Beruflich Dokumente

Kultur Dokumente

Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas Internas

Hochgeladen von

Sy HimOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas Internas

Hochgeladen von

Sy HimCopyright:

Verfügbare Formate

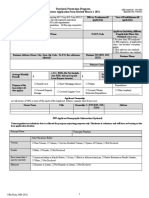

REPUBLIKA NG PILIPINAS

KAGAWARAN NG PANANALAPI

KAWANIHAN NG RENTAS INTERNAS

April 25, 2005

REVENUE REGULATIONS NO. 13-2005

SUBJECT

TO

Regulations Defining Gross Income Earned to Implement the

Tax Incentive Provision under Paragraph (c) of Section 12 of

Republic Act No. 7227, otherwise known as The Bases

Conversion Development Act of 1992 Revoking Section 7 of

Revenue Regulations No. 2-2005, and Suspending the Effectivity

of Certain Provisions of Revenue Regulations No. 2-2005.

All Internal Revenue Officers and Other Concerned

SECTION 1. Scope - Pursuant to the provisions of Sections 244 and 245 of the

National Internal Revenue Code of 1997, as amended, these regulations are hereby

promulgated to define gross income earned to implement the tax incentive provision under

Paragraph (c) of Section 12 of Republic Act No. 7227, thus, revoking Section 7 of Revenue

Regulations No. 2-2005.

SECTION 2. Gross Income Earned. For purposes of implementing the tax

incentive provision under paragraph (c) of Section 12 of Republic Act No. 7227, otherwise

known as The Bases Conversion Development Act of 1992, Section 3 (o) of Revenue

Regulations No. 1-95 as amended by Revenue Regulations No. 16-99 shall read as follows:

(o) Gross income earned - shall refer to gross sales or gross revenues

derived from business activity within the Zone, net of sales discounts, sales

returns and allowances and minus costs of sales or direct costs but before any

deduction is made for administrative, marketing, selling and/or operating

expenses or incidental losses during a given taxable period. For financial

enterprises, gross income shall include interest income, gains from sales, and

other income, net of costs of funds. For purposes of computing the total five

percent (5%) tax rate imposed, the following deductions shall be allowable for

the calculation of gross income earned for specific types of enterprises:

1. Trading Enterprises:

-

Cost of Sales

(Cost of Sales which is equal to inventory, beginning plus purchases

minus Inventory of goods, ending)

2. Manufacturing Enterprises:

-

Direct salaries, wages or labor expenses

Production supervision salaries

Raw materials used in the manufacture of products

Decrease in Goods in Process Account (Intermediate

goods)

Decrease in Finished Goods Account

Supplies and fuels used in production

Depreciation of machinery and equipment used in

production, and of that portion of the building owned

or constructed by the registered enterprise that is used

exclusively in the production of goods

Rent and utility charges associated with building,

equipment and warehouses used in production

Financing charges associated with fixed assets used in

production the amount of which were not previously

capitalized

3. Service Enterprises:

-

Direct salaries, wages or labor expense

Service supervision salaries

Direct materials, supplies used

Depreciation of machineries and equipment used in the

rendition of registered services, and of that portion of the

building owned or constructed that is used exclusively in

the rendition of the registered service

Rent and utility charges for buildings and capital

equipment used in the rendition of registered services

Financing charges associated with fixed assets used in the

registered service business the amount of which were not

previously capitalized.

4. Financial Institutions:

-

None

SECTION 2. Suspension of Certain Provisions of Revenue Regulations No. 22005 - The effectivity of Sections 3, 4, and 6 of Revenue Regulations No. 2-2005 is hereby

suspended in so far as it applies to enterprises registered under paragraph (c) of Section 12 of

R.A. 7227, pending the issuance of a new regulations pertaining on the matter related thereto.

Pending the issuance of said new regulations, the provisions of Revenue Regulations No. 195, in so far as the same is not in conflict with these Regulations, shall apply.

SECTION 3. Effectivity Clause. These Regulations shall take effect beginning

March 5, 2005.

(Original Signed)

CESAR V. PURISIMA

Acting Secretary of Finance

Recommending Approval:

(Original Signed)

GUILLERMO L. PARAYNO, JR.

