Beruflich Dokumente

Kultur Dokumente

Rca Soc

Hochgeladen von

Krishna Kiran VyasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rca Soc

Hochgeladen von

Krishna Kiran VyasCopyright:

Verfügbare Formate

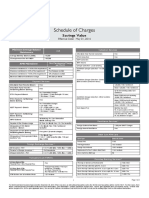

ROAMING CURRENT ACCOUNT SCHEDULE OF CHARGES w.e.

f Apr 1, 2015

Glossary of Terms

MAB

Monthly Average Balance (MAB) calculated as average of daily closing positive balances of each day spread over a

period of the month

NMMAB

Non-maintenance of Monthly Average Balances

Base Location Base Location refers to the all the Branches belonging to the same clearing zone in which the account is opened

Non-Cash

Non Cash Transactions Collections include - Local Cheque collection Non base & Upcountry Cheque Collections. Non

Transactions

Cash Transaction Payments include -Demand Drafts, Pay Order & Multicity Cheque payments,

All Cash transactions of Rs 10 Lacs & above on a single day would require prior intimation & approval of the Branch at least one

working day in advance

Variant

Standard

Classic

Premium

Gold

Gold Plus

Platinum

Elite

MAB Requirement (Rs.)

10,000

25,000

50,000

100,000

300,000

1,000,000

NMMAB Charges (Rs.)

400

500

750

1,000

3,000

500,000

2,500 if MAB

>= 50% &

5,000 if MAB

<50%

5,000 if MAB >=

50% & 10,000 if

MAB <50%

Free Limits

Variant

Standard

Classic

Premium

Cash Deposit Base

100,000

250,000

500,000

location (Rs.)

Cash Deposit Non base

NIL

NIL

NIL

location (Rs.)

No cash deposit free limit if MAB maintained is less than:

i) 50% of MAB required for Gold, Gold Plus, Platnium & Elite

ii)80% of MAB required for Standard, Classic & Premium

Non Cash TransactionFree

Free

Free

Collections (Rs.)

Non Cash Transaction1,000,000

2,500,000

Free

Payments (Rs.)

Cheque Leaves per

25

50

100

month (nos.)

Total Transactions

20

50

100

(nos.)

Cash Withdrawal Base

Branch (Rs.)

Cash Withdrawal Non

Base Branch (Rs.)

RTGS Payment (Rs.)

(applicable only for

Standard and Classic)

Gold

Gold Plus

Platinum

Elite

1,000,000

3,000,000

5,000,000

10,000,000

100,000

300,000

500,000

1,000,000

Free

Free

Free

Free

Free

Free

Free

Free

200

600

1,000

2,000

200

600

1,000

2,000

Unlimited free on Value for self ;

Maximum Rs 50,000 per transaction for 3rd party payment

Rs.50,000 Free per day. Allowed only for self-cheques

Transaction amount between Rs. 2 lakh to Rs. 5 lakh

Transaction amount > Rs. 5 lakh

Rs. 25 per transaction

Rs. 50 per transaction

Charges Beyond Free Limits

Service

Charges beyond Free Limits

Minimum Charge

(Rs.)

Cash Deposit-Base location

Rs 3 per Rs 1,000.

50

Cash Deposit-Non-Base location

Cash Withdrawal Non-Base

Rs 3 per Rs 1,000 plus anywhere cash deposit charge of Rs 5

per Rs 1,000.

Rs.2 per 1000

100

50

Non Cash Transaction -Payments

Cheque Leaves

Rs.0.50 per 1000 ; Minimum Rs 50 per Transaction &

Maximum Rs 500 per Transaction

Rs.2 per leaf

50

Transaction Charges

Penal charges for accounts not maintaining

MAB (not applicable on cash deposit

transaction)

Bulk Cash Volume Charges

Rs. 50 per cash deposit transaction & Rs 25 for others

Other transaction includes all cash withdrawal & clearing transactions except 1.

Payments / collections through RTGS & NEFT, 2. Upcountry Cheque Collection

3.

Transactions done through Internet / Phone / Mobile / ATM

Rs 25 per transaction from first transaction for Standard & Classic Variants and Rs 10

per transaction from first transaction for Premium, Gold, Gold Plus, Platinum & Elite

variants.

