

INDIA

Sales growth dips marginally in Jan16 (incl. bonus units)

Fig 13 - DRRD sales growth trend

(%)

30

25.1

24.0 24.9

24.1

21.0

15

16.1

14.9

15.8

10.3

15.4

10

12.6

7.5

Source: AIOCD AWACS

Source: AIOCD AWACS

Fig 14 - GNP sales growth trend

Fig 15 - TRP sales growth trend

(%)

35

30.8

28.7

30.5

25

20

21.7

15

16.0

5.3

Fig 17 - LPC sales growth trend

(%)

35

25

Oct-15

32.4

30

Anti-Diabetic

16%

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Feb-15

Jan-15

Mar-15

Fig 16 - LPC therapy breakup (FY15)

Gynac

4%

7.4

3.7

Source: AIOCD AWACS

CVS

22%

25.1

22.2

21.2

23.2

20

Anti-TB

8%

Dec-15

18.3

10

Source: AIOCD AWACS

Others

13%

19.8

27.0

25.0

Oct-15

28.3

30

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Feb-15

Jan-15

(%)

50

43.6

45

40

34.5

33.3

30.9

30.1

35

28.0

30

25

18.6

28.9

28.1

16.3

20

15 21.3

10

13.1

11.5

5

0

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Feb-15

Jan-16

Dec-15

Nov-15

Oct-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Sep-15

4.5

Sep-15

Sep-15

13.0

CNS

4%

14.0

19.0

12.4

Jan-15

10

11.6

11.5 11.0

Dec-15

15.4

21.0

20

16.7

16.6

15

24.8

Nov-15

20

25.8

25

Nov-15

25

Jan-16

(%)

30

Jan-16

Fig 12 - Cipla sales growth trend

15.0

12.4

15

13.4

10

Source: Annual report, RCML Research

5.0

0.6

3.4

7.5

3.0

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Anti-Infectives

14%

Feb-15

Anti-Asthma

11%

Jan-15

GI

8%

Source: AIOCD AWACS

9 February 2016

Page 4 of 8

India PharmaScope

Sector Update

Subdued showing

PHARMACEUTICALS

INDIA

Opthal

3%

32.9

26.7

30

22.7

25

Gynac

4%

Vitamins +

Minerals +

Nutrients

5%

Cardiology

17%

20.0

20

15

15.8

15.0 16.0

23.2

13.5

17.5

7.6

10

Source: AIOCD AWACS

Fig 20 - CDH therapy breakup (FY15)

Fig 21 - CDH sales growth trend

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Source: Annual report, RCML Research

Nov-15

6.2

Mar-15

Anti-Infective

12%

Gastroenterology

11%

Feb-15

Diabetology

8%

5.9

Jan-15

Pain /

Analgesics

7%

(%)

35

NeuroPsychiatry

18%

Others

7%

Jan-16

Respiratory

4%

Derma

4%

Fig 19 - SUNP sales growth trend

Dec-15

Fig 18 - SUNP therapy breakup (FY15)

(%)

