Beruflich Dokumente

Kultur Dokumente

Effectiveness of Technical Analysis in Banking Sector of Equity Market

Hochgeladen von

Sriranga G HOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Effectiveness of Technical Analysis in Banking Sector of Equity Market

Hochgeladen von

Sriranga G HCopyright:

Verfügbare Formate

IOSR Journal of Business and Management (IOSR-JBM)

e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 16, Issue 7. Ver. V (July. 2014), PP 20-28

www.iosrjournals.org

Effectiveness of Technical Analysis in Banking Sector of Equity

Market.

Mrs.J.Nithya, Dr.G.Thamizhchelvan

Department of Commerce and International Business, Dr.GRD College of Science.

Abstract: This study is aimed at undertaking technical analysis of selected companies included in the CNX

Nifty. The project also demonstrates how technical analysis can be of valuable use for the investors in marking

their investment decisions. To analyze tools of technical analysis can be used in forecasting stock prices. To find

the right stock for investment and to provide the justification for the investment based on the candlestick charts

and indicators. To know the movements (upward or downward) of stock prices of selected company stocks

through Technical analysis.The descriptive method is used to study the price trend of fifteen stocks using MACD

and RSI charting technique of technical analysis. The data used for analysis is secondary data obtained from

the spider software for technical analysis. The sampling method used in this research is simple random

sampling. The three banking companies are taken from the NSC quoted stocks where more than 9000

companies were listed.

Key Words: convergence, divergence, investor optimism, investor pessimism, oscillators

I.

Introduction

Technical Analysis is important to form a view on the likely trend of the overall market, and it is

helpful to have some idea of how to go about selecting individual stocks. Naturally, all investors would like

their investments to appreciate rapidly in price, but stocks, which may satisfy this wish, tend to accompanied by

a substantially greater amount of risk then many investors are normally willing to accept. However, it is

important to understand that investors can be very conscious when it comes to stock ownership.

Technical analysis or charting is considered to be as a supplement to Fundamental Analysis of

securities. Technical analysis can be applied to any market with a comprehensive price history. The premises of

technical analysis were derived from empirical observations of financial markets over hundreds of years.

Perhaps the oldest branch of technical analysis is the use of candlestick techniques by Japanese traders at least

as early as the 18th century, and still very popular today. Stock markets have now turned to be one of the

favourable sectors for investment. The prime reason for the same can be attributed to the overwhelming returns

that the market has provided to the investors during the years. The investment pattern will differ according to the

stocks considered and the risk appetite of the investor.

1.1 Dow Theory- Its Cornerstone

New tools and theories have been produced and existing tools have been enhanced at a rapid rate in

recent decades, with an increasing emphasis on computer-assisted techniques. Technical analysis is not

concerned with why a price is moving but rather whether it is moving in a particular direction or in a particular

chart pattern. Technical analysts believe that profits can be made by "trend following." In other words if a

particular stock price is steadily rising then a technical analyst will look for opportunities to buy this stock. Until

the technical analyst is convinced this uptrend has reversed or ended, all else equal, he will continue to own this

security. Additionally, technical analysts look for various price patterns to form on a price chart and will take

positions in anticipation of the expected move following that pattern. The various tools of technical analysis

assist the technician in determining when trends have formed, ended, etc. and when particular patterns are

unfolding.

1.2 Technical Analysis: The Basic Assumptions

Technical analysis is a method of evaluating securities by analysing the statistics generated by market

activity, such as past prices and volume. Technical analysts do not attempt to measure a security's intrinsic

value, but instead use charts and other tools to identify patterns that can suggest future activity. The field of

technical analysis is based on three assumptions:

1. The market discounts everything.

2. Price moves in trends.

3. History tends to repeat itself.

www.iosrjournals.org

20 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

II.

Statement Of The Problem

Stock investment requires meticulous planning and careful evaluation of the underlying stock before

making investment. A statistical data in the recent past indicated that 95 per cent of the investors in the stock

markets are losers, since they undertake investment without any information and without discipline.

Which stock to invest?

What type of security to buy?

When to sell the securities?

Where to Invest?

How to Invest?

Whether hold, sell or buy securities?

It is much required for the investors to study the market and to understand market psychology so that they can

make optimal decisions

Objectives of the Study

The following are the main objectives of this study,

To find the right stock for investment and to provide the justification for the investment based on the

candlestick charts and indicators.

To know the movements of stock prices of selected company stocks through Technical analysis.

To know how best we can utilize these analyses to meet the financial goals.

Research Design

This study is descriptive research. The descriptive method is used to study the price trend of fifteen

stocks using MACD and RSI charting technique of technical analysis. The sampling method used in this

research is simple random sampling. The fifteen companies are taken from the NSC quoted stocks where more

than 9000 companies were listed. This study has been done for the calendar year Jan2013 to Feb2014. The

Probability sampling method is used by the researcher. The sampling technique used here is Purposive

sampling. The data used in this study are publicly available data collected from secondary source. The major

source of the data is the website of NSE India.

Statistical Tools Used

Most analysis is done for the short or intermediate-term, but some technicians also predict long-term

cycles based on charts, technical indicators, oscillators and other data. Examples of common technical indicators

include relative strength index, Money Flow Index, Stochastic, MACD and Bollinger bands. Technical

indicators do not analyse any part of the fundamentals of a business, like earnings, revenue and profit margins.