Transaction includes all cash withdrawal & clearing transactions except payments /

collections through RTGS & NEFT, Upcountry Cheque Collection and transactions done

through Internet / Phone / Mobile / ATM

Rs 3 per 1000 beyond 5 times free limit on base cash deposit

Free Services

Service

Charges

NEFT Payment, RTGS Collections and NEFT Collections

Local Cheque Collection at base branch, Local Cheque Payments, Fund Transfers

(Transaction charges applicable beyond free transaction limits)0

Product type change to any ICICI Bank Current Account product

Transactions done through Internet / Phone / Mobile Banking / Email & ICICI Bank ATM

FREE

Other Charges

Debit Card Related

Debit Card Charges

Free-Platinum &

Elite;Rs.250 for

other Variants

Per annum

De hotlisting of Debit Card

Free

ATM Transactions at other bank ATM (India)

Balance Inquiry

Withdrawal (per transaction)

Rs 8.5

ATM Transactions at other bank ATM (Outside India )

Withdrawal (per transaction)

Rs.125

Replacement of lost / stolen debit card, Replacement of PIN Per instance

Rs.20

Rs. 200

Other Common Charges

Account Closure Charges:

Standard, Classic & Premium

If closed within 14 days

If closed beyond 14 days but within 6 months

If closed beyond 6 months

Nil

Rs.500

Rs. 200

Nil

Rs.1000

Account Closure Charges:

Gold, Gold Plus, Platinum & Elite

If closed within 14 days

If closed beyond 14 days but within 6 months

If closed beyond 6 months

Mobile Alerts - Standard, Classic and Premium

Per month

Rs. 500

Rs.25

Mobile Alerts - Gold, Gold Plus, Platinum & Elite

Per month

Free

Monthly Account Statement

Per month

Account Statement through Fax:

(Daily / Weekly / Fortnightly / Monthly)

Per page

Minimum per month

Interest Certificate

Per certificate

Cheque Return - Issued by customer

(Including Fund Transfers)

Cheque Return - Deposited by Customer

For first 2 instruments of the month

1) If MAB is maintained during the month:Rs. 350/- per instrument &

2) If MAB is not maintained during the month:Rs. 500/- per instrument

From 3rd instrument onwards of the month Rs.750/- per instrument

Per instrument

Rs 100

ECS Debit Return

Per Instrument

Speed Clearing charges

Per Instrument of value above Rs. 100,000/-

Branch Based transactions:

Including Stop Payment, Standing Instruction, DD

Cancellation, DD Duplicate, DD revalidation, Duplicate

Statement, Bankers' Report, Certificate of Balance for

Previous Year, Old Record Retrieval, Signature Verification

Phone Banking transactions:

Per instance

Free

Free

Rs 5

Rs 200

Free

Rs. 350

Rs. 150/Rs.100

For transactions available on IVR, if done through Phone

Banking Officer

Services Daily/ On Call

Cash Pick up

Cash Delivery

Cheque Pick up

Trade Documents Pick up

Doorstep Banking

Charges/ Registration process

Please contact the nearest ICICI Bank Branch/ your Relationship

Manager for details.

For any services or charges not covered under this brochure, please contact any of our branches or write to

corporatecare@icicibank.com

The service charges are subject to change without any prior intimation to customer. However, the prevailing charges would be hosted

on www.icicibank.com. Charge cycle period shall be from 1st to 31st of the month.

For Domestic General Banking Transactions the pricing for Trade RCA variants would be as per the following mapping:

TRCA USD 25K - RCA Premium, TRCA USD 75K - RCA Gold, TRCA USD 300K - RCA Platinum, TRCA USD 600K RCA Elite, TRCA

1500K RCA Elite.

All charges are exclusive of Service Tax as applicable from time to time

DD/PO For single DD/PO Issuance, the number of transactions will count as 2 transactions

Salary payment to multiple accounts through cheque Transaction count will be considered equivalent to number of multiple accounts

credited

For details Terms and Conditions please refer to www.icicibank.com

Das könnte Ihnen auch gefallen

- Charges for Roaming Current Account at ICICI BankDokument3 SeitenCharges for Roaming Current Account at ICICI Bankashishtiwari92100% (1)

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Dokument2 SeitenNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741Noch keine Bewertungen

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Dokument2 SeitenMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNoch keine Bewertungen

