Beruflich Dokumente

Kultur Dokumente

Case # 1: Institute of Cost and Management Accountants of Pakistan

Hochgeladen von

Sajid AliOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case # 1: Institute of Cost and Management Accountants of Pakistan

Hochgeladen von

Sajid AliCopyright:

Verfügbare Formate

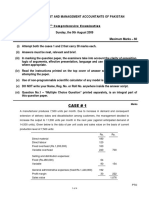

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN

11 t h Comprehensive Examination

Sunday, the 7th February 2010

Maximum Marks 60

Time Allowed 2 Hours

(i)

(ii)

(iii)

Attempt both the cases 1 and 2 that carry 30 marks each.

Answers must be neat, relevant and brief.

In marking the question paper, the examiners take into account the clarity of exposition, logic of arguments,

effective presentation, language and use of clear diagram or chart where appropriate.

Read the instructions printed on the top cover of answer script CAREFULLY before attempting the paper.

Use of non-programmable scientific calculator of any model is allowed.

DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script.

Paper of Multiple Choice Questions printed separately, is an integral part of Comprehensive Examination.

(iv)

(v)

(v)

(vi)

CASE # 1

Marks

ABC Company is planning to launch a new product line of sports goods. The specifications

(design, material etc.) are expected to be acceptable in the market for 4 or 5 years. In view of

this period, company considered the project P which would remain in operation from 2011 to

2014 and there would be no production after 2014. Information related to the project are as

under:

Capital expenditure:

A study was conducted to assess the feasibility of the project for which an amount of

Rs.450,000 was paid in last year. The recommendations made in the report are:

Buy new plant and machinery costing Rs.16,400,000 to be paid at the start of the project.

The machinery and plant would be depreciated at 20% of cost per annum and sold during

year 2015 for Rs.2,420,000 to be received at the end of 2015.

An old machine be sold for cash at the start of the project at book value of Rs.160,000. This

machine had been scheduled to be sold for cash at the end of 2012 for its book value of

Rs.120,000.

Material cost

Material Y costing Rs.64,000, purchased last year is already in stock, and can be used in

the manufacture of the new product. If it is not used the company would have to dispose it

incurring an additional cost of Rs.20,000 in 2011.

Material Z is also in stock and will be used for new product line. It was purchased some

years ago at a cost of Rs.115,000. The company has no other use for it, but could sell it in

the open market for Rs.30,000 in 2011.

Labour cost

Three employees, currently working in another department and earning Rs.120,000 per

annum each, would be transferred at the start of 2011, to work on the new product line.

An employee currently earning Rs.200,000 per annum would be promoted to work also on

the new product line at a salary of Rs.300,000 per annum.

The effect of transfer of employees from the other department to the project is included in

the lost contribution figures given in the table of other data.

1 of 3

PTO

Marks

Four employees in another department currently earning Rs.100,000 per annum each would

have to be made redundant at the end of 2011 and paid redundancy pay of Rs.155,000

each at the end of 2012.

As a result of negotiations with trade union it had been agreed that wages and salaries

would be increased each year by 5% with effect from 2012.

Other related data for new product line is as under:

Sales

Accounts receivable (at the year end)

Contribution lost on existing products

Purchases

Accounts payable (at the year end)

Payments to sub-contractors

Prepayments to sub-contractors

Net tax payable associated with this project

2011

10,000

840

300

4,000

800

600

50

960

2012

13,000

1,150

400

5,000

1,000

900

100

1,420

2013

15,000

1,400

400

5,800

1,100

800

80

1,740

Rs.000

2014

18,000

1,600

360

6,200

1,200

800

80

2,750

13,300

12,000

11,000

10,000

9,900

9,000

9,000

8,000

Fixed overheads and advertising:

With new product line

Without new product line

Other information:

Accounts receivable and payable (at the year end) are received and paid in the following

year.

There is one year time-lag in the payment of tax. The effect of any capital allowance has

been taken into the amount of net tax payable.

Cost of capital of the company is constant @ 10% per annum.

It is assumed that operating cash flows occur at the year end.

There is no other financial implication after 2014 apart from the above data and information.

Required:

(a)

Prepare a cash flow budget for Project P for its production period from 2011 to 2015.

20

(b)

Calculate the net present value (NPV) of the project.

