Beruflich Dokumente

Kultur Dokumente

Case DIgest No. 10

Hochgeladen von

joyiveeongCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case DIgest No. 10

Hochgeladen von

joyiveeongCopyright:

Verfügbare Formate

Philippine Amusement and Gaming Corporation (PAGCOR) vs.

Bureau of

Internal Revenue

G.R. No. 215427, December 10, 2014

Facts:

This is a motion for reconsideration filed by PAGCOR after the court in a previous

case upheld the validity of Sec. 1 of RA 9337 which amended Sec. 27 (C) of the NIRC

by excluding PAGCOR from the enumeration of government-owned or controlled

corporations (GOCCs) exempted from liability for corporate income tax.

In response to the said decision, BIR issued RMC No. 33-2013 which classified

PAGCORs income into two, and subjecting it both to corporate income tax and 5%

franchise tax. As the decision of the court upholding the validity of RA 9337 has

already became final, PAGCOR sought to clarify such decision and have RMC No. 332013 nullified for being issued with grave abuse of discretion. Hence, this petition.

Issues: WON PAGCORs tax privilefe of paying 5% franchise tax in lieu of all other

taxes with respect to its gaming income is repealed by RA 9337.

Ruling: NO.

PAGCORs income is classified into two: (1) income from gaming operations, and (2)

income from other related services. RMC No. 33- 2013 further classified PAGCORs

income (1) income from its operations and licensing of gambling casinos, gaming

clubs and other similar recreation or amusement places, gaming pools, and other

enumerated operations; and (2) income from other related operations. The court

ruled that its income from gaming operations is subject only to 5% franchise tax as

provided for under PAGCORs chapter, while its income from other related services

is subject to corporate income tax pursuant to its charter, as amended as well as RA

9337.

This is because the tax exemption found in the NIRC which was taken away by RA

9337 only refers to its income from other related operations since PAGCORs charter

already exempts its income from gaming operations.

In other words, there was no need for Congress to grant tax exemption to petitioner

with respect to its income from gaming operations as the same is already exempted

from all taxes of any kind or form, income or otherwise, whether national or local,

under its Charter, save only for the five percent (5%) franchise tax. The exemption

attached to the income from gaming operations exists independently from the

enactment of NIRC.

As we see it, there is no conflict between P.D. 1869, as amended, and R.A. No. 9337.

The former lays down the taxes imposable upon petitioner, as follows: (1) a five

percent (5%) franchise tax of the gross revenues or earnings derived from its

operations conducted under the Franchise, which shall be due and payable in lieu of

all kinds of taxes, levies, fees or assessments of any kind, nature or description,

levied, established or collected by any municipal, provincial or national government

authority; 2) income tax for income realized from other necessary and related

services, shows and entertainment of petitioner. With the enactment of R.A. No.

9337, which withdrew the income tax exemption under R.A. No. 8424, petitioner's

tax liability on income from other related services was merely reinstated.

Even assuming that an inconsistency exists, P.D. 1869, as amended, which

expressly provides the tax treatment of petitioner's income prevails over R.A. No.

9337, which is a general law. It is a canon of statutory construction that a special

law prevails over a general law regardless of their dates of passage and the

special is to be considered as remaining an exception to the general.

For proper guidance, the first classification of PAGCOR's income under RMC No. 332013 (i.e., income from its operations and licensing of gambling casinos, gaming

clubs and other similar recreation or amusement places, gambling pools) should be

interpreted in relation to Section 13 (2) of P.D. 1869, which pertains to the income

derived from issuing and/or granting the license to operate casinos to PAGCOR's

contractees and licensees, as well as earnings derived by PAGCOR from its own

operations under the Franchise. On the other hand, the second classification of

PAGCOR's income under RMC No. 33-2013 (i.e., income from other related

operations) should be interpreted in relation to Section 14 (5) of P.D. 1869, which

pertains to income received by PAGCOR from its contractees and licensees in the

latter's operation of casinos, as well as PAGCOR's own income from operating

necessary and related services, shows and entertainment.