Technical indicators are used extensively by active traders, as they are designed primarily for analysing shortterm price movements. The most effective uses of technical indicators for a long-term investor are to help them

to identify good entry and exit points for a stock investment by analysing the short and long-term trends

III.

Review Of Literature

C. L. Osler (2001) provides a micro structural explanation for the success of two familiar predictions from

technical analysis: (1) trends tend to be reversed at predictable support and resistance levels, and (2) trends gain

momentum once predictable support and resistance levels are crossed. There are marked differences between the

clustering patterns of stop-loss and take-profit orders, and between the patterns of stop-loss buy and stop-loss

sell orders. These differences explain the success of the two predictions. CESARI, R. and D. CREMONINI,

Gupta, (2003) examined the perceptions about the main sources of his worries concerning the stock market. A

sample comprise of middle-class households spread over 21 sates/union territories. The study reveals that the

foremost cause of worry for household investors is fraudulent company management and in the second place is

too much volatility and in the third place is too much price manipulation. Ravindra and Wang (2006) examine

the relationship of trading volume to stock indices in Asian markets. Stock market indices from six developing

markets in Asia are analysed over the 34 month period ending in October 2005. In the South Korean market, the

causality extends from the stock indices to trading volume while the causality is the opposite in the Taiwanese

market. Subrata Kumar Mitra (2002) has identified persuasive reasons to believe the relationship between

stock prices and determinants are complex nonlinear process. The analysis was performed by using moving

average and filters combination of stock prices of ACC, Reliances industries, State bank of India, TISCO and

BSE index. He found the profitability changes widely with changes of periods and the two methods are giving

profitable results that help us to believe that making profits in stock market is not just a matter of chance and

there is need of analytical and systematic approaches to making profits in cumulative basis. Parvez Ahmed,

Kristine Beck, Elizabeth Goldreyer (2005) studies the efficacy of using moving average technical trading

rules with currencies of emerging economies. If technical trading rules are successful, they can become a risk

www.iosrjournals.org

21 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

management tool for multinational firms and investors in emerging markets. They use 4 Variable Length

Moving Average (VMA) trading models and compare them to a simple buy and hold strategy. Results support

the effectiveness of trading models, which imply the presence of strong serial correlation among currency

returns for emerging markets. Hence, the predictability of future currency prices will allow investors to create

effective hedges in the often volatile emerging markets. Muhannad A. Atmeh, Ian M. Dobbs (2006)analysis

the performance of moving average trading rules in Jordanian stock market. The conditional returns on buy or

sell signals from actual data are examined for a wide range of trading rules. These are compared with

conditional returns from simulated series generated by a range of models (random walk with a drift, AR (1), and

GARCH-(M)) and the consistency of the general index series with these processes is examined. The empirical

results show that technical trading rules can help to predict market movements, and that there is some evidence

that (short) rules may be profitable after allowing for transactions costs, although there are some cautions on

this.MassoudMetghalchi, Jianjun Du, YixiNing (2009) tests two moving average technical trading rules for 4

Asian markets. Identify that moving average rules do indeed have predictive power and can discern recurring

price patterns for profitable trading. It supports the hypothesis that technical trading rules can outperform the

buy-and-hold strategy. Break-even one-way trading costs are estimated to be high for all 4 markets. It was

concluded from the statistical results that moving average rules are valid and indeed have predictive power. It is

implied that the trading rules may be used to design a trading strategy that will beat the buy-and-hold strategy in

the Hong Kong, Singapore, South Korea, and Taiwan markets.

IV.

EXPLORING OSCILLATORS AND INDICATORS

4.1. MACD: Moving Average Convergence and Divergence

The moving average convergence divergence (MACD) is one of the most well known and used

indicators in technical analysis. It is used to signal both the trend and momentum behind a security.

In Common, the MACD is a trend following, momentum indicator that shows the relationship

between two moving averages of prices. To Calculate the MACD subtract the 26-day EMA from a 12-day

EMA. A 9-day dotted EMA of the MACD called the signal line is then plotted on top of the MACD.

Here is a visual example using stock price

Figure 1: Moving Average Convergence Divergences (MACD)

Notice that back, in September the stock price dropped well below its 50-day average (the green line)

there has been a steady downward trend since then and no really strong divergence until the end of December

when it rose above its 50-days average and continued to rise for several weeks.

The most commonly used moving average values are 26-day and 12-day EMAs for the MACD

calculation and a nine-day EMA of the MACD for the signal line. These values can be adjusted to meet the

needs of the technician and the security. For more volatile securities shorter term averages are used while less

volatile securities should have longer averages.

4.2.Relative Strength Index RSI

The relative strength index (RSI) is another one of the most frequently used and well known

momentum indicators in technical analysis. It is used to signal overbought and oversold conditions in a security.

The indicator is plotted between a range of zero to 100 where 100 is the highest overbought condition and zero

is the highest oversold condition. The RSI helps to measure the strength of a security's recent up moves

compared to the strength of its recent down moves. This helps to indicate whether a security has seen more

buying or selling pressure over the trading period.

www.iosrjournals.org

22 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

Calculation

Like most indicators there are two general ways in which the indicator is used to generate signals crossovers and divergence. In the case of the RSI, the indicator uses crossovers of its overbought, oversold and

centreline.

The first technique is to use overbought and sold lines to generate buy-and-sell signals. In the RSI, the

overbought line is typically set at 70 and when the RSI is above this level the security is considered to be

overbought. The security is seen as oversold when the RSI is below 30. These values can be adjusted to either

increase or decrease the amount of signals that are formed by the RSI.