02

(c)

Write a short report for the board of directors which:

(i)

(ii)

explains the reasons for excluding certain figures while preparing cash flow budget

at (a) above and

05

advises them on whether or not the project should be undertaken pointing out other

factors which would also need to be considered.

03

Year

1

2

3

4

5

6

P RESE NT VALUE

10%

11%

12%

0.909 0.901 0.893

0.826 0.812 0.797

0.751 0.731 0.712

0.683 0.659 0.636

0.621 0.593 0.567

0.564 0.535 0.507

2 of 3

FACTORS

13%

14%

0.885 0.877

0.783 0.769

0.693 0.675

0.613 0.592

0.543 0.519

0.480 0.456

15%

0.870

0.756

0.658

0.572

0.497

0.432

CASE # 2

Marks

XYZ Company is engaged in maintenance and sale of electrical equipment and pumps. Its

customers/ client are medium sized companies. Companys business is relatively capital

intensive. The most recent year-end financial statement of XYZ Company reflects the following

figures:

Rs. 000

11,200

2,800

700

1,200

17,200

5,400

4,000

Revenues

Operating income

Depreciation

Net income after taxes

Total assets

Mark-up-bearing debt

Shareholders equity

The company has 560,000 shares outstanding and its current share price is Rs.16.25. Its cash

position is negligible. In view of the nature of business of XYZ Company, M/s Kalam Industries

is considering acquiring their business. M/s Kalam Industries and its investment banker believe

that by offering a premium of 40%, XYZ Company can be acquired.

At present, free cash flow (excluding interest on debt ) of XYZ Company is as under:

Rs. 000

1,700

700

2,400

800

300 1,100

1,300

Operating income after taxes

Depreciation

Operating cash flow

Less: Capital expenditures

Working-capital additions

Free cash flow

M/s Kalam Industries believe that with synergy, they can grow operating cash flow (after tax

operating income plus depreciation) by 20% per annum for 3 years, and then by 12% for the

next 3 years. At the same time, it believes they can hold capital expenditures and working

capital additions to a combined increase (from the present Rs.1,100,000) of only Rs.200,000

per year. At the end of 6 years, M/s Kalam Industries assume that free cash flow will grow at

5% per annum into perpetuity. It also assumes that the required discount rate is 15% for such

an investment.

The median valuation of ratios of recently acquired companies comparable to XYZ Company

are as under:

Equity value-to-book

Enterprise value-to-sales

Equity value-to-earnings

Enterprise value-to-EBITDA

2.9x

1.4x

15.3x

7.8x

Required:

Do you think that acquisition of XYZ Company is justified at 40% premium and as compared to

recently acquired companies valuation. Substantiate your answer with all necessary

30

calculations.

THE END

3 of 3

Das könnte Ihnen auch gefallen

- ProblemSet Cash Flow Estimation QA1Dokument13 SeitenProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- AFM Capital Budgeting AssignmentDokument5 SeitenAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- CasesDokument18 SeitenCasesparmendra_singh25Noch keine Bewertungen

- Case Study Basics FinanceDokument2 SeitenCase Study Basics FinanceYuvraj BholaNoch keine Bewertungen

- Question Paper UEIM007 Financial ManagementDokument2 SeitenQuestion Paper UEIM007 Financial ManagementPratik RathaurNoch keine Bewertungen

- Project Financial Appraisal - NumericalsDokument5 SeitenProject Financial Appraisal - NumericalsAbhishek KarekarNoch keine Bewertungen

- 185f8question BankDokument18 Seiten185f8question Bank55amonNoch keine Bewertungen

- Business - Analysis Dec-11Dokument3 SeitenBusiness - Analysis Dec-11SHEIKH MOHAMMAD KAUSARUL ALAMNoch keine Bewertungen

- Mock Questions PDFDokument6 SeitenMock Questions PDFMadhuram SharmaNoch keine Bewertungen

- FM Revision Q BankDokument10 SeitenFM Revision Q BankOmkar VaigankarNoch keine Bewertungen

- ABC Limited - Case StudyDokument2 SeitenABC Limited - Case StudyRahul BhagatNoch keine Bewertungen

- Mid Term Exam Paper 4Dokument2 SeitenMid Term Exam Paper 4Rohansh AroraNoch keine Bewertungen