In view of the foregoing disquisition, respondent, therefore, committed grave abuse

of discretion amounting to lack of jurisdiction when it issued RMC No. 33-2013

subjecting both income from gaming operations and other related services to

corporate income tax and five percent (5%) franchise tax.

Das könnte Ihnen auch gefallen

- Sofia Petrovna EssayDokument4 SeitenSofia Petrovna EssayMatthew Klammer100% (1)

- Dominik Geppert, William Mulligan, Andreas Rose-The Wars Before The Great War - Conflict and International Politics Before The Outbreak of The First World War-Cambridge University Pres PDFDokument392 SeitenDominik Geppert, William Mulligan, Andreas Rose-The Wars Before The Great War - Conflict and International Politics Before The Outbreak of The First World War-Cambridge University Pres PDFRoberto Rodriguez Flores100% (1)

- GLQ Vol. 18, N. 1 Queer Studies and The Crises of CapitalismDokument205 SeitenGLQ Vol. 18, N. 1 Queer Studies and The Crises of CapitalismBarbara G. PiresNoch keine Bewertungen

- Memorandum of Law RE Shylock CaseDokument13 SeitenMemorandum of Law RE Shylock CaseKei Takishima ShengNoch keine Bewertungen

- Bill of Right CasesDokument5 SeitenBill of Right CasesNesleyCruzNoch keine Bewertungen

- 14th Assignment Digested CasesDokument39 Seiten14th Assignment Digested CasesJunpyo ArkinNoch keine Bewertungen

- Musngi v. West Coast Life, GR 41794, 30 Aug. 1935Dokument4 SeitenMusngi v. West Coast Life, GR 41794, 30 Aug. 1935Vincent Rey BernardoNoch keine Bewertungen

- Bpi Express V Ca - MarasiganDokument2 SeitenBpi Express V Ca - Marasigancary_puyatNoch keine Bewertungen

- Use of Force After 11 Septmbr PDFDokument14 SeitenUse of Force After 11 Septmbr PDFAbdul SattarNoch keine Bewertungen

- People Vs AncajasDokument2 SeitenPeople Vs AncajasCharles Roger RayaNoch keine Bewertungen

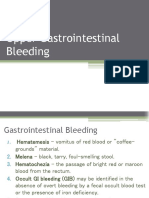

- Upper Gastrointestinal BleedingDokument7 SeitenUpper Gastrointestinal BleedingironNoch keine Bewertungen

- Expertravel V CADokument2 SeitenExpertravel V CANico NuñezNoch keine Bewertungen

- Canon 18 CasesDokument15 SeitenCanon 18 CasesMargarette Pinkihan SarmientoNoch keine Bewertungen

- Republic of The Philippines Court of Tax Appeals Quezon CityDokument12 SeitenRepublic of The Philippines Court of Tax Appeals Quezon CityPatricia Ann RueloNoch keine Bewertungen

- 74 - WT Construction V DPWHDokument2 Seiten74 - WT Construction V DPWHJanine Castro100% (1)

- Paris Agreement Powerpoint PDFDokument20 SeitenParis Agreement Powerpoint PDFKevin AmanteNoch keine Bewertungen

- Negros Slashers Vs Teng2Dokument15 SeitenNegros Slashers Vs Teng2Mariam PetillaNoch keine Bewertungen

- 95 Avon Insurance PLC v. CADokument1 Seite95 Avon Insurance PLC v. CARojan PaduaNoch keine Bewertungen

- Del Rosario Vs Equitable, Inc and Casualty Co., Inc - G.R. No. L-16215 June 29, 1963 - Paredes, J. - by Jasper Summary: NotesDokument1 SeiteDel Rosario Vs Equitable, Inc and Casualty Co., Inc - G.R. No. L-16215 June 29, 1963 - Paredes, J. - by Jasper Summary: NotesJames LouNoch keine Bewertungen