Figure: 3

A buy signal is generated when the RSI breaks the oversold line in an upward direction, which means

that it goes from below the oversold line to moving above it. A sell signal is formed when the RSI breaks the

overbought line in a downward direction crossing from above the line to below the line.

Another crossover technique used in formulating signals is using the centreline (50). This technique is exactly

the same as using the overbought and oversold lines to formulate signals. This technique will often form signals

after a movement in the direction they are predicting but are used more as a confirmation then a signal compared

to the other techniques. The relative strength indicator focuses on the momentum underlying the security and is

a great secondary measure to be used by traders. It is important to note that the RSI is often not used as the sole

generation of buy-and-sell signals but used in conjunction with other indicators and chart patterns.

4.3.About Companies:

Can Bk

Canara Bank provides various banking products and services primarily in India. It offers personal

banking products and services, including savings, current, and salary accounts, as well as re-investment plans,

tax saver and gold schemes, recurring deposits, deposit schemes for senior citizens and children, unclaimed

deposits, and fixed deposits; and loan products, such as housing, home improvement, vehicle, site, personal,

teachers, gold, online education, and consumer loans, as well as loans against shares/debentures/bonds/units,

loans for senior citizens and owners of the property against rents receivable, mortgages, reverse mortgage loans

for senior citizens, and loans for medical practitioners.

IDBI

IDBI Bank Ltd. is a Universal Bank with its operations driven by a cutting edge core Banking IT

platform. The Bank offers personalized banking and financial solutions to its clients in the retail and corporate

banking arena through its large network of Branches and ATMs, spread across length and breadth of India. We

have also set up an overseas branch at Dubai and have plans to open representative offices in various other parts

of the Globe, for encasing emerging global opportunities. Our experience of financial markets will help us to

effectively cope with challenges and capitalize on the emerging opportunities by participating effectively in our

countrys growth process. The Bank had an aggregate balance sheet size of Rs. 3, 22,769 crore and total

business of Rs 4, 23,423 crore as on March 31, 2013. IDBI Bank's operations during the financial year ended

March 31, 2013 resulted in a net profit of Rs. 1882 crore.

www.iosrjournals.org

23 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

Ingyysya Bk

ING Vysya Bank is a privately owned Indian multinational bank based in Bangalore, with retail, wholesale,

and private banking platforms formed from the 2002 purchase of an equity stake in Vysya Bank by the Dutch

ING Group. As of March 2013, ING Vysya is the seventh largest private sector bank in India with assets

totalling 54836 crore (US$8.8 billion) and operating a pan-India network of over 1,000 outlets, including 527

branches, which service over two million customers. ING Group, the highest-ranking institutional shareholder,

currently holds a 44% equity stake in ING Vysya Bank, followed by Aberdeen Asset Management, private

equity firm Chrys Capital, Morgan Stanley, and Citigroup, respectively.

V.

RESULTS AND DISCUSSIONS OF MACD AND RSI

5.1.1 Moving average convergence and divergence (MACD):It indicates CAN BK, for the period January 2013 to 20 February 2014

It can be observed that the moving average lines (EMA-9 and EMA-21) had 14 crossovers during the past 1

year. The stock of CAN BK was range bound for the past 1year between the prices of Rs.200 to Rs.450. The

fourth cross over in the beginning of April13 shows the signal to buy and the EMA9 shows an uptrend till

beginning of May13 which lasted for only one month The eight crossovers in August 2013 indicated the trend

would turn bearish; prices dipped from Rs.400 to Rs.325, but were not able to sustain for longer period. The

divergence in eighth cross over at the end of September2013 was so prominent and clear. It also indicated the

reversal of patterns to bearish trend. It can be clearly interpreted when the EMA 9 cuts EMA 21 from below; it

indicates the arrival of bullish phase.

Graph 5.1.1 MACD OF CAN BK

After a sharp correction the prices turned bullish in the month of Oct13 but the prices of the stock was

range bound Rs.200 to Rs.275 from Oct13 till now. The volume of trading was high in the previous three

months.

5.1.2 Relative Strength Index: RSI

It indicates CAN BK, for the period Jan 2013 to 20 February 2014

Graph 5.1.2 RSI OF CAN BK

The RSI indiacator follows the 30:70 rule and it shows the stocks of CAN BK fluctuates between the

support and resistance level of only nine times during the year. The stock touches resistance level in the months

of Mar,Aug,Sep13 and end of Jan14.This indicates the upward market trends associated with increasing

www.iosrjournals.org

24 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

investor confidence and increased investing in anticipation of future price rise stocks are oversold.This is

generally interpreted as a sign of the stock is becoming over valued and indication of bullish markets.

It is also inferred that stocks nears the support level four times in the month of April, May and Novand

Dec13.This indicates the downward market trends so stocks are over bought(Predcition to sell).It is a transition

from high investor optimism to wide spread investor pessimism. The RSI indicator provided an indication that

the stock reached over sold regions (Prediction to buy) in the end of Jan14 and overbought signal (Prediction to

sell) in Nov and Dec13.

5.2.1 Moving average convergence and divergence (MACD):It indicates IDBI, for the period January 2013 to 20 February 2014

Graph 5.2.1 MACD OF IDBI

The stock of IDBI was range bound for the past 6 months between the prices of Rs.56 to Rs.70. It can

be observed that the moving average lines (EMA-50 and EMA-100) had 12 crossovers during the past 1 year.

