Beruflich Dokumente

Kultur Dokumente

Dig v27 n4 171

Hochgeladen von

sushmanthqrewrerOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dig v27 n4 171

Hochgeladen von

sushmanthqrewrerCopyright:

Verfügbare Formate

Corporate Finance 49

CORPORATE FINANCE

Agency Problems, Equity Ownership, and

Corporate Diversification

David J. Denis, Diane K. Denis, and Atulya Sarin

Journal of Finance

vol. 52, no. 1 (March 1997):13560

Corporate diversification causes a loss of market value

for the firm. The authors find evidence that the loss of

market value is an agency cost. As the degree of

managerial ownership rises, the degree of corporate

diversification falls. They also find that external corporate control events often precede the divestiture of

corporate segments.

Recent evidence suggests that the costs of corporate diversification outweigh the benefits. The authors test the hypotheses that

managers receive private benefits from diversifying lines of business and that the resulting loss of market value is, therefore, an

agency cost. They also test the hypothesis that effective monitoring of corporate activity reduces the degree of diversification and

thus reduces those agency costs.

Berger and Ofek (Journal of Financial Economics, 1995), Lang

and Stulz (Journal of Political Economy, 1994), and Servaes

(Journal of Finance, 1996) find significant losses in market value

resulting from corporate diversification. Managers, however, may

receive private benefits from diversification in the form of prestige, added compensation, or job security. If managers do receive

those benefits, then the loss of market value associated with diversification is an agency cost borne by the shareholders.

David J. Denis and Diane K. Denis are at Purdue University. Atulya Sarin

is at Santa Clara University. The abstract was prepared by Robert A.

McLean, CFA, the University of Alabama at Birmingham.

The CFA Digest Fall 1997

50 Corporate Finance

The authors use the Value Line universe of firms and restrict their

sample to those firms that had sales of at least $20 million and no

sales in the financial services or regulated utilities industries in

1985, as reported in COMPUSTATs Industry Segment file. The

resulting sample includes 933 firms. They draw data on equity

ownership from the firms last proxy statements prior to December 1984. To measure diversification, the authors use (1) the fraction of firms with multiple segments, (2) the number of segments

reported by management, (3) the number of four-digit SIC codes

that COMPUSTAT assigns the firm, (4) a revenue-based Herfindahl index, and (5) an asset-based Herfindahl index. Finally, the authors use Berger and Ofeks measure of the excess value

associated with diversification: the firms total market value (market value of equity plus book value of debt) minus the imputed

value of the firms segments as stand-alone businesses.

As managers share of equity ownership in the firm increases, the

managers bear a progressively larger share of the agency costs of

diversification. Therefore, the authors hypothesize that as managers share of ownership increases, the degree of diversification

will fall. They test this hypothesis and find a consistent negative

relationship between managers equity share and the degree of diversification.

Amihud and Lev (Bell Journal of Economics, 1981) suggest that

as managers ownership share increases, they will engage in more

diversification in order to reduce personal risk. The authors incorporate that hypothesis into their model by allowing the ownership

share/diversification to be nonlinear. They find some evidence for

Amihud and Levs hypothesis at very high levels of managerial

ownership. The authors note that this evidence applies to only 13

of the 933 firms in the sample. Thus, the vast majority of sample

firms fall into the category in which diversification is negatively

related to managerial ownership.

The authors determine that significant negative excess values are

associated with diversification, but they find little support for the

hypothesis that negative excess values change as the degree of

managerial ownership changes. Furthermore, the authors find that

Association for Investment Management and Research

Corporate Finance 51

changes in the degree of diversification are associated with significant negative excess value (resulting from diversification), corporate control events, and product/market failures.

Diversification causes a loss of market value for firms. The size of

that loss of market value is not related to the degree of managerial

ownership. The degree of diversification, however, falls as the degree of managerial ownership (and, therefore, the degree to which

managers bear agency costs) rises. External corporate control

events, which indicate enhanced market monitoring, often precede

decreases in diversification.