- Tayag V AlcantaraDokument2 SeitenTayag V AlcantaraJaz SumalinogNoch keine Bewertungen

- Mahan V MahanDokument2 SeitenMahan V MahanNap GonzalesNoch keine Bewertungen

- Ochoa Vs G.S. TransportDokument5 SeitenOchoa Vs G.S. Transportkatherine magbanuaNoch keine Bewertungen

- Insurance Cases On PremiumDokument6 SeitenInsurance Cases On PremiumNathalie QuinonesNoch keine Bewertungen

- Dela Cruz V Capital InsuranceDokument1 SeiteDela Cruz V Capital InsuranceAlfonso Miguel LopezNoch keine Bewertungen

- G.R. No. 173870 April 25, 2012Dokument11 SeitenG.R. No. 173870 April 25, 2012ShaiNoch keine Bewertungen

- Medina vs. Castro-BartolomeDokument11 SeitenMedina vs. Castro-BartolomejokuanNoch keine Bewertungen

- Obligations and Contracts DigestsDokument122 SeitenObligations and Contracts DigestsNathaniel Niño TangNoch keine Bewertungen

- Petitioner vs. vs. Respondents: en BancDokument6 SeitenPetitioner vs. vs. Respondents: en BancJessica Magsaysay CrisostomoNoch keine Bewertungen

- 02 CIR v. CFI de CebuDokument2 Seiten02 CIR v. CFI de CebuFrances Angelica Domini KoNoch keine Bewertungen

- G.R. No. 191525 IAME Vs LittonDokument6 SeitenG.R. No. 191525 IAME Vs LittonJoovs JoovhoNoch keine Bewertungen

- Great Pacific Life Assurance Corporation vs. CA, 89 SCRA 543Dokument6 SeitenGreat Pacific Life Assurance Corporation vs. CA, 89 SCRA 543ZsazsaNoch keine Bewertungen

- Cruz V CADokument3 SeitenCruz V CAAngela Louise SabaoanNoch keine Bewertungen

- Abbott vs. AlcarazDokument4 SeitenAbbott vs. AlcarazJannaNoch keine Bewertungen

- 09 Lim v. Executive SecretaryDokument34 Seiten09 Lim v. Executive SecretaryCamille CruzNoch keine Bewertungen

- Insurance June 14Dokument17 SeitenInsurance June 14Nikki AndradeNoch keine Bewertungen

- Transpo Digest Week 4.1Dokument25 SeitenTranspo Digest Week 4.1Neil FrangilimanNoch keine Bewertungen

- Some Jurisprudence On Alternative Dispute ResolutionDokument13 SeitenSome Jurisprudence On Alternative Dispute ResolutionmastaacaNoch keine Bewertungen

- Final DIGEST LACSON VS. EXECUTIVE SECRETARYDokument2 SeitenFinal DIGEST LACSON VS. EXECUTIVE SECRETARYalbemartNoch keine Bewertungen

- Prudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines Inc, G.R. No. 151890 June 20, 2006 (Full Text and Digest)Dokument14 SeitenPrudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines Inc, G.R. No. 151890 June 20, 2006 (Full Text and Digest)RhoddickMagrataNoch keine Bewertungen

- SPL Digest CasesDokument12 SeitenSPL Digest CasesMikaelGo-OngNoch keine Bewertungen

- Simplified and Harmonized Forest Regulatory Practices 2004 PDFDokument455 SeitenSimplified and Harmonized Forest Regulatory Practices 2004 PDFJOHN SPARKSNoch keine Bewertungen

- 52 Metrobank v. CIRDokument1 Seite52 Metrobank v. CIRNN DDLNoch keine Bewertungen

- 1958-People v. VersolaDokument4 Seiten1958-People v. VersolaKathleen MartinNoch keine Bewertungen