Neutraceuticals

5%

Derma

7%

Pain Mgt

7%

CVS

18%

22.5

25

Anti-Infective

15%

20

12.9

15

9.2

10

7.4

7.6

10.6

8.1

7.2

8.5

6.8

4.8

Source: Annual report, RCML Research

Dec-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

May-15

Apr-15

Mar-15

Nov-15

4.0

Feb-15

GI

14%

3.8

Jan-15

Neurologicals

2%

Female HC

8%

Jan-16

Biologicals

4%

Respiratory

12%

Others

8%

Source: AIOCD AWACS

9 February 2016

Page 5 of 8

RESEARCH TEAM

ANALYST

SECTOR

TELEPHONE

Mihir Jhaveri

Auto, Auto Ancillaries, Cement, Logistics

mihir.jhaveri@religare.com

+91 22 6766 3459

Siddharth Vora

Auto, Auto Ancillaries, Cement, Logistics

siddharth.vora@religare.com

+91 22 6766 3435

Misal Singh

Capital Goods, Infrastructure, Utilities

misal.singh@religare.com

+91 22 6766 3466

Prashant Tiwari

Capital Goods, Infrastructure, Utilities

prashant.tiwari@religare.com

+91 22 6766 3485

Premal Kamdar

Consumer

premal.kamdar@religare.com

+91 22 6766 3469

Rohit Ahuja

Energy

ahuja.rohit@religare.com

+91 22 6766 3437

Parag Jariwala, CFA

Financials

parag.jariwala@religare.com

+91 22 6766 3442

Vikesh Mehta

Financials

vikesh.mehta@religare.com

+91 22 6766 3474

Rumit Dugar

IT, Telecom, Media

rumit.dugar@religare.com

+91 22 6766 3444

Saumya Shrivastava

IT, Telecom, Media

saumya.shrivastava@religare.com

+91 22 6766 3445

Pritesh Jani

Metals

pritesh.jani@religare.com

+91 22 6766 3467

Arun Baid

Mid-caps

arun.baid@religare.com

+91 22 6766 3446

Praful Bohra

Pharmaceuticals

praful.bohra@religare.com

+91 22 6766 3463

Aarti Rao

Pharmaceuticals

aarti.rao@religare.com

+91 22 6766 3436

Arun Aggarwal

Real Estate

arun.aggarwal@religare.com

+91 22 6766 3440

Jay Shankar

Economics & Strategy

shankar.jay@religare.com

+91 11 3912 5109

Rahul Agrawal

Economics & Strategy

ag.rahul@religare.com

+91 22 6766 3433

9 February 2016

Page 6 of 8

RESEARCH DISCLAIMER

Important Disclosures

This report was prepared, approved, published and distributed by a Religare Capital Markets (RCM)

group company located outside of the United States (a non-US Group Company). This report is

distributed in the U.S. by Enclave Capital LLC (Enclave Capital), a U.S. registered broker dealer, on

behalf of RCM only to major U.S. institutional investors (as defined in Rule 15a-6 under the U.S.

Securities Exchange Act of 1934 (the Exchange Act)) pursuant to the exemption in Rule 15a-6 and

any transaction effected by a U.S. customer in the securities described in this report must be effected

through Enclave Capital. Neither the report nor any analyst who prepared or approved the report is

subject to U.S. legal requirements or the Financial Industry Regulatory Authority, Inc. (FINRA) or

other regulatory requirements pertaining to research reports or research analysts. No non-US Group

Company is registered as a broker-dealer under the Exchange Act or is a member of the Financial

Industry Regulatory Authority, Inc. or any other U.S. self-regulatory organization.

Information and opinions presented in this report were obtained or derived from sources that RCM

believes to be reliable, but RCM makes no representations or warranty, express or implied, as to their

accuracy or completeness or correctness. RCM accepts no liability for loss arising from the use of the

material presented in this report, except that this exclusion of liability does not apply to the extent that

liability arises under specific statutes or regulations applicable to RCM. This report is not to be relied

upon in substitution for the exercise of independent judgment. RCM may have issued, and may in the

future issue, a trading call regarding this security. Trading calls are short term trading opportunities

based on market events and catalysts, while stock ratings reflect investment recommendations based

on expected absolute return over a 12-month period as defined in the disclosure section. Because

trading calls and stock ratings reflect different assumptions and analytical methods, trading calls may

differ directionally from the stock rating.

Subject to any applicable laws and regulations at any given time, non-US Group Companies, their

affiliates or companies or individuals connected with RCM (together, Connected Companies) may

make investment decisions that are inconsistent with the recommendations or views expressed in this

report and may have long or short positions in, may from time to time purchase or sell (as principal or

agent) or have a material interest in any of the securities mentioned or related securities or may have

or have had a business or financial relationship with, or may provide or have provided investment

banking, capital markets and/or other services to, the entities referred to herein, their advisors and/or

any other connected parties. As a result, recipients of this report should be aware that Connected

Companies may have a conflict of interest that could affect the objectivity of this report.

Past performance should not be taken as an indication or guarantee of future performance, and no

representation or warranty, express or implied, is made regarding future performance. Information,

opinions and estimates contained in this report reflect a judgment of its original date of publication by

RCM and are subject to change without notice. The price, value of and income from any of the

securities or financial instruments mentioned in this report can fall as well as rise. The value of

securities and financial instruments is subject to exchange rate fluctuation that may have a positive or

adverse effect on the price or income of such securities or financial instruments. Investors in

securities such as ADRs, the values of which are influenced by currency volatility, effectively assume

this risk.

This report is only for distribution to investment professionals and institutional investors.

This report is distributed in India by Religare Capital Markets Limited, which is a registered

intermediary regulated by the Securities and Exchange Board of India. In Singapore, it is being

distributed (i) by Religare Capital Markets (Singapore) Pte. Limited (RCMS) (Co. Reg. No.