The appearance of shooting star in the month of May 2013 indicated an end to the uptrend and the reversal of

uptrend is clearly indicated by the inverted hammer. For the past 9 months the IDBI shows the highest price of

Rs.90 in the month of May13.MACD shows the buy signal in the month of feb14 for only lesser profits.

5.2.2 RELATIVE STRENGTH INDEX: RSI

It indicates IDBI, for the period Jan 2013 to 20 February 2014

Graph 5.2.2 RSI OF IDBI

From the above chart, the RSI indiacator follows the 30:70 rule and it shows the stocks of IDBItouches

the resistance level sixteen times during the year. This indicates the upward market trends associated with

increasing investor confidence so stocks are oversold.This is generally interpreted as a sign of the stock is

becoming over valued and indication of bullish markets.The IDBI stock shows the strong resistance level at

Rs.62, once the stock breaks the first resistance, it is better to go for stock with the target of Rs.Rs.90 in 2

months.It is also inferred that stocks nears the support level threee times in the month of April, May and

Nov13.This indicates the downward market trends so stocks are over bought.It is a transition from high

investor optimism to wide spread investor pessimism. The RSI indicator provided an indication that the stock

reached overbought (Prediction to sell) in Nov13 and over sold regions (Prediction to buy) in the end of Jan14indicating buy and sell signals respectively.

www.iosrjournals.org

25 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

5.3.1 Moving average convergence and divergence (MACD):It indicates INGVYSYA BK, for the period January 2013 to 20 February 2014

Graph 5.3.1 MACD OF INGVYSYA BK

It can be observed that the moving average lines (EMA-9 and EMA-21) had 12 crossovers during the

past 1 year. The stock of INGVYSYA BK was range bound for the past 1year between the prices of Rs.425 to

Rs.650. We can observe Doji in the end of July2013. The third cross over in the end of April13 shows the

signal to buy and the EMA-50 shows an uptrend till May13. The seventh crossover in the mid of August 2013

indicated the trend would turn bearish; prices dipped but was not able to sustain for longer period. The

divergence in eighth cross over at the end of September2013 was so prominent and clear. It also indicated the

reversal of patterns to bullish trend. It can be clearly interpreted when the EMA 9 cuts EMA 21 from below; it

indicates the arrival of bullish phase. After a sharp correction the prices turned bullish and reached new high

range bound from Rs. 475 to Rs.575 till mid of October 2013.The volume of trading was high in the month of

June13. The MACD shows the buy signal in the beginning of February14.

5.3.2 RELATIVE STRENGTH INDEX: RSI

It indicates INGVYSYA BK, for the period Jan 2013 to 20 February 2014

Graph 5.3.2 RSI OF INGVYSYA BK

From the above chart, the RSI indiacator follows the 30:70 rule and it shows the stocks of INGVYSYA

BK touches the resistance level thirteen times during the months Feb, march, Aug,Sep,Jan and Feb2014. This

indicates the upward market trends associated with increasing investor confidence so stocks are oversold.This is

generally interpreted as a sign of the stock is becoming over valued and indication of bullish market.

It is also inferred that stocks touches support level six times in the month of Jan, April, May,June13.This

indicates the downward market trends so stocks are over bought.It is a transition from high investor optimism

to wide spread investor pessimism.The RSI indicator provided the trend reversal indication that the stock

reached over sold regions (Prediction to buy) in the end of Aug, Sep13 and Feb14 and overbought (Prediction

to go for sell) in Apr,May and June13.

www.iosrjournals.org

26 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

VI.

FINDINGS AND RECOMMENDATIONS

FINDINGS:

1. The IDBI stock shows the strong resistance level at Rs.62, once the stock breaks the first resistance, it

is better to go for stock with the target of Rs.Rs.90 in 2 months.

MACD shows the buy signal in the month of Feb14 for only lesser profits.

2. The stock of INGVYSYA BK was range bound for the past 1year between the prices of Rs.425 to

Rs.650. The MACD shows the buy signal in the beginning of February14, indicates the upward

market trends associated with increasing investor confidence so stocks are oversold.

3. CANBK has shown only lesser growth, but the traded volume increased in the past quarter of 2013.

The MACD lines show the buy signal and RSI also shows the oversold position of the stock.

Suggestions and Recommendations:

The investment in stocks is based on the risk appetite of the investor. Hence the investments suggested

for the year Jan2013 to Feb14 for various categories of investors from the stocks considered for analysis are as

follows:

Low Risk Appetite Investor

INGVYSYABK is a low stock and returns are guaranteed over longer period of time.

Medium Risk Appetite Investor

IDBI is a large cap stocks and although they have shown lesser or negative returns during the past one

year, they have the capability to rebound back in next six months. The stocks show significant trend reversal

patterns and chances of bullish trend are available.

High Risk Appetite Investor

CANBK has undergone severe price correction and it is available at a low price for investors. But the

stock seems range bound and is likely to give returns only in 2 or 3 years. CANBK has also undergone

correction and high divergence between the crossovers.

VII.

CONCLUSION

Technical analysis is a useful technique in guiding investment decisions. In light of our study on fifteen

companies, we have seen how technical analysis can be used to predict the possible futures swings of stock

prices. After analysing the companies, the following conclusion was drawn.