Commissioner of Internal Revenue

Das könnte Ihnen auch gefallen

- RR No. 12-2005 Defines Gross Income for Cagayan, Zamboanga ZonesDokument2 SeitenRR No. 12-2005 Defines Gross Income for Cagayan, Zamboanga Zonesa.bergerNoch keine Bewertungen

- Excise Law PDFDokument54 SeitenExcise Law PDFJay BudhdhabhattiNoch keine Bewertungen

- Modvat Re-Christened As Cenvat - Modvat Has Been Renamed As 'Cenvat' W.E.F. 1-4-2000Dokument9 SeitenModvat Re-Christened As Cenvat - Modvat Has Been Renamed As 'Cenvat' W.E.F. 1-4-2000sangramdeyNoch keine Bewertungen

- Revenue Regulations No. 25-20: September 30, 2020Dokument3 SeitenRevenue Regulations No. 25-20: September 30, 2020rian.lee.b.tiangcoNoch keine Bewertungen

- TM 07Dokument31 SeitenTM 07Rohan KawaleNoch keine Bewertungen

- RR 2-2001Dokument7 SeitenRR 2-2001Eumell Alexis PaleNoch keine Bewertungen

- Small Scale Exemption SchemeDokument8 SeitenSmall Scale Exemption SchemebakulhariaNoch keine Bewertungen

- RR 9-98Dokument5 SeitenRR 9-98matinikkiNoch keine Bewertungen

- Briefing On The Corporate Recovery and Tax Incentives For Enterprise (CREATE) ActDokument56 SeitenBriefing On The Corporate Recovery and Tax Incentives For Enterprise (CREATE) ActEdward GanNoch keine Bewertungen

- Modvat and CenvatDokument3 SeitenModvat and CenvatpravinsankalpNoch keine Bewertungen

- Central Value Added Tax PPT at Bec Doms Bagalkot MbaDokument16 SeitenCentral Value Added Tax PPT at Bec Doms Bagalkot MbaBabasab Patil (Karrisatte)Noch keine Bewertungen

- Bir Ruling No. Vat-419-2022 - Peza Vat and Non Vat HmoDokument7 SeitenBir Ruling No. Vat-419-2022 - Peza Vat and Non Vat HmoJohnallen MarillaNoch keine Bewertungen

- Explaining tax treatment in project profitability projectionsDokument3 SeitenExplaining tax treatment in project profitability projectionsKrishna TiwariNoch keine Bewertungen

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisVon EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNoch keine Bewertungen

- RR 16-99Dokument6 SeitenRR 16-99matinikkiNoch keine Bewertungen

- Prepared By: Leyla B. Malijan J19-65663Dokument31 SeitenPrepared By: Leyla B. Malijan J19-65663leyla malijanNoch keine Bewertungen

- CREBA V RomuloDokument58 SeitenCREBA V RomuloBuladasPukikiNoch keine Bewertungen

- VAT 404 - Guide For Vendors - External GuideDokument110 SeitenVAT 404 - Guide For Vendors - External Guidesimphiwe8043Noch keine Bewertungen

- Lecture Outline/Notes and Guide Questions Minimum Corporate Income Tax (Mcit) InstructionsDokument8 SeitenLecture Outline/Notes and Guide Questions Minimum Corporate Income Tax (Mcit) InstructionsPaul S.D.Noch keine Bewertungen

- Accounting Standards for Inventory Valuation and Financial DisclosuresDokument15 SeitenAccounting Standards for Inventory Valuation and Financial Disclosuresashish kumar jhaNoch keine Bewertungen

- Presentation Taxation LawsDokument8 SeitenPresentation Taxation LawsVineet GuptaNoch keine Bewertungen

- Unit 5 Profits and Gains of Business or Profession StructureDokument31 SeitenUnit 5 Profits and Gains of Business or Profession StructuredeepaksinghalNoch keine Bewertungen

- CREBA Vs Romulo DigestDokument20 SeitenCREBA Vs Romulo DigestMigen SandicoNoch keine Bewertungen

- Guide to Zambia's VAT rulesDokument56 SeitenGuide to Zambia's VAT rulesC ChamaNoch keine Bewertungen

- Cenvat: Presented To: Namit Sir Presented By: Jasmine 4270Dokument23 SeitenCenvat: Presented To: Namit Sir Presented By: Jasmine 4270JatinderNoch keine Bewertungen

- Chamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlDokument20 SeitenChamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlMark Gabriel B. MarangaNoch keine Bewertungen

- Case DigestsDokument67 SeitenCase DigestsCattleyaNoch keine Bewertungen

- Revenue Regulations on Minimum Corporate Income TaxDokument5 SeitenRevenue Regulations on Minimum Corporate Income TaxKayzer SabaNoch keine Bewertungen

- Location of New Undertaking & Types of ActivityDokument46 SeitenLocation of New Undertaking & Types of ActivityKanika KambojNoch keine Bewertungen

- Minimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Dokument48 SeitenMinimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Andrea Renice S. FerriolNoch keine Bewertungen

- ITC Under GVat 231113Dokument78 SeitenITC Under GVat 231113ravindra_manek123Noch keine Bewertungen

- Presentation On Tax Planning With Referrence To Setting Up A New BusinessDokument30 SeitenPresentation On Tax Planning With Referrence To Setting Up A New BusinessPooja MishraNoch keine Bewertungen

- ATax - 05 Business Income - 1Dokument58 SeitenATax - 05 Business Income - 1Haseeb Ahmed ShaikhNoch keine Bewertungen

- Tax Planning and Managerial Decision - MAKE or BUYDokument3 SeitenTax Planning and Managerial Decision - MAKE or BUYDr Linda Mary Simon100% (1)

- KPMG - Change in Tax Audit ReportDokument5 SeitenKPMG - Change in Tax Audit ReportDhananjay KulkarniNoch keine Bewertungen

- AFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)Dokument14 SeitenAFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)salahuddin ahmedNoch keine Bewertungen

- Revenue Regulations No.15-2010Dokument3 SeitenRevenue Regulations No.15-2010Orlando O. CalundanNoch keine Bewertungen

- RR 9 98 PDFDokument7 SeitenRR 9 98 PDFJoey Villas MaputiNoch keine Bewertungen

- Preferential Taxation - Magumpara, AliahDokument8 SeitenPreferential Taxation - Magumpara, AliahAliah MagumparaNoch keine Bewertungen

- Preferential Tax Incentives for Registered EnterprisesDokument8 SeitenPreferential Tax Incentives for Registered EnterprisesAliah MagumparaNoch keine Bewertungen

- BDO Budget Snapshot - 2012-13Dokument9 SeitenBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNoch keine Bewertungen

- (Updated July 2010) (2.2.1) Corporation Tax - General BackgroundDokument13 Seiten(Updated July 2010) (2.2.1) Corporation Tax - General BackgroundjfjkavanaghNoch keine Bewertungen

- Detailed Analysis of Section 115BAA & Section 115BABDokument3 SeitenDetailed Analysis of Section 115BAA & Section 115BABdamanoberoiNoch keine Bewertungen

- RR 2-01Dokument3 SeitenRR 2-01matinikkiNoch keine Bewertungen

- Chamber vs. Romulo 614 SCRA 605 2010Dokument17 SeitenChamber vs. Romulo 614 SCRA 605 2010Jacinto Jr JameroNoch keine Bewertungen

- New Business Tax PlanningDokument47 SeitenNew Business Tax PlanningashishNoch keine Bewertungen

- Create LawDokument200 SeitenCreate Lawtara bajarlaNoch keine Bewertungen

- Powerpoint-03 19 22Dokument126 SeitenPowerpoint-03 19 22CrizziaNoch keine Bewertungen

- Tax Brief - June 2012Dokument8 SeitenTax Brief - June 2012Rheneir MoraNoch keine Bewertungen

- Minimum Alternate TaxDokument8 SeitenMinimum Alternate Taxjainrahul234Noch keine Bewertungen

- Various Sections in PGBP Are Briefly Discussed Below:: PGBP (Profits and Gains From Business or Profession) Sec 28-44Dokument4 SeitenVarious Sections in PGBP Are Briefly Discussed Below:: PGBP (Profits and Gains From Business or Profession) Sec 28-44Abhishek MishraNoch keine Bewertungen

- VAT Guide 2023Dokument46 SeitenVAT Guide 2023ELIJAHNoch keine Bewertungen

- 1040 Exam Prep Module X: Small Business Income and ExpensesVon Everand1040 Exam Prep Module X: Small Business Income and ExpensesNoch keine Bewertungen

