Beruflich Dokumente

Kultur Dokumente

Ain20140920003 - Case Study Finance

Hochgeladen von

Qurr'atulaynAlyJaferiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ain20140920003 - Case Study Finance

Hochgeladen von

Qurr'atulaynAlyJaferiCopyright:

Verfügbare Formate

Islamic Finance

Case study

1. Define the main assets of Islamic banking?

The main assets in Islamic banking are based on principles of Islamic sharia. The

Islamic banks mentioned in case study have various different assets including cash

and cash equivalents that is under possession for bank commitments, higher liquid

assets to get some returns as liquid assets are lesser in Islamic banks comparative

to conventional banks. High liquid assets are substitutions of bonds in Islamic

banking. accounts and notes receivables in mentioned Islamic banks of the case

originates from credit facilities and is determined by economic well-being and

customers credit policy. The short term trade financing includes murabaha(Profit

sharing) and salam comes under receivables that is a signed contract with an

agreed down payment along with price. The medium term investment in Islamic

banking leads to assets generation called Ijarah,Istisnaa and long term investment

yields musharakah(PARTNERSHIP)(Chong and Liu,2007) these all constitute main

assets in Islamic banks mentioned in the above case

1. Break down

percentages?

Banks

Shamil bank

of bahrain

Emirates

bank

intl

UAE

Al

rajhi

banking and

investment

corp

ABC Islamic

banking

Jorden

Islamic bank

First Islamic

investment

bank

investor

bank

the

assets

Assets(major groups)

Inventory

(Cash AND DEPOSITS)

in

to

major

groups

and

calculate

Year 1999 Year

$US

2000$US

310,751

358,535

47,784

2,570,809

1,308,286

1,262,523

Percentage%

1,331,564

2,041,015

709,451

53,2%

164

283

119

197,511

155,386

42,125

3839

1268

2571

0.6%

3,199,446

2,215,526

983,920

30.7%

15.3%

49.1%

21%

66%

2. Are the assets treated identically in the accounts by the different

banks?

The assets mentioned in the list of Islamic bank in this case study have classified

the assets in to four major categories and all are treating the assets identically, the

four major segments each bank is treating its assets are inventory that constitutes

cash and deposits, then is asset backed transactions that pertains with murabaha/

ijarah (leasing) Istisna(services/credit products salam(related to delivery), Porfit

sharing transactions(Mudarabah that entails profit sharing

and loss bearing;

Musharakh profit and loss sharing) and finally the fee based transactions that comes

in terms of trade financing. the bank vary from each other in terms of distinct

characteristics in ownership of these assets and contractual relationships for their

receivable(Bibadad and Bojan, 2005).

3. Define the major sources of finance for Islamic banking

In order to operate like conventional banks the Islamic banks also needs funds and

financing to run its transactions that come from various categories of halal sources

that are legitimates in light of shariah and the shariah presents two concepts for

sources of finance in Islamic banks i.e wadiah (restrictions for profit sharing for the

depositor) and Mudaribah(profit will be shared with the depositor but loss will stay

with the capital provider)(Bibadad and Bojan, 2005). The two main categories

constituting the sources of funds include:

Shareholders working capital

Customer deposit collections(contracts: al-wadiah deposits and mudharabah

deposits)

Separate accounting records to avoid any mingling at islamic banks are done to

avoid any ambiguity and conflict with conventional banking means of doing

transctions and obtaining sources of funds

4. Identify the key liabilities of Islamic banking

The key liabilities of Islamic banks very much like that of asset classification comes

under five distinct sections. The first and top most being current or demand

deposits that constitutes wadiah and wakalah that are considered to be same as

demand deposits. Unrestricted investment accounts that undertake fixed

deposits called as Mudaribah based SIA and profit yielded on the basis of asset

performance leads to profit sharing. Restricted Investment accounts that

contain mudarabah PSIA and same as unrestricted investment account it

undertakes profit sharing based on performance of assets. Profit equalization

Reserves this liability has distinctive characteristics and is considered as a

practical tool in balance sheet of all Islamic banks. Shareholders equity, the very

imperative liability in Islamic as well as conventional banks that is kept to invest in

infrastructure maintenance and other important transactions for the Islamic

banks(Hidayati et al, 2002)

5. How important are current accounts and investment accounts a s

sources of finance

Current accounts and investment accounts serves as a potential source of funding

in Islamic banking. The deficit in any of this section implies significant after affects

to the funding of Islamic banking transaction. current account serves as a means of

savings and ultimately boost the investment opportunities so a deficit or negative

current account could bring uncertainties to the banking well-being.so financing the

deficit in current account is always recommended in islamic as well a conventional

banking

6. Where in the accounts do you find restricted and unrestricted

investment accounts

In Islamic banks the restricted and unrestricted investment accounts are located in

mudaribah(profit sharing investment) section of investment account. the

unresteicted Investment account or URIA that refers to no limitations when it comes

to investing in accounts funds. Through appropriate but not restricted means bank

allows the depositor to invest funds on an agreed percentage amount to share the

returns generated through this investment. Contrary to this,restricted investment

account refers to certain impositions while making investemnty, in ways of making

investemnts so certain conditions are set while undergoing this investment between

the account holder and investing parties to refrain from certain activities while

undertaking this investment.