200902065N) which is a holder of a capital markets services licence and an exempt financial adviser

in Singapore and (ii) solely to persons who qualify as institutional investors or accredited investors

as defined in section 4A(1) of the Securities and Futures Act, Chapter 289 of Singapore (the SFA).

Pursuant to regulations 33, 34, 35 and 36 of the Financial Advisers Regulations (the FAR), sections

25, 27 and 36 of the Financial Advisers Act, Chapter 110 of Singapore shall not apply to RCMS when

providing any financial advisory service to an accredited investor, or overseas investor (as defined

in regulation 36 of the FAR). Persons in Singapore should contact RCMS in respect of any matters

arising from, or in connection with this publication/communication. In Hong Kong, it is being

distributed by Religare Capital Markets (Hong Kong) Limited (RCM HK), which is licensed and

regulated by the Securities and Futures Commission, Hong Kong. In Australia, it is being distributed

by RCMHK which is approved under ASIC Class Orders. In Sri Lanka, it is being distributed by

Bartleet Religare Securities, which is licensed under Securities and Exchange Commission of Sri

Lanka. If you wish to enter into a transaction please contact the RCM entity in your home jurisdiction

unless governing law provides otherwise. In jurisdictions where RCM is not registered or licensed to

trade in securities, transactions will only be effected in accordance with applicable securities

legislation which may vary from one jurisdiction to another and may require that the trade be made in

accordance with applicable exemptions from registration or licensing requirements.

Analyst Certification

Each of the analysts identified in this report certifies, with respect to the companies or securities that

the individual analyses, that (1) the views expressed in this report reflect his or her personal views

about all of the subject companies and securities and (2) no part of his or her compensation was, is

or will be directly or indirectly dependent on the specific recommendations or views expressed in this

report.

Analysts and strategists are paid in part by reference to the profitability of RCM.

Stock Ratings are defined as follows

Recommendation Interpretation (Recommendation structure changed with effect from March 1, 2009)

Recommendation

Buy

Hold

Sell

Expected absolute returns (%) over 12 months

More than 15%

Between 15% and 5%

Less than 5%

Expected absolute returns are based on the share price at market close unless otherwise stated.

Stock recommendations are based on absolute upside (downside) and have a 12-month horizon. Our

target price represents the fair value of the stock based upon the analysts discretion. We note that

future price fluctuations could lead to a temporary mismatch between upside/downside for a stock

and our recommendation.

Stock Ratings Distribution

As of 1 February 2016, out of 183 rated stocks in the RCM coverage universe, 109 have BUY ratings

(including 5 that have been investment banking clients in the last 12 months), 53 are rated HOLD and

21 are rated SELL.

Research Conflict Management Policy

RCM research has been published in accordance with our conflict management policy, which is

available here.

Disclaimers

This report is not directed to, or intended for distribution to or use by, any person or entity who is a

citizen or resident of or located in any locality, state, country or other jurisdiction where such

distribution, publication, availability or use would be contrary to law or regulation or which would

subject RCM to any registration or licensing requirement within such jurisdiction(s). This report is

strictly confidential and is being furnished to you solely for your information. All material presented in

this report, unless specifically indicated otherwise, is under copyright to RCM. None of the material,

its content, or any copy of such material or content, may be altered in any way, transmitted, copied or

reproduced (in whole or in part) or redistributed in any form to any other party, without the prior

express written permission of RCM. All trademarks, service marks and logos used in this report are

trademarks or service marks or registered trademarks or service marks of RCM or its affiliates, unless

specifically mentioned otherwise.

The information, tools and material presented in this report are provided to you for information

purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or

to buy or subscribe for securities or other financial instruments. RCM has not taken any steps to

ensure that the securities referred to in this report are suitable for any particular investor. RCM will

not treat recipients as its customers by virtue of their receiving the report. The investments or

services contained or referred to in this report may not be suitable for you and it is recommended that

you consult an independent investment advisor if you are in doubt about such investments or

investment services. In addition, nothing in this report constitutes investment, legal, accounting or tax

advice or a representation that any investment or strategy is suitable or appropriate to your individual

circumstances or otherwise constitutes a personal recommendation to you.

Religare Capital Markets does and seeks to do business with companies covered in our research

report. As a result, investors should be aware that the firm may have a conflict of interest that could

affect the objectivity of research produced by Religare Capital Markets. Investors should consider our

research as only a single factor in making their investment decision.

