Beruflich Dokumente

Kultur Dokumente

Mexico Standard and Supplemental Benefits Perks A General Guide1

Hochgeladen von

Av Raham B. AriasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mexico Standard and Supplemental Benefits Perks A General Guide1

Hochgeladen von

Av Raham B. AriasCopyright:

Verfügbare Formate

Mexico Standard and Supplemental Benefits & Perks: A General Guide

A. - Mandatory minimum benefits offered to Mexico full time based employees (regulated by

Mexican Labor Law):

INFONAVIT (Financial institution for government subsidized housing purchase for Mexican

employees). An amount is deducted from each paycheck and goes to an account administered

by a Bank of the employees choice as a form of savings to acquire a house through this

institutions housing program.

IMSS (Instituto Mexicano del Seguro Social, a social security government entity). An amount is

deducted from each paycheck and goes to an account administered by a Bank of the

employees choice as a form of saving for retirement, disability insurance and to receive minor

and major health care benefits subsidized by the Government.

AGUINALDO (Christmas Bonus) is a lump sum that is equal to 15 days salary that every

employer must provide to the employee on a yearly basis and paid during the first 20 days of

the month of December.

PAID VACATION DAYS. After the first year of employment, the employee receives a minimum

6 days paid vacation, the second year 8 days, third year 10 days, fourth year 12 days

VACATION PREMIUM. In addition to the paid vacation days, the employer must pay a premium

of 25% on top of the paid vacation days.

PAID HOLIDAYS, a total of 8 observed Mexican paid holidays.

PROFIT SHARING. If the company or entity reports a profit during the fiscal year, the employer

must share a percentage of these profits with all employees, except Directors. This according to

a complex formula regulated by the Government.

SENIORITY BONUS. A bonus must be paid to the employee after 15 years of seniority and for

every year employed. The employee has the right to receive 12 days of bonus.

SEVERANCE PAYMENT. This is a lump sum that every employer must provide to the severed

employee without cause. Law mandates a 3 months salary and an additional 20 days per

every year employed (Pro-rated) to every employee that has been let go.

B. Supplemental or Additional benefits (optional) offered in Mexico as a common practice for

Management and Professional level positions:

MAJOR MEDICAL INSURANCE is paid for by the employer and provided to the employee

through a group policy. Sometimes the employee is asked for a small contribution. Many

companies offer this to insure their direct family members (spouse and children), as well. At

times, the family coverage has a partial cost to the employee.

LIFE INSURANCE. This is a very common practice and only covers employee. Typically the

benefit is one years salary for management and professionals and up to three times salary for

senior management.

EDUCATION REIMBURSEMENT. Employers increasingly provide support for postgraduate

studies that are directly related to current responsibilities and nature of company activities.

Common practice ranges from a capped fixed amount up to a 100% reimbursement with

above average school grades.

SAVINGS FUND. This is an amount deducted from the employees paycheck that is matched by

the employer at 100% and returned to the employee at the end of the year (sometimes every 6

months) with additional annual interest which varies by company. This amount is capped by the

Federal Labor Law for tax exempt status and it cant be above $2,400.00 pesos/month.

2531 Windward Way Chula Vista, CA 91914 Tel: (619) 427-2310 Fax: (619) 427-2312 Email: barbachano@bipsearch.com

Web site: http://www.bipsearch.com OFFICE LOCATIONS: SAN DIEGO TIJUANA MEXICO CITY

FOOD COUPONS. This is a benefit that is typically provided as cash compensation

(sometimes in food stamps) mainly used for groceries and department stores and it is also

capped by the Mexican Labor Law for tax exempt status of up to $1,800.00 pesos/month.

ADDITIONAL AGUINALDO (CHRISTMAS BONUS). Most companies offer above the 15

mandatory days and can go up to 30, 45, and even 60 days salary. The average is typically 25

to 30 days salary.

COMPANY CAR (Vehiculo Utilitario). This is a common benefit offered to Sales executives and

increasingly to Senior Management and is considered as a basic working tool. Companies

sometimes provide a leased car to employees with the benefit of purchasing this same auto at

discounted blue book value after 3 or 4 years and receiving a newly leased car. In addition,

most of the companies cover all car expenses that include car insurance, maintenance,

registration fees, and license plates. In lieu of car benefit, a car allowance is also customary.

GAS ALLOWANCE. In lieu of a cash gas allowance or gas expense reimbursement, some

companies provide a plastic credit card (type of a device) so the employee can use it exclusively

in registered gas stations. The employer makes the deposit when the monthly amount has been

used. For sales professionals, it can range from $2,500 pesos to $10,000 pesos depending on

the mileage used to visit clients. For non-sales employees, senior management may receive

this benefit, typically ranges between $2,500 to $4,000 pesos per month.

