Beruflich Dokumente

Kultur Dokumente

TDS Rate Chart PDF

Hochgeladen von

jdhamdeep07Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TDS Rate Chart PDF

Hochgeladen von

jdhamdeep07Copyright:

Verfügbare Formate

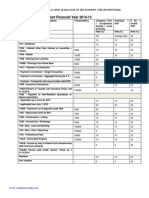

TDS RATE CHART FOR FY 2015-16 (AY 2016-17)

- BY SIKCHI AND THAKKAR (CHARTERED ACCOUNTANTS)

Section

192

192A

Nature of income

Salary

Payment of accumulated balance due of Employees Provident Fund

Scheme, 1952, to Employess (w.e.f 01-06-15)

Time of Deduction

Threshold

Rate of TDS

At the time of payment where estimated yearly net taxable salary exceeds tax Average montly rate as per

free limit.

rules

Payment

(withdrawal before 5 yrs of service,

Rs. 30,000

10%

Rs. 5,000

10%

Rs. 2500

20%

Form 15G/15H not submitted)

Interest on securities

a) any debentures or securities for money issued by or on behalf of any

local authority or a corporation established by a Central, State or

Provincial Act;

193

(Note- 1)

b) any debentures issued by a company where such debentures are listed

on a recognised stock exchange in accordance with the Securities

Credit or payment whichever is earlier

Contracts (Regulation) Act, 1956 (42 of 1956) and any rules made

thereunder;

c) any security of the Central or State Government;

d) interest on any other security

194

194A

(Note-2)

Dividends

Interest other than Interest on securities

Winnings from lottery, cross word puzzles card games, horse race, games

194BB

of any sort including T.V. Game Shows

(Note-3)

194D

194DA

194H

Credit or payment whichever is earlier

Rs. 5000

Rs. 10,000 - in case of interest

10%

credited by banks

194B /

194C

Before making payment to shareholder,

other than dividend declared U/s 115-0

Payment to contractors/ sub - contractors

Insurance Commission

Payment under life insurance policy (including Bonus)

Payment of commission brokerage

Payment

Credit or payment whichever is earlier

Credit or payment whichever is earlier

Payment

Credit or payment whichever is earlier

Rs. 2,500 in the case of horse race,

Rs. 5,000 in other games

Single Payment Rs. 30,000

Annually Rs. 75,000

30%

2% - other than

Individual/HUF

1% - Individual/HUF

Rs. 20,000

10%

Annually more than Rs. 1,00,000

2%

Rs. 5,000

10%

10% - Land, Building or

194I

Rent

Credit or payment, whichever is earlier

Annually Rs. 1,80,000

furniture

2% - Machinery, Plant or

Equipment

TDS RATE CHART FOR FY 2015-16 (AY 2016-17)

- BY SIKCHI AND THAKKAR (CHARTERED ACCOUNTANTS)

Section

Nature of income

194IA

Payment on transfer of certain immovable property other than agriculture

Time of Deduction

Threshold

Rate of TDS

At the time of payment where estimated yearly

taxablein

salary

exceeds

Land net

is situated

specified

areatax

(Note-4)

land.

free limit.Rs. 50 lakh,

Credit or payment, whichever is earlier

Land situated in other than

1%

specified area - Rs. 20 lakh.

194J

Any sum paid by way of

a) Fee for professional services,

b) Fee for technical services,

c) Royalty,

Credit or payment, whichever is earlier Annually Rs. 30,000

10%

Credit or payment whichever is earlier

5% #

d) Remuneration/fee/commission to a director,

e) For not carrying out any activity in relation to any business,

f) For not sharing any know-how, patent, copyright etc.

194LB

Payment of interest on infrastructure debt fund to non resident or foreign

company

Payment of distributed income to resident unit holder by a business trust

194LBA

and Payment of distributed income to non resident unit holder by a

10%

Credit or payment whichever is earlier

5% #

business trust

194LBB

Payment of distributed income to unit holder in respect of units of an

investment fund (w.e.f 01-06-15)

Credit or payment whichever is earlier

10%

Credit or payment whichever is earlier

5% #

Credit or payment whichever is earlier

5% #

Payment of interest by an Indian Company or a business trust in respect of

194LC

money borrowed in foreign currency under a loan agreement or by way of

issue of long-term bonds (including long-term infrastructure bond)

Payment of interest on rupee denominated bond of an Indian Company or

194LD

Government securities to a Foreign Institutional Investor or a Qualified

Foreign Investor

206C

Collection on Sale of bullion and Jewellery

At time of sale, when sale consideration

is received in cash

Amount in cash exceeds Rs. 2 Lakh

1%

# Surcharge, education cess and secondary and higher education cess will be added to the above tax rate, as applicable.

Notes:

1. Securities includes listed as well as unlisted debentures issued by companies in which public are substantially interested.