According to RSI as the Gain increases, there is increase in the RSI value, which indicates that there is

increase in the share price. This states to the investor that it is a strong sell signal. Whenever there is decrease in

the share price value, RSI value decreases which indicates the investor that it is a strong buy signal. In general,

we can conclude from the result that technical indicators can play useful role in the timing stock market entry

and exit. By applying technical indicators brokers or investors enjoy substantial profit. Technical analysis

cannot be answer for the questions faced by analyst. It has to be in combination with fundamental analysis to

have maximum effect.

Analysis can offer great insight but if used improperly, they can also produce false signals. As the stock

prices are dynamic in nature, combination of Fundamental analysis and technical analysis will increases the

percentage of accuracy and thus giving an idea to the investor to invest in that stock which will yield him good

returns.

Technical analysis gives investor a better understanding of the stocks and also gives them right

direction to go on further to buy or sell the stocks .Investors must also take into account various factors like

Government of India budget, company performance, political and social events, climatic conditions etc. before

any decision is made. The scrip should also be fundamentally good. Therefore, the small investors and traders

should not blindly make an investment rather they should analyse using the various tools to check if the scrip is

technically strong.

REFERENCES

[1].

[2].

[3].

[4].

Barber, Brad M., Terrance Odean (2000). Trading is hazardous to your wealth: The common stock investment

performance of individual investors. Journal of Finance, 55, p 773- 806.

Edwards, Magee (1997) Technical Analysis of Stock Trends. Fifth edition, Boston: John Magee Inc: 1997.

Eugene F.Fama (1965). The Study of Stock Prices. Journal of Business, January 1965

Fernando Fernndez-Rodrguez, SimNSosvilla-Rivero, Julin Andrada-Flix (1999). Technical Analysis in the

Madrid Stock Exchange, FEDEA D.T.99-05, p 1-29

www.iosrjournals.org

27 | Page

Effectiveness of Technical Analysis in Banking Sector of Equity Market.

[5].

[6].

[7].

[8].

[9].

[10].

[11].

[12].

[13].

[14].

[15].

Gupta, L.G (2003). Stock Market Investors Biggest Worries Today. Portfolio Organiser. Vol.41, No.5, 2003, p 4751.

LeBaron, B. (1999). Technical trading rule profitability and foreign exchange intervention .Journal of International

Economics, Vol. 49, p 125-143.

Levich, R., Thomas, L. (1993). The significance of technical trading rule profits in the foreign exchange market: A

bootstrap approach. Journal of International Money and Finance, Vol.12, p 451-474.

Lo, Andrew, Harry Mamaysky, Jiang Wang (2000). Foundations of Technical Analysis, Journal of Finance 54, p

1705-65.

Neely, C. J., Weller, P. (1998). Technical training rules in the EMS. Journal of International Money and Finance

18, p 429-458.

Nefti, S. N. (1991). Naive trading rules in financial markets and Wiener-Kolmogorov prediction theory: A study of

technical analysis. Journal of Business 64, p 549-571.

Osler, C.L. (2000).Support for Resistance: Technical Analysis and Intraday Exchange Rates, Federal Reserve Bank

of New York Economic Policy Review 6 , p 53-65. A

Ravindra, K., Y. Wang, (2006). The causality between stock index returns and volumes in the asian equity

markets. Journal of International Business. Res., 5, p 63-74.

J. L. Sharma, Robert E. Kennedy (1977). A comparative analysis of stock price behavior on the Bombay, London

and New York stock exchange. Journal of Financial and Quantitative Analysis, Vol. 12, No.3, p 391 - 394[20]

Prasanna Chandra, Investment Analysis & Portfolio Management. 3rd edition, 2008

Bodie& Kane, Securities Analysis & Portfolio Management. 6 th edition, 2004

Websites

www.nseindia.com

http://www.indiainfoline.com

www.in.yahoo.finance.com

www.bseindia.com

www.icharts.com

www.iosrjournals.org

28 | Page

Das könnte Ihnen auch gefallen

- Technical Analysis SynopsisDokument15 SeitenTechnical Analysis Synopsisfinance24100% (1)

- Statement of The ProblemDokument4 SeitenStatement of The ProblemsunilNoch keine Bewertungen

- Technical Analysis of Indian Pharma CompaniesDokument3 SeitenTechnical Analysis of Indian Pharma CompaniesRaj KumarNoch keine Bewertungen

- Technical AnalysisDokument11 SeitenTechnical AnalysisnimbarknimawatNoch keine Bewertungen

- Dmb1921111 Final SipDokument14 SeitenDmb1921111 Final SipMinal Sunil PawarNoch keine Bewertungen

- IJRAR21D1055Dokument23 SeitenIJRAR21D1055Mansi ChauhanNoch keine Bewertungen

- Forecasting Stock Trend Using R and Technical IndicatorsDokument14 SeitenForecasting Stock Trend Using R and Technical Indicatorsmohan100% (1)

- Investment Decision Making Using Technical Analysis: A Study On Select Stocks in Indian Stock MarketDokument10 SeitenInvestment Decision Making Using Technical Analysis: A Study On Select Stocks in Indian Stock MarketSachin AntonyNoch keine Bewertungen

- Varshini EquityresearchusingtechnicalanalysisDokument10 SeitenVarshini EquityresearchusingtechnicalanalysisNeeraj KumarNoch keine Bewertungen

- Equity Research Using Technical Analysis: July 2019Dokument10 SeitenEquity Research Using Technical Analysis: July 2019Siva RajNoch keine Bewertungen