- Account Tariff Structure Basic Savings AccountDokument1 SeiteAccount Tariff Structure Basic Savings Accountgaddipati_ramuNoch keine Bewertungen

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Dokument2 SeitenParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNoch keine Bewertungen

- Regular Saving AccountDokument92 SeitenRegular Saving AccountSimu MatharuNoch keine Bewertungen

- Annex 2 Super Savings AccountDokument2 SeitenAnnex 2 Super Savings AccountPhani BhupathirajuNoch keine Bewertungen

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Dokument5 SeitenSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNoch keine Bewertungen

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDokument13 SeitenSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNoch keine Bewertungen

- New Schedule of Charges For Current AccountDokument2 SeitenNew Schedule of Charges For Current AccountKishan DhootNoch keine Bewertungen

- Schedule of Charges for No Frills Smart Salary AccountDokument2 SeitenSchedule of Charges for No Frills Smart Salary AccountRupali WaliaNoch keine Bewertungen

- New Dgtca SocDokument2 SeitenNew Dgtca SocchintankantariaNoch keine Bewertungen

- Schedule of Charges: Savings ValueDokument2 SeitenSchedule of Charges: Savings ValueNavjot SinghNoch keine Bewertungen

- Value Based Current Accounts Schedule of ChargesDokument2 SeitenValue Based Current Accounts Schedule of ChargesDhawan SandeepNoch keine Bewertungen

- Sabka Basic Savings Account Complete KYC 10-10-2013Dokument2 SeitenSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNoch keine Bewertungen

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Dokument15 SeitenSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNoch keine Bewertungen

- Axis Bank savings account chargesDokument6 SeitenAxis Bank savings account chargesArnab Nandi100% (1)

- Crown salary account benefitsDokument2 SeitenCrown salary account benefitsVikram IsgodNoch keine Bewertungen

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDokument2 SeitenTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNoch keine Bewertungen

- From Kotak WebsiteDokument20 SeitenFrom Kotak WebsiteHimadri Shekhar VermaNoch keine Bewertungen

- Privilege Banking AccountsDokument5 SeitenPrivilege Banking AccountsVinod MohiteNoch keine Bewertungen

- Notification FinalDokument4 SeitenNotification FinalBrahmanand DasreNoch keine Bewertungen

- Schedule of Charges: Smart Salary ExclusiveDokument2 SeitenSchedule of Charges: Smart Salary ExclusivevedavakNoch keine Bewertungen

- Multicity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesDokument6 SeitenMulticity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesEraivan EraiNoch keine Bewertungen

- Bank Alfalah Schedule of Islamic Banking ChargesDokument16 SeitenBank Alfalah Schedule of Islamic Banking Chargesfaisal_ahsan7919Noch keine Bewertungen

- CD PremiumDokument1 SeiteCD PremiumnelzonpouloseNoch keine Bewertungen

- Bank Alfalah Islamic Banking Schedule of Charges July-Dec 2013Dokument14 SeitenBank Alfalah Islamic Banking Schedule of Charges July-Dec 2013krishmasethiNoch keine Bewertungen

- Super Savings NewDokument2 SeitenSuper Savings NewwinnermeNoch keine Bewertungen

- SERVICE CHARGES AND FEES SUMMARYDokument10 SeitenSERVICE CHARGES AND FEES SUMMARYBella BishaNoch keine Bewertungen

- Yes Bank Smart SalaryDokument2 SeitenYes Bank Smart SalaryVicky SinghNoch keine Bewertungen

- RBI SERVICE CHARGES GUIDELINESDokument11 SeitenRBI SERVICE CHARGES GUIDELINESJithin VijayanNoch keine Bewertungen

- KFS Current ACDokument23 SeitenKFS Current ACFakharNoch keine Bewertungen

- Bank service charges guideDokument17 SeitenBank service charges guideshaantnuNoch keine Bewertungen

- General Schedule of Features and Charges: Particulars Product Level Free Limits & Charges (In RS.)Dokument2 SeitenGeneral Schedule of Features and Charges: Particulars Product Level Free Limits & Charges (In RS.)Bella BishaNoch keine Bewertungen

- Kathmandu Nepal Bank Schedule of Fees ChargesDokument8 SeitenKathmandu Nepal Bank Schedule of Fees ChargesnayanghimireNoch keine Bewertungen