2. In case of interest payment by co-operative banks to its members the TDS Provision is applicable from 1-June-2015.

3. If the payment is made to contractor/sub contractor in transport business, no TDS shall be deducted at source in the course of payment for plying, hiring or leasing goods carriages if the contractor provides PAN

Number and such contractor owns ten or less goods carriage at any time during the previous year and furnishes a declaration to that effect.

4. In case of section 194LA, the sub-registrar shall register the document only after the challan for payment of TDS is presented before him.

5. If the payment is made to a person (including non resident) whose receipts are subject to TDS shall mandatory furnish his PAN to the deductor (even though the deductee file a declaration in form no. 15G or 15H)

otherwise the deductor shall deduct the TDS at higher of the following rates

The applicable rate prescribed OR the rate mentioned in the Finance Act OR 20%

Das könnte Ihnen auch gefallen

- Intro of TdsDokument6 SeitenIntro of Tdsshivani singhNoch keine Bewertungen

- For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Dokument6 SeitenFor Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Savoir PenNoch keine Bewertungen

- What Is Tax Deducted at SourceDokument6 SeitenWhat Is Tax Deducted at SourcejdonNoch keine Bewertungen

- TDS Rate Financial Year 13-14Dokument10 SeitenTDS Rate Financial Year 13-14Heena AgreNoch keine Bewertungen

- Some Issues On Practice of TDS Law Seminar by NIRCDokument29 SeitenSome Issues On Practice of TDS Law Seminar by NIRCHarish KalidasNoch keine Bewertungen

- For Tds On Non SalaryDokument39 SeitenFor Tds On Non SalaryicahimanshumehtaNoch keine Bewertungen

- What Is Tax Deducted at Source?Dokument5 SeitenWhat Is Tax Deducted at Source?Bhagyashree SondagarNoch keine Bewertungen

- TDS 3Dokument16 SeitenTDS 3payal AgrawalNoch keine Bewertungen

- Introduction To TDS:-: Tax Deducted at SourceDokument3 SeitenIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14Noch keine Bewertungen

- Tds Rate Chart Fy 2014-15 Ay 2015-16Dokument26 SeitenTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86Noch keine Bewertungen

- Tax Deducted at SourceDokument10 SeitenTax Deducted at SourcesreedevivcnNoch keine Bewertungen

- A Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingDokument12 SeitenA Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingSipoy SatishNoch keine Bewertungen

- Some Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCDokument29 SeitenSome Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCJinoy P MathewNoch keine Bewertungen

- Individual Paper Income Tax Return 2015Dokument23 SeitenIndividual Paper Income Tax Return 2015marrukhjNoch keine Bewertungen

- TDS Rates and ReturnsDokument3 SeitenTDS Rates and ReturnsKashishKumarNoch keine Bewertungen

- Food Corporation of India - 41202411354277Dokument9 SeitenFood Corporation of India - 41202411354277abhimanyu7004Noch keine Bewertungen

- Tax Guide - 2011: Kantilal Patel & CoDokument0 SeitenTax Guide - 2011: Kantilal Patel & Coanpuselvi125Noch keine Bewertungen

- Articleship Exam QuestionsDokument33 SeitenArticleship Exam QuestionsVarshiniNoch keine Bewertungen

- Seminar On TDSDokument29 SeitenSeminar On TDSCA Virendra ChhajerNoch keine Bewertungen

- Tds Amendements Via Finance Bill 2020Dokument12 SeitenTds Amendements Via Finance Bill 2020ABHISHEKNoch keine Bewertungen

- TDS On SalariesDokument3 SeitenTDS On SalariesSpUnky RohitNoch keine Bewertungen

- Tax Deduction at SourceDokument4 SeitenTax Deduction at SourcevishalsidankarNoch keine Bewertungen

- Tax Deducted at SourceDokument29 SeitenTax Deducted at SourceAmbar Pratik MishraNoch keine Bewertungen

- FBR IncomeTax Return 2016Dokument40 SeitenFBR IncomeTax Return 2016Muhammad Awais100% (1)

- Individual Paper Income Tax Return 2016Dokument39 SeitenIndividual Paper Income Tax Return 2016aarizahmadNoch keine Bewertungen