Any reference to a third party research material or any other report contained in this report represents

the respective research organization's estimates and views and does not represent the views of RCM

and RCM, its officers, employees do not accept any liability or responsibility whatsoever with respect

to its accuracy or correctness and RCM has included such reports or made reference to such reports

in good faith. This report may provide the addresses of, or contain hyperlinks to websites. Except to

the extent to which the report refers to material on RCMs own website, RCM takes no responsibility

whatsoever for the contents therein. Such addresses or hyperlinks (including addresses or hyperlinks

to RCMs own website material) is provided solely for your convenience and information and the

content of the linked site does not in any way form part of this report. Accessing such website or

following such link through this report or RCMs website shall be at your own risk.

Other Disclosures by Religare Capital Markets Limited under SEBI (Research Analysts)

Regulations, 2014 with reference to the subject companies(s) covered in this report:

Religare Capital Markets Limited (RCML) is engaged in the business of Institutional Stock Broking

and Investment Banking. RCML is a member of the National Stock Exchange of India Limited and

BSE Limited and is also a SEBI-registered Merchant Banker. RCML is a subsidiary of Religare

Enterprises Limited which has its various subsidiaries engaged in the businesses of commodity

broking, stock broking, lending, asset management, life insurance, health insurance, wealth

management, portfolio management, etc. RCML has set up subsidiaries in Singapore, Hong Kong

and Sri Lanka to render stock broking and investment banking services in respective jurisdictions.

RCMLs activities were neither suspended nor has it defaulted with any stock exchange authority with

whom it has been registered in the last five years. RCML has not been debarred from doing business

by any Stock Exchange / SEBI or any other authority. No disciplinary action has been taken by any

regulatory authority against RCML impacting its equity research analysis activities.

RCML or its research analyst or his/her relatives do not have any financial interest in the subject

company.

RCML or its research analyst or his/her relatives do not have actual/beneficial ownership of one per

cent or more securities in the subject company at the end of the month immediately preceding the

date of publication of this research report.

9 February 2016

Page 7 of 8

RESEARCH DISCLAIMER

Research analyst or his/her relatives do not have any material conflict of interest at the time of

publication of this report.

RCML may from time to time solicit or perform investment banking services for the company(ies)

mentioned in this report.

Research analyst has not received any compensation from the subject company in the past 12

months.

RCML or its associates may have material conflict of interest at the time of publication of this

research report.

RCML may have managed or co-managed a public offering of securities for the subject company in

the past 12 months.

RCMLs associates may have financial interest in the subject company. RCMLs associates may have

received compensation from the subject company in the past 12 months. RCMLs associates may

hold actual / beneficial ownership of one per cent or more securities in the subject company at the

end of the month immediately preceding the date of publication of this research report.

RCML may have received compensation from the subject company in the past 12 months.

Research analyst has not served as an officer, director or employee of the subject company.

RCML or its research analyst is not engaged in any market making activities for the subject company.

RCM has obtained registration as Research Entity under SEBI (Research Analysts) Regulations,

2014.

Digitally signed by RAO AARTI AMRUTH

Date: 2016.02.09 15:12:49 +05'30'

9 February 2016

Page 8 of 8

Das könnte Ihnen auch gefallen

- GX LSHC 2015 Health Care Outlook IndiaDokument4 SeitenGX LSHC 2015 Health Care Outlook IndiaRajesh KatareNoch keine Bewertungen

- Impact of Trips Agreement On Pharmaceutical Industry in IndiaDokument10 SeitenImpact of Trips Agreement On Pharmaceutical Industry in IndiaAparna KadianNoch keine Bewertungen

- W ParasDokument8 SeitenW ParasRajesh KatareNoch keine Bewertungen

- Axis Capital Screener 21aug15Dokument49 SeitenAxis Capital Screener 21aug15Rajesh KatareNoch keine Bewertungen

- Guidelines For Importation and Exportation of Pharmaceutical Products in TanzaniaDokument23 SeitenGuidelines For Importation and Exportation of Pharmaceutical Products in TanzaniaRajesh KatareNoch keine Bewertungen

- Emkay - Pharmaceuticals Sector Update - ERr Grp-Rupee-led Fears OverblownDokument3 SeitenEmkay - Pharmaceuticals Sector Update - ERr Grp-Rupee-led Fears Overblownisland7Noch keine Bewertungen

- Kesavanand Bharti Case Analysis PDFDokument20 SeitenKesavanand Bharti Case Analysis PDFRajesh KatareNoch keine Bewertungen

- Business of Healthcare, Wellness & Beauty Franchising Report Franchising in IndiaDokument2 SeitenBusiness of Healthcare, Wellness & Beauty Franchising Report Franchising in IndiaRajesh KatareNoch keine Bewertungen