- 434 Supreme Court Reports Annotated: Nario vs. Philippine American Life Ins. CoDokument8 Seiten434 Supreme Court Reports Annotated: Nario vs. Philippine American Life Ins. CoAmer Lucman IIINoch keine Bewertungen

- Hur Tin Yang vs. People of The Philippines G.R. No. 195117 August 14, 2013 Velasco JR., JDokument10 SeitenHur Tin Yang vs. People of The Philippines G.R. No. 195117 August 14, 2013 Velasco JR., JMonalizts D.Noch keine Bewertungen

- Advertising Associates, Inc. v. CTADokument7 SeitenAdvertising Associates, Inc. v. CTARebekah SupapoNoch keine Bewertungen

- 32 Gallent v. GallentDokument2 Seiten32 Gallent v. GallentWendy PeñafielNoch keine Bewertungen

- CONFLICTSDokument7 SeitenCONFLICTSIrish PrecionNoch keine Bewertungen

- LIM FILCRO Illegal RecruitmentDokument2 SeitenLIM FILCRO Illegal RecruitmentVivienne Nicole LimNoch keine Bewertungen

- Oesmer v. ParaisoDokument4 SeitenOesmer v. ParaisoTJ CortezNoch keine Bewertungen

- Civil Procedure Cases 32-35Dokument9 SeitenCivil Procedure Cases 32-35Jane Therese RoveloNoch keine Bewertungen

- Insurance Bar QsDokument13 SeitenInsurance Bar QsDenise Christine C LimNoch keine Bewertungen

- Grace Christian High School v. LavanderaDokument2 SeitenGrace Christian High School v. LavanderaJaneen ZamudioNoch keine Bewertungen

- People v. Pangilinan (Arraignment)Dokument2 SeitenPeople v. Pangilinan (Arraignment)adrianmdelacruzNoch keine Bewertungen

- 48 Philippine American Life Insurance Co. v. PinedaDokument3 Seiten48 Philippine American Life Insurance Co. v. PinedaKaryl Eric BardelasNoch keine Bewertungen

- G.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerDokument13 SeitenG.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerChatNoch keine Bewertungen

- 50 - Pioneer Insurance vs. Olivia YapDokument1 Seite50 - Pioneer Insurance vs. Olivia YapN.SantosNoch keine Bewertungen

- 5) San Miguel v. Law UnionDokument1 Seite5) San Miguel v. Law UnionRod Ralph ZantuaNoch keine Bewertungen

- Paris Manila Vs Phoenix Assurance G.R. No. L-25845 December 17, 1926Dokument1 SeiteParis Manila Vs Phoenix Assurance G.R. No. L-25845 December 17, 1926Emrico CabahugNoch keine Bewertungen

- Lanuzo Vs PingDokument4 SeitenLanuzo Vs Pingangelsu04Noch keine Bewertungen

- PAGCOR vs. BIRDokument1 SeitePAGCOR vs. BIRDette de LaraNoch keine Bewertungen

- Pagcor V Bir Gr. No. 215427Dokument1 SeitePagcor V Bir Gr. No. 215427Oro ChamberNoch keine Bewertungen

- Sample LawRev Case DigestDokument2 SeitenSample LawRev Case DigestZacky AzarragaNoch keine Bewertungen

- Kukan International v. ReyesDokument1 SeiteKukan International v. ReyesjoyiveeongNoch keine Bewertungen

- Manila Electric Company v. T.E.A.M. Electronics CorporationDokument1 SeiteManila Electric Company v. T.E.A.M. Electronics CorporationjoyiveeongNoch keine Bewertungen

- Prince Transport v. GarciaDokument1 SeitePrince Transport v. GarciajoyiveeongNoch keine Bewertungen

- International Express Travel v. CADokument1 SeiteInternational Express Travel v. CAjoyiveeongNoch keine Bewertungen

- Lim v. Philippine FishingDokument1 SeiteLim v. Philippine FishingjoyiveeongNoch keine Bewertungen