- Technic AnalysisDokument66 SeitenTechnic AnalysisqrweqtweqtqNoch keine Bewertungen

- A Study On Technical Analysis of Select Listed Companies in Bse With Referene To KarvyDokument12 SeitenA Study On Technical Analysis of Select Listed Companies in Bse With Referene To KarvyRaj KumarNoch keine Bewertungen

- Technical Analysis Report on Ventura SecuritiesDokument65 SeitenTechnical Analysis Report on Ventura Securitiesaurorashiva1Noch keine Bewertungen

- Balaji ProjectDokument72 SeitenBalaji ProjectDeepak RanjanNoch keine Bewertungen

- Introduction to Technical AnalysisDokument76 SeitenIntroduction to Technical Analysispandukrish0143Noch keine Bewertungen

- Vinod PJCT NEWDokument90 SeitenVinod PJCT NEWmanojNoch keine Bewertungen

- 1 Technical AnalysisDokument12 Seiten1 Technical Analysismonik shahNoch keine Bewertungen

- Stock Market Analysis of Top Indian Power CompaniesDokument76 SeitenStock Market Analysis of Top Indian Power CompaniesRohit AggarwalNoch keine Bewertungen

- Technical analysis of PSUDokument42 SeitenTechnical analysis of PSUVignesh HollaNoch keine Bewertungen

- Nihar - TECHNICAL ANALYSISDokument56 SeitenNihar - TECHNICAL ANALYSISNihar SavaliyaNoch keine Bewertungen

- Technical AnalysisDokument94 SeitenTechnical AnalysisPranav Vira100% (1)

- Technical Analysis Tools for Stock PredictionDokument82 SeitenTechnical Analysis Tools for Stock PredictionwqewqdefeNoch keine Bewertungen

- Project Report On Banking Sector Stocks by Using Technical AnalysisDokument12 SeitenProject Report On Banking Sector Stocks by Using Technical Analysisaurorashiva167% (3)

- Technicalanalysis Astudyonselectedstocks 120105030453 Phpapp02Dokument76 SeitenTechnicalanalysis Astudyonselectedstocks 120105030453 Phpapp02Ankita DoddamaniNoch keine Bewertungen

- Market Dynamism and Few Indicators of Technical AnalysisDokument85 SeitenMarket Dynamism and Few Indicators of Technical AnalysisDivya VootkuruNoch keine Bewertungen

- Chethan Project SynopsisDokument6 SeitenChethan Project Synopsischethan halandurNoch keine Bewertungen

- A Study On All The Technical Tools and Indicators Used To Predict Movement of Equity SharesDokument26 SeitenA Study On All The Technical Tools and Indicators Used To Predict Movement of Equity Sharesashishmaharana188Noch keine Bewertungen

- The Paper Also Discusses Suggestions For Future Research in Combing Impact of The Fundamental and Technical AnalysisDokument7 SeitenThe Paper Also Discusses Suggestions For Future Research in Combing Impact of The Fundamental and Technical AnalysisHarleen KaurNoch keine Bewertungen

- Stock Price Prediction Using Machine LearningDokument15 SeitenStock Price Prediction Using Machine LearningIJRASETPublications100% (1)

- Securities Analysis and Portfolio Management: Prices Usually Always Move in TrendsDokument8 SeitenSecurities Analysis and Portfolio Management: Prices Usually Always Move in TrendsStuti Jain100% (1)

- Technical Analysis of Bank StocksDokument88 SeitenTechnical Analysis of Bank StocksjainisvishalNoch keine Bewertungen

- Intelligent Prediction Model of Shanghai CompositeDokument20 SeitenIntelligent Prediction Model of Shanghai Compositeمحمد عبدالله عباسNoch keine Bewertungen

- Cory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisDokument43 SeitenCory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisRahul ChaudharyNoch keine Bewertungen

- Investment Model ProjectDokument76 SeitenInvestment Model ProjectPulkit JainNoch keine Bewertungen

- Paes ReligareDokument8 SeitenPaes ReligareMubeenNoch keine Bewertungen

- Research Study On Technical Analysis of Dc21acfbDokument22 SeitenResearch Study On Technical Analysis of Dc21acfbABOOBAKKERNoch keine Bewertungen

- Technical Analysis On Nifty Sectors Final Synopsis ReportDokument10 SeitenTechnical Analysis On Nifty Sectors Final Synopsis ReportFuzail ArabNoch keine Bewertungen

- Stock Market Prediction of NIFTY 50 IndexDokument25 SeitenStock Market Prediction of NIFTY 50 IndexappuNoch keine Bewertungen

- Project On Technical AnalysisDokument82 SeitenProject On Technical Analysistulasinad12375% (8)

- Balaji ProjectDokument72 SeitenBalaji ProjectGediya RockyNoch keine Bewertungen

- Importance of Technical and Fundamental Analysis and Other Strategic Factors in The Indian Stock MarketDokument39 SeitenImportance of Technical and Fundamental Analysis and Other Strategic Factors in The Indian Stock MarketArkajeet PaulNoch keine Bewertungen

- Questionnaire Stock MarketDokument18 SeitenQuestionnaire Stock Marketprateek gangwaniNoch keine Bewertungen

- Investment Assignment (Yitagesu Wondachew)Dokument9 SeitenInvestment Assignment (Yitagesu Wondachew)yitNoch keine Bewertungen