The CFA Digest Fall 1997

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Return of The Quants - Risk-Based InvestingDokument13 SeitenReturn of The Quants - Risk-Based InvestingdoncalpeNoch keine Bewertungen

- Financial Management & Int Finance Study Text P-12Dokument744 SeitenFinancial Management & Int Finance Study Text P-12Saleem Ahmed100% (4)

- Disney Diversification and Swot AnalysisDokument9 SeitenDisney Diversification and Swot Analysisapi-251907197Noch keine Bewertungen

- How To Start Investing in Philippine Stock MarketDokument53 SeitenHow To Start Investing in Philippine Stock MarketAlbert Aromin100% (1)

- Hyundai New Product DevelopmentDokument29 SeitenHyundai New Product DevelopmentDheeraj Kumar100% (2)

- List of Engineers Deployed for Municipal Polls in APDokument8 SeitenList of Engineers Deployed for Municipal Polls in APsushmanthqrewrerNoch keine Bewertungen

- Sa MPL e Coe Ffici Ent of Cor Rela Tion: WrongDokument10 SeitenSa MPL e Coe Ffici Ent of Cor Rela Tion: WrongsushmanthqrewrerNoch keine Bewertungen

- Teaching BrochureDokument26 SeitenTeaching Brochuresushmanthqrewrer100% (1)

- Ryqwerwerew Rwe Rwerwer We Rwe R We Rwe R We Rwe R We R We T Y Trtwe Rwe Trt5e E 3 5) 46 34 3Dokument3 SeitenRyqwerwerew Rwe Rwerwer We Rwe R We Rwe R We Rwe R We R We T Y Trtwe Rwe Trt5e E 3 5) 46 34 3sushmanthqrewrerNoch keine Bewertungen

- Age Cross Tab AnalysisDokument53 SeitenAge Cross Tab AnalysissushmanthqrewrerNoch keine Bewertungen

- HownDokument1 SeiteHownsushmanthqrewrerNoch keine Bewertungen

- Dndnfdsfnsdaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa AaaaaaaaaaaaaDokument2 SeitenDndnfdsfnsdaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa AaaaaaaaaaaaasushmanthqrewrerNoch keine Bewertungen

- FMDokument7 SeitenFMsushmanthqrewrerNoch keine Bewertungen

- Comparitive Study On Mutual Fund: Master of Business AdministrationDokument7 SeitenComparitive Study On Mutual Fund: Master of Business AdministrationsushmanthqrewrerNoch keine Bewertungen

- Go 179Dokument2 SeitenGo 179sushmanthqrewrerNoch keine Bewertungen

- HownDokument1 SeiteHownsushmanthqrewrerNoch keine Bewertungen

- Appl - Form Faculty PositionsDokument4 SeitenAppl - Form Faculty PositionssushmanthqrewrerNoch keine Bewertungen

- (By Order and in The Name of The Governor of Andhra Pradesh) Dr. S.K Joshi Principal Secretary To GovernmentDokument1 Seite(By Order and in The Name of The Governor of Andhra Pradesh) Dr. S.K Joshi Principal Secretary To GovernmentsushmanthqrewrerNoch keine Bewertungen

- Indian Economy 2012-13 Handbook of Statistics by RBIDokument426 SeitenIndian Economy 2012-13 Handbook of Statistics by RBIJhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Indian Economy 2012-13 Handbook of Statistics by RBIDokument426 SeitenIndian Economy 2012-13 Handbook of Statistics by RBIJhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- RBI LIABILITIES AND ASSETSDokument102 SeitenRBI LIABILITIES AND ASSETSsushmanthqrewrerNoch keine Bewertungen

- Accounts ManualDokument521 SeitenAccounts Manualabeed517Noch keine Bewertungen

- Group 1 Syllabus and PatternDokument7 SeitenGroup 1 Syllabus and Patternsai198Noch keine Bewertungen

- ADVT Qualification CWS-1Dokument3 SeitenADVT Qualification CWS-1sushmanthqrewrerNoch keine Bewertungen

- 2014-15 PanchangamDokument161 Seiten2014-15 PanchangamsushmanthqrewrerNoch keine Bewertungen

- ATL Report Draft Version As On June 23rd 2013Dokument28 SeitenATL Report Draft Version As On June 23rd 2013sushmanthqrewrerNoch keine Bewertungen

- MBA R13 Coursestructure and SyllabusDokument80 SeitenMBA R13 Coursestructure and Syllabusraghu_iictNoch keine Bewertungen

- Panchayat Secretary NotificatonDokument18 SeitenPanchayat Secretary NotificatonTelugu VaahiniNoch keine Bewertungen

- Application Guguloth GaneshDokument2 SeitenApplication Guguloth GaneshsushmanthqrewrerNoch keine Bewertungen