- Gold Line Tours v. LasacaDokument1 SeiteGold Line Tours v. LasacajoyiveeongNoch keine Bewertungen

- Macasaet v. FranciscoDokument1 SeiteMacasaet v. FranciscojoyiveeongNoch keine Bewertungen

- Villamor v. UmaleDokument2 SeitenVillamor v. Umalejoyiveeong100% (1)

- Forest Hills Golf and Country ClubDokument1 SeiteForest Hills Golf and Country ClubjoyiveeongNoch keine Bewertungen

- Abad v. CommunicationsDokument1 SeiteAbad v. CommunicationsjoyiveeongNoch keine Bewertungen

- Ching v. Subic BayDokument1 SeiteChing v. Subic BayjoyiveeongNoch keine Bewertungen

- Arco Pulp and Paper Co v. LimDokument1 SeiteArco Pulp and Paper Co v. LimjoyiveeongNoch keine Bewertungen

- FVR Skills v. SEVDokument1 SeiteFVR Skills v. SEVjoyiveeongNoch keine Bewertungen

- Forest Hills Golf and Country ClubDokument1 SeiteForest Hills Golf and Country ClubjoyiveeongNoch keine Bewertungen

- Loadstar Shipping Company Inc. Et Al. v. Malayan Insurance CoDokument1 SeiteLoadstar Shipping Company Inc. Et Al. v. Malayan Insurance CojoyiveeongNoch keine Bewertungen

- COC v. OIlink InternationalDokument1 SeiteCOC v. OIlink InternationaljoyiveeongNoch keine Bewertungen

- Olongapo v. SubicDokument1 SeiteOlongapo v. SubicjoyiveeongNoch keine Bewertungen

- WPM International Trading, Inc. and Warlito P. Manlapaz v. Fe Corazon LabayenDokument1 SeiteWPM International Trading, Inc. and Warlito P. Manlapaz v. Fe Corazon LabayenjoyiveeongNoch keine Bewertungen

- Legal Opinion de MinimisDokument6 SeitenLegal Opinion de MinimisjoyiveeongNoch keine Bewertungen

- Loadstar Shipping Company Inc. Et Al. v. Malayan Insurance Co.Dokument1 SeiteLoadstar Shipping Company Inc. Et Al. v. Malayan Insurance Co.joyiveeongNoch keine Bewertungen

- Digests Rule 11-13 Rules of COurtDokument12 SeitenDigests Rule 11-13 Rules of COurtjoyiveeongNoch keine Bewertungen

- Foreign CorporationsDokument11 SeitenForeign Corporationsjoyiveeong0% (1)

- Caseload 5 DigestsDokument11 SeitenCaseload 5 DigestsjoyiveeongNoch keine Bewertungen

- Pieter Mulder: Jump To Navigation Jump To SearchDokument4 SeitenPieter Mulder: Jump To Navigation Jump To SearchBugme KnottsNoch keine Bewertungen

- National Service Training Program (Ra 9163) : Implementing Rules and Regulations of TheDokument9 SeitenNational Service Training Program (Ra 9163) : Implementing Rules and Regulations of Themonica_gallardo_24100% (1)

- THE LIFE OF A ROMAN CATHOLIC BISHOP RT Rev DR RAYAPPU JOSEPH and Others in DANGERDokument36 SeitenTHE LIFE OF A ROMAN CATHOLIC BISHOP RT Rev DR RAYAPPU JOSEPH and Others in DANGERSri Lanka Guardian100% (1)

- CHAVEZ V. PUBLIC ESTATE AUTHORITY - Private CorporationDokument1 SeiteCHAVEZ V. PUBLIC ESTATE AUTHORITY - Private CorporationMary Dorothy TalidroNoch keine Bewertungen

- United Paracale Vs Dela RosaDokument7 SeitenUnited Paracale Vs Dela RosaVikki AmorioNoch keine Bewertungen

- Lariosa - 3A - Philippines A Century HenceDokument2 SeitenLariosa - 3A - Philippines A Century HenceAllan Gabriel LariosaNoch keine Bewertungen