- Technical and Fundamental Stock AnalysisDokument22 SeitenTechnical and Fundamental Stock AnalysismoltenadNoch keine Bewertungen

- A Study On Stock and Investment Decision Using Fundamental and Technical AnalysisDokument12 SeitenA Study On Stock and Investment Decision Using Fundamental and Technical AnalysispavithragowthamnsNoch keine Bewertungen

- Bond and Equity Trading Strategies UZ Assignment 2Dokument15 SeitenBond and Equity Trading Strategies UZ Assignment 2Milton ChinhoroNoch keine Bewertungen

- Trends and TA in StocksDokument5 SeitenTrends and TA in StocksUzair UmairNoch keine Bewertungen

- Applied Sciences: Prediction of Stock Performance Using Deep Neural NetworksDokument20 SeitenApplied Sciences: Prediction of Stock Performance Using Deep Neural NetworksLuiz RamosNoch keine Bewertungen

- Technical Analysis of Public Sector Unit Project ReportDokument42 SeitenTechnical Analysis of Public Sector Unit Project Reportdhiraj singhNoch keine Bewertungen

- Analysis of State Bank of IndiaDokument88 SeitenAnalysis of State Bank of IndiaSadhan Kumar100% (1)

- The Technical Analysis For Gaining Profitability On Large Cap StocksDokument7 SeitenThe Technical Analysis For Gaining Profitability On Large Cap StocksBhaskar PatilNoch keine Bewertungen

- Technical Analysis of StockDokument77 SeitenTechnical Analysis of StockBhavesh RogheliyaNoch keine Bewertungen

- Difference Between Fundamental and Technical AnalysisDokument6 SeitenDifference Between Fundamental and Technical Analysistungeena waseemNoch keine Bewertungen

- Sapm Report SanDokument53 SeitenSapm Report Sansandheepvs6132Noch keine Bewertungen

- Technical AnalysisDokument5 SeitenTechnical AnalysisNiño Rey LopezNoch keine Bewertungen

- Technical Analysis Portfolio ConstructionDokument4 SeitenTechnical Analysis Portfolio ConstructionChandrashekhar ChanduNoch keine Bewertungen

- Shree Devi Institute of Technology: Synopsis On The TopicDokument6 SeitenShree Devi Institute of Technology: Synopsis On The TopicVinod Manoj SaldanhaNoch keine Bewertungen

- CHP 8. Security Analysis ConceptDokument16 SeitenCHP 8. Security Analysis Conceptowusujeffery18Noch keine Bewertungen

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongVon EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongNoch keine Bewertungen

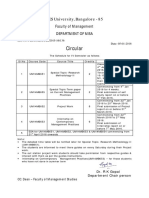

- Circular - Schedule (Revised)Dokument1 SeiteCircular - Schedule (Revised)Sriranga G HNoch keine Bewertungen

- Reliance Life Insurance AwardsDokument1 SeiteReliance Life Insurance AwardsSriranga G HNoch keine Bewertungen

- Commodity Market Study at KarvyDokument193 SeitenCommodity Market Study at KarvySriranga G HNoch keine Bewertungen

- Calculate 3-Day Moving Averages in ExcelDokument3 SeitenCalculate 3-Day Moving Averages in ExcelSriranga G HNoch keine Bewertungen

- MPRA Paper 60793Dokument8 SeitenMPRA Paper 60793Sriranga G HNoch keine Bewertungen

- 13841Dokument13 Seiten13841Sriranga G HNoch keine Bewertungen

- Chart No. Particulars Page No.: List of ChartsDokument1 SeiteChart No. Particulars Page No.: List of ChartsSriranga G HNoch keine Bewertungen

- Technical Analysis Workshop Series Session One Trend IndicatorsDokument61 SeitenTechnical Analysis Workshop Series Session One Trend IndicatorsSriranga G H100% (1)

- ChitraDokument5 SeitenChitraSruthi BalakrishnanNoch keine Bewertungen

- Research Paper LRDokument7 SeitenResearch Paper LRSriranga G HNoch keine Bewertungen

- Technical S AnalysisDokument3 SeitenTechnical S AnalysisSarvesh SinghNoch keine Bewertungen

- An Empirical Study On Technical Analysis: GARCH (1, 1) ModelDokument18 SeitenAn Empirical Study On Technical Analysis: GARCH (1, 1) ModelSriranga G HNoch keine Bewertungen

- Technical indicators A-WDokument4 SeitenTechnical indicators A-WSriranga G HNoch keine Bewertungen

- A Study On Technical Analysis of New Private Sector Banking Stocks in IndiaDokument14 SeitenA Study On Technical Analysis of New Private Sector Banking Stocks in IndiaSriranga G HNoch keine Bewertungen

- TechDokument7 SeitenTechSriranga G HNoch keine Bewertungen

- Calculate 3-Day Moving Averages in ExcelDokument3 SeitenCalculate 3-Day Moving Averages in ExcelSriranga G HNoch keine Bewertungen

- Future Outlook of PrudentialDokument1 SeiteFuture Outlook of PrudentialSriranga G HNoch keine Bewertungen

- EpisodesDokument54 SeitenEpisodesSriranga G HNoch keine Bewertungen

- Reliance Life Insurance AwardsDokument1 SeiteReliance Life Insurance AwardsSriranga G HNoch keine Bewertungen