- Service Charges 15-03-2011Dokument13 SeitenService Charges 15-03-2011AnandshingviNoch keine Bewertungen

- Yes Bank - Schedule of Charges - Savings Select AccountDokument2 SeitenYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENoch keine Bewertungen

- Sbprime - Bde'sDokument16 SeitenSbprime - Bde'sParteek JangraNoch keine Bewertungen

- Services ProvidedDokument15 SeitenServices ProvidedParul AroraNoch keine Bewertungen

- RSPDokument24 SeitenRSPMassrNoch keine Bewertungen

- ROAMING CURRENT ACCOUNT SCHEDULE AND CHARGESDokument3 SeitenROAMING CURRENT ACCOUNT SCHEDULE AND CHARGESHimesh ShahNoch keine Bewertungen

- Pca 14 6Dokument2 SeitenPca 14 6Arora MathewNoch keine Bewertungen

- Personal Banking Charges ScheduleDokument1 SeitePersonal Banking Charges ScheduleSaravanan ParamasivamNoch keine Bewertungen

- Sme BookDokument397 SeitenSme BookVivek Godgift J0% (1)

- Fees and Charges For Debit CardDokument2 SeitenFees and Charges For Debit CardAnandraojs JsNoch keine Bewertungen

- Preferred Banking SOC FinalDokument2 SeitenPreferred Banking SOC FinalWelkin SkyNoch keine Bewertungen

- Mojo Platinum Credit Card: INR 1000 INR 1000Dokument4 SeitenMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- PNB Suvidha Scheme (Deposits) : Categorization of Retail Lending SchemesDokument3 SeitenPNB Suvidha Scheme (Deposits) : Categorization of Retail Lending Schemesnishi namitaNoch keine Bewertungen

- ICICI Bank Silver Savings Account Features, Eligibility and BenefitsDokument14 SeitenICICI Bank Silver Savings Account Features, Eligibility and BenefitsAgarwal Devu DivyanshuNoch keine Bewertungen

- Glossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteDokument4 SeitenGlossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteAlka RanjanNoch keine Bewertungen

- Pocket Savings Account Final UpdatedDokument3 SeitenPocket Savings Account Final UpdatedDAYA VNoch keine Bewertungen

- Key Fact StatementDokument2 SeitenKey Fact StatementJohn AdariNoch keine Bewertungen

- Effective From 1st April, 2020Dokument2 SeitenEffective From 1st April, 2020SundarNoch keine Bewertungen

- Schedule of Charges (Standard Charterd)Dokument0 SeitenSchedule of Charges (Standard Charterd)Kiran Maruti ShindeNoch keine Bewertungen

- Banking Operations - Bank of IndiaDokument21 SeitenBanking Operations - Bank of IndiaEkta singhNoch keine Bewertungen

- RBL Mitc FinalDokument16 SeitenRBL Mitc FinalVivekNoch keine Bewertungen

- PK Saadiq EnglishDokument53 SeitenPK Saadiq EnglishZeeshan AshrafNoch keine Bewertungen

- CBQ - Tariff of ChargesDokument9 SeitenCBQ - Tariff of Chargesanwarali1975Noch keine Bewertungen

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaVon EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNoch keine Bewertungen

- 110930TS676484Dokument2 Seiten110930TS676484Krishna Kiran VyasNoch keine Bewertungen

- Indian Grocery Translations - English To TeluguDokument2 SeitenIndian Grocery Translations - English To TeluguKrishna Kiran Vyas100% (1)

- 110930TS676484 - 4d43030a 563a 4960 A416 29abadeb3d6Dokument2 Seiten110930TS676484 - 4d43030a 563a 4960 A416 29abadeb3d6Krishna Kiran VyasNoch keine Bewertungen

- Andhra HC upholds uniform entrance exam for medical coursesDokument25 SeitenAndhra HC upholds uniform entrance exam for medical coursesKrishna Kiran VyasNoch keine Bewertungen

- Interview DW DataStageDokument5 SeitenInterview DW DataStageMahendiran McaNoch keine Bewertungen

- ETLDesignMethodologyDocument DataStageDokument14 SeitenETLDesignMethodologyDocument DataStageSaniya KhalsaNoch keine Bewertungen

- Data StageDokument150 SeitenData StagevenmerNoch keine Bewertungen

- DS Warning RemovalsDokument2 SeitenDS Warning RemovalsKrishna Kiran VyasNoch keine Bewertungen