7. Are investment accounts assets or liabilities

Investment account comes under asset category provided that it is not borrowed

from some external party in that case it will be rendered as a liability. A long term

investment is a long term asset to facilitate long term transactions and flow of

business in banking arena. Investments are considered as a mean of positive cash

flows and economic benefits.

8. How do activities of Islamic bank differ between countries

The comparative study of Islamic banking practices in banks mentioned in case

studies from different countries represent somehow coherence in the way they

finance the business and do banking. There is no market disparity in the way they

transact and keep balance of their accounts in terms of assets and liabilities and in

the way they invest in the banking transactions. Islamic banks are based on same

Islamic principles across boundaries. Shariah communicates same laws for Muslim

countries so the difference in operations may occur in usage of shariah principles

by these islamic banks. the way banks accommodates the funds may vary from

other bank operating in different location.

9. How are activities of Islamic commercial banks different from

conventional ones

Islamic banking activities are in accordance and consistent with Islamic law

sharia,that follows the banking transactions in light of holy Quran and sunnah and

avoid all unjust means of making profit that usually is overlooked in conventional

banking. Islamic banks are free of riba based transactions, activities that are

favoring oppressions are avoided in islamic banking, islamic taxation is favored for

zakat to help needy. All such activities and actions taking place in economy through

unfair and unjust mean and through haram means are prohibited in Islamic banking,

contrary to this in conventional banking a relationship of debtor and creditor is

established in accordance with an agreed amount of interest between both parties

that in other term is taking advanatage of borrower money and interest that is

prohibited in islam is used as opportunity cost of money

10.

Do the Islamic banks featured in this case study make money

Despite the prohibition of interest and loan in islamic banks, shariah does allow

islamic banks the means to make money to Islamic banks. The list of Islamic banks

mentioned in case study follow the aspects of musharakah, the profit and loss

sharing tactic in Islamic banks where depositor invest capital aim the bank for the

growth of their business very much similar to direct investment and consequent

loss and profit is shared between bank and depositor. The mentioned Islamic banks

are also making money through ijarah that is rentals that usually ends up in

purchase of those assets through leasing. The mortgage transactions is Islamic

banking, Islamic banks resells the purchased items on profit(Kesowani,2012).

11.

Calculate return on capital employed for each bank

Return on capital employed that measures the profitability of a firm. In this case

study the ROCE for the islamic banks have been calculated below in the table using

the formula:

Return on capital employed= earnings before interest and tax/ capital

employed

Capital employed is directly obtained by subtracting current liabilities and total

assets and in case of interest zakat and other provisions were considered

banks

Shamil bank of bahrain

Emirates bank intl UAE

Al rajhi banking and investment corp

ABC Islamic banking

JORDAN ISLAMIC BANK

First islamic investment bank

Meezan bank

Investor bank

Al-baraka islamic bank

Arab islamic bank

Tadamon islamic bank

Amana investment

ROCE for yr 2000

15,617-230,000=-214,386 =-214383

1,033,635-1,435,014= -410,379

1,584,454-2,250,000= -665,546

13,432-42,500= -229,068

1,382,279-38,500= 1,343,779

4582-112,500= -107,918

148,116-1,697,152= -1,549,036

1,379,645-1,297,049=82,596

4,125,319-4064= 4,121,255

551-95,022= -94,471

1,394,287-1,741,207= -346,920

48,773-205,200= -156,427

REFERNCES:

Bidabad, Bijan (2005), Non-Usury Bank Corporation (NUBankCo), The Solution

to Islamic banking, Proceeding of the 3rd International Islamic Banking and

Finance Conference, Monash University, KL, Malaysia, 16-17 November, 2005.

Chong,B.S. and Liu,M. (2007)," Islamic Banking: Interest-Free or InterestBased?", [Online]. Available from: www.efmaefm.org/0EFMAMEETINGS/EFMA

%20ANNUAL%20MEETINGS/2007-Vienna/Papers/0019.pdf

Hedayati, Aliaskhar, and other co-authors, (2002), "Internal banking

operation (2) ", Iran Bank Institute, Central Bank Of Iran, 5th publish, pp 9 (in

Farsi).

Kesowani.J.(2012).comparative study between islamic and convental

banking.[Online]. Available from:

http://www.academia.edu/3643191/Comparative_study_between_islamic_and

_conventional_bank.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

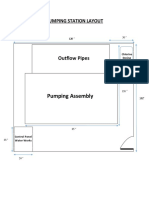

- Pumping Assembly: Outflow PipesDokument1 SeitePumping Assembly: Outflow PipesQurr'atulaynAlyJaferiNoch keine Bewertungen

- Dyslexia Labelling in Inclusive Education: Reality and ConsequencesDokument28 SeitenDyslexia Labelling in Inclusive Education: Reality and ConsequencesQurr'atulaynAlyJaferiNoch keine Bewertungen