- Presentation On TDS Provision: by Nilesh Deharkar & AMAN BhattacharyaDokument15 SeitenPresentation On TDS Provision: by Nilesh Deharkar & AMAN BhattacharyaAman BhattacharyaNoch keine Bewertungen

- Corporate Tax PlanningDokument139 SeitenCorporate Tax PlanningDr Linda Mary SimonNoch keine Bewertungen

- Sl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersDokument4 SeitenSl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersLisa StewartNoch keine Bewertungen

- Tax AmendmentDokument10 SeitenTax AmendmentVinay BoradNoch keine Bewertungen

- Chapter 12 Tds & TcsDokument28 SeitenChapter 12 Tds & TcsRajNoch keine Bewertungen

- CA-Ashok-Mehta - PPT - Income TaxDokument88 SeitenCA-Ashok-Mehta - PPT - Income TaxAbinash DasNoch keine Bewertungen

- Requirements U/S 195: By: Ca Sanjay K. AgarwalDokument71 SeitenRequirements U/S 195: By: Ca Sanjay K. AgarwalHemanthKumarNoch keine Bewertungen

- All About TDS Part 2Dokument9 SeitenAll About TDS Part 2Animesh Kumar TilakNoch keine Bewertungen

- Manual Return Ty 2017Dokument56 SeitenManual Return Ty 2017Muhammad RizwanNoch keine Bewertungen

- Taxation Management (Planning) : I:Some Model QuestionsDokument9 SeitenTaxation Management (Planning) : I:Some Model QuestionsRajesh WariseNoch keine Bewertungen

- INLAND REV DIRECTIVE - LatestDokument4 SeitenINLAND REV DIRECTIVE - LatestKrrish GuruNoch keine Bewertungen

- Tax Planning and Financial Management Decisions: CA Aarti PatkiDokument50 SeitenTax Planning and Financial Management Decisions: CA Aarti PatkiRahul SinghNoch keine Bewertungen

- Tax Deduct at SourceDokument4 SeitenTax Deduct at Sourceankit1070Noch keine Bewertungen

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsDokument5 SeitenUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403Noch keine Bewertungen

- TDS - IT Act (09-03-2024)Dokument16 SeitenTDS - IT Act (09-03-2024)santhoshgopal2005Noch keine Bewertungen

- PPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Dokument37 SeitenPPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Kartik AgrawalNoch keine Bewertungen

- Tds Rates Chart ADokument2 SeitenTds Rates Chart AshivshenoyNoch keine Bewertungen

- Some Issues On Practice of TDS Law Seminar by NIRCDokument29 SeitenSome Issues On Practice of TDS Law Seminar by NIRCShashank Deva SunnyNoch keine Bewertungen

- Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartDokument3 SeitenTax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartChandan KumarNoch keine Bewertungen

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDokument11 SeitenTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86Noch keine Bewertungen

- Tds On Foreign Remittances: Surprises Continued.Dokument9 SeitenTds On Foreign Remittances: Surprises Continued.AdityaNoch keine Bewertungen

- Tax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)Dokument20 SeitenTax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)shefalijais6491Noch keine Bewertungen

- Tax Deducted at Source - I: KPPM & AssociatesDokument63 SeitenTax Deducted at Source - I: KPPM & AssociatesSaksham JoshiNoch keine Bewertungen

- Bhubaneswar 08112015 Session I PDFDokument42 SeitenBhubaneswar 08112015 Session I PDFsachin NegiNoch keine Bewertungen

- Hand BookDokument82 SeitenHand Booknmshamim7750Noch keine Bewertungen

- F6 Tax RulesDokument2 SeitenF6 Tax RulesLavneesh ShibduthNoch keine Bewertungen

- Tax Deducted at Source IMPORTANT POINTSDokument2 SeitenTax Deducted at Source IMPORTANT POINTSnABSAMNNoch keine Bewertungen

- Tax ChangesDokument7 SeitenTax ChangesSujan SanjayNoch keine Bewertungen

- NTPC Tax CircularDokument20 SeitenNTPC Tax CircularKundan RathodNoch keine Bewertungen

- Taxation of Cryptocurrency 2022 Final Update 2022Dokument17 SeitenTaxation of Cryptocurrency 2022 Final Update 2022aryan sarangNoch keine Bewertungen

- MTP 4 (Additional MCQ) - Q&ADokument19 SeitenMTP 4 (Additional MCQ) - Q&ADeepsikha maitiNoch keine Bewertungen

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDokument40 SeitenInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionSammar EllahiNoch keine Bewertungen

- Taxation Report Vina MarieDokument12 SeitenTaxation Report Vina MarieAnonymous gmDxRbnwONoch keine Bewertungen