STOCKS can be provided by publicly traded companies (domestic and international) as grants,

stock options, preferred stock, restricted stock or an employee stock discount purchase plan.

Typically reserved for senior management.

HOUSING ALLOWANCE is provided on a monthly basis typically only to some employees that

are moved from one city to another for employment reasons. This varies from company to

company and level of employees position. For existing employees, this could be for longer

periods, for new employees that are relocated this could be on a temporary basis, typically 1 to

3 months.

CELL AND LAPTOP. This is the most common practice when it is considered a basic working

tool for Sales executives, management, and professionals. Most of the companies cover the

monthly cell phone expenses and increasingly wireless or DSL internet service for certain

management positions.

For Executive Senior Management: Other supplemental benefits occasionally offered include

Country Club membership including monthly quotas, Children school tuition for private schools, up

to two company cars (very seldom), and travel expenses to and from country of origin on a monthly

or quarterly basis.

BENEFIT GUIDE FOR MEXICO

The Mexico benefit information provided is only a general guideline. Determining competitive benefits for your

company in Mexico is a task that requires benchmarking industry sector and may be affected by many factors

including company size, location, target workforce, educational requirements, salary ranges, etc. If you require

additional specific information or you wish to talk to a consultant, please call Barbachano International at (619)

427-2310.

2531 Windward Way Chula Vista, CA 91914 Tel: (619) 427-2310 Fax: (619) 427-2312 Email: barbachano@bipsearch.com

Web site: http://www.bipsearch.com OFFICE LOCATIONS: SAN DIEGO TIJUANA MEXICO CITY

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- New Testament Greek To Hebrew DictionaryDokument131 SeitenNew Testament Greek To Hebrew DictionaryJay Cracklyn100% (4)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Business Case ROI Workbook For IT Initiatives: On This WorksheetDokument33 SeitenBusiness Case ROI Workbook For IT Initiatives: On This WorksheetMrMaui100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Your Life Your LegacyDokument23 SeitenYour Life Your LegacyMightyOakNoch keine Bewertungen

- Branding For Impact by Leke Alder PDFDokument22 SeitenBranding For Impact by Leke Alder PDFNeroNoch keine Bewertungen

- Action Plan To Control The BreakagesDokument1 SeiteAction Plan To Control The BreakagesAyan Mitra75% (4)

- IC August 2014Dokument68 SeitenIC August 2014sabah8800Noch keine Bewertungen

- Customer Service ESL WorksheetDokument4 SeitenCustomer Service ESL WorksheetPatricia Maia50% (2)

- CRM in Axis BankDokument92 SeitenCRM in Axis BankKartik RateriaNoch keine Bewertungen

- Cookbook 2 ADokument68 SeitenCookbook 2 AAv Raham B. AriasNoch keine Bewertungen

- Bukovina: Food and Food StoriesDokument30 SeitenBukovina: Food and Food StoriesAv Raham B. AriasNoch keine Bewertungen

- Asus p5lp Le Manual enDokument26 SeitenAsus p5lp Le Manual ensamruggerNoch keine Bewertungen

- Cold Chain Ebook Vaisala PDFDokument14 SeitenCold Chain Ebook Vaisala PDFFaisal AbbasNoch keine Bewertungen

- 2016 Mexico Salary GuideDokument3 Seiten2016 Mexico Salary GuideAv Raham B. AriasNoch keine Bewertungen

- Mexico Standard and Supplemental Benefits Perks A General Guide1Dokument2 SeitenMexico Standard and Supplemental Benefits Perks A General Guide1Av Raham B. AriasNoch keine Bewertungen

- 81058014EN Tutorial NIRS Vision Instument Calibration 2014-12-01Dokument81 Seiten81058014EN Tutorial NIRS Vision Instument Calibration 2014-12-01Av Raham B. AriasNoch keine Bewertungen

- Hebrew Proficiency Test and Placement ExamDokument10 SeitenHebrew Proficiency Test and Placement ExamAv Raham B. AriasNoch keine Bewertungen

- 80005111en PDFDokument16 Seiten80005111en PDFAv Raham B. AriasNoch keine Bewertungen

- Manual For NIRS XDS RapidContent Analyzer PDFDokument90 SeitenManual For NIRS XDS RapidContent Analyzer PDFAv Raham B. AriasNoch keine Bewertungen

- Matot 2Dokument5 SeitenMatot 2Av Raham B. AriasNoch keine Bewertungen

- 80005111en PDFDokument16 Seiten80005111en PDFAv Raham B. AriasNoch keine Bewertungen