- Problem Recognition: Consumer Behaviour: Implications For Marketing Strategy 3e by Neal, Quester and HawkinsDokument8 SeitenProblem Recognition: Consumer Behaviour: Implications For Marketing Strategy 3e by Neal, Quester and HawkinsQurr'atulaynAlyJaferiNoch keine Bewertungen

- IdeoDokument8 SeitenIdeoQurr'atulaynAlyJaferiNoch keine Bewertungen

- Ain20140922021-How Does Health Affect StudiesDokument6 SeitenAin20140922021-How Does Health Affect StudiesQurr'atulaynAlyJaferiNoch keine Bewertungen

- Quality in Customer Focused OperationsDokument22 SeitenQuality in Customer Focused OperationsQurr'atulaynAlyJaferiNoch keine Bewertungen

- Final GK Power Capsule For Rbi Assistant Mains 2017 by Gopal Sir and TeamDokument66 SeitenFinal GK Power Capsule For Rbi Assistant Mains 2017 by Gopal Sir and TeamJagannath JagguNoch keine Bewertungen

- Quatloos - NESARA ScamDokument7 SeitenQuatloos - NESARA Scam05C1LL473Noch keine Bewertungen

- Chapter 7 Extinguishment of SaleDokument17 SeitenChapter 7 Extinguishment of SaleMona Liza Sulla Perez100% (3)

- GR 167530Dokument2 SeitenGR 167530Cyruz TuppalNoch keine Bewertungen

- Signed Agreement PLA7214991101Dokument26 SeitenSigned Agreement PLA7214991101ramanjireddy166Noch keine Bewertungen

- Lic ProjectDokument58 SeitenLic ProjectMukesh ManwaniNoch keine Bewertungen

- Caps, Floors, SwapDokument3 SeitenCaps, Floors, SwapFransiskus Saut Sandean SinagaNoch keine Bewertungen

- Vat On Sales of Goods or PropertiesDokument10 SeitenVat On Sales of Goods or Propertiesgoerginamarquez100% (1)

- Job Order CostingDokument32 SeitenJob Order CostingSetia NurulNoch keine Bewertungen

- Unit 3 - 5Dokument35 SeitenUnit 3 - 5YonasNoch keine Bewertungen

- Debt Snowball MethodDokument4 SeitenDebt Snowball Methodjackie555Noch keine Bewertungen

- Special Power of AttorneyDokument2 SeitenSpecial Power of AttorneyƖPɘ AŋʌvɘNoch keine Bewertungen

- Function and Role of Financial System (Chapter-1)Dokument44 SeitenFunction and Role of Financial System (Chapter-1)Kishor Mahmud83% (6)

- Finanicial AccountingDokument147 SeitenFinanicial AccountingShailesh RathiNoch keine Bewertungen

- Virata Vs SandiganbayanDokument16 SeitenVirata Vs SandiganbayanJacquelyn AlegriaNoch keine Bewertungen

- Irma Resume Teaching eDokument5 SeitenIrma Resume Teaching eapi-273353364Noch keine Bewertungen

- Cash FlowDokument19 SeitenCash FlowHira FarooqNoch keine Bewertungen

- Limitations To Financial Statement AnalysisDokument4 SeitenLimitations To Financial Statement Analysissangya01Noch keine Bewertungen

- Compound Financial InstrumentsDokument3 SeitenCompound Financial Instrumentskevior2Noch keine Bewertungen

- T 2Dokument3 SeitenT 2Corazon Lim LeeNoch keine Bewertungen

- Module 1 Task 1 VceDokument10 SeitenModule 1 Task 1 VcevedantNoch keine Bewertungen

- Negative Effects of Unpaid GSIS Loans On Members' Future Benefits - TeacherPHDokument5 SeitenNegative Effects of Unpaid GSIS Loans On Members' Future Benefits - TeacherPHMirandy MoresNoch keine Bewertungen

- Bangladesh - Banking SystemsDokument2 SeitenBangladesh - Banking SystemsMd. SufianNoch keine Bewertungen

- Intermediate Accounting 2 Week 1 Lecture AY 2020-2021 Chapter 1: Current LiabilitiesDokument7 SeitenIntermediate Accounting 2 Week 1 Lecture AY 2020-2021 Chapter 1: Current LiabilitiesdeeznutsNoch keine Bewertungen

- Final Business PlanDokument27 SeitenFinal Business PlanAnkit Kalra100% (1)

- Northern Rock Provisional Restructuring Plan March 31 2008Dokument12 SeitenNorthern Rock Provisional Restructuring Plan March 31 2008mckenzie0415Noch keine Bewertungen

- RFBTDokument35 SeitenRFBTJohn Bryan100% (2)

- Fs SP Us High Yield Corporate Bond Energy IndexDokument5 SeitenFs SP Us High Yield Corporate Bond Energy IndexpabloNoch keine Bewertungen

- Frauds-in-Indian-Banking SectorDokument61 SeitenFrauds-in-Indian-Banking SectorPranav ViraNoch keine Bewertungen

- CHANEL Price - 2014with PhotoDokument325 SeitenCHANEL Price - 2014with PhotowhitewitchNoch keine Bewertungen