- 37 Rustan Vs IAC - Conditional ObligationsDokument2 Seiten37 Rustan Vs IAC - Conditional ObligationsJoyelle Kristen TamayoNoch keine Bewertungen

- Esoteric NazismDokument18 SeitenEsoteric NazismGnosticLucifer100% (2)

- MCWD VsJ. King and SonsDokument1 SeiteMCWD VsJ. King and SonsSteve NapalitNoch keine Bewertungen

- Adriano v. de JesusDokument3 SeitenAdriano v. de JesuscrisjavaNoch keine Bewertungen

- Executive Order 02-22 - Revitalizing Anti-Drug Abuse Council - BadacDokument4 SeitenExecutive Order 02-22 - Revitalizing Anti-Drug Abuse Council - BadacCollene FayeNoch keine Bewertungen

- American National Fire Insurance Company, Plaintiff-Appellant-Cross-Appellee v. Thomas J. Kenealy and Diane Kenealy, Defendants-Appellees-Cross-Appellants, 72 F.3d 264, 2d Cir. (1995)Dokument12 SeitenAmerican National Fire Insurance Company, Plaintiff-Appellant-Cross-Appellee v. Thomas J. Kenealy and Diane Kenealy, Defendants-Appellees-Cross-Appellants, 72 F.3d 264, 2d Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- People V Del RosarioDokument2 SeitenPeople V Del RosariocaloytalaveraNoch keine Bewertungen

- Filipino Mulims Issues and Chanllenges (Tobe-Edit)Dokument5 SeitenFilipino Mulims Issues and Chanllenges (Tobe-Edit)JonathanNoch keine Bewertungen

- PDS # 305, 2009 PTCL 433, 99 Tax 196Dokument12 SeitenPDS # 305, 2009 PTCL 433, 99 Tax 196Mohammad Khalid ButtNoch keine Bewertungen

- Maternity Leave PDFDokument1 SeiteMaternity Leave PDFdeep72Noch keine Bewertungen

- Special Power of Attorney To Represent in The CaseDokument2 SeitenSpecial Power of Attorney To Represent in The CaseEligene PatalinghugNoch keine Bewertungen

- Law As An Agent of Social ControlDokument5 SeitenLaw As An Agent of Social ControlShagun VishwanathNoch keine Bewertungen

- Wisconsin V Yoder - Case DigestDokument3 SeitenWisconsin V Yoder - Case DigestgabbieseguiranNoch keine Bewertungen

- Doctrine of Res SubDokument2 SeitenDoctrine of Res SubAdan HoodaNoch keine Bewertungen

- Aarohan Classes For Details Whatsapp 9437002210 Oas Test SeriesDokument49 SeitenAarohan Classes For Details Whatsapp 9437002210 Oas Test SeriesNirupama KhatuaNoch keine Bewertungen

- PH Histo Essay#2 ReyDokument3 SeitenPH Histo Essay#2 ReymkNoch keine Bewertungen

- Dir of Lands v. IAC and EspartinezDokument3 SeitenDir of Lands v. IAC and EspartinezKerriganJamesRoiMaulitNoch keine Bewertungen

- 105 Day Expanded Maternity Leave Law R.A. No. 11210Dokument6 Seiten105 Day Expanded Maternity Leave Law R.A. No. 11210Joseph Tangga-an GiduquioNoch keine Bewertungen

- Gender - Responsive Basic Education PolicyDokument38 SeitenGender - Responsive Basic Education PolicyJoan Tajale de GuzmanNoch keine Bewertungen

- Ople v. TorresDokument1 SeiteOple v. TorresJilliane OriaNoch keine Bewertungen

- History, The Sublime, Terror: Notes On The Politics of Fear: Gene RayDokument10 SeitenHistory, The Sublime, Terror: Notes On The Politics of Fear: Gene Rayjacopo_natoliNoch keine Bewertungen