- How Do You Rate Your Organization's Performance Appraisal System?)Dokument3 SeitenHow Do You Rate Your Organization's Performance Appraisal System?)sushmanthqrewrerNoch keine Bewertungen

- Seminar ReportDokument24 SeitenSeminar ReportAnup BorseNoch keine Bewertungen

- Ministerial Rules CorrectedDokument68 SeitenMinisterial Rules CorrectedsushmanthqrewrerNoch keine Bewertungen

- Scince&TechnologyDokument11 SeitenScince&TechnologyKranthi Kumar MarojuNoch keine Bewertungen

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument41 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownUsman KWLNoch keine Bewertungen

- Chapter Two: Strategy AnalysisDokument30 SeitenChapter Two: Strategy AnalysissdfdsfNoch keine Bewertungen

- Capital Markets and Pricing of RiskDokument23 SeitenCapital Markets and Pricing of RiskAshesh DasNoch keine Bewertungen

- Wealth ManagementDokument31 SeitenWealth Management16july1994Noch keine Bewertungen

- Coinforex Company ProfileDokument15 SeitenCoinforex Company Profilelewisjr344Noch keine Bewertungen

- Finch 11713Dokument166 SeitenFinch 11713Ali ReynoldsNoch keine Bewertungen

- Roll No. 15 TYBAF Project FileDokument68 SeitenRoll No. 15 TYBAF Project FileNehaNoch keine Bewertungen

- Whitepaper: Version 9.0 - 9 May 2018Dokument54 SeitenWhitepaper: Version 9.0 - 9 May 2018Mongol ZaluuNoch keine Bewertungen

- Chapter 8: International StrategyDokument25 SeitenChapter 8: International StrategyKashif Ullah KhanNoch keine Bewertungen

- Corporate Level StrategyDokument38 SeitenCorporate Level StrategyAishwarya ShivaramNoch keine Bewertungen

- Comparative Study of Mutual FundDokument65 SeitenComparative Study of Mutual Fundsimantt100% (2)

- Tata Mutual Fund Performance and AnalysisDokument69 SeitenTata Mutual Fund Performance and AnalysisGoutham Bindiga100% (1)

- Meet The Manager of SouthRidge CapitalDokument5 SeitenMeet The Manager of SouthRidge CapitalkvisaNoch keine Bewertungen

- Why Interest Rates ChangeDokument15 SeitenWhy Interest Rates ChangeAniket GuptaNoch keine Bewertungen

- Week 7Dokument37 SeitenWeek 7NageenNoch keine Bewertungen

- Industry Profile Journey of Indian Stock MarketDokument16 SeitenIndustry Profile Journey of Indian Stock MarketapurvwebworldNoch keine Bewertungen

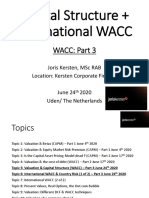

- Capital Structure + International WACCDokument34 SeitenCapital Structure + International WACCSiobhainNoch keine Bewertungen

- Risk and Return: Fourth EditionDokument50 SeitenRisk and Return: Fourth EditionChabby ManarinNoch keine Bewertungen

- Changing Role of Indian BanksDokument25 SeitenChanging Role of Indian BanksImdad HazarikaNoch keine Bewertungen

- Executive Summary: TH NDDokument20 SeitenExecutive Summary: TH NDRocky MahmudNoch keine Bewertungen

- Chapter 6: Corporate-Level Strategy Diversification: Pooled Negotiating Power: ImprovementDokument2 SeitenChapter 6: Corporate-Level Strategy Diversification: Pooled Negotiating Power: ImprovementcaicaiiNoch keine Bewertungen

- ICICI Pru Signature Online Brochure 230331 150752Dokument30 SeitenICICI Pru Signature Online Brochure 230331 150752Tamil PokkishamNoch keine Bewertungen

- Unit - 3Dokument25 SeitenUnit - 3ShriHemaRajaNoch keine Bewertungen

- Mutual Fund and Insurance SellingDokument39 SeitenMutual Fund and Insurance SellingsashumaruNoch keine Bewertungen

- Summer Internship Project - Sharang Dev - CMBA2Y3Dokument55 SeitenSummer Internship Project - Sharang Dev - CMBA2Y3Kausik BhagatNoch keine Bewertungen