- DerivativesDokument39 SeitenDerivativesAnuradha ShettyNoch keine Bewertungen

- PSM Scientific Instryment CoDokument3 SeitenPSM Scientific Instryment CoSriranga G HNoch keine Bewertungen

- MissionDokument1 SeiteMissionSriranga G HNoch keine Bewertungen

- Bibliography LRDokument2 SeitenBibliography LRSriranga G HNoch keine Bewertungen

- CodDokument2 SeitenCodSriranga G HNoch keine Bewertungen

- Welcome To Prudential FinancialDokument1 SeiteWelcome To Prudential FinancialSriranga G HNoch keine Bewertungen

- Speakers From RBIDokument3 SeitenSpeakers From RBISriranga G HNoch keine Bewertungen

- History of Prudential FinancialDokument1 SeiteHistory of Prudential FinancialSriranga G HNoch keine Bewertungen

- Technical indicators A-WDokument4 SeitenTechnical indicators A-WSriranga G HNoch keine Bewertungen

- C 13Dokument416 SeitenC 13Arun Victor Paulraj50% (2)

- Periodic Method-Joseph MerchandiseDokument8 SeitenPeriodic Method-Joseph MerchandiseRACHEL DAMALERIONoch keine Bewertungen

- Introduction To Business EthicsDokument46 SeitenIntroduction To Business EthicsGlai zaNoch keine Bewertungen

- Career Channel News: Your One-Stop Destination for Educational ResourcesDokument6 SeitenCareer Channel News: Your One-Stop Destination for Educational ResourcesMubashir fareedNoch keine Bewertungen

- Quality StandardsDokument34 SeitenQuality StandardsChristina ErminoNoch keine Bewertungen

- Citi Bank StatementDokument6 SeitenCiti Bank Statementminhdang0306201733% (3)

- ODI's First Year: Annual ReportDokument56 SeitenODI's First Year: Annual ReportOpen Data Institute100% (1)

- University of Cape Town: Honours Project ProposalDokument11 SeitenUniversity of Cape Town: Honours Project ProposalHasiniNoch keine Bewertungen

- Accounting Information Systems Chapter 5 Discussion QuestionsDokument36 SeitenAccounting Information Systems Chapter 5 Discussion QuestionspnharyonoNoch keine Bewertungen

- CBSE Class 12 Case Studies in Business Studies - Financial ManagementDokument46 SeitenCBSE Class 12 Case Studies in Business Studies - Financial Managementgv4t47gx7dNoch keine Bewertungen

- How Ferrero Can Strengthen Its Brand Positioning Through Quality and EmotionsDokument14 SeitenHow Ferrero Can Strengthen Its Brand Positioning Through Quality and EmotionsЈованаNoch keine Bewertungen

- 2 CBA Loop Bank Statement PDFDokument7 Seiten2 CBA Loop Bank Statement PDFStephen Sony MsafiNoch keine Bewertungen

- Cash Flow StatementDokument9 SeitenCash Flow StatementMUHAMMAD UMARNoch keine Bewertungen

- UsersguideDokument87 SeitenUsersguideJanet OtienoNoch keine Bewertungen

- Development Innovation Principles in PracticeDokument35 SeitenDevelopment Innovation Principles in PracticeOlivia ChangNoch keine Bewertungen

- CV Final Ilias Iliovits 1Dokument4 SeitenCV Final Ilias Iliovits 1api-341037183Noch keine Bewertungen

- MPOWER Case Question Collections AnalystDokument2 SeitenMPOWER Case Question Collections AnalystthesambhavkpandeyNoch keine Bewertungen

- Business Contract StructureDokument55 SeitenBusiness Contract StructureMY NGUYEN TRA100% (2)

- Course WorkbooksDokument8 SeitenCourse Workbookszseetlnfg100% (2)

- CH 3Dokument10 SeitenCH 3mariaNoch keine Bewertungen

- Henry Ford Script ChnagedDokument19 SeitenHenry Ford Script ChnagedMubashshara AmeerNoch keine Bewertungen

- Customer Satisfaction in Coffee Shop ThesisDokument8 SeitenCustomer Satisfaction in Coffee Shop Thesisbsk89ztx100% (2)

- Accounting Assignment - 1Dokument9 SeitenAccounting Assignment - 1Idah MutekeriNoch keine Bewertungen

- Rent AggreementDokument5 SeitenRent AggreementUtkarsh KhandelwalNoch keine Bewertungen

- Meralco v. Prov of LagunaDokument2 SeitenMeralco v. Prov of LagunaJoms TenezaNoch keine Bewertungen

- SFE Commertial AgricultureDokument61 SeitenSFE Commertial Agricultureashenafi girma67% (3)

- Oracle Fusion GL Configuration Thrive AcademyDokument64 SeitenOracle Fusion GL Configuration Thrive AcademyRavi UpparNoch keine Bewertungen

- Social Relevance Project Report - Format - MMSDokument8 SeitenSocial Relevance Project Report - Format - MMSSoham BhurkeNoch keine Bewertungen

- File Annual 5e1bec2ecdb1aDokument203 SeitenFile Annual 5e1bec2ecdb1aTera Nova Puspa WijayantiNoch keine Bewertungen

- Rajnish Kumar - The Custodian of Trust - A Banker's Memoir-India Viking (2022)Dokument259 SeitenRajnish Kumar - The Custodian of Trust - A Banker's Memoir-India Viking (2022)Shireesh COSindhuNoch keine Bewertungen