- SD 9Dokument20 SeitenSD 9Orsu HarishNoch keine Bewertungen

- 0831-Local Cadre Posts-Telangana-1Dokument95 Seiten0831-Local Cadre Posts-Telangana-1Krishna Kiran VyasNoch keine Bewertungen

- Credit Card Application FormDokument4 SeitenCredit Card Application FormKrishna Kiran VyasNoch keine Bewertungen

- 1221 Neetpg2018dataDokument114 Seiten1221 Neetpg2018dataKrishna Kiran VyasNoch keine Bewertungen

- CLUSTERS LIST - (CHNCS) GO-209Dokument45 SeitenCLUSTERS LIST - (CHNCS) GO-209Gadde Srinivasarao67% (3)

- Answers To Frequently Asked Questions (FAQ)Dokument35 SeitenAnswers To Frequently Asked Questions (FAQ)Krishna Kiran VyasNoch keine Bewertungen

- KNR University of Health Sciences::WarangalDokument1 SeiteKNR University of Health Sciences::WarangalKrishna Kiran VyasNoch keine Bewertungen

- Commodities Account Opening Form: Document Significance PAGE(s)Dokument40 SeitenCommodities Account Opening Form: Document Significance PAGE(s)Krishna Kiran VyasNoch keine Bewertungen

- Name Pincode Tracking Id CourierDokument26 SeitenName Pincode Tracking Id CourierKrishna Kiran VyasNoch keine Bewertungen

- TTD Special Entry Darshan Receipt - PramillaDokument1 SeiteTTD Special Entry Darshan Receipt - PramillaKrishna Kiran VyasNoch keine Bewertungen

- Customer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDokument3 SeitenCustomer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressKrishna Kiran VyasNoch keine Bewertungen

- Procedure For Obtaning Online Mutation CertificateDokument1 SeiteProcedure For Obtaning Online Mutation CertificatesathishNoch keine Bewertungen

- FD Transfer PDFDokument1 SeiteFD Transfer PDFSelva GaneshNoch keine Bewertungen

- Mitesh BhardwajDokument22 SeitenMitesh BhardwajKrishna Kiran VyasNoch keine Bewertungen

- Mitesh Bhardwaj 4 - 8Dokument2 SeitenMitesh Bhardwaj 4 - 8Krishna Kiran VyasNoch keine Bewertungen

- Customer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDokument3 SeitenCustomer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressKrishna Kiran VyasNoch keine Bewertungen

- Name Pincode Tracking Id CourierDokument9 SeitenName Pincode Tracking Id CourierKrishna Kiran VyasNoch keine Bewertungen

- 1 - 13 TrackingDokument25 Seiten1 - 13 TrackingKrishna Kiran VyasNoch keine Bewertungen

- TIMS Notification PDFDokument1 SeiteTIMS Notification PDFKrishna Kiran VyasNoch keine Bewertungen

- Nptel19ge33s1as377383 PDFDokument1 SeiteNptel19ge33s1as377383 PDFKrishna Kiran VyasNoch keine Bewertungen

- 9 - 16 TrackingDokument24 Seiten9 - 16 TrackingKrishna Kiran VyasNoch keine Bewertungen

- Option Buying Setup: by - Jitendra JainDokument17 SeitenOption Buying Setup: by - Jitendra JainKrishna Kiran VyasNoch keine Bewertungen

- Nestle Marketing Plan - Study Helper - Academia - EduDokument31 SeitenNestle Marketing Plan - Study Helper - Academia - EducpalenikNoch keine Bewertungen

- GST Certificate - MaharashtraDokument3 SeitenGST Certificate - MaharashtragvthomasNoch keine Bewertungen

- BSNL Internship Report FinalDokument75 SeitenBSNL Internship Report FinalAmrutha Kashinath100% (5)

- QB DPMT VI Industrial Management EntrepreneurshipDokument16 SeitenQB DPMT VI Industrial Management Entrepreneurshipjitendra mauryaNoch keine Bewertungen

- Business Communication and Entrepreneurship: BCOA-001 /2017-18Dokument10 SeitenBusiness Communication and Entrepreneurship: BCOA-001 /2017-18arun1974Noch keine Bewertungen