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineVon EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Ping Pong AnyoneDokument5 SeitenPing Pong AnyoneSy HimNoch keine Bewertungen

- K-12 Science Curriculum Guide promotes scientific literacyDokument66 SeitenK-12 Science Curriculum Guide promotes scientific literacycatherinefernandezNoch keine Bewertungen

- 28495rr No. 04-2006Dokument11 Seiten28495rr No. 04-2006Jas MineNoch keine Bewertungen

- 27695rr No. 01-2006Dokument4 Seiten27695rr No. 01-2006Sy HimNoch keine Bewertungen

- Chapter 1Dokument8 SeitenChapter 1Rafael GarciaNoch keine Bewertungen

- 26814rr No. 19-2005Dokument1 Seite26814rr No. 19-2005Sy HimNoch keine Bewertungen

- 29411rr No. 06-2006Dokument7 Seiten29411rr No. 06-2006Sy HimNoch keine Bewertungen

- K-12 Science Curriculum Guide promotes scientific literacyDokument66 SeitenK-12 Science Curriculum Guide promotes scientific literacycatherinefernandezNoch keine Bewertungen

- Revenue Regulations No. 7 - 2006: Quezon City May 18, 2006Dokument2 SeitenRevenue Regulations No. 7 - 2006: Quezon City May 18, 2006Sy HimNoch keine Bewertungen

- 29083rr No. 05-2006Dokument1 Seite29083rr No. 05-2006Sy HimNoch keine Bewertungen

- 27697rr No. 02-2006Dokument10 Seiten27697rr No. 02-2006Sy HimNoch keine Bewertungen

- Implementing Guidelines on Revised Tax Rates for Alcohol and TobaccoDokument44 SeitenImplementing Guidelines on Revised Tax Rates for Alcohol and TobaccoSy HimNoch keine Bewertungen

- Philippine Tax Subsidy Regulations for Subic-Clark-Tarlac Expressway ProjectDokument10 SeitenPhilippine Tax Subsidy Regulations for Subic-Clark-Tarlac Expressway ProjectSy HimNoch keine Bewertungen

- 26715rr No. 18-2005Dokument9 Seiten26715rr No. 18-2005Sy HimNoch keine Bewertungen

- 21171rr05 14Dokument54 Seiten21171rr05 14Sy HimNoch keine Bewertungen

- 21429RR15 2005Dokument3 Seiten21429RR15 2005Sy HimNoch keine Bewertungen

- 21103RR 11-2005Dokument2 Seiten21103RR 11-2005Sy HimNoch keine Bewertungen

- Revenue Regulation No. 16-2005Dokument0 SeitenRevenue Regulation No. 16-2005Kaye MendozaNoch keine Bewertungen

- 20286RR 8-2005Dokument3 Seiten20286RR 8-2005Sy HimNoch keine Bewertungen

- Ask For ReceiptDokument2 SeitenAsk For ReceiptSy HimNoch keine Bewertungen

- Ensuring Tax Compliance for Government ContractsDokument4 SeitenEnsuring Tax Compliance for Government ContractsCarla GrepoNoch keine Bewertungen

- 17541rr05 06Dokument6 Seiten17541rr05 06Sy HimNoch keine Bewertungen

- 15711rr04 11Dokument16 Seiten15711rr04 11Sy HimNoch keine Bewertungen

- 16771rr05 05Dokument8 Seiten16771rr05 05Sy HimNoch keine Bewertungen

- 16723RR 1-2005Dokument4 Seiten16723RR 1-2005Sy HimNoch keine Bewertungen

- 14592rr04 10Dokument2 Seiten14592rr04 10Sy HimNoch keine Bewertungen

- 16769rr05 04Dokument4 Seiten16769rr05 04Sy HimNoch keine Bewertungen

- 15441rr04 13Dokument14 Seiten15441rr04 13Sy HimNoch keine Bewertungen

- 15439rr04 12Dokument16 Seiten15439rr04 12Sy HimNoch keine Bewertungen

- Agrarian Crisis and Farmer SuicidesDokument38 SeitenAgrarian Crisis and Farmer SuicidesbtnaveenkumarNoch keine Bewertungen