- Visaka Industries Annual Report FY11Dokument60 SeitenVisaka Industries Annual Report FY11rajan10_kumar_805053Noch keine Bewertungen

- BBA 221 MANAGERIAL ACCOUNTING Set 1Dokument6 SeitenBBA 221 MANAGERIAL ACCOUNTING Set 1Lawrence jnr MwapeNoch keine Bewertungen

- Exercises (Capital Budgeting)Dokument2 SeitenExercises (Capital Budgeting)bdiitNoch keine Bewertungen

- Study Material of FMDokument22 SeitenStudy Material of FMPrakhar SahuNoch keine Bewertungen

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDokument4 SeitenInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNoch keine Bewertungen

- AssigmentDokument8 SeitenAssigmentnonolashari0% (1)

- The Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Dokument9 SeitenThe Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Amal VinothNoch keine Bewertungen

- Soal Uas MK Gasal 2021-2022 KkiDokument6 SeitenSoal Uas MK Gasal 2021-2022 KkiRifqi RinaldiNoch keine Bewertungen

- Strategic Corporate Finance Assignemnt 2Dokument5 SeitenStrategic Corporate Finance Assignemnt 2Sukrit NagpalNoch keine Bewertungen

- Project Appraisal & Finance ProblemsDokument3 SeitenProject Appraisal & Finance ProblemsBhargav Tej PNoch keine Bewertungen

- Introduction To SFAD (Class1)Dokument17 SeitenIntroduction To SFAD (Class1)Asmer KhanNoch keine Bewertungen

- F402 In-Class Exercise - Capital Budgeting September 8, 2020Dokument3 SeitenF402 In-Class Exercise - Capital Budgeting September 8, 2020Harrison Galavan0% (1)

- Group Assignment Fm2 A112Dokument15 SeitenGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- RTP Dec 2021 Cap II Group IIDokument106 SeitenRTP Dec 2021 Cap II Group IIRoshan KhadkaNoch keine Bewertungen

- 01 Corporate Finance ExercisesDokument13 Seiten01 Corporate Finance ExercisesnityaNoch keine Bewertungen

- HW3MGT517Dokument3 SeitenHW3MGT517Jaya PaudwalNoch keine Bewertungen

- Importanat Questions - Doc (FM)Dokument5 SeitenImportanat Questions - Doc (FM)Ishika Singh ChNoch keine Bewertungen

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDokument2 SeitenFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNoch keine Bewertungen

- Assigment 6 - Managerial Finance Capital BudgetingDokument5 SeitenAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenNoch keine Bewertungen

- Assignment First Semester (January To June) 2019Dokument3 SeitenAssignment First Semester (January To June) 2019Saurabh singhNoch keine Bewertungen

- FM Assignment N0.1Dokument4 SeitenFM Assignment N0.1Hafiz Usman ShariefNoch keine Bewertungen

- CAP II Group II June 2022Dokument97 SeitenCAP II Group II June 2022aneupane465Noch keine Bewertungen

- AFM Assignment (2019)Dokument9 SeitenAFM Assignment (2019)Videhi BajajNoch keine Bewertungen

- 01 s303 CmapaDokument3 Seiten01 s303 Cmapaimranelahi3430Noch keine Bewertungen

- Corporate Finance - IIDokument18 SeitenCorporate Finance - IIMadhuram SharmaNoch keine Bewertungen

- CBE - Corporate Finance - SPJG - FinalDokument16 SeitenCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNoch keine Bewertungen

- Asad NotesDokument15 SeitenAsad NotesassadjavedNoch keine Bewertungen

- Finance Cap 2Dokument19 SeitenFinance Cap 2Dj babuNoch keine Bewertungen

- FM Assignment: Liabilities 2010 (') 2011 (') Assets 2010 (') 2011 (')Dokument2 SeitenFM Assignment: Liabilities 2010 (') 2011 (') Assets 2010 (') 2011 (')Avinash ToraneNoch keine Bewertungen

- Cap BudgetDokument20 SeitenCap Budgetprachik87Noch keine Bewertungen

- 9 Comprehensive Examination: Case # 1Dokument4 Seiten9 Comprehensive Examination: Case # 1Sajid AliNoch keine Bewertungen