- Bayag 1Dokument41 SeitenBayag 1Jan Angelo MagnoNoch keine Bewertungen

- Concept of Vistex: Generic IntroductionDokument6 SeitenConcept of Vistex: Generic IntroductionRamesh Kumar B0% (1)

- Naveen State Bank of India Acc StatementDokument26 SeitenNaveen State Bank of India Acc StatementSRV MOTORSSNoch keine Bewertungen

- CH 22Dokument22 SeitenCH 22Eng-Mohammed Abu NuktaNoch keine Bewertungen

- The Social Dimension of Organizations Recent ExperDokument15 SeitenThe Social Dimension of Organizations Recent ExperZebaNoch keine Bewertungen

- A Case Study On Euro Disney (A) : Presented by Anurag Gupta Ankita Banik Ankit Mehrotra Arti Kumari Anjusha KumariDokument10 SeitenA Case Study On Euro Disney (A) : Presented by Anurag Gupta Ankita Banik Ankit Mehrotra Arti Kumari Anjusha KumariArti KumariNoch keine Bewertungen

- CPD - Procurement of Public Works in UgandaDokument32 SeitenCPD - Procurement of Public Works in UgandaIvan BuhiinzaNoch keine Bewertungen

- E-Auction Process Document - Shirt Company - 11 Nov 2022 PDFDokument55 SeitenE-Auction Process Document - Shirt Company - 11 Nov 2022 PDFRishabh VakhariaNoch keine Bewertungen

- Benilal.O 098001185006Dokument79 SeitenBenilal.O 098001185006Prasanth PrabhakarNoch keine Bewertungen

- Entrepreneur Research ProjectDokument7 SeitenEntrepreneur Research Projectapi-690546602Noch keine Bewertungen

- FM - Module 1, Part 1Dokument52 SeitenFM - Module 1, Part 1Aamna MunaimaNoch keine Bewertungen

- Bosh Training Schedule 2020Dokument1 SeiteBosh Training Schedule 2020Franz Von MuhlfeldNoch keine Bewertungen

- Online BusinessDokument23 SeitenOnline BusinessJim TagannaNoch keine Bewertungen

- Proces CostingDokument14 SeitenProces CostingKenDedesNoch keine Bewertungen

- Debt ManagementDokument9 SeitenDebt ManagementAngelie AnilloNoch keine Bewertungen

- A Study On Effectiveness of Performance Appraisal System at BHEL-EPD, BangaloreDokument84 SeitenA Study On Effectiveness of Performance Appraisal System at BHEL-EPD, Bangaloreishwari28Noch keine Bewertungen

- Toyota Production SystemDokument4 SeitenToyota Production SystemNaveed IrshadNoch keine Bewertungen

- SAP S/4HANA Cloud 2302: Feature Scope DescriptionDokument306 SeitenSAP S/4HANA Cloud 2302: Feature Scope DescriptionAnirudh SeshadriNoch keine Bewertungen

- Slide 3 - LEVERAGING RESOURCES AND CAPABILITIESDokument11 SeitenSlide 3 - LEVERAGING RESOURCES AND CAPABILITIESXiao Yun YapNoch keine Bewertungen

- Project finance essentialsDokument10 SeitenProject finance essentialsAakash KumarNoch keine Bewertungen

- Internationalization of Financial MarketsDokument2 SeitenInternationalization of Financial MarketsJannaviel MirandillaNoch keine Bewertungen

- Finace Chapter 4Dokument24 SeitenFinace Chapter 4Phạm Thùy DươngNoch keine Bewertungen

- SAP Project TemplatesDokument19 SeitenSAP Project Templatesharinda100% (3)

- Test Bank For Community Health Nursing A Canadian Perspective 5th Edition Lynnette Leeseberg Stamler Lynnette Leeseberg Stamler Lucia Yiu Aliyah Dosani Josephine Etowa Cheryl Van Daalen SmithDokument86 SeitenTest Bank For Community Health Nursing A Canadian Perspective 5th Edition Lynnette Leeseberg Stamler Lynnette Leeseberg Stamler Lucia Yiu Aliyah Dosani Josephine Etowa Cheryl Van Daalen SmithLinda Burnham100% (31)

- Real Life Change Management StoriesDokument30 SeitenReal Life Change Management StoriesNash SharmaNoch keine Bewertungen