- CTX Lifesciences Corporate Presentation1Dokument10 SeitenCTX Lifesciences Corporate Presentation1Rajesh KatareNoch keine Bewertungen

- Emkay - Pharmaceuticals Sector Update - ERr Grp-Rupee-led Fears OverblownDokument3 SeitenEmkay - Pharmaceuticals Sector Update - ERr Grp-Rupee-led Fears Overblownisland7Noch keine Bewertungen

- Panacea Biotec Crisil 071010 PDFDokument27 SeitenPanacea Biotec Crisil 071010 PDFRajesh KatareNoch keine Bewertungen

- DTTL LSHC 2014 Global Life Sciences Sector Report PDFDokument28 SeitenDTTL LSHC 2014 Global Life Sciences Sector Report PDFRajesh KatareNoch keine Bewertungen

- Pharmaceuticals-August 2015 PDFDokument55 SeitenPharmaceuticals-August 2015 PDFRajesh KatareNoch keine Bewertungen

- Guidelines For Importation and Exportation of Pharmaceutical Products in TanzaniaDokument23 SeitenGuidelines For Importation and Exportation of Pharmaceutical Products in TanzaniaRajesh KatareNoch keine Bewertungen

- DIS83TZN Medicines MhambaDokument25 SeitenDIS83TZN Medicines MhambaRajesh Katare100% (1)

- Wellness Report by PWCDokument64 SeitenWellness Report by PWCPranav Santurkar100% (1)

- Press Release Sun Pharma To Acquire Ranbaxy PDFDokument4 SeitenPress Release Sun Pharma To Acquire Ranbaxy PDFRajesh KatareNoch keine Bewertungen

- Actis Inreview 2014 PDFDokument21 SeitenActis Inreview 2014 PDFRajesh KatareNoch keine Bewertungen

- Sun - Pharma - Ranbaxy - Nishiyj Desai PDFDokument32 SeitenSun - Pharma - Ranbaxy - Nishiyj Desai PDFRajesh KatareNoch keine Bewertungen

- Interpretation of StatutesDokument33 SeitenInterpretation of StatutesChaitu Chaitu100% (4)

- Syllabus 15Dokument36 SeitenSyllabus 15Rajesh KatareNoch keine Bewertungen

- Healthcare Telemedicine and Medical Tourism in IndiaDokument19 SeitenHealthcare Telemedicine and Medical Tourism in IndiaRajesh KatareNoch keine Bewertungen

- Amp - 131223Dokument14 SeitenAmp - 131223Rajesh KatareNoch keine Bewertungen

- Axis Capital - Telecom-eRr Group - Upcoming Auction To Shape Competitive LandscapeDokument6 SeitenAxis Capital - Telecom-eRr Group - Upcoming Auction To Shape Competitive LandscapeRajesh KatareNoch keine Bewertungen

- NBIE - GMR Infrastructure-Company Update-13 December 2013Dokument4 SeitenNBIE - GMR Infrastructure-Company Update-13 December 2013Rajesh KatareNoch keine Bewertungen

- NBIE IIP October 2013 13 December 2013Dokument3 SeitenNBIE IIP October 2013 13 December 2013Rajesh KatareNoch keine Bewertungen

- Weekly Technical Report 161213Dokument9 SeitenWeekly Technical Report 161213Rajesh KatareNoch keine Bewertungen

- Weekly Technical Report 161213Dokument9 SeitenWeekly Technical Report 161213Rajesh KatareNoch keine Bewertungen

- JP Morgan - India PSU Banks-eRr Group - Basel 3 Capital Raising - A Challenge, Not A CrisisDokument8 SeitenJP Morgan - India PSU Banks-eRr Group - Basel 3 Capital Raising - A Challenge, Not A CrisisRajesh KatareNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hon Elly Karuhanga UMCP PDFDokument4 SeitenHon Elly Karuhanga UMCP PDFPeter BofinNoch keine Bewertungen

- Jurnal EmaDokument9 SeitenJurnal EmaZaraNoch keine Bewertungen

- VAluation On TATA Corus DealDokument32 SeitenVAluation On TATA Corus Dealromeel3079% (14)

- Portfolio Risk & ReturnDokument6 SeitenPortfolio Risk & ReturnMeet RiarNoch keine Bewertungen