- Wapda Taxmemo2013Dokument50 SeitenWapda Taxmemo2013Naveed ShaheenNoch keine Bewertungen

- Assignment On: "Business Law"Dokument8 SeitenAssignment On: "Business Law"swarna sahaNoch keine Bewertungen

- HW2 ch12bDokument10 SeitenHW2 ch12bBAurNoch keine Bewertungen

- Daisy Lopez Realty Vs FontechaDokument1 SeiteDaisy Lopez Realty Vs FontechaAllenNoch keine Bewertungen

- Problem 3.2Dokument3 SeitenProblem 3.2MedicareMinstun ProjectNoch keine Bewertungen

- Hilton6e SM08Dokument70 SeitenHilton6e SM08Eych MendozaNoch keine Bewertungen

- Xacc280 Chapter 2Dokument46 SeitenXacc280 Chapter 2jdcirbo100% (1)

- Business Ethics, Corporate Governance & CSRDokument24 SeitenBusiness Ethics, Corporate Governance & CSRali hassanNoch keine Bewertungen

- AVG LOGISTICS-Annual Report-2018 PDFDokument66 SeitenAVG LOGISTICS-Annual Report-2018 PDFdbareddy100% (1)

- Wipro MainDokument30 SeitenWipro Mainalbert100% (1)

- Prospectus, Allotment of Securities and Private Placement Co Act 2013 BGDokument5 SeitenProspectus, Allotment of Securities and Private Placement Co Act 2013 BGachuthan100% (1)

- Instructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsDokument12 SeitenInstructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsIRSNoch keine Bewertungen

- 03 Worksheet 1Dokument2 Seiten03 Worksheet 1Maj MarticioNoch keine Bewertungen

- Strategic Management:: Creating Competitive AdvantagesDokument108 SeitenStrategic Management:: Creating Competitive AdvantagesSharath KannanNoch keine Bewertungen

- BEL Code of ConductDokument10 SeitenBEL Code of Conductatulrlondhe143Noch keine Bewertungen

- Credit Suisse - Sell SX5E SkewDokument3 SeitenCredit Suisse - Sell SX5E SkewZhenhuan SongNoch keine Bewertungen

- International Portfolio DiversificationDokument34 SeitenInternational Portfolio DiversificationGaurav KumarNoch keine Bewertungen

- Characteristics of The Major Forms of Ownership: TABLE 3.1Dokument4 SeitenCharacteristics of The Major Forms of Ownership: TABLE 3.1isyaNoch keine Bewertungen

- Bifd050202.PDF Why Tax CorporationsDokument10 SeitenBifd050202.PDF Why Tax CorporationsAntonioMarinielloNoch keine Bewertungen

- Cabot Corporation Annual Report PDFDokument116 SeitenCabot Corporation Annual Report PDFDedi Satria WahyuNoch keine Bewertungen

- Compileeee Business CombiDokument14 SeitenCompileeee Business CombiEddie Mar JagunapNoch keine Bewertungen

- Lic Housing Finance LimitedDokument19 SeitenLic Housing Finance Limitedsoujanya_nagarajaNoch keine Bewertungen

- Corporation Law Dean Cesar L VillanuevaDokument21 SeitenCorporation Law Dean Cesar L Villanuevaamsanro50% (2)

- R. Muhammad Siddique Khatri: ChairmanDokument8 SeitenR. Muhammad Siddique Khatri: ChairmanfahadNoch keine Bewertungen

- AGU POT Agrium Potash Merger Presentation Sept 2016Dokument23 SeitenAGU POT Agrium Potash Merger Presentation Sept 2016Ala BasterNoch keine Bewertungen

- Conso FS at The Date of AcquisitionDokument3 SeitenConso FS at The Date of Acquisitionguliramsam5Noch keine Bewertungen

- The Fine Act of Friendly AcquisitionDokument14 SeitenThe Fine Act of Friendly AcquisitionArpita TripathyNoch keine Bewertungen

- Mergers and Acquisition - Indian Scenario 2010 OnwardsDokument37 SeitenMergers and Acquisition - Indian Scenario 2010 Onwardspriya bearing50% (12)

- Greaves CottonDokument12 SeitenGreaves CottonRevathy MenonNoch keine Bewertungen

- Buslaw 2Dokument5 SeitenBuslaw 2Rose Jean Raniel OropaNoch keine Bewertungen

- Financial Statements: Class: Bsais 2ADokument12 SeitenFinancial Statements: Class: Bsais 2AMadonna LuisNoch keine Bewertungen