- How to Fold a MenorahDokument1 SeiteHow to Fold a MenorahAv Raham B. AriasNoch keine Bewertungen

- Accelero Twin Turbo III Installation Manual EnglishDokument8 SeitenAccelero Twin Turbo III Installation Manual EnglishAv Raham B. AriasNoch keine Bewertungen

- Jewish Recipes: Recipe For LatkesDokument1 SeiteJewish Recipes: Recipe For LatkesAv Raham B. AriasNoch keine Bewertungen

- Passover - Jewish RecipesDokument4 SeitenPassover - Jewish RecipesAv Raham B. AriasNoch keine Bewertungen

- (Plum Dumplings) : Breadcrumb CoatingDokument16 Seiten(Plum Dumplings) : Breadcrumb CoatingAv Raham B. AriasNoch keine Bewertungen

- Suburban Sheet Metal LTD SPECSDokument43 SeitenSuburban Sheet Metal LTD SPECSAv Raham B. AriasNoch keine Bewertungen

- Argyris Maturity Theory by RameshDokument8 SeitenArgyris Maturity Theory by RameshHarish.PNoch keine Bewertungen

- Lectura 2 - Peterson Willie, Reinventing Strategy - Chapters 7,8, 2002Dokument42 SeitenLectura 2 - Peterson Willie, Reinventing Strategy - Chapters 7,8, 2002jv86Noch keine Bewertungen

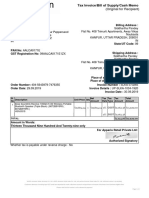

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Satyam SinghNoch keine Bewertungen

- MGT602 Finalterm Subjective-By KamranDokument12 SeitenMGT602 Finalterm Subjective-By KamranKifayat Ullah ToheediNoch keine Bewertungen

- BLGF Opinion March 17 2011Dokument7 SeitenBLGF Opinion March 17 2011mynet_peterNoch keine Bewertungen

- BUITEMS Entry Test Sample Paper NAT IGSDokument10 SeitenBUITEMS Entry Test Sample Paper NAT IGSShawn Parker100% (1)

- Commercial Lease AgreementDokument4 SeitenCommercial Lease AgreementRajesh KhetanNoch keine Bewertungen

- 0452 s05 QP 2Dokument16 Seiten0452 s05 QP 2Nafisa AnwarAliNoch keine Bewertungen

- HR Getting Smart Agile Working - 2014 - tcm18 14105.pdf, 08.07.2018 PDFDokument38 SeitenHR Getting Smart Agile Working - 2014 - tcm18 14105.pdf, 08.07.2018 PDFKhushbuNoch keine Bewertungen

- Tally PPT For Counselling1Dokument11 SeitenTally PPT For Counselling1lekhraj sahuNoch keine Bewertungen

- Impact of LiberalisationDokument23 SeitenImpact of Liberalisationsourabhverdia100% (5)

- MQP For MBA I Semester Students of SPPUDokument2 SeitenMQP For MBA I Semester Students of SPPUfxn fndNoch keine Bewertungen

- Dhurjoti Bhattacharjee's ResumeDokument6 SeitenDhurjoti Bhattacharjee's ResumeSai Anil KumarNoch keine Bewertungen

- My Dream Company: Why Join ITC Limited (Under 40 charsDokument9 SeitenMy Dream Company: Why Join ITC Limited (Under 40 charsamandeep152Noch keine Bewertungen

- Marketing Domain ...........................Dokument79 SeitenMarketing Domain ...........................Manish SharmaNoch keine Bewertungen

- Kwality WallsDokument18 SeitenKwality WallsKanak Gehlot0% (2)

- What Makes a Great Product ManagerDokument16 SeitenWhat Makes a Great Product Managerpresident fishrollNoch keine Bewertungen

- Exploring Supply Chain Collaboration of Manufacturing Firms in ChinaDokument220 SeitenExploring Supply Chain Collaboration of Manufacturing Firms in Chinajuan cota maodNoch keine Bewertungen

- MTAP Saturday Math Grade 4Dokument2 SeitenMTAP Saturday Math Grade 4Luis SalengaNoch keine Bewertungen

- Project Profile On Automobile WiresDokument8 SeitenProject Profile On Automobile WiresGirishNoch keine Bewertungen

- Volume 01 - Pe 02Dokument123 SeitenVolume 01 - Pe 02drunk PUNISHER100% (1)

- NTPC Limited: Korba Super Thermal Power StationDokument9 SeitenNTPC Limited: Korba Super Thermal Power StationSAURAV KUMARNoch keine Bewertungen

- Corporate Governance Assignment by JunaidDokument3 SeitenCorporate Governance Assignment by JunaidTanzeel HassanNoch keine Bewertungen