- F-17 MacDokument4 SeitenF-17 MacNadeem HanifNoch keine Bewertungen

- SCMPEDokument8 SeitenSCMPEkalyanNoch keine Bewertungen

- Strategic Corporate Finance AssignmentDokument6 SeitenStrategic Corporate Finance AssignmentAmbrish (gYpr.in)0% (1)

- Tutorial 4 - Capital Investment DecisionsDokument4 SeitenTutorial 4 - Capital Investment DecisionsIbrahim HussainNoch keine Bewertungen

- Strategic Financial Management PaperDokument6 SeitenStrategic Financial Management Papersanaskhh508Noch keine Bewertungen

- Tutorial 4 Capital Investment Decisions 1Dokument4 SeitenTutorial 4 Capital Investment Decisions 1phillip HaulNoch keine Bewertungen

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDokument7 SeitenCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNoch keine Bewertungen

- Capital BudgetingmbaeserveDokument30 SeitenCapital BudgetingmbaeserveDavneet ChopraNoch keine Bewertungen

- Metcasr CaseDokument3 SeitenMetcasr CasePraveen PamnaniNoch keine Bewertungen

- Tutorial 3 For FM-IDokument5 SeitenTutorial 3 For FM-IarishthegreatNoch keine Bewertungen

- F9 RM QuestionsDokument14 SeitenF9 RM QuestionsImranRazaBozdar0% (1)

- Costing FM Model Paper - PrimeDokument17 SeitenCosting FM Model Paper - Primeshanky631Noch keine Bewertungen

- FB Practice Test 1 Set 2 SolutionsDokument11 SeitenFB Practice Test 1 Set 2 SolutionsShivam Mehta100% (6)

- Budgeting and Cost ControlDokument7 SeitenBudgeting and Cost Controlnags18888Noch keine Bewertungen

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItVon EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNoch keine Bewertungen

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportVon EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNoch keine Bewertungen

- Chapter 15Dokument6 SeitenChapter 15Rayhan Atunu100% (1)

- Chapter 13 Solutions MKDokument26 SeitenChapter 13 Solutions MKCindy Kirana17% (6)

- Chapter 14 SolutionsDokument10 SeitenChapter 14 SolutionsAmanda Ng100% (1)

- Chapter 11 SolutionsDokument22 SeitenChapter 11 SolutionsChander Santos Monteiro100% (3)

- Chapter 16Dokument11 SeitenChapter 16Aarti J50% (2)

- Chpater 4 SolutionsDokument13 SeitenChpater 4 SolutionsAhmed Rawy100% (1)

- Chapter 1 SolutionsDokument3 SeitenChapter 1 SolutionsChadwick PohNoch keine Bewertungen

- Chapter 8 Solutions GitmanDokument22 SeitenChapter 8 Solutions GitmanCat Valentine100% (3)

- Chapter 12 SolutionsDokument13 SeitenChapter 12 SolutionsCindy Lee75% (4)

- Chapter 7 SolutionsDokument9 SeitenChapter 7 SolutionsMuhammad Naeem100% (3)

- Chapter 10 SolutionsDokument21 SeitenChapter 10 SolutionsFranco Ambunan Regino75% (8)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument14 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (2)

- Chapter 9 SolutionsDokument11 SeitenChapter 9 Solutionssaddam hussain80% (5)

- Chapter 2 SolutionsDokument5 SeitenChapter 2 SolutionskendozxNoch keine Bewertungen

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument11 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNoch keine Bewertungen

- 3-7 2005 Dec Q PDFDokument12 Seiten3-7 2005 Dec Q PDFSajid AliNoch keine Bewertungen

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument12 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument11 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (2)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument11 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument12 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali50% (2)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument12 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali67% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument12 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNoch keine Bewertungen

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument12 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNoch keine Bewertungen

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument10 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument13 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNoch keine Bewertungen

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument11 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- AccA P4/3.7 - 2002 - Dec - QDokument12 SeitenAccA P4/3.7 - 2002 - Dec - Qroker_m3Noch keine Bewertungen

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument15 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNoch keine Bewertungen

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument12 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokument14 Seiten3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- REAL ESTATE MORTGAGE-CalubayanDokument5 SeitenREAL ESTATE MORTGAGE-CalubayanChristopher JuniarNoch keine Bewertungen

- Taxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBDokument35 SeitenTaxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBFlorante De LeonNoch keine Bewertungen

- Slide Commission SecuritiesDokument4 SeitenSlide Commission SecuritiesNADHIRAH DIYANA BINTI AHMAD LATFINoch keine Bewertungen

- Accounting Intern Cover Letter ExamplesDokument7 SeitenAccounting Intern Cover Letter Examplesiyldyzadf100% (2)

- ExpiringMonthly - Trading With or Against The Skew 0410Dokument4 SeitenExpiringMonthly - Trading With or Against The Skew 0410Samoila RemusNoch keine Bewertungen

- DeAngelo - 1990 - Equity Valuation and Corporate ControlDokument21 SeitenDeAngelo - 1990 - Equity Valuation and Corporate ControlAna Luisa EisenlohrNoch keine Bewertungen

- Engineering EconomyDokument19 SeitenEngineering EconomyGreg Calibo LidasanNoch keine Bewertungen

- BSBCRT611 BriefDokument2 SeitenBSBCRT611 BriefJohnNoch keine Bewertungen

- ChatGPT 18Dokument2 SeitenChatGPT 18ashaykosare.007Noch keine Bewertungen

- Lecture 5Dokument1 SeiteLecture 5JohnNoch keine Bewertungen

- Corporate Finance and Investment Decisions and Strategies 9Th Edition Full ChapterDokument41 SeitenCorporate Finance and Investment Decisions and Strategies 9Th Edition Full Chapterharriett.murphy498100% (24)

- Far - First Preboard QuestionnaireDokument14 SeitenFar - First Preboard QuestionnairewithyouidkNoch keine Bewertungen

- PDF SSTT X Jamal Browner Deadlift Specialization Vol 2 Y6y6sg CompressDokument147 SeitenPDF SSTT X Jamal Browner Deadlift Specialization Vol 2 Y6y6sg CompressDemarkusNoch keine Bewertungen

- Chapter 3 ProblemsDokument7 SeitenChapter 3 ProblemsShaila MarceloNoch keine Bewertungen

- PGI Sample QuestionDokument4 SeitenPGI Sample QuestionleoneseNoch keine Bewertungen

- I2BE-Morning Evening PDFDokument10 SeitenI2BE-Morning Evening PDFusama sajawalNoch keine Bewertungen

- DigiKhata PDFDokument2 SeitenDigiKhata PDFtufailnazir Muhammad tufailNoch keine Bewertungen

- Manual TAX 1. 2019 20 PDFDokument35 SeitenManual TAX 1. 2019 20 PDFkNoch keine Bewertungen

- Management AccountingDokument155 SeitenManagement AccountingBbaggi Bk100% (2)

- BSP M-2020-016 PDFDokument9 SeitenBSP M-2020-016 PDFRaine Buenaventura-EleazarNoch keine Bewertungen

- Cash Receipts Record (Crrec) : InstructionsDokument1 SeiteCash Receipts Record (Crrec) : InstructionsdinvNoch keine Bewertungen

- Technical Analysis in Forex TradingDokument7 SeitenTechnical Analysis in Forex TradingIFCMarketsNoch keine Bewertungen

- SEC 204 Status ReportDokument17 SeitenSEC 204 Status Reportthe kingfishNoch keine Bewertungen

- 40 Most Important Questions Business Studies SPCCDokument14 Seiten40 Most Important Questions Business Studies SPCCtwisha malhotraNoch keine Bewertungen

- Start Day Trading NowDokument44 SeitenStart Day Trading Nowfuraito100% (2)

- PA Sample MCQs 2Dokument15 SeitenPA Sample MCQs 2ANH PHẠM QUỲNHNoch keine Bewertungen

- Pi ECO Vietnam Project Abstract & Summary 7 March 2019Dokument11 SeitenPi ECO Vietnam Project Abstract & Summary 7 March 2019ICT Bảo HànhNoch keine Bewertungen

- 1 Alfino Borrowed Money From Yakutsk and Agreed in WritingDokument1 Seite1 Alfino Borrowed Money From Yakutsk and Agreed in Writingjoanne bajetaNoch keine Bewertungen

- 122 1004Dokument32 Seiten122 1004api-275486640% (1)

- Sbi Code of ConductDokument5 SeitenSbi Code of ConductNaved Shaikh0% (1)