- Chapter 7Dokument34 SeitenChapter 7MorerpNoch keine Bewertungen

- Dean Grazazios Student Secrets RevealedDGSS - BookDokument145 SeitenDean Grazazios Student Secrets RevealedDGSS - BookFrederico M'BakassyNoch keine Bewertungen

- Microfinance Growth in BangladeshDokument6 SeitenMicrofinance Growth in BangladeshFotoClippingNoch keine Bewertungen

- Introduction to Money Markets, Their Roles and Key ParticipantsDokument32 SeitenIntroduction to Money Markets, Their Roles and Key ParticipantsAaqib MunirNoch keine Bewertungen

- ZPAR Real Estate Business Plan Form 851f3aDokument23 SeitenZPAR Real Estate Business Plan Form 851f3aMilton Carmelo Montero SánchezNoch keine Bewertungen

- FIN621 Midterm Paper SolvedDokument11 SeitenFIN621 Midterm Paper Solvedcs619finalproject.comNoch keine Bewertungen

- Family Offices Investment PrioritiesDokument18 SeitenFamily Offices Investment PrioritiesJoel Warren100% (1)

- Chap004 IntermediateDokument82 SeitenChap004 IntermediateDeepika Sriraman AnandNoch keine Bewertungen

- Economic Order QuantityDokument6 SeitenEconomic Order QuantityJelay QuilatanNoch keine Bewertungen

- Risk & Return: BY: S.S. R. Krishna, Faculty (Finance) (Icfai)Dokument25 SeitenRisk & Return: BY: S.S. R. Krishna, Faculty (Finance) (Icfai)LEADERS CHOICENoch keine Bewertungen

- Depreciation MethodsDokument30 SeitenDepreciation MethodsJc UyNoch keine Bewertungen

- Creating A Winning Day Trading Plan by Jay WiremanDokument43 SeitenCreating A Winning Day Trading Plan by Jay WiremanlowtarhkNoch keine Bewertungen

- Annual Reports - A Tool For BusinessesDokument17 SeitenAnnual Reports - A Tool For BusinessesJomol JosyNoch keine Bewertungen

- Financial Mathematics 16A WD - Prepared by Mr. Ramesh RajasuriyaDokument4 SeitenFinancial Mathematics 16A WD - Prepared by Mr. Ramesh RajasuriyaMayon UbeysekaraNoch keine Bewertungen

- 1 QSG9 GF7 SLAj EADc XGbewidu SRPiwmj LTDokument1 Seite1 QSG9 GF7 SLAj EADc XGbewidu SRPiwmj LTANSHUL BHATIANoch keine Bewertungen

- Keyware Technologies - Arrowhead Report - 20 April 2017Dokument29 SeitenKeyware Technologies - Arrowhead Report - 20 April 2017Angus SadpetNoch keine Bewertungen

- 11 Candlestick Reversal Patterns Every Trader Should KnowDokument12 Seiten11 Candlestick Reversal Patterns Every Trader Should KnowNelson Alfonzo100% (3)

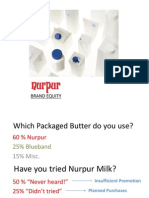

- Nurpur Brand EquityDokument19 SeitenNurpur Brand EquityBilal100% (2)

- 03 - The Reality of Trading - What Most Traders Will Never Find Out PDFDokument14 Seiten03 - The Reality of Trading - What Most Traders Will Never Find Out PDFextreme100% (1)

- CAIIB Revised Syllabus for Advanced Banking ExamsDokument14 SeitenCAIIB Revised Syllabus for Advanced Banking ExamsSaurav_Vishal_6361Noch keine Bewertungen

- Registration of A Representative OfficeDokument2 SeitenRegistration of A Representative OfficeGlory PerezNoch keine Bewertungen

- Watg ReportDokument15 SeitenWatg ReportRenata DoralievaNoch keine Bewertungen

- Future of ASEAN CommunityDokument18 SeitenFuture of ASEAN CommunitySiti Sarah Zalikha Binti Umar BakiNoch keine Bewertungen

- 209 THEME Yield ManagementDokument3 Seiten209 THEME Yield ManagementRavi ThakurNoch keine Bewertungen

- Dividends: Factors Affecting Dividend PolicyDokument7 SeitenDividends: Factors Affecting Dividend PolicyNouman MujahidNoch keine Bewertungen

- Accounting Standard (AS) 30 Financial Instruments: Recognition and MeasurementDokument22 SeitenAccounting Standard (AS) 30 Financial Instruments: Recognition and MeasurementkarthickvitNoch keine Bewertungen