- DD On StocksDokument4 SeitenDD On StocksMimiNoch keine Bewertungen

- CH 14Dokument40 SeitenCH 14franchesca1230% (1)

- Basics of Demand and SupplyDokument29 SeitenBasics of Demand and SupplyNuahs Magahat100% (2)

- Auditing ProblemsDokument8 SeitenAuditing ProblemsKheianne DaveighNoch keine Bewertungen

- Managerial Accounting 14Th Edition Garrison Test Bank Full Chapter PDFDokument67 SeitenManagerial Accounting 14Th Edition Garrison Test Bank Full Chapter PDFykydxnjk4100% (11)

- SAUCE (Phil - Tax)Dokument9 SeitenSAUCE (Phil - Tax)Darren GreNoch keine Bewertungen

- Quiz TAX2 FINALSDokument3 SeitenQuiz TAX2 FINALSJoyce Anne MananquilNoch keine Bewertungen

- Verification and Valuation of Different Kinds of AssetsDokument4 SeitenVerification and Valuation of Different Kinds of AssetsRamesh RanjanNoch keine Bewertungen

- Bar ExamsDokument17 SeitenBar ExamsCatherine PantiNoch keine Bewertungen

- Uy Law Office Balance SheetDokument2 SeitenUy Law Office Balance SheetA c100% (1)

- Income Tax Act 1959Dokument217 SeitenIncome Tax Act 1959KSeegurNoch keine Bewertungen

- Cmeef KPK FormDokument11 SeitenCmeef KPK FormShahid KhanNoch keine Bewertungen

- Dallas Police and Fire Pension BriefingDokument85 SeitenDallas Police and Fire Pension BriefingTristan HallmanNoch keine Bewertungen

- CHAPTER 5 ADJUSTING PROCESS - AssignmentDokument1 SeiteCHAPTER 5 ADJUSTING PROCESS - AssignmentjepsyutNoch keine Bewertungen

- RM Dynamic Pricing Demand ForecastingDokument41 SeitenRM Dynamic Pricing Demand ForecastingSankha BhattacharyaNoch keine Bewertungen

- Corporate Finance - Mock ExamDokument5 SeitenCorporate Finance - Mock ExamMinh Hạnh NguyễnNoch keine Bewertungen

- Futures Algo EvolutionDokument15 SeitenFutures Algo Evolutionsvejed123Noch keine Bewertungen

- AIS ReviewerDokument20 SeitenAIS ReviewerkimmibanezNoch keine Bewertungen

- Samudera Indonesia TBK - 30 September 2023 - FinalDokument114 SeitenSamudera Indonesia TBK - 30 September 2023 - Finalade.yulyansyahNoch keine Bewertungen

- Cost TB C02 CarterDokument23 SeitenCost TB C02 CarterArya Stark100% (1)

- Tax Treatment of Dividend Received From CompanyDokument10 SeitenTax Treatment of Dividend Received From CompanymukeshNoch keine Bewertungen

- 2012 Payee Disclosure Report - Saskatchewan GovernmentDokument252 Seiten2012 Payee Disclosure Report - Saskatchewan GovernmentAnishinabe100% (1)

- Financial Ratio Analysis Aldar UpdatedDokument36 SeitenFinancial Ratio Analysis Aldar UpdatedHasanNoch keine Bewertungen

- Fortis Healthcare - Submission PDFDokument3 SeitenFortis Healthcare - Submission PDFKumar Praharsh RakhejaNoch keine Bewertungen

- Digitizing Cash Eco - After Demon - TrendsDokument126 SeitenDigitizing Cash Eco - After Demon - Trendschimp64100% (1)

- DuPont analysis assignmentDokument5 SeitenDuPont analysis assignmentআশিকুর রহমান100% (1)

- Borrower Application 2483 RevisedDokument5 SeitenBorrower Application 2483 RevisedJustin Davies33% (3)

- NCC Annual Report - 2018-19 - FINALDokument204 SeitenNCC Annual Report - 2018-19 - FINALAshish SalunkheNoch keine Bewertungen

- Project Report for a 500 Bird Per Week Broiler Poultry FarmDokument3 SeitenProject Report for a 500 Bird Per Week Broiler Poultry FarmRajesh